Nifty ends above 25,700 after US–India trade pact; rupee strengthens sharply

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we move beyond price and focus on volatility as a core non-price market feature, breaking down what volatility really means, how it is measured, the differences between Historical, Implied, and Realised Volatility, how India VIX works, and why volatility itself often mean-reverts, while also exploring why short volatility strategies perform better in certain regimes, why fully rules-based systems are difficult to build, and how institutions use valuation and relative relationships to complete the full picture of mean reversion as a trading and investing framework.

Market Overview

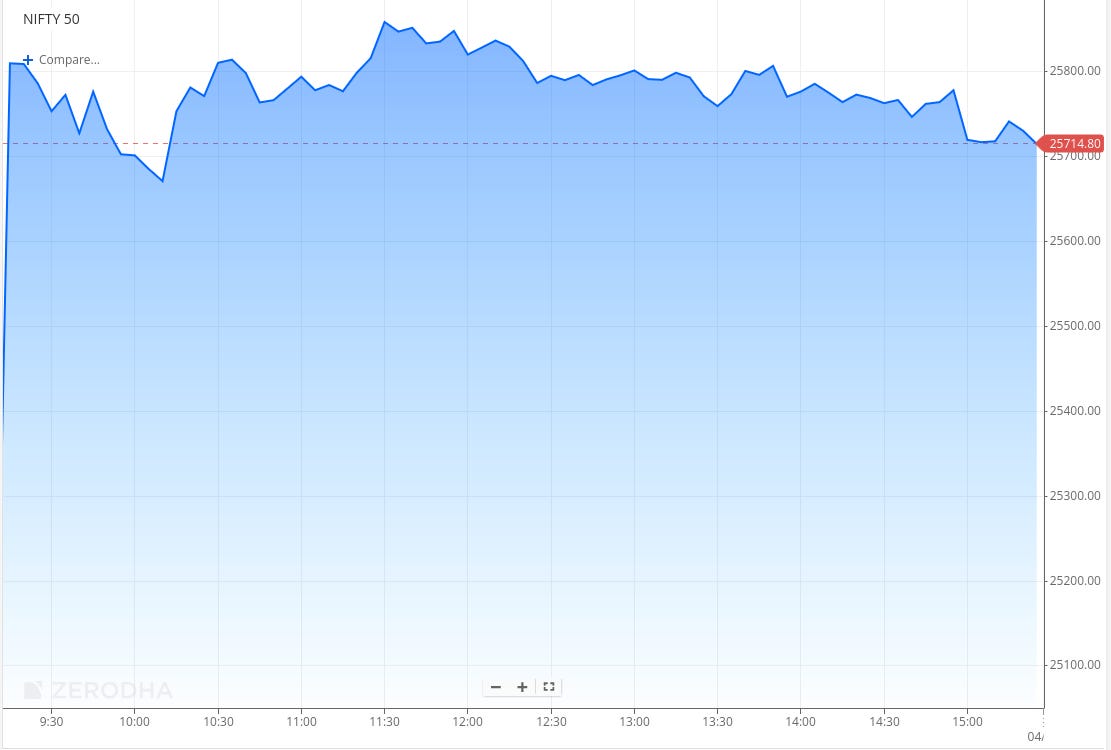

Nifty opened with a massive 1,220-point gap-up at 26,308, reacting sharply to the announcement of a long-awaited trade deal between India and the U.S. However, the euphoric opening was quickly followed by sharp profit-taking, with the index slipping to the 25,800 zone and gradually grinding lower to around 25,650 by 10:30 AM. A swift rebound followed soon after, lifting Nifty back toward the 25,800 level.

For the remainder of the session, the index largely remained range-bound between 25,700 and 25,850, as the initial surge gave way to consolidation. Nifty eventually closed at 25,727.55, marking a strong session underpinned by a positive structural shift in sentiment following the trade deal, even as intraday volatility cooled off after the early excitement.

Looking ahead, markets are likely to remain sensitive to global risk appetite, ongoing Q3 earnings, the upcoming RBI policy, and further clarity on the India–U.S. trade deal announced last night.

