Nifty rebounds sharply to close near 25,100 after initial hiccup

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we move beyond price and focus on volatility as a core non-price market feature, breaking down what volatility really means, how it is measured, the differences between Historical, Implied, and Realised Volatility, how India VIX works, and why volatility itself often mean-reverts, while also exploring why short volatility strategies perform better in certain regimes, why fully rules-based systems are difficult to build, and how institutions use valuation and relative relationships to complete the full picture of mean reversion as a trading and investing framework.

Market Overview

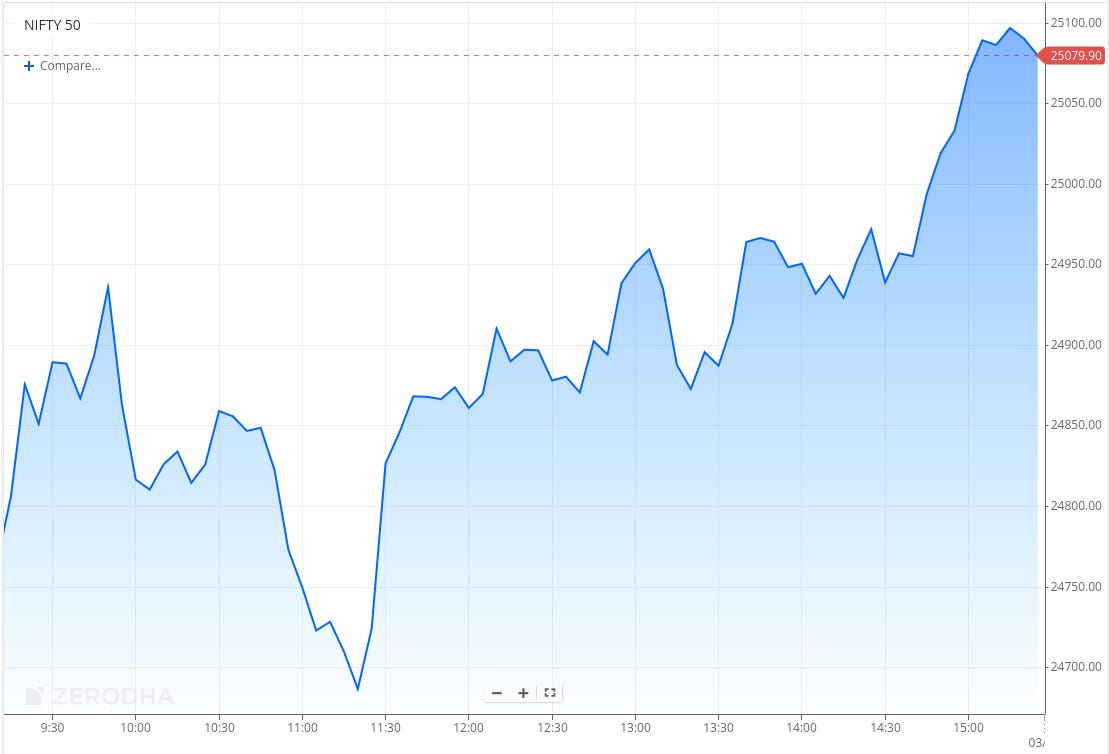

Nifty opened with a small 29-point gap-down at 24,796 and witnessed sharp volatility in the opening hour. The index initially slipped toward the 24,730–24,750 zone before staging a quick rebound, briefly testing the 24,920–24,940 levels as buying interest emerged at lower levels. However, the early strength proved short-lived, and Nifty drifted lower once again, hitting intraday lows near the 24,680–24,690 zone around 11:30 AM.

After forming these lows, the index recovered sharply and reclaimed the 24,850 mark by noon. In the second half, the uptrend strengthened further, with Nifty grinding higher through the afternoon and crossing the 25,000 level post 2:30 PM amid sustained buying interest. Strong late-session momentum pushed the index to fresh intraday highs above 25,100, and Nifty eventually closed near the day’s high at 25,088.40. Overall, it was a strong recovery from early weakness, ending with a decisive positive close driven by broad-based buying in the final hour.

Looking ahead, markets are likely to remain sensitive to global risk appetite, ongoing Q3 earnings, the upcoming RBI policy, and further developments around India–U.S. trade negotiations.

