Nifty gains moderately; faces resistance near 25,150

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real-time by Tijori.

Market Overview

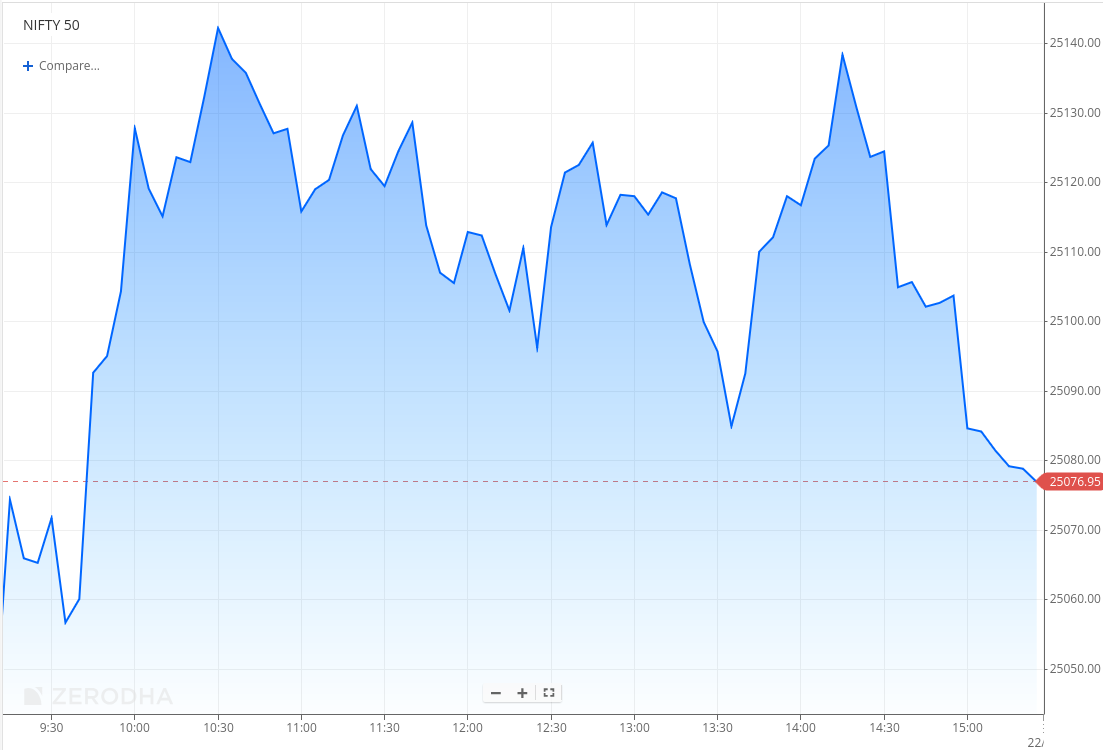

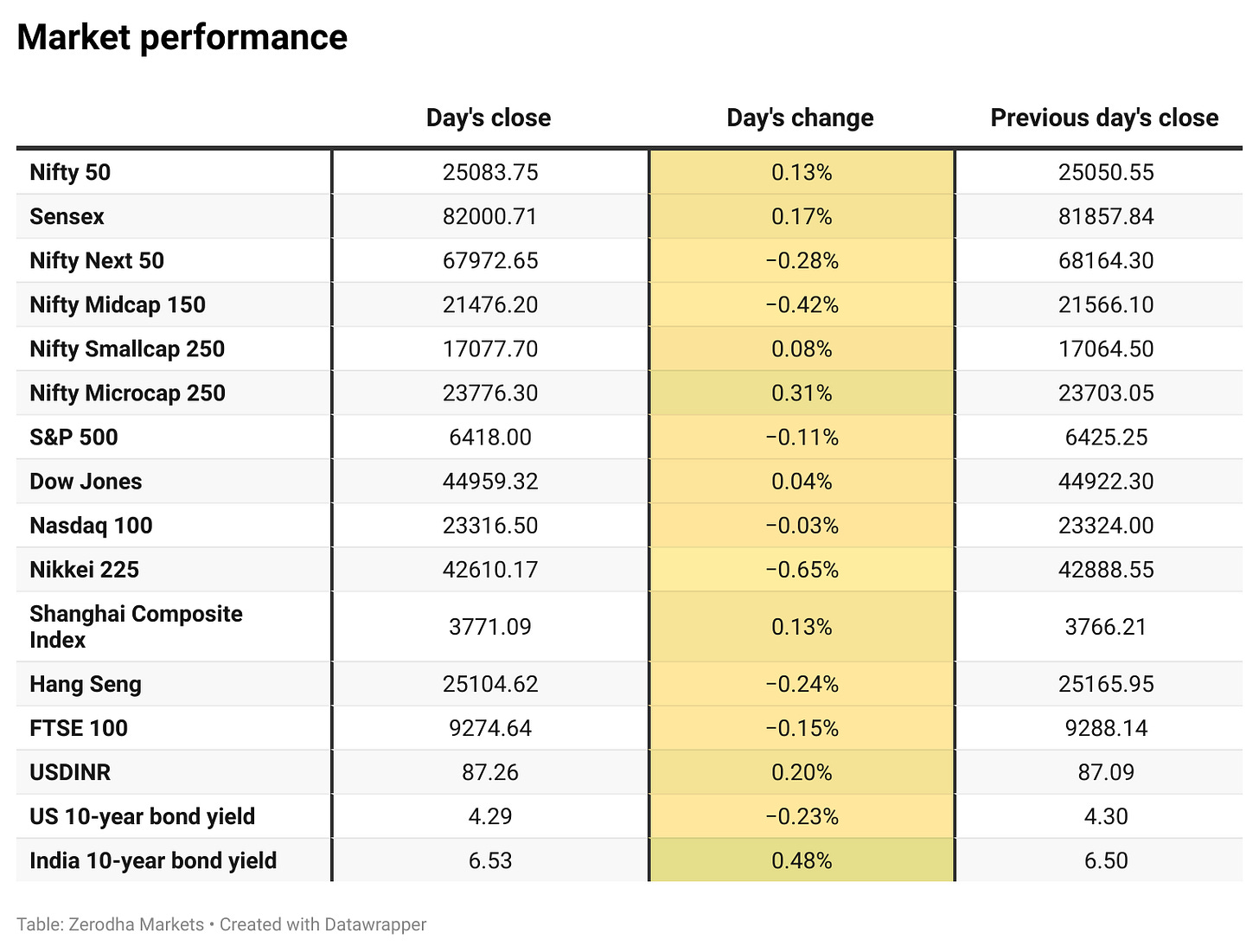

Nifty opened with a 92-point gap-up but quickly slipped to the 25,080–25,090 zone within the opening ticks, extending losses to 25,055 in the first 30 minutes. It then rebounded sharply by nearly 100 points to test 25,150, before settling into a range between 25,080 and 25,120 for most of the second half. The index eventually closed at 25,083.75, up by 0.13%.

Despite the modest gain, market sentiment remains fragile. While it has shown signs of recovery since last week, concerns persist over escalating tariffs, continued FII outflows, and muted earnings reactions. Investors are closely tracking intensifying U.S.-India trade tensions and ongoing U.S.-Russia discussions over the Ukraine conflict, both of which are expected to shape near-term market direction.

Broader Market Performance:

Broader markets had a mixed session today. Of the 3,068 stocks traded on the NSE, 1,503 advanced, 1,475 declined, and 90 remained unchanged.

