Nifty powers ahead for 8th straight day, closes at 2-month high

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we break down the realities of full-time trading—from proof of work, barriers to entry, and leverage, to the actual amount of capital you’d need to survive. More importantly, we ask: is trading full-time worth your time, or are there smarter alternatives?

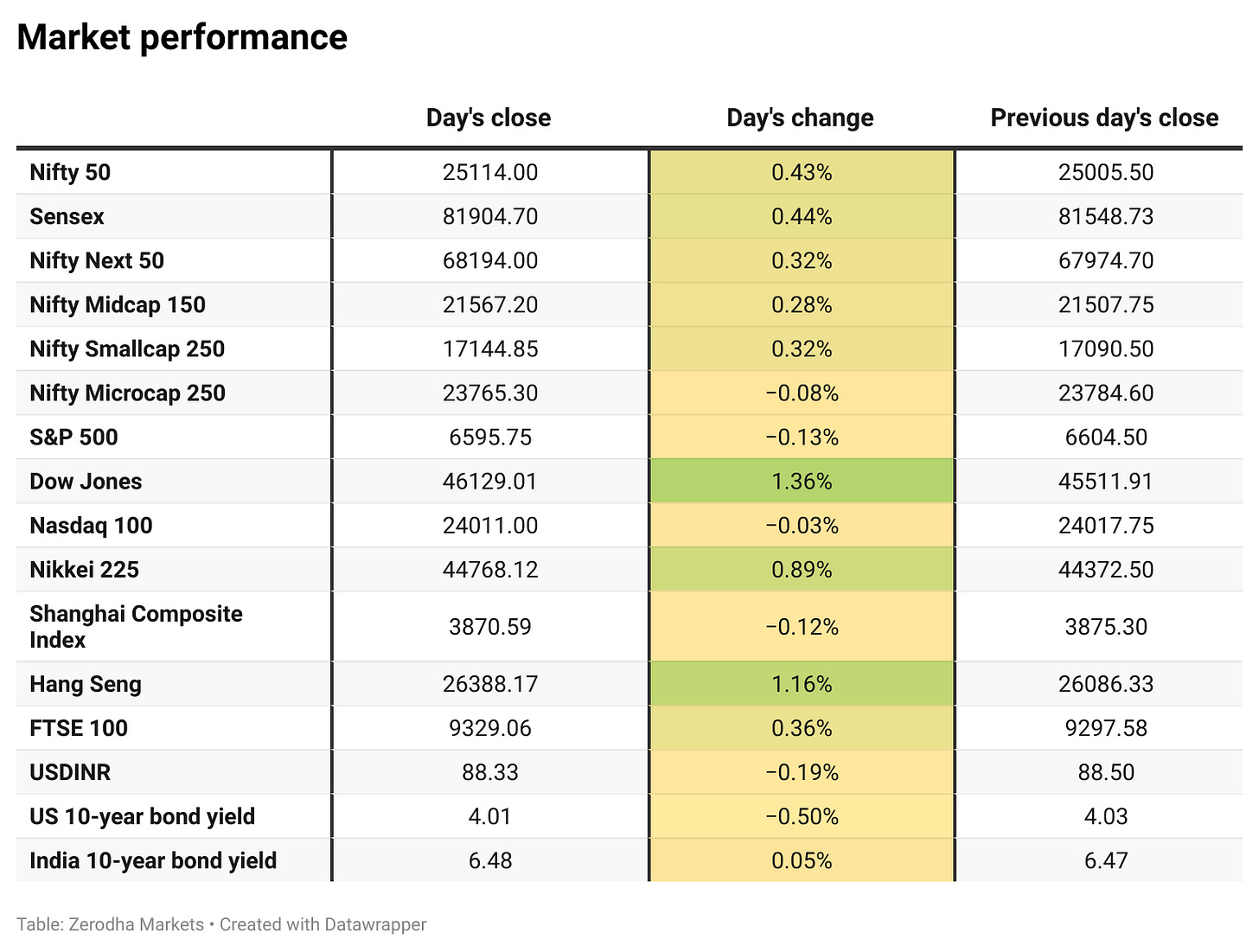

Market Overview

Nifty opened with a 70-point gap-up at 25,075, reacting to strong global cues, and after consolidating between 25,040 and 25,070 in the first hour, extended its gains through the morning session. The index steadily climbed higher, crossing 25,130 by mid-day.

