Nifty holds above 25,550; Recovery capped amid lack of buying conviction at higher levels

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we break down the short trading week where what initially looked like a simple pause in NIFTY quickly turned into a slow, painful drift downward — a reminder that market expectations are, indeed, the mother of all problems.

Market Overview

Nifty opened flat with a mild 10-point gap-up at 25,504, and with the opening level marking the day’s low, the index quickly stabilised and began recovering, reclaiming the 25,550 mark within the first 20 minutes. Through the late morning session, Nifty maintained a steady upward bias, gradually climbing toward the 25,620–25,650 zone by noon.

In the second half, the index continued to trade firm, oscillating within a tight band between 25,600 and 25,640 as intraday volatility remained limited. By 2 PM, Nifty once again tested the 25,640 level before witnessing a mild pullback, dipping toward the 25,570 zone in the final hour. Despite the late cooling, the index stabilised and ended at 25,574.25, up around 0.32%, marking a calm and constructive session after last week’s weakness.

Looking ahead, markets are expected to remain sensitive to developments around the India–U.S. trade deal, while investors closely monitor Q2 earnings and management commentary on festive-season demand momentum following the recent GST rate cuts.

Broader Market Performance:

The broader markets had a mixed session with a slightly bearish bias today. Of the 3,233 stocks traded on the NSE, 1,501 advanced, 1,634 declined, and 98 remained unchanged.

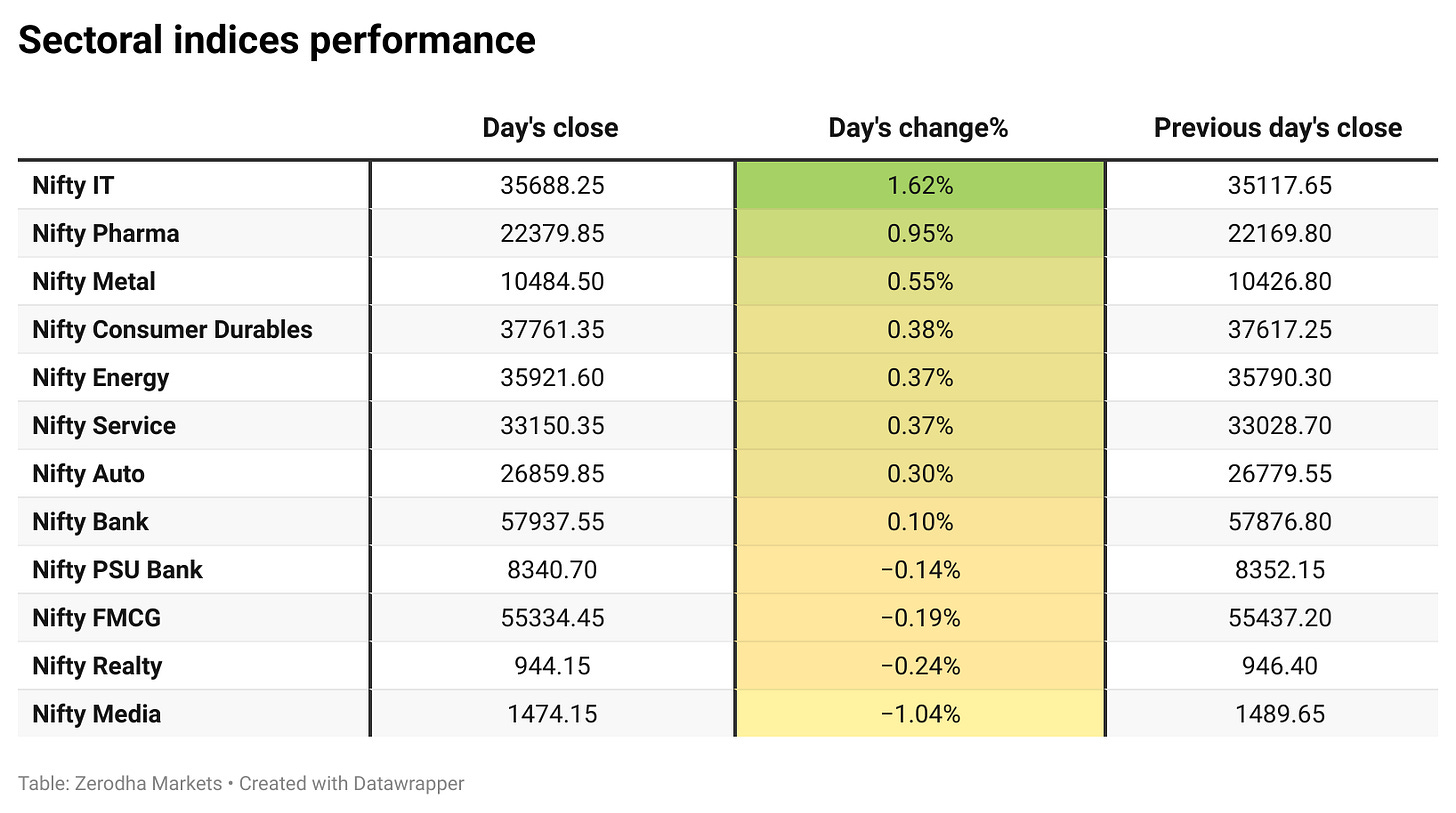

Sectoral Performance:

Nifty IT emerged as the top gainer, rising 1.62%, while Nifty Media was the biggest loser, slipping 1.04%. Out of the 12 sectoral indices, 8 closed in the green and 4 ended in the red, reflecting a broadly positive sentiment across sectors.

