Nifty ends higher above 25,300 as sectoral strength returns

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we uncover one of the most fascinating and persistent market puzzles ever documented — the Overnight Anomaly, also known as the Overnight Drift Effect. First identified in the late 1970s by Ken French (of Fama-French fame), this anomaly challenges the Efficient Market Hypothesis (EMH) by revealing that most market gains occur outside trading hours, while intraday returns often drift lower.

In this episode, we explore this enduring overnight effect across markets — from the US to India — testing it on indices and stocks to understand why it persists and what it means for systematic traders.

Market Overview

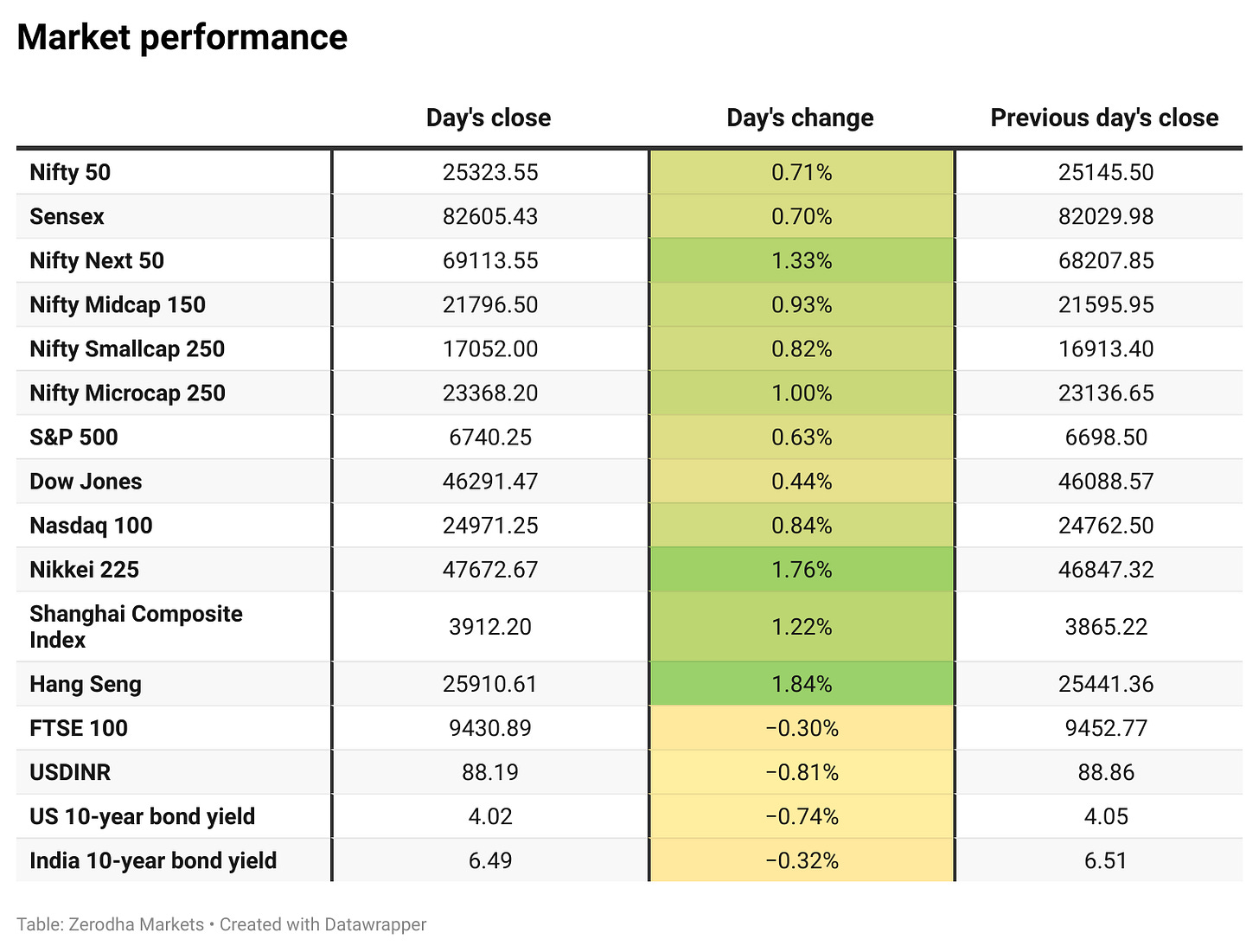

Nifty opened with a gap-up of 37 points at 25,182, tracking positive global cues and strong momentum in Asian markets. After a muted start, the index gained traction through the morning session, moving steadily higher toward the 25,300 zone amid broad-based sectoral buying.