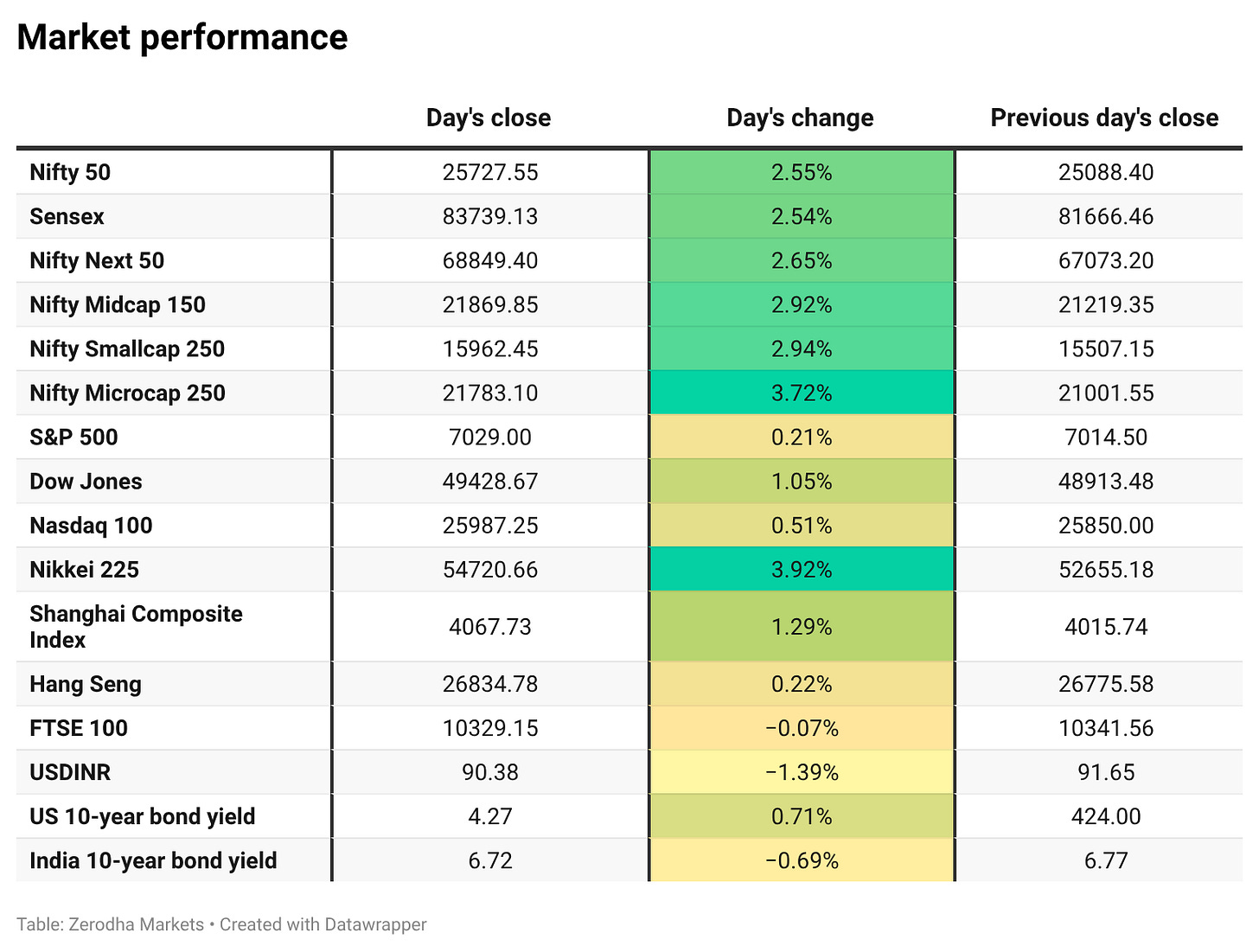

Broader Market Performance:

The broader market had an extremely bullish session today. Of the 3,315 stocks that traded on the NSE, 2,691 advanced, 533 declined, and 91 remained unchanged.

