Nifty extends losing streak amid weak sentiment

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, Sandeep breaks down the week gone by and shares key pointers to watch out for in the days ahead.

Market Overview

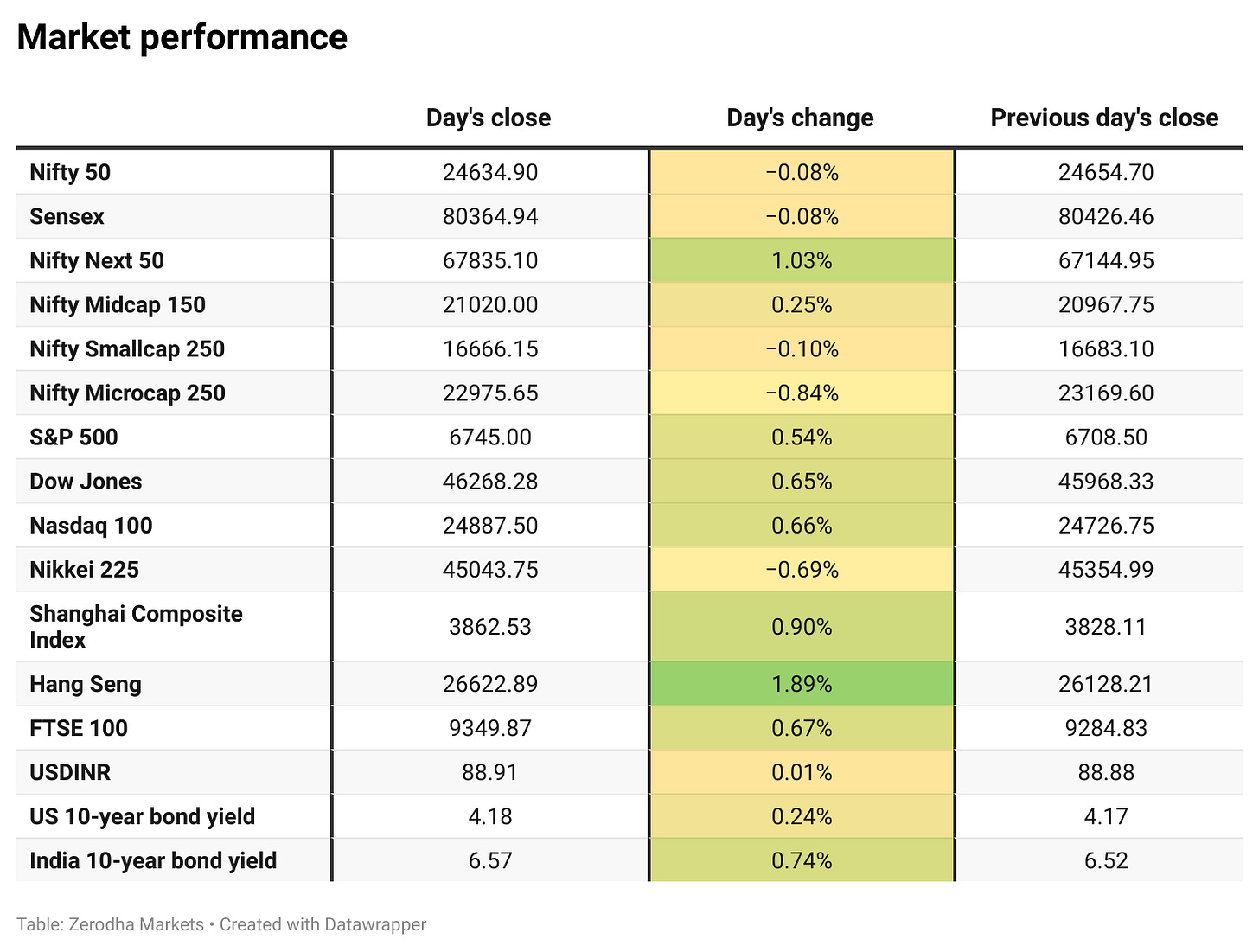

Nifty opened with a 74-point gap-up at 24,728.55 and extended its gains in the opening hour, climbing past 24,775 before facing resistance. Through the morning session, the index oscillated within a broad 24,720–24,770 range before slipping lower by mid-day.