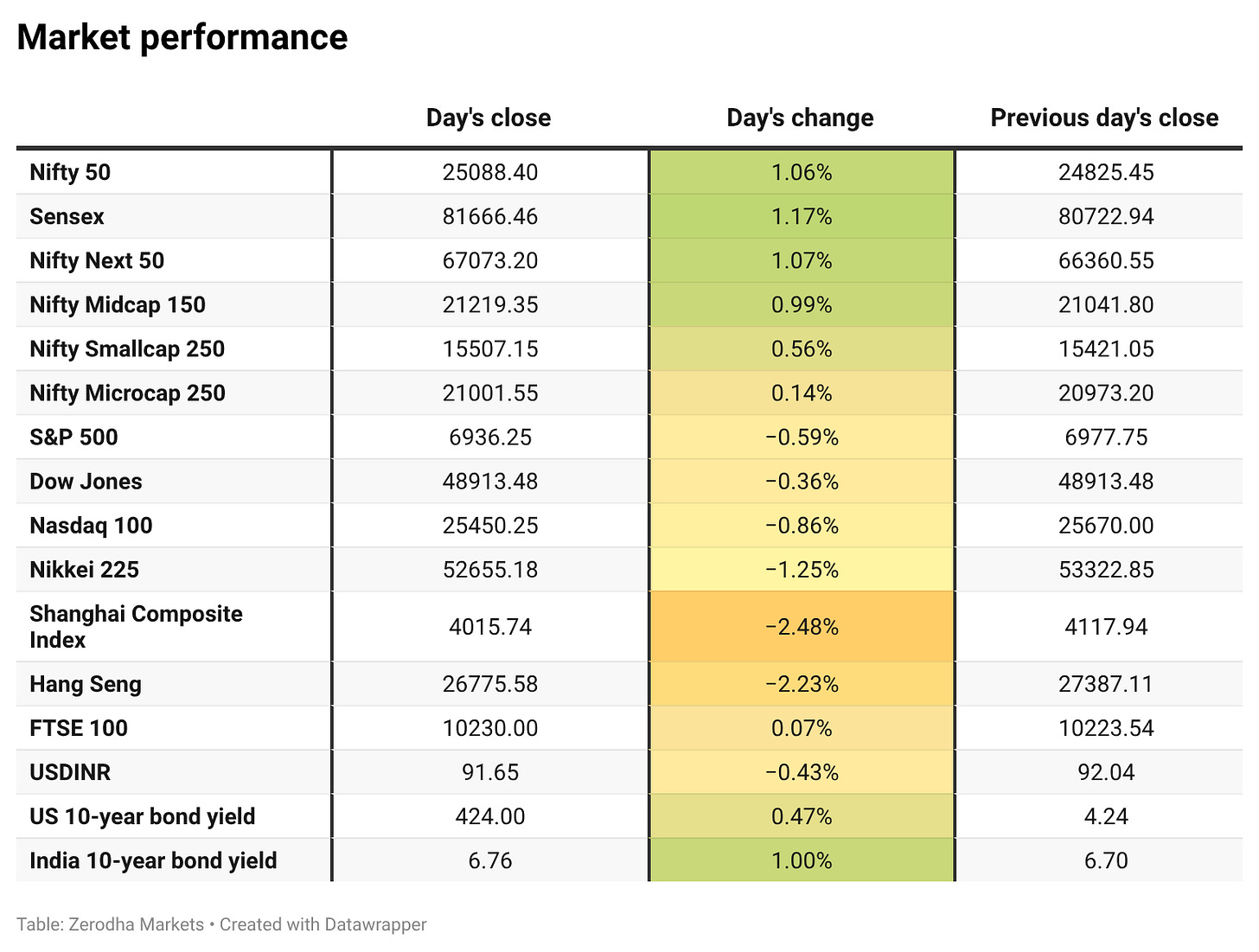

Broader Market Performance:

The broader market had a mixed session today. Of the 3,288 stocks that traded on the NSE, 1,551 advanced, 1,639 declined, and 98 remained unchanged.