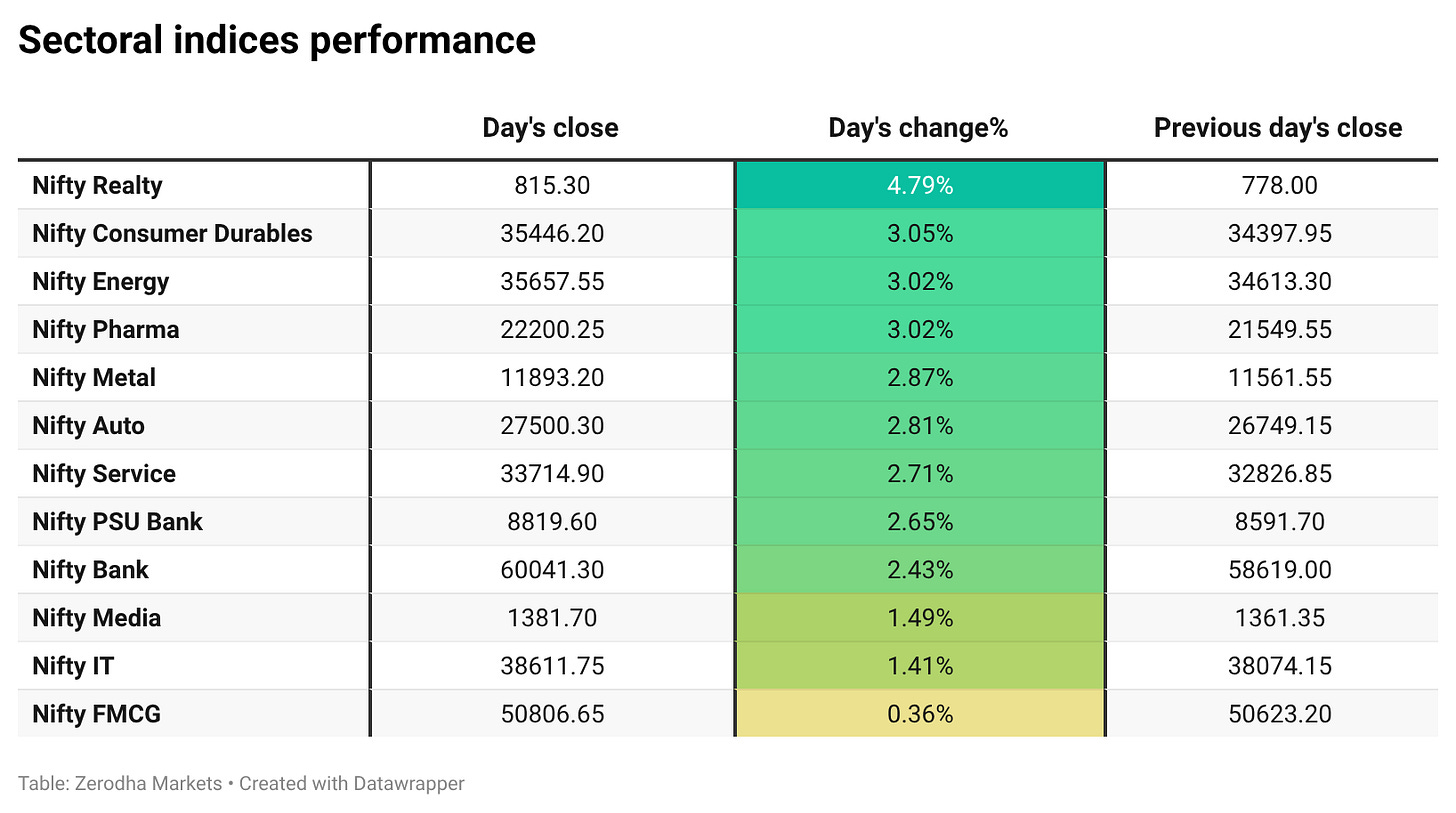

Sectoral Performance:

Nifty Realty was the top gainer today, surging 4.79%, while Nifty FMCG posted the smallest gain at just 0.36%. All 12 sectoral indices ended in the green, with none closing in the red — marking a broad-based rally across the board.

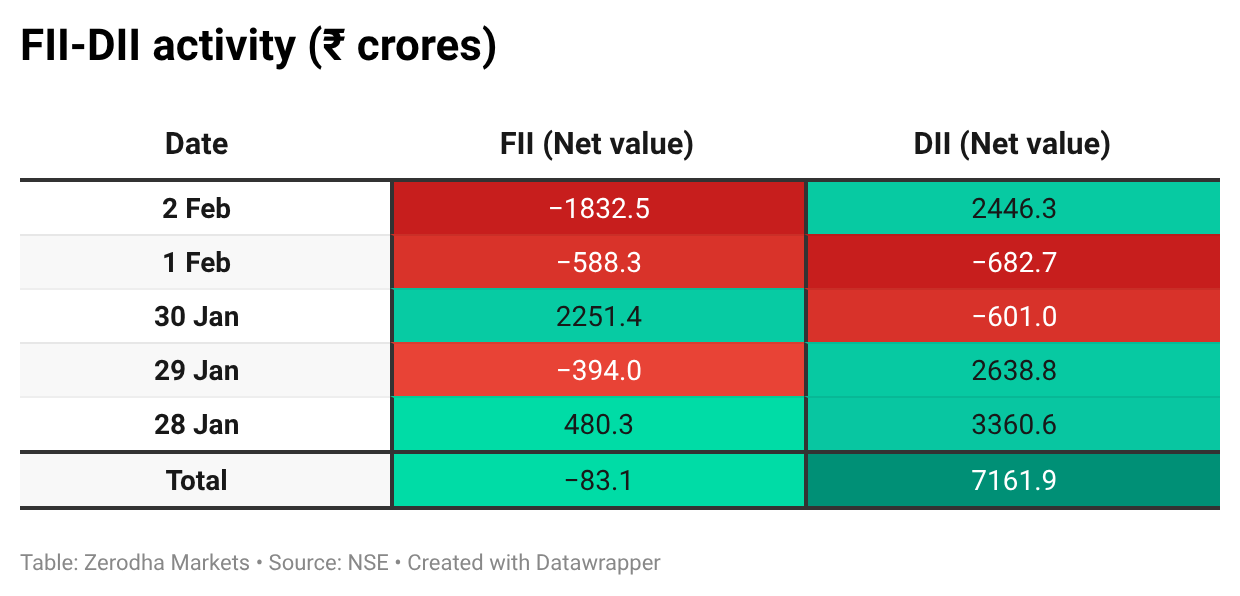

Here’s the trend of FII-DII activity from the last 5 days:

