Nifty remains shaky at higher levels as it slips below 25,700

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we explore Week 2 of 2026, where the year started on a shaky note as Indian markets reversed sharply after fresh all-time highs just a week earlier. Rising global tariff tensions—particularly around the US trade stance—hit sentiment hard, leading to a broad-based sell-off, broken support levels, a pickup in volatility, and a sharp expansion in option premiums.

In this episode, we break down price action across NIFTY, SENSEX, and BANKNIFTY across timeframes, examine ranges and open interest positioning, track the volatility spike, review sector and commodity performance, and discuss what this sudden regime shift means for traders and investors heading into the coming week.

Market Overview

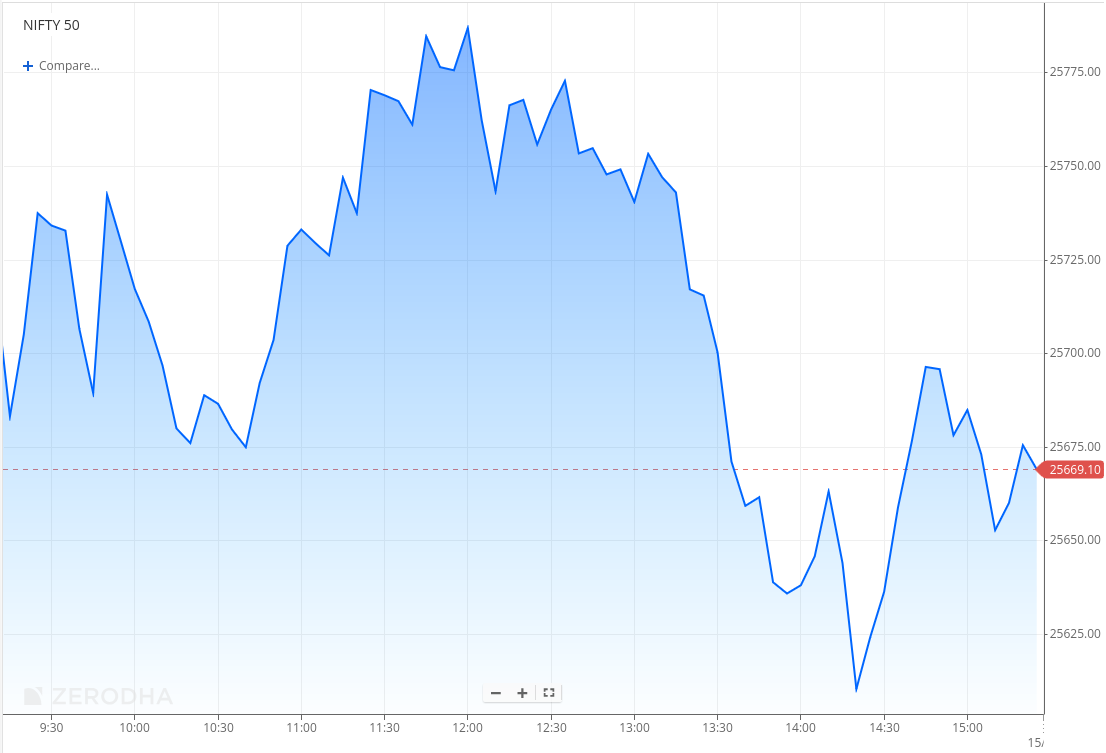

Nifty opened with an 83-point gap-down at 25,649 but moved higher in the opening minutes, rallying toward 25,750 within the first 15 minutes. The early gains, however, were followed by sharp volatility, with the index slipping back toward the 25,670 zone during the first hour. As the morning progressed, buying interest gradually emerged, allowing Nifty to recover steadily and extend gains into the first half, testing the 25,780–25,790 zone around noon.

In the second half, selling pressure resurfaced. Post 1 PM, the index slipped sharply, falling toward the 25,600–25,610 zone by around 2:30 PM, marking the weakest phase of the session. A recovery attempt followed in the final hour, helping Nifty retrace part of the losses. The index eventually closed at 25,665.60, ending marginally above the day’s lows and reflecting a volatile, two-sided session marked by profit-taking at higher levels and late dip-buying.

Looking ahead, markets are likely to remain sensitive to global risk appetite, the onset of the Q3 earnings season, and further developments around India–U.S. trade negotiations.

