Nifty ends flat after late sell-off; Auto outperforms, IT slips

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

Introducing In The Money by Zerodha

This newsletter and YouTube channel aren’t about hot tips or chasing the next big trade. It’s about understanding the markets, what’s happening, why it’s happening, and how to sidestep the mistakes that derail most traders. Clear explanations, practical insights, and a simple goal: to help you navigate the markets smarter.

Market Overview

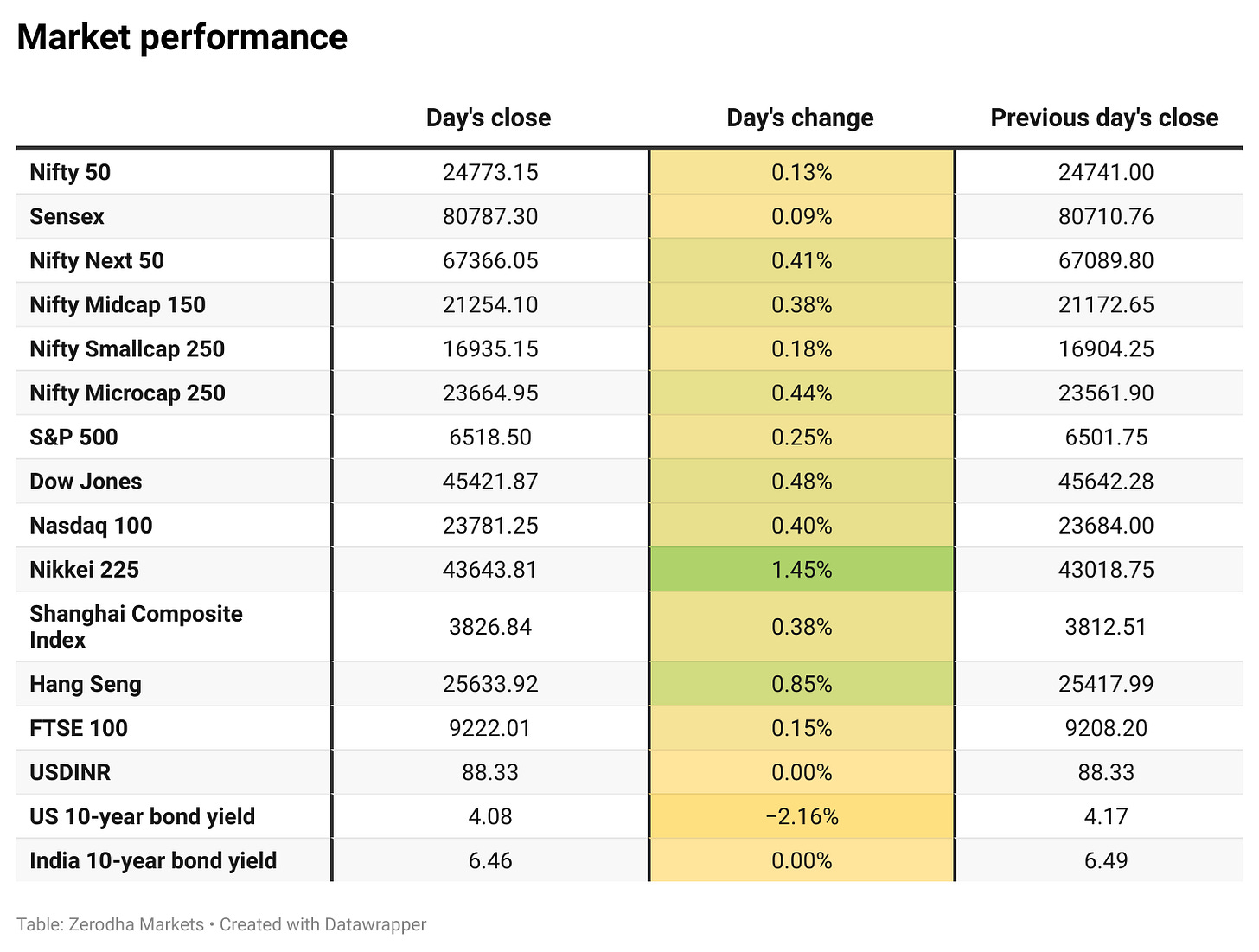

Nifty opened with a 61-point gap-up at 24,803 but slipped below 24,780 in the opening minutes. After a brief dip, the index recovered steadily, moving higher through the morning session and touching 24,870 levels around mid-day.

