Nifty overcomes intraday wobble to close above 25,400

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we trace the fascinating origins of hedge funds, break down how they actually work, and explore whether India has its own hedge-fund-like structures. From Alfred Winslow Jones’s unlikely story to the modern-day Category III AIFs in India, we’ll uncover how regulation, leverage, taxation, and fees shape the world of hedge funds—and why you don’t hear of “celebrity” hedge fund managers in India.

Market Overview

Nifty opened with a 111-point gap-up at 25,441, reacting positively to the Fed’s 25 bps rate cut decision. The index retained gains in the early session, before slipping into consolidation. Through the first half, Nifty remained range-bound between 25,400 and 25,430.

In the second half, weakness emerged as the index drifted lower, hitting an intraday low near 25,330 by 2:30 PM. However, a sharp late rebound lifted Nifty back above 25,420, and it eventually closed at 25,423.60, holding on to most of its opening gains.

Market sentiment is slowly tilting from caution to optimism, supported by signs of easing U.S.-India trade tensions. Still, worries over steep 50% tariffs, persistent foreign investor outflows, and muted earnings are tempering the upside.

Broader Market Performance:

Broader markets had a mixed session with a bullish bias today. Of the 3,177 stocks traded on the NSE, 1,606 advanced, 1,423 declined, and 105 remained unchanged.