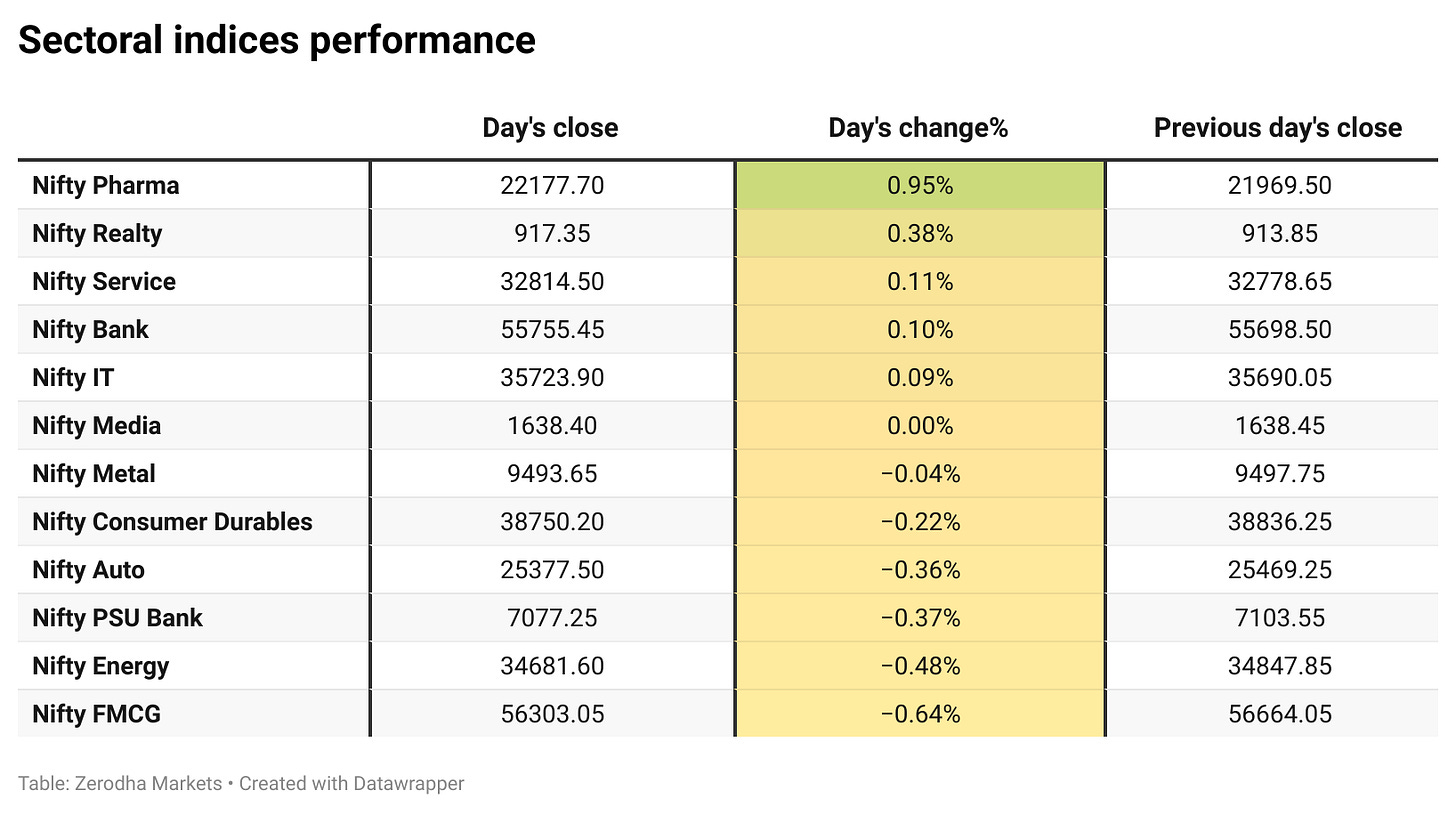

Sectoral Performance

Among the sectoral indices, Nifty Pharma was the top gainer, rising 0.95%, while Nifty FMCG emerged as the top loser, declining 0.64%. Out of the 12 sectors listed, five sectors closed in the green, one remained flat (Nifty Media), and six sectors ended in the red, indicating a largely mixed but slightly negative market breadth for the day.

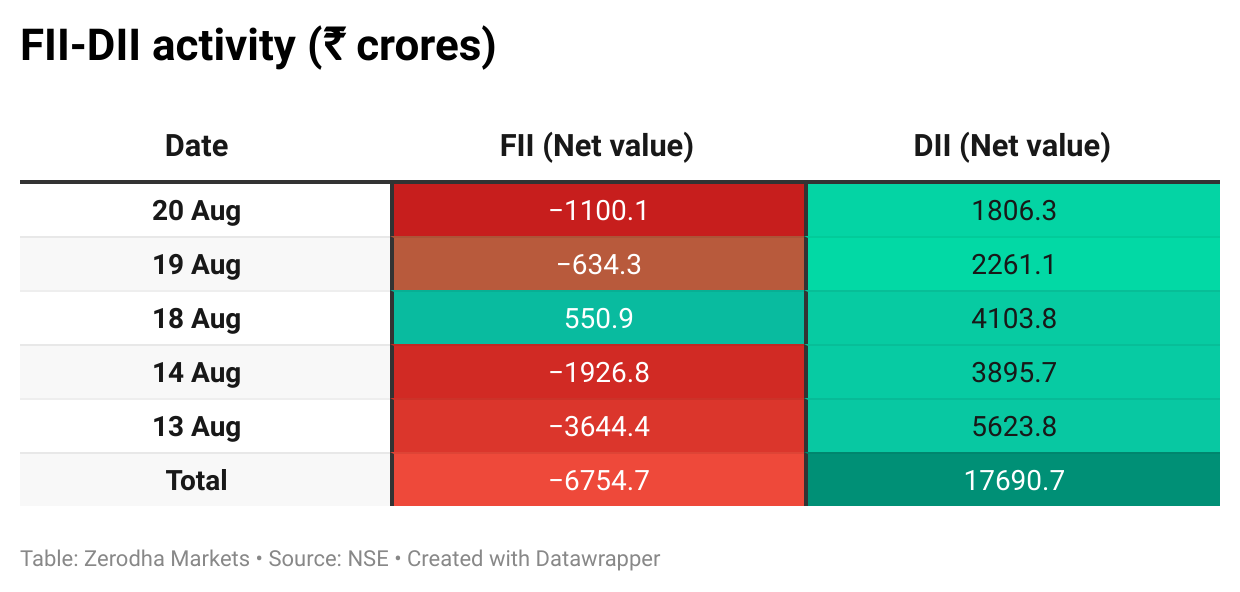

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 28th August:

The maximum Call Open Interest (OI) is observed at 25,500, followed closely by 25,000, suggesting strong resistance at 25,200 - 25,300 levels.

