Nifty ends below 25,100 as broad-based selling resurfaces

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we take a step deeper into the trading landscape and explore the three foundational trading strategy archetypes: Trend Following, Mean Reversion, and Arbitrage.

Market Overview

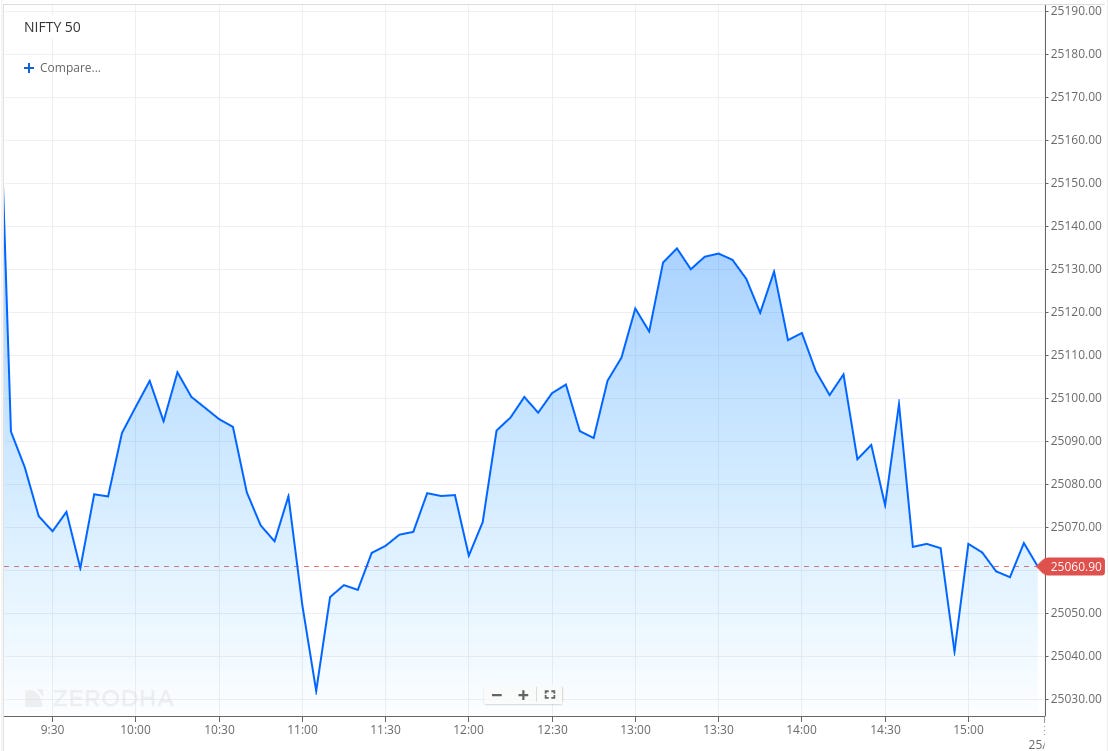

Nifty opened with a 60-point gap-down at 25,109 and extended its decline in the opening hour, slipping below 25,050 by mid-morning. The index stayed weak through the first half, briefly touching an intraday low near 25,030 before stabilizing.

In the second half, Nifty staged a recovery, climbing back above 25,130 around 1 PM. However, the rebound proved short-lived as selling pressure resurfaced post 2 PM, dragging the index lower once again. Nifty eventually closed at 25,056.90, down nearly 50 points from the day’s open, marking a soft finish.

Market sentiment is gradually shifting from caution to optimism, aided by signs of easing U.S.-India trade tensions. However, concerns over steep 50% tariffs, persistent foreign investor outflows, and muted earnings continue to cap the upside. As we advance, investors will closely track festival season sales and management commentary on demand trends across industries.