In the second half, weakness intensified as Nifty dipped below 24,650, making lows near 24,600 around 12:30 PM. However, a sharp rebound followed, lifting the index back toward 24,725 by 2 PM. The volatility continued in the final hour, with Nifty eventually closing at 24,634.90, closing just 30 points above the day’s low.

Market sentiment is gradually shifting from caution to optimism, aided by signs of easing U.S.-India trade tensions. However, concerns over steep 50% tariffs, persistent foreign investor outflows, and muted earnings continue to cap the upside. As we advance, investors will closely track festival season sales and management commentary on demand trends across industries.

Broader Market Performance:

Broader markets had a mixed session today. Of the 3,168 stocks traded on the NSE, 1,497 advanced, 1,578 declined, and 93 remained unchanged.

Sectoral Performance

The top-gaining sector was Nifty PSU Bank, which rose 1.78%, followed by Nifty Realty and Nifty Energy. On the flip side, the top losing sector was Nifty Media, which slipped 0.85%. Out of the 12 sectoral indices, 7 closed in the green, while 5 ended in the red, reflecting a broadly positive but mixed market tone.

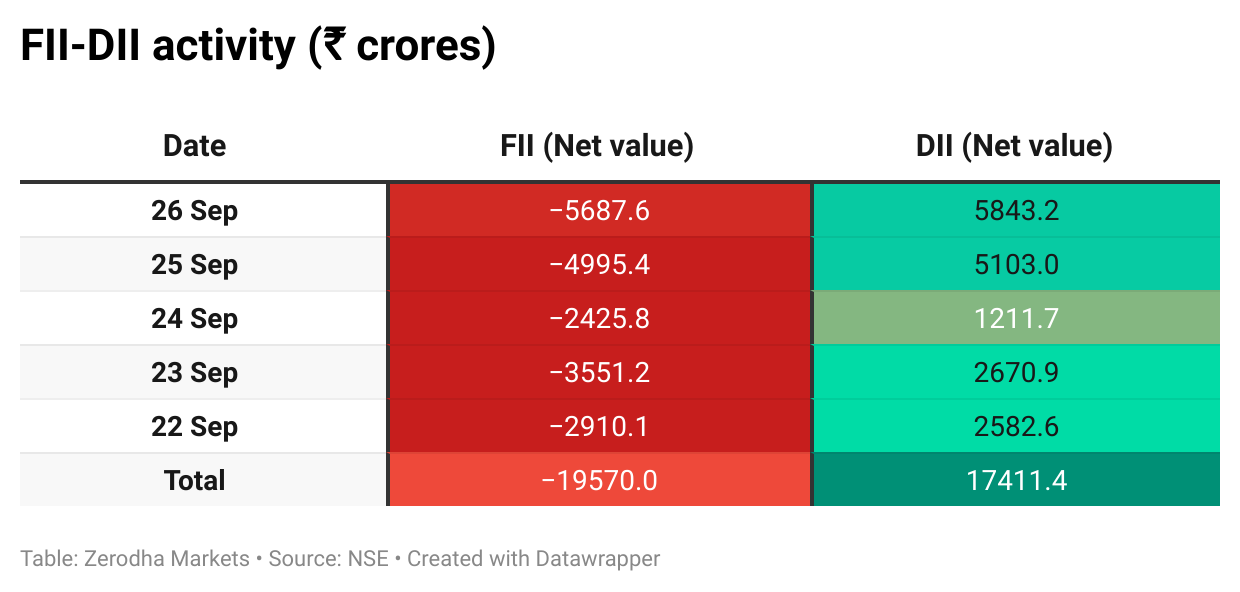

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 30th September:

The maximum Call Open Interest (OI) is observed at 25,000, followed by 24,800, suggesting strong resistance at 24,800 - 24,900 levels.

