Nifty reclaims 26,000 on trade deal optimism; Broader markets outperform

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we explore the widely-used but deeply misunderstood expiry-day phenomenon of penny options—those far-OTM ₹1–₹2 “chillar” strikes that create asymmetric payoffs for both buyers and sellers.

We examine how far-OTM pricing reflects market fear, when selling can make sense around events, and why famous blow-ups like LTCM, XIV, and volatility spikes echo the same risk profile—showing why penny options look tempting, so often ruin traders, and why payoff asymmetry ultimately drives both risk and reward.

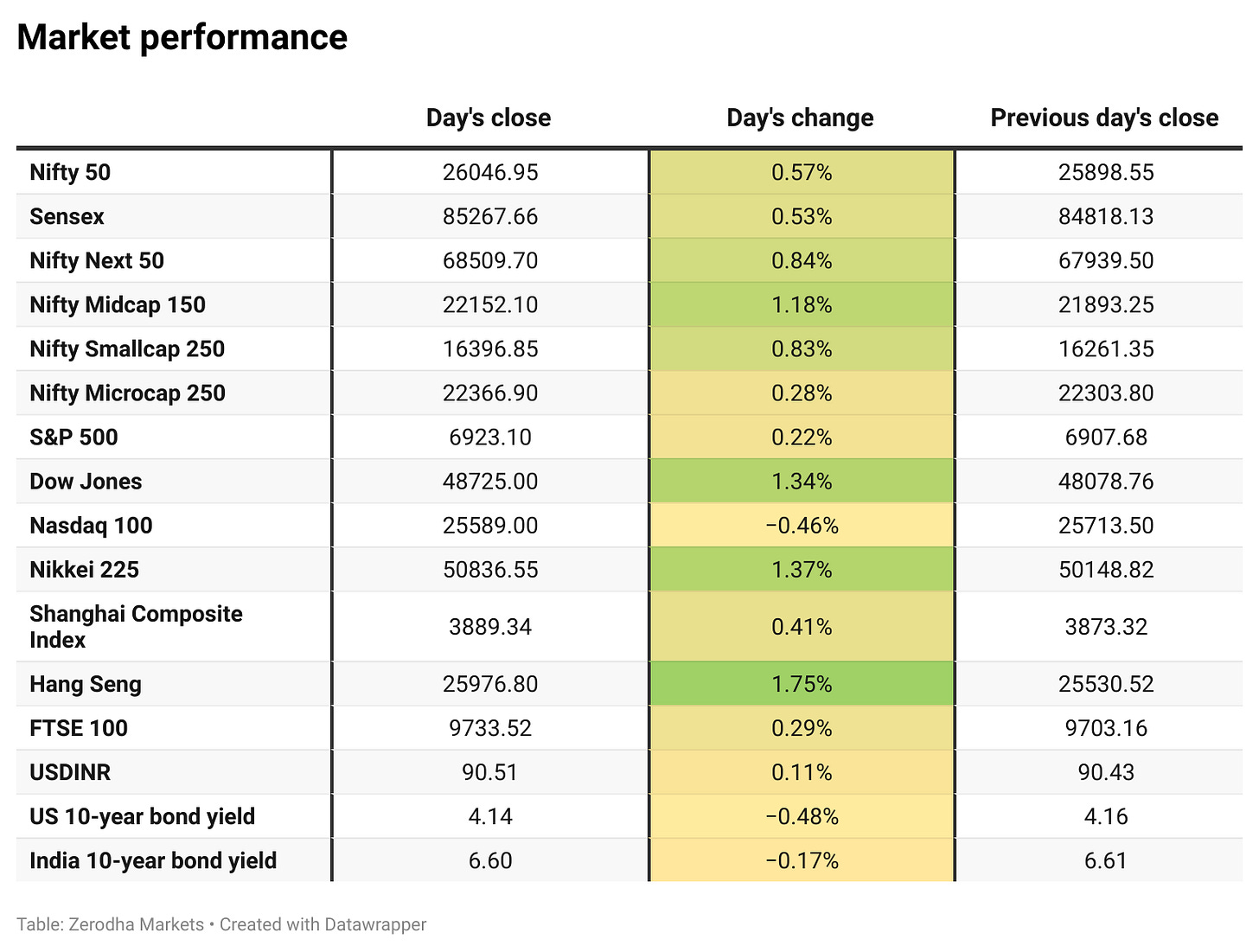

Market Overview

Nifty opened with a 73-point gap-up at 25,971, supported by improved sentiment after PM Modi’s tweet on progress in trade discussions following his conversation with U.S. President Trump. After some early volatility, the index moved toward the 26,020–26,030 zone in the first half hour but gradually eased back to the 25,940–25,950 range by around 11 AM.

