Nifty pauses after recent highs, closes near 26,250

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we explore Week 1 of 2026, where markets began the new year on a strong note, with NIFTY and BANKNIFTY closing at fresh all-time highs. Expanding ranges, improving momentum, and leadership from cyclicals like banking and metals drove the move, while mid-week compression gave way to rising volatility into Friday — setting a constructive early-year tone even as option-implied moves stayed relatively modest.

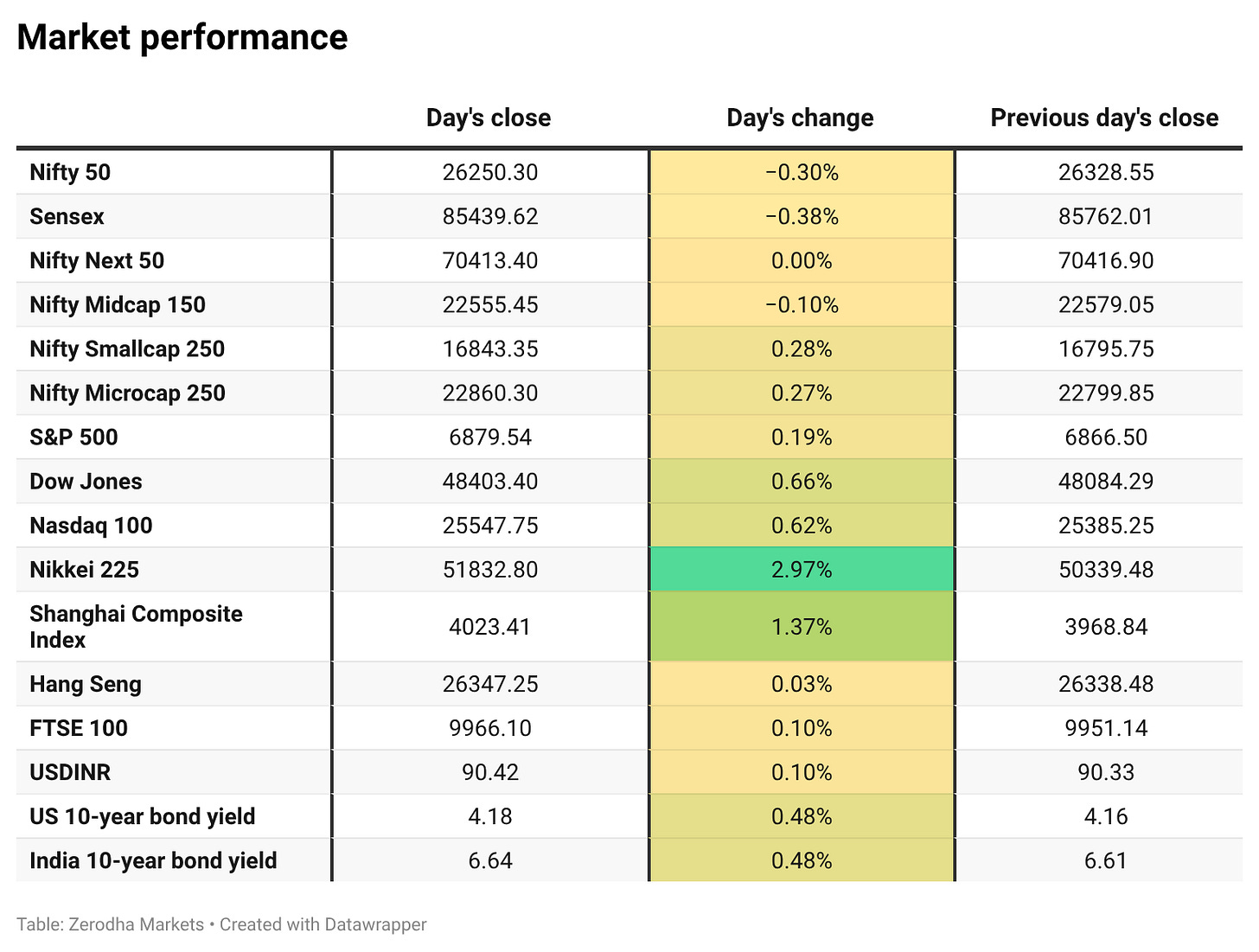

Market Overview

Nifty opened flat at 26,334 amid cautious sentiment following the news of a U.S. strike on Venezuela and comments from U.S. President Trump on the possibility of higher tariffs on India. The index saw sharp intraday volatility in the opening hour, slipping toward the 26,270–26,280 zone before staging a swift rebound to test the 26,350–26,360 area by 10:30 AM.

