Nifty flirts around the 26,000 mark ahead of monthly expiry

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, Sandeep breaks down the Diwali week that had both sparkle and sobering moments. Markets started strong with a 400-point GIFT NIFTY surge on the Hindu New Year but cooled off later, leaving NIFTY only slightly higher. Still, the overall sentiment remains upbeat, with key indices holding above crucial moving averages.

Market Overview

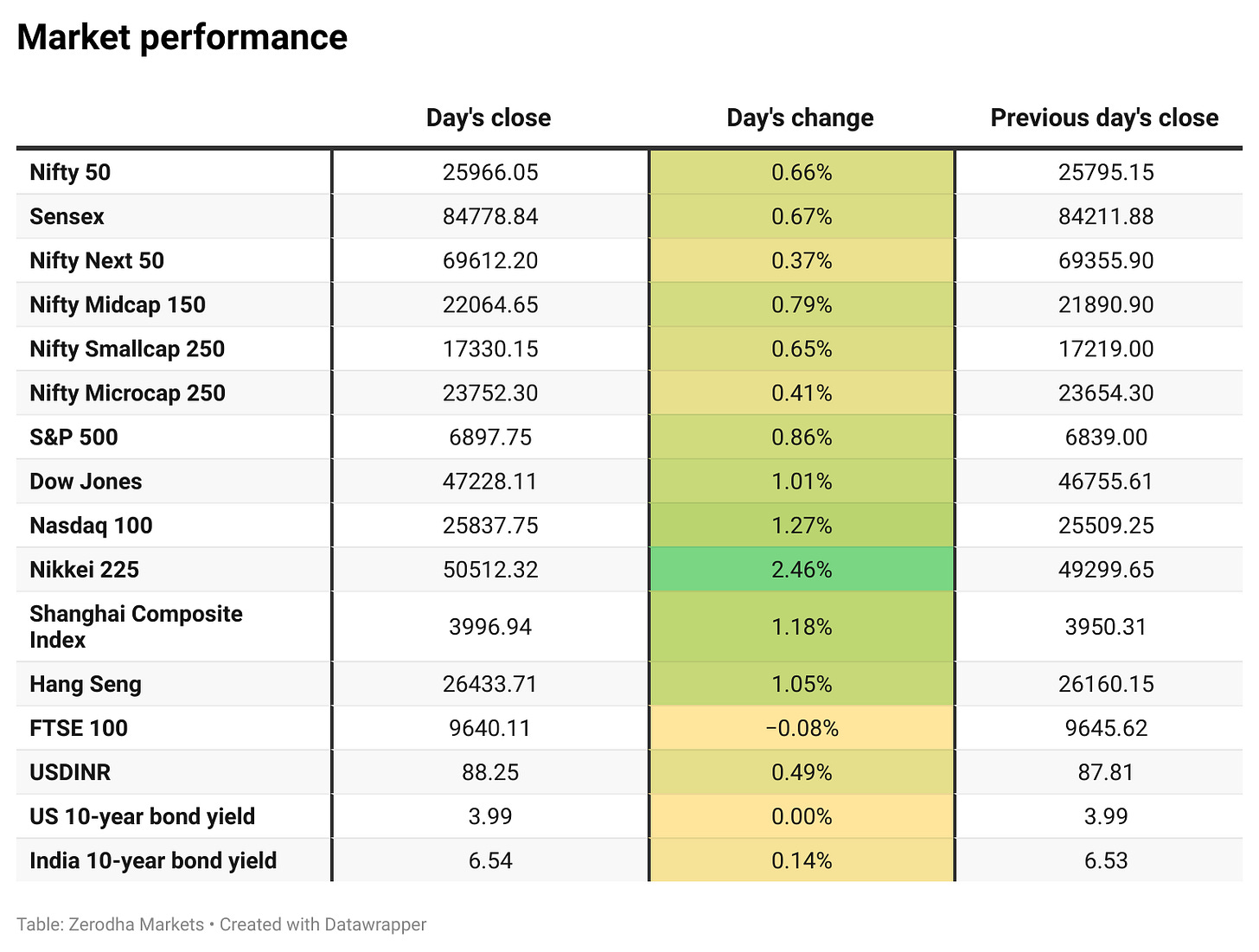

Nifty opened with a 48-point gap-up at 25,843, supported by positive global cues and firm sentiment in domestic equities. After a strong start, the index extended gains, crossing the 25,950 mark in the first hour. Through the mid-session, Nifty largely held on to its gains, trading in a narrow band between 25,930 and 25,970, reflecting resilience despite bouts of profit-taking.