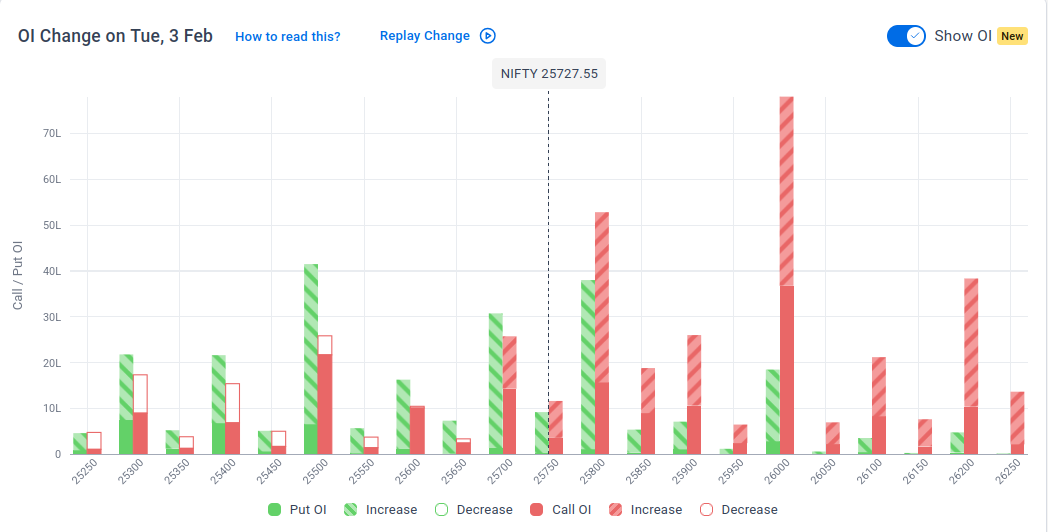

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 10th February:

The maximum Call Open Interest (OI) is observed at 26,000, followed by 25,800 & 25,400, indicating potential resistance at the 25,900 -26,000 levels.

The maximum Put Open Interest (OI) is observed at 25,500, followed by 25,800, suggesting support at 25,600-25,500.

Note: OI is subject to multiple interpretations; however, generally, an increase in Call OI indicates resistance in a falling market, while an increase in Put OI indicates support in a rising market.