Through the late morning and early afternoon, Nifty traded with a mild negative bias, gradually giving up gains as selling pressure emerged at higher levels. Post 1 PM, weakness intensified, with the index sliding nearly 100 points to the 26,210–26,220 zone by around 2 PM. A modest recovery followed in the final hour, but upside traction remained limited.

Nifty eventually closed at 26,250.30, ending near the lower end of the day’s range after a volatile session marked by profit-taking near record highs and heightened geopolitical uncertainty.

Looking ahead, markets are likely to remain sensitive to global risk appetite, currency movements, and further developments around India–U.S. trade negotiations.

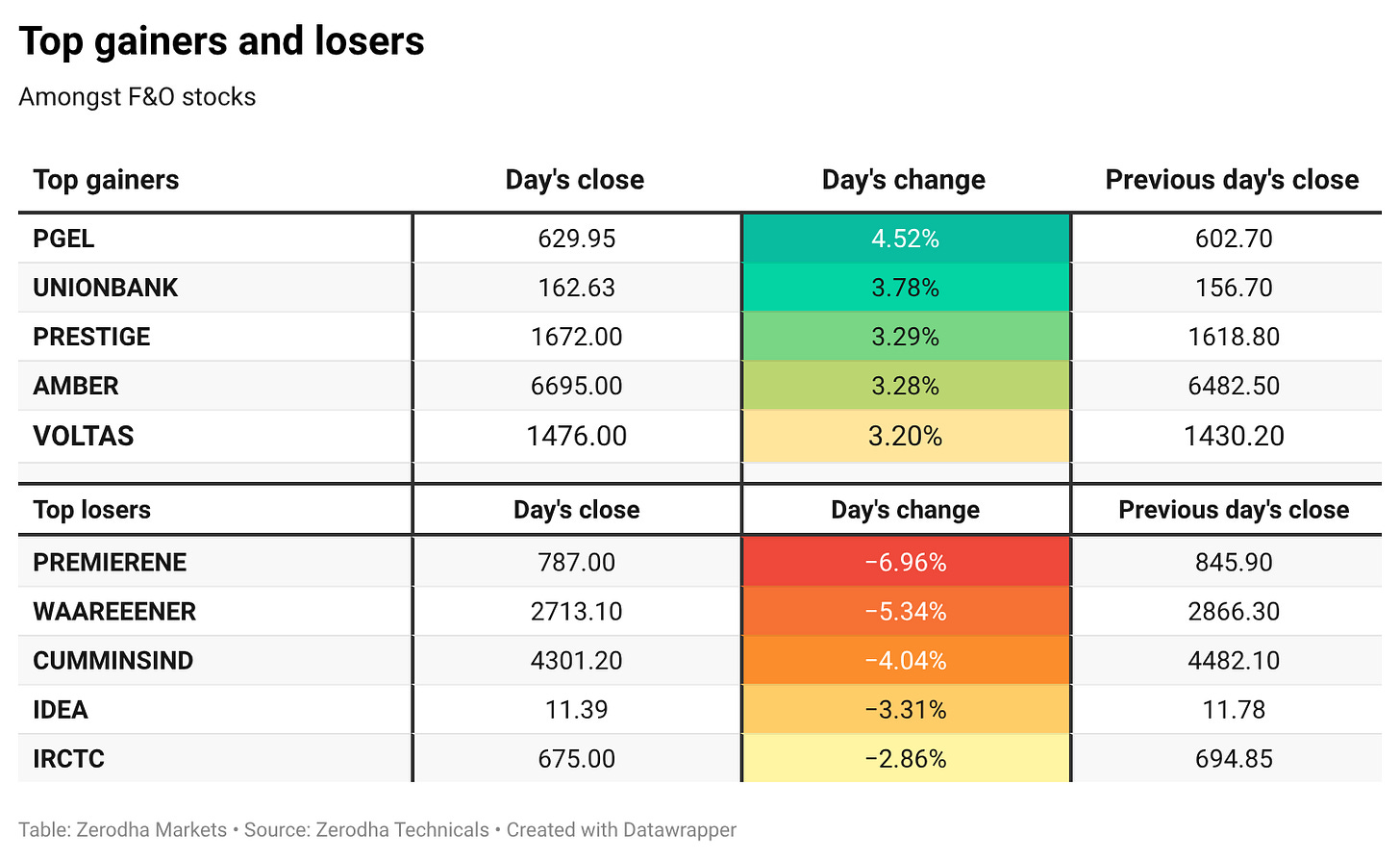

Broader Market Performance:

The broader market had a weak session today. Out of 3,258 stocks that traded on the NSE, 1,208 advanced, while 1,943 declined, and 107 remained unchanged.

