Nifty retreats from highs, closes under 24,600

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

Introducing In The Money by Zerodha

This newsletter and YouTube channel aren’t about hot tips or chasing the next big trade. It’s about understanding the markets, what’s happening, why it’s happening, and how to sidestep the mistakes that derail most traders. Clear explanations, practical insights, and a simple goal: to help you navigate the markets smarter.

Market Overview

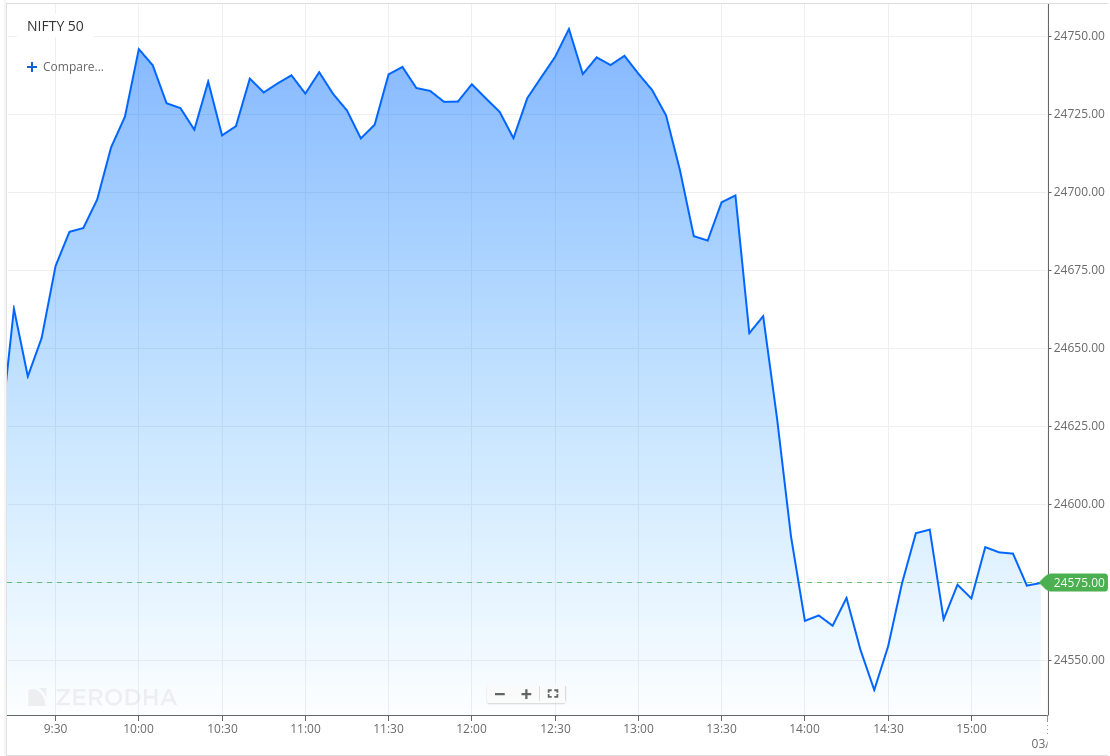

Nifty opened with a 28-point gap up at 24,653 and gradually climbed higher through the morning, reaching an intraday high near 24,750 just before 1 PM. The index remained in a tight range for most of the first half, showing signs of strength and stability.

However, sentiment turned sharply negative post-lunch, with Nifty witnessing a steep decline of nearly 175 points over the next hour. The index broke below the 24,600 mark and touched an intraday low near 24,520.

A mild recovery attempt was seen in the final 30 minutes, but the rebound lacked strength. Nifty eventually closed at 24,579.60, reflecting a volatile session where early gains were erased by aggressive selling pressure in the second half.

Market sentiment remains cautious. While the recent GST cut announcement has lifted hopes of a consumption boost, concerns around 50% tariffs, persistent FII outflows, and muted earnings continue to weigh on investor confidence. Focus remains on escalating U.S.-India trade tensions, which are expected to shape near-term market direction.