The maximum Put Open Interest (OI) is observed at 25,000, followed closely by 24,800, suggesting strong support at 24,900 to 24,800 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

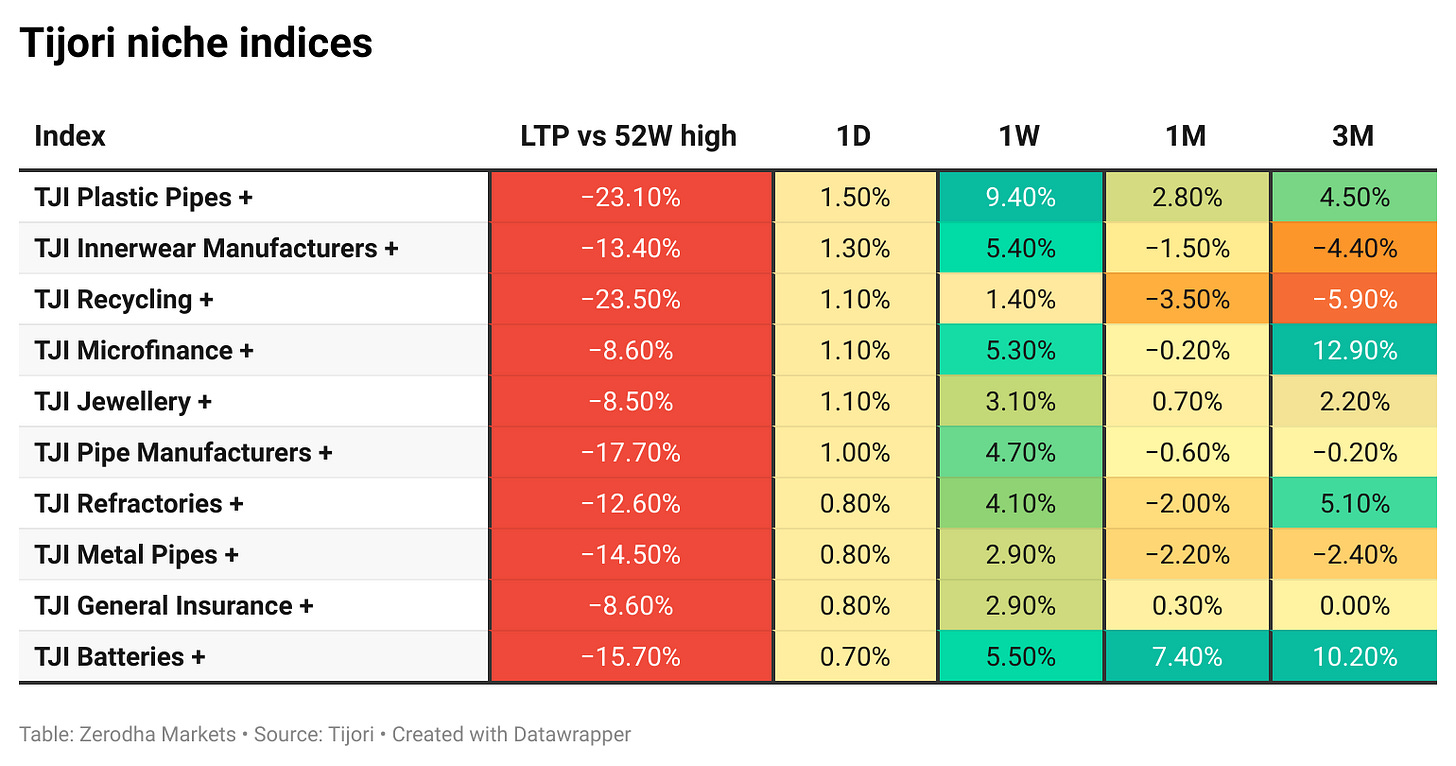

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

Parliament has passed the Promotion and Regulation of Online Gaming Bill, 2025, which bans real money games, sending it to President Murmu for assent. The government said enforcement will be immediate, ending self-regulation attempts and barring platforms like Dream11 and MPL from taking deposits. Ministries will instead promote e-sports as a regulated alternative. Dive deeper