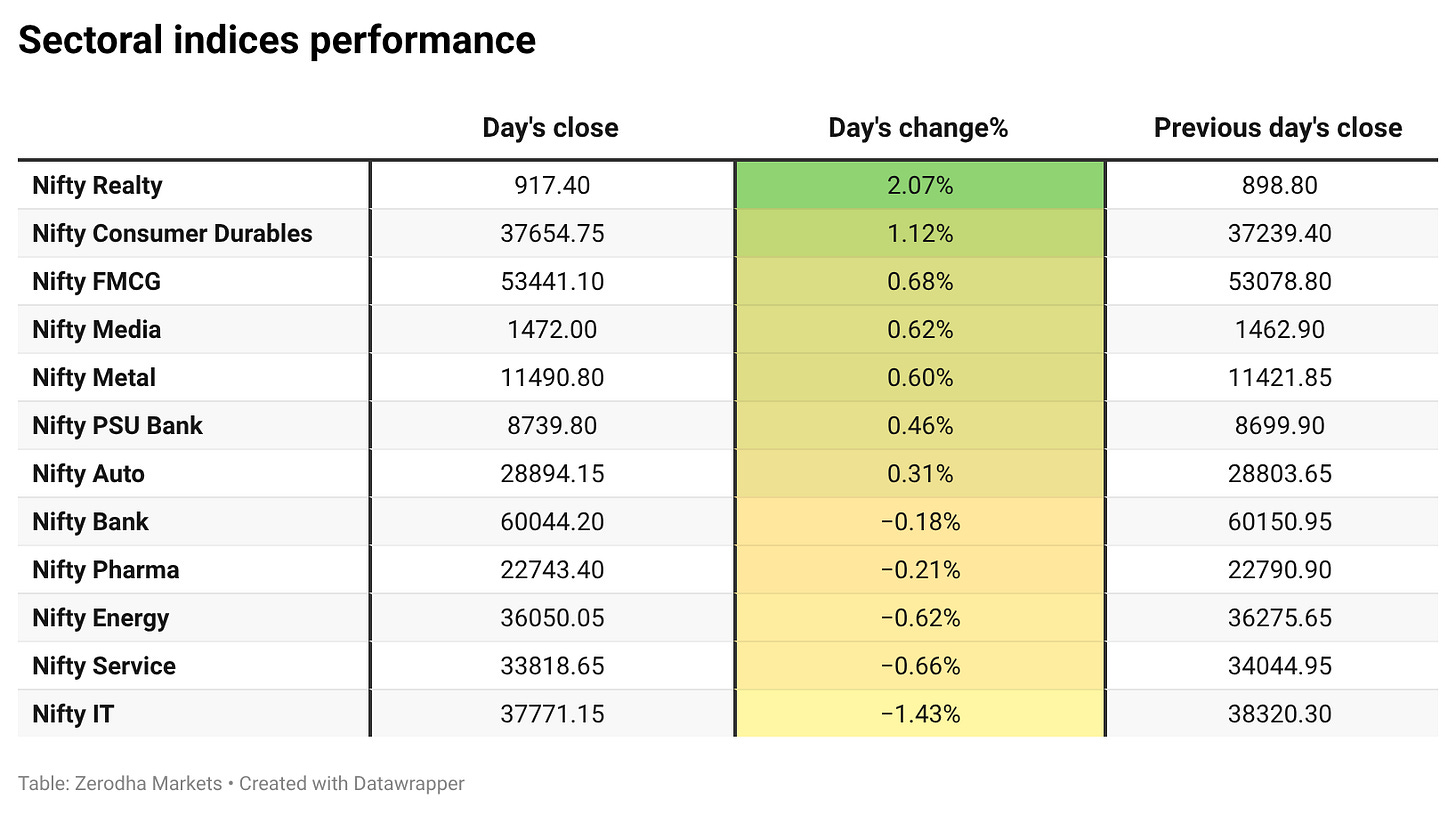

Sectoral Performance:

Nifty Realty was the top gainer, rising 2.07%, while Nifty IT was the biggest loser, slipping 1.43%. Out of the 12 sectoral indices, 7 ended in the green and 5 closed in the red.