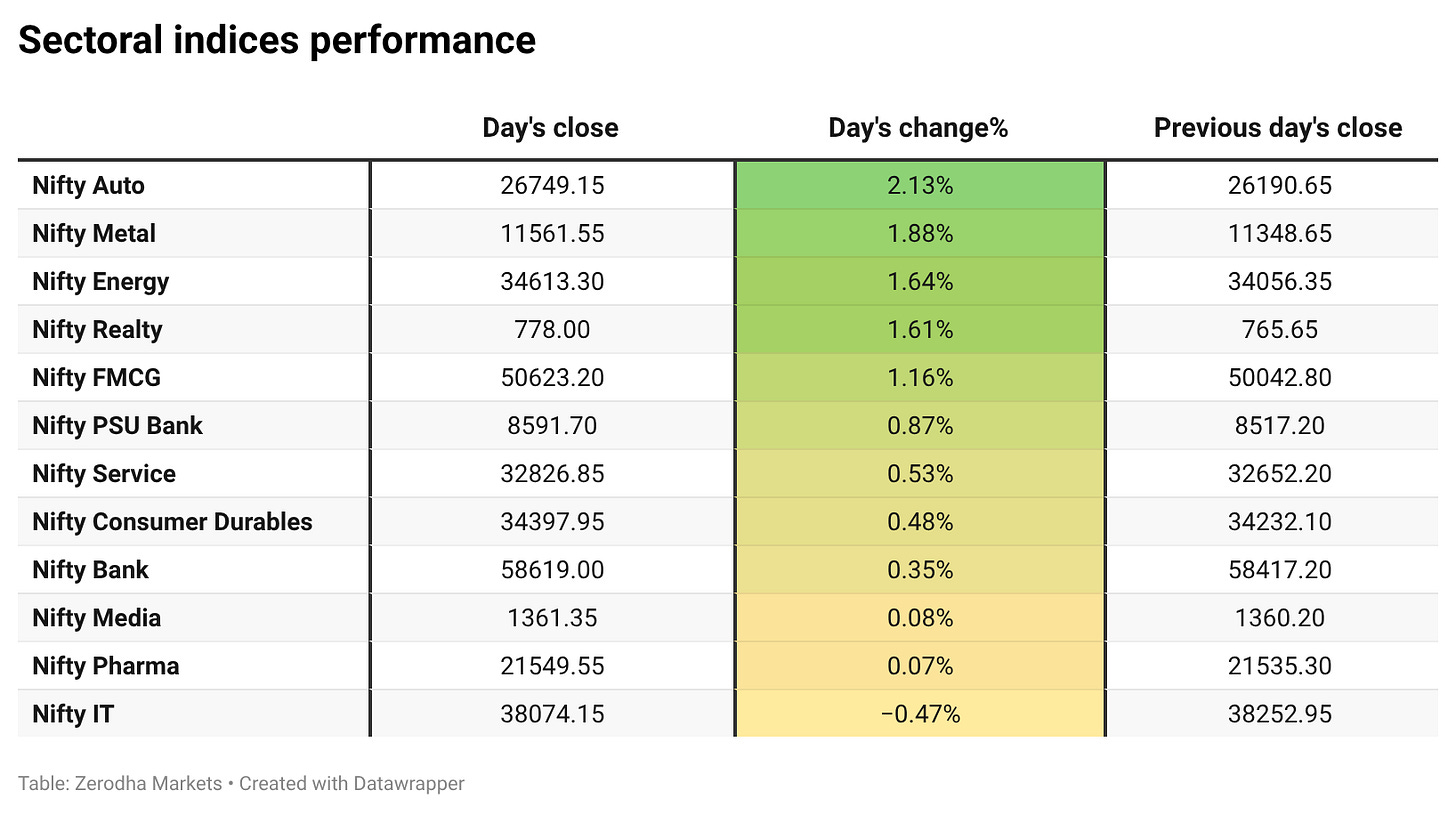

Sectoral Performance:

Nifty Auto was the top gainer, rising 2.13%, while Nifty IT was the only index in the red, slipping 0.47%. Out of the 12 sectoral indices, 11 closed in the green and just 1 ended in the red, indicating broad-based market strength.