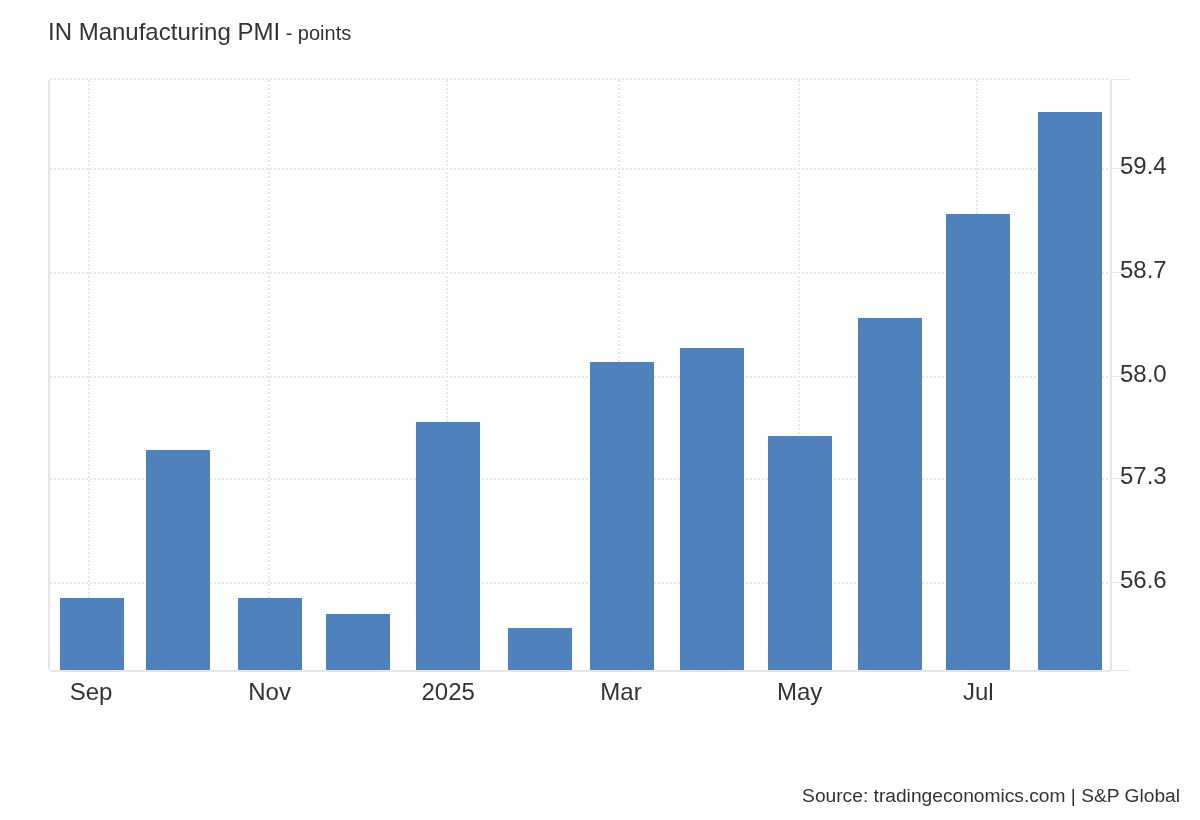

India’s Manufacturing PMI climbed to 59.8 in August, the highest since 2008, on strong domestic demand and new orders. Export growth stayed flat, but sentiment improved with a positive outlook. Selling prices also rose, supported by firm demand. Dive deeper

Air India and Air India Express posted a combined loss of ₹9,568 crore in FY25, with the latter slipping into losses after years of profitability. Tata-owned Air India reported a ₹3,890 crore loss, while Air India Express lost ₹5,678 crore. Dive deeper

HAL secured Cabinet approval for a ₹62,000 crore order of 97 Tejas Mk-1A jets to replace the MiG-21 fleet. The announcement lifted investor sentiment, with the stock edging higher. Dive deeper

Microfinance firms are speeding up bad loan write-offs to strengthen balance sheets as stress levels rise. CreditAccess Grameen, Fusion Finance, and Muthoot Microfin advanced timelines, with Fusion shifting to a 180-day policy. The strategy improved reported NPAs, though sector stress in higher defaults remains high. Dive deeper

RailTel secured new contracts worth nearly ₹50 crore, including a ₹34.99 crore deal with Kerala’s IT Mission for data centre operations and a ₹15.42 crore project with Odisha’s Higher Education Department for bilingual college websites. The wins add to its growing government project portfolio. Dive deeper

India’s $25 billion online real money gaming sector faces a valuation hit as the new gaming bill, awaiting presidential assent, will effectively ban such platforms. Unlisted players like Dream11, Gameskraft, and Winzo may be forced to shut or pivot. Dive deeper

Shares of capital-market-linked firms fell after Sebi signaled plans to extend equity derivative tenures. The move, aimed at curbing retail-driven risks, follows earlier steps like limiting expiries and raising lot sizes. Markets fear longer maturities could dampen trading activity and reduce volatility. Dive deeper

Ola Electric shares fell after VAHAN data showed it trailing a rival in August registrations, with sentiment also weighed by GST uncertainty and weak quarterly results. Dive deeper

Godrej Properties won a bid to acquire 7.82 acres of land in Hyderabad’s Kukatpally for about ₹550 crore via a Telangana Housing Board e-auction. The firm plans a housing project on the site with an estimated revenue potential of ₹3,800 crore. Dive deeper