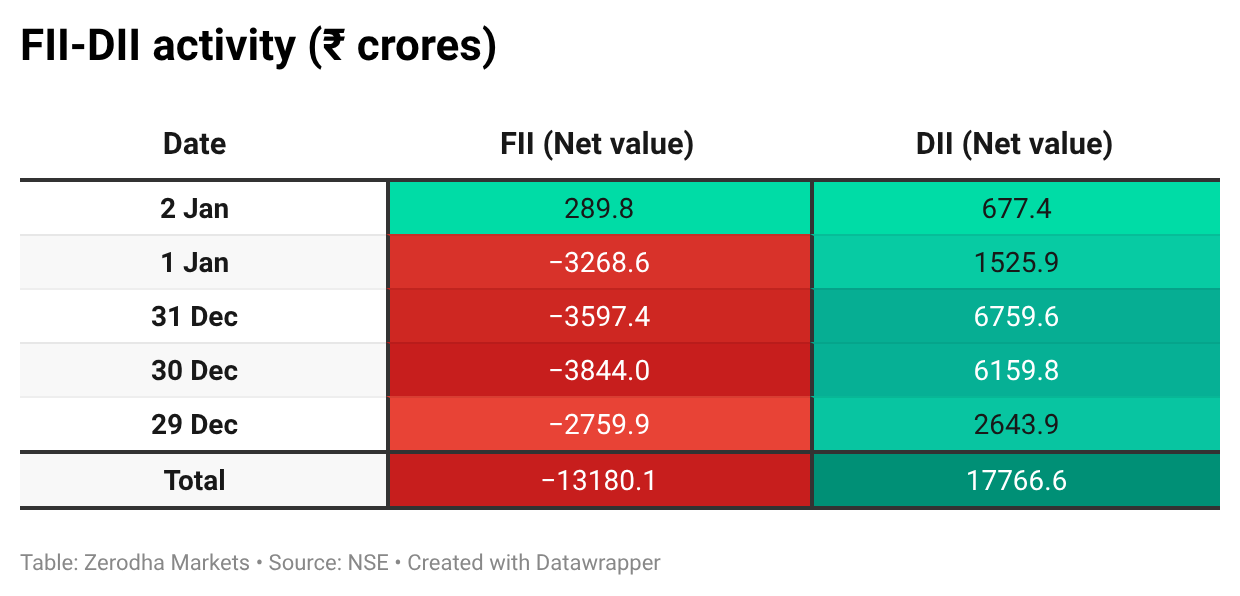

Here’s the trend of FII-DII activity from the last 5 days:

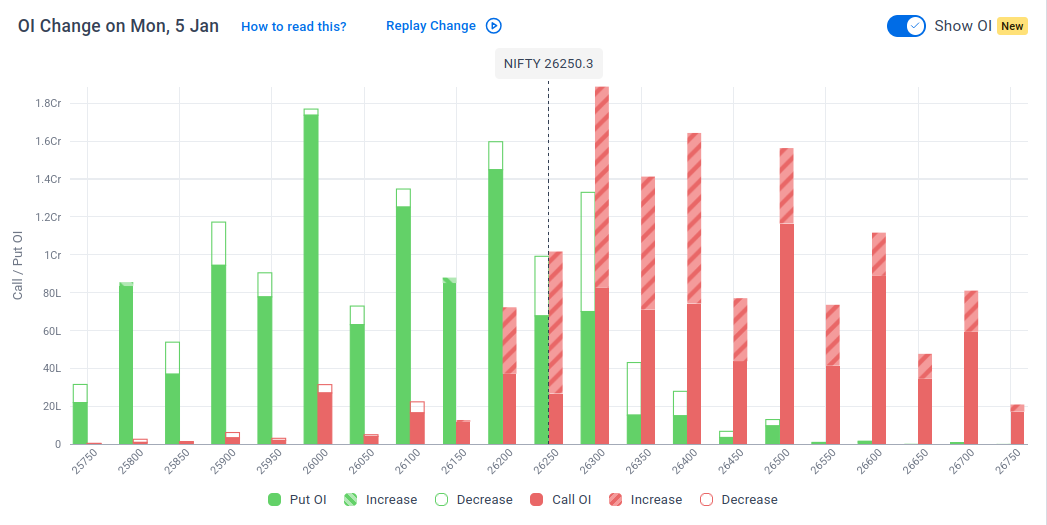

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 6th January:

The maximum Call Open Interest (OI) is observed at 26,300, followed by 26,400, indicating potential resistance at the 26,300 -26400 levels.