Broader Market Performance:

The broader market had a mixed session today. Out of 3,242 stocks that traded on the NSE, 1,573 advanced, while 1,570 declined, and 99 remained unchanged.

Sectoral Performance:

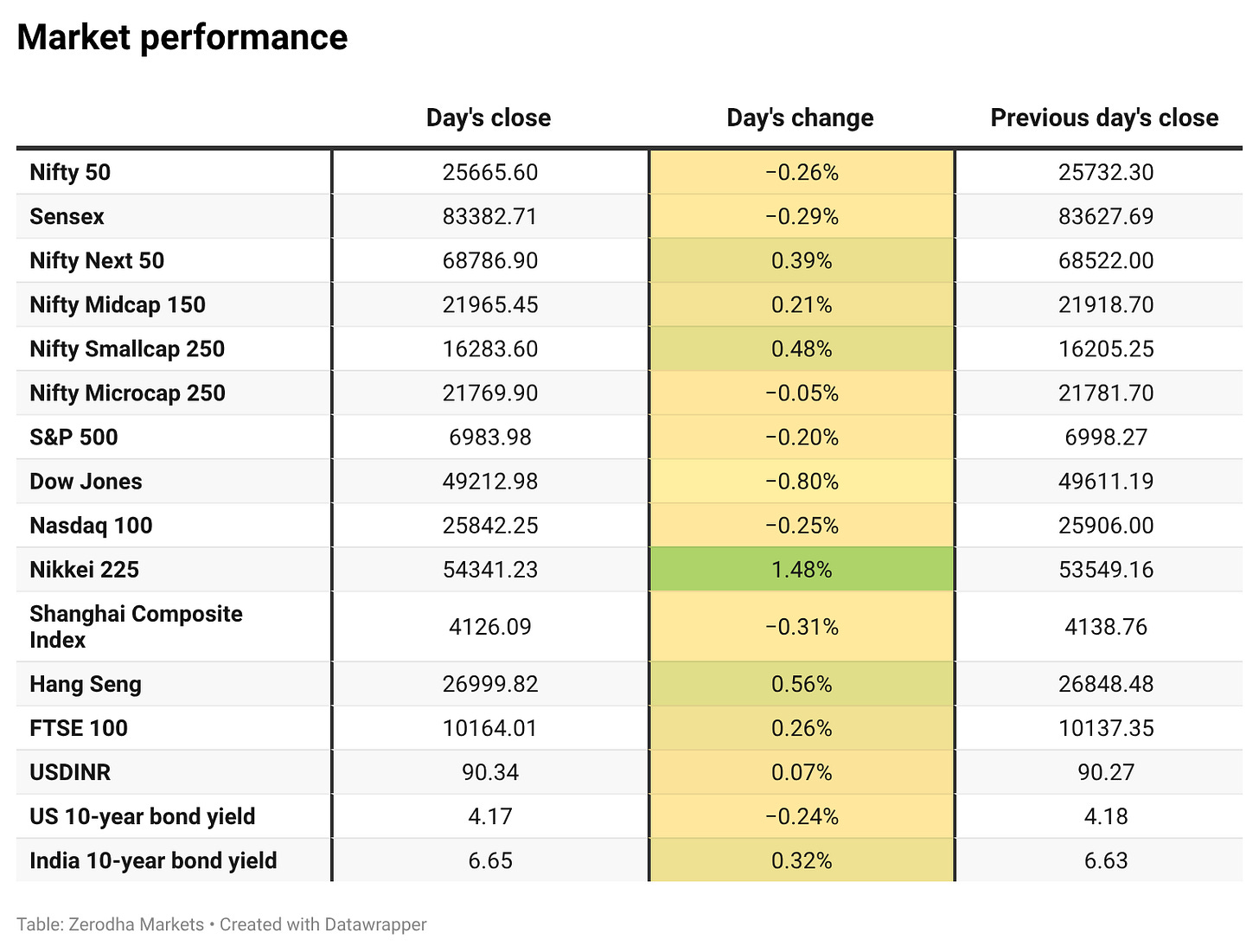