Source: Sensibull

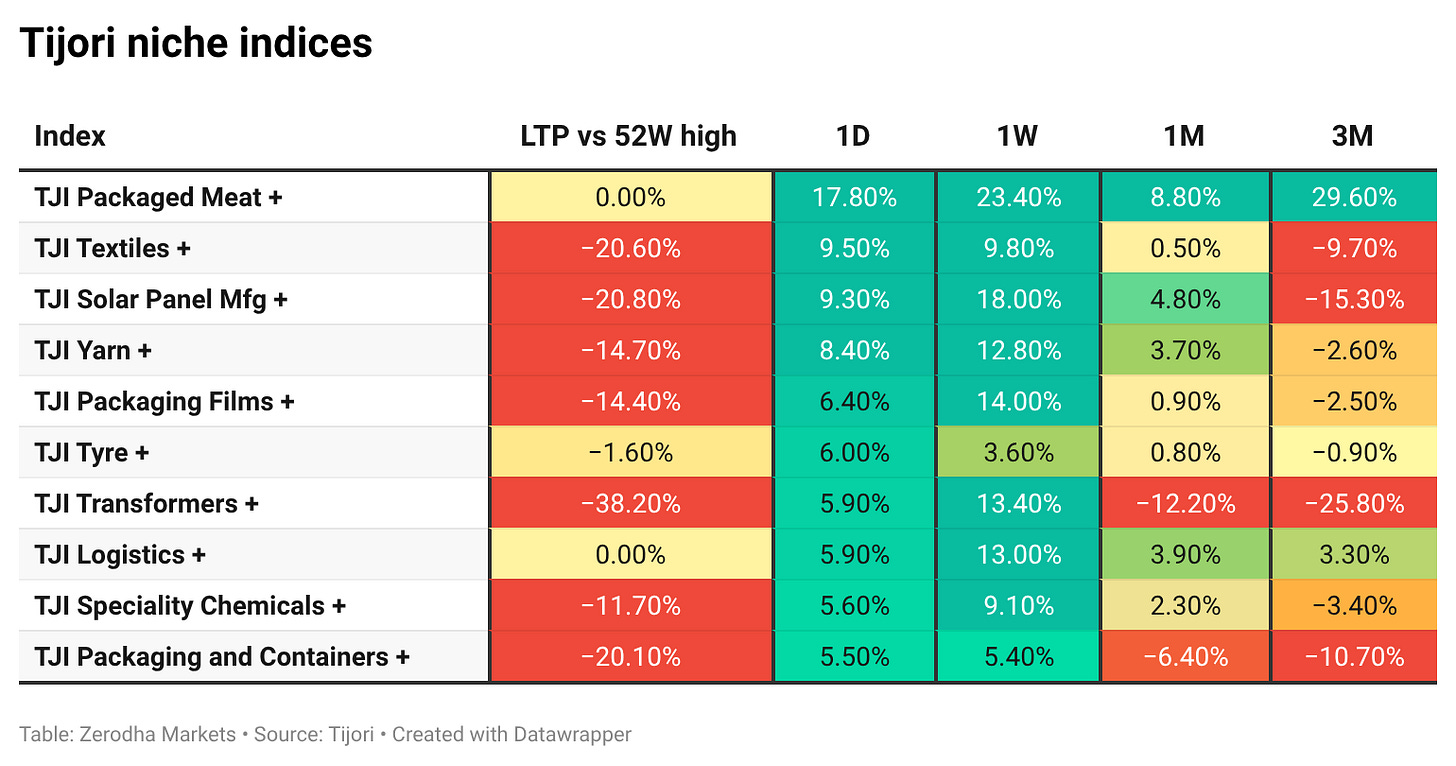

Tijori is an investment research platform that has constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

Donald Trump and Narendra Modi announced a landmark India–U.S. trade deal aimed at easing tariff tensions. The agreement cuts U.S. tariffs on Indian goods to 18%, removing penalties linked to Russian oil purchases. Dive deeper

The rupee strengthened to around 90.3 per dollar after the US lowered tariffs on Indian goods following a trade agreement with India. Dive deeper

India’s 10-year government bond yield eased to around 6.72% amid improved market sentiment following a US–India trade agreement. Dive deeper

Gems and jewellery stocks rallied after India and the US agreed to cut tariffs on Indian goods to 18%, improving export prospects for the sector. Dive deeper

Bajaj Finance reported a 6% year-on-year decline in Q3 FY26 net profit to ₹3,978 crore. Net interest income rose 21% to ₹11,317 crore, while assets under management grew 22% to ₹4.86 lakh crore, reflecting strong balance-sheet expansion. Dive deeper