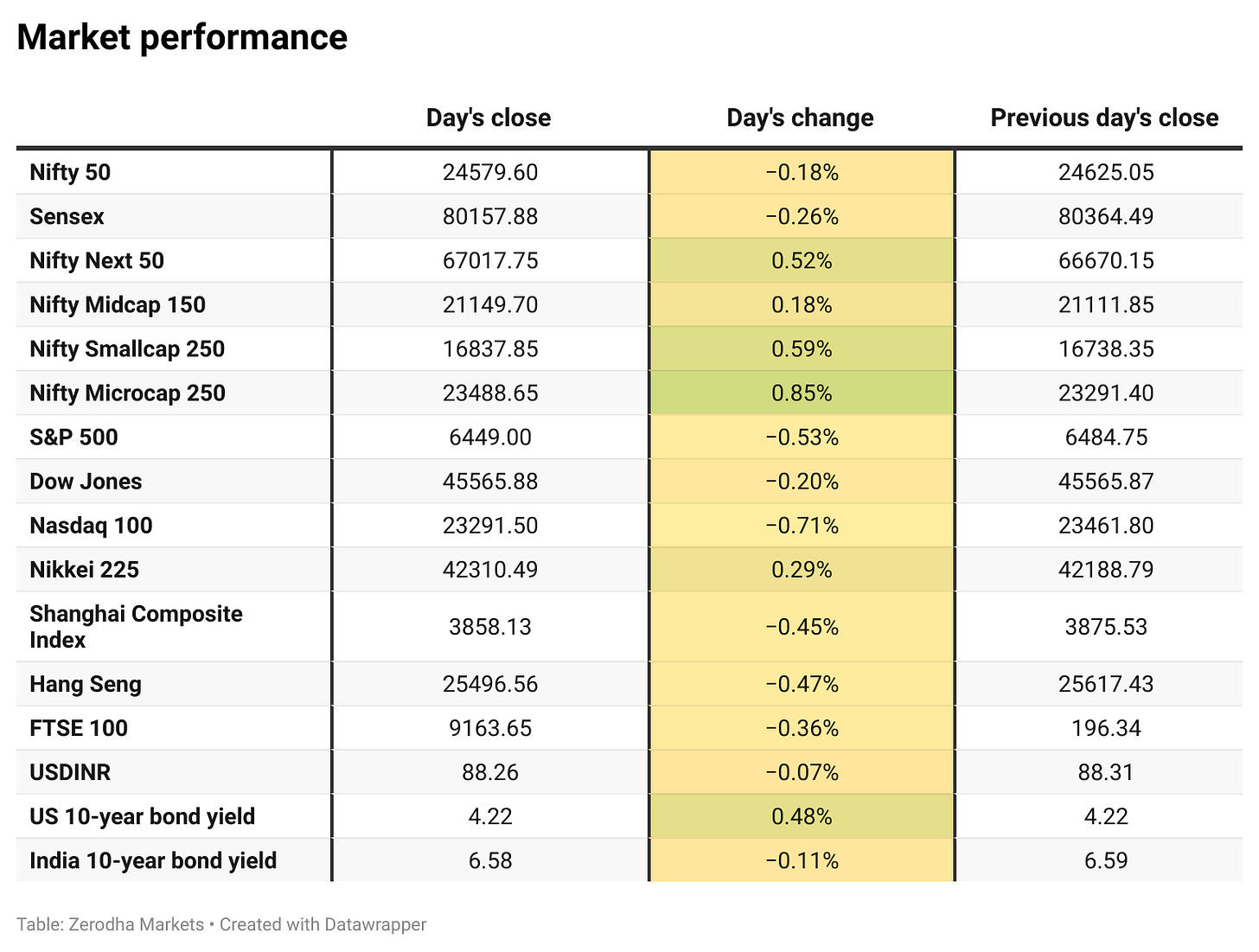

Broader Market Performance:

Broader markets, however, remained strong today. Of the 3,132 stocks traded on the NSE, 1,927 advanced, 1,116 declined, and 89 remained unchanged.

