Nifty rebounds from morning lows, ends flat below 25,200

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we take a step deeper into the trading landscape and explore the three foundational trading strategy archetypes: Trend Following, Mean Reversion, and Arbitrage.

Market Overview

Nifty opened flat at 25,209 and slipped lower in the opening hour, testing 25,085 levels by mid-morning as selling pressure weighed on sentiment. The index remained under pressure through the first half, consolidating in a narrow range between 25,080 and 25,130.

In the second half, Nifty staged a sharp rebound around mid-day, reclaiming the 25,200 mark and extending gains to touch an intraday high near 25,260. However, some volatility in the final hour capped the upside, and the index eventually turned red and closed at 25,169.50, modestly lower from the opening level but off its early lows.

Market sentiment is gradually shifting from caution to optimism, aided by signs of easing U.S.-India trade tensions. However, concerns over steep 50% tariffs, persistent foreign investor outflows, and muted earnings continue to cap the upside. As we advance, investors will closely track festival season sales and management commentary on demand trends across industries.

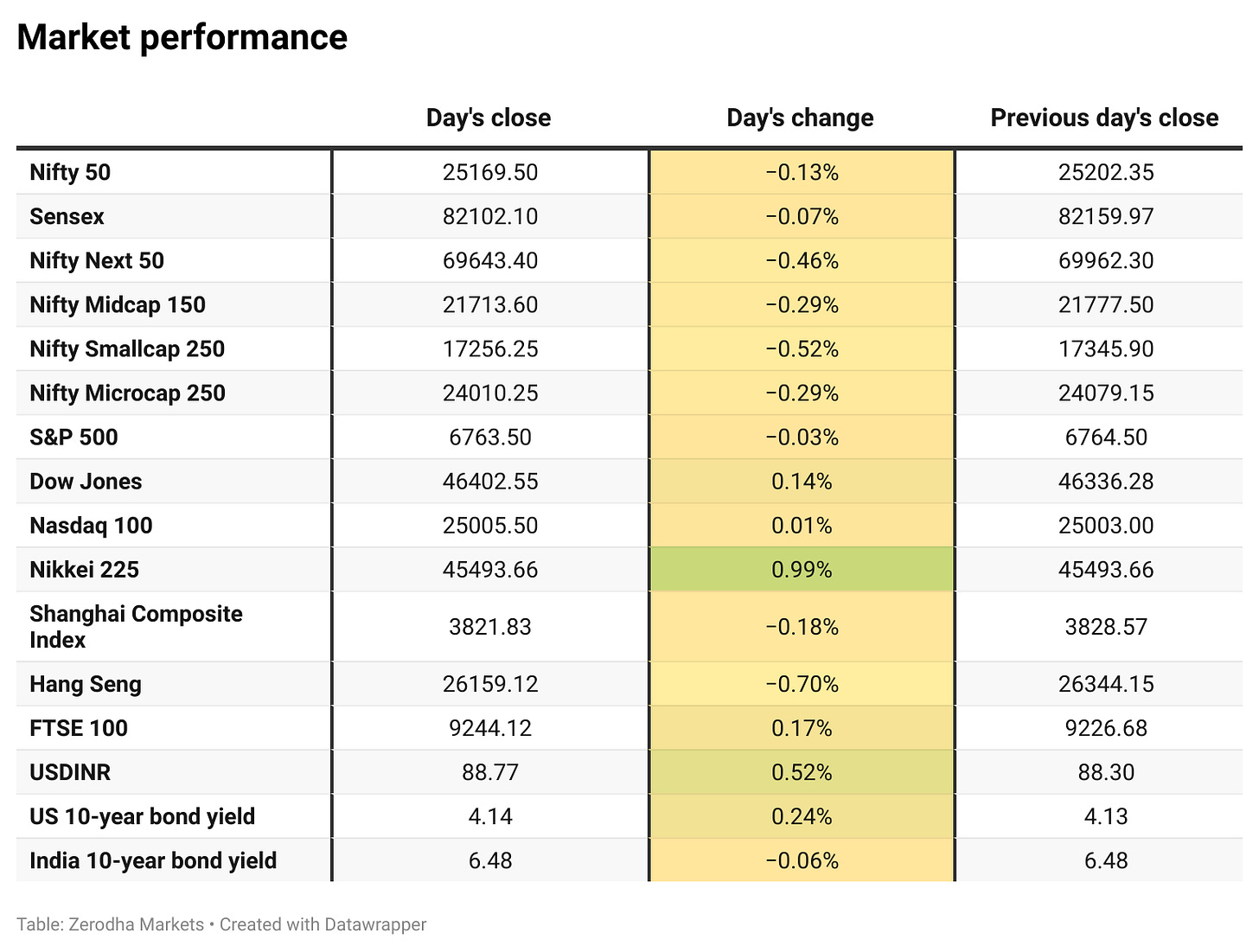

Broader Market Performance:

Broader markets had a weak session today. Of the 3,136 stocks traded on the NSE, 1,329 advanced, 1,714 declined, and 93 remained unchanged.