By late morning, Nifty reclaimed the 26,000 mark and continued to grind higher, maintaining a positive bias through the noon session. In the second half, gains extended further, with the index moving into the 26,030–26,060 zone. Although brief intraday pullbacks toward 26,010–26,020 were seen, overall momentum remained constructive.

In the final hour, Nifty held firm near the highs and closed at 26,046.95, up 0.57%, marking a strong follow-through session driven by optimism around trade developments.

Looking ahead, markets are likely to remain sensitive to global risk appetite, currency movements, and further updates on India–U.S. trade negotiations.

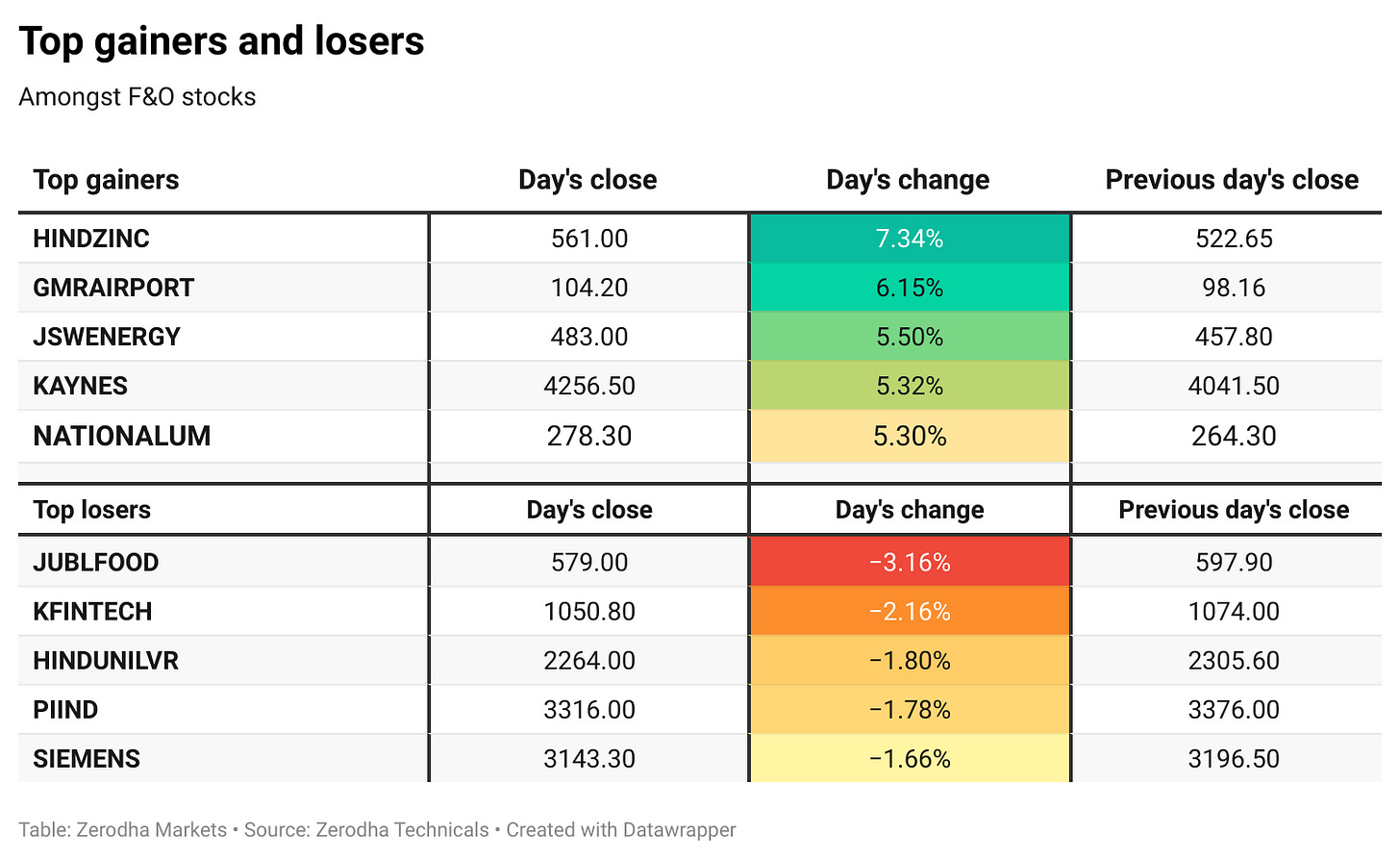

Broader Market Performance:

The broader markets continued their recovery today. Out of 3,196 stocks that traded on the NSE, 2,072 advanced, while 1,036 declined, and 88 remained unchanged.