The maximum Put Open Interest (OI) is observed at 26,000, followed by 26,200, suggesting support at the 26,200 to 26,100 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

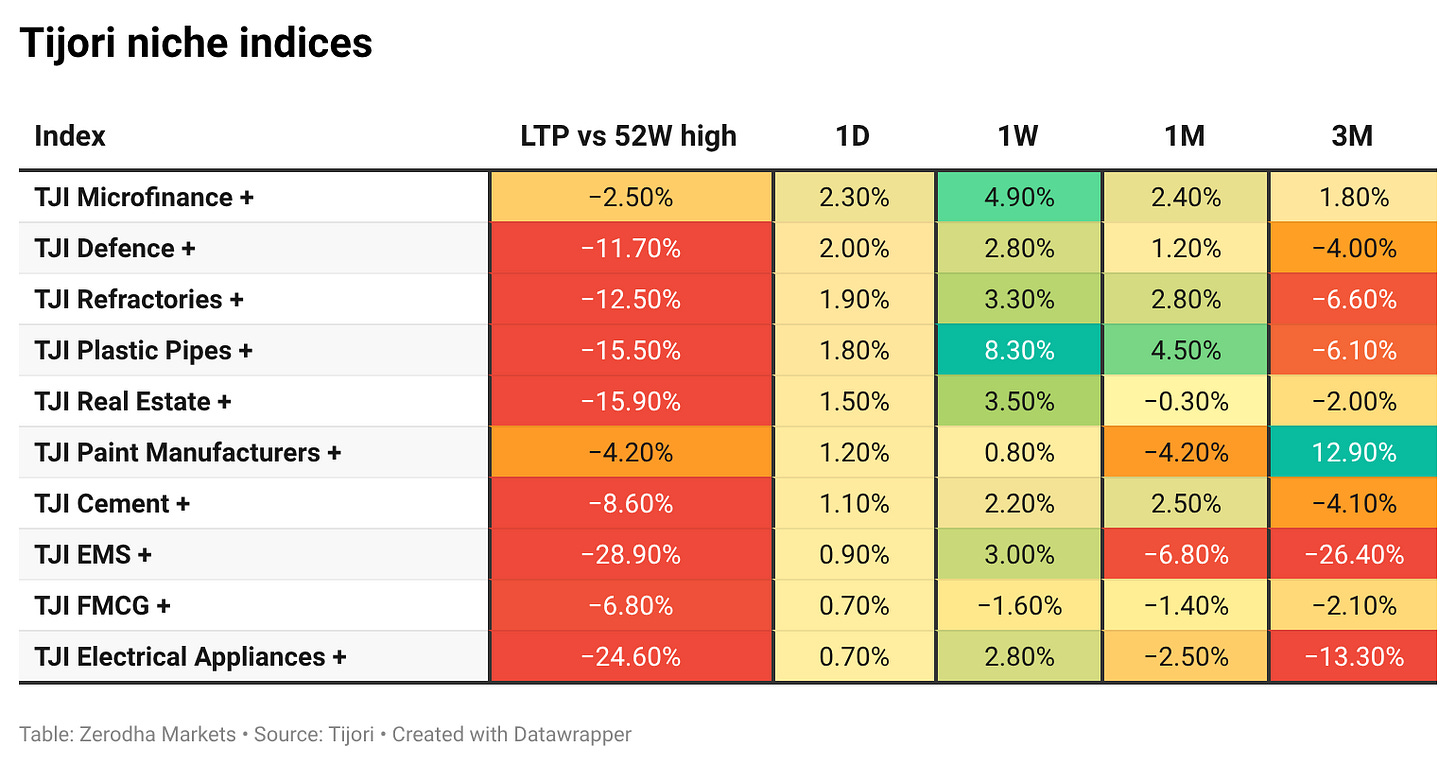

Tijori is an investment research platform that has constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

Reliance Industries and ONGC may benefit from a US-led restructuring of Venezuela’s oil sector if sanctions are eased, potentially improving crude supply access and enabling the release of long-pending cash flows. Dive deeper

The 10-year G-Sec yield rose to a two-week high as markets priced in record state borrowing and tight liquidity. Bond selling and cautious investor sentiment outweighed support from upcoming RBI bond purchases. Dive deeper

The rupee weakened slightly as dollar demand picked up around the RBI’s reference rate, with routine corporate buying and limited exporter selling weighing on the currency. Dive deeper