In the second half, the uptrend continued as Nifty extended gains to test an intraday high near 24,880 by 2:30 PM. However, sharp selling emerged in the last hour, dragging the index down to around 24,750 before a mild recovery into the close. Nifty eventually ended at 24,773.15, up modestly from the previous close but well off its intraday highs.

Market sentiment remains cautious, with concerns over 50% tariffs, persistent foreign investor outflows, and muted earnings weighing on confidence. Escalating U.S.-India trade tensions are expected to remain the key driver of near-term market direction.

Broader Market Performance:

Broader markets had a strong session today. Of the 3,145 stocks traded on the NSE, 1,750 advanced, 1,284 declined, and 111 remained unchanged.

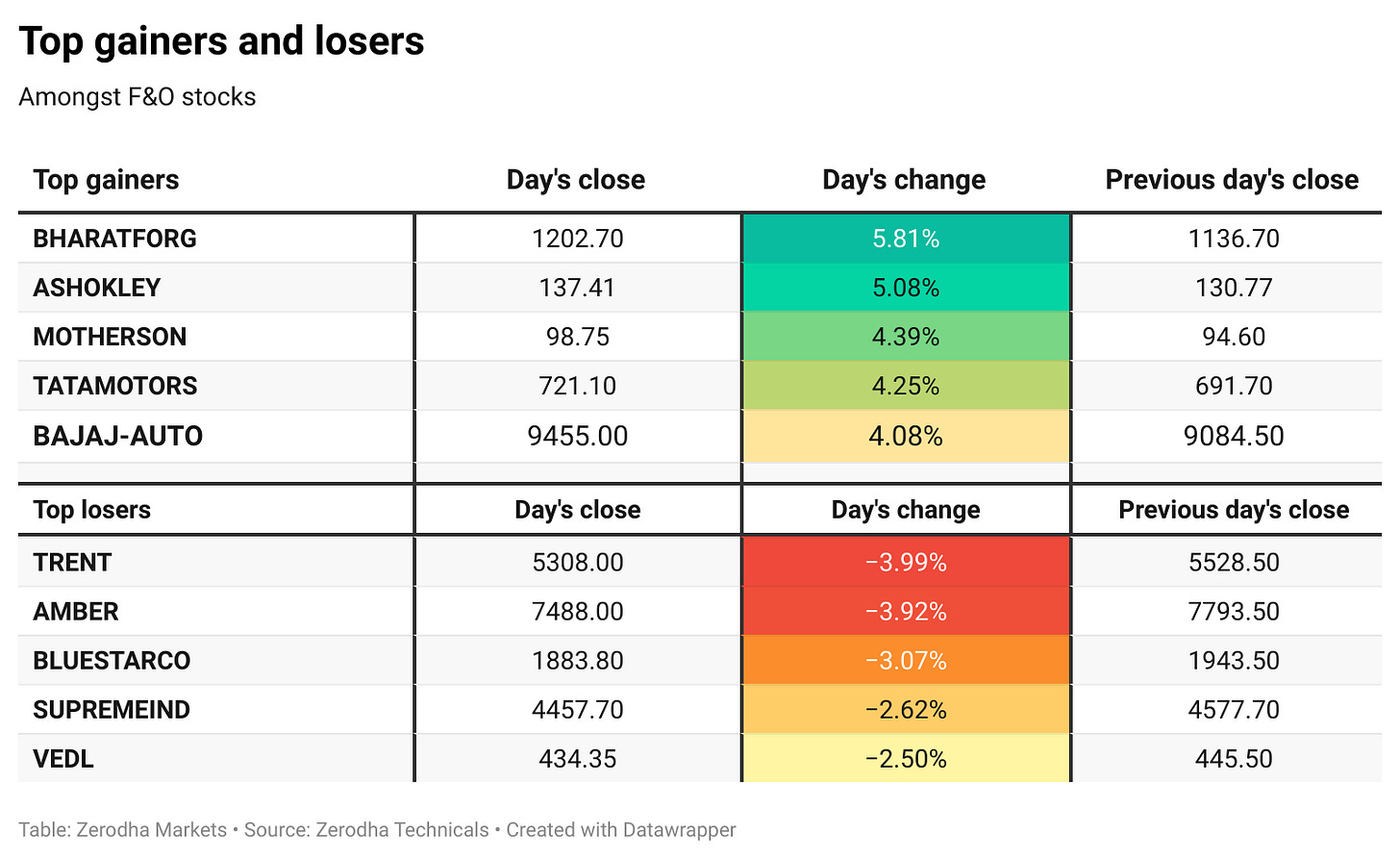

Sectoral Performance

Nifty Auto was the top gainer, jumping 3.30%, while Nifty IT was the biggest loser, slipping 0.94%. Out of the 12 sectoral indices, 6 closed in the green, while 6 ended in the red, reflecting mixed sentiment across sectors.

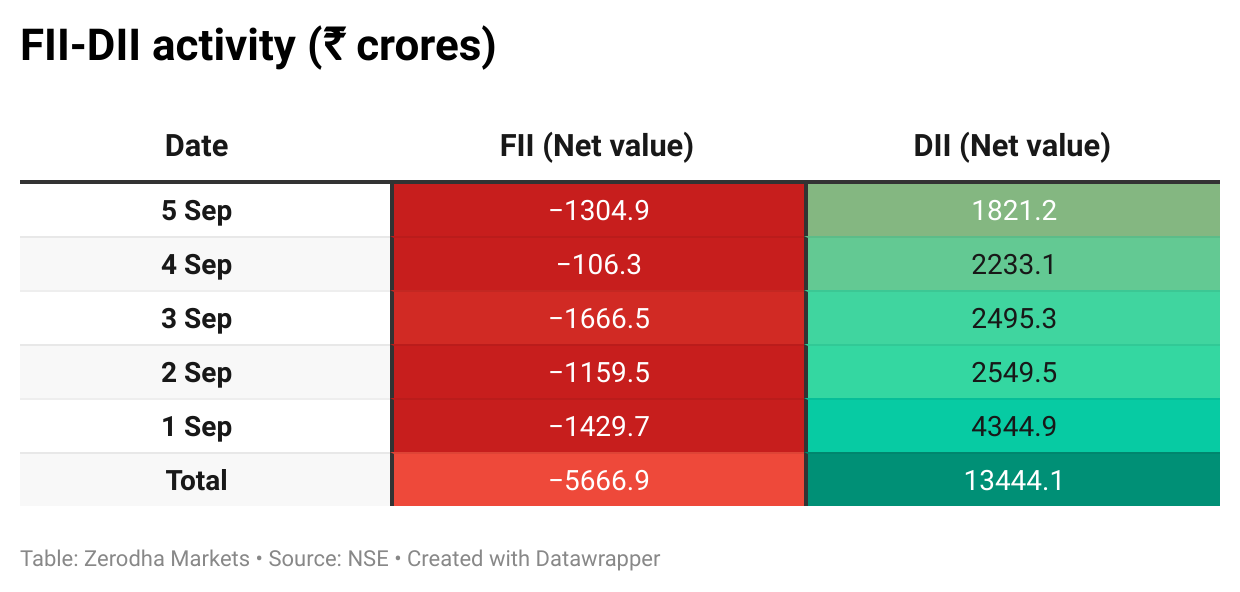

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 9th September:

The maximum Call Open Interest (OI) is observed at 25,000, followed closely by 24,900, suggesting strong resistance at 24,900 - 25,000 levels.