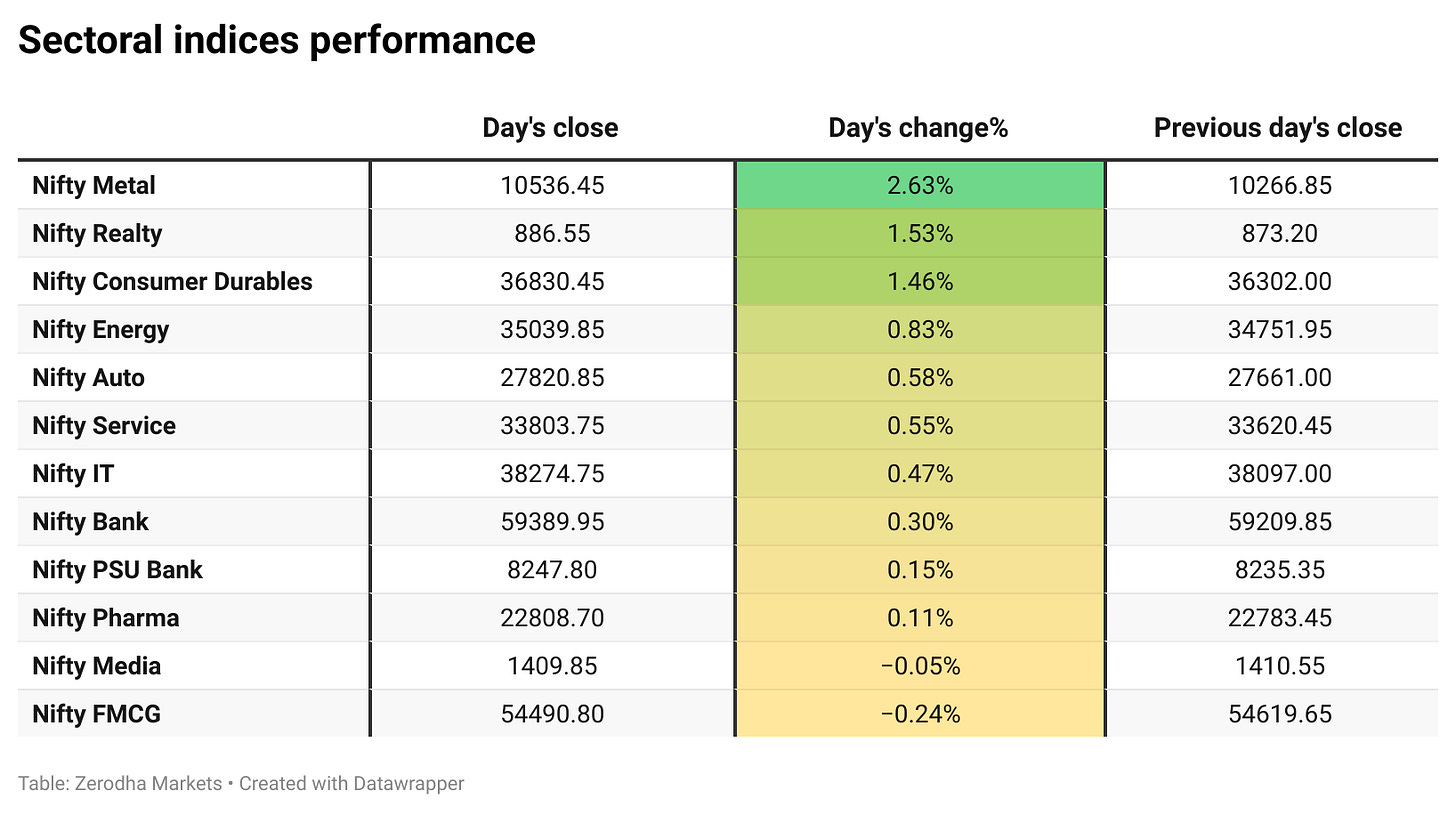

Sectoral Performance:

Nifty Metal was the top gainer, rising 2.63%, followed by Nifty Realty and Consumer Durables with gains of 1.53% and 1.46%, respectively. On the flip side, Nifty FMCG was the worst performer, slipping 0.24%. Out of the 12 sectoral indices, 10 ended in the green while 2 closed in the red, reflecting broad-based positive sentiment.

