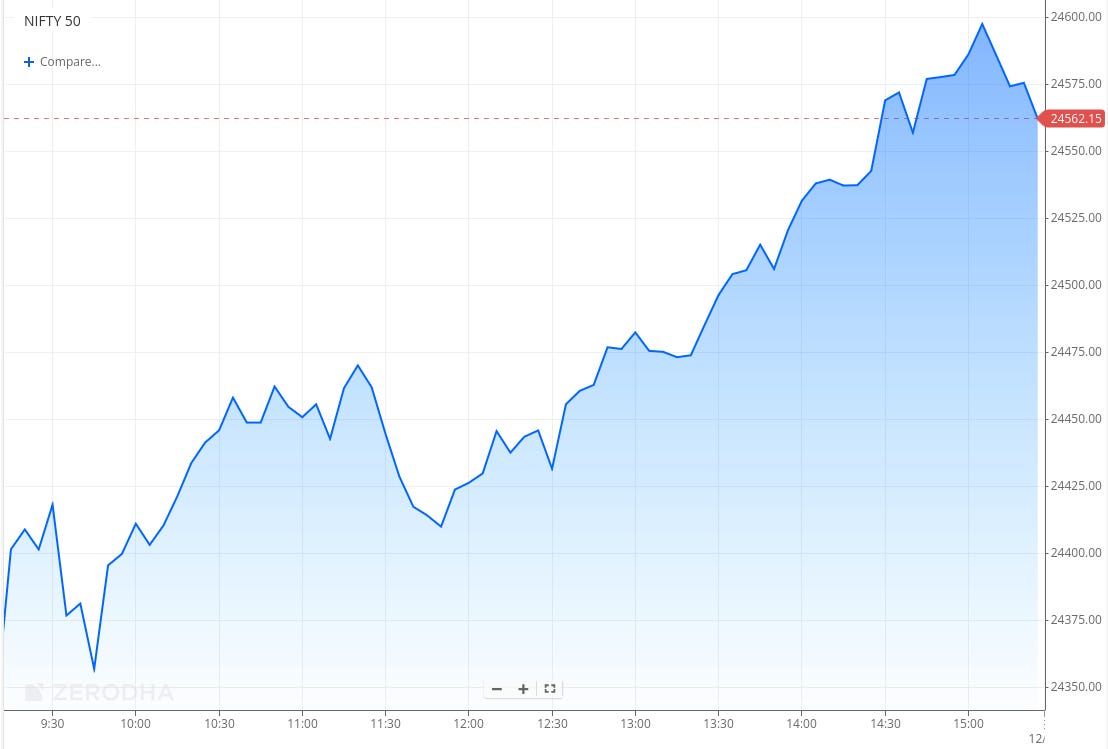

Nifty rallies to fully reverse friday’s setback

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real-time by Tijori.

Market Overview

Nifty opened flat at 24,371.50 and consolidated between 24,350 and 24,400 in the first hour before inching higher to 24,475 by noon. In the second half, the index gained momentum, crossing 24,500 and 24,600 in the last hour. It eventually closed near the day’s high at 24,585.05, up 0.91%, fully reversing Friday’s decline.

Market sentiment, however, remained fragile amid negative global cues, persistent FII outflows, and muted earnings reactions. Investors are closely tracking the escalating U.S.-India trade tensions, which are likely to steer near-term market direction.

Broader Market Performance:

Broader markets had a mixed session with a slight bullish bias. Of the 3,096 stocks traded on the NSE, 1,606 advanced, 1,414 declined, and 76 remained unchanged.

Sectoral Performance

Among sectors, Nifty PSU Bank led the gains with a rise of 2.20%, while Nifty Consumer Durables was the only loser, slipping 0.72%. Out of the 13 sectoral indices, 11 ended in the green and 1 closed in the red.

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 14th August:

The maximum Call Open Interest (OI) is observed at 25,000, followed closely by 24,600, suggesting strong resistance at 24,700 - 24,800 levels.

