Nifty extends losing run as muted results and global worries mount

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real-time by Tijori.

Market Overview

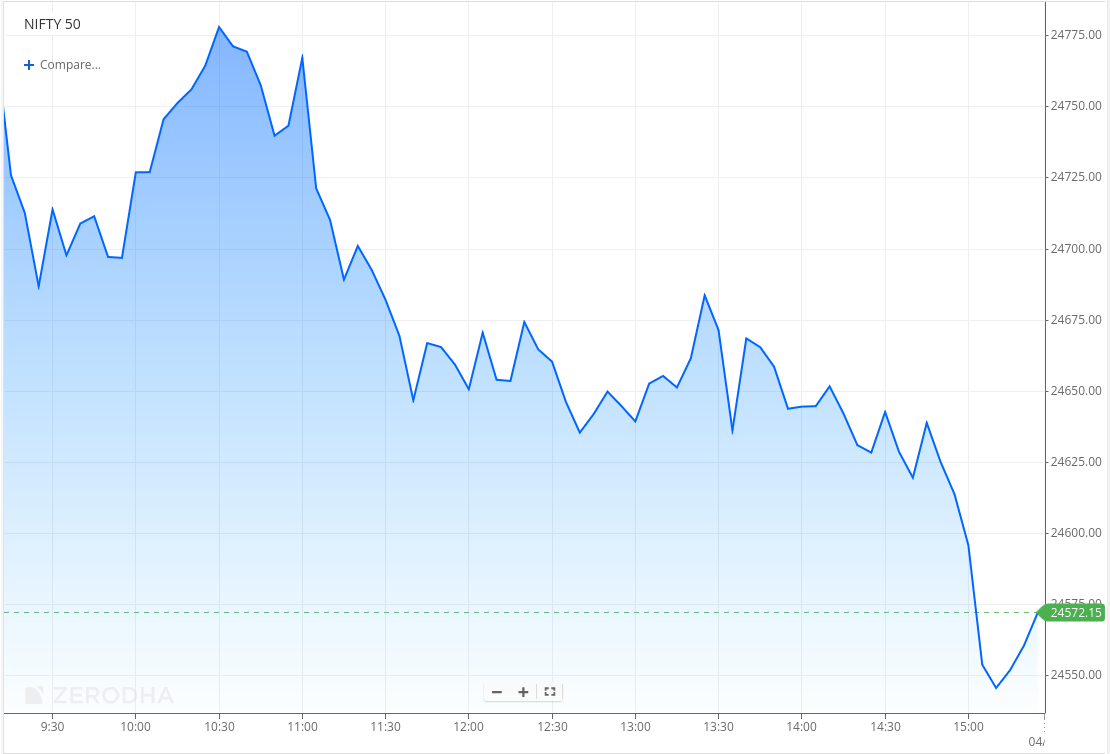

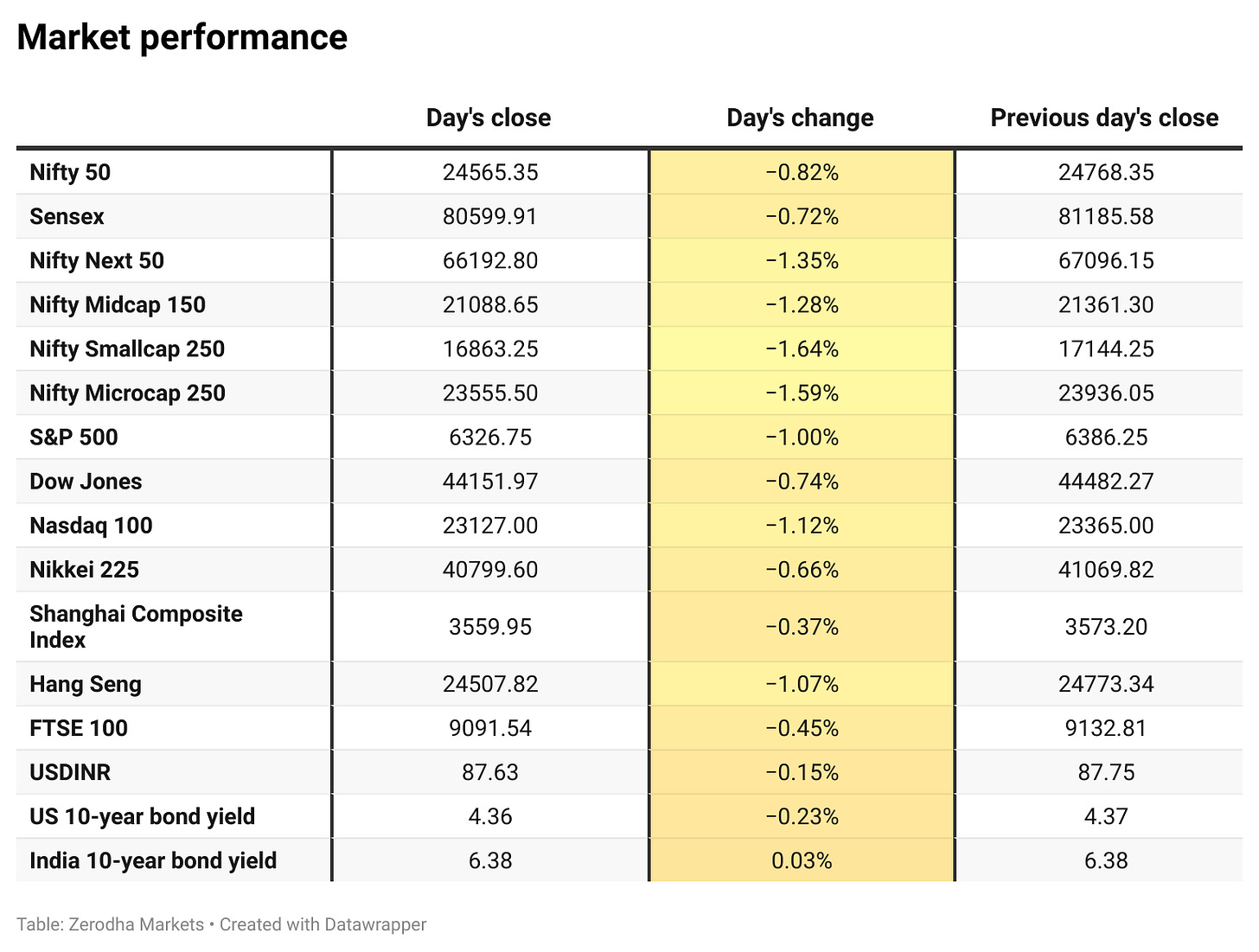

Nifty opened with a mild gap-down at 24,735 and briefly recovered to hit a high of 24,785 in the morning session. However, the rebound was short-lived, and the index steadily declined through the afternoon, touching an intraday low of 24,535. It eventually settled at 24,565, down 203 points or 0.82%, marking its fifth consecutive weekly decline.

Sentiment remained cautious amid weak global cues, FII outflows, and subdued earnings reactions. Investors are eyeing upcoming results and India’s response to US tariffs. Trade developments may guide market direction in the near term.

Broader Market Performance:

Broader markets remained under pressure. Of the 3,040 stocks traded on the NSE, 784 advanced, 2,173 declined, and 83 remained unchanged.

Sectoral Performance

Nifty FMCG was the only gainer among the sectoral indices, ending the day up 0.69%. Nifty Media saw a marginal decline of 0.59%.

The rest of the sectors closed lower, with Nifty Pharma falling the most at 3.33%, followed by Nifty Metal down 1.97%, IT down 1.85%, and Realty down 1.78%. Overall, 11 out of 12 sectors ended in the red, reflecting broad-based market weakness.