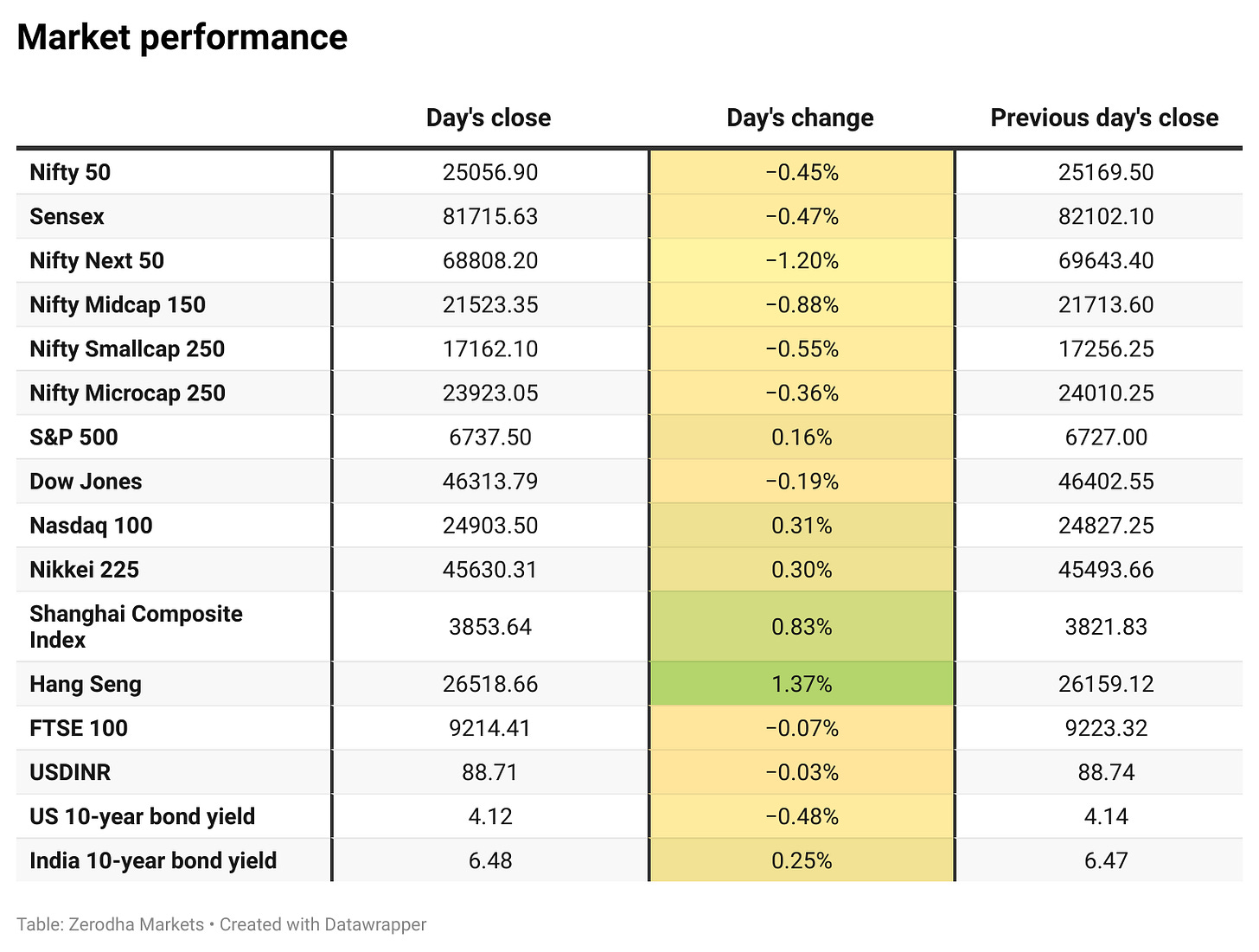

Broader Market Performance:

Broader markets had a weak session today. Of the 3,134 stocks traded on the NSE, 992 advanced, 2,053 declined, and 89 remained unchanged.