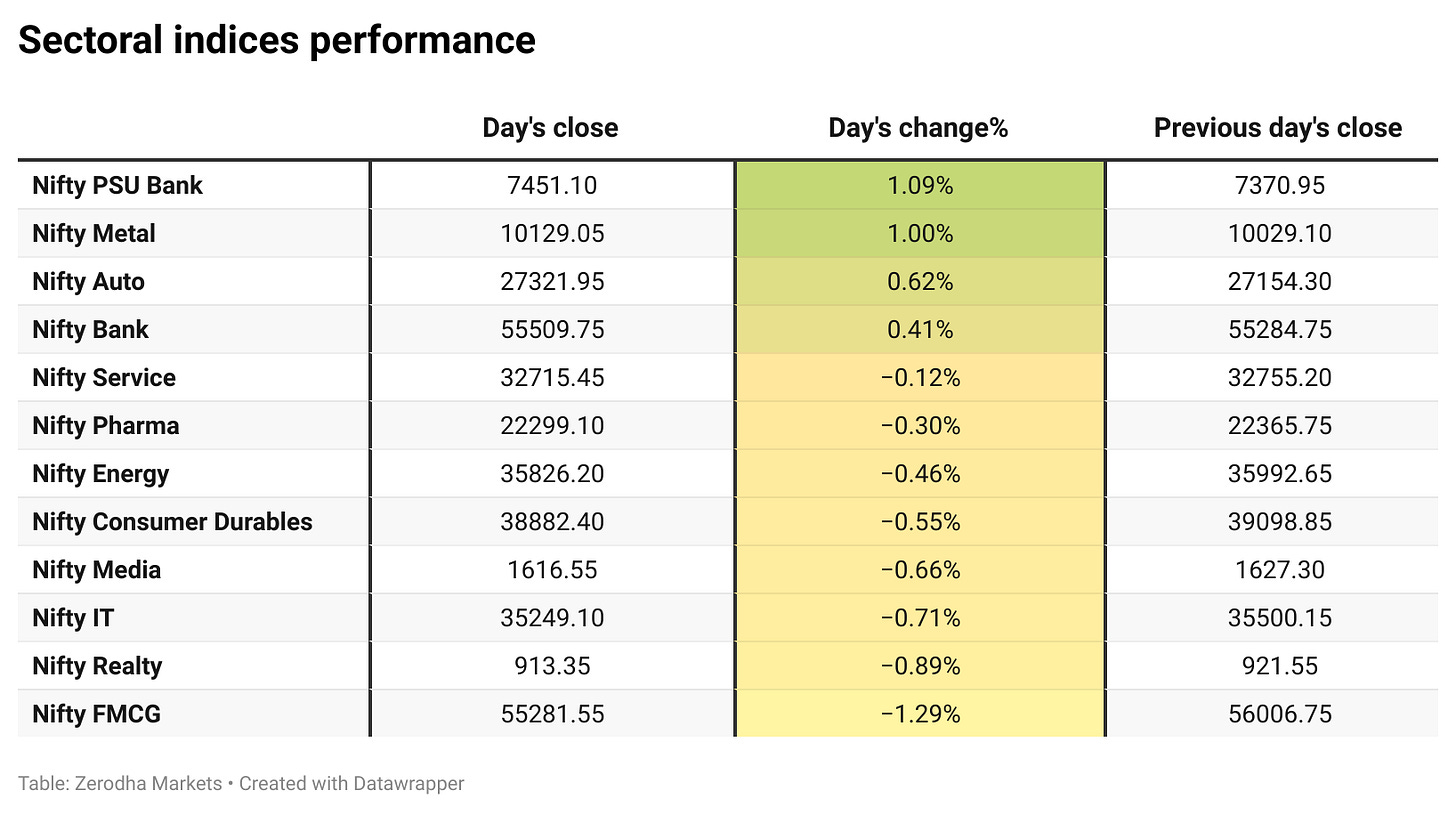

Sectoral Performance

The top-gaining sector for the day was Nifty PSU Bank, which rose by 1.09%, while the top losing sector was Nifty FMCG, which fell by 1.29%. Out of the 12 sectoral indices, 4 closed in the green, and 8 ended in the red, indicating broad-based weakness across sectors.

