Nifty retreats from 26,050-100 levels despite upbeat trade related headlines; Tech stocks lead

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we step away from our regular format to explore something close to every trader and investor’s heart — the Muhurat Trading session. We’ll look at how this one-hour symbolic session beautifully blends tradition and trading, and how you can make the most of it — whether you’re a long-term investor or a short-term trader sneaking in a quick Diwali setup before the sweets arrive. This episode isn’t just about charts and numbers — it’s about faith, discipline, and a fresh financial start for the new Samvat year.

Market Overview

Nifty opened with a strong 190-point gap-up at 26,057, buoyed by reports of progress in the India–US trade deal following positive communication between President Trump and Prime Minister Modi. The upbeat start saw the index briefly test the 26,100 mark within the opening hour, led primarily by gains in IT stocks.

However, profit booking emerged at higher levels, causing Nifty to pare early gains and move into a narrow consolidation phase through the late morning session. Post 1:30 PM, selling pressure intensified, dragging the index steadily below the 26,000 mark. Despite a brief recovery attempt around 2:30 PM, Nifty closed near the day’s low at 25,891.40, erasing all intraday gains to end flat.

Going forward, markets are likely to remain sensitive to developments around the trade deal, while investors will closely track Q2 earnings and management commentary on festive season demand trends following the recent GST rate cuts.

Broader Market Performance:

Broader markets had a subdued session today. Of the 3,202 stocks traded on the NSE, 1,305 advanced, 1,801 declined, and 96 remained unchanged.

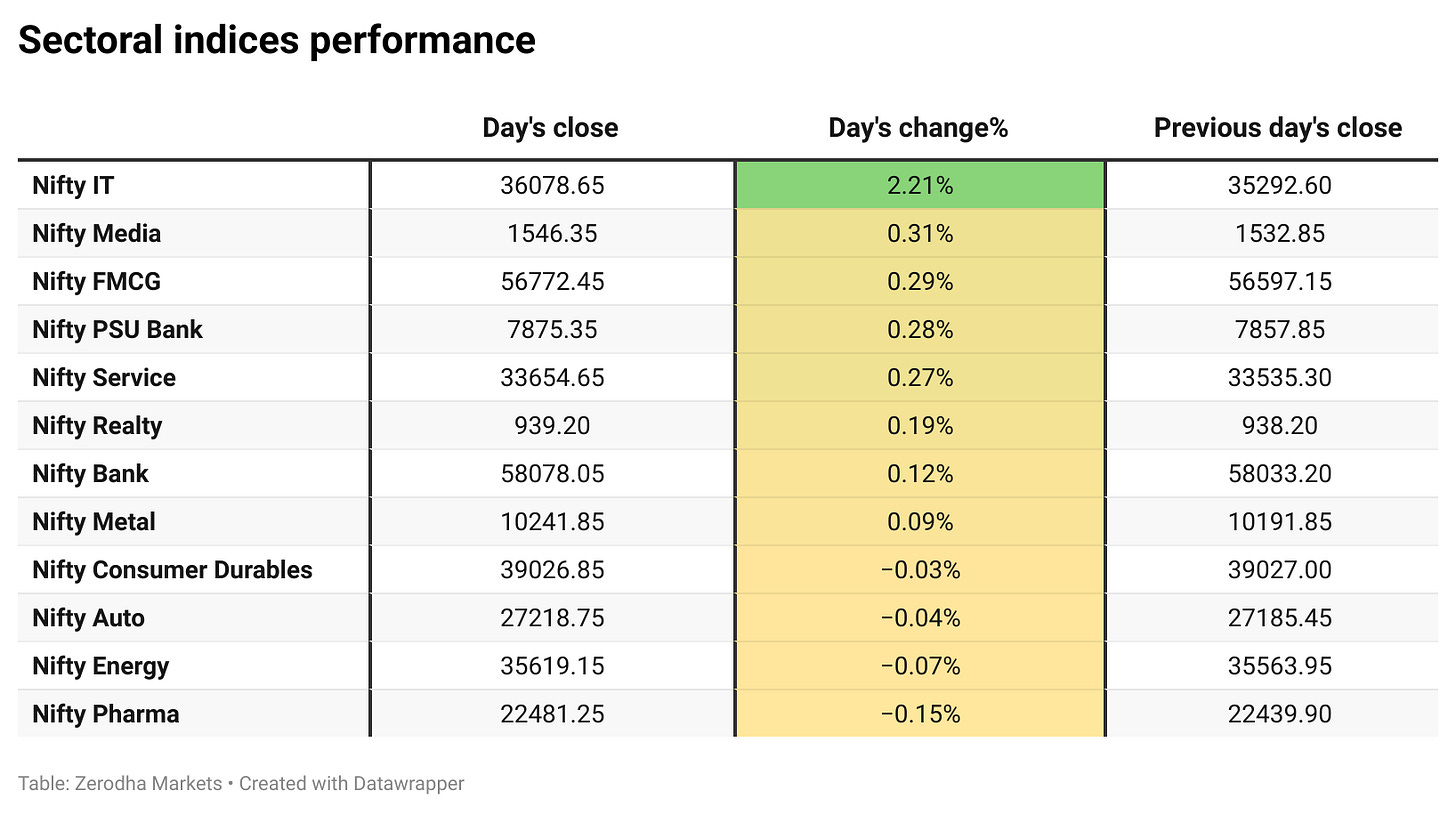

Sectoral Performance

Nifty IT emerged as the top gainer, rising 2.21%, while Nifty Pharma was the biggest loser, slipping 0.15%. Out of the 12 sectoral indices, 8 closed in the green and 4 ended in the red. .