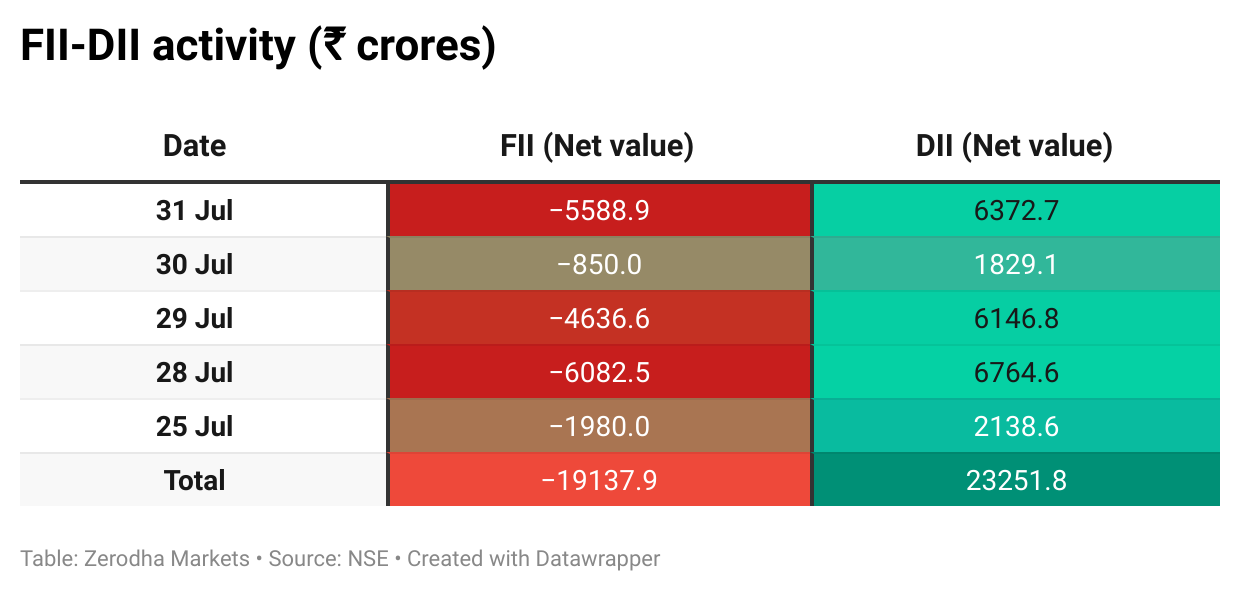

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 7th August:

The maximum Call Open Interest (OI) is observed at 25,000, followed closely by 24,800, suggesting strong resistance at 24,700 - 24,800 levels.

The maximum Put Open Interest (OI) is observed at 24,200, followed closely by 24,500, suggesting strong support at 24,300 to 24,400 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