What’s happening globally

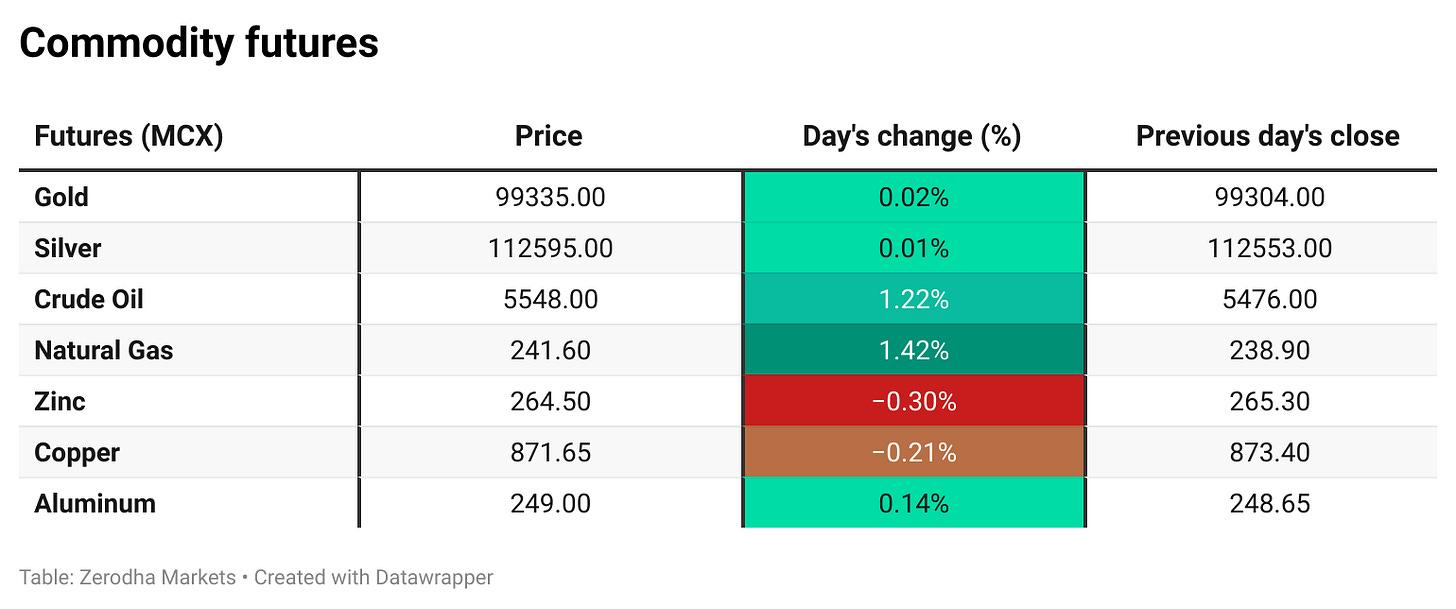

Brent crude climbed above $67 as US crude and fuel stocks fell more than expected, signaling steady demand. Gasoline inventories also dropped, while investors tracked Russia-Ukraine talks that could reshape sanctions and global supply. Dive deeper

Gold slipped below $3,340 as investors awaited Powell’s Jackson Hole speech for rate-cut signals, with markets pricing an 82% chance of a September cut. Fed minutes showed caution, while Russia warned the West on Ukraine security talks. Dive deeper

The Fed left rates unchanged at 4.25% - 4.50% for a fifth meeting, with two governors dissenting in favor of a cut, the first such move since 1993. Officials noted moderating growth, low unemployment, and sticky inflation, keeping a wait-and-see stance amid trade war risks. Dive deeper

US initial jobless claims rose to 235,000 in mid-August, the highest in eight weeks, while continuing claims climbed to their strongest level since 2021, signaling a cooling labor market. Dive deeper

The UK Composite PMI rose to 53 in August, its fastest private-sector growth in a year, driven by strong services momentum that offset deeper factory weakness, S&P Global data showed. Dive deeper

Canada’s industrial producer prices rose 0.7% in July, led by higher energy and non-ferrous metals, with refined petroleum and platinum group metals seeing the sharpest gains. Dive deeper

The Eurozone Composite PMI rose to 51.1 in August, the fastest expansion since May 2024, as services grew and manufacturing rebounded for the first time in three years, though confidence eased on tariff and economic concerns. Dive deeper

Sony will raise PlayStation 5 prices in the U.S. as it faces tariff uncertainty on imports from China and Japan. The hike follows earlier increases in Europe and comes amid delays of major game releases, clouding growth prospects for the gaming market. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

S. Jaishankar, External Affairs Minister, on Russian oil trade

"India is not the country which has the biggest trade surge with Russia after 2022."

"We are not the biggest purchaser of Russian oil, it is China that is the largest buyer."

