Nifty reclaims 26,000 once again; Will it sustain this time?

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we break down a week defined by trend continuation, fresh all-time highs, and a clear return of bullish momentum across major indices.

The global headline belonged to Warren Buffett, who officially announced his retirement — marking the end of an era in investing.

On the home front, Bihar’s election results brought a mid-week jolt of uncertainty. While we expected it to be a non-event, the market clearly had other ideas.

Market Overview

Nifty opened with a 40-point gap-up at 25,948, extending the strong momentum from Friday’s late surge despite mixed global cues. After a brief dip toward the 25,910 zone in the opening minutes, the index stabilised and gradually moved higher through the morning session, reclaiming 25,980 and inching toward the 26,000 mark by noon.

Through the afternoon, Nifty maintained a firm upward bias, oscillating steadily between 25,980 and 26,020. In the final hour, the index strengthened further, decisively crossing 26,000 and touching the day’s high near 26,020 before settling at 26,013.45, up around 0.39%.

Overall, it was a constructive session characterised by steady intraday accumulation and continued follow-through buying after Friday’s strong close.

Looking ahead, markets are likely to remain sensitive to developments around the India–U.S. trade deal and broader global cues.

Broader Market Performance:

The broader markets had a mixed session, slightly tilted towards bullish bias today. Of the 3,253 stocks traded on the NSE, 1,651 advanced, 1,523 declined, and 79 remained unchanged.

Sectoral Performance:

The top-gaining sector was Nifty PSU Bank, which rose 1.09%, while the top-losing sector was Nifty Metal, ending almost flat with a marginal 0.01% uptick.

Out of the 12 tracked indices, all 12 sectors closed in the green, indicating broad-based market participation and sectoral strength across the board.

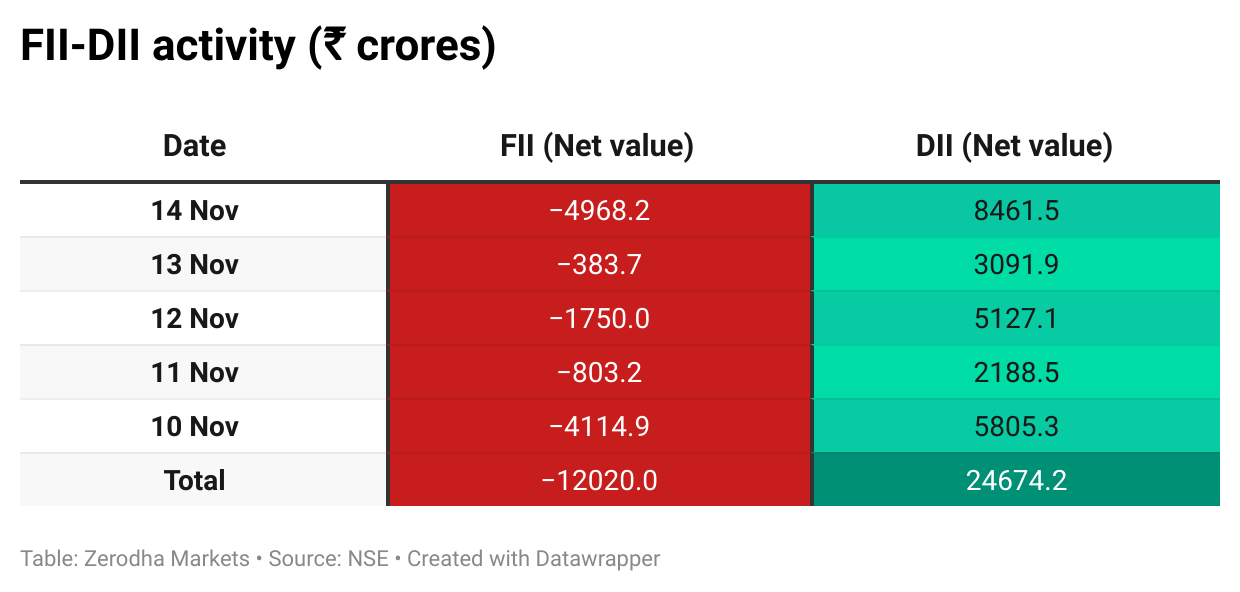

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 18th November:

The maximum Call Open Interest (OI) is observed at 26,000, followed by 26,100, indicating potential resistance at the 26,100 -26,200 levels.