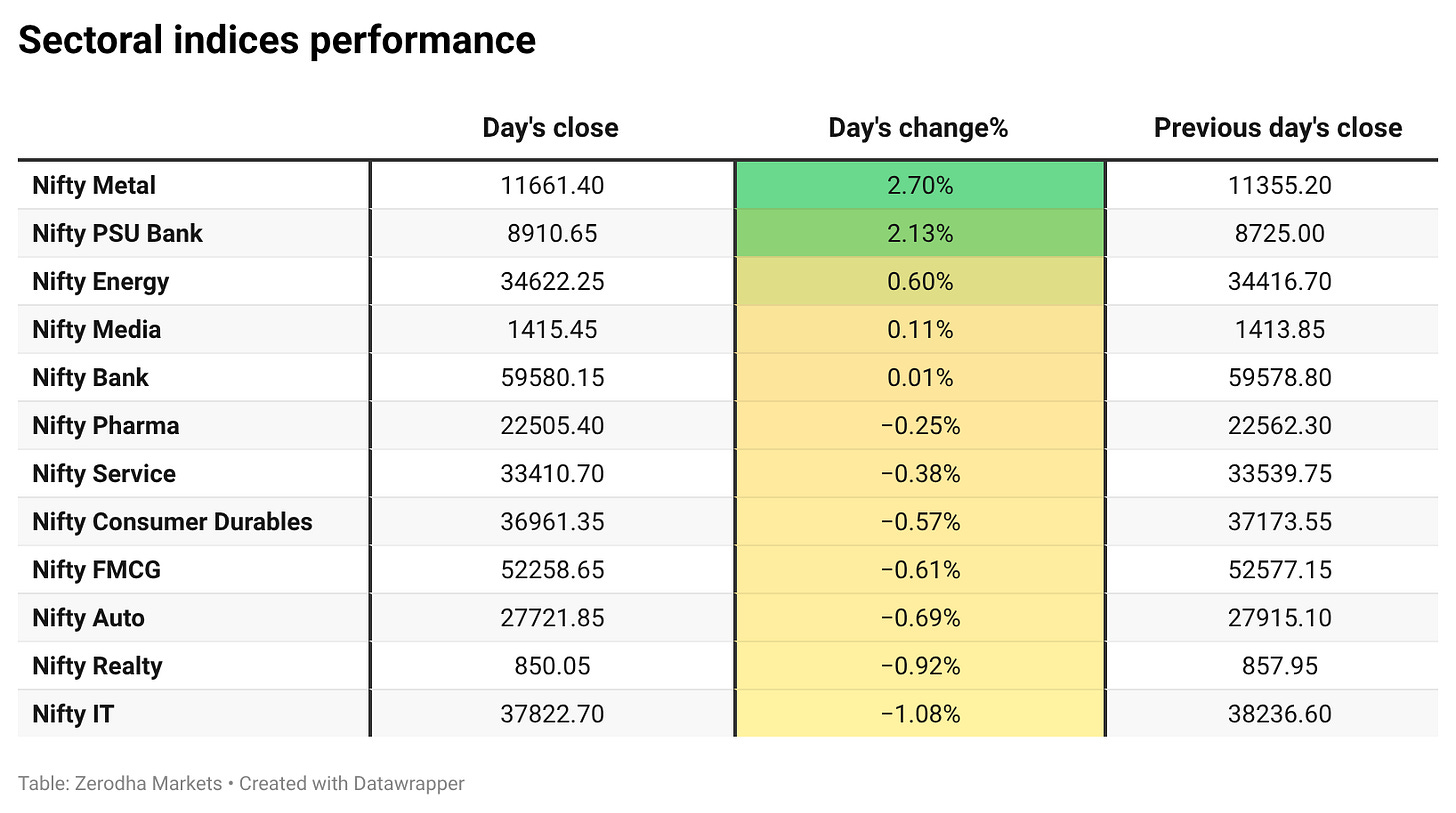

Nifty Metal was the top gainer for the day, rising 2.70%, while Nifty IT was the biggest loser, dropping 1.08%. Out of the 12 sectoral indices, 5 ended in the green and 7 closed in the red, indicating a mildly negative breadth across sectors.