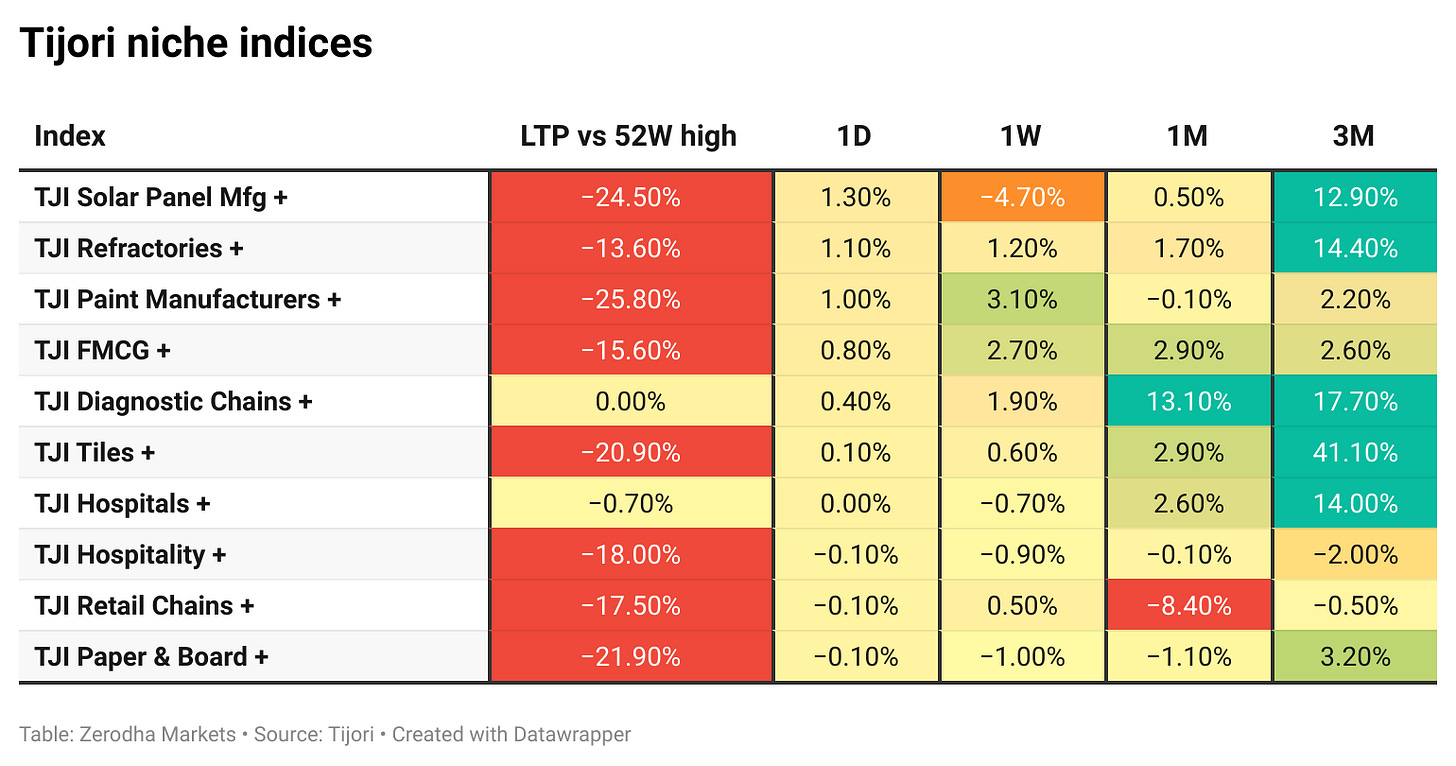

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

ED has summoned Anil Ambani on Aug 5 in a ₹3,000 crore loan fraud probe linked to Yes Bank loans. Raids were conducted on July 24 across firms and executives tied to his group. Reliance Power and Infra said the action has no business impact. Dive deeper

