Nifty rebounds sharply from lows to close near 25,700 amid Bihar polls & US trade deal buzz

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we break down the short trading week where what initially looked like a simple pause in NIFTY quickly turned into a slow, painful drift downward — a reminder that market expectations are, indeed, the mother of all problems.

Market Overview

Nifty opened flat with a 42-point gap-up at 25,617 but quickly slipped in the first few minutes, testing levels near 25,550. Within the first hour, the index even breached the 25,500 mark, extending weakness and hitting lows around the 25,450 zone by 11 AM.

After marking the day’s low, Nifty staged a steady and sustained recovery, reclaiming the 25,600 mark and gradually extending gains. By 2 PM, the index had pushed toward 25,650 and continued to build momentum through the second half.

In the final hour, Nifty accelerated further, touching an intraday high near 25,715 before settling strongly at 25,694.95, up around 0.47%.

Looking ahead, markets are likely to remain sensitive to developments around the India–U.S. trade deal and the Bihar state election results, which could spark short-term volatility. Investors will also continue monitoring Q2 earnings and management commentary on festive-season demand trends following the recent GST rate cuts.

Broader Market Performance:

The broader markets had an evenly balanced mixed session today. Of the 3,203 stocks traded on the NSE, 1,560 advanced, 1,560 declined, and 83 remained unchanged.

Sectoral Performance:

Nifty IT led the gains with a rise of 1.20%, while Nifty PSU Bank was the top loser, slipping 0.39%. Out of the 12 sectoral indices, 7 closed in the green and 5 ended in the red, reflecting broadly positive sentiment across the market.

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 18th November:

The maximum Call Open Interest (OI) is observed at 26,000, followed by 25,700 & 25,800, indicating potential resistance at the 25,800 -25,900 levels.

The maximum Put Open Interest (OI) is observed at 25,600, followed by 25,500, suggesting support at the 25,600 to 25,500 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