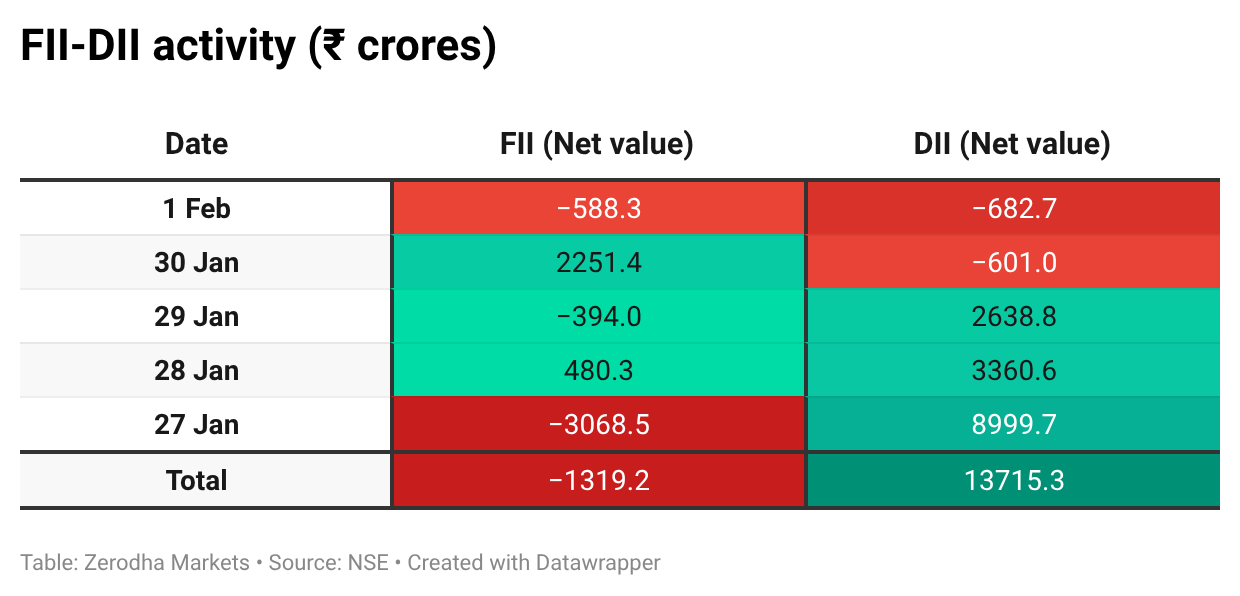

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 3rd February:

The maximum Call Open Interest (OI) is observed at 25,500, followed by 25,500 & 25,400, indicating potential resistance at the 25,200 -25,300 levels.

The maximum Put Open Interest (OI) is observed at 24,800, followed by 25,000, suggesting support at 24,900-24,800.

Note: OI is subject to multiple interpretations; however, generally, an increase in Call OI indicates resistance in a falling market, while an increase in Put OI indicates support in a rising market.