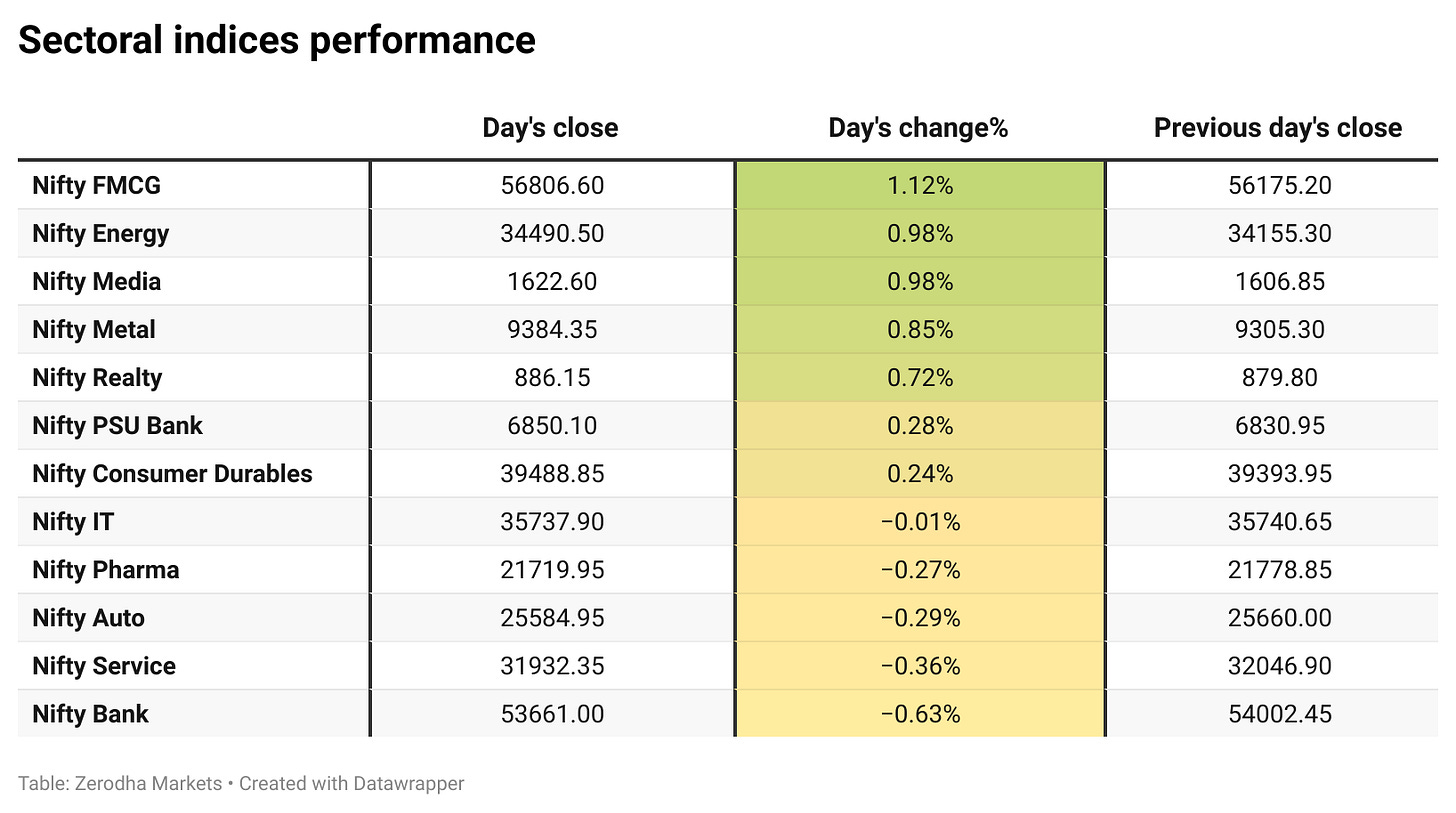

Sectoral Performance

Nifty FMCG was the top gainer, rising 1.12%, while Nifty Bank was the top loser, falling 0.63%. Out of the 12 sectoral indices, 7 closed in the green and 5 ended in the red, indicating a mildly positive but selective market breadth led by gains in FMCG, energy, and metal stocks.