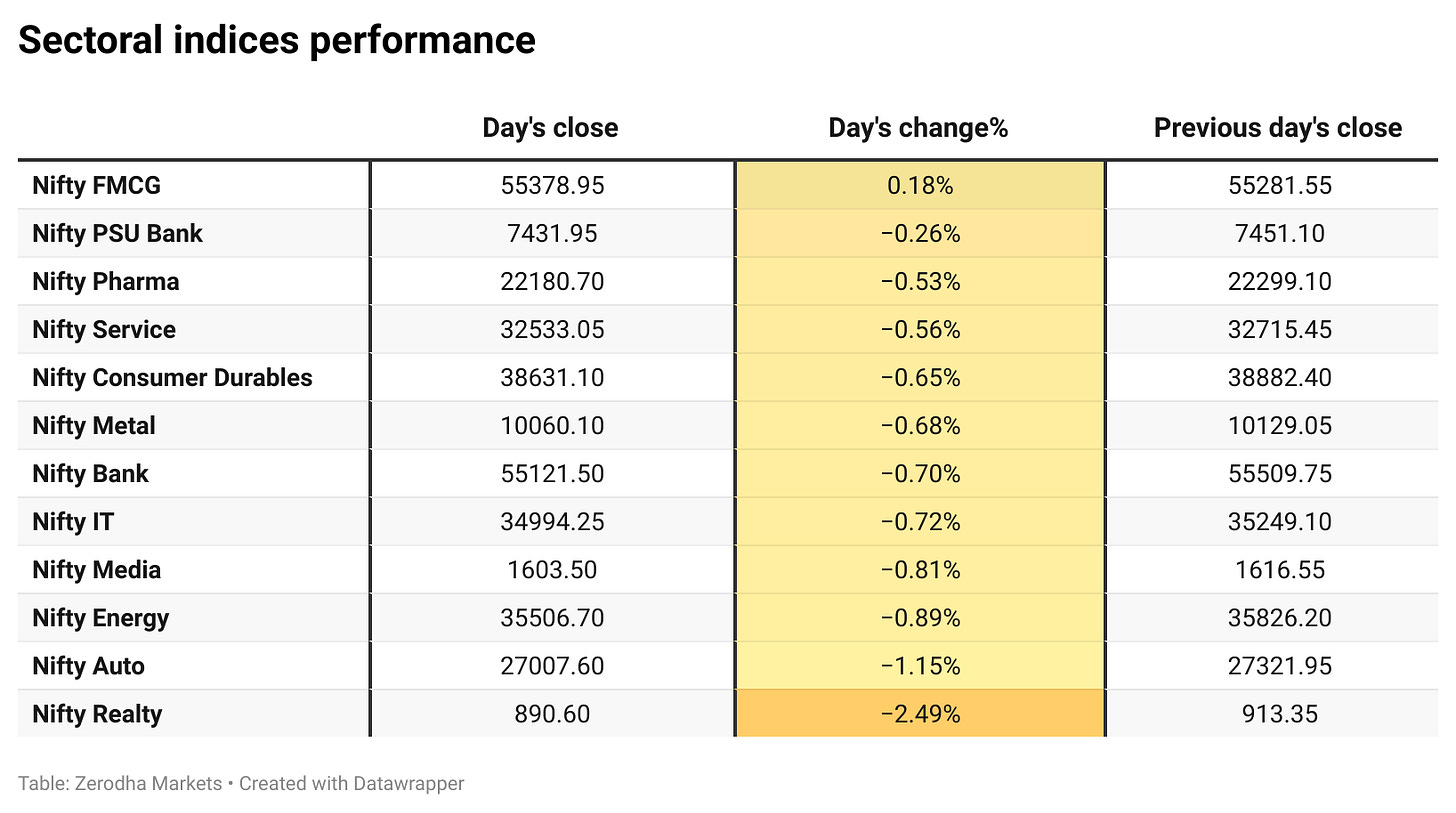

Sectoral Performance

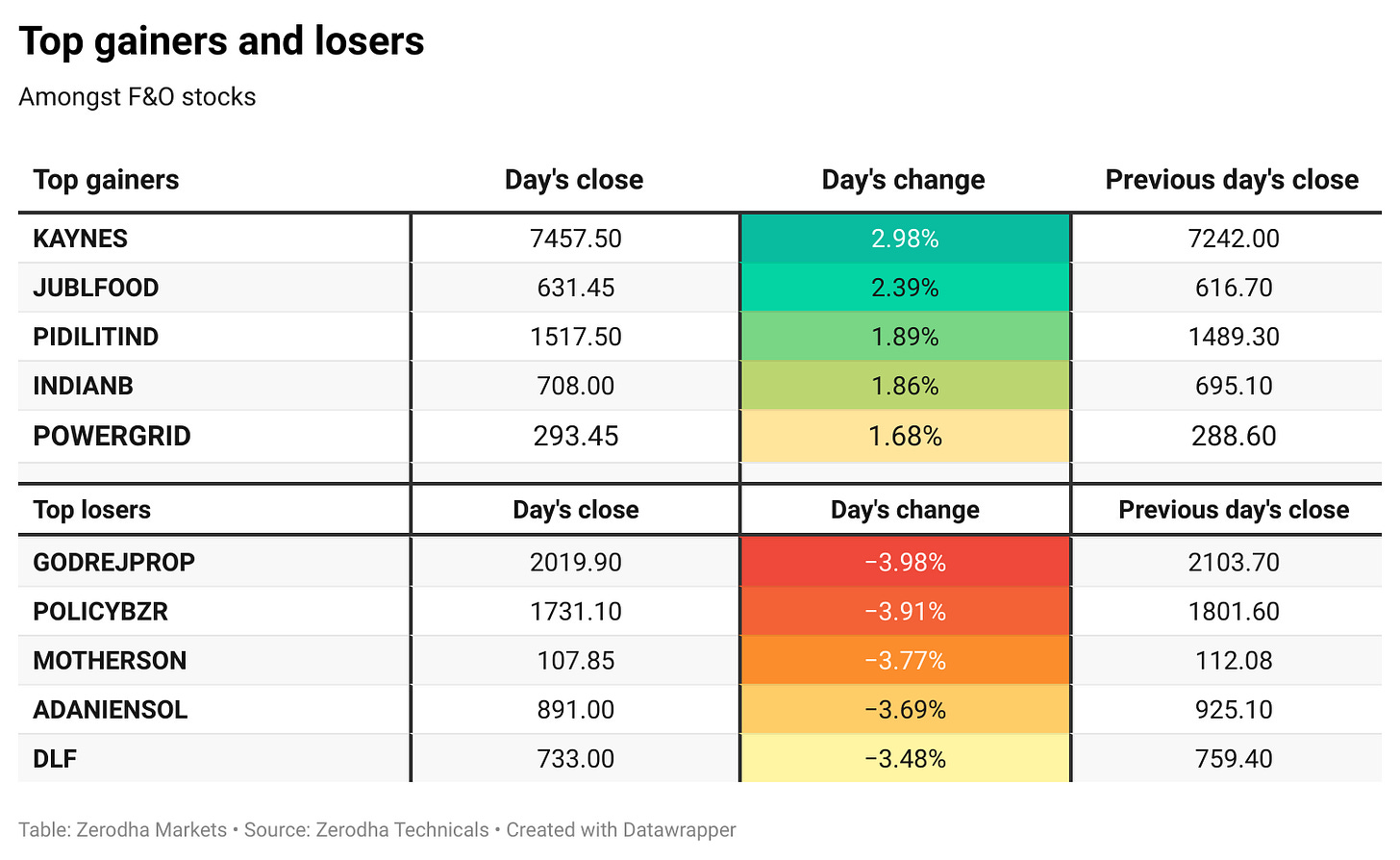

The top gaining sector for the day was Nifty FMCG, rising 0.18%, while the worst performer was Nifty Realty, which slumped 2.49%. Out of the 12 sectoral indices, only one closed in the green, and 11 ended in the red, reflecting broad-based weakness across sectors.

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 30th September:

The maximum Call Open Interest (OI) is observed at 25,500, followed by 25,300 & 25,200, suggesting strong resistance at 25,200 - 25,300 levels.

The maximum Put Open Interest (OI) is observed at 25,000, followed by 25,100, suggesting strong support at 25,000 to 24,900 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