By mid-session, Nifty held firm above 25,280, with limited volatility as traders remained optimistic ahead of key corporate earnings later in the week. In the second half, the index maintained a tight range, consolidating near the day’s high. It eventually closed at 25,323.55, up by 0.7%, marking a strong comeback after yesterday’s minor setback.

Market sentiment has once again turned optimistic regarding demand revival following the GST cuts, despite the cautious sentiment prevailing on the global trade front due to high tariffs from the U.S. As we advance, investors will closely track quarterly results, festival season sales, and management commentary on demand trends across various industries.

Broader Market Performance:

Broader markets staged a strong comeback today. Of the 3,189 stocks traded on the NSE, 1,979 advanced, 1,125 declined, and 85 remained unchanged.

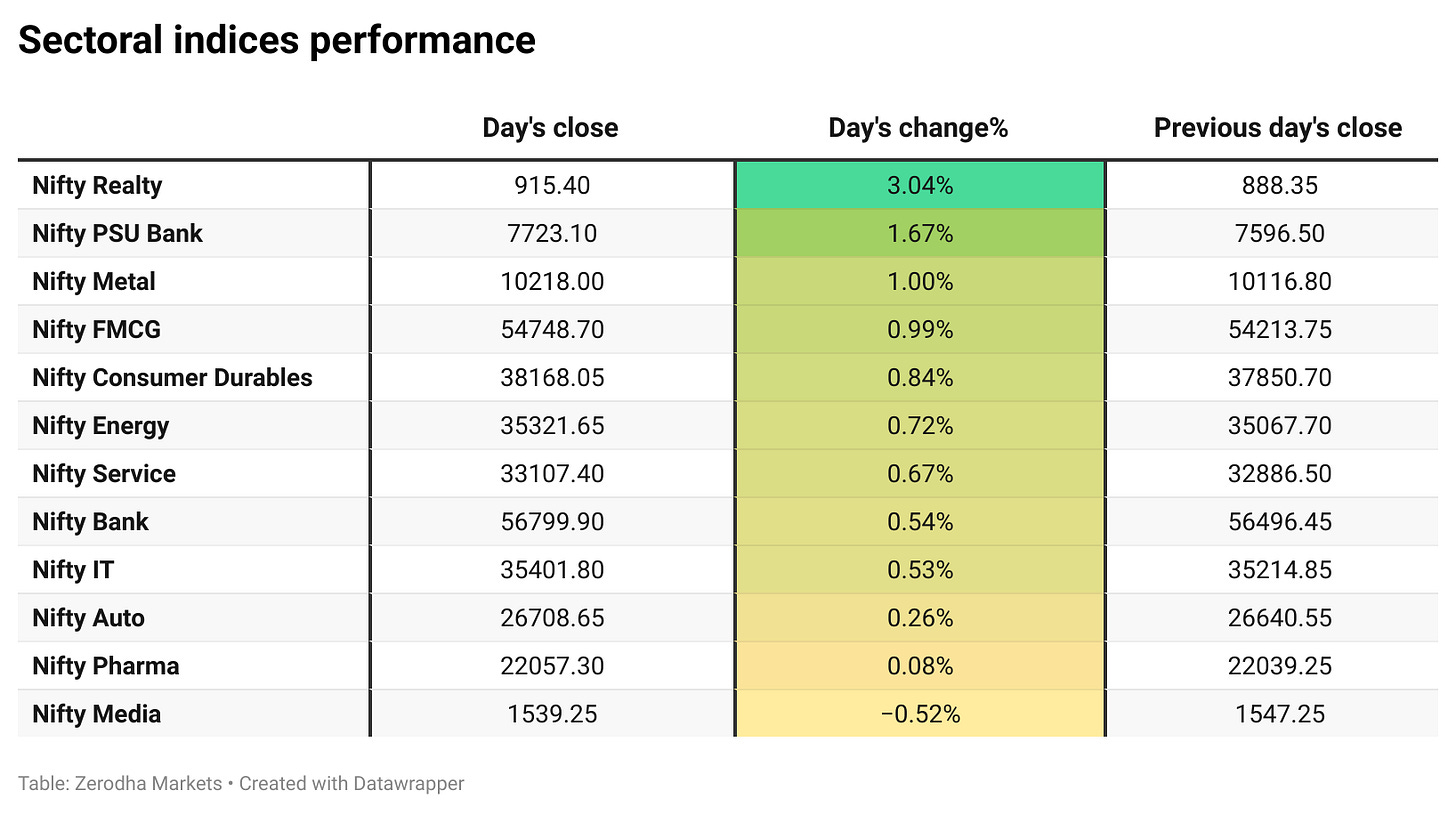

Sectoral Performance

Nifty Realty was the top gainer among sectoral indices with a sharp 3.04% rise, followed by Nifty PSU Bank and Nifty Metal, which gained 1.67% and 1.00%, respectively. On the other hand, Nifty Media was the only sector to close in the red, slipping 0.52%. Out of the 13 indices, 12 ended in the green, while only 1 closed in the red, indicating broad-based market strength.

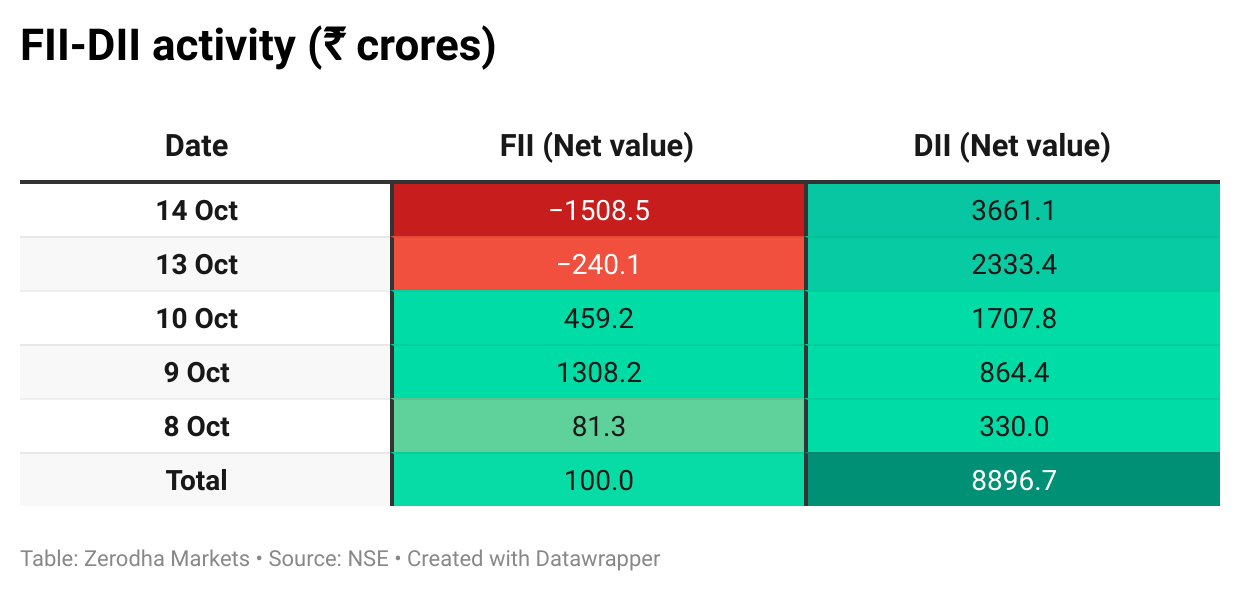

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 20th October:

The maximum Call Open Interest (OI) is observed at 25,500, followed by 25,400, indicating potential resistance at the 25,400 -25,500 levels.