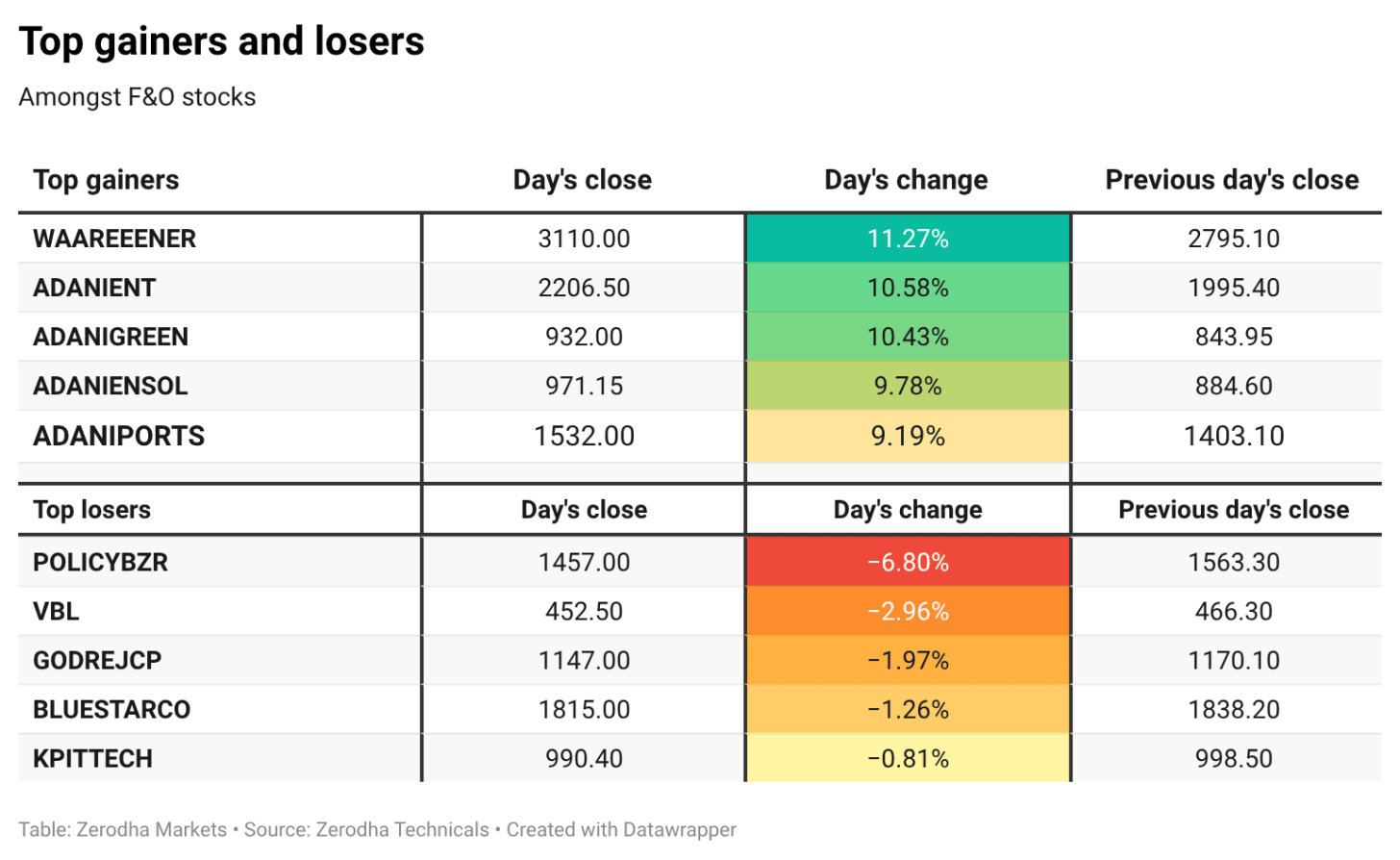

Adani Ports and Special Economic Zones reported a 21% year-on-year rise in consolidated net profit to ₹3,054 crore for Q3. Revenue from operations grew 22% to ₹9,705 crore, reflecting strong growth across port operations. Dive deeper

Adani Enterprises reported a sharp rise in Q3 net profit to ₹5,627 crore, aided by a one-time gain, while revenue grew 8.6% year-on-year. Dive deeper

City Union Bank reported a 16% year-on-year rise in Q3 net profit to ₹332 crore. Net interest income grew 28%, with margins improving to 3.89%. Dive deeper

What’s happening globally

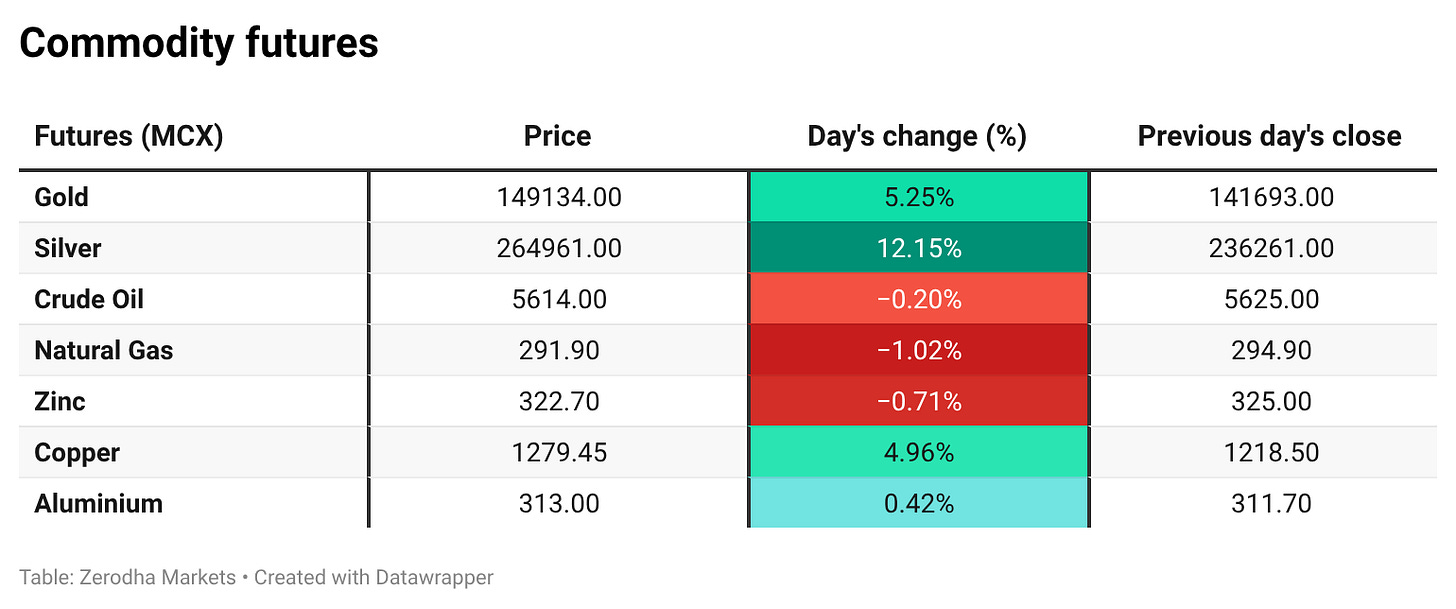

WTI crude slipped below $62 per barrel as easing US–Iran tensions reduced fears of supply disruptions. Prices were also pressured by OPEC+ maintaining output levels and expectations of ample global supply. Dive deeper

Gold rebounded over 5% to above $4,900 per ounce on bargain buying after recent sharp losses. Markets continue to weigh US policy developments, easing geopolitical tensions, and upcoming labour market data. Dive deeper