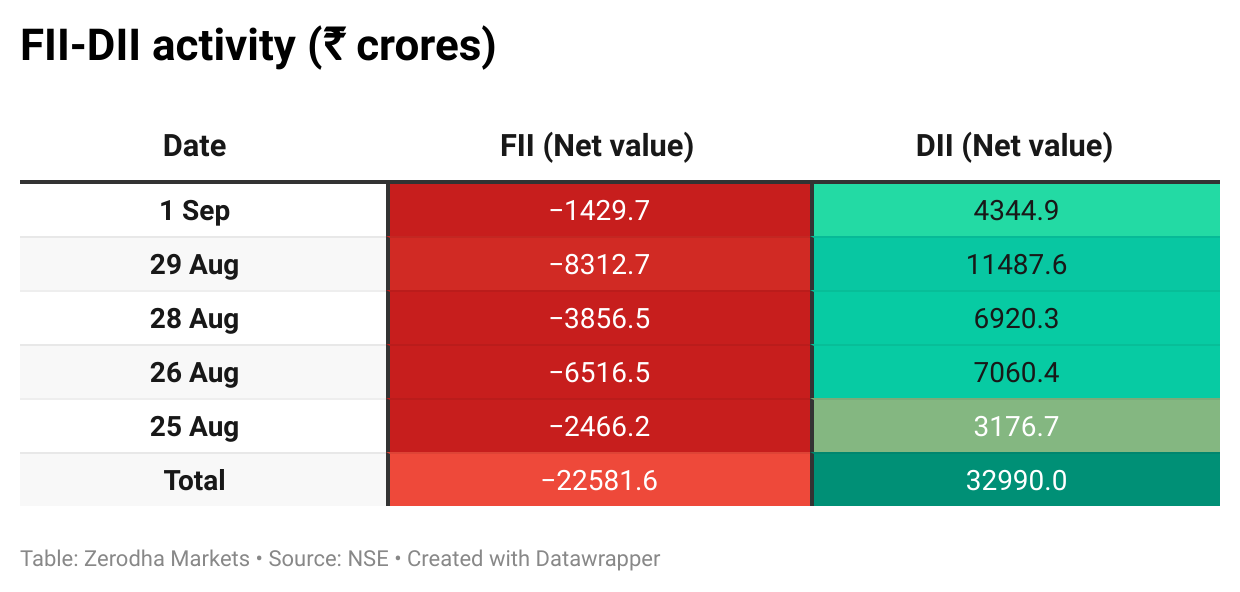

Here’s the trend of FII-DII activity from the last 5 days:

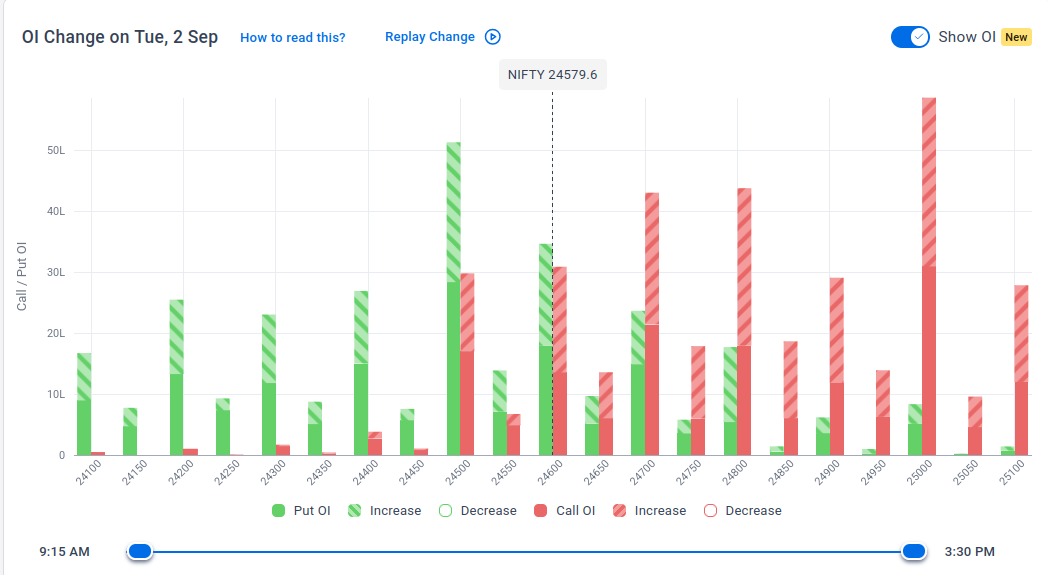

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 9th September:

The maximum Call Open Interest (OI) is observed at 25,000, followed closely by 24,800 & 24,700, suggesting strong resistance at 24,700 - 24,800 levels.