The maximum Put Open Interest (OI) is observed at 24,600, followed by 24,500, suggesting strong support at 24,600 to 24,500 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

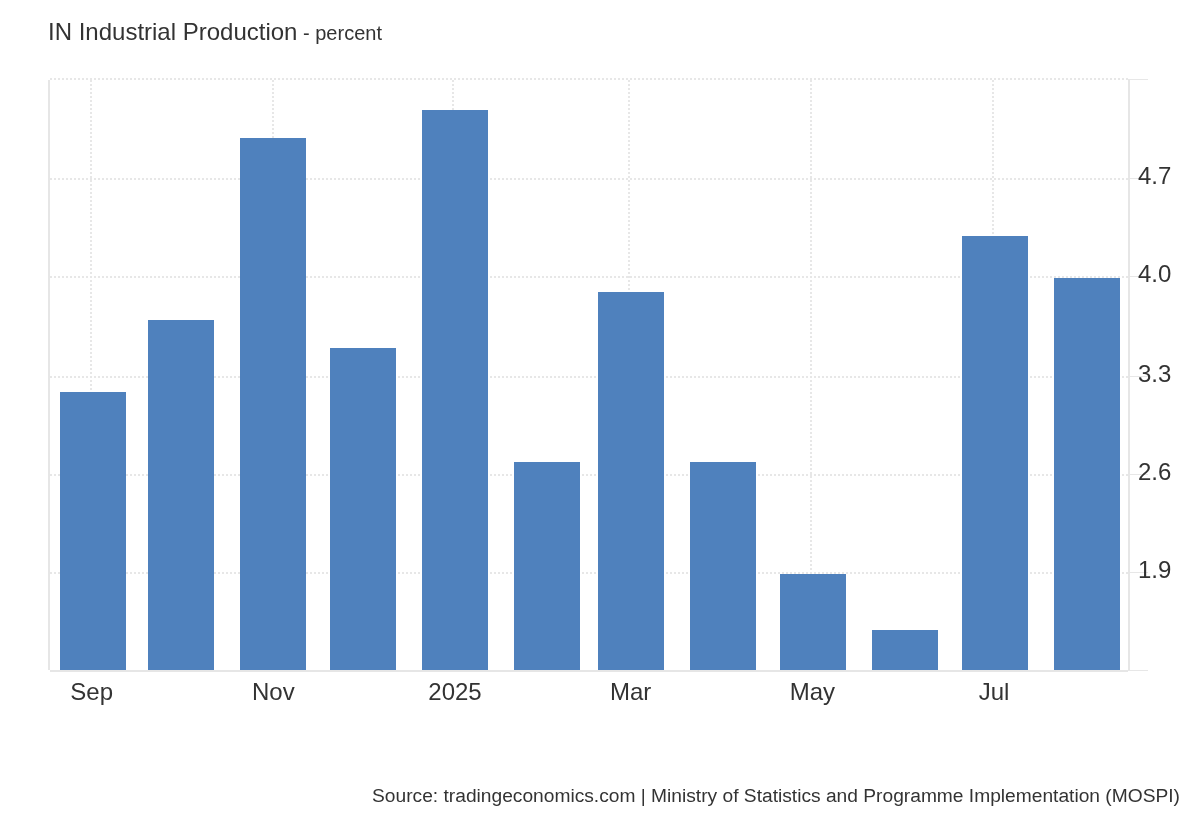

India’s industrial production grew 4% in August 2025, easing from 4.3% in July and below expectations of 5%. Mining and utilities supported growth, offsetting weaker manufacturing, while early US tariffs showed limited immediate impact. Dive deeper

RBI has mandated Tata Sons to list by September 30 under new NBFC rules, but the group has sought deregistration, citing structural unpreparedness. Tata Trusts opposes listing, leaving the outcome crucial for regulators and major shareholders like Shapoorji Pallonji Group. Dive deeper

India’s 10-year bond yield rose to 6.53%, a three-week high, after the government increased the share of 10-year bonds in its October-March borrowing plan. The added supply pressure comes ahead of the RBI policy decision, with global tariff and capital flow concerns also weighing on sentiment. Dive deeper

WeWork India has set a price band of ₹615-648 for its ₹3,000 crore IPO, comprising a fresh issue and an offer for sale by existing shareholders. Anchor bidding opens on October 1, with public subscription from October 3 to 7. Dive deeper

Lupin will acquire Dutch ophthalmology firm VISUfarma for an enterprise value of €190 million through its subsidiary Nanomi B.V., with completion expected by December. The deal adds a portfolio of over 60 branded products and expands Lupin’s specialty presence across key European markets. Dive deeper

JLR has secured a £2 billion loan guarantee to address liquidity pressures after a cyberattack halted production across multiple plants, with a phased restart now underway. Tata Motors also announced leadership changes, appointing Shailesh Chandra as MD & CEO and P B Balaji as CEO of JLR Automotive from October 1. Dive deeper