European equities rose further, with the STOXX 50 and STOXX 600 hitting fresh record highs. Dive deeper

France’s inflation slowed sharply to 0.3% in January, the lowest since 2020, driven by declines in manufactured goods and energy prices. Dive deeper

The dollar index held near 97.5, supported by strong US economic data and firmer expectations around Fed policy. Dive deeper

Japan’s Nikkei jumped nearly 4% to close at a record high as the sell-off in precious metals paused. Gains were led by technology stocks, supported by improved global risk sentiment. Dive deeper

The Reserve Bank of Australia raised rates by 25 bps to 3.85%, its first hike since 2023. The decision reflects ongoing inflation pressures and a data-dependent outlook. Dive deeper

Management chatter

In this section, we highlight interesting comments made by the management of major companies and policymakers from the Indian and Global Economies.

Madhusudan Kela, founder at MK Ventures, on the U.S. and India trade deal:

“Today is true Diwali from a market perspective. What I feel is there was some amount of feel-good feeling that was lacking… markets have seen very, very meaningful corrections.”

“This is a clear market which will now become buy on decline… Everyone’s portfolio had taken a beating in the last 15 months, and something like this is a feel-good feeling.” - Link

Anuradha Thakur, Secretary in the Department of Economic Affairs, on the trade deal:

“It does relieve us of the uncertainty in this space. It was mentioned in the Budget speech as well that there was uncertainty in the trade space. So, to that extent, it is definitely a positive development.”

“FPIs, by their very nature, are very cyclical, and we have been seeing the impact. Also, the financial market is driven a lot by sentiment, so I would certainly say we expect a turn in sentiment on account of the certainty this brings. To that extent, it should have an impact on FPIs as well.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