The maximum Put Open Interest (OI) is observed at 24,500, followed closely by 24,600, suggesting strong support at 24,500 to 24,400 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

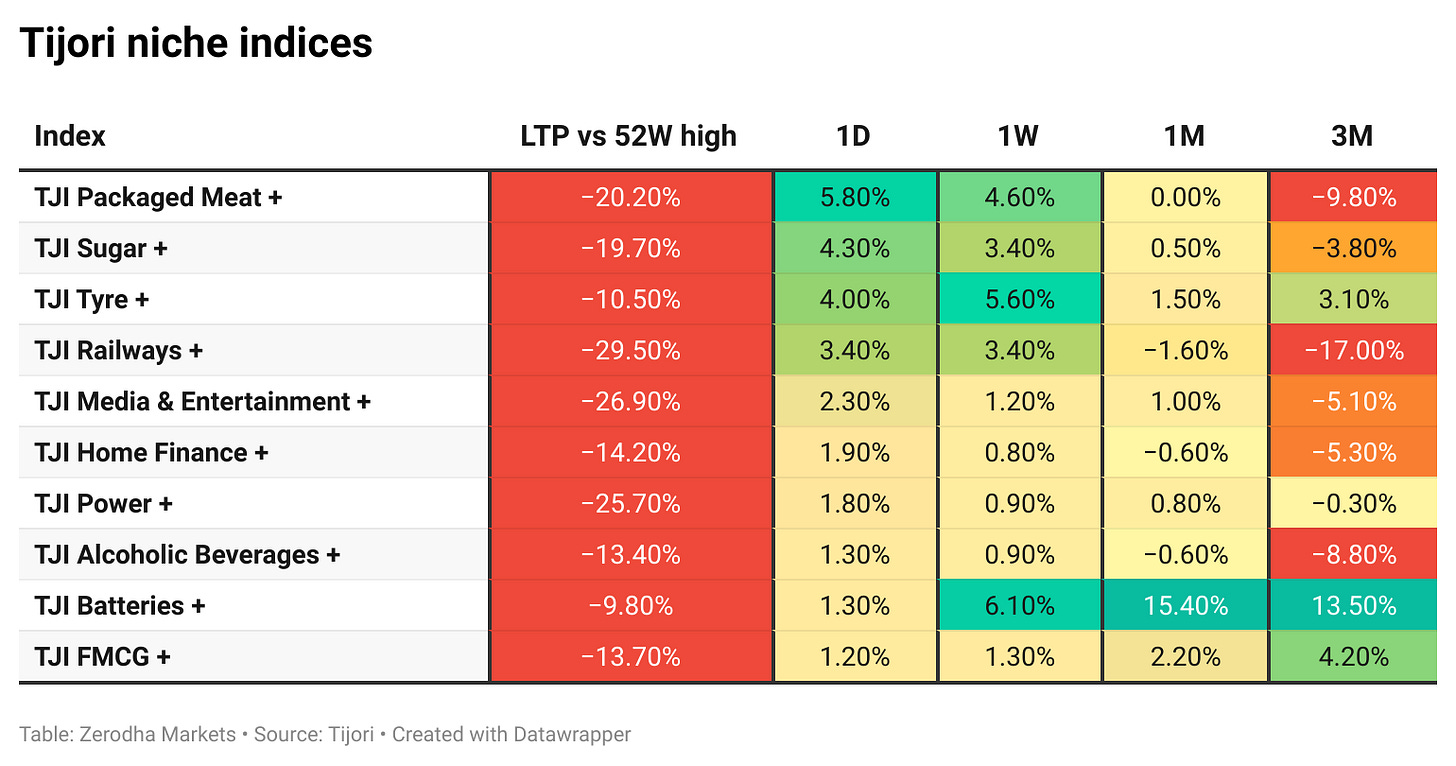

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

SEBI has capped intraday net positions in index options at ₹5,000 crore and gross positions at ₹10,000 crore per entity from October 1, 2025. Exchanges will monitor via random snapshots, with expiry day breaches attracting penalties. Dive deeper