Azad Engineering signed a ₹651 crore five-year contract with Mitsubishi Heavy Industries to supply turbine engine components, taking the total business value with MHI to ₹1,387 crore. Dive deeper

World Food India 2025 concluded with MoUs worth ₹1.02 lakh crore signed by 26 global and domestic firms, including Reliance, Coca-Cola bottlers, Amul, Nestle, Tata Consumer, and Lulu Group. The investments span dairy, packaged foods, beverages, and more, with commitments expected to create over 64,000 direct jobs and 10 lakh indirect opportunities. Dive deeper

The government has appointed Shirish Chandra Murmu as RBI Deputy Governor for a three-year term starting October 9, replacing Rajeshwar Rao, whose tenure ends on October 8. Murmu is currently an Executive Director at RBI. Dive deeper

What’s happening globally

The US government faces a shutdown from Tuesday midnight unless President Trump and congressional leaders reach a funding agreement, with both parties still divided over health care policy. Dive deeper

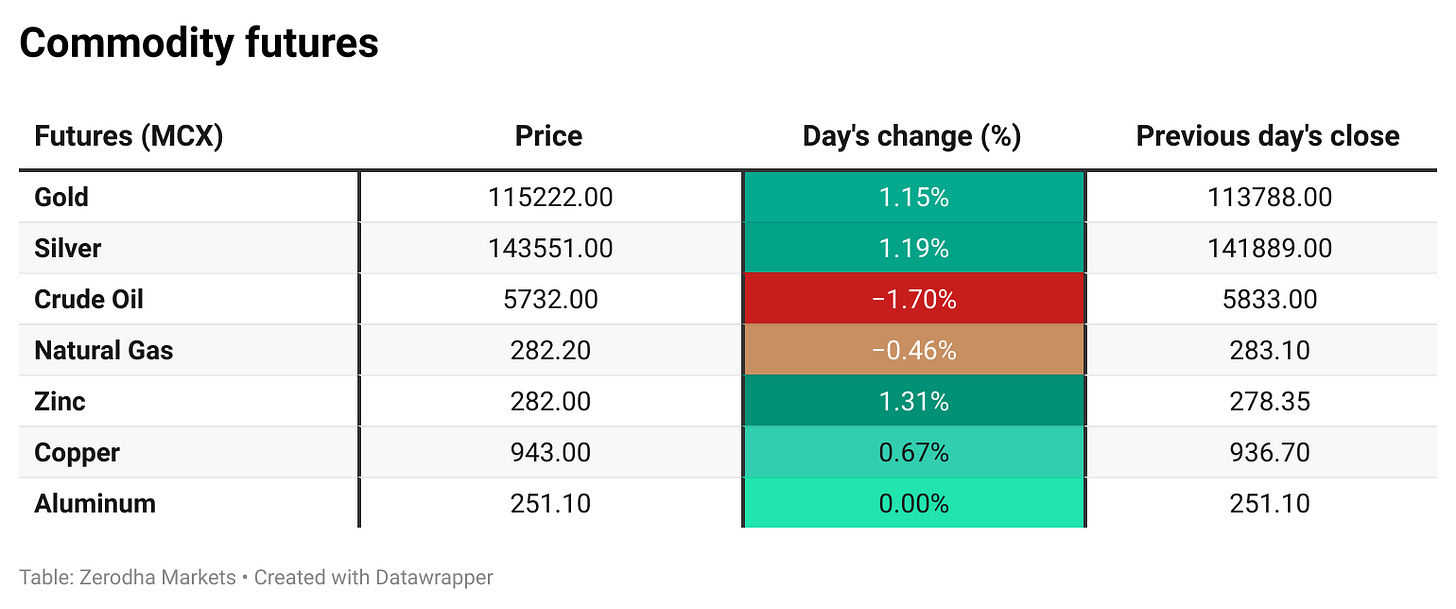

Brent crude slipped below $70 as Kurdistan resumed exports of up to 230,000 bpd after a long halt, adding to supply pressures. The drop comes ahead of an expected OPEC+ output hike in November, offsetting last week’s rally from disruptions to Russian fuel exports. Dive deeper

Gold surged past $3,800 an ounce for the first time, supported by a weaker dollar and expectations of US rate cuts, with markets pricing a high chance of easing in October and December. Dive deeper