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 28th October:

The maximum Call Open Interest (OI) is observed at 26,200, followed by 26,000 & 26,100, indicating potential resistance at the 26,000 -26,100 levels.

The maximum Put Open Interest (OI) is observed at 25,500, followed by 25,700, suggesting support at the 25,700 to 25,600 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

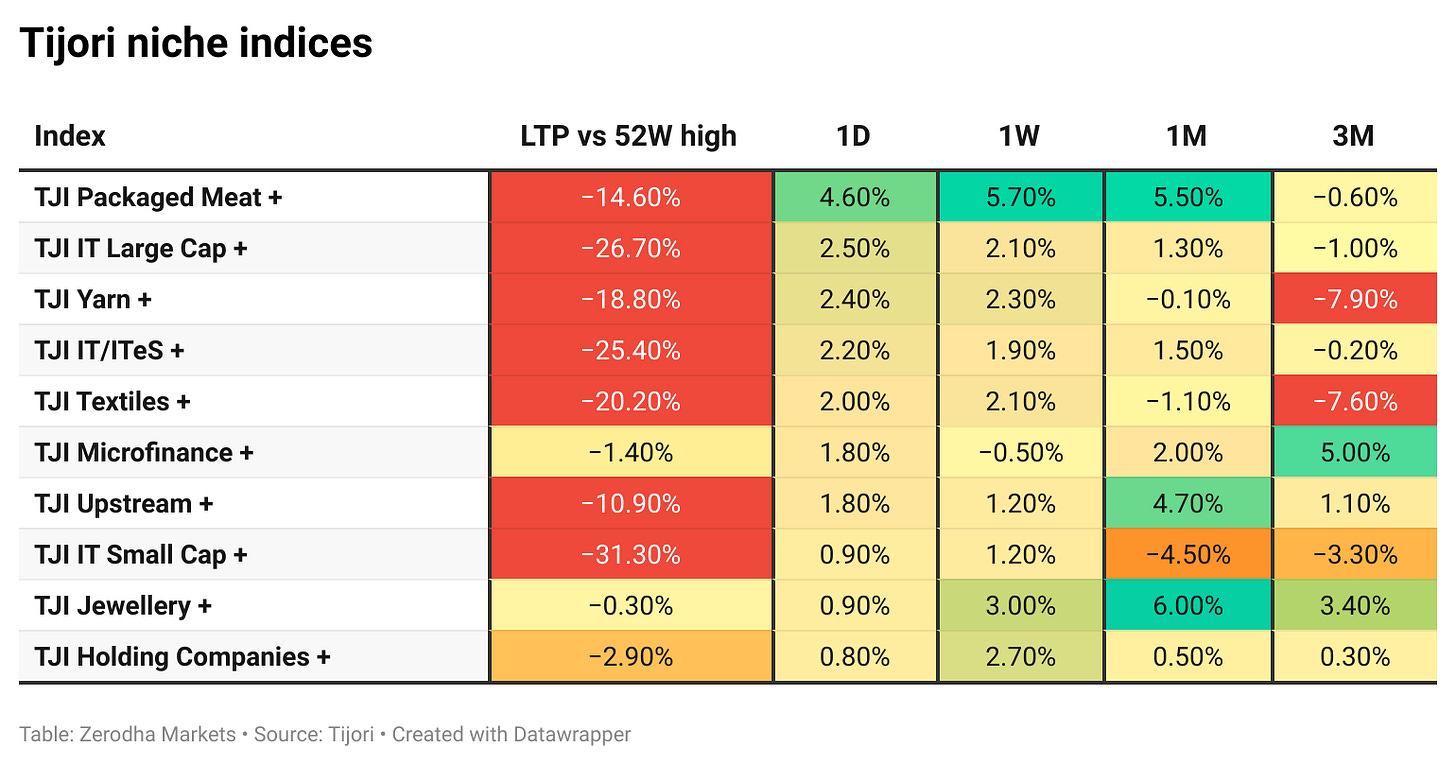

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

RBI’s gold reserves crossed 880 metric tonnes by September 2025, with 0.2 metric tonnes added in the last week of the month. The total value stood at USD 95 billion, reflecting continued buying amid global uncertainties. Dive deeper