The maximum Put Open Interest (OI) is observed at 24,400, followed closely by 24,500, suggesting strong support at 24,400 to 24,300 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

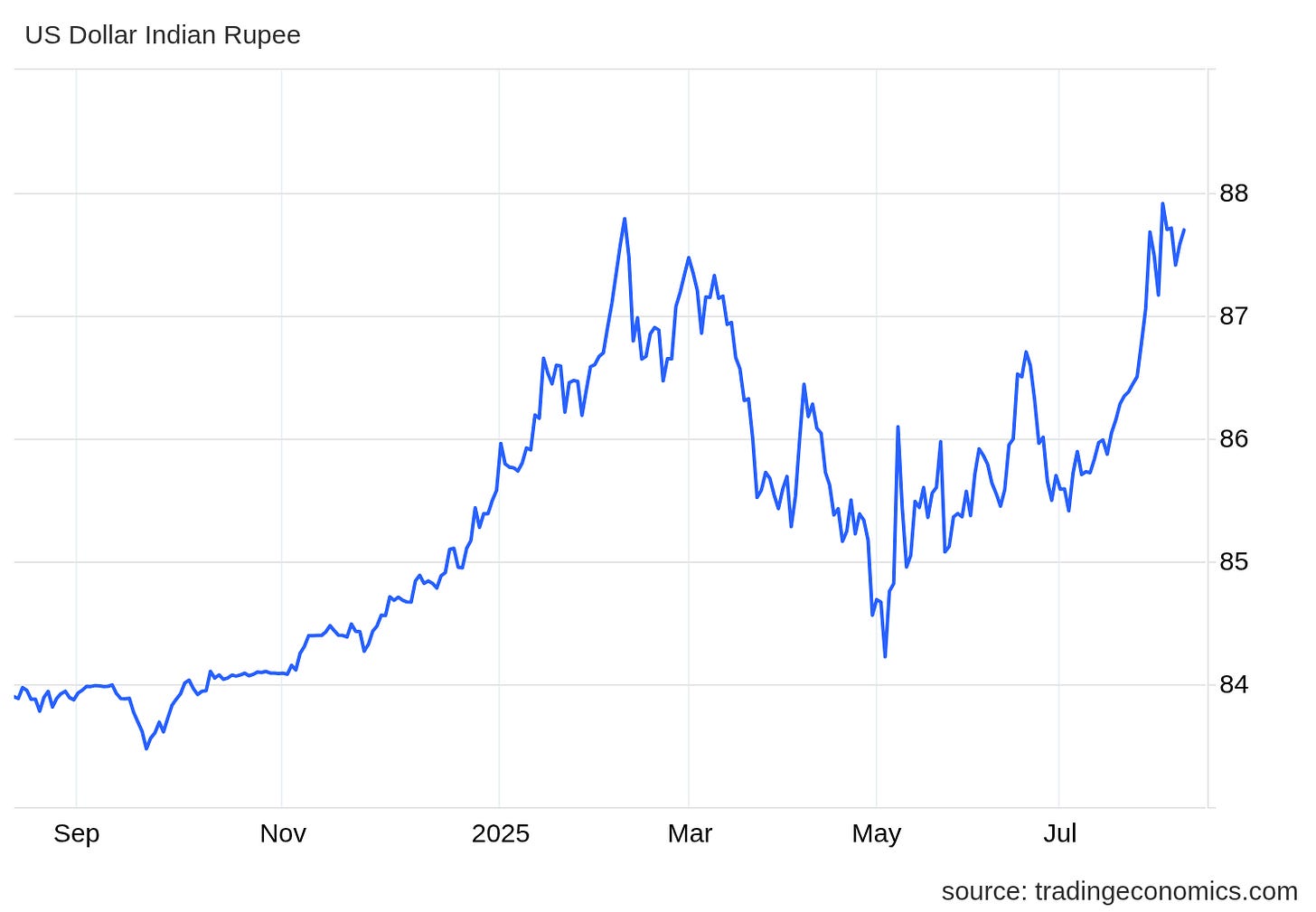

The Indian rupee weakened to 87.7 per USD after the US doubled tariffs on Indian imports to 50% over Russian oil purchases. Consumer inflation fell to a six-year low of 2.1%, leading the RBI to hold rates steady. Markets now expect another rate cut later this year. Dive deeper

Indian bonds traded narrowly ahead of state debt auctions and inflation data, with the 10-year yield near 6.42%. Lower state borrowing led to some short covering, but yields remain stable. Inflation readings from India and the U.S. will guide market moves. Dive deeper

Adani Defence and Prime Aero acquired 100% of Indamer Technics through Horizon Aero Solutions. Indamer’s Nagpur facility has 15 aircraft bays across 10 hangars. The deal aims to build a top-tier MRO ecosystem and boost India’s aviation infrastructure. Dive deeper

ONGC plans to invest Rs 4,600 crore to drill 10 wells, build two unmanned platforms, an offshore pipeline, and a gas processing facility in Andhra Pradesh’s KG Basin. It has sought fresh environmental clearance and must conduct a biodiversity assessment with a restoration plan. Dive deeper