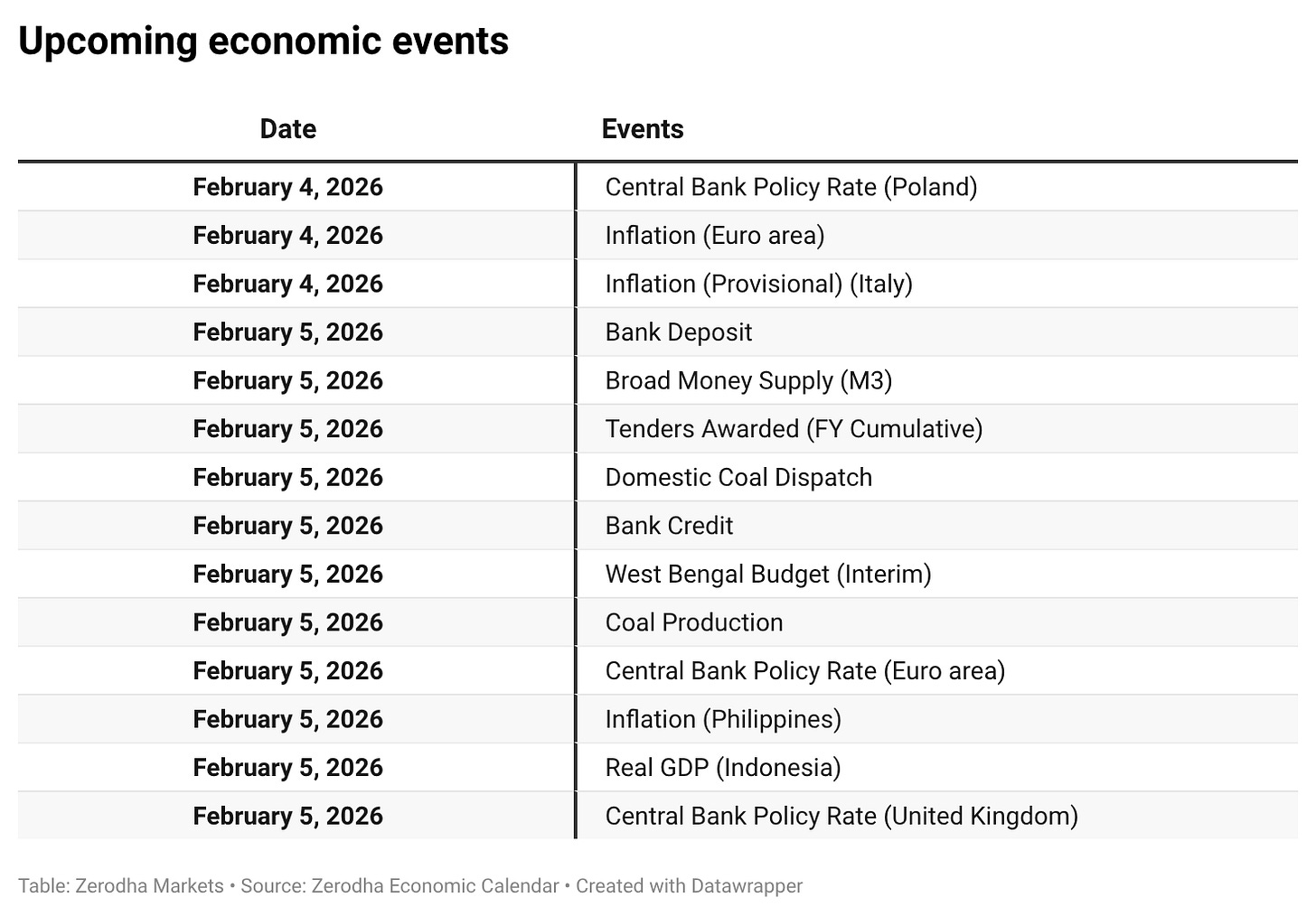

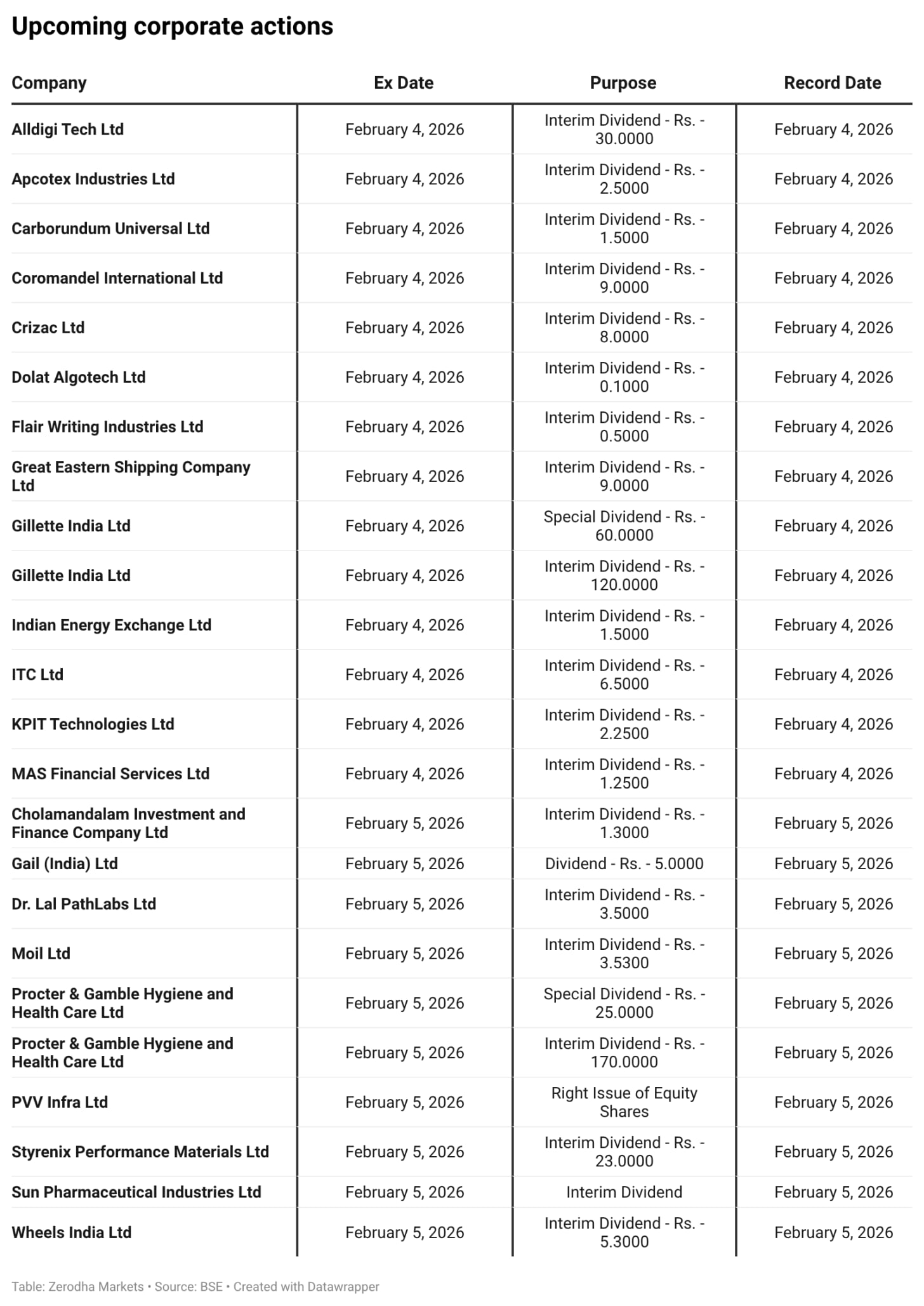

Calendars

In the coming days, we have the following significant events, quarterly results, and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

Excellent wrapeup. The 1,220-point gap-up was wild but the fact that it held above 25,700 after profit-taking shows real conviction. The breadth with 2,691 advancers is probablymore telling than the headline number. Realty jumping nearly 5% makes sense given improved trade sentiment, but the broader participation suggests this wasnt just sector-specific noise.