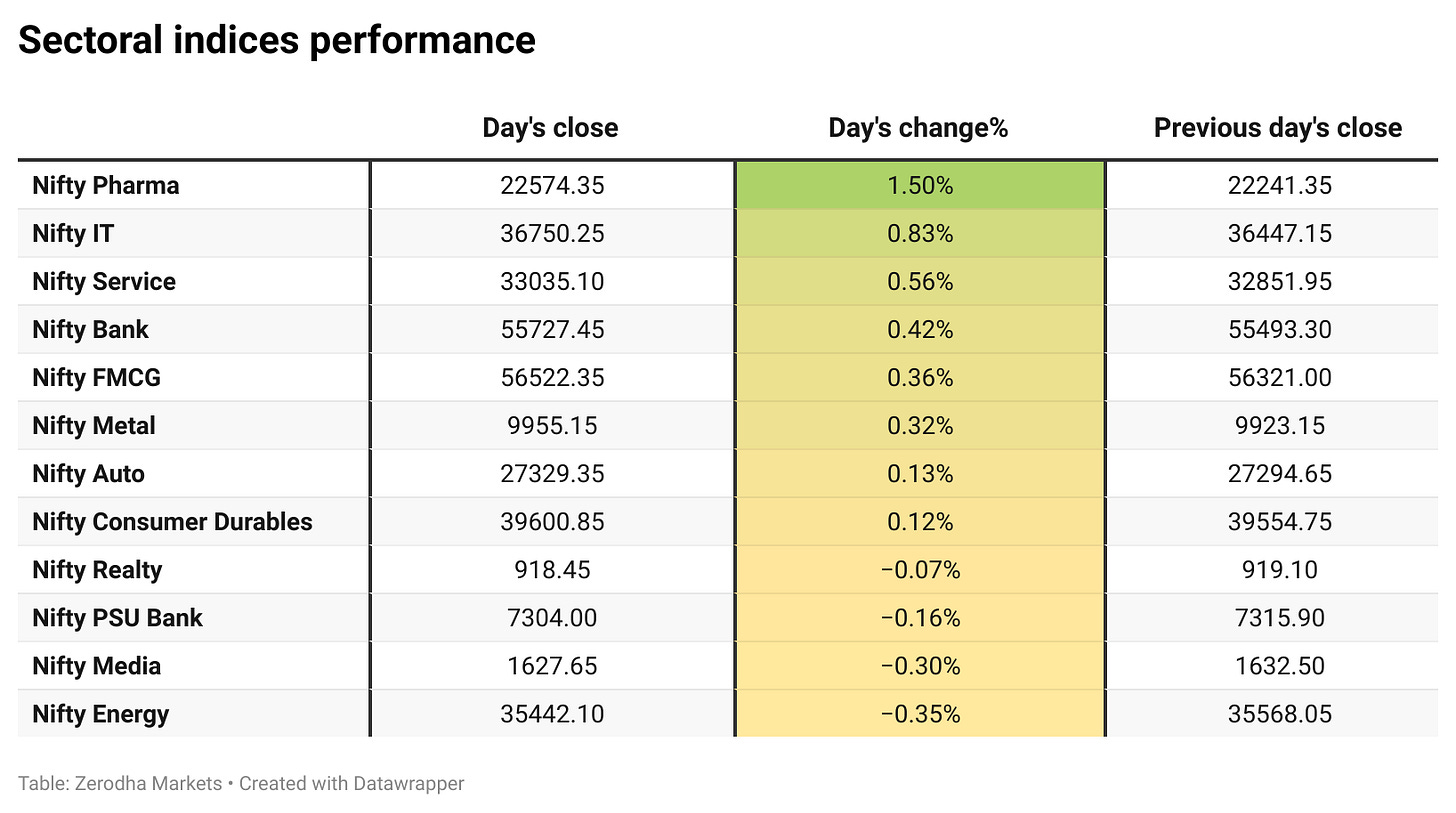

Sectoral Performance

Nifty Pharma was the top gainer today, rising 1.50%, while Nifty Energy was the top loser with a decline of 0.35%. Out of the 12 sectoral indices, 8 closed in the green and 4 ended in the red, indicating broad-based market strength led by defensive and tech-heavy sectors.

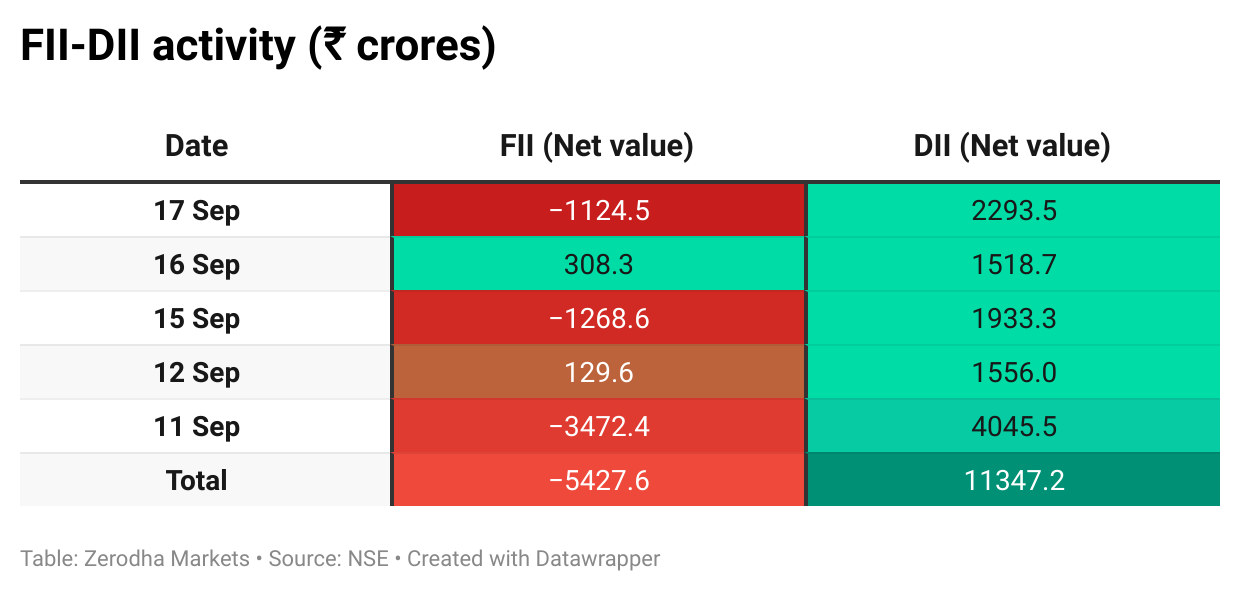

Here’s the trend of FII-DII activity from the last 5 days:

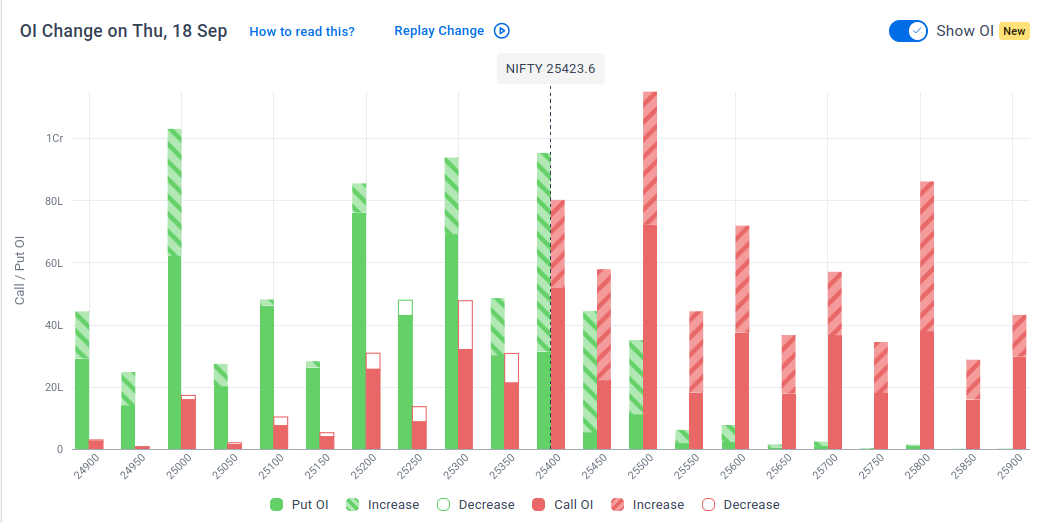

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 23rd September:

The maximum Call Open Interest (OI) is observed at 25,500, followed by 25,800, suggesting strong resistance at 25,500 - 25,600 levels.

The maximum Put Open Interest (OI) is observed at 25,000, followed closely by 25,400, suggesting strong support at 25,300 to 25,200 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