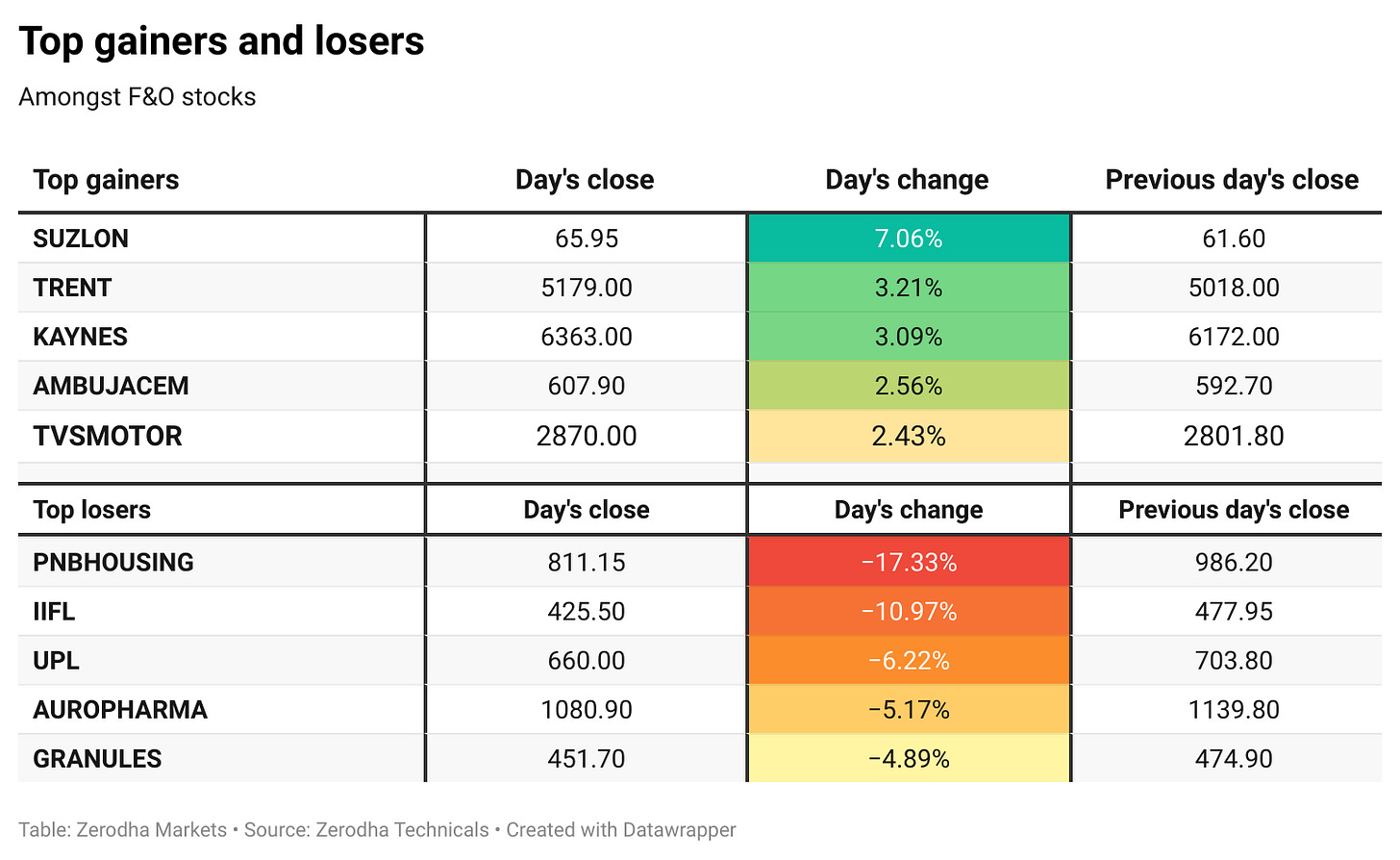

PNB Housing Finance shares fell over 15% after CEO Girish Kousgi resigned, effective October 28. The company cited leadership continuity and a smooth transition, while Kousgi plans to pursue new opportunities. He will also step down from subsidiary boards on the same date. Dive deeper

IDFC First Bank allotted ₹4,876 crore worth of preference shares to Warburg Pincus affiliate Currant Sea Investments for a 10% stake. The funds will support growth initiatives. Dive deeper

Adani Power reported a Q1 net profit of ₹3,305 crore, down YoY due to lower merchant tariffs and higher expenses. Revenue stood at ₹14,167 crore, with operating capacity rising to 18,150 MW. Power sales grew 1.6% YoY to 24.6 BU. Dive deeper

Indus Towers reported ₹1,570 crore free cash flow in Q1 FY26, aided by dues recovery from Vodafone Idea. Despite improved receivables, the board opted to conserve cash amid high capex needs and sector uncertainties. Maintenance capex for H1 2025 stood at ₹1,190 crore. Dive deeper

Reliance Industries will hold its 48th AGM on August 29 and has set August 14 as the record date for the ₹5.50 final dividend. Q1FY26 net profit surged 78% YoY to ₹26,994 crore, aided by a one-time gain from its Asian Paints stake sale. Revenue rose 5.3% to ₹2,48,660 crore. Dive deeper

PB Fintech reported a 41% YoY rise in Q1 net profit to ₹85 crore, with revenue up 33% to ₹1,348 crore. Core online insurance premiums grew 35%, driven by a 46% jump in new protection premiums. Renewal revenue and new initiatives also saw strong growth. Dive deeper

SEBI has proposed reducing the retail quota to 25% and raising QIB allocation to 60% for IPOs over ₹5,000 crore, citing low retail participation in large issues. It also suggested including insurers and pension funds in the anchor investor category alongside mutual funds. Dive deeper

PNB is targeting ₹16,000 crore in recoveries and 11-12% credit growth in FY26, with plans to raise CASA share above 38% and maintain NIM between 2.8-2.9%. The bank aims to keep gross NPA below 3% and slippage ratio under 1%. International operations are also expanding steadily. Dive deeper