Air India will suspend flights between Delhi and Washington, D.C., from September 1 due to a planned shortfall caused by retrofitting 26 Boeing 787-8 aircraft. The retrofit and continued closure of Pakistan airspace have increased operational challenges. Dive deeper

SECI’s net profit rose 15% to Rs 502 crore in FY25 on revenues of Rs 15,185 crore, driven by growth in power trading and project execution. The company’s expanding role supports India’s clean energy goals. This marks a significant milestone in SECI’s financial progress. Dive deeper

The RBI sold at least $5 billion in August to support the rupee, contributing to a $9.3 billion drop in foreign-exchange reserves, the largest since November. This marks increased intervention as the rupee neared a record low amid rising US tariffs. The central bank used both onshore and offshore markets to manage currency weakness. Dive deeper

Voltas reported a 58% drop in Q1 net profit to Rs 140.6 crore due to weak AC sales from unseasonal weather, with revenue falling 20% to Rs 3,938.6 crore and EBITDA halving to Rs 178.6 crore. Operating margins contracted sharply to 4.5% from 8.6% a year ago. The company attributed the decline to the delayed summer and early monsoon impacting demand. Dive deeper

Platinum Invictus received RBI approval to invest Rs 2,624 crore in IDFC First Bank via a preferential issue, gaining a 5.09% stake. The bank launched ‘RemitFIRST2India’ to facilitate faster NRI remittances. Dive deeper

Tata Steel aims to double ‘Aashiyana’ GMV to Rs 7,000 crore in FY26, expanding to non-Tata Steel products. The platform serves 1.1 lakh users with design tools and AI-powered recommendations. ‘Aashiyana 3.0’ will enhance user engagement and ease homebuilding. Dive deeper

ICICI Bank raised minimum balance requirements for new savings accounts, causing shares to slip. It also updated cash transaction fees with limits on free deposits and withdrawals. The bank’s recent quarterly profit improved, supported by deposit growth and better asset quality. Dive deeper

What’s happening globally

Brent crude futures dropped to $66.1 per barrel, the lowest in over two months, amid hopes for a Russia-Ukraine peace deal that could ease supply disruptions. The planned Trump-Putin meeting on August 15 may lead to lifted sanctions on Russian oil. Dive deeper

Gold prices fell to around $3,360 per ounce as easing geopolitical tensions, including a planned Trump-Putin meeting, reduced safe-haven demand. Dive deeper

China’s consumer prices were flat year-on-year in July 2025, beating expectations, with non-food prices rising and food prices falling sharply. Core inflation increased 0.8%, the highest in 17 months. Monthly CPI rose 0.4%, the strongest since January, driven partly by extreme weather. Dive deeper

South Africa’s manufacturing output rose 1.9% year-on-year in June 2025, up from 0.7% in May and exceeding expectations. Growth was driven by food and beverages and petroleum-related products. Seasonally adjusted output was flat in June, with Q2 production up 1.5% from Q1. Dive deeper

Intel CEO Lip-Bu Tan will visit the White House to address President Trump’s concerns over his ties to Chinese firms. Tan plans to emphasize Intel’s importance to U.S. national security. The meeting follows scrutiny of his investments and past business dealings. Dive deeper

Paramount secured exclusive U.S. UFC rights in a seven-year, $7.7 billion deal starting in 2026, streaming all events on Paramount+ and some on CBS. The deal ends UFC’s pay-per-view model in the U.S. Paramount made this move after merging with Skydance. Dive deeper

Rumble is considering a $1.17 billion bid for German AI cloud firm Northern Data to acquire its GPU cloud and data center units. Northern Data’s board is reviewing the offer, with Tether backing the deal. The final offer is expected to be higher, and shareholders would own about 33% of Rumble post-transaction. Dive deeper

Lithium carbonate prices rose above CNY 75,000 per tonne in August on concerns over reduced output from key mines. China’s capacity cuts and mining permit suspensions have fueled supply worries. However, global production is expected to grow as miners maintain operations. Dive deeper

China’s vehicle sales rose 14.7% year-on-year to 2.59 million units in July 2025, with new energy vehicles up 27.4%, making up nearly half of sales. Total sales for the first seven months grew 12%, while NEV sales jumped 38.5%. Monthly sales fell 10.7% in July after June’s gain. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Sanjay Malhotra, Governor of the Reserve Bank of India, on minimum balance requirements

“The RBI has left it to banks to decide on the minimum balance requirements. Some banks have kept it at Rs 10,000, some at Rs 2,000, and some have no requirement. It is not in the regulatory domain.” - Link

Nilesh Shah, Managing Director, Kotak AMC, on U.S. tariffs and India’s trade position

"India faces the second-largest trade deficit in the world, exceeding $250 billion."