By the close, Nifty settled near the day’s high at 25,966.05, up 0.66%, marking a positive start to the week and closing just shy of the 26,000 mark ahead of the monthly expiry for Nifty, Bank Nifty, Fin Nifty, and Midcap Nifty.

Looking ahead, markets are expected to remain sensitive to developments around the India–US trade deal, while investors will closely track Q2 earnings and management commentary on festive-season demand trends following the recent GST rate cuts.

Broader Market Performance:

Broader markets had a mixed session with bullish bias today. Of the 3,241 stocks traded on the NSE, 1,637 advanced, 1,504 declined, and 100 remained unchanged.

Sectoral Performance

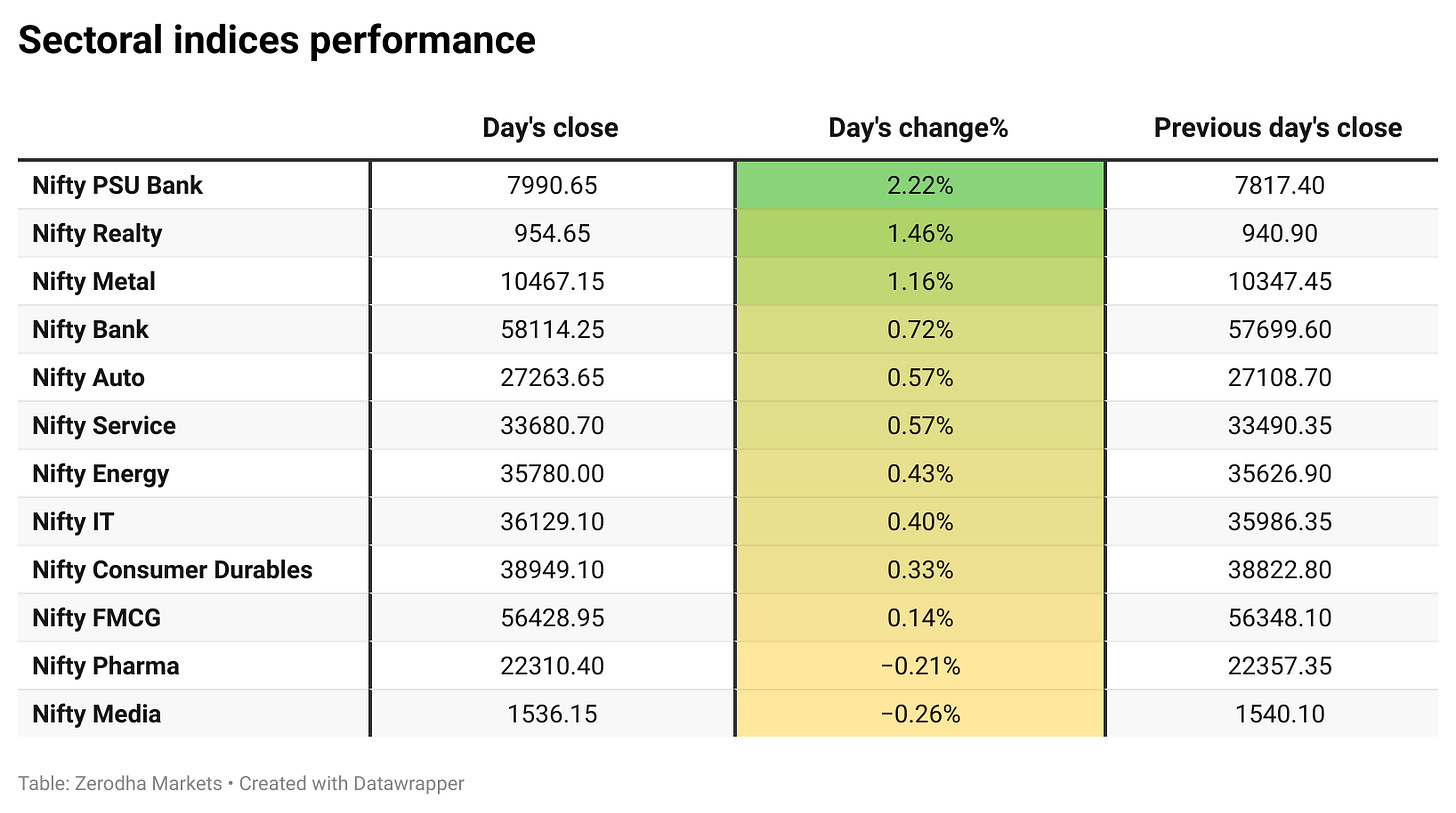

Nifty PSU Bank was the top gainer, rising 2.22%, while Nifty Media was the biggest loser, slipping 0.26%. Out of the 12 sectoral indices, 10 closed in the green and 2 ended in the red, reflecting broad-based strength across the market.

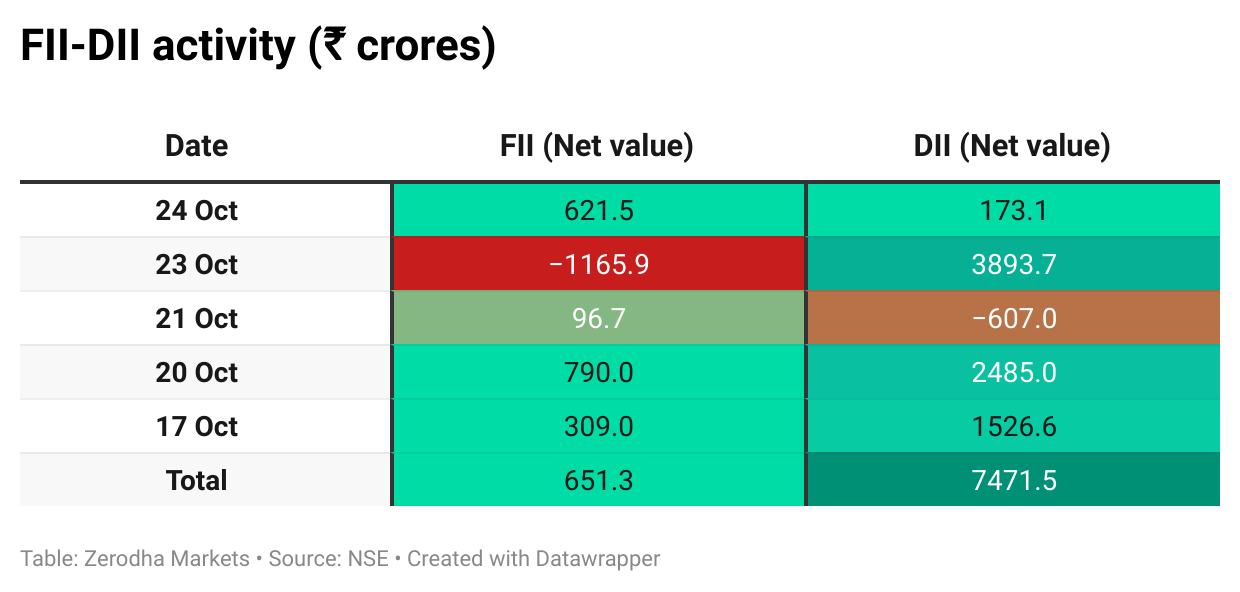

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 28th October:

The maximum Call Open Interest (OI) is observed at 26,100, followed by 26,000 & 26,200, indicating potential resistance at the 26,100 -26,200 levels.