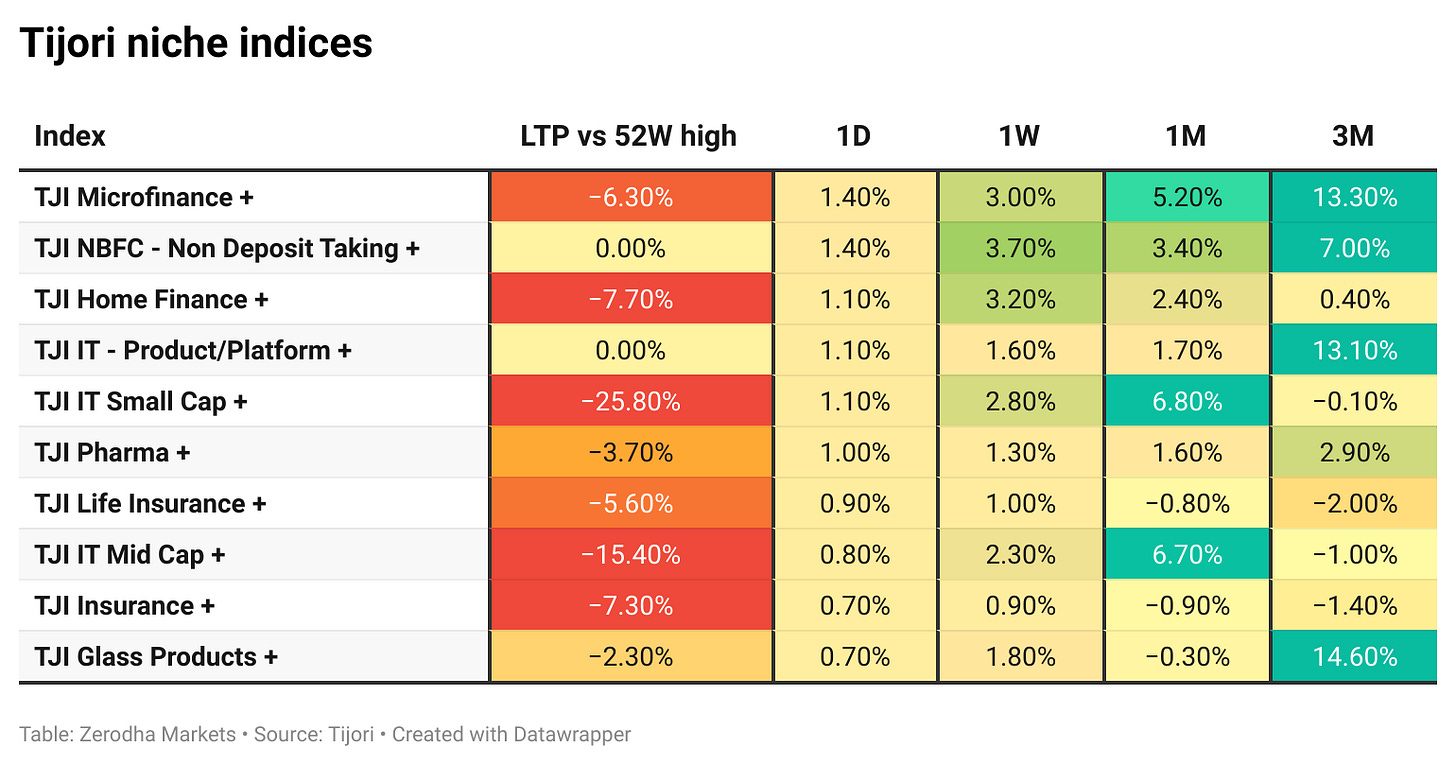

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

Sebi has closed its probe into Hindenburg’s allegations against the Adani Group, stating the charges could not be established, and no liability or penalty arises. It found that loans routed through intermediaries were fully repaid and did not qualify as undisclosed related-party transactions under rules prevailing before 2021. Dive deeper