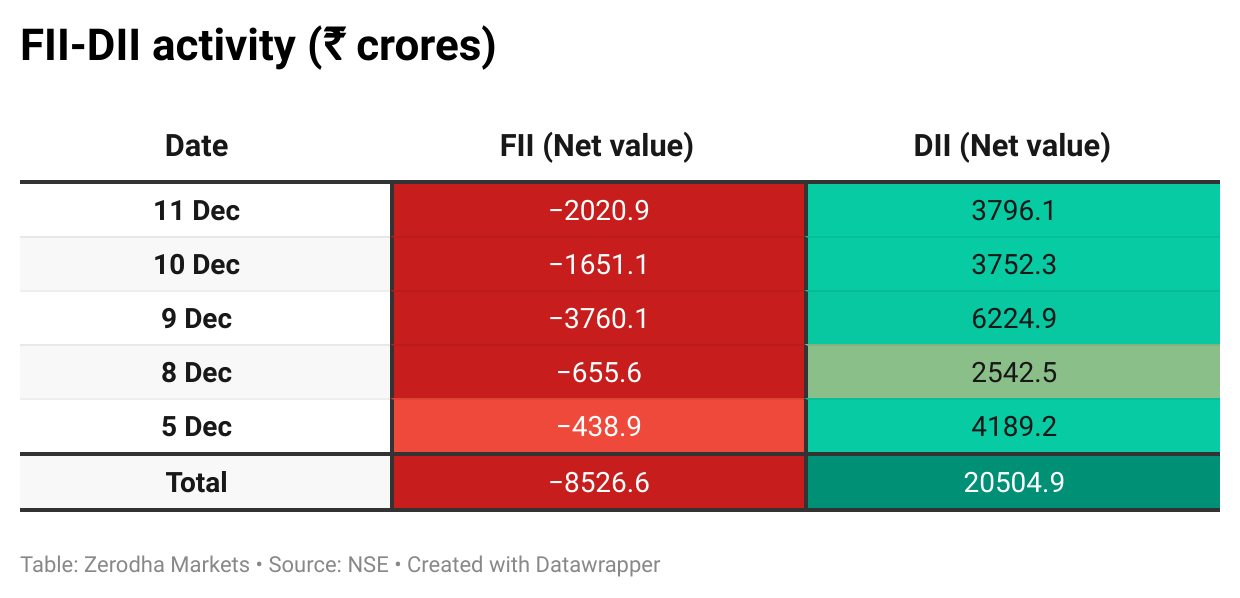

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 16th December:

The maximum Call Open Interest (OI) is observed at 26,500, followed by 26,200, indicating potential resistance at the 26,200 -26,300 levels.

The maximum Put Open Interest (OI) is observed at 26,000, followed by 25,800 & 25,900, suggesting support at the 26,000 to 25,900 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