India’s CAD fell to $2.4 billion (0.2% of GDP) in Q1FY26 from $8.6 billion a year earlier, though the trade deficit widened to $68.5 billion. Net services receipts rose to $47.9 billion and remittances to $33.2 billion. The quarter also saw $5.7 billion in FDI inflows and a $4.5 billion forex reserve addition. Dive deeper

India plans to cut GST by at least 10 percentage points on about 175 products, including lowering rates on shampoos and toothpaste from 18% to 5%, TVs from 28% to 18%, and small petrol hybrid cars from 28% to 18%. The GST Council will finalize the list on September 3-4. Dive deeper

The government has extended the export obligation period for the chemical and petrochemical industry under the Advance Authorization Scheme from six to 18 months. Duty-free imports used exclusively for exports are exempt from QCO compliance, easing operational pressures. The sector contributed $46.4 billion, or 10.6% of India’s exports in 2024-25. Dive deeper

NMDC’s iron ore production in August rose 10% to 3.37 MT, while sales grew 8% to 3.39 MT. For April-August, output increased 28% to 18.45 MT and sales 13% to 18.37 MT. The company targets a record 55 MT production this fiscal, compared to 44.04 MT in 2024-25. Dive deeper

Maruti Suzuki has started exports of its first battery EV, the e-Vitara, with 2,900 units shipped from Gujarat to 12 European countries. The ‘Made in India’ model will also be sold domestically and exported to over 100 countries. Dive deeper

Airtel Africa has engaged Citigroup for the planned IPO of its mobile money unit, Airtel Money, targeted for the first half of 2026. The business, valued at over $4 billion in earlier reports, had 45.8 million customers and $162 billion in annualized transactions as of June. Dive deeper

Sebi has approved Imagine Marketing’s IPO, with boAt’s parent targeting a $1.5 billion valuation. Dive deeper

Tesla has received just over 600 orders in India since its July launch, far below the 2,500-car annual quota it had targeted. High import tariffs and steep prices have limited demand, with deliveries this year expected at only 350–500 cars, focused on four cities. Dive deeper

SBI plans to raise $500 million to $1 billion through five-year dollar bonds following India’s S&P rating upgrade, with strong demand expected to lower pricing. Dive deeper

BEL bagged ₹644 crore orders in August for defence systems, including fire control, navigation, communication equipment, and EVMs, along with upgrades and services. Dive deeper

Tata Motors’ Jaguar Land Rover is facing global IT issues that have disrupted operations, leaving it unable to register new cars. The company is working with TCS to resolve the problem, which began on Sunday. Dive deeper

Puravankara has won a contract to redevelop Samrat Ashok Co-operative Housing Society in Mumbai’s Malabar Hill. The 1.43-acre project, with 7 lakh sq. ft. development potential, is expected to generate about ₹2,700 crore in revenue. Dive deeper

Deutsche Bank is seeking to fully exit its India retail banking business, which spans 17 branches and generated $278.3 million in revenue in FY25. Bids were invited by August 29, marking its latest attempt to divest amid stiff competition and regulatory challenges. Dive deeper

NCDEX has raised $88 million from global trading firms and domestic brokers as it plans to launch equity trading within a year. Dive deeper

What’s happening globally

Brent crude rose over 1% toward $69 a barrel as Ukraine’s drone strikes hit Russian oil facilities and China’s manufacturing showed strength. Gains were capped by surplus concerns, with focus now on the upcoming OPEC+ meeting. Dive deeper

Gold surged past $3,480 per ounce to a record high, driven by Fed rate cut expectations, a weaker dollar, and safe-haven demand. Dive deeper

The US Logistics Manager’s Index inched up to 59.3 in August, with inventories and warehousing costs rising while transportation prices and utilization fell. Expanding transport capacity signaled a mild negative freight inversion. Dive deeper

Euro area inflation rose to 2.1% in August 2025, above July’s pace and forecasts, as food prices climbed and energy costs fell less sharply. Core inflation stayed at 2.3%, its lowest since January 2022, with services easing and industrial goods steady. Dive deeper

The UK’s 30-year gilt yield jumped to 5.695%, the highest since 1998, amid rising fiscal concerns. Markets await the Autumn Budget with likely tax hikes and look to BoE hearings for signals on rates and quantitative tightening. Dive deeper

Nestle has ousted CEO Laurent Freixe over a code-of-conduct breach, appointing Philipp Navratil as successor in its second leadership change in a year. Dive deeper