NCC secured government orders worth ₹791.5 crore in July, including ₹461.4 crore for its buildings division and ₹330.2 crore for the electrical division. The contracts were received in the normal course of business. Shares closed 2.29% lower before the announcement. Dive deeper

BIAL has completed India’s largest unlisted bond issuance in the airport sector, raising ₹9,000 crore via NCDs in two tranches. The 15-year refinancing, supported by an AAA rating, aims to reduce borrowing costs and fund future expansion. Dive deeper

SEBI has proposed expanding the definition of strategic investors in REITs and InvITs to include foreign investors and qualified institutional buyers. This aims to boost capital inflows, allowing broader participation from entities like insurance, pension, and provident funds in these sectors. Dive deeper

Godrej Properties reported a 15% YoY rise in Q1 net profit to ₹600 crore, while total income declined 3% to ₹1,593 crore. Sales fell 18%, but collections rose 22% to ₹3,670 crore. Dive deeper

What’s happening globally

WTI crude fell toward $69, pressured by concerns that new US tariffs could slow global growth and weaken oil demand. Despite the pullback, prices are set for a weekly gain of over 6%, supported by supply risks tied to threats of secondary sanctions on Russian oil buyers. Dive deeper

Gold hovered near $3,290/oz on Friday, heading for its worst week since June, weighed down by a stronger dollar after Trump’s sweeping tariff hikes. Hot US PCE data added to inflation concerns, clouding prospects for a September Fed rate cut. Dive deeper

Eurozone inflation held steady at 2.0% in July, matching the ECB’s target for the second month. A dip in services inflation offset rising prices in food and industrial goods, while energy prices continued to fall. Core inflation remained unchanged at 2.3%. Dive deeper

US nonfarm payrolls are expected to rise by 110K in July, the slowest pace in five months, with unemployment seen edging up to 4.2%. Wage growth may pick up to 0.3%, reflecting a cooling but resilient labor market amid policy-related uncertainties. Dive deeper

Spain’s manufacturing PMI rose to 51.9 in July, its highest this year, driven by stronger output and new orders. Job growth hit a 7-month high, but export demand stayed weak. Rising input costs and trade uncertainty weighed on business confidence. Dive deeper

UK house prices rose 2.4% YoY in July, beating expectations, with a 0.6% monthly gain. Improved affordability, steady mortgage approvals, and easing rates supported resilience, while housing activity may pick up further if rate cuts follow. Dive deeper

China’s Caixin manufacturing PMI fell to 49.5 in July, signaling contraction amid weaker export demand and slower new orders. Output and employment declined, while input costs rose and selling prices fell. Business sentiment improved slightly but stayed below average. Dive deeper

The South African Reserve Bank cut its key rate by 25 bps to 7%, citing global trade uncertainty, a stronger rand, and easing inflation. With June CPI at 3%, growth forecasts were trimmed for 2025-26, while a modest rebound is expected in 2027. Dive deeper

Meta plans to ramp up AI spending in 2025 and beyond, leveraging strong ad revenues to fund data centers and top talent. Q2 earnings beat estimates, with AI already boosting ad efficiency and revenue. The company raised its capex outlook, positioning itself as a long-term AI frontrunner. Dive deeper

McDonald’s plans to double its AI investments by 2027 and is positioning India as a key global hub for data and tech operations. The Hyderabad office is set to become its largest outside the US, with AI tools already used in 400 outlets and a global rollout planned across 40,000 locations. Dive deeper

Apple reported record June-quarter revenue of $94.04 billion with strong growth in India and other emerging markets. Net profit rose 9.2% to $23.42 billion. CEO Tim Cook flagged a $1.1 billion tariff cost for the September quarter. Dive deeper

UnitedHealth appointed Wayne DeVeydt as its new CFO, effective September 2, as part of ongoing leadership changes. He replaces John Rex, who will transition to a strategic advisor role. Dive deeper

Ford is recalling over 312,000 vehicles in the US due to a brake assist defect that could extend stopping distances and raise crash risks. The issue also affects ADAS performance, potentially causing unexpected braking behavior. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Uday Kotak, Founder and Director, Kotak Mahindra Bank, on preparing for tough economic times

“I would like every Indian to assume we will be in rough weather and prepare to do very well in rough weather. Men and women and strength are built not in good weather.”