HDFC Bank reported steady growth in its Q3 business update, with advances under management rising 9.8% year on year to ₹29.46 lakh crore and deposits increasing 11.5% to ₹28.60 lakh crore. Dive deeper

DMart reported a 13% year on year increase in Q3 revenue to ₹17,613 crore, according to its provisional business update for the quarter ended December 31, 2025. The company’s total store count stood at 442 during the quarter. Dive deeper

NHPC has announced that its board will meet on January 8, 2026, to consider raising up to ₹2,000 crore through the issuance of unsecured, redeemable, taxable, non-convertible bonds via private placement as part of its FY26 borrowing plan. Dive deeper

HDFC Asset Management is entering the private credit space with a Structured Credit Fund targeting up to ₹2,500 crore, including a green shoe option. The International Finance Corporation (IFC) has committed ₹220 crore as the anchor investor. Dive deeper

SBI plans to enable India - Israel trade settlements in Indian rupees amid closer bilateral ties and FTA discussions. The bank also aims to support remittances by helping Indian workers in Israel open NRI accounts. Dive deeper

Bandhan Bank shares rose after the lender reported loan growth for the December quarter, driven by stronger retail and microcredit demand. Dive deeper

Coal India has opened its e-auctions to buyers from Bangladesh, Nepal, and Bhutan as domestic coal demand for power generation weakens. Dive deeper

IDBI Bank reported a 12% year-on-year increase in total business to ₹5.46 lakh crore in Q3 FY26, with deposits rising 9% to ₹3.08 lakh crore and net advances growing 15% to ₹2.39 lakh crore, based on provisional December-quarter data. Dive deeper

Sundaram Alternates plans to raise up to ₹2,000 crore for its real estate credit fund by March, having already raised ₹1,000 crore. The fund will focus on residential sector credit opportunities with an emphasis on capital protection. Dive deeper

What’s happening globally

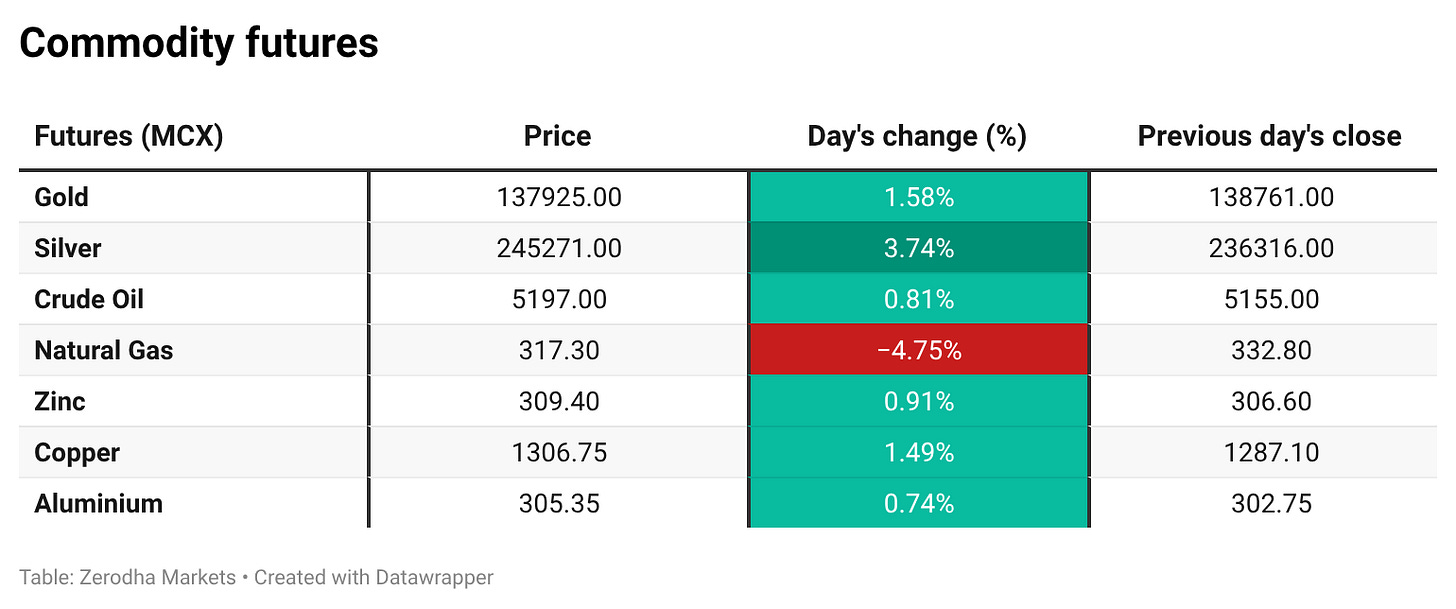

Brent crude steadied after early losses as markets assessed the impact of political developments in Venezuela, with near-term supply disruptions seen as limited due to low output. Dive deeper