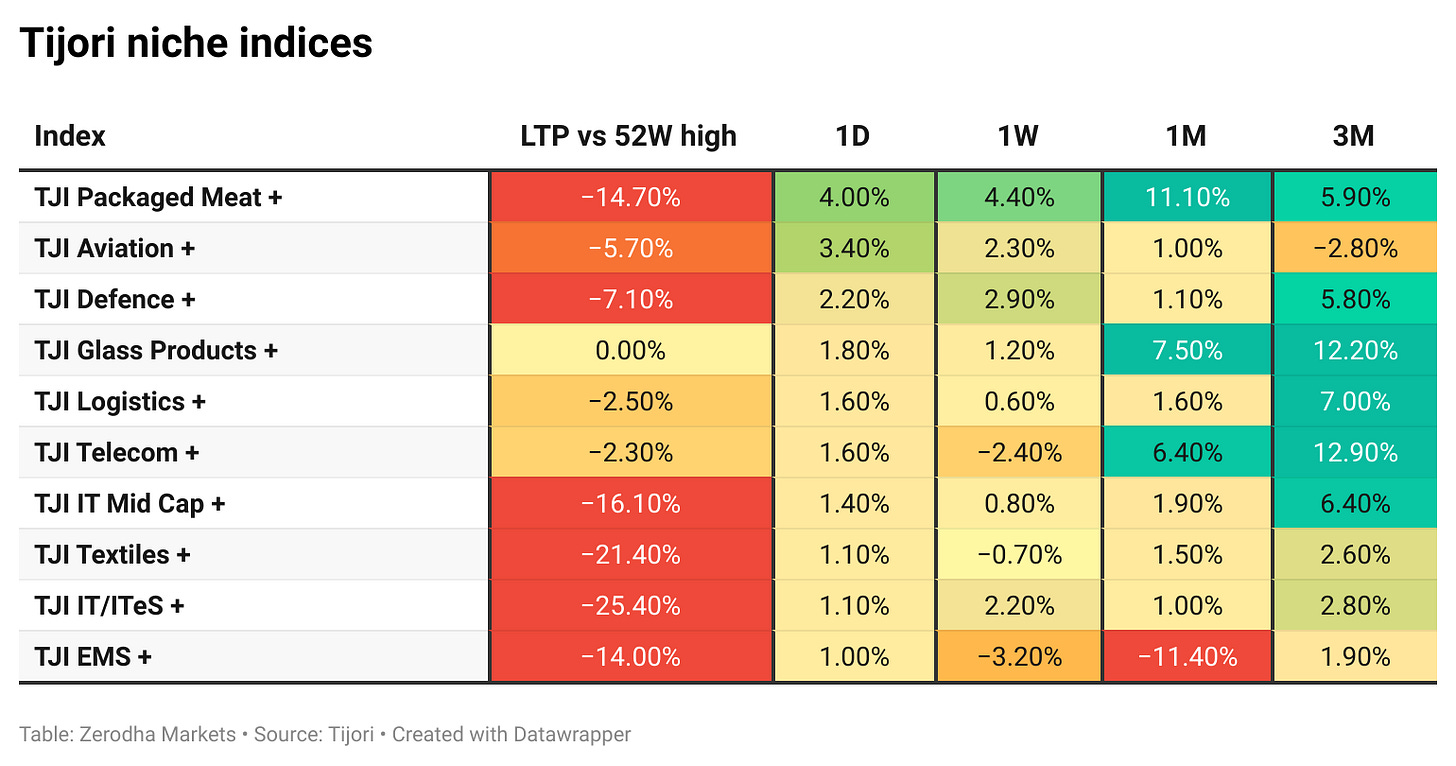

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

India’s 10-year G-Sec yield dropped below 6.5%, the lowest in nearly four weeks, on expectations of RBI bond purchases through OMOs amid tight liquidity. Dive deeper

India’s unemployment rate fell to 5.2% in the July-Sept quarter from 5.4%, driven by higher rural hiring and increased female workforce participation, while urban joblessness edged up to 6.9%, according to PLFS data. Dive deeper

Granules Life Sciences, a subsidiary of Granules India, received its first U.S. FDA approval for its Hyderabad facility after a pre-approval inspection. The company plans to launch the approved product in the U.S. market soon. Dive deeper

The Indian rupee held near 88.7 per USD as trade deal comments failed to move markets, with a firm dollar and weak sentiment weighing on the currency. Dive deeper

Bharat Petroleum said consortium partners have lifted the force majeure on the Mozambique LNG project, citing improved security. BPCL holds a 10% stake in the project, operated by TotalEnergies. Dive deeper

Ather Energy reported its highest quarterly revenue at ₹941 crore in Q2 FY26, up 57% YoY, while net loss narrowed to ₹154 crore. Deliveries grew 67% YoY to 65,595 units, with gross margin improving to 22%. Dive deeper

Bajaj Finserv reported a 7% YoY rise in Q2 consolidated profit to ₹2,244 crore and 11% higher revenue at ₹37,403 crore. Shares fell 8% intraday to ₹1,952 despite growth across major subsidiaries. Dive deeper

Airtel Payments Bank reported Q2 profit of ₹11.8 crore, up from ₹11.2 crore YoY, with quarterly revenue crossing ₹800 crore for the first time at ₹804 crore. Dive deeper

ONGC posted a 28% rise in Q2 consolidated profit to ₹12,615 crore and declared a ₹6 dividend. Revenue dipped 0.9% amid lower oil prices. Dive deeper

Sula Vineyards reported a 58% YoY fall in Q2 net profit to ₹6 crore, while revenue dipped 1.1% to ₹139 crore, impacted by disruptions in Telangana. EBITDA margins declined to 18.2% from over 23% a year ago. Dive deeper

What’s happening globally

Brent crude traded near $64 as markets awaited OPEC and IEA outlooks, with supply concerns persisting amid planned OPEC+ output hikes, India pausing Russian oil purchases, and Lukoil declaring force majeure in Iraq. Dive deeper

Gold climbed above $4,130 to a three-week high on US uncertainty and rate-cut bets, while JPMorgan sees prices crossing $5,000 next year. Dive deeper

Germany’s ZEW Economic Sentiment slipped to 38.5 in November from 39.3, missing expectations, as policy confidence weakened. The chemical and metal sectors dragged, while private consumption and IT-linked sectors showed improvement. Dive deeper

SoftBank sold its entire Nvidia stake for $5.8B, after building it to ~$3B earlier this year. The sale contributed to a ¥2.5T Q2 profit as SoftBank ramps up AI investments, including OpenAI and planned infrastructure plays. Dive deeper

SoftBank posted a $16.6B profit in Q2, driven largely by gains from its OpenAI stake. This marked its third straight profitable quarter. Dive deeper

Intel’s CEO Lip-Bu Tan will take over the company’s AI initiatives after CTO Sachin Katti, who had been leading Intel’s AI efforts since January, exited to join OpenAI. Dive deeper

Warren Buffett said he will no longer write Berkshire Hathaway’s annual shareholder letters, marking the end of a nearly 60-year run. He will continue communicating through his Thanksgiving message. Greg Abel will assume the role of CEO by year-end. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

US President Donald Trump, on the trade deal with India

“You know, we are making a deal with India, a much different deal than we had in the past. So right now, they don’t love me, but they will love us again. We are getting a fair deal, just a fair trade deal. We had pretty unfair trade deals,”- Link

Commerce and Industry Minister Piyush Goyal on the US trade deal

“We are working for a good trade deal. India is not going to compromise with the interests of farmers, dairy workers… We are working on a fair, equitable and balanced trade deal,” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

Calendars

In the coming days, we have the following quarterly results, significant events, and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!