In the second half, Nifty consolidated its gains, trading in a narrow range between 25,100 and 25,130. Despite minor volatility, the index managed to hold above the 25,100 mark and eventually closed at 25,114, up 0.43%, retaining its early strength.

While market sentiment remains cautious in general, with concerns over 50% tariffs, persistent foreign investor outflows, and muted earnings weighing on confidence, some encouraging triggers, such as easing U.S.-India trade tensions, have helped markets recover from lows in the last week.

Broader Market Performance:

Broader markets had a mixed session today. Of the 3,145 stocks traded on the NSE, 1,561 advanced, 1,483 declined, and 101 remained unchanged.

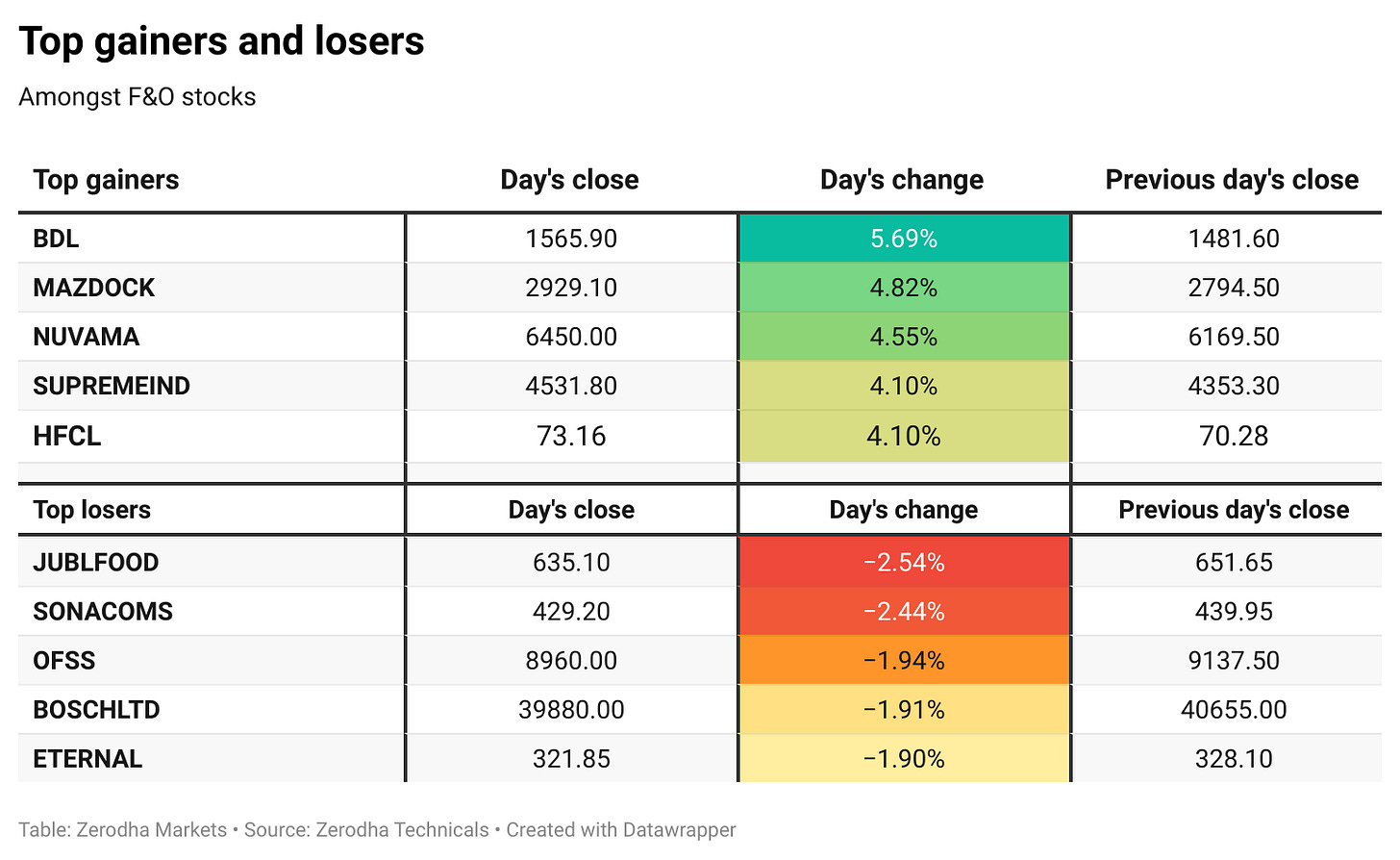

Sectoral Performance

The top gaining sector of the day was Nifty Metal, which rose by 0.93%, while the Nifty FMCG index was the worst performer, slipping 0.71%. Out of the 12 sectoral indices, 9 closed in the green and 3 ended in the red, indicating a broadly positive market breadth across sectors.

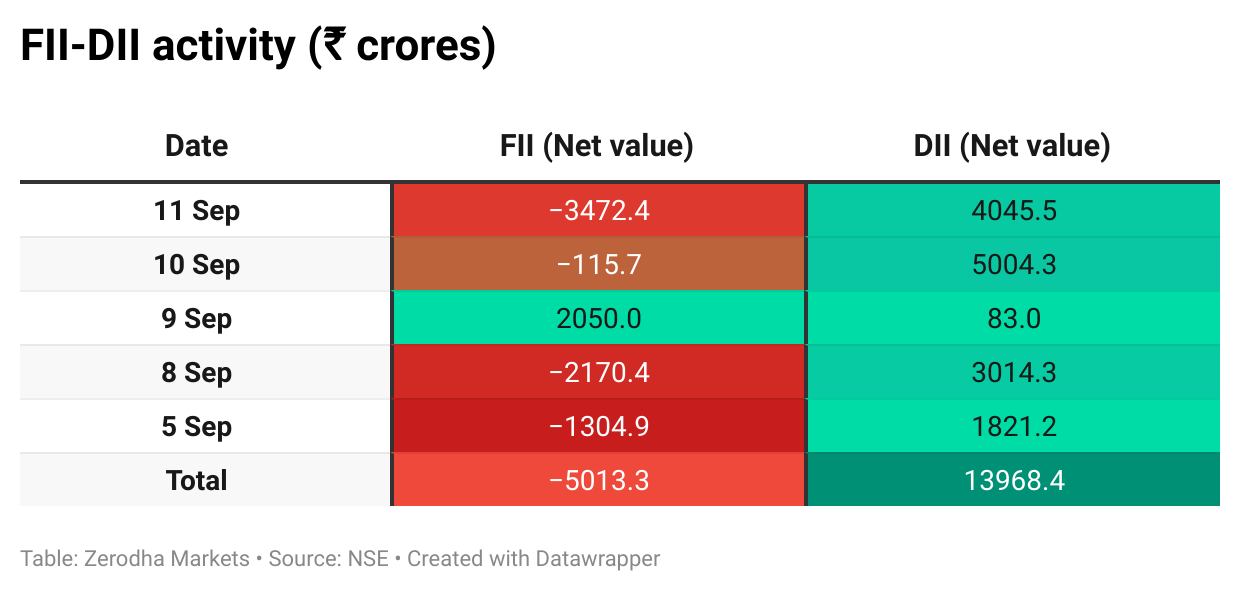

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 16th September:

The maximum Call Open Interest (OI) is observed at 25,500, followed by 25,200, suggesting strong resistance at 25,200 - 25,300 levels.