The maximum Put Open Interest (OI) is observed at 25,900, followed by 25,500, suggesting support at the 25,900 to 25,800 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

SEBI has proposed offering incentives such as higher coupon rates or issue price discounts to retail investors, including senior citizens, women, and armed forces personnel, to boost participation in debt public issues. The move follows a sharp drop in non-convertible debenture issuances to ₹81.5 billion in FY25 from ₹191.7 billion in FY24. Dive deeper

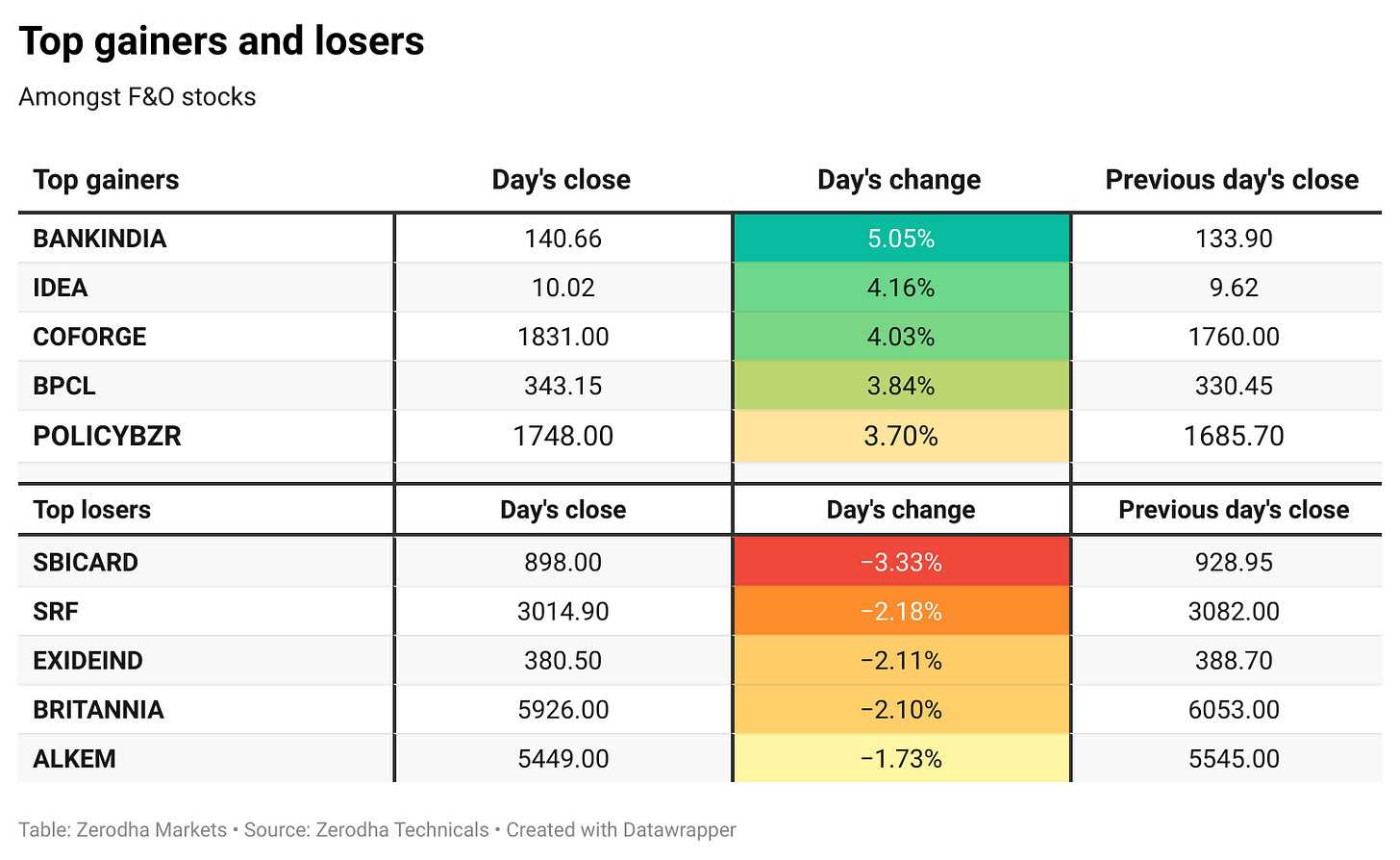

Vodafone Idea shares jumped over 4% after the Supreme Court allowed the government to revisit the company’s pending dues. The order gives the Centre flexibility to renegotiate repayment terms, paving the way for one of the largest debt restructurings in India’s telecom sector. Dive deeper