Kraft Heinz will split into two listed companies by 2026. Global Taste Elevation, housing its sauces brands, and North American Grocery, covering products like Oscar Mayer and Kraft Singles. The tax-free spinoff aims to simplify operations and revive growth after years of sluggish sales. Dive deeper

Amazon shares slipped after U.S. Prime sign-ups during this year’s Prime Day were 116,000 below last year and missed internal targets by 106,000. The four-day event beat expectations, but the lead-up period saw weaker growth. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Arun Raste, CEO, NCDEX, on equity foray and fundraising

"We raised $87.99 million from global trading firms, brokers, and HNIs who are active traders; these investors will have skin in the game."

"Our mainstay has been agricultural commodities, giving us deep reach into smaller towns, which can translate into higher equity market participation."

"We will first offer equity trading and then equity derivatives within the next twelve months." - Link

Sunil Kataria, CEO & MD, Godrej Agrovet, on leadership priorities

"My priority is to unlock value across the portfolio by investing in capability building and strengthening our go-to-market strategy."

"We will focus on scaling up high-potential businesses while ensuring strong execution across different stages of evolution."

"With a wealth of experience in building businesses across challenging contexts, I am aligned with the intent to scale up Godrej Agrovet while prioritising profitability." - Link

Anish Tawakley, Co-CIO, ICICI Prudential MF, on India’s economy and markets

"There are no fundamental problems in the economy. Fiscal deficit, current account balance, and corporate balance sheets are in good shape."

"What we need is a slight pick-up in demand, which can be stimulated by an RBI rate cut and potential GST cuts."

"We prefer domestic cyclicals like autos, cement, financials, and industrials for incremental demand, while being cautious on staples and small/mid-cap valuations." - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

📚 Also reading Mind Over Markets by Varsity?

It goes out thrice a week, covering markets, personal finance, or the odd question you didn’t know you had. The Varsity team writes across three sections: Second Order, Side Notes, and Tell Me Why, thoughtfully put together without trying to be too clever.

Go check out Mind Over Markets by Zerodha Varsity here.