"By giving access to our domestic market, we should seek opening up of local markets for Indian products and support companies to survive this 50% tariff imposition."

"Let us hope for the best but prepare for the worst."

"We have to focus on the economy. The market will take care of itself. FPIs will be taken care of by focusing on the economy."

"We must leverage our large trade deficit to divert exports from tariff-hit goods to other countries."

"The government is stimulating the domestic economy through income tax cuts, GST rationalisation, petrol-diesel price cuts, and ease of doing business."

"We must focus on becoming self-reliant in technology and R&D."

"Earnings growth will drive stock performance and must be supported by economic growth."

"Returns depend on earnings growth and valuation. Even 100% earnings growth won’t generate returns if valuation derates."

"FY26 is expected to be a year of consolidation with Nifty EPS around Rs 1,100 to Rs 1,125." - Link

Nirmala Sitharaman, Union Finance Minister, on GST tax evasion in Karnataka

“Central GST authorities have not issued any notices based on UPI transactions.”

“In 2024-25, 1,254 cases involving ₹39,577 crore of GST evasion were detected by CGST officers.”

“Nine persons were arrested and ₹1,623 crore voluntary payments were made.”

“The amount detected by CGST officers in FY25 was over 5 times that of FY24.”

“In 2023-24, 925 cases involving ₹7,202 crore evasion were detected, with two arrests and ₹1,197 crore voluntary payments.”

“In 2022-23, 959 cases involving ₹25,839 crore tax evasion were detected, with two arrests and ₹1,705 crore voluntary payments.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

📚 Also reading Mind Over Markets by Varsity?

It goes out thrice a week, covering markets, personal finance, or the odd question you didn’t know you had. The Varsity team writes across three sections: Second Order, Side Notes, and Tell Me Why, thoughtfully put together without trying to be too clever.

Go check out Mind Over Markets by Zerodha Varsity here.

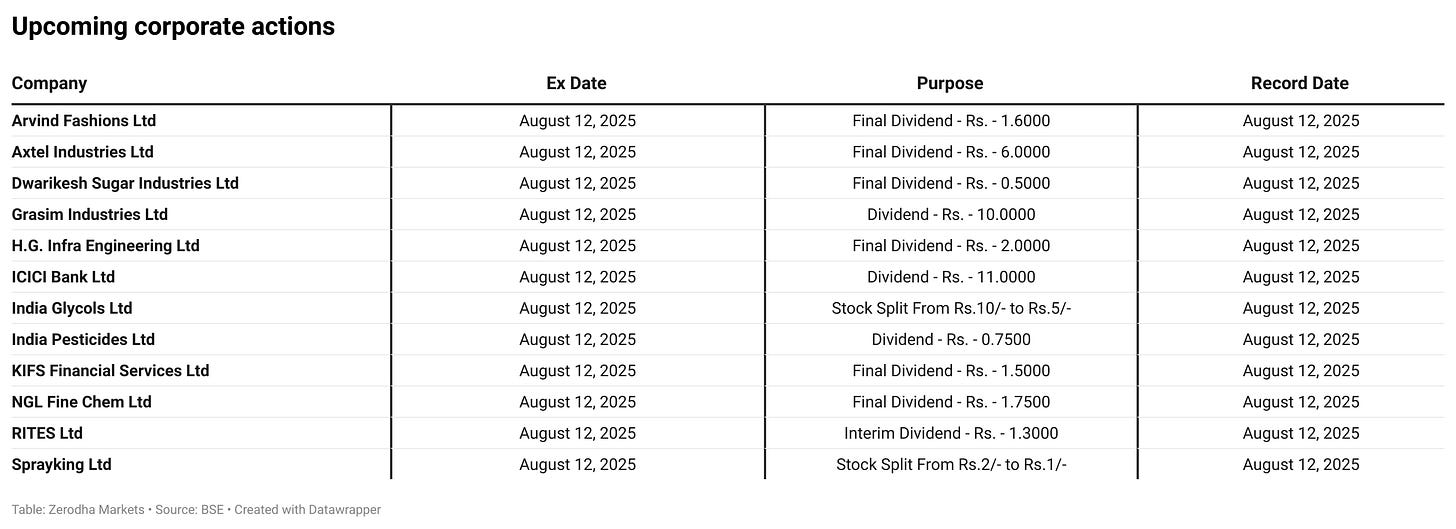

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.