"Our trade engagement with Russia must be seen in the right perspective, without exaggeration." - Link

Tuhin Kanta Pandey, Chairman, SEBI, on equity derivatives and market reforms

"Sebi’s approach in relation to equity derivatives has been thoughtful and consultative. We are considering increasing contract tenure and maturity in a calibrated manner."

"We are looking to deepen the cash equities market, which is the true foundation of capital formation, even as derivatives play a crucial role."

"Innovation in capital markets must lower friction and compliance cost while providing diverse opportunities, ensuring transparency and risk management for all investors." - Link

Samrat Choudhary, Bihar Deputy CM & GoM Chair on GST rate rationalisation

"It was the Centre’s proposal to end two slabs of GST, the 12% and 28% slabs, we discussed and have supported it."

"We have recommended the two-rate structure to the GST Council, which will now take the final decision."

"Under this structure, 99% of items from the 12% slab will move to 5%, and about 90% of items from the 28% slab will shift to 18%." - Link

Vartika Shukla, CMD, Engineers India Ltd., on growth targets and strategy

"Our current order book is the highest in EIL’s history, giving strong visibility to achieve our ₹5,000 crore turnover target by 2028."

"Our MoU with NPCIL on small modular reactors aligns with India’s 2047 green energy vision and marks a key step in sectoral diversification."

"Q1 turnover rose ~40% YoY, with PBT and PAT up ~27–28%, reflecting robust order book transition into active execution." - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

📚 Also reading Mind Over Markets by Varsity?

It goes out thrice a week, covering markets, personal finance, or the odd question you didn’t know you had. The Varsity team writes across three sections: Second Order, Side Notes, and Tell Me Why, thoughtfully put together without trying to be too clever.

Go check out Mind Over Markets by Zerodha Varsity here.