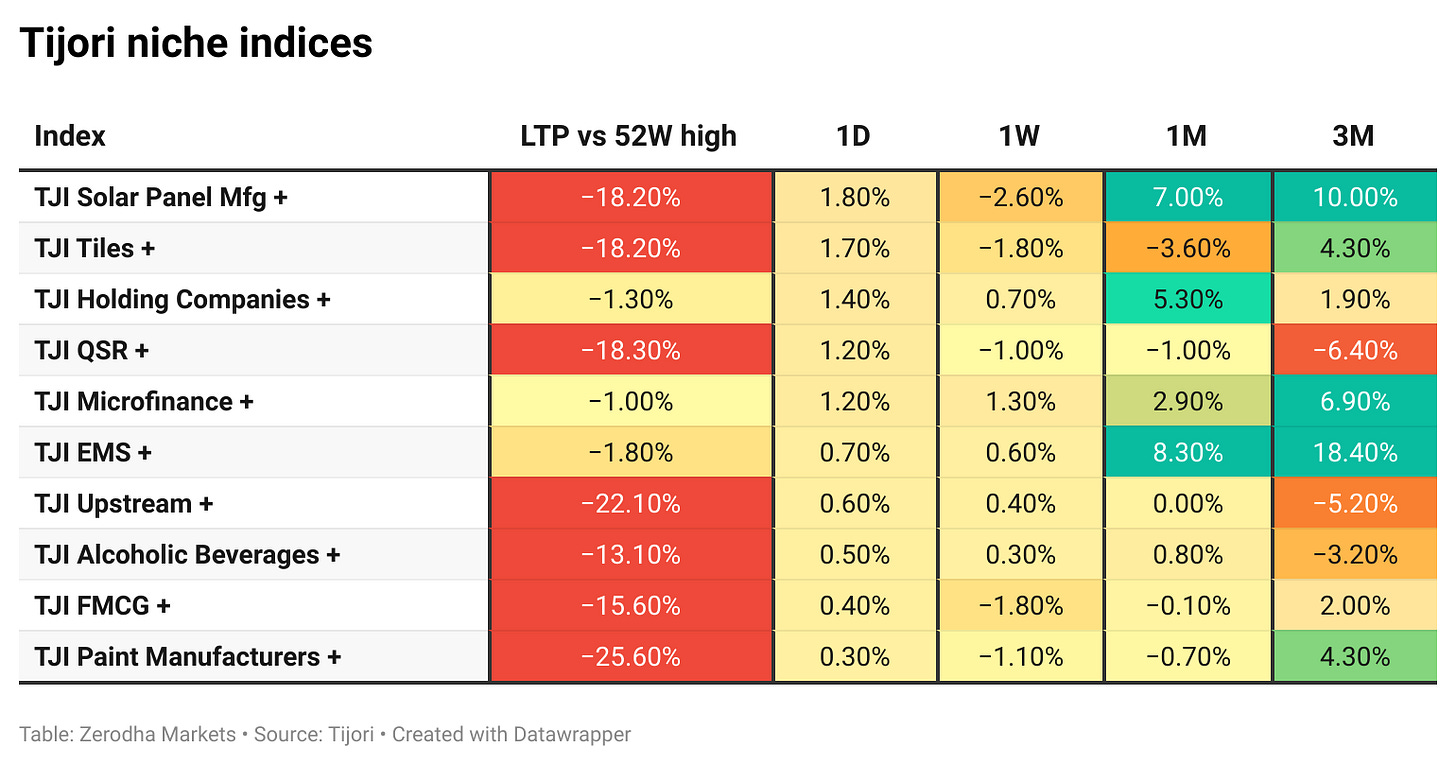

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

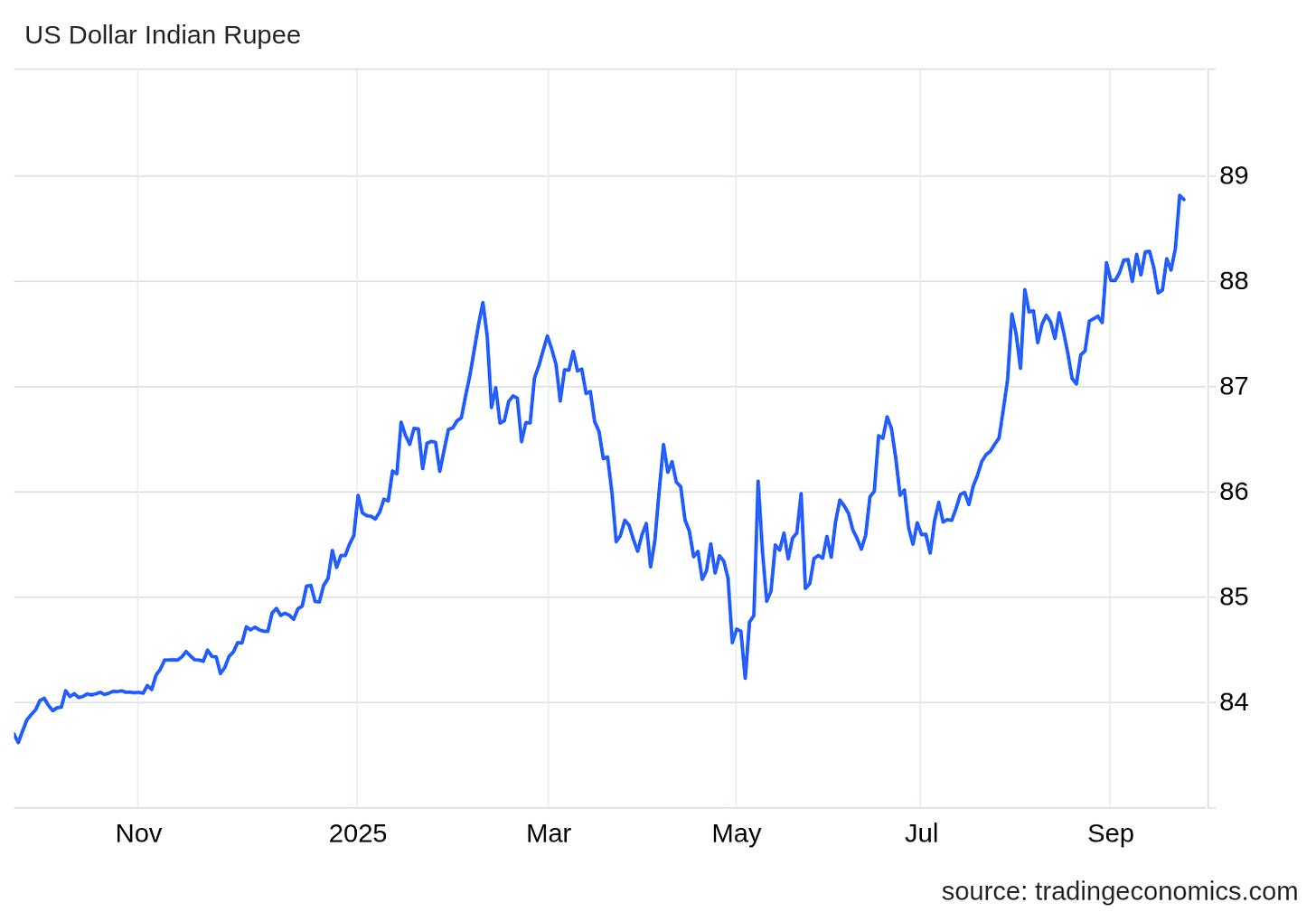

The rupee hovered near 88.7 per dollar, weighed down by steep US tariffs and President Trump’s $100,000 H-1B visa fee that could hit India’s IT sector and remittances. Dive deeper

Edelweiss Financial Services has opened a ₹300 crore public issue of secured redeemable NCDs with yields of 9–10.25% and tenures of 24-120 months. Rated Crisil A+/Stable, the proceeds will be used mainly for debt repayment. The issue closes on October 8, 2025, and will be listed on BSE. Dive deeper

A Sebi panel will propose public asset disclosure by its chairman and senior officials to address conflict of interest concerns and align with global norms. The recommendations include stricter rules, clearer recusal policies, and defined disclosure processes. They will be submitted next month and could become law if approved. Dive deeper

IdeaForge Technology announced a 50:50 joint venture with US-based First Breach Inc. to manufacture and distribute drones in the US. The new entity, First Forge Technology Inc., is expected to be incorporated by FY26. Dive deeper

GST 2.0 reforms have boosted festive sales on Amazon, Flipkart, and offline retailers, driving strong demand across electronics, appliances, and premium products. Quick-commerce saw record orders, with Flipkart delivering iPhones in under three minutes and reporting sharp growth in metros and tier-2 cities. Dive deeper

Walmart-backed PhonePe has confidentially filed for an IPO to raise about $1.5 billion at a valuation of nearly $15 billion. The UPI-based payments firm has over 600 million users and processes 310 million daily transactions. Dive deeper

Mazagon Dock Shipbuilders signed an MoU with Guidance Tamil Nadu to explore setting up a greenfield shipyard on India’s eastern coast. The agreement, formalized at a Ministry of Defense event, aims to expand MDL’s shipbuilding capabilities in the region. Dive deeper

Swiggy’s board has approved the sale of its Rapido stake worth ₹2,399 crore to MIH Investments and Setu AIF Trust, along with the slump sale of its Instamart business to a wholly owned subsidiary. Both transactions await regulatory and shareholder approvals. Dive deeper