The maximum Put Open Interest (OI) is observed at 24,500, followed closely by 24,700 & 24,800, suggesting strong support at 24,700 to 24,600 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

The Nifty Auto index rallied over 3% as investors welcomed GST rate cuts and price reductions by auto OEMs. Sector majors M&M, Maruti Suzuki, TVS Motor, and Eicher Motors all hit fresh 52-week highs, though August retail sales rose just 2.84% as buyers delayed purchases ahead of reforms. Dive deeper

Adani Power gained 4.3% after signing a shareholders’ agreement with Bhutan’s Druk Green Power Corporation, strengthening cross-border energy collaboration. Dive deeper

Vikram Solar jumped 7% after securing a 336 MW solar module order from L&T Construction, boosting its growth prospects soon after its market debut. Dive deeper

SpiceJet fully settled its $24 million dues to Credit Suisse, closing a long-standing liability and fulfilling the terms of a 2022 settlement agreement. Dive deeper

Ceigall India is expanding into renewable energy, winning two LOIs from MSEDCL to set up 337 MW of solar projects in Maharashtra under the Mukhyamantri Saur Krushi Vahini Yojana 2.0. Dive deeper

What’s happening globally

The 10-year US Treasury yield dropped to 4.10%, the lowest in five months, as weak labor data fueled bets on Fed rate cuts. Nonfarm payrolls rose just 22,000 in August versus 75,000 expected, while unemployment hit its highest since 2021. Dive deeper

Oil rose over $1 as OPEC+’s planned output hike from October was smaller than expected, easing oversupply fears. Concerns about potential new sanctions on Russian crude also supported prices. Dive deeper

Germany’s industrial output grew 1.3% in July, beating expectations, driven by machinery (+9.5%), autos (+2.3%), and pharma (+8.4%). A 4.5% fall in energy production partially offset the gains. Dive deeper

China’s exports rose 4.4% YoY in August to $321.8B, slowing from 7.2% in July and below forecasts. It marked the weakest growth in six months, weighed down by softer demand and easing tariff pressures. DIve deeper

Japan’s GDP grew 0.5% QoQ in Q2 2025, above the 0.3% flash estimate and up from 0.1% in Q1. Growth was driven by stronger private consumption, marking the fifth consecutive quarterly expansion. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Finance Minister Nirmala Sitharaman on supporting exporters affected by Tariffs

“The Union Government is working on a comprehensive package to support exporters impacted by a steep 50% tariff imposed by the U.S.,”

"So, we are getting their inputs...something is being worked out to do some hand-holding for those exporters who have been affected by the U.S. tariff of 50%,"

"Till the time we get that assessment, how can we assume how much the impact is? So every respective Ministry is speaking to their stakeholders and asking for an assessment of 'Kitne Tak Apke Upar Iska Asar Padega' (how much will be the impact). We will have to see," - Link

Chief Economic Adviser V Anantha Nageswaran on US tariff impact on India’s GDP

"Depending upon how long it lasts even in this financial year, it may translate into a GDP impact of somewhere between 0.5 per cent to 0.6 per cent," - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

📚 Also reading Mind Over Markets by Varsity?

It goes out thrice a week, covering markets, personal finance, or the odd question you didn’t know you had. The Varsity team writes across three sections: Second Order, Side Notes, and Tell Me Why, thoughtfully put together without trying to be too clever.

Go check out Mind Over Markets by Zerodha Varsity here.