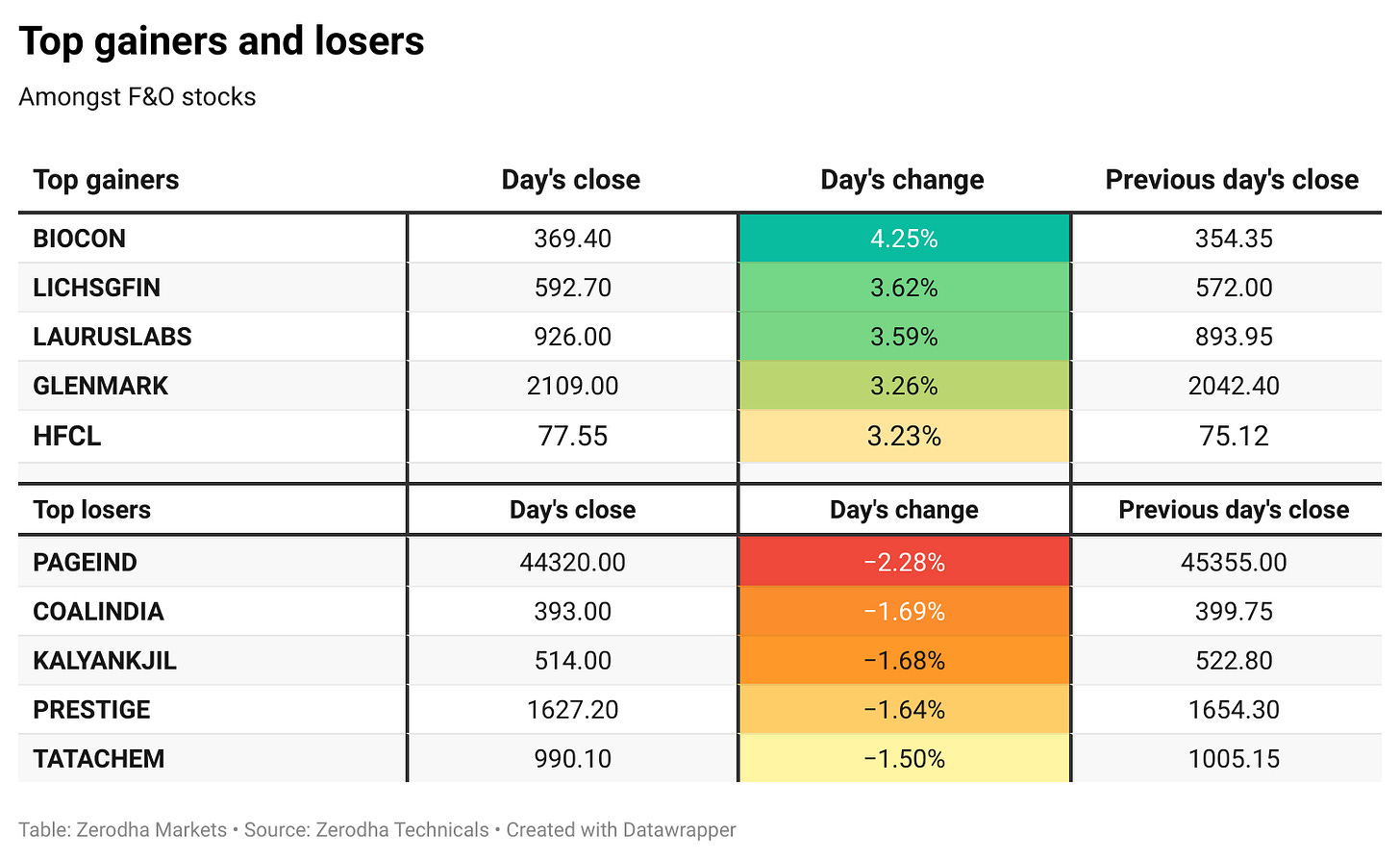

Biocon Biologics got USFDA approval for two denosumab biosimilars, Bosaya and Aukelso. Both received provisional interchangeability, enabling pharmacy-level substitution. The approvals strengthen Biocon’s position in the biosimilars market. Dive deeper

Indian government bonds slipped with the 10-year yield touching 6.50% after Fed Chair Jerome Powell’s hawkish remarks offset the impact of a rate cut. The Fed signaled more reductions this year but kept the outlook data-dependent. Dive deeper

SMBC will acquire an additional 4.2% stake in Yes Bank from Carlyle’s affiliate for ₹2,850 crore, raising its total holding to 24.2% after completing a 13.18% purchase from SBI. SBI will retain 10%, while SMBC has approvals to lift its stake up to 24.99%. The move underscores SMBC’s India push, with plans to infuse further capital into Yes Bank. Dive deeper

Rolls-Royce has expanded its Global Capability and Innovation Centre in Bengaluru, making it the company’s largest hub for civil, defence, and power systems. The firm plans to double its sourcing from India over the next five years. Dive deeper

Lupin secured USFDA approval for Lenalidomide capsules, a generic of Revlimid, in six strengths for treating multiple myeloma, to be made at its Pithampur facility. The drug has estimated US annual sales of $7.5 billion. Separately, Lupin’s Nagpur injectable plant received six FDA observations, which it plans to address. Dive deeper

The Finance Ministry has notified new CGST rates effective September 22, moving to a two-tier structure where most goods and services will attract 5% or 18%. Ultra-luxury items will face 40%, while tobacco products remain at 28% plus cess. States must now notify corresponding SGST rates for implementation. Dive deeper

KPI Green Energy has listed its first green bond worth ₹670 crore on NSE, backed by a 65% GuarantCo guarantee that enabled an AA+(CE) rating. The five-year bond carries an 8.5% coupon with quarterly amortisation, attracting long-term institutional investors. Dive deeper

Cochin Shipyard shares rose 3% after the company won a Rs 200 crore contract from ONGC for dry dock and major lay-up repairs of a jack-up rig. The 12-month project strengthens Cochin Shipyard’s offshore engineering portfolio. Dive deeper

What’s happening globally

The Federal Reserve cut the federal funds rate by 25 bps to 4.00%-4.25%, its first reduction since December. Governor Stephen Miran dissented, favoring a 50 bps cut. The Fed also raised growth and inflation projections while keeping unemployment largely unchanged. Dive deeper