Gold prices climbed as investors sought safety amid heightened geopolitical tensions following political upheaval in Venezuela. Markets also remained focused on upcoming US economic data for cues on interest rate expectations. Dive deeper

Silver prices advanced as geopolitical tensions after the US action in Venezuela lifted demand for safe-haven metals. Dive deeper

European natural gas prices fell further as abundant LNG supply and steady imports continued to ease supply concerns. High inflows, mild weather, and reliable pipeline deliveries have structurally improved Europe’s gas balance, keeping prices under pressure. Dive deeper

China’s services sector growth softened slightly in December amid weaker foreign demand. Employment continued to decline, even as business sentiment improved modestly. Dive deeper

Japanese equities rallied in the first trading session of the year, led by gains in technology stocks on optimism around AI-driven growth. Sentiment was also supported by expectations of policy support, while global geopolitical developments remained in focus. Dive deeper

Samsung plans to double the number of mobile devices equipped with its Galaxy AI features to 800 million this year, expanding AI integration across its product lineup. The move underscores intensifying competition in consumer AI as smartphone makers seek to differentiate offerings. Dive deeper

South Korean equities advanced as investor focus shifted to growth prospects from the wider adoption of artificial intelligence. Optimism around non-US beneficiaries of the AI theme outweighed geopolitical concerns, supporting broader regional gains. Dive deeper

Foxconn reported a 22.07% year on year jump in fourth quarter revenue to a record T$2.60 trillion, driven by strong demand for AI-related products. Growth was led by its cloud and networking division, while consumer electronics saw a mild decline. Dive deeper

Management chatter

In this section, we highlight interesting comments made by the management of major companies and policymakers from the Indian and Global Economies.

Navneet Munot, Managing Director & CEO, HDFC Asset Management Company, on entering private credit

“The launch of the Structured Credit Fund marks a pivotal step in scaling HDFC AMC’s alternatives platform, with IFC coming on board as a partner and anchor investor.”

“The fund builds on our credit expertise and underwriting discipline, following the earlier launch of our venture capital and private equity fund-of-funds.”

“As we continue to expand our alternatives platform, investors will hear from us soon on the next chapter with another distinct product in the coming weeks.” - Link

A. Balasubramanian, Managing Director & CEO, Aditya Birla Sun Life AMC, on Nifty’s record high and earnings outlook

“The trend at the start of the year is clearly positive, with expectations of better earnings after GST cuts and RBI rate reductions getting reflected in market behaviour.”

“What we are seeing is value-driven participation, either through attractive earnings yields or stocks where prices have corrected but underlying businesses remain strong.”

“Earnings improvement in the current year should take the market to a different level, and the Nifty touching a new high is broadly in line with that expectation.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