The maximum Put Open Interest (OI) is observed at 25,300, followed by 25,200, suggesting strong support at the 25,200 to 25,100 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

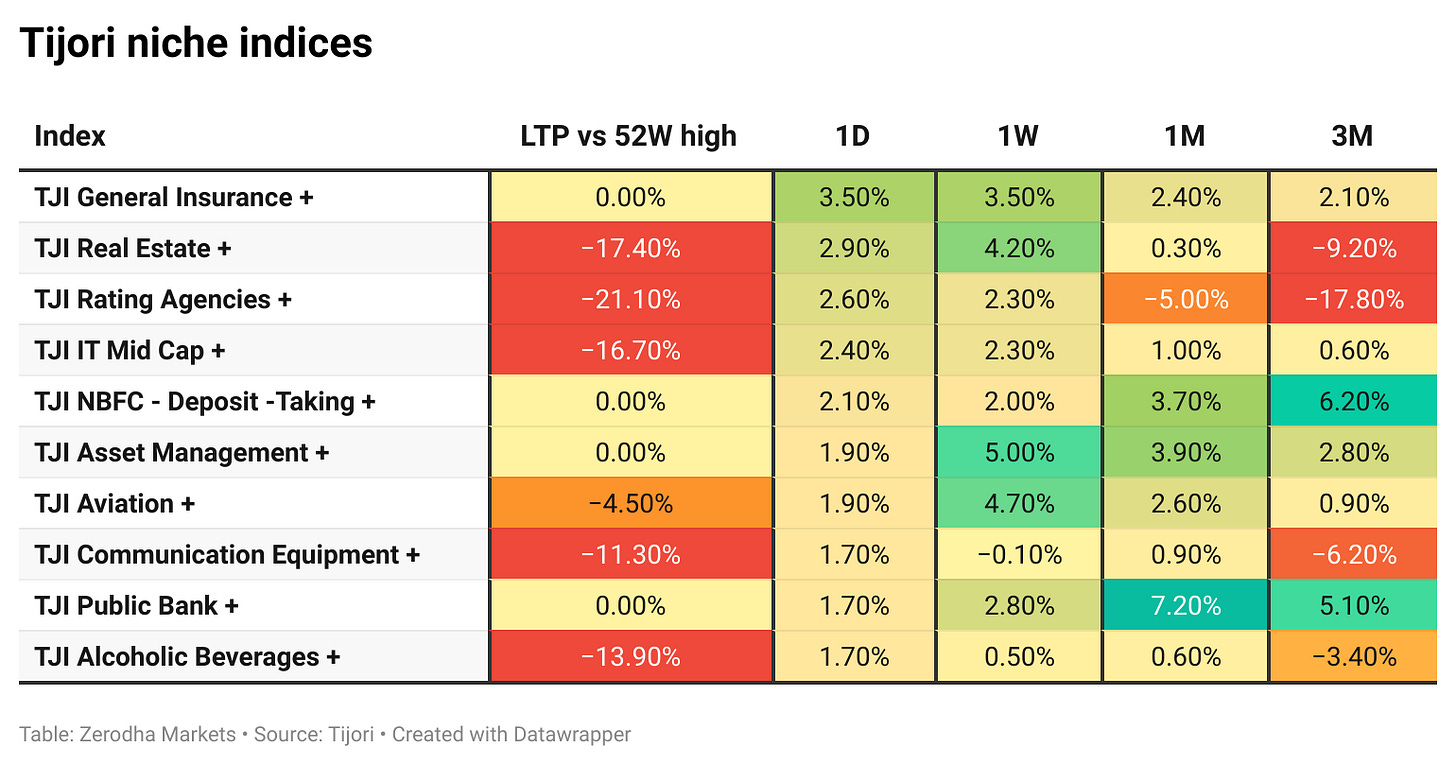

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

The rupee rebounded sharply by 75 paise to close at 88.06 against the U.S. dollar on Wednesday, marking its biggest single-day gain in nearly four months. The recovery was driven by suspected RBI intervention, upbeat domestic equities, and optimism over India–U.S. trade talks. A weaker dollar and lower crude oil prices further supported the currency. Dive deeper

Axis Bank’s Q2 FY26 net profit fell 26% year-on-year to ₹5,090 crore from ₹6,918 crore a year ago. Net interest income rose slightly by 2% to ₹13,744 crore. The bank also made a one-time standard asset provision of ₹1,231 crore for two discontinued crop loan variants following an RBI advisory. Dive deeper