“You remember in 1992 when India first started opening up... that same Bombay club and manufacturers... woke up and by year 2000 Indian manufacturers started competing with the best in the world.”

“I genuinely believe Indians should get out of their comfort zone... This is the time for Indians to wake up and say next 2 or 3 years are tough for us.” - Link

Mahesh Iyer, MD and CEO, Thomas Cook (India), on outlook and challenges

“Some sectors are pointing to a slowdown, while others are signalling lower job creation, and even job cuts. In the near term, there could be some softness, but the long term travel story remains intact.”

“People have continuing aspirations to travel. There is money. You see the RBI’s liquidity infusion and the corporate capex cycle. We expect H2 of fiscal year 2026 to be better than H1.”

“More and more customers want to build their own packages, and we are building tech tools to help them pre-book and pre-plan their trips.” - Link

Tim Cook, CEO, Apple, on AI investment and strategy

“We’re very open to M&A that accelerates our roadmap. We are not stuck on a certain size company, although the ones that we have acquired thus far this year are small in nature.”

“We basically ask ourselves whether a company can help us accelerate a roadmap, and if they do, then we’re interested.”

“It’s not going to be exponential growth, but it is going to grow substantially. A lot of that’s a function of the investments we’re making in AI.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

📚 Also reading Mind Over Markets by Varsity?

It goes out thrice a week, covering markets, personal finance, or the odd question you didn’t know you had. The Varsity team writes across three sections: Second Order, Side Notes, and Tell Me Why, thoughtfully put together without trying to be too clever.

Go check out Mind Over Markets by Zerodha Varsity here.