The maximum Put Open Interest (OI) is observed at 25,000, followed closely by 25,100, suggesting strong support at 25,000 to 24,900 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

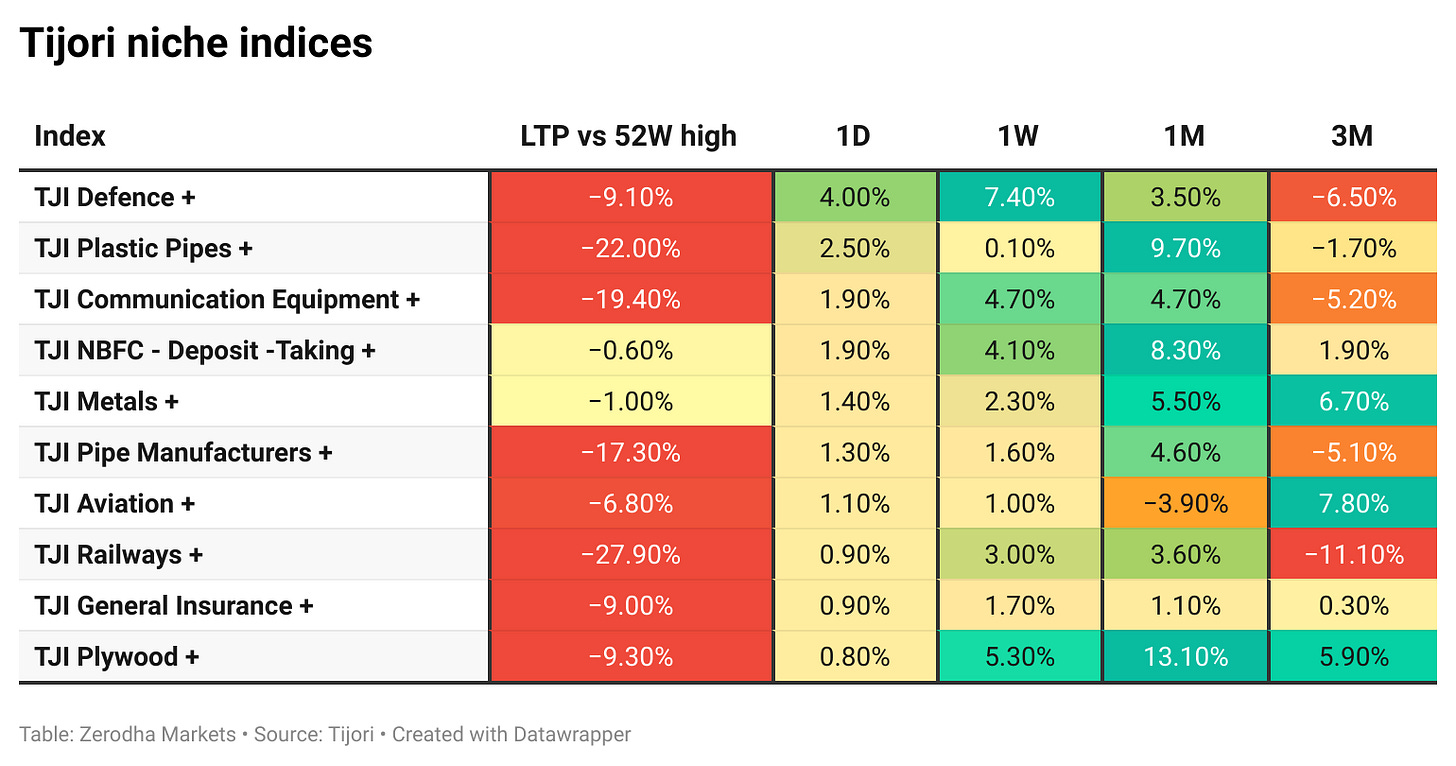

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

India’s retail inflation rose to 2.07% in August from 1.61% in July, the first uptick in ten months, but still near the RBI’s lower tolerance band. Food prices eased their decline, while housing, fuel, and clothing inflation moderated slightly. Dive deeper

Sebi has eased IPO norms for large issuers, lowering minimum public offer requirements and extending timelines to meet 25% public shareholding. It also raised anchor investor reservations for QIBs to 40% while retaining 35% for retail investors. Dive deeper

The rupee recovered seven paise from its all-time low to close at 88.28 against the US dollar, aided by dollar weakness and firm domestic markets. Dive deeper

India’s REIT market, valued at $18 billion as of August 2025, is projected to cross $25 billion by 2029, according to an ANAROCK-CREDAI report. Growth will be driven by regulatory reforms, diversification into new asset classes, and strong institutional participation. Dive deeper