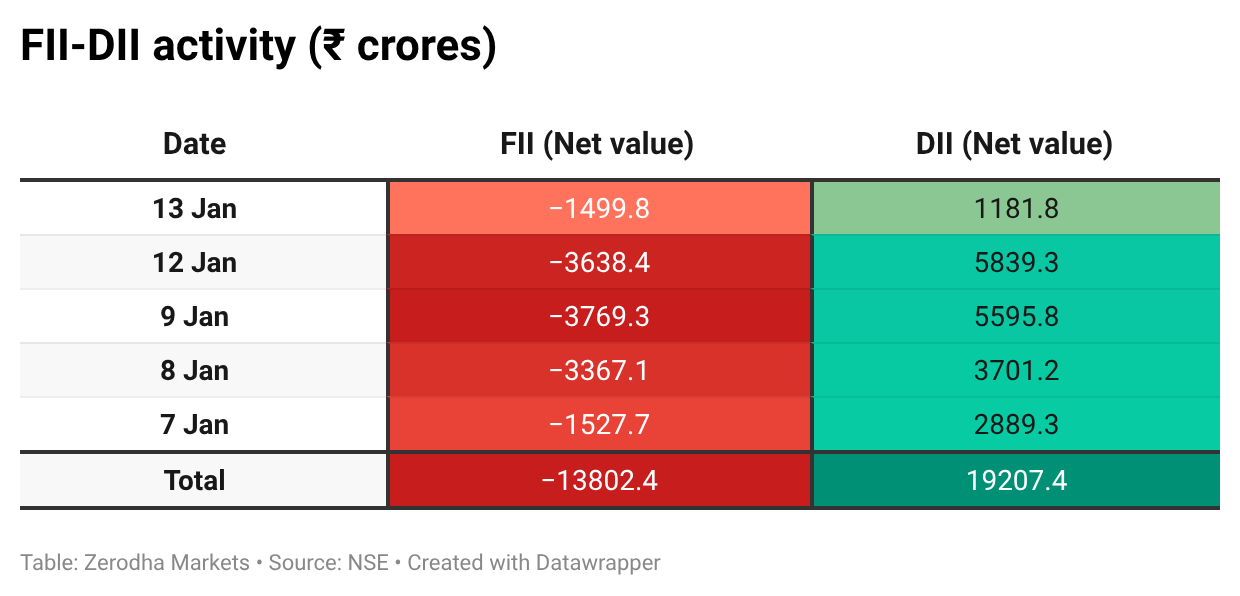

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 20th January:

The maximum Call Open Interest (OI) is observed at 26,000, followed by 25,800, indicating potential resistance at the 25,900 -26,000 levels.

The maximum Put Open Interest (OI) is observed at 25,600, followed by 25,500, suggesting support at the 25,600 to 25,500 levels.

Note: OI is subject to multiple interpretations; however, generally, an increase in Call OI indicates resistance in a falling market, while an increase in Put OI indicates support in a rising market.