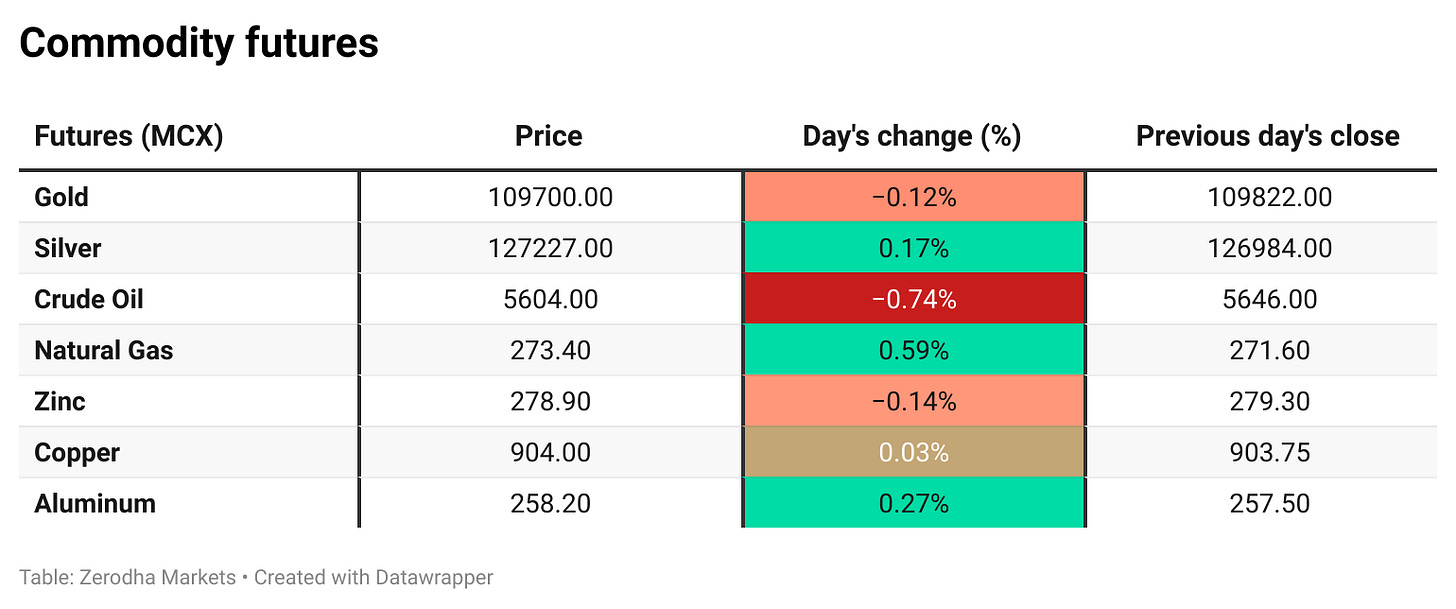

Brent crude fell below $67 per barrel as traders weighed a sharp 9.3 million-barrel US inventory draw against rising distillate stocks and the Fed’s 25 bps rate cut. Dive deeper

Gold fell toward $3,630 per ounce on Thursday after the Fed cut rates by 25 bps but struck a cautious tone on further easing, with Chair Jerome Powell stressing a meeting-by-meeting approach. Dive deeper

US initial jobless claims dropped by 33,000 to 231,000 in the second week of September, well below expectations, after fraudulent filings had inflated the prior week’s data. Continuing claims also eased to 1.92 million, the lowest since May. Claims from federal workers edged up slightly to 572. Dive deeper

The Bank of England kept rates steady at 4% in a 7–2 vote, with two members favoring a 25 bps cut. The MPC also voted 7–2 to reduce gilt holdings by £70 billion over the next year. Policymakers cited progress on disinflation, easing wage growth, and a softening economy while maintaining flexibility on future rate moves. Dive deeper

Switzerland’s trade surplus narrowed to CHF 3.9 billion in August 2025, the lowest in three months, as exports fell 1% to CHF 22 billion on weaker sales of watches and jewelry. Exports to the US plunged 22.1% amid Washington’s 39% tariff, while shipments to Europe rose 1.6%. Imports grew 0.4% to CHF 18.1 billion, driven by higher energy and vehicle purchases. Dive deeper

Amazon will invest over $1 billion to raise pay and cut healthcare costs for US fulfillment and transportation staff, lifting average total compensation to above $30 an hour. Average pay will exceed $23 an hour, with full-time staff seeing an annual boost of $1,600. Dive deeper

The Bank of Canada cut its key rate to 2.5%, a three-year low, citing a weak job market and easing inflation pressures. Governor Tiff Macklem said the bank is ready to cut further if risks rise, highlighting uncertainty from US tariffs. The decision was unanimous, with another rate review due on October 29. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Commerce and Industry Minister Piyush Goyal on exports and FTAs

" India's exports would grow by around 6% this year compared to the corresponding period last year. I believe we will end the year on a positive note."