The maximum Put Open Interest (OI) is observed at 25,900, followed by 25,800, suggesting support at the 25,900 to 25,800 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

Indian oil companies have signed their first-ever deal to import LPG from the US, reducing reliance on traditional Middle Eastern suppliers. The move is aimed at diversifying India’s energy sources and strengthening long-term supply security. Dive deeper

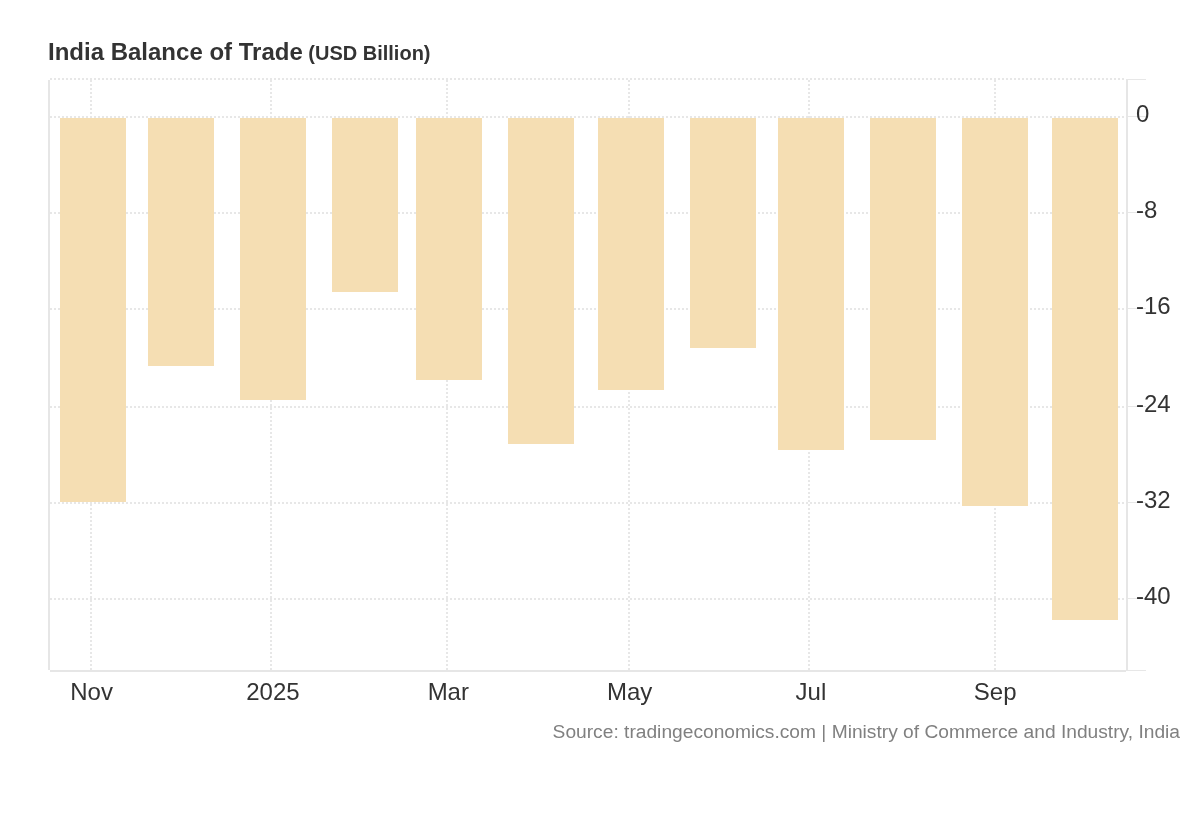

India’s trade deficit hit a record USD 41.68 billion in October 2025 as imports surged to USD 76.06 billion on sharply higher gold and silver purchases. Exports fell to USD 34.38 billion, partly due to the impact of recent US tariffs. Dive deeper

Passenger vehicle sales in India rose 15.8% year-on-year to 399,605 units in October 2025, helped by festive demand and the GST rate cut. Monthly sales were also higher, jumping 27.8% from September, according to SIAM. Dive deeper

CNG pumps across Mumbai saw long queues and several closures after third-party damage to GAIL’s main pipeline disrupted supply, leading to low gas pressure. The disruption affected thousands of CNG-run vehicles across the city. Dive deeper

Titan Intech Ltd has signed an MoU with the Andhra Pradesh Economic Development Board to invest ₹250 crore in setting up a display-electronics manufacturing facility in the Amaravati region, in what signals a notable boost to the state’s manufacturing ambitions. Dive deeper

SEBI will inform the court that it will not release additional data sought by Jane Street in its appeal against a temporary trading ban. The regulator says the information requested is unnecessary and could affect its ongoing investigation into alleged index manipulation. Dive deeper