Source: Sensibull

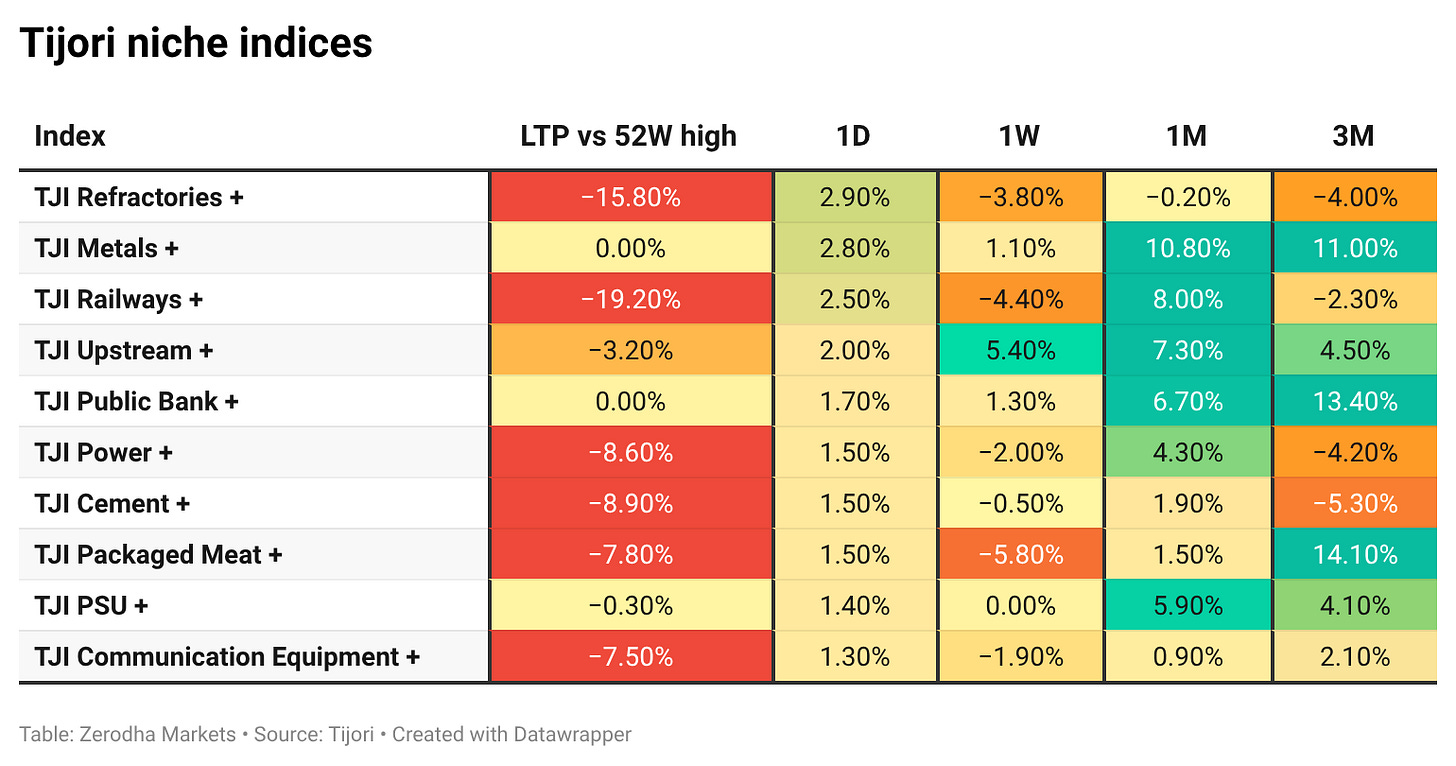

Tijori is an investment research platform that has constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

The rupee recovered to around 90.1 per dollar amid cautious sentiment ahead of India - US trade talks, with tariff concerns easing due to limited exposure. The World Bank retained India’s FY27 growth forecast at 6.5%, pointing to a moderation from this year. Dive deeper

Infosys reported a 2% YoY drop in Q3 net profit to ₹6,666 crore due to the labour code impact, while revenue rose about 9% to ₹45,479 crore, and the company revised FY26 revenue growth guidance to 3 to 3.5%. Dive deeper

Indian government bonds extended losses as markets reacted to Bloomberg’s surprise decision to defer including Indian debt in the Global Aggregate Index, prompting caution and higher yields. Dive deeper

HDFC AMC reported a robust Q3 with standalone net profit rising 20% YoY to ₹770 cr and revenue up 15% to ₹1,074 cr, reflecting continued growth momentum in its core business. Dive deeper

Union Bank of India’s Q3 results showed easing bad loans and a rise in net profit, with improved asset quality and steady loan growth underpinning the earnings. Dive deeper

IOC and BPCL’s joint venture Urja Bharat has announced two oil discoveries in Abu Dhabi’s Onshore Block 1, strengthening India’s overseas upstream presence. The discoveries will now be appraised to assess commercial viability and potential development. Dive deeper

India’s wholesale price inflation rose to 0.83% year-on-year in December, reversing a contraction seen in the previous month and coming in above market expectations. The increase was driven by higher manufacturing costs in sectors such as machinery, food products, and textiles. Dive deeper

Swiggy and Zepto have removed “10-minute” delivery branding from their apps following a government directive, amid concerns over rider safety and work conditions. The companies said the change does not alter their core quick-commerce business model. Dive deeper

Mercedes-Benz India expects a modest decline in 2025 sales to around 19,007 units as it shifts focus to value over volume amid a slower luxury vehicle market outlook, prioritising profitability and premium offerings over sheer unit growth. Dive deeper

Bharat Coking Coal’s IPO listing was deferred to January 19 from January 16 due to Maharashtra municipal elections and the market holiday on January 15. Dive deeper

Flipkart is set to more than double its investment in Shadowfax, with its 14.8% stake valued at about ₹929 crore at the IPO price band, implying a paper gain of over ₹600 crore. Dive deeper

What’s happening globally

WTI crude rose to around $61.9 a barrel, hitting a multi-month high as geopolitical tensions in the Middle East raised concerns over potential supply disruptions from Iran. Dive deeper