Source: Sensibull

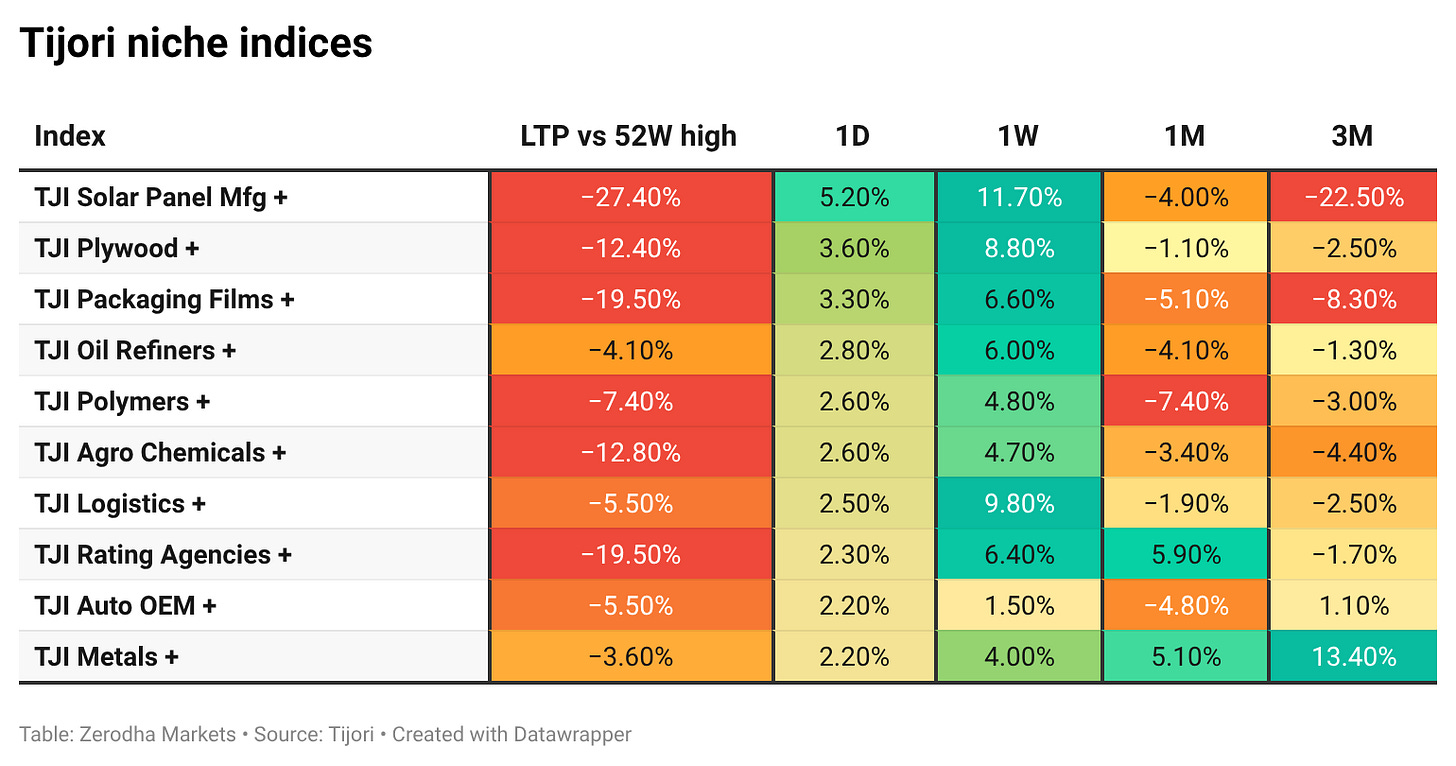

Tijori is an investment research platform that has constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

India’s 10-year government bond yield rose to around 6.76% as markets reacted to a higher-than-expected borrowing plan in the FY27 Budget. Dive deeper

The rupee rose to around 91.4 per dollar after early RBI intervention. However, risk-off sentiment and budget-related concerns continue to cap gains. Dive deeper

India’s manufacturing PMI edged up to 55.4 in January, indicating a modest improvement in factory activity. The pickup was driven mainly by domestic demand, while export orders and hiring remained subdued. Dive deeper

India is considering raising the foreign ownership limit in state-run banks to 49% to help strengthen capital and support credit growth. Dive deeper

Hyundai Motor India reported a 6.35% rise in Q3 FY26 profit after tax to ₹1,234 crore, driven by GST 2.0 benefits and festive season demand. Revenue from operations increased to ₹17,973 crore from ₹16,648 crore year-on-year, reflecting strong sales momentum during the December quarter. Dive deeper

Maruti Suzuki’s January wholesales rose 11.6% year-on-year to a record 2.37 lakh units. The growth was driven by strong domestic demand and a sharp surge in exports. Dive deeper