Calendars

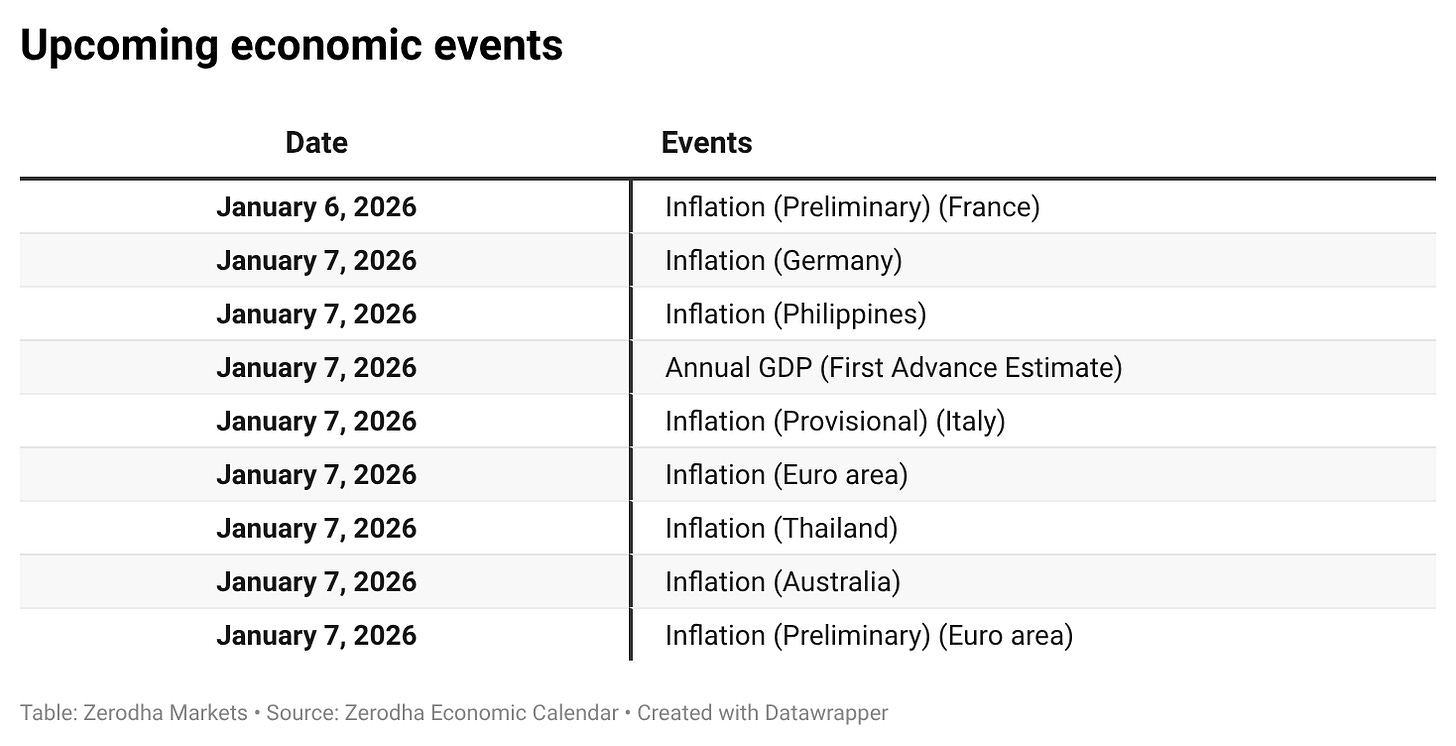

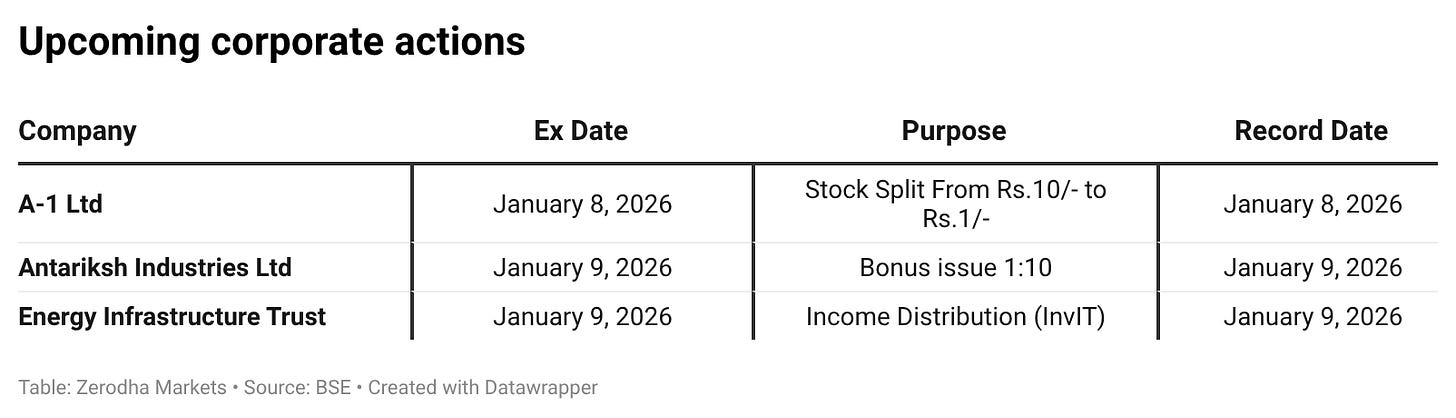

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

Volatility like this often shows what traders are doing behind the scenes more than what the price is showing. Profit-booking near highs, weak market breadth, and the OI buildup around 26,300–26,400 suggest the market wants to go higher but is waiting for clearer global cues. For now, flows may matter more than fundamentals, especially with FIIs reacting to currency moves and the ongoing US - India trade headlines.