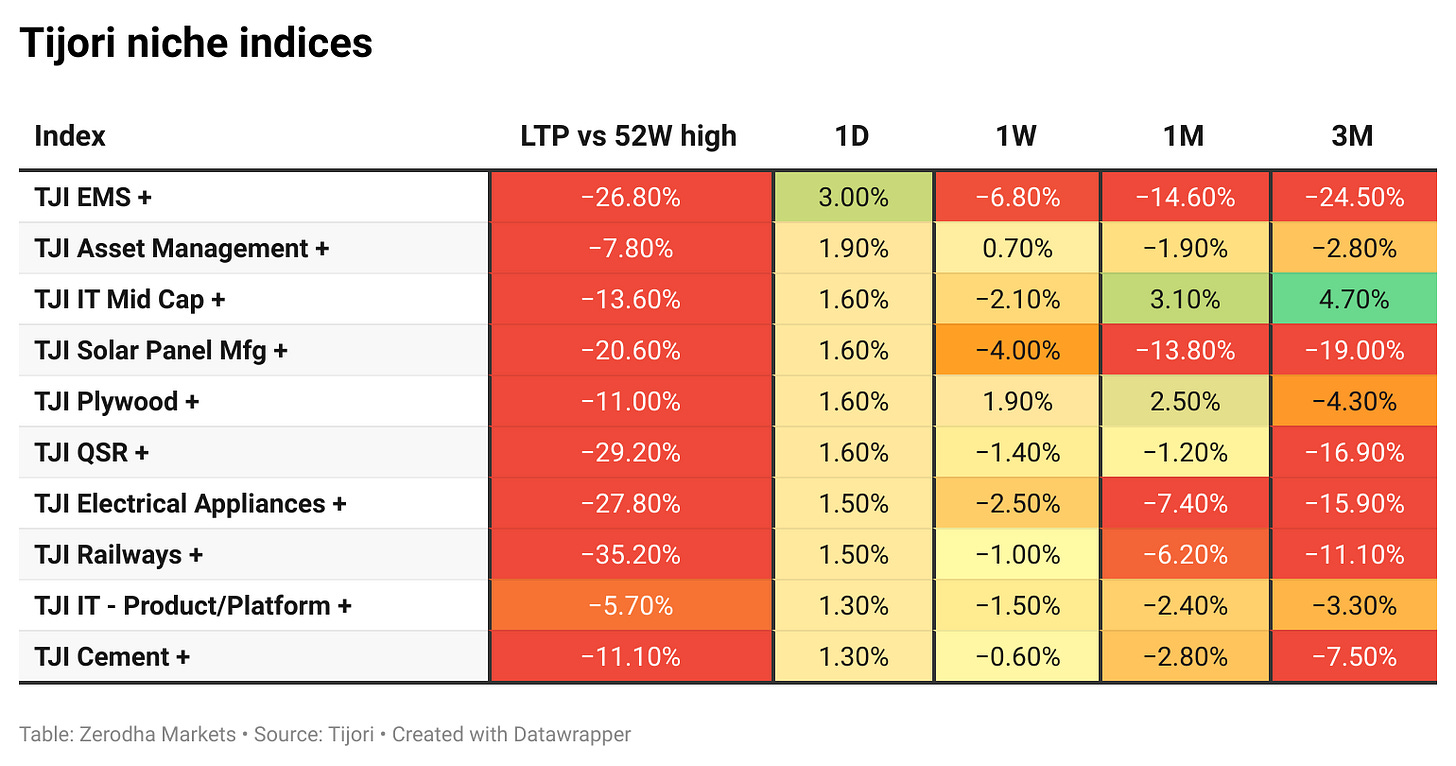

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

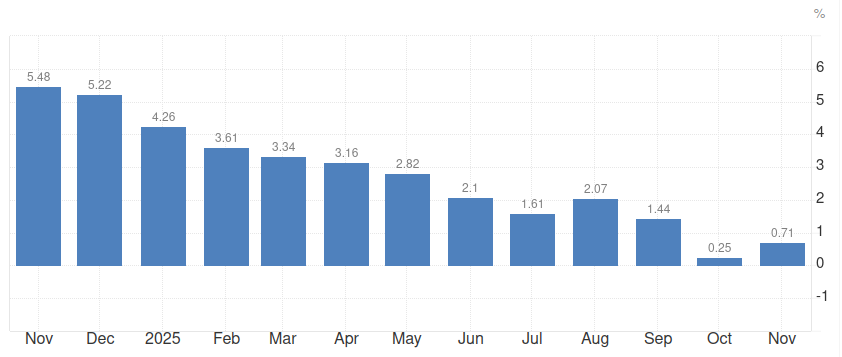

India’s CPI inflation edged up to 0.71% in November from a record low of 0.25% in October, driven by higher prices of vegetables, eggs, meat, spices, and fuel. Food inflation, however, remained in deflation at –3.91% year-on-year. Dive deeper

India’s auto wholesales posted strong year-on-year growth in November, led by broad-based demand across segments. Passenger vehicle wholesales rose 18.7% to 4.12 lakh units, while two-wheelers grew 21.2% to 19.44 lakh units. Three-wheeler wholesales increased 21.3% to 72,000 units, according to SIAM data. Dive deeper

