Nifty just shy of fresh highs; Broader Markets continue to remain soft

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we sit down with Tom Sosnoff — trader, entrepreneur, and one of the most influential voices in modern options trading. He talks about his early journey from the CBOE floor to building Thinkorswim and Tastytrade, his contrarian approach to risk, and why most traders misread probability and volatility. Tom also shares his take on Indian markets, the rise of retail participation, and the future of quantitative thinking for everyday traders.

Market Overview

Nifty opened with a gap-up of 80 points at 26,132, supported by strong global cues after Nvidia’s earnings beat lifted sentiment across global markets. After a brief dip toward the 26,070 zone in the opening minutes, the index stabilised and began a steady upward climb through the morning session, reclaiming 26,150 and holding comfortably above that level by mid-day.

In the second half, Nifty extended its upward momentum, inching consistently higher into the 26,180–26,200 range. The index continued to grind upward without any meaningful pullback, eventually hitting an intraday high near 26,246 before 2:30 PM.

In the final hour, Nifty cooled off by 50–70 points from the highs but managed to hold firm, closing at 26,192.15, up 0.54%. The index remains within striking distance of fresh all-time highs.

Looking ahead, markets are likely to remain sensitive to developments surrounding the India–U.S. trade deal, as well as broader global cues.

Broader Market Performance:

Despite a strong upmove in Nifty, the broader markets continue to remain subdued. Of the 3,202 stocks traded on the NSE, 1,383 advanced, 1,716 declined, and 103 remained unchanged.

Sectoral Performance:

Nifty Service led the day with a 0.49% gain, followed by Auto and Energy, while Nifty Media was the biggest loser, sliding 1.54%. Out of 12 sectoral indices, 6 closed in the green and 6 ended in the red, reflecting an evenly balanced sectoral breadth.

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 25th November:

The maximum Call Open Interest (OI) is observed at 26,500, followed by 26,200 & 26,000, indicating potential resistance at the 26,300 -26,400 levels.

The maximum Put Open Interest (OI) is observed at 26,000, followed by 25,900, suggesting support at the 26,000 to 25,900 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