HDFC Life Insurance reported a 3% year-on-year rise in net profit to ₹448 crore for Q2 FY26. Total premium income increased 15% to ₹34,162 crore, led by strong growth in both new and renewal segments. Individual APE rose 10% to ₹6,471 crores. Dive deeper

Infosys secured a £1.2 billion, 15-year contract from the UK’s NHS to build an AI-driven workforce management platform. It will replace the current system and manage payroll for 1.9 million NHS employees processing £55 billion annually. Dive deeper

Tech Mahindra’s Q2 profit fell 4.4% YoY to ₹1,194 crore while revenue rose 5.1% to ₹13,995 crore. Dive deeper

China challenged India’s EV subsidies at WTO, claiming unfair advantage to domestic manufacturers. India offers 46% subsidy on EV prices (highest globally), yet EV adoption remains only 2% of the vehicle market. Dive deeper

IRFC posted a Q2 net profit of ₹1,777 crore, up 10% YoY, while its revenue slipped 8% to ₹6,372 crore; the company also announced a dividend of ₹1.05 per share. Dive deeper

India’s palm oil imports in September fell 16.3% to 829,017 metric tons, their lowest in four months, as refiners shifted toward cheaper soyoil imports, which surged 36.8% to 503,240 tons. Dive deeper

What’s happening globally

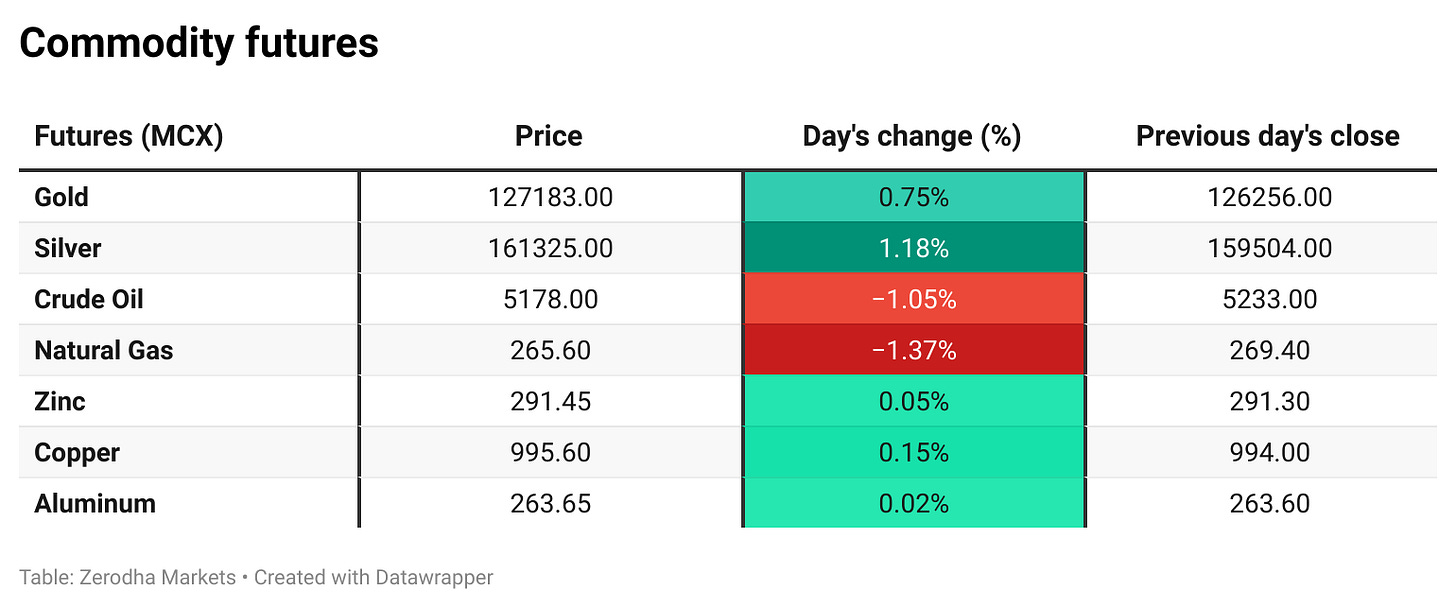

Crude oil prices edged lower, with Brent futures at $62.18 (and WTI November futures at $58.56. According to the IEA’s October report, global oil supply rose by 760,000 barrels per day in September to 108 million, driven by higher OPEC+ output. The agency expects global supply to increase by 3 million barrels per day in 2025 and another 2.4 million in 2026. Dive deeper