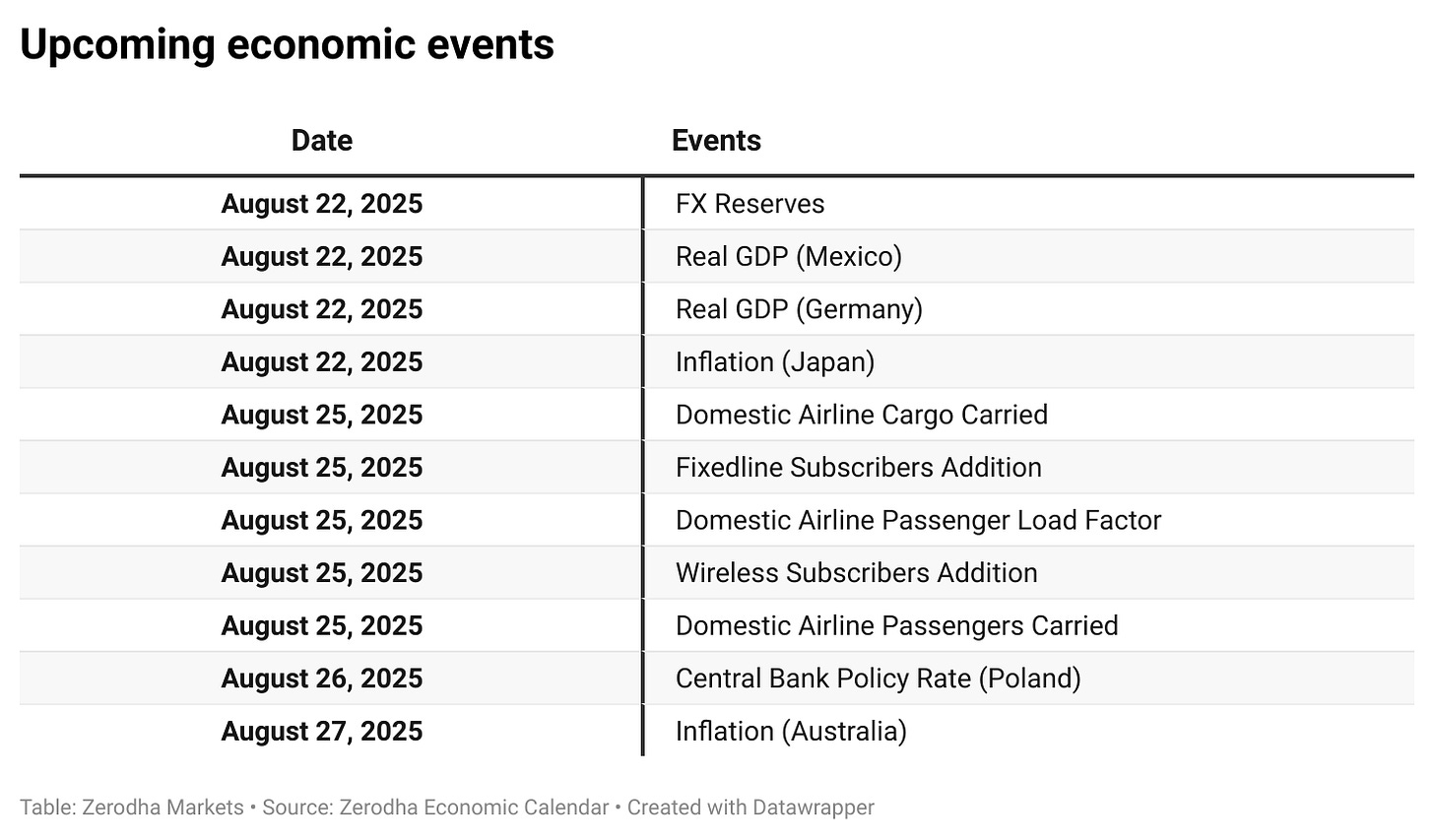

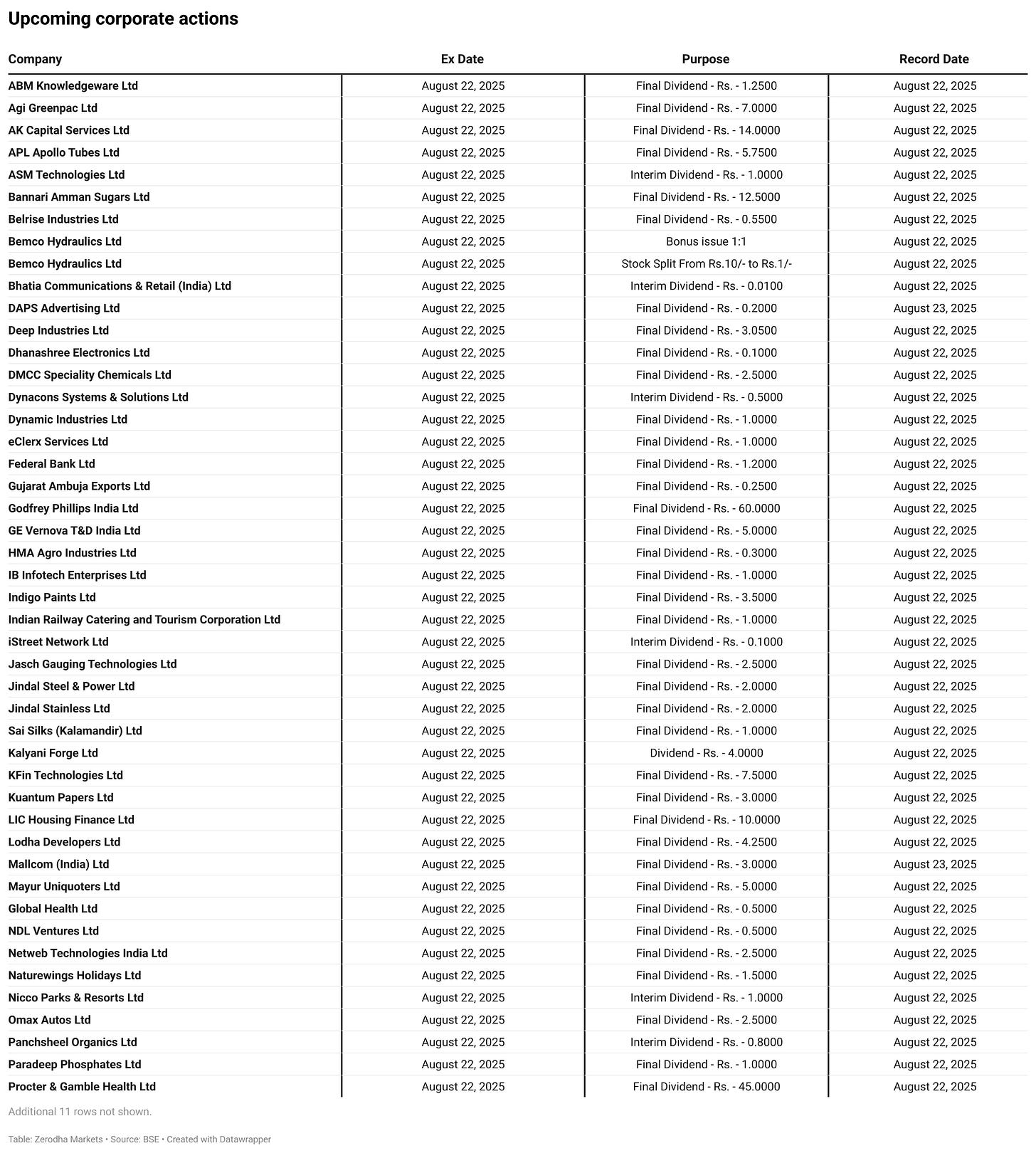

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.