Calendars

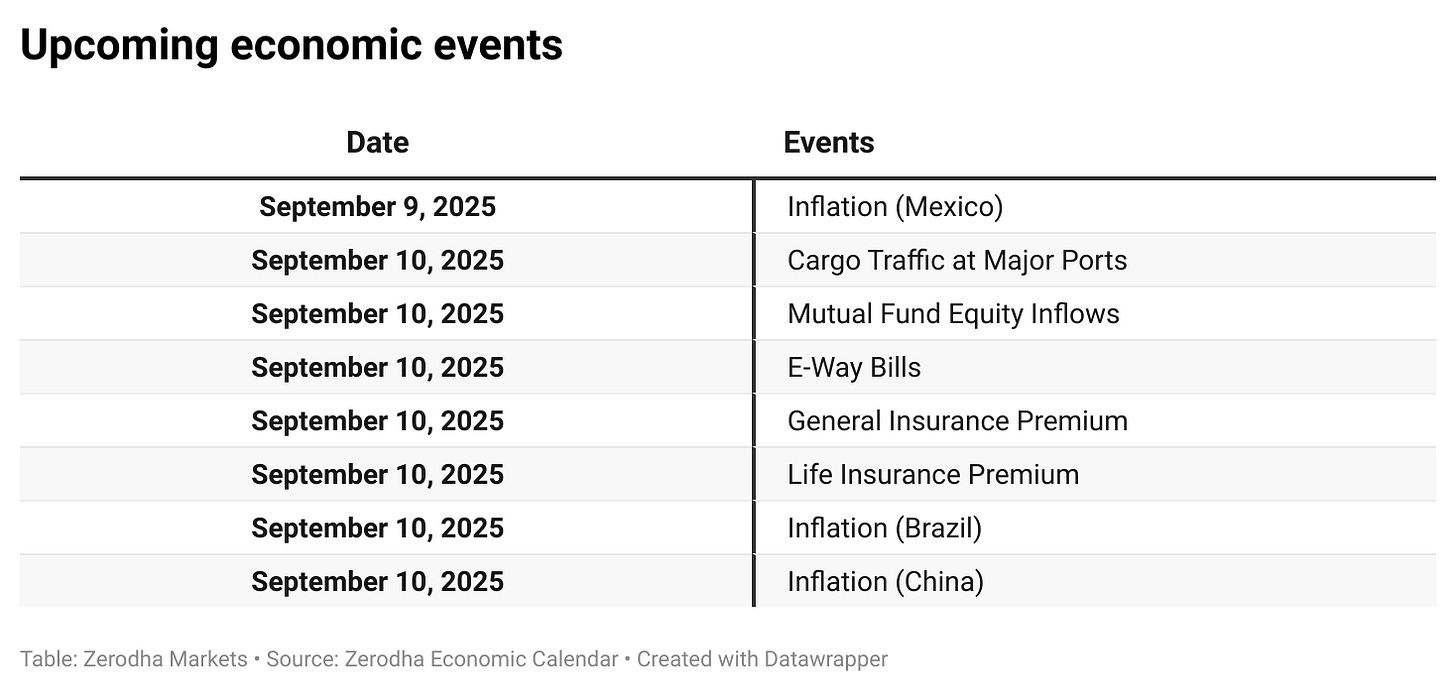

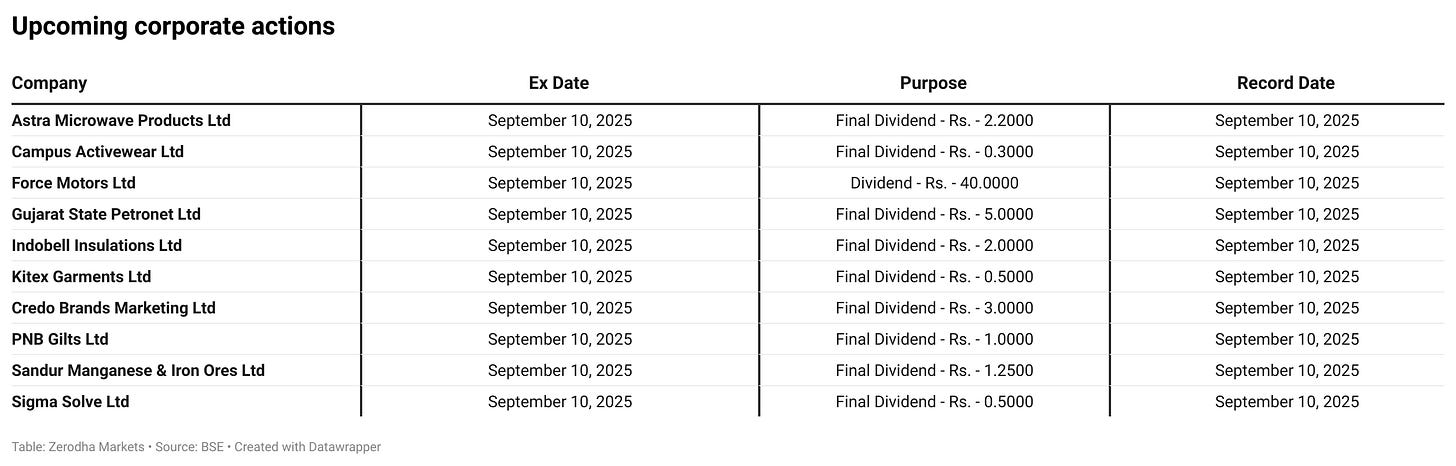

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!