South Korea’s KOSPI index jumped 2.68% to a record 3,657 on Wednesday, rebounding sharply from the previous session. The rally was fueled by growing optimism over potential U.S. rate cuts and an improving global growth outlook, boosting overall risk appetite across Asian markets. Dive deeper

Japan’s Nikkei bounced back strongly, led by a surge in Mercari, which gained on upbeat earnings momentum and renewed investor interest in Japanese tech names. Dive deeper

Trump has threatened to cut cooking oil trade with China, framing Beijing’s refusal to buy U.S. soybeans as an “economically hostile act.” The move comes despite already collapsing Chinese exports of used cooking oil to the U.S. in 2025. Dive deeper

European stocks rose sharply on Wednesday as upbeat quarterly results from LVMH lifted sentiment across luxury shares. LVMH jumped over 12%, its best single-day gain in nearly two years, on stronger-than-expected Chinese demand. Peers including Hermès, L’Oréal, Richemont, and Moncler advanced between 2.7% and 7.2%. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Jerome Powell, Chairman of the Federal Reserve, on the US economy

“Rising downside risks to employment have shifted our assessment of the balance of risks,” - Link

“some signs have begun to emerge that liquidity conditions are gradually tightening,” - Link

Railway Minister Ashwini Vaishnaw on India’s ambition to become a centre for railway innovation and exports

“Indian Railways is scaling unprecedented heights, manufacturing 7,000 coaches and 1,681 locomotives annually, surpassing the combined outputs of multiple continents. With a ₹2.56 trillion yearly Capex, 325 km of bullet train corridor completed, and exports to Africa and Europe underway, India is fast emerging as a global railway powerhouse.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