Indian Oil Corporation reported a sharp rise in net profit to ₹7,610 crore for Q2 FY26, up from ₹180 crore a year earlier. Revenue from operations grew 4% year-on-year to ₹2.03 lakh crore. The company attributed the strong performance partly to a low base from last year and a sequential 33.8% rise in profit from Q1. Dive Deeper

As per Reuters, the Indian government is planning to raise the foreign investment cap in state-run banks from 20% to 49%, while retaining at least 51% government ownership. The move aims to attract more overseas capital and align public sector banks with private lenders on regulatory standards. Dive deeper

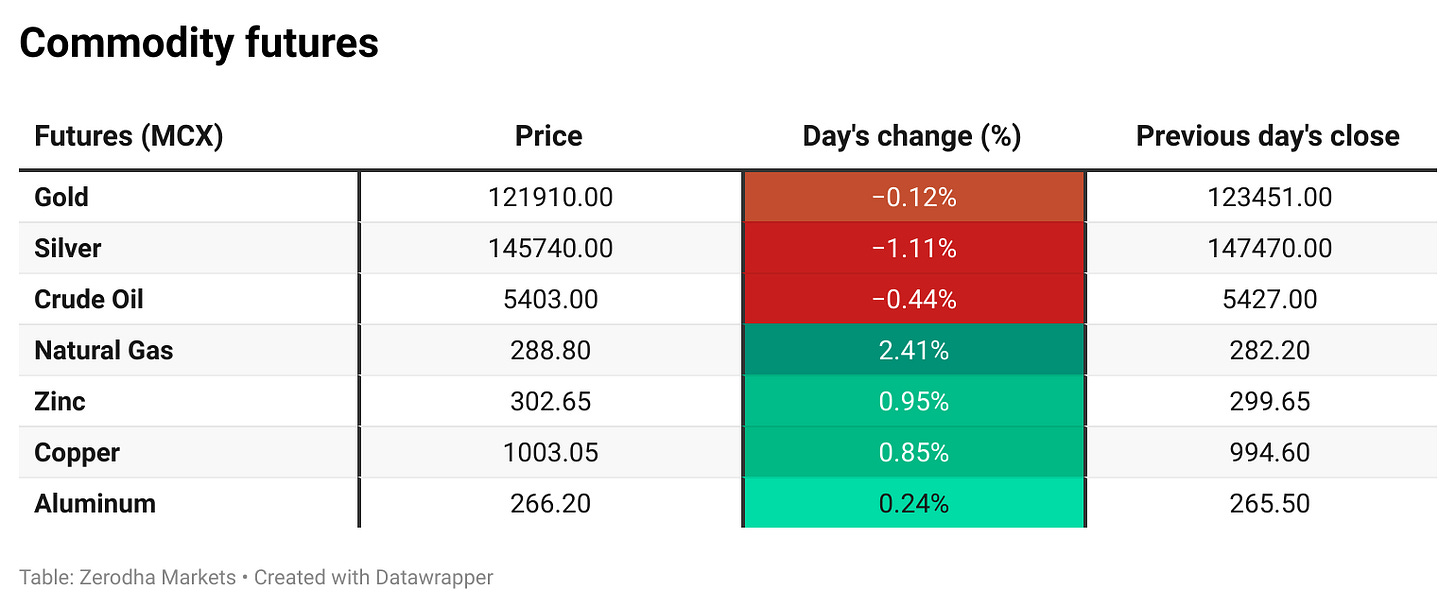

Singapore’s gross refining margins (GRMs) surged 2,000% in just 10 days to $8.6 per barrel, nearly double the Q2 average, driven by supply constraints, sanctions on Russia, and global refinery shutdowns. The spike is expected to significantly boost earnings for Indian refiners like IOCL, BPCL, HPCL, RIL, MRPL, and Chennai Petroleum. Dive deeper

SRF Ltd reported a 92.7% year-on-year surge in consolidated net profit to ₹388.18 crore for Q2 FY26, driven by higher sales. Total income rose 6.3% to ₹3,640.19 crore compared to ₹3,424.30 crore in the same quarter last year. Dive deeper