HFCL has secured 1,000 acres of land from the Andhra Pradesh government in Sri Sathya Sai district to set up defence manufacturing facilities. The project will be developed in two phases, focusing on ammunition, grenades, and other defence products. Dive deeper

Royal Orchid Hotels aims to raise RoCE to 25% in five years by focusing on cost control and an asset-light expansion model, with 80% of growth from management contracts. The company expects a strong boost from the GST cut on rooms priced below ₹7,500, which make up most of its portfolio. Dive deeper

The Karnataka cabinet has approved allotment of 18 acres to GAIL India in Bengaluru to set up a bio-CNG unit with 300-500 TPD capacity. It also cleared guidelines against spurious bio-diesel sales and extended Ayushman Bharat Arogya Karnataka benefits to all citizens aged 70 and above. Dive deeper

Hindustan Copper announced a ₹2,000 crore capex plan over the next five to six years, with plans to acquire new copper deposits in India and abroad. The company is also exploring collaborations, including with Chile’s Codelco, to expand its mining portfolio. Dive deeper

ICICI Prudential Life reported a 99.6% claim settlement ratio in Q1 FY26, settling claims worth ₹407 crore with an average turnaround of 1.1 days. Under its ‘Claim for Sure’ initiative, ₹75 crore of claims were cleared within one day of receiving documents. Dive deeper

Infosys has approved its largest-ever share buyback of ₹18,000 crore ($2 billion) at ₹1,800 per share via the tender offer route. This marks the company’s fifth buyback, with the last conducted in 2022-23. Dive deeper

Lodha Developers shares opened higher after signing a ₹30,000 crore MoU with the Maharashtra government to build a green integrated data centre park in Mumbai. The project will have 2 GW capacity and create about 6,000 jobs. Dive deeper

India’s sugar production is projected to rise to 349 lakh tonnes in 2025-26 from 295 lakh tonnes this season, supported by strong crop conditions in Maharashtra, Karnataka, Uttar Pradesh, and Tamil Nadu. Minor output declines are expected in Punjab, Haryana, and Uttarakhand due to floods. Dive deeper

Tata Capital is set to launch its $2 billion (₹17,000 crore) IPO in early October after receiving an RBI extension beyond September 30. The issue, valuing the firm at $18 billion, will include a fresh issue and OFS, making it the largest in India’s financial sector. Dive deeper