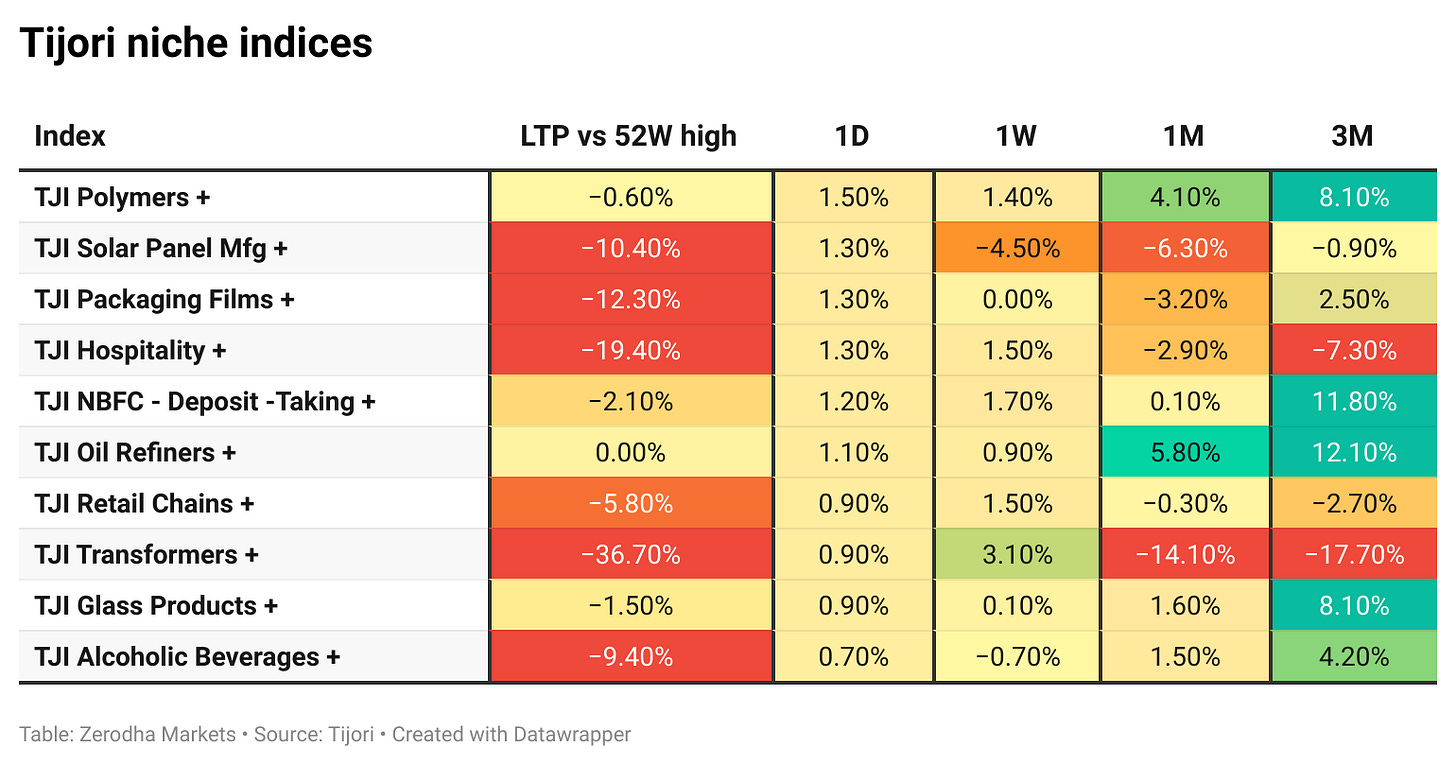

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

India’s infrastructure output was flat year-on-year in October 2025, after 3.3% growth in September. Coal production fell 8.5%, crude oil dipped 1.2%, and natural gas declined 5%. Fertiliser output rose 7.4%, steel production grew 6.7%, and petroleum refinery output increased 4.6% year-on-year. Dive deeper

The rupee closed slightly weaker at 88.7050 on Thursday, pressured by a stronger dollar following the Fed’s hawkish stance, while modest foreign inflows helped limit losses. Dive deeper

TCS has partnered with U.S. private equity firm TPG to jointly build and scale its AI data-centre business, HyperVault. The venture will be funded through a mix of equity and debt, with both firms committing up to ₹18,000 crore over the coming years. Of this, TPG will invest up to ₹8,820 crore ($1 billion). Dive deeper

Man Industries shares rose over 4% after the company signed an MoU with Aramco Asia India Pvt. Ltd. to explore long-term product supply opportunities and assess the potential for setting up a manufacturing facility in Saudi Arabia. Dive deeper

Adani Enterprises has secured unanimous creditor approval for its ₹135 billion takeover bid for Jaiprakash Associates, choosing it over a higher offer from Vedanta because of quicker upfront payments and a shorter repayment timeline. Dive deeper

What’s happening globally

Nvidia reported third-quarter revenue of $57 billion, up 22% sequentially and 62% year-on-year. Net income surged 65% to $31.91 billion from $19.31 billion a year earlier. Its data-centre division delivered a strong $51.2 billion in revenue, while gaming chips contributed $4.3 billion. Dive deeper

WTI crude edged up to about $59.5 per barrel after a sharp fall, as markets weighed a U.S. peace proposal on the Ukraine war against looming sanctions on Rosneft and Lukoil. Dive deeper

Gold slipped to about $4,060 per ounce as investors reduced expectations of Fed rate cuts ahead of key U.S. jobs data. Dive deeper

U.S. nonfarm payrolls are expected to rise by 50,000 in September, up from 22,000 in August, while the unemployment rate is seen holding at 4.3%. Dive deeper

FOMC minutes showed Fed officials were split in October, with some favoring a rate cut, others preferring to hold, and a few opposing further easing. Dive deeper

Euro-zone government bond yields edged higher as investors reacted to firmer U.S. Treasury yields and monitored global fiscal pressures. Dive deeper

Japan’s Nikkei 225 index snapped a four-day slide, buoyed by upbeat outlook from Nvidia and strength in tech stocks across the region. Dive deeper

Taiwan’s export orders rose 25.1% year-on-year in October to USD 69.4 billion, easing from September’s 30.5% surge. Dive deeper

Management chatter

In this section, we highlight interesting comments made by the management of major companies and policymakers from the Indian and Global Economies.

Jensen Huang, founder and CEO of Nvidia, on the Q3 performance & AI Bubble

“Blackwell sales are off the charts, and cloud GPUs are sold out.”

“Compute demand keeps accelerating and compounding across training and inference, each growing exponentially. We’ve entered the virtuous cycle of AI. The AI ecosystem is scaling rapidly with the emergence of new foundation model makers and AI startups across multiple industries and in numerous countries. AI is going everywhere, doing everything, all at once.”

“There’s been a lot of talk about an AI bubble. From our vantage point, we see something very different.” - Link

Reserve Bank governor Sanjay Malhotra, on the Rupee and Indian Banks

“We do not target any level. Why is the Rupee depreciating? [It] is because of the demand...It’s a financial instrument, and there is a demand for dollars, and if the demand for dollars goes up, the Rupee depreciates; if the demand for Rupee goes up, dollar comes down, then it appreciates,”

“The way Indian banks are performing, very soon a few of them will be among the top 100 global lenders,” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!