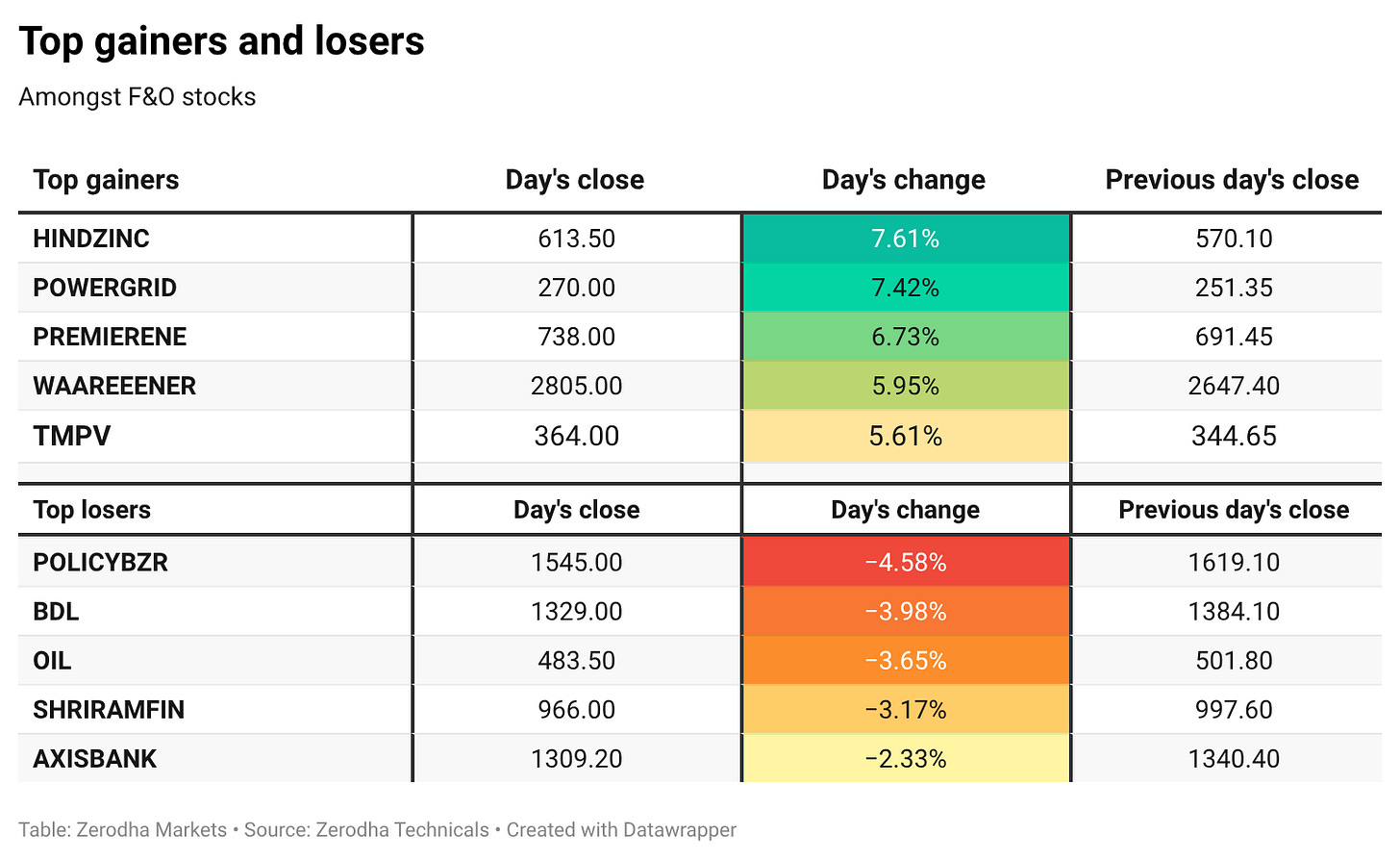

Power Grid Corporation surged over 7% to ₹270 after raising its FY26 capital expenditure guidance by 14% to ₹32,000 crore from ₹28,000 crore, while also increasing capitalisation estimates by 10% to ₹22,000 crore. Dive deeper

Bajaj Housing Finance reported 21% yoy growth in net profit at ₹665 crore, supported by steady loan growth and higher core income. Net interest income grew 19% to ₹963 crore while net total income jumped 24% to ₹1,153 crore. Dive deeper

Lupin launched generic Dasatinib Tablets in six strengths (20-140 mg) in the US market following USFDA approval, targeting the cancer treatment segment. The product addresses a significant market opportunity with estimated annual sales of $930 million in the US, according to IQVIA MAT October 2025 data. Dive deeper

What’s happening globally

Brent crude fell over 5% to below $66 per barrel as signs of easing US–Iran tensions reduced supply disruption fears. Dive deeper

Gold fell over 4% to below $4,700 per ounce, extending a sharp sell-off after last week’s steep decline. The pullback followed the nomination of a more hawkish Fed chair and profit-taking after a strong rally. Dive deeper

The dollar index stayed above 97, supported by the nomination of Kevin Warsh as the next Fed chair, which reinforced expectations of a relatively hawkish policy stance. Dive deeper

The US 10-year Treasury yield slipped to around 4.22% on risk-off sentiment. Markets are reassessing Fed policy expectations after Kevin Warsh’s nomination as chair. Dive deeper

Germany’s retail sales rose 0.1% month-on-month in December, defying expectations of a decline and signalling mild resilience in consumer spending. Dive deeper

Japan’s Nikkei and Topix fell as global risk sentiment weakened, with losses in technology stocks amid renewed concerns over AI investment sustainability. Dive deeper

Alibaba plans to spend $431 million on promotional incentives to boost adoption of its Qwen AI app during the Lunar New Year. Dive deeper

Management chatter

In this section, we highlight interesting comments made by the management of major companies and policymakers from the Indian and Global Economies.

Arvind Shrivastava, Revenue Secretary, on the rationale behind the STT hike:

"The government's intention is to discourage speculative tendencies, and the increase in rate is essentially in that direction. So, it is meant to essentially handle the systemic risk in derivative markets. Even after this increase, the STT rates will remain modest compared to the volume of transactions." - Link

Neelkanth Mishra, Chief Economist (Axis Bank) on the Union Budget — focusing strictly on his remarks as reported:

“So, the budget in many ways was absolutely predictable. There was not much of a surprise and I mean it in a very good way. The government increasing the visibility and reducing policy uncertainty for businesses and investors is a very positive step. The hard miles on fiscal consolidation are behind us.”