What’s happening globally

The U.S. and China have reached a framework for a trade deal ahead of the upcoming Trump–Xi meeting. Treasury Secretary Scott Bessent said the agreement, finalized at the ASEAN summit in Malaysia, averts planned 100% tariffs on Chinese imports from November 1 and includes a resolution on TikTok’s U.S. operations. U.S. stock futures surged to record highs on optimism over the deal and strong tech earnings. Dive deeper

Hong Kong’s exports surged 16.1% year-on-year in September 2025 to $462.2 billion, the highest in nearly four years and up from 14.5% growth in August. The rise was driven by strong demand for scientific instruments, power-generating machinery, and electrical equipment. Dive deeper

Japan’s Nikkei 225 surged 2.46% to a record 50,512, while the Topix gained 1.7% to 3,325 on Monday, with both indices hitting new highs. The rally came ahead of Prime Minister Sanae Takaichi’s meeting with U.S. President Donald Trump and optimism over a potential U.S.–China trade deal after negotiators reached consensus on key issues. Dive deeper

Shares of rare-earth miners dropped as much as 8% after the United States and China agreed to pause planned tariffs and export controls on critical minerals, easing earlier supply-disruption fears that had boosted the sector. Dive deeper

China is deploying its domestic AI model DeepSeek to power next-generation military systems, including robot dogs, drone swarms, and autonomous battlefield decision tools. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Mr Vivek Vikram Singh, MD & Group CEO, of Sona BLW Precision Forgings on Rare-earth magnets

“We achieved our highest-ever quarterly revenue, EBITDA, and net profit in Q2 FY26. Our revenue grew by 24% year-on-year, primarily driven by the expansion of our electric vehicle traction motor and railway business in India. Due to the unavailability of heavy rare-earth magnets, we shifted to alternative motor designs and now manufacture light rare-earth magnet motors for electric two-wheelers. We have developed a rare-earth-free ferrite-assisted synchronous reluctance motor for three-wheelers and light commercial vehicles.” - Link

Rajan Venkatesan, Chief Financial Officer at LatentView Analytics, on GenAI growth and margins

“We’re building depth in GenAI and Databricks because they’re integral to future analytics delivery.”

“These investments will help us deliver sustainable, high-percentage growth in the coming years.”

“There’s absolutely no pricing pressure. Margins have been stable; the slight moderation is due to capability-building investments, not cost or client-side issues.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