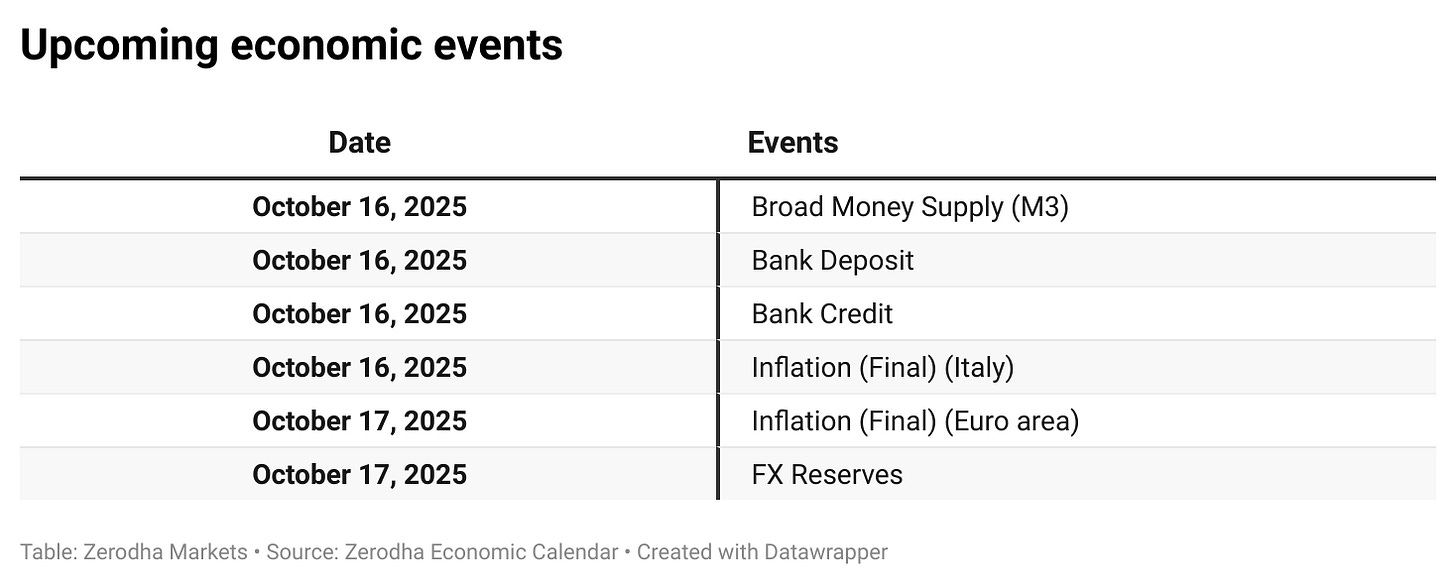

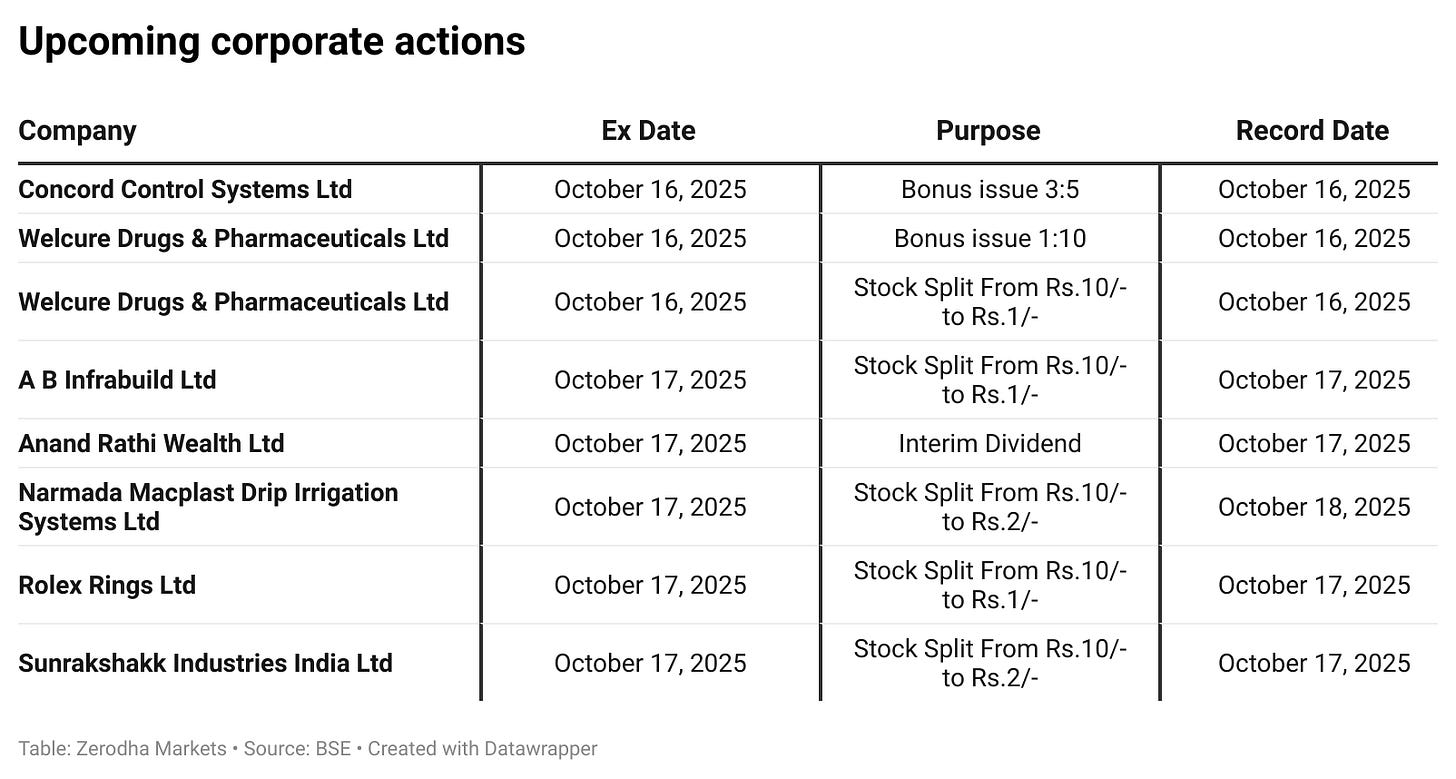

Calendars

In the coming days, we have the following quarterly results, significant events, and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

Literally i don't see this much overview anywhere else thank you zerodha for doing this much effort for us

The most helpful thing ever