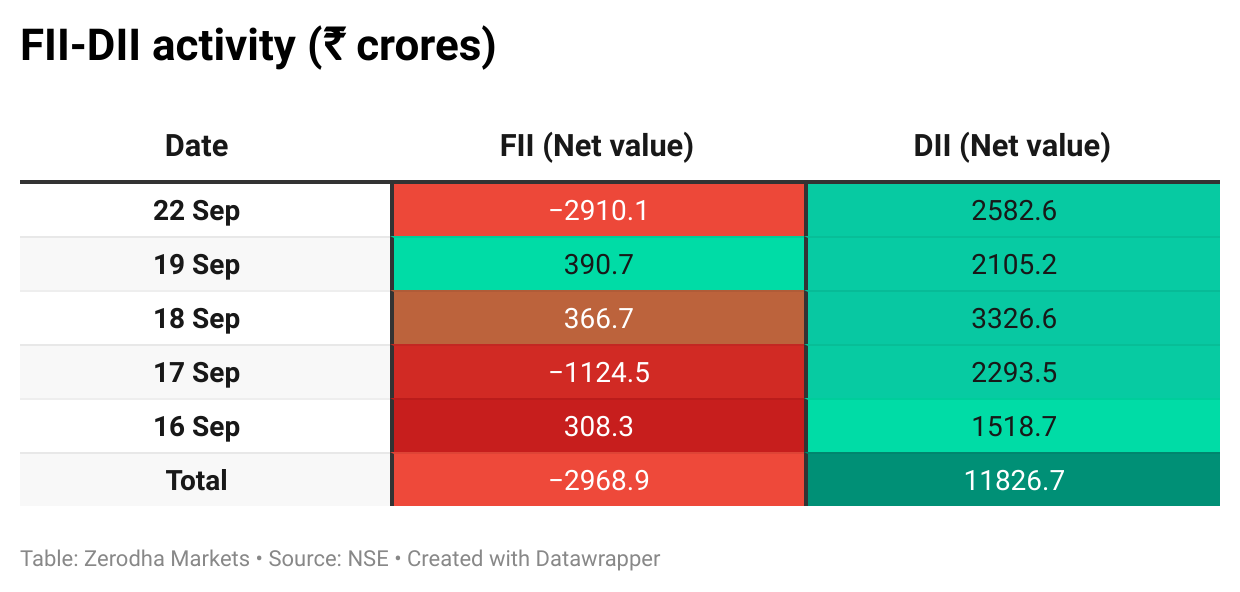

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 30th September:

The maximum Call Open Interest (OI) is observed at 25,500, followed by 25,300 & 25,200, suggesting strong resistance at 25,300 - 25,400 levels.

The maximum Put Open Interest (OI) is observed at 25,000, followed by 25,200, suggesting strong support at 25,100 to 25,000 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

The rupee hit a record low of ₹88.85/$ amid US visa fee hikes, subdued equity inflows, and trade pressures, with foreign investors pulling over $15 billion this year. Dive deeper

Tata Investment Corporation shares surged nearly 12% to a new 52-week high of ₹8,131.50 after the board approved a 1:10 stock split, reducing the face value from ₹10 to ₹1 to boost liquidity and retail participation, with the record date set for October 14, 2025. Dive deeper

Refex Industries shares surged 15.5% after the board approved a composite scheme of amalgamation and arrangement. The move is aimed at unlocking the potential of its Green Mobility business. Dive deeper

Cochin Shipyard signed a long-term collaboration pact with HD Korea Shipbuilding & Offshore Engineering (HD KSOE) on September 23. The PSU is also exploring a ₹15,000 crore shipyard project in Tamil Nadu, expected to create around 10,000 jobs. Dive deeper

NSE has announced that the Diwali Muhurat Trading session will be held on October 21 from 1:45 pm to 2:45 pm, marking the start of the new Samvat year with the traditional one-hour special trading window. Dive deeper

TCS will announce its Q2 results on October 9 and also consider a second interim dividend for FY26, with October 15 set as the record date for shareholder eligibility. Dive deeper

Hero Future Energies has secured ₹1,024 crore funding from SBI to develop a 60 MW solar, wind, and storage hybrid project in Kurnool, Andhra Pradesh, contracted with SECI and structured through SPV Clean Solar Power Barmer. Dive deeper