ACME Solar has secured ₹1,100 crore refinancing from SBI for its 300 MW Rajasthan project, aimed at reducing financing costs by about 100 bps. The 17-year facility will replace existing debt and strengthen the company’s credit profile as it pursues capacity growth. Dive deeper

The Supreme Court will hear Vodafone Idea’s plea on September 26 against the Department of Telecom’s ₹9,450 crore AGR dues demand, a case seen as crucial for its funding plans and debt resolution. Dive deeper

Reliance Consumer Products Limited plans to set up an integrated manufacturing facility in Tamil Nadu. The facility will produce various consumer goods, boosting local production. It is expected to enhance employment and economic development in the region. Dive deeper

ONGC is considering acquiring 25-3 GW renewable energy projects to boost its green energy portfolio. This move is part of the company’s strategy to transition towards more sustainable energy sources. Dive deeper

According to a Reuters report, India’s Exim Bank has stepped up credit support to help exporters cope with U.S. tariffs. The bank also plans to expand its presence in Africa, aiming to diversify markets and open up new growth opportunities for Indian exporters.. Dive deeper

What’s happening globally

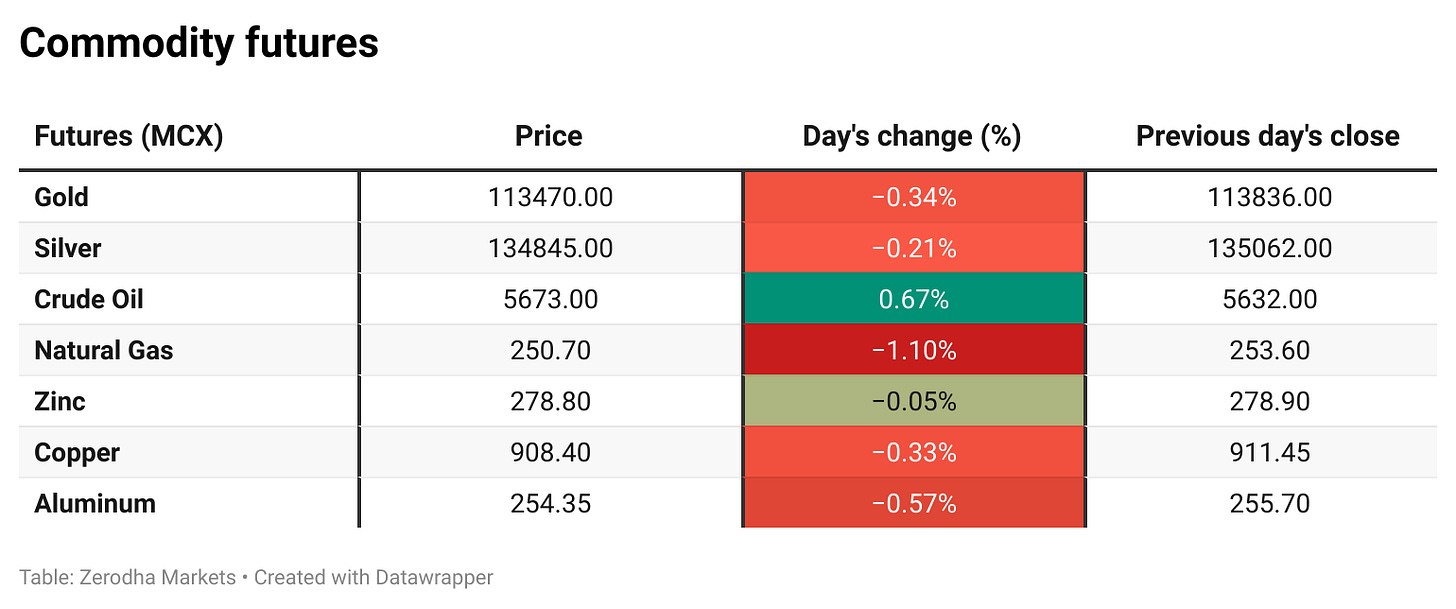

Gold rose to about $3,770 per ounce, near record highs, supported by Fed commentary, expectations of further rate cuts, and safe-haven demand from geopolitical tensions after President Trump reaffirmed strong backing for Ukraine at the UN. Robust ETF inflows also boosted bullion. Dive deeper