What’s happening globally

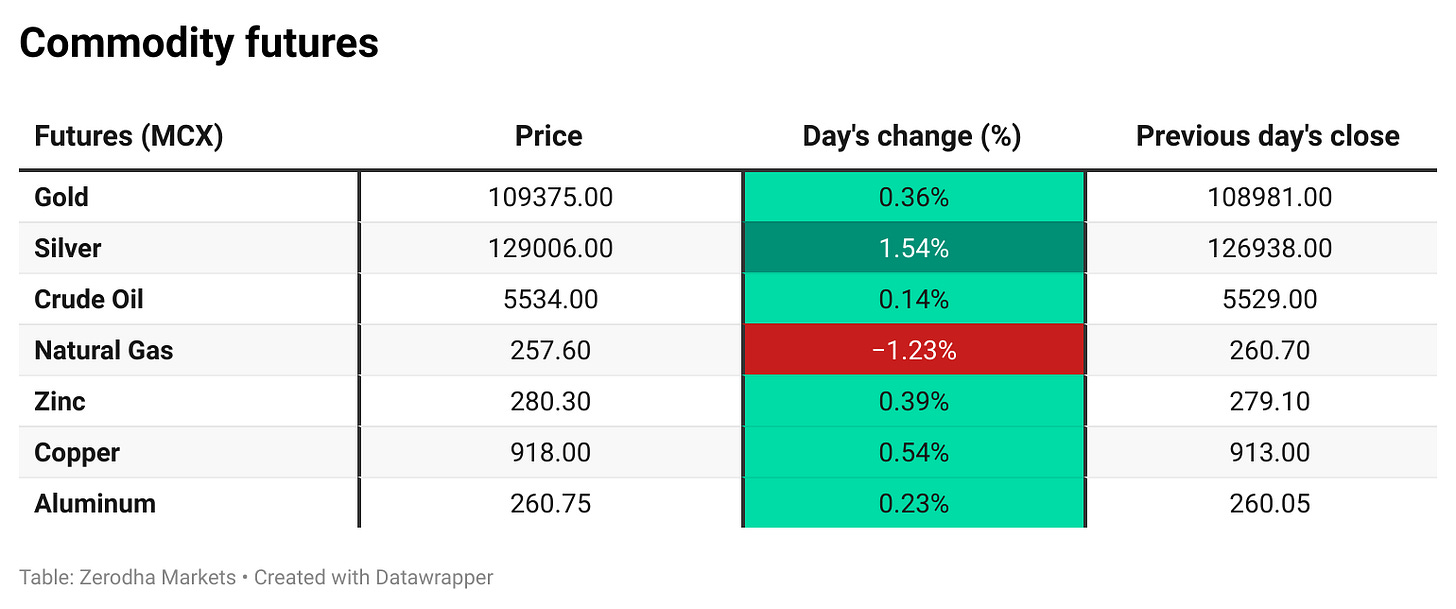

WTI crude rose to $63.5 a barrel after a Ukrainian drone strike disrupted operations at Russia’s Primorsk port, raising supply concerns. Dive deeper

Gold rose to about $3,650 per ounce, heading for a fourth straight weekly gain as weak US data reinforced Fed rate cut bets. Geopolitical tensions in Europe and the Middle East added to its safe-haven appeal. Dive deeper

Canada’s industrial capacity utilization slipped to 79.3% in Q2 2025 from 79.9% in Q1, though above forecasts. The drop was led by weaker oil and gas output, lower hydro generation, and declines in petroleum, coal, and food manufacturing. Dive deeper

The Bank of Russia cut its key rate by 100 bps to 17%, its third straight reduction and totaling 400 bps since June, though smaller than expected. Policymakers noted inflation eased to 8.1% but warned of persistent risks from strong consumption, high expectations, and labor shortages. Dive deeper

The UK economy was flat in July after June’s 0.4% growth, as gains in services and construction were offset by a sharp fall in manufacturing. GDP rose 0.2% over the three months to July and 1.4% year-on-year, slightly below expectations. Dive deeper

Alibaba has started using its own chips for smaller AI models, while Baidu is testing its Kunlun P800 chip to train new versions of Ernie, partly replacing Nvidia processors. The shift highlights China’s push for homegrown AI technology amid US export restrictions. Dive deeper

OpenAI is restructuring into a public benefit corporation, giving its nonprofit arm an equity stake worth at least $100 billion, or about 20% if valued at $500 billion. The move, backed by Microsoft, aims to align governance with financial growth while preserving the nonprofit’s control and mission. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Mahesh Patil, CIO, Aditya Birla Sun Life AMC, on market outlook

"Indian markets may remain range-bound in the near term, but earnings growth of 10-12% in H2, aided by GST cuts and demand revival, should drive momentum."

"Consumption-led sectors like autos, FMCG, white goods, and apparel will see buoyancy, while metals, cement, pharma, NBFCs, and power are likely outperformers."

"FII selling has been valuation-driven, but with ownership at a 20-year low and the gap narrowing, inflows should return as global rate cuts and policy support kick in." - Link

Kelly Ortberg, CEO, Boeing, on certification delays and production goals

"We are falling behind schedule on the certification of the 777X, with a mountain of work still to complete."

"We still plan for the 737 MAX 7 and MAX 10 variants to be certified in 2026 and aim to produce 42 MAX aircraft per month by year-end."

"Our free cash flow guidance for Q3 stands, and we expect to generate positive free cash flow in Q4 despite ongoing challenges." - Link

Willem Buiter, Economist on Fed policy and global outlook

"There can be little doubt that the Fed will cut rates by 25 basis points on September 16–17 and probably hint at one or two more cuts this year."

"The central bank is now prioritizing weak employment data over inflation risks, so I expect two or three more cuts starting this September."

"India is growing at a spectacular 7.8%, China may slip below 5%, and despite tariffs hitting Brazil, key emerging markets like India, China, and Indonesia should do well over the next year." - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

📚 Also reading Mind Over Markets by Varsity?