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 11th November:

The maximum Call Open Interest (OI) is observed at 25,700, followed by 26,000 & 25,800, indicating potential resistance at the 25,700 -25,800 levels.

The maximum Put Open Interest (OI) is observed at 25,500, followed by 25,400 & 25,300, suggesting support at the 25,500 to 25,400 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

Nalco shares jumped 9.6% after the company posted a 36.7% year-on-year rise in Q2 net profit to ₹1,430 crore and announced an interim dividend. Revenue grew 31.5% to ₹4,292 crore, supported by higher realisations and improved operating efficiency. Dive deeper

Global brokerage Goldman Sachs has upgraded India to “overweight” from “neutral,” reversing its October 2024 downgrade. The firm cited strengthening earnings momentum and supportive policy tailwinds as key drivers for the improved outlook. Dive deeper

Nykaa reported a strong Q2 with net profit at ₹34 crore and revenue at ₹2,346 crore, supported by record-high margins and double-digit growth across beauty and fashion. EBITDA marked a post-IPO high, while retail expansion continued across cities. Dive deeper

Lenskart listed at a discount of ~3% to its issue price, slipped further intraday, and later recovered to trade marginally above listing levels. Dive deeper

Shipping Corporation of India reported Q2 net profit of ₹176 crore, lower YoY, with revenue declining to ₹1,339 crore. EBITDA also softened, reflecting a weaker quarter. The company announced an interim dividend of ₹3 per share with a record date set for November 19. Dive deeper

Ola Electric denied claims of improperly acquiring battery technology, calling the report misleading. The company highlighted progress in its 4680 Bharat Cell production and recent ARAI certification. It also reported a narrower Q2 loss, while revenue declined due to weaker two-wheeler sales. Dive deeper

Swiggy approved raising up to ₹10,000 crore through a new QIP, a year after raising over ₹11,000 crore via its IPO and OFS. The company cited a competitive environment for the fundraising. Dive deeper

GRSE posted Q2 net profit of ₹154 crore, up YoY, with higher revenue and EBITDA. H1 earnings also rose on stronger execution and income growth. The company maintained a healthy order book for future delivery. Dive deeper

Shakti Pumps reported Q2 net profit of ₹91 crore, down YoY, despite a slight rise in revenue to ₹666 crore. Solar pump installations and export revenue grew, supported by ongoing global demand. Order book remained healthy at ₹13,000 million. Dive deeper

What’s happening globally

US President Donald Trump defended his tariff policy, claiming the aggressive duties have made the U.S. the “richest” and “most respected” nation globally. He said every American—except the wealthy—will soon receive at least $2,000 from tariff revenues, while dismissing critics of his policy as “fools.” Dive deeper

Brent crude futures rose above $64/bbl on Monday. The move came before upcoming OPEC and IEA market outlook reports, amid US sanctions on Russia’s Rosneft and Lukoil, and rising non-OPEC oil supply. Dive deeper

Gold rose 2% to $4,080/oz, nearing its highest level since late October, amid broader market reaction to recent US economic weakness and developments around the government shutdown. Dive deeper

Silver climbed 3% to $50 per ounce, the highest since October 20, supported by expectations of a December Fed rate cut. Dive deeper

US natural gas futures rose to $4.45/MMBtu, the highest since March, supported by strong LNG export demand and record feedgas flows. Production and storage remain elevated as supply and demand trend higher. Dive deeper

The 10-year US Treasury yield rose 3 bps to 4.13% after the Senate advanced a bill to fund the government through January. Dive deeper

Japan’s leading economic index rose to 108.0 in September, the highest since January, supported by continued growth in household spending. Consumer confidence hit a 10-month high, while unemployment remained steady at 2.6%. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Rakesh Sharma, Executive Director, Bajaj Auto, on GST cuts and motorcycle demand

“Yes, the GST cuts came into effect on 22nd September, and combined with festive cheer, it turned into a very strong retail month.”

“We saw quality growth in the domestic motorcycle market; higher-end models performed exceptionally well.”

“Export growth is broad-based across regions, with LATAM markets, particularly Brazil, doing very well.” - Link

Mark Matthews, Global market strategist from Julius Baer on artificial intelligence, and foreign institutional investor (FII) flows:

“Big tech is monetising AI well, improving ad revenue and cutting labour costs. The recent 153,000 job cuts were mostly AI-driven in tech. AI is boosting profits but causing some job losses.”

Foreign holding in India is down to 15% of free float, near historic lows. Most selling this year was to fund China. I don’t see much more selling from here, and if earnings improve next year, there should be foreign buying.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

Calendars

In the coming days, we have the following quarterly results, significant events, and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!