Brazil’s consumer confidence rose to 87.5 in September, the highest since December 2024, driven by improved expectations. Current conditions weakened, while high debt remains a key constraint. Dive deeper

Spain’s producer prices fell 1.5% year-on-year in August, the first drop in three months, driven by lower energy costs. Prices for consumer and intermediate goods also declined, while capital goods rose modestly. Month-on-month, PPI slipped 0.4%. Dive deeper

China said it will no longer claim developing country benefits at the WTO, giving up access to special tariffs and subsidies in current and future agreements. Premier Li Qiang announced the move at the UN, addressing U.S. concerns over unfair advantages under WTO rules. Dive

Japan’s Nikkei closed at a record high (45,630.31), recovering from earlier losses thanks to strong momentum in AI-related stocks. Dive deeper

Alibaba plans to expand its AI investment beyond the earlier commitment of ¥380 billion (~US$53 billion), signaling an escalation in fighting for a lead in global AI infrastructure. Dive deeper

Switzerland’s growth outlook for 2026 has been sharply revised downward, with the KOF Institute now projecting 0.9 percent expansion, down from its earlier forecast of 1.5 percent, as US tariffs of 39 percent weigh heavily on exports and industrial activity. Dive deeper

Japan’s manufacturing PMI fell to 48.4 in September, the steepest drop since March and below forecasts, marking the 14th contraction in 15 months. New orders and output declined sharply, foreign sales fell, and business sentiment weakened, while rising costs kept output prices elevated. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Rajiv Batra, JPMorgan on market trends & earnings expectations

“We started the year at a PE of around 22, and a year ago it was 24. Currently, we are at 21. The market expects low to mid-teen earnings growth, which will likely show in the second half of the fiscal year. The December quarter could deliver 11% growth, and March next year around 13%. Double-digit growth will be a second-half story, but the market is always forward-looking.”

“This year, nominal revenue growth is around 8.8-9%. Next year, double-digit GDP growth is likely. With costs, borrowing, and raw material prices easing, earnings growth of 14-15% for FY27 is possible. Consensus forecasts are cautious, but upward revisions could come after strong festive sales.” - Link

Adani Group chairman Gautam Adani on SEBI ruling and post-Hindenburg resilience

“This moment is more than a regulatory clearance, it is a powerful validation of the transparency, governance, and purpose with which your company has always operated. Truth has prevailed.”

“The attack was not just on the Adani Group but a direct challenge to the audacity of Indian enterprises to dream on a global scale.”

“What was meant to weaken us has instead strengthened the very core of our foundations.”

“We will double down on nation building, strengthening governance, accelerating innovation, and deepening infrastructure investments.” - Link

OpenAI CEO Sam Altman and Nvidia CEO Jensen Huang on Trump’s $100,000 H-1B visa fee

“We want all the brightest minds to come to the U.S. and remember immigration is the foundation of the American Dream... but I’m glad to see President Trump making the moves he’s making.” Jensen Huang, Nvidia CEO

“The smartest people need to get in the country, and sort of outlining financial incentives seems good to me.” Sam Altman, OpenAI CEO - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

Calendars

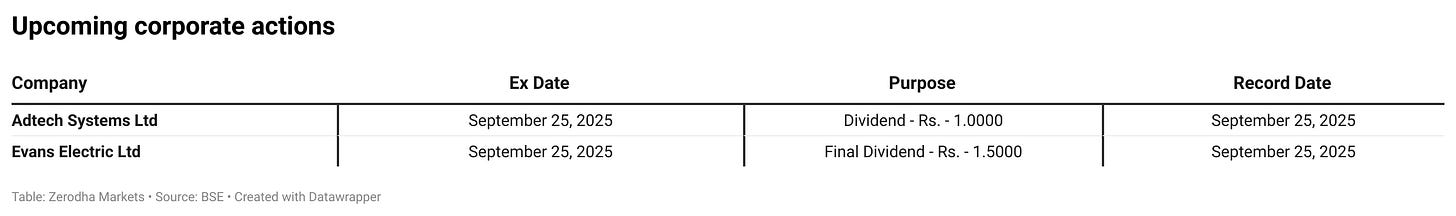

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!