Gold rose above $4,630 an ounce to a record high, supported by easing US inflation data and growing expectations of multiple Federal Reserve rate cuts. Dive deeper

Silver surged past $90 an ounce to record highs as safe-haven buying, strong industrial demand, supply deficits, and tariff uncertainty lifted prices. Dive deeper

The dollar index climbed to around 99.2, nearing a multi-month high as US inflation data reinforced expectations of the Fed keeping policy unchanged in the near term. Dive deeper

US inflation held steady at 2.7% in December, in line with expectations, with easing energy prices offset by faster increases in food and shelter costs. Core inflation remained unchanged at 2.6%, marking its lowest level since 2021. Dive deeper

European equities hit fresh record highs, led by gains in utilities and healthcare stocks, with the STOXX 50 and STOXX 600 both advancing. Markets were also supported by strong China trade data, while investors tracked developments around US tariffs and luxury sector exposures. Dive deeper

China’s trade surplus hit a record of nearly $1.2 trillion in 2025, as export growth offset weaker shipments to the US. Exports rose 5.5% for the year, while imports remained largely flat, underscoring the role of trade in supporting growth. Dive deeper

Amazon said it has held talks with some suppliers to adjust pricing following a reduction in US tariffs on Chinese imports. The discussions come as the company reassesses cost concessions made earlier to offset tariff-related pressures. Dive deeper

Shares of several US and Israeli cybersecurity firms fell after reports that Chinese authorities asked domestic companies to stop using certain foreign security software over national security concerns. The move raised fears of reduced access to the Chinese market for affected firms. Dive deeper

Management chatter

In this section, we highlight interesting comments made by the management of major companies and policymakers from the Indian and Global Economies.

Subrahmanyam Jaishankar, External Affairs Minister, India, on India-US trade and energy talks

“Just concluded a good conversation with Secretary Rubio.”

“Discussed trade, critical minerals, nuclear cooperation, defence, and energy.”

“We have a shared interest in strengthening economic cooperation between India and the United States.” - Link

Karan Taurani, Executive Vice President, Elara Capital, on quick commerce branding changes

“The removal of the 10-minute delivery catchline is largely optics-driven rather than business-altering.”

“The proposition of quick commerce continues to be anchored in speed, convenience, and proximity led fulfilment.”

“This model remains structurally superior to horizontal e-commerce timelines.” - Link

Geoff Dennis, Head of Global Strategy, Matthews Asia, on 2026 outlook and the role of geopolitics:

“I think 2026 will be the year of geopolitics, not AI.”

“Emerging markets still remain resilient despite global uncertainties.”

“Investors should focus on macro and geopolitical catalysts rather than purely technology-led narratives.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