It goes out thrice a week, covering markets, personal finance, or the odd question you didn’t know you had. The Varsity team writes across three sections: Second Order, Side Notes, and Tell Me Why, thoughtfully put together without trying to be too clever.

Go check out Mind Over Markets by Zerodha Varsity here.

Calendars

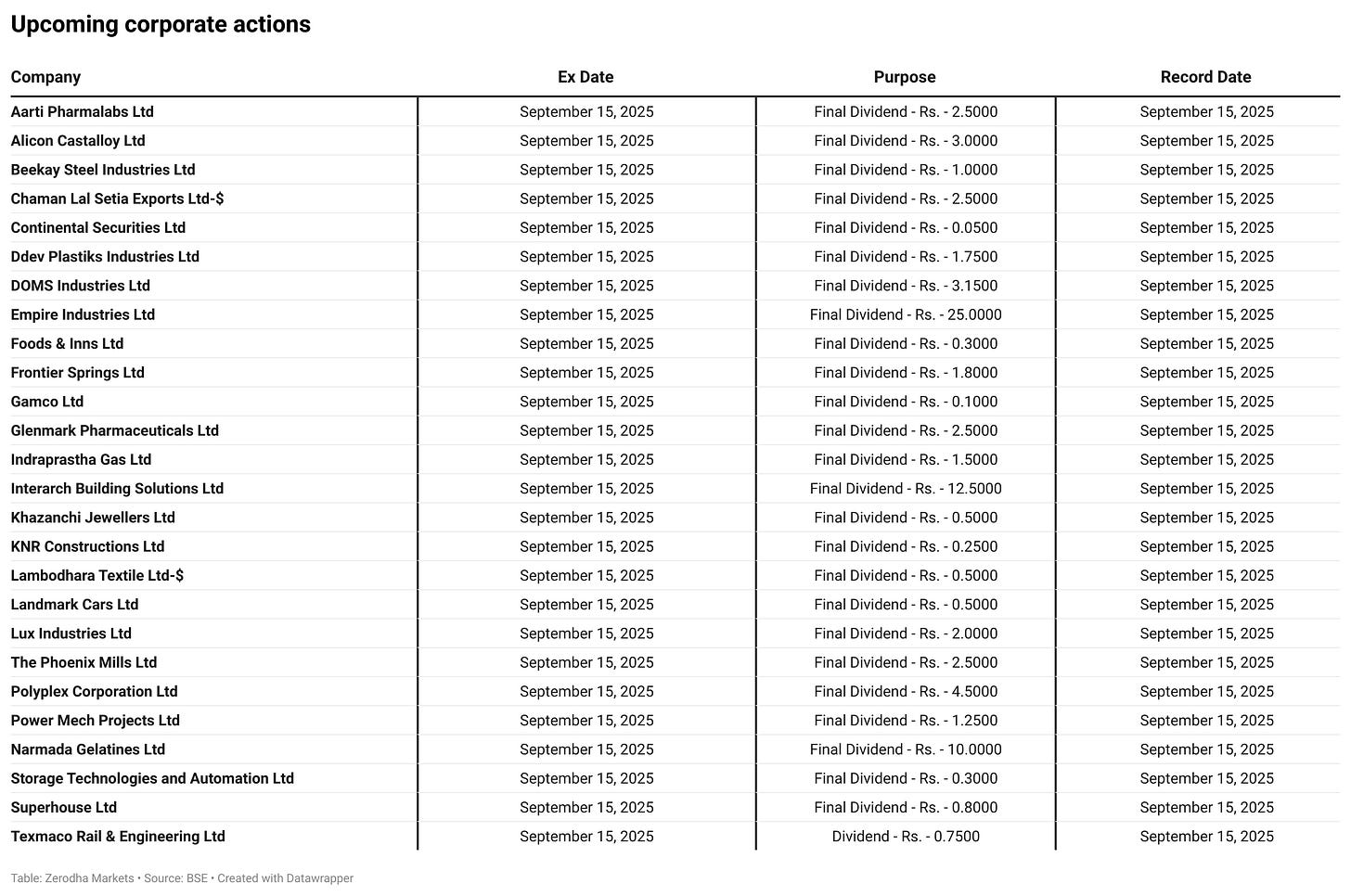

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!