“As you know, reduction in fiscal deficit is a drag on growth. So, clearly now with the deficit barely falling, the economy can start getting closer to its trend growth rates.”

“This remarkable fiscal discipline needs to show up in lower bond yields, lower cost of borrowing and unfortunately, as you also mentioned, the borrowing targets and perhaps excessively conservative plan to finance it” - Link

Ravi Dharamshi, Managing Director & CIO, ValueQuest Investment Advisors on the Union Budget and market reaction :

“First of all, we should not be judging the budget only through the prism of the capital market.”

“We have been essentially facing FIIs selling since last year or so and there was nothing in the budget to stem that flow.”

“The budget is credible. Their numbers are credible whether it is the debt to GDP, whether it is the fiscal deficit, whether it is the capex increase, expenditure increase, everything seems to be credible.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

Calendars

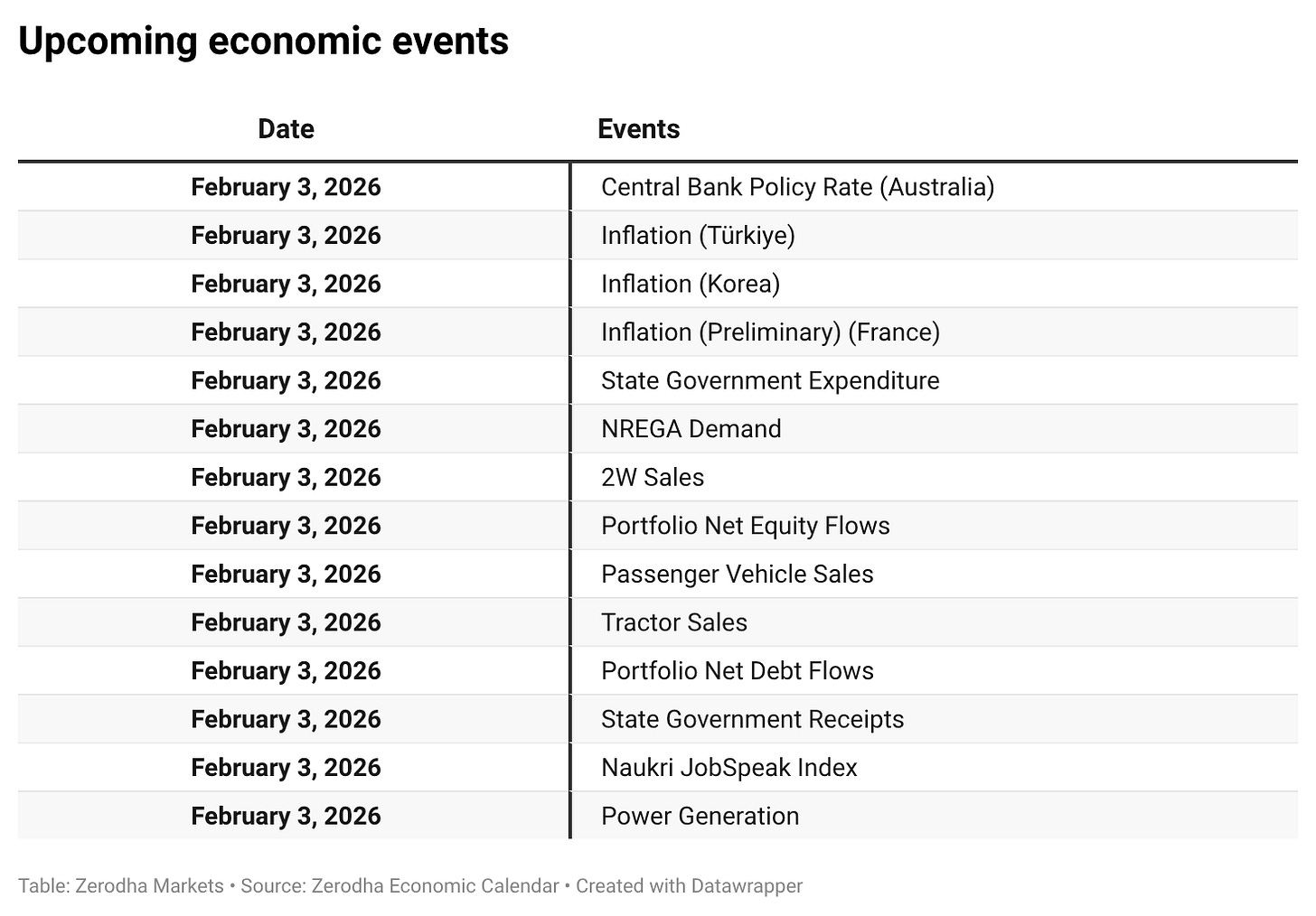

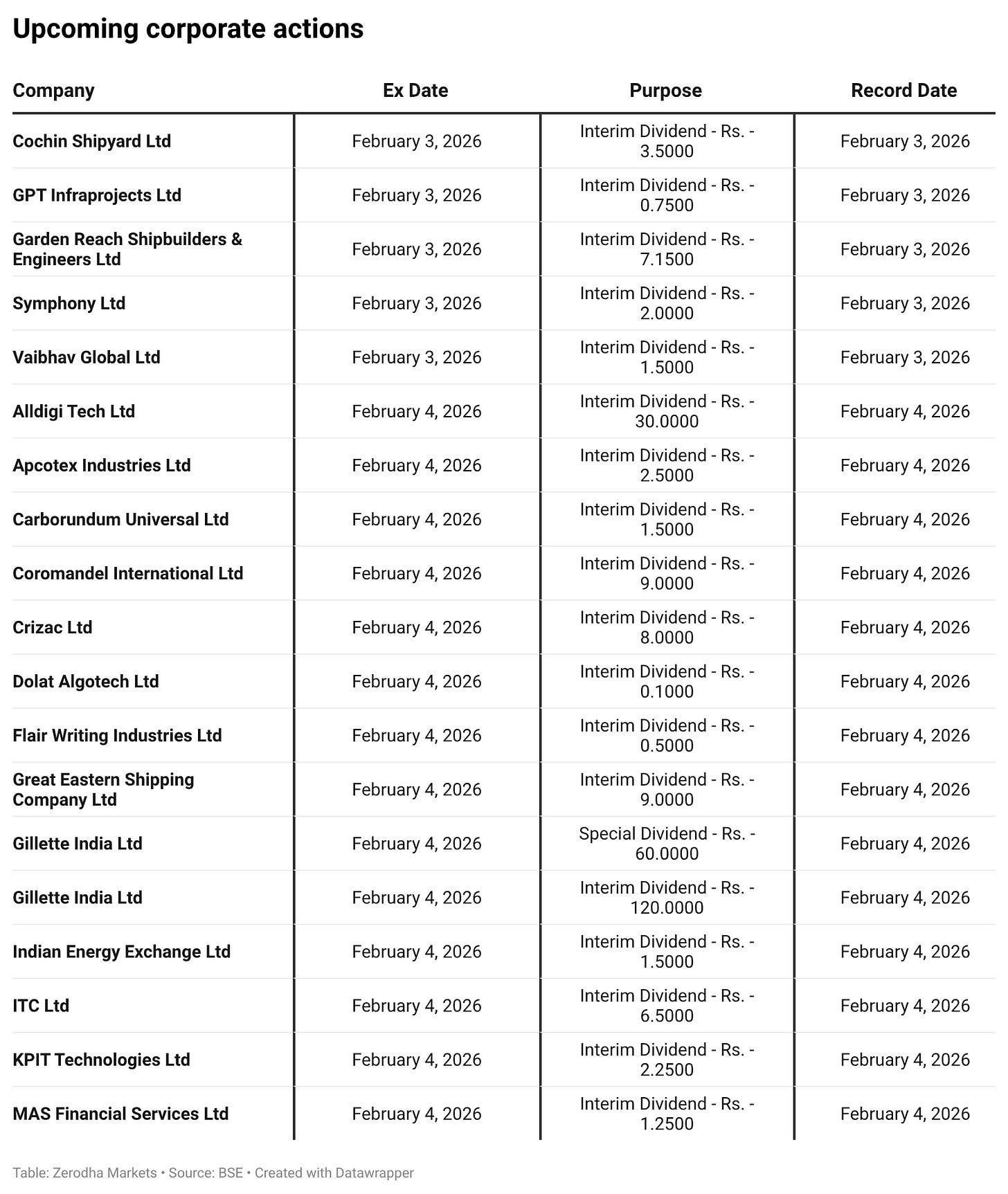

In the coming days, we have the following significant events, quarterly results, and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

Solid breakdown of that V-shaped recovery. What caught my attention was how the late-hour momentum completley flipped the narrative from the morning weakness around 24,680. I've seen this pattern a few times recenly where domestic institutions step in during the final hour, almost like they're using foreign selling as an entry point.