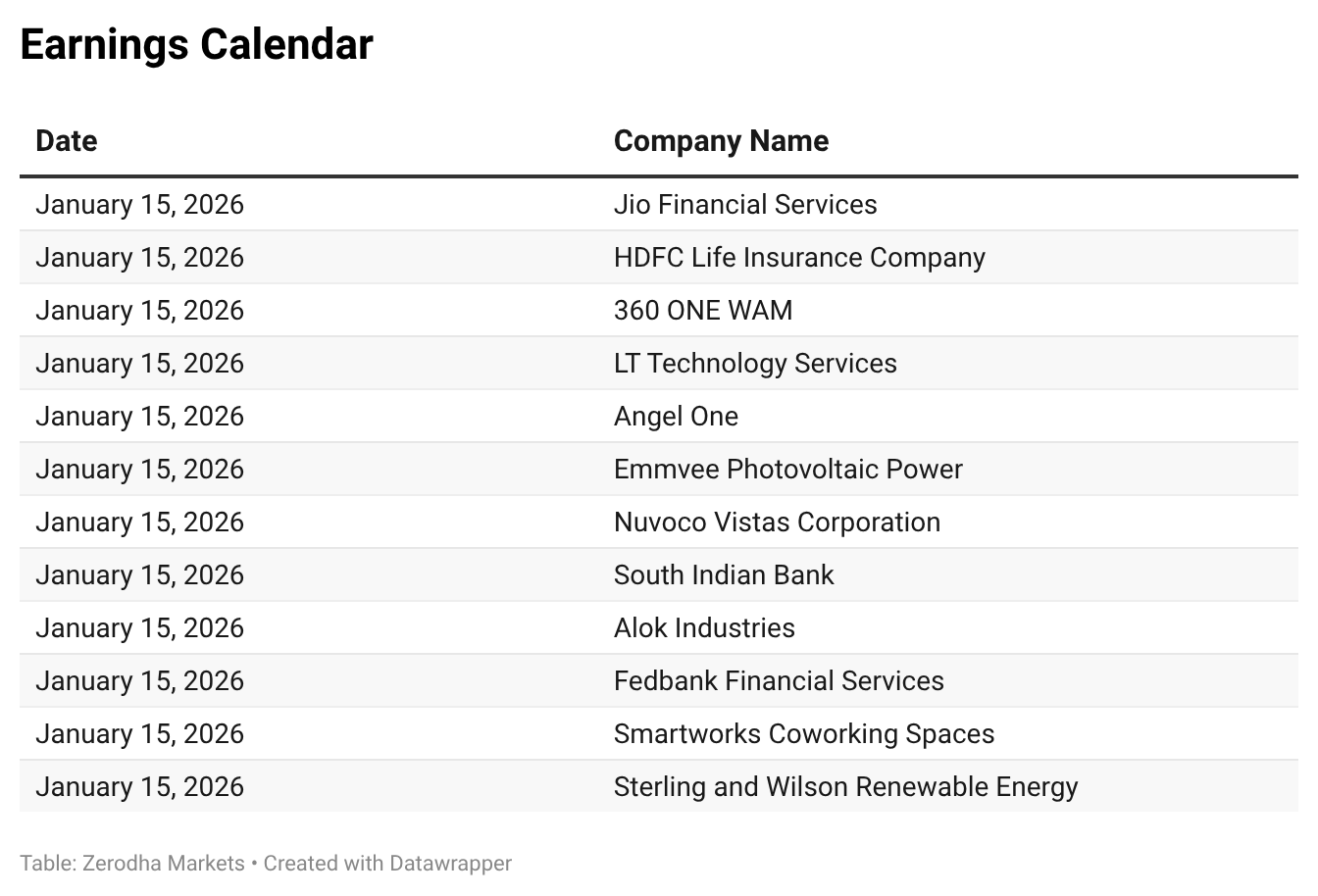

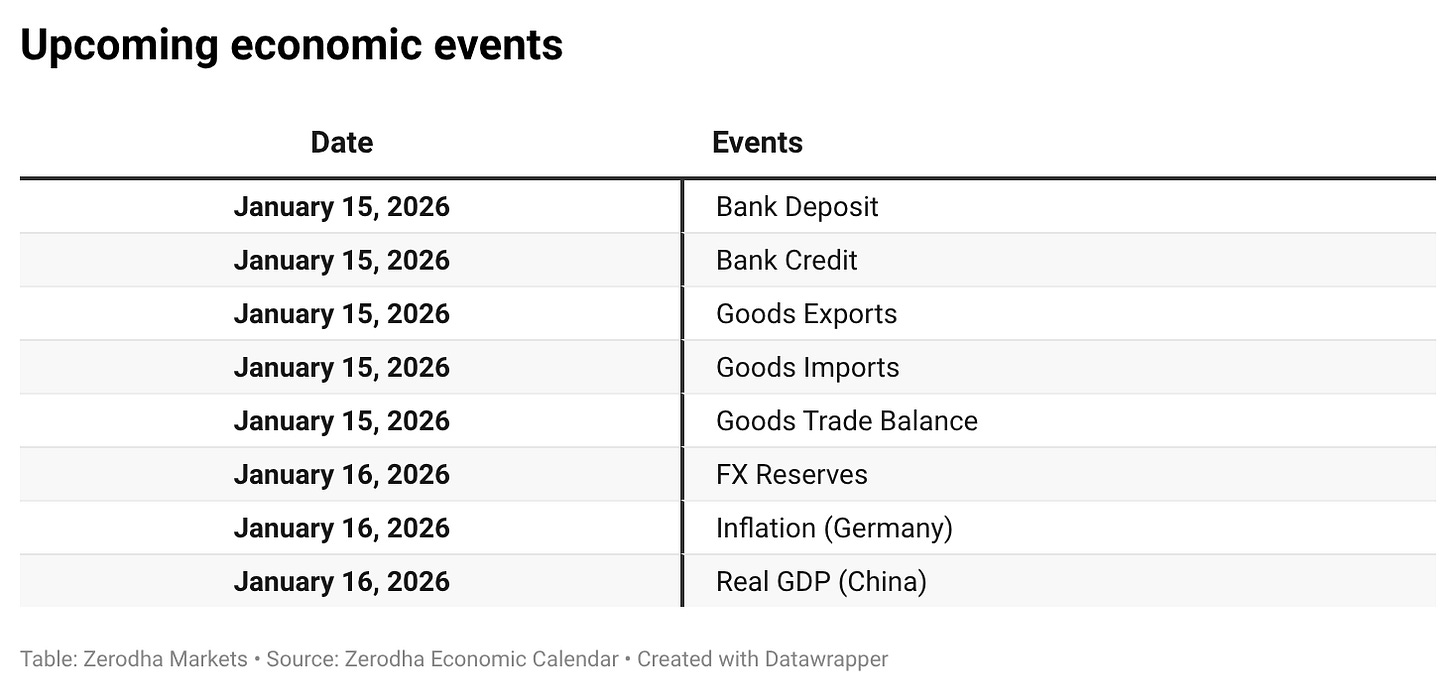

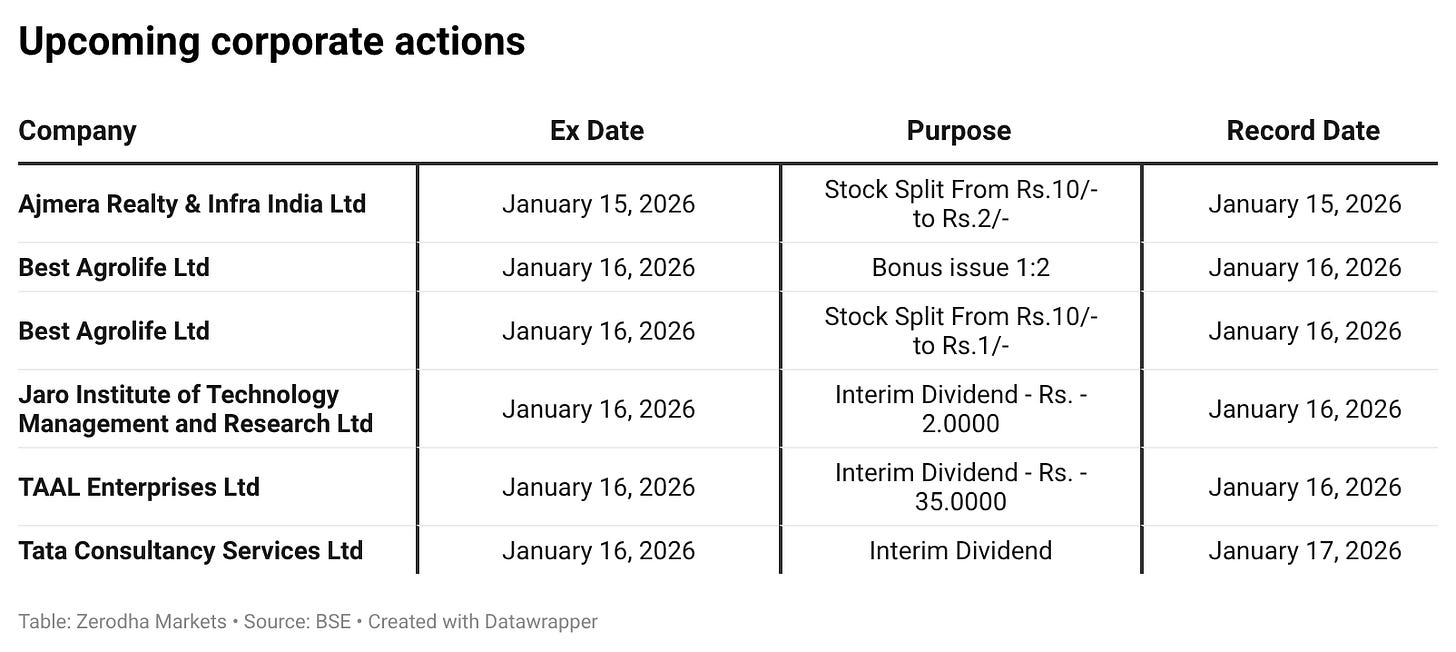

Calendars

In the coming days, we have the following significant events, quarterly results, and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!