Maruti Suzuki India Ltd has announced a recall of 39,506 units of its Grand Vitara model, manufactured between December 9, 2024, and April 29, 2025, due to a fault in the fuel-level indicator and warning light that may misreport fuel status. Dive deeper

The government has placed import restrictions on certain categories of unstudded platinum jewellery, shifting their status to “restricted” until April 2026 and requiring import licences from the Directorate General of Foreign Trade (DGFT). Dive deeper

Alembic Pharmaceuticals received USFDA final approval for its Diltiazem Hydrochloride Tablets used for hypertension and angina. With this, the company’s total ANDA approvals reached 230. Dive deeper

Ideaforge Technology secured over ₹100 crore in defence orders, including a ₹75-crore Indian Army contract for its new Zolt tactical UAV and a ₹30-crore order for its SWITCH 2 drone. The orders follow extensive field trials and will be delivered within 6–12 months. Dive deeper

V2 Retail reported a profitable Q2 with revenue at ₹709 crore and net profit at ₹17.2 crore, compared to a loss last year. The company added 43 new stores, taking its total to 259. H1 results also showed higher revenue, EBITDA, and net profit. Dive deeper

IRB Infrastructure received NHAI’s ₹9,270-crore TOT-17 project, a 20-year concession covering 366 km across the Lucknow–Ayodhya–Gorakhpur and Lucknow–Varanasi corridors. With this award, the IRB Group’s portfolio expands to 27 highway assets across its platforms. Dive deeper

RBI’s latest export relief measures, including extending the realisation window to 15 months, may lead exporters to delay bringing back foreign earnings. Bankers say this could reduce near-term dollar supply and add pressure on the rupee. Dive deeper

The government approved 17 projects worth ₹7,172 crore under the Electronics Component Manufacturing Scheme. These projects are expected to generate a cumulative production of ₹65,111 crore. Dive deeper

What’s happening globally

Brent crude fell to $64.1 after Russia’s Novorossiysk port reopened following a two-day shutdown from a drone strike. Tanker activity resumed, reversing last week’s disruption-driven price gains. Dive deeper

Gold hovered near $4,080 ahead of multiple delayed US economic data releases, including the September jobs report and the Fed’s meeting minutes. Expectations for a December rate cut have decreased following recent Fed comments. Dive deeper

Euro Area full-year GDP growth rose to 0.9% in 2024 from 0.4% in 2023, with forecasts pointing to a gradual recovery toward 1.1% in 2025 and around 1.4% by 2027. Dive deeper

Japan’s super-long bond yields surged, with the 20-year yield hitting a 26-year high, driven by concerns over Prime Minister Sanae Takaichi’s fiscal plans. The jump followed reports of a possible 17 trillion yen stimulus package. Dive deeper

Switzerland’s economy contracted 0.5% in Q3 2025, its first decline since 2023, as the 39% US tariff hit the export-heavy economy. The chemical and pharmaceutical sector saw a sharp drop, and the overall industry weakened. Dive deeper

Samsung announced a $310 billion investment over five years, largely focused on AI-related technologies. The plan includes a new semiconductor plant set to start operations in 2028 and two AI data centres, along with EV-battery projects under Samsung SDI. Dive deeper

Japan’s GDP fell 0.4% in Q3 2025, its first decline since early 2024, as consumption weakened and exports dropped following new U.S. tariffs. Government spending and business investment, however, saw their strongest increases in five quarters. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Rajeev Kannan, Managing Executive Officer & India Head, SMBC, on Yes Bank stake and long-term plans

“We do see Yes Bank as a very strong top-five bank in the future, and we see it getting back to that position with our support.”

“We have no intentions to come in now and exit with a timeline; we are here with permanent capital, as long as regulators allow us.”

“If there is an option to go beyond 24.99% stake, we may be open to it, subject to regulatory discussions.” - Link

Kirthi Chilukuri, Founder & Managing Director, Stonecraft Group, on the new Telangana township project

“The 110-acre integrated development, Temple Town, reflects our commitment to creating spaces that honour India’s spiritual roots while meeting the aspirations of today’s homebuyers.”

“We are witnessing a growing interest in owning homes near revered religious destinations.”

“This project underscores our focus on building developments that blend cultural significance with modern living.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

This article comes at the perfect time! Thank you for such a clear and smart analysis. It's truly fascinating to see Nifty reclaim 26,000 and the continous follow-through buying. I always wonder about the complex dynamics driving these market movements. So insightful!