"India's growing strength and the fact that we will be moving in the Amritkal from a $4 trillion economy to a $30 trillion-plus economy clearly show that India is the place to do business. The world would like to work closer with India."

"With the European Union, we had good discussions in the last round… we may have another virtual or physical round soon. EU President Ursula von der Leyen and Prime Minister Narendra Modi guided us to complete the negotiations by year-end."

"We negotiated, finalised, and signed the UAE FTA in 88 days. Ever since, our exports to the UAE have been growing rapidly… textiles, marine, leather, and pharmaceuticals are particular areas where we are looking for trade expansion and diversification." - Link

Jensen Huang, CEO of Nvidia on the China chip ban report

"We can only be in service of a market if a country wants us to be,"

"I'm disappointed with what I see, but they have larger agendas to work out between China and the United States. And I'm patient about it. We'll continue to be supportive of the Chinese government and Chinese companies as they wish." - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

📚 Also reading Mind Over Markets by Varsity?

It goes out thrice a week, covering markets, personal finance, or the odd question you didn’t know you had. The Varsity team writes across three sections: Second Order, Side Notes, and Tell Me Why, thoughtfully put together without trying to be too clever.

Go check out Mind Over Markets by Zerodha Varsity here.

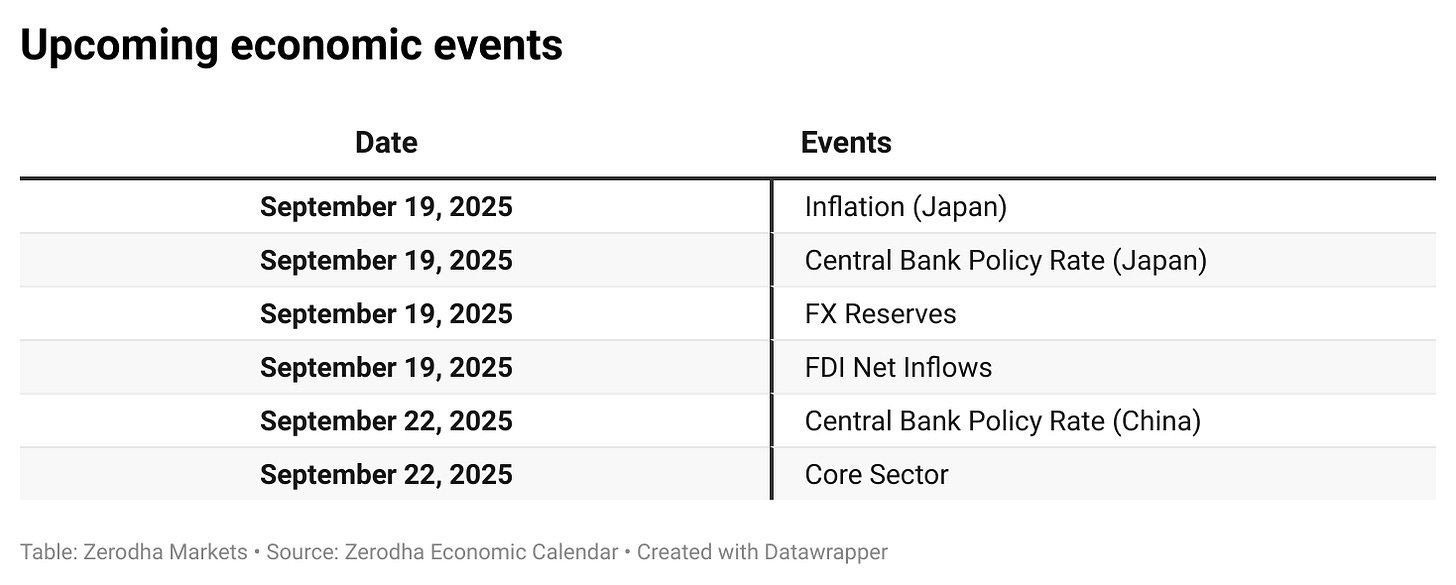

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!