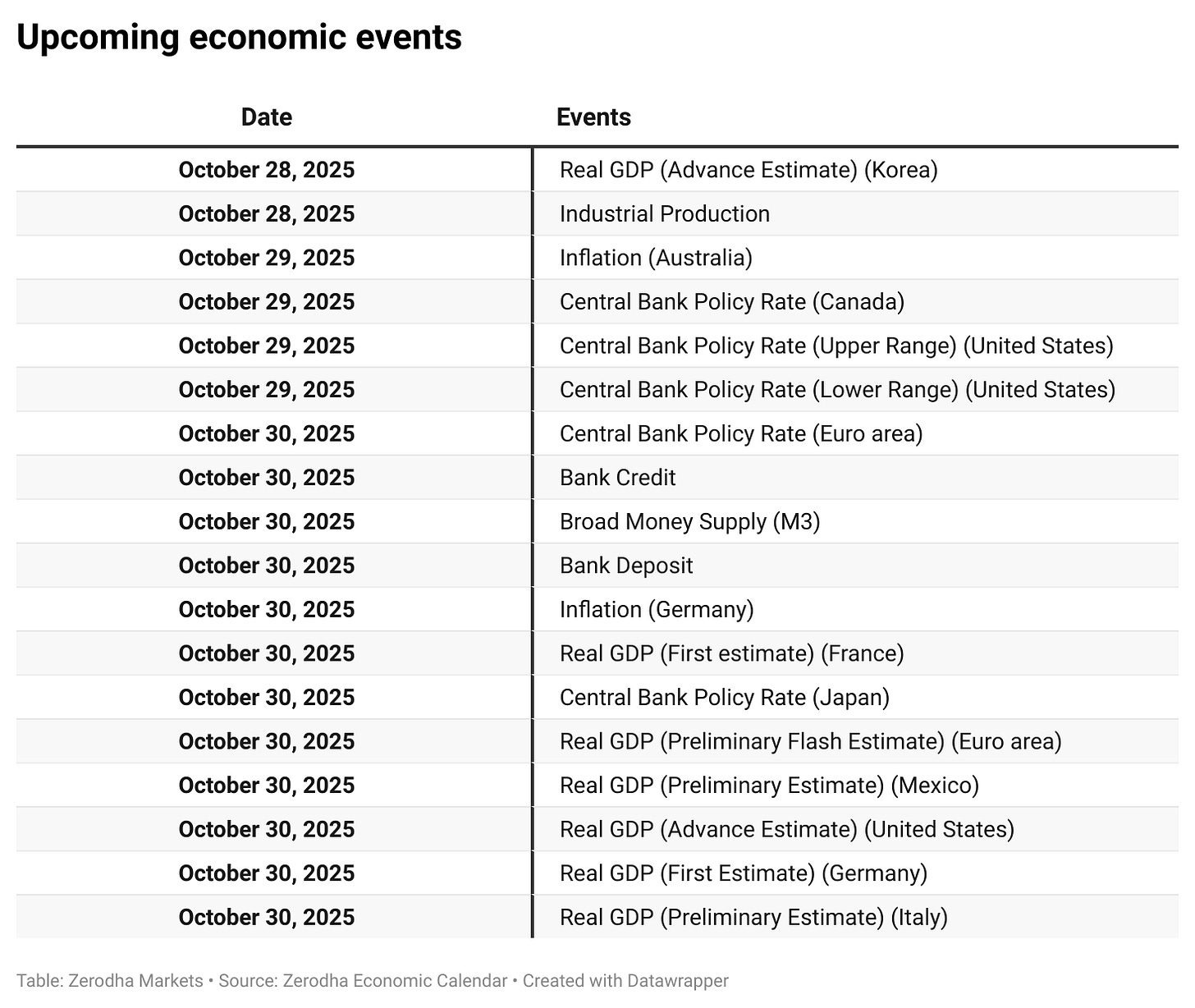

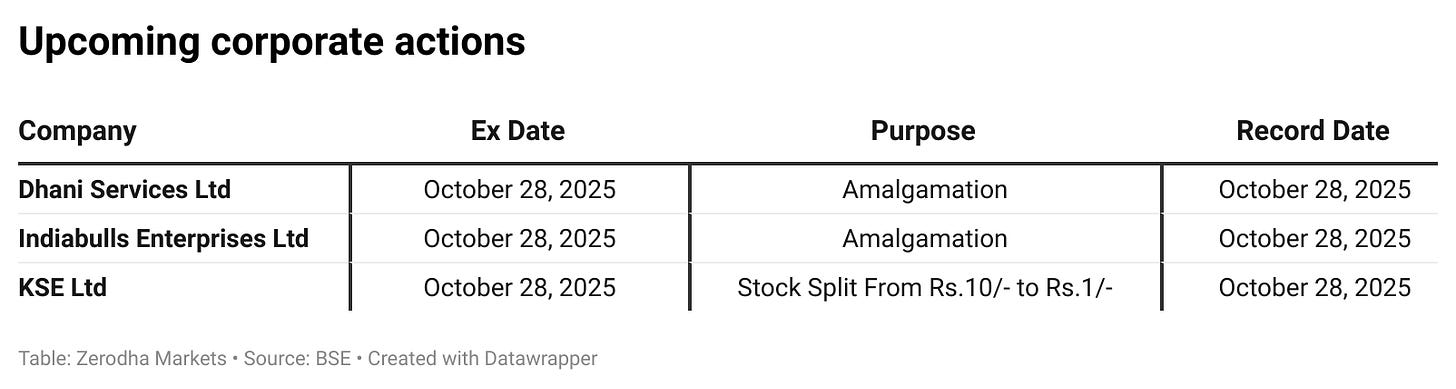

Calendars

In the coming days, we have the following quarterly results, significant events, and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!