Brigade Enterprises has signed a joint development agreement to build a 7.5-acre residential project in Banashankari, South Bengaluru, with an estimated sales potential of about ₹1,200 crore. Dive deeper

KEC International has secured international Transmission and Distribution orders worth ₹3,243 crore, including 400 kV transmission line projects in the UAE and supply contracts in the Americas, marking its largest-ever EPC order in the segment. Dive deeper

Flipkart has invested $30 million in its fintech arm Supermoney to expand into lending and stock broking. Supermoney, now among the top UPI apps in India, has disbursed over $700 million through partners and is aiming for profitability by year-end. Dive deeper

ICICI Prudential Asset Management, India’s second-largest fund house, has begun investor roadshows for its planned ₹10,000 crore IPO. The issue involves Prudential Plc selling a 10% stake, valuing the firm at about $11 billion. The launch is expected in late October, subject to regulatory approval. Dive deeper

Jaguar Land Rover has extended its production halt until October 1 following the August cyberattack, marking a second delay in resuming operations. Tata Motors said festive season deliveries have been strong, but uncertainty remains over JLR’s recovery timeline. Dive deeper

What’s happening globally

Nvidia will invest up to $100 billion in OpenAI, supplying it with advanced data centre chips through a partnership involving non-voting shares. The deal will help OpenAI scale its compute needs and strengthen collaboration between the two AI leaders. Dive deeper

South Korean shares hit a new record high, propelled by strong performances in chip and pharmaceutical stocks, indicating robust investor confidence in key industries. Dive deeper

China has sharply increased exports of low-cost goods to offset Trump-era tariffs, aiming to retain its global market edge. This flood of cheap products is reshaping trade dynamics worldwide. Dive deeper

Denmark will issue the EU’s first sovereign green bond under new rules, boosting sustainable finance and attracting climate-focused investors. Dive deeper

The OECD says the full impact of Trump-era tariffs is yet to unfold, with delayed effects likely to disrupt trade and growth globally. Dive deeper

The euro zone’s private sector grew at its fastest pace in 16 months, with strong demand in manufacturing and services driving recovery. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Samir Arora, Founder, Helios Capital, on H1-B visa issue

“People are asking the wrong question by focusing only on the math,”

“The bigger picture is that for months, everyone assumed tariffs on services were off the table since the US is a net surplus player. To suddenly see barriers being imposed on services is a macro negative. Growth was already 2-4 percent and not expected to improve near term — this adds one more reason to stay cautious.”

“Investors were already wondering whether to wait one or two years to reassess growth and AI impact. Now they have one more reason to pause,”

“If growth is 30 percent and it slips to 28 percent, that’s different. But when growth is 3 percent and you hoped it might rise to five or six percent, a 1-3 percent margin hit is material,”- Link

Sajjid Chinoy, Chief India Economist at JP Morgan, on Consumption revival in India

“First, we have got record low inflation this year. Second, we have had another very strong monsoon. Third, the monetary easing that the RBI has undertaken is working its way through the system. Fourth, we had direct tax cuts in the February budget. Fifth, we now have indirect tax cuts. All these factors are reinforcing each other,”

“What has been very encouraging in the last six months is that you have seen clear signs that rural demand and rural consumption are picking up,” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we're now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what's a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content and where we can improve! Here's the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

Calendars

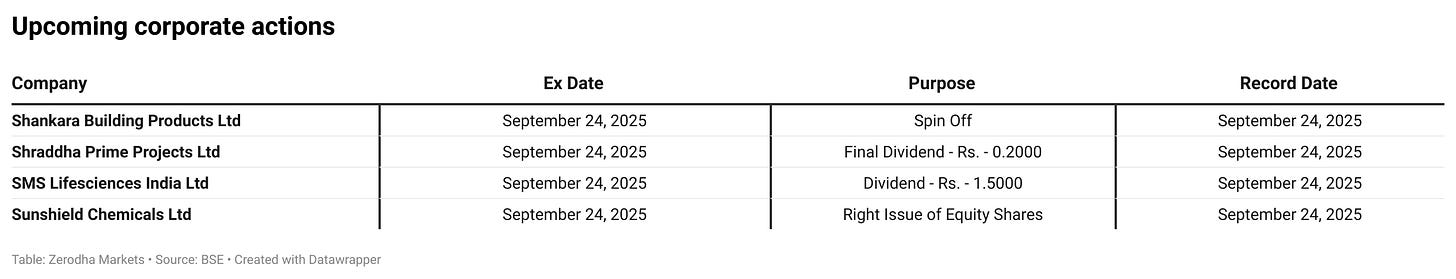

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

Sandeep rocks