PM Narendra Modi and U.S. President Donald Trump spoke on Thursday to review progress in the India–U.S. partnership and discussed expanding cooperation across key areas. Both leaders emphasized strengthening ties in trade, critical technologies, energy, defence, and security. Dive deeper

Satya Group, in partnership with Maple Group, will develop a luxury housing project in Gurugram with an investment of around ₹1,600 crore. The project, Levante Residences, is spread over 5 acres in Sector 104 along the Dwarka Expressway. Dive deeper

Refex Industries hit a 20% lower circuit after the company disclosed that the Income Tax Department conducted search operations at its registered office and other group-linked locations. Dive deeper

GMDC shares rose over 5% after the state-owned miner announced progress in its coal expansion plans. The company awarded operational responsibilities for its Baitarni-West coal mine in Odisha to a mining partner. Dive deeper

The Union Cabinet has approved CoalSETU, a new policy creating a dedicated auction window to make coal supply more seamless, efficient, and transparent. The reform allows coal linkage holders to export up to 50% of their coal, underscoring India’s adequate domestic coal production and ongoing sector reforms. Dive deeper

What’s happening globally

Gold rose above $4,350 per ounce on Friday, retesting the record highs seen in October. The metal is on track for a weekly gain, supported by expectations of further easing in U.S. monetary policy. Dive deeper

The UK trade deficit widened sharply to £4.82 billion in October 2025, the largest gap since February. The deterioration was driven by a 0.3% fall in exports and a 4.5% jump in imports, which rose to a seven-month high. Dive deeper

The European Union is set to indefinitely freeze around €210 billion of Russian central bank assets held in Europe to support Ukraine. EU governments are expected to approve the move by a qualified majority vote. Dive deeper

The Malaysian ringgit strengthened to a more than four-year high against the U.S. dollar, driven by optimism around the country’s economic outlook and exposure to the global tech cycle. The currency touched 4.0938 per dollar and is now Asia’s best-performing currency this year, up over 9%. Dive deeper

The UK economy unexpectedly shrank 0.1% month-on-month in October 2025, marking a second straight contraction and the fourth consecutive month without growth. The decline was led by a 0.3% drop in services, with sharp weakness in wholesale and retail trade and IT-related activities. Dive deeper

Management chatter

In this section, we highlight interesting comments made by the management of major companies and policymakers from the Indian and Global Economies.

Santosh Iyer, MD and CEO, Mercedes-Benz India, on hiking vehicle prices by up to 2% from January:

“Currency headwinds have persisted longer than we anticipated this year, with the euro consistently trading over the ₹100 mark. This prolonged volatility affects every aspect of our operations, from imported components for local production to completely built units.” - Link

Anil Agarwal, founder and chairman of Vedanta Ltd., on the recent oil & gas sector reforms:

This policy opens the sector to entrepreneurs, innovators, and even start‑ups. For the first time, university students and young professionals will be able to participate in exploration with minimal investment.

This is the kind of bold, inclusive policy that transformed the United States from a major importer into an energy‑surplus nation. Nearly 20,000 companies and individuals contributed to that revolution, supported by a facilitative ecosystem.

With these changes, I am confident that India can produce at least 50% of its energy domestically. - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