The Indian rupee traded around 87.7 per USD, supported by reports of a potential US-India trade deal and intervention by state-run banks on behalf of the RBI. Dive deeper

Indian state refiners are reviewing their Russian oil trade documents to ensure no supplies come directly from Rosneft or Lukoil after the U.S. imposed sanctions on both companies. Dive deeper

Reliance Industries has reportedly purchased at least 2.5 million barrels of Middle Eastern crude, including grades from Iraq and Qatar, indicating a possible shift in sourcing amid global supply changes and pressure to reduce dependence on Russian oil. Dive deeper

Hindustan Unilever reported a 4% rise in consolidated net profit to ₹2,685 crore for Q2FY26, with revenue up 2% to ₹16,241 crore. EBITDA margin fell to 23.2% due to higher costs. The company declared an interim dividend of ₹19 per share, record date November 7, payout on November 20. Dive deeper

SBI General Insurance reported an 11% rise in gross written premium to ₹7,376 crore in H1FY26, with profit after tax at ₹422 crore and solvency ratio at 2.13 times. Dive deeper

Infosys founders and promoters, including Nandan Nilekani and Sudha Murty, have opted out of the company’s ₹18,000 crore share buyback. The promoters collectively hold 13.05% of the company’s equity as of the buyback announcement date. Dive deeper

The Ministry of Information Technology has proposed new IT rules requiring social media platforms to label and trace AI-generated or deepfake content and mandate users to disclose synthetic origins. Dive deeper

Small finance banks have approached the Reserve Bank of India seeking to double the loan size cap from ₹25 lakh to ₹50 lakh and to allow their participation in co-lending arrangements. Dive deeper

Bharat Electronics Limited received a ₹633 crore order from Cochin Shipyard for supplying sensors, weapon systems, fire control, and communication equipment. Dive deeper

Epack Prefab Technologies reported a 104% year-on-year rise in Q2FY26 net profit to ₹29.5 crore, with revenue up 62% to ₹433.9 crore, driven by strong growth across its business segments. Dive deeper

United Breweries shares were in focus after parent Heineken reported a mid-single-digit decline in India beer volumes for Q2, though net revenue rose similarly due to strong pricing, premium brand growth, and a favorable product mix. Dive deeper

Torrent Pharmaceuticals will issue bonds worth up to ₹14,000 crore after receiving regulatory approval for its acquisition of JB Chemicals & Pharmaceuticals, marking the largest rated bond issue of the fiscal year. Dive deeper

What’s happening globally

Brent crude oil futures rose over 5% to above $65 per barrel after the US imposed sanctions on Russian oil majors Rosneft and Lukoil, intensifying pressure on Moscow over the Ukraine conflict. Dive deeper

Gold rose to around $4,120 per ounce as geopolitical tensions and potential US export curbs on China boosted safe-haven demand, while expectations of further Fed rate cuts also supported prices. Dive deeper

France’s manufacturing business climate index rose to 101 in October 2025 from 97 in September, its highest since early 2024, driven by stronger order books and improved production prospects, particularly in transport and machinery sectors. Dive deeper

The U.S. is considering curbs on exports to China made with American software, including products like laptops and jet engines, in response to Beijing’s rare earth export restrictions, as part of a broader trade escalation planned by the Trump administration. Dive deeper

Singapore’s annual inflation rose to 0.7% in September 2025 from 0.5% in August, driven by higher transport and education costs, while core inflation edged up to 0.4%. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Sukamal Banerjee, Executive Director & CEO, Cyient, on inorganic growth and AI-led expansion

“We’re evaluating acquisitions worth over $100 million to build competencies in high-growth areas like digital, AI, automotive, and U.S. defence.”

“The idea isn’t just to scale numbers but to acquire firms that add strategic value and can be cross-leveraged across our customer base.”

“AI is fundamentally transforming engineering processes, and we’re investing heavily to stay ahead of the curve and engage clients proactively.” - Link

Poonam Upadhyay, Director, Crisil Ratings, on GST rate cut and apparel retail growth

“The GST rate cut comes at the perfect time for apparel retailers, aligning with the festive and wedding seasons when spending peaks.”

“We expect this move, along with easing inflation and stronger consumer sentiment, to add nearly 200 basis points to organized retailers’ revenue growth, keeping it in the 13–14% range this fiscal.”

“Larger brands will see quicker gains, but smaller organized retailers too will benefit as the GST revision narrows the price gap with the unorganized market, especially in tier II and III cities.”- Link

Alexandr Wang, Chief AI Officer, Meta, on restructuring its AI division

“Meta is cutting 600 jobs in its AI division to streamline operations and address organizational bloat after an aggressive hiring phase.”

“The job reductions will focus on AI product and infrastructure teams, while the TBD Lab led by Mark Zuckerberg remains unaffected.”

“The goal is to boost efficiency; fewer conversations will be required to make a decision without slowing progress on core AI initiatives.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

Calendars

In the coming days, we have the following quarterly results, significant events, and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!