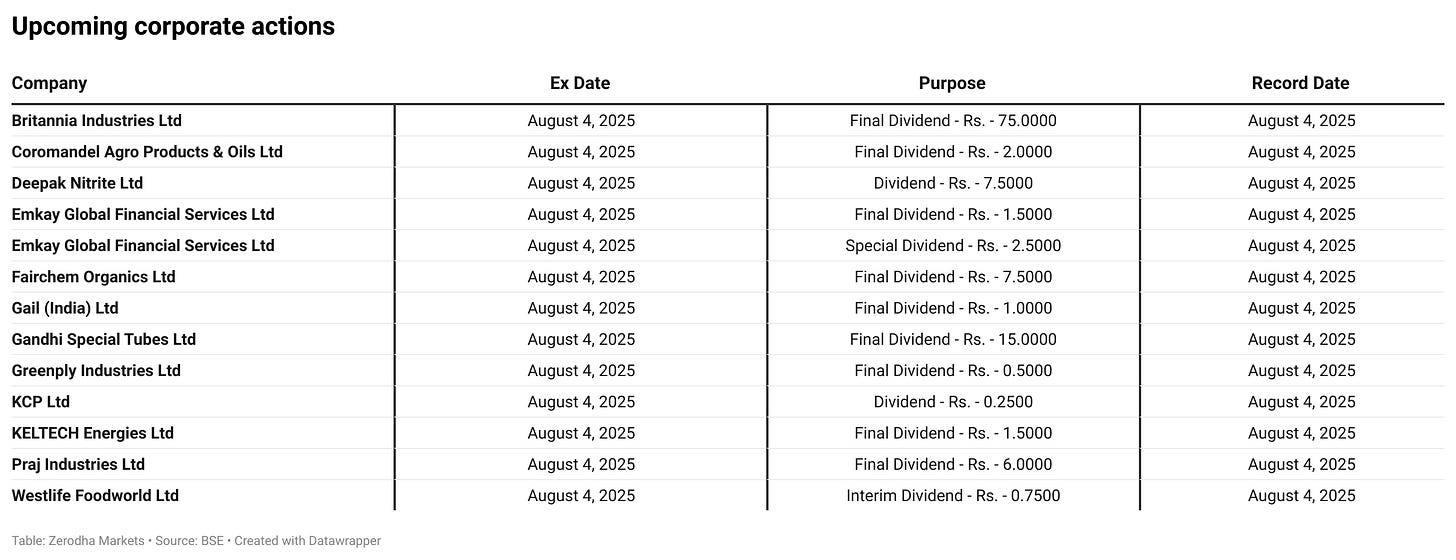

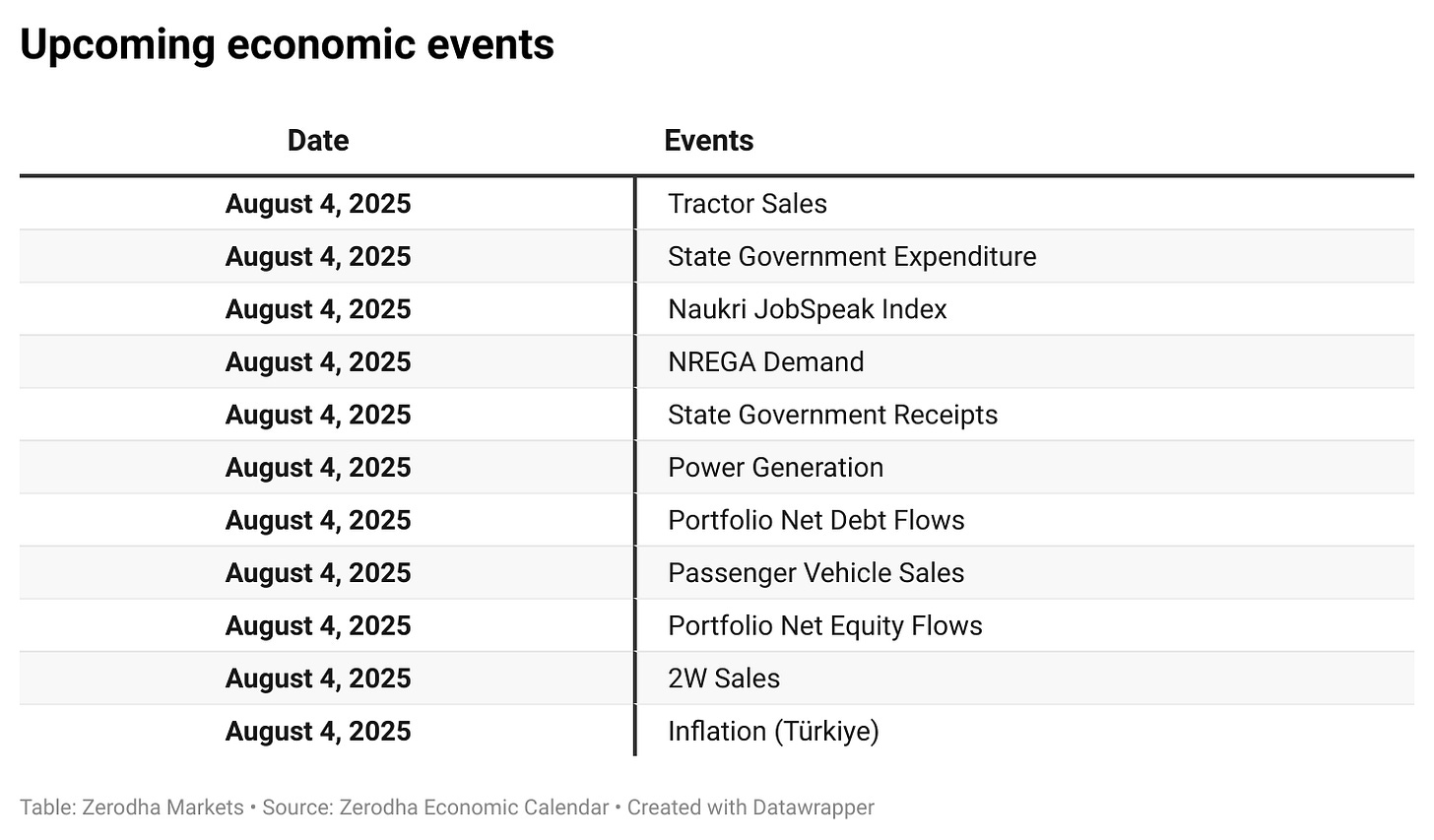

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.