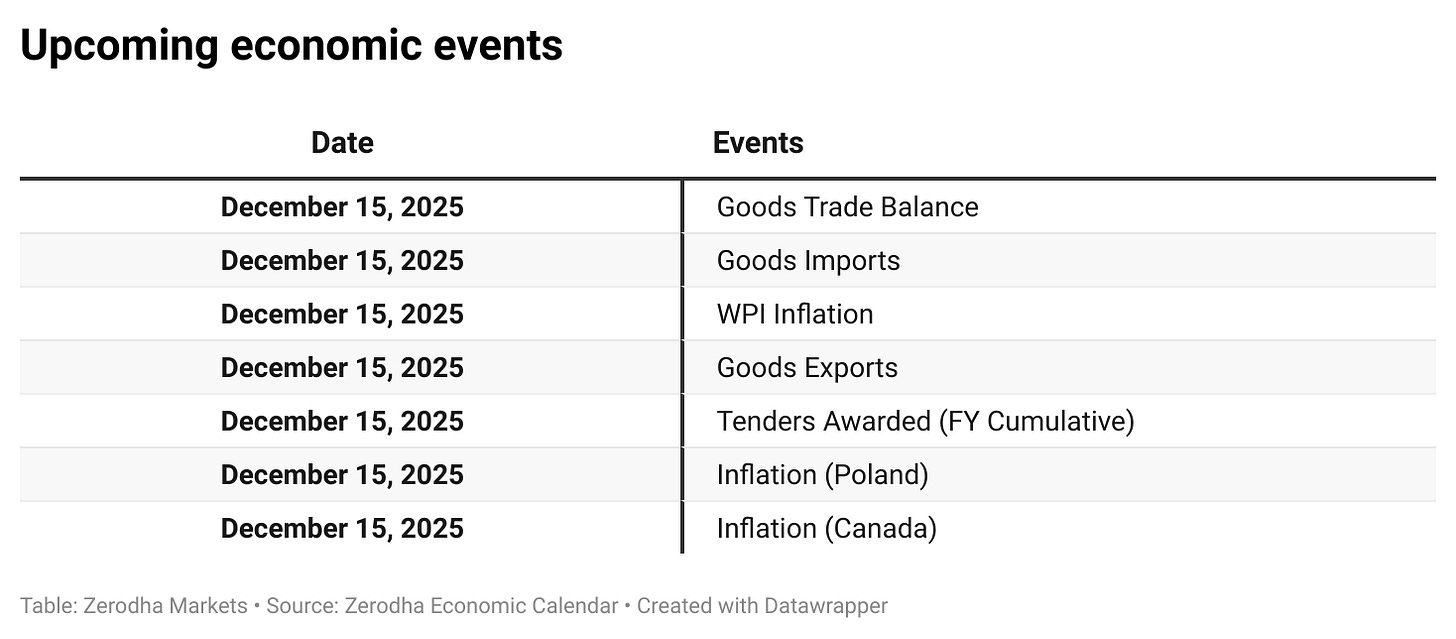

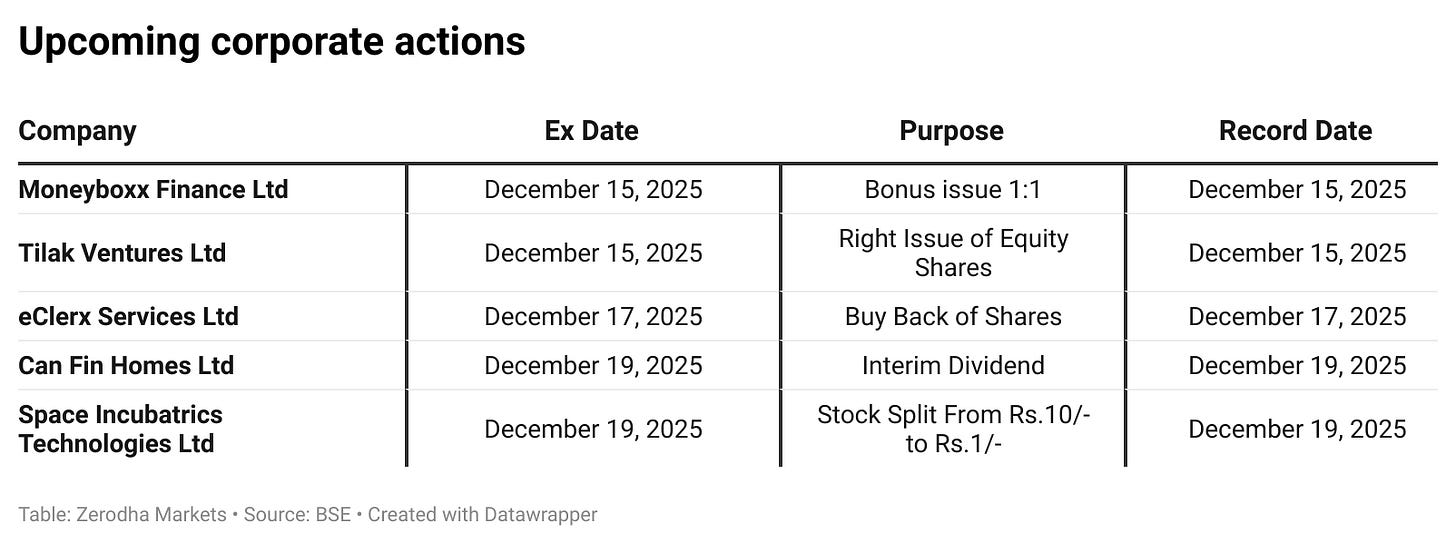

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!