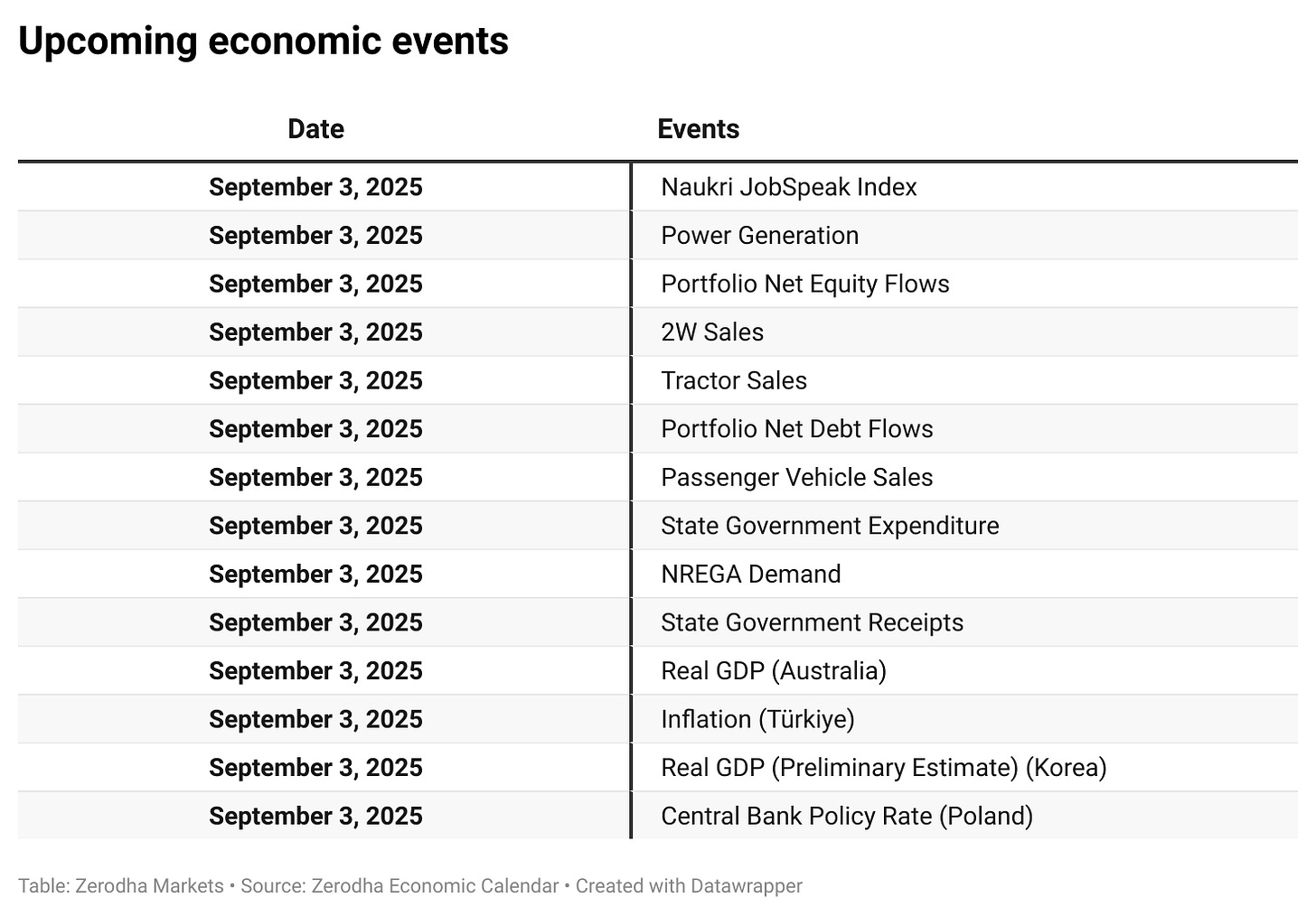

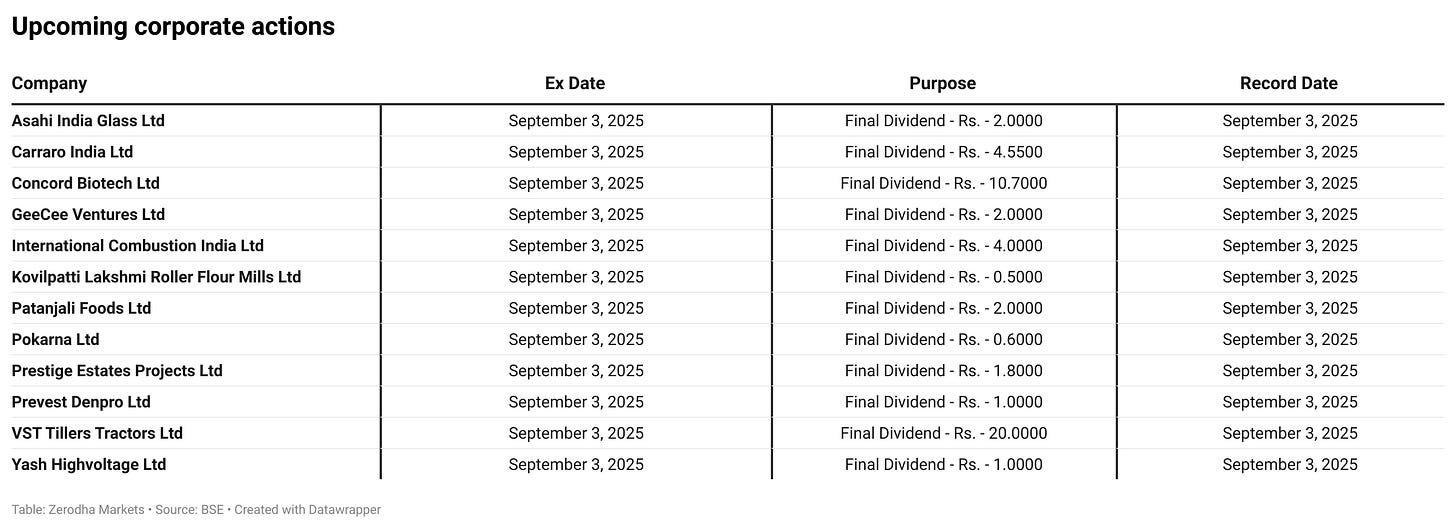

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.