The Euro Area’s Economic Sentiment Indicator rose slightly to 95.5 in September from 95.3 in August, above expectations of 95.2. Consumer and construction sentiment improved, while industry, services, and retail eased. Spain, Italy, and France saw gains, while Germany and the Netherlands weakened. Dive deeper

China’s industrial profits rose 0.9% year-on-year to CNY 4.69 trillion in Jan–Aug 2025, rebounding from earlier declines, aided by private sector gains and smaller losses at SOEs. August alone saw a sharp 20.4% surge, the first monthly growth in four months, supported by strength in manufacturing and equipment sectors. Dive deeper

The US will impose a 100% tariff on all movies made outside the country, President Donald Trump announced on Truth Social, marking a sharp escalation in trade measures targeting global entertainment imports. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Commerce and Industry Minister Piyush Goyal on FTAs

“Talks are going with the U.S. (for a trade agreement). Talks are also underway with the EU, New Zealand, Oman, Peru, and Chile” - Link

Hindustan Unilever on Q2 business update and GST 2.0 impact

“While GST rate cuts support long-term consumption, we have seen a transitory impact due to disruption at distributors and retailers clearing old inventories.”

“This has resulted in postponed ordering in anticipation of new stocks with revised MRPs and lower consumer pantry buying in September.”

“Given our existing pipeline inventory in the channels, we expect this impact to continue into October as well.” - Link

Preeti Chheda, Executive Committee Member, Indian REITs Association & CFO, Mindspace Business Parks REIT, on joining the Global REIT Alliance

“This alliance provides a vital platform to collaborate with the global REIT community, exchange market perspectives, and collectively drive the growth of REITs globally.”

“By uniting 24 countries and regions, the Global REIT Alliance creates a unified voice for REIT advocacy and standard-setting.”

“Participation will strengthen India’s five listed REITs by connecting them to global best practices and knowledge-sharing opportunities.” - Link

Cathy Smith, CFO, Starbucks, on CTO transition and tech revamp

“Our tech priorities aren’t changing. We’re focused on the tech work needed to deliver our Back to Starbucks plan.”

“We’re rolling out an AI-powered automated inventory counter to all company-owned stores in North America by the end of September.”

“The focus is on the most important capabilities and the most important work, with a significant in-house technology team supported by partners.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

Calendars

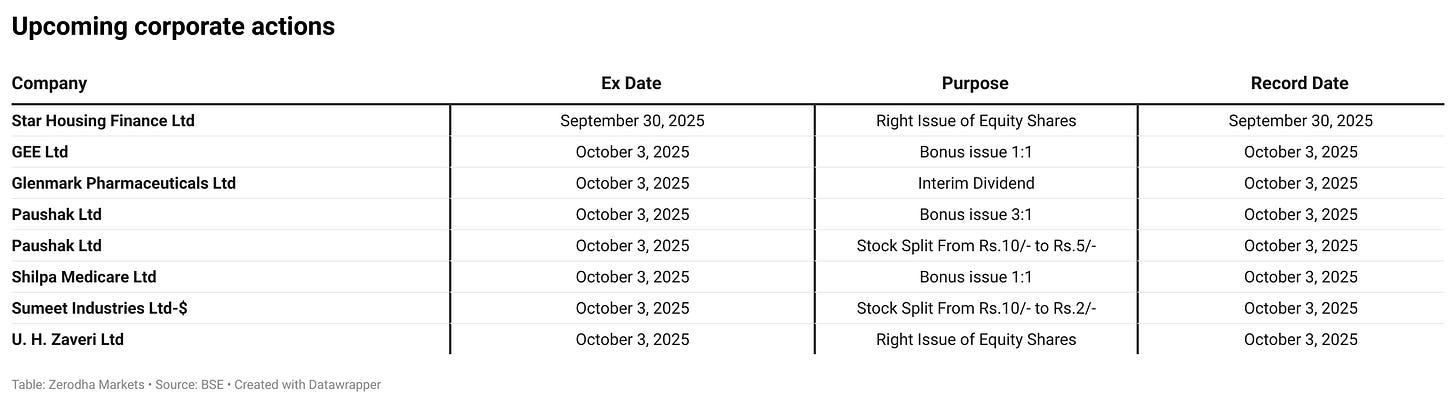

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!