Nifty eases below 25,350 after recent run; Broader Indices outperform

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we trace the fascinating origins of hedge funds, break down how they actually work, and explore whether India has its own hedge-fund-like structures. From Alfred Winslow Jones’s unlikely story to the modern-day Category III AIFs in India, we’ll uncover how regulation, leverage, taxation, and fees shape the world of hedge funds—and why you don’t hear of “celebrity” hedge fund managers in India.

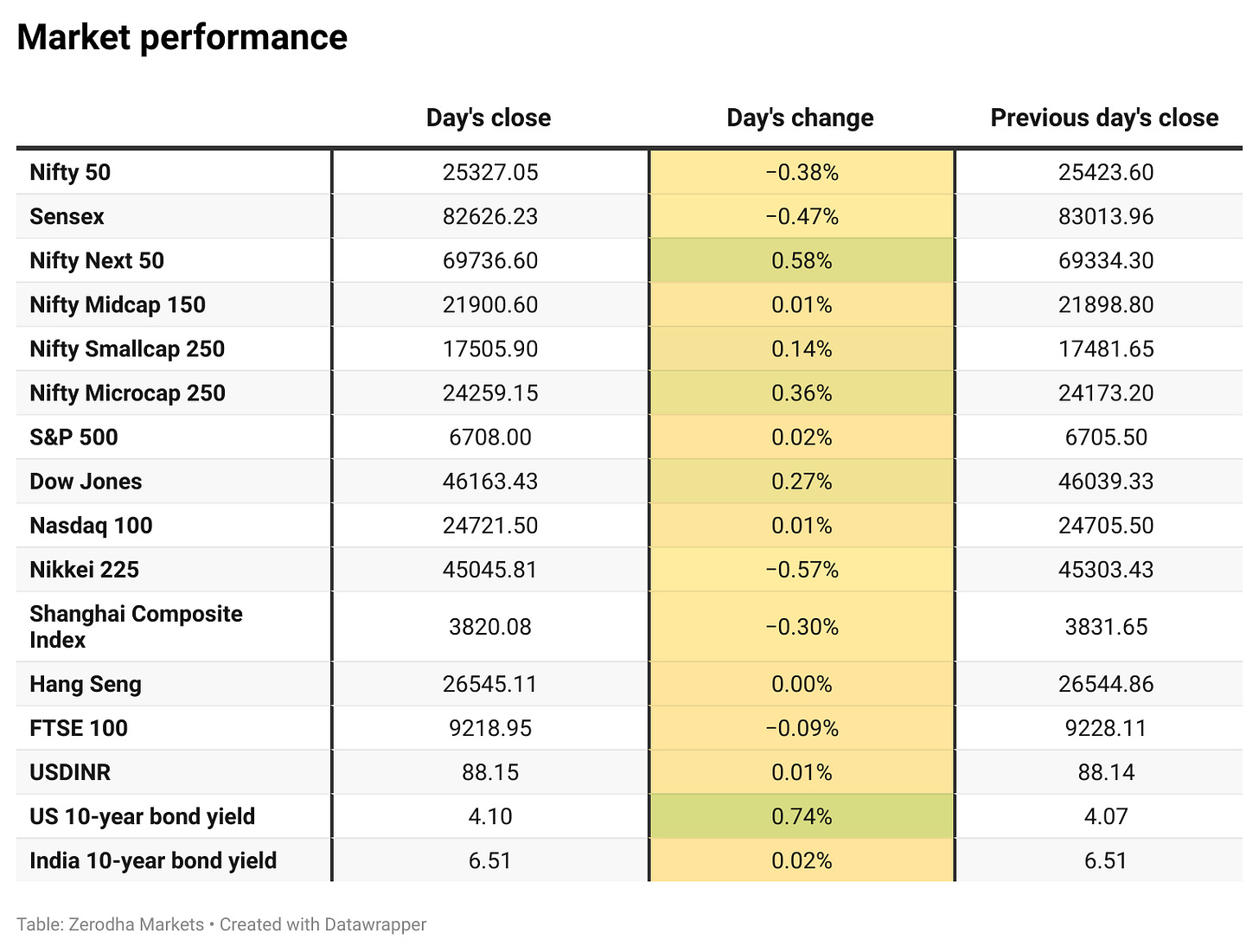

Market Overview

Nifty opened flat with a minor 13-point gap-down at 25,410 and quickly slipped lower in the opening ticks, testing the 25,310–25,320 zone within the first hour. Selling pressure persisted through the morning session, dragging the index to an intraday low near 25,285 by mid-day.

In the second half, Nifty staged a gradual recovery, reclaiming the 25,330–25,350 zone and managing to hold those levels for some time despite bouts of volatility. A late rebound lifted the index further, and it eventually closed at 25,327.05, trimming some of its early losses but still ending below the 25,350 mark.

Market sentiment is slowly tilting from caution to optimism, supported by signs of easing U.S.-India trade tensions. Still, worries over steep 50% tariffs, persistent foreign investor outflows, and muted earnings are tempering the upside.

Broader Market Performance:

Broader markets had a mixed session with a slightly bullish bias today. Of the 3,133 stocks traded on the NSE, 1,601 advanced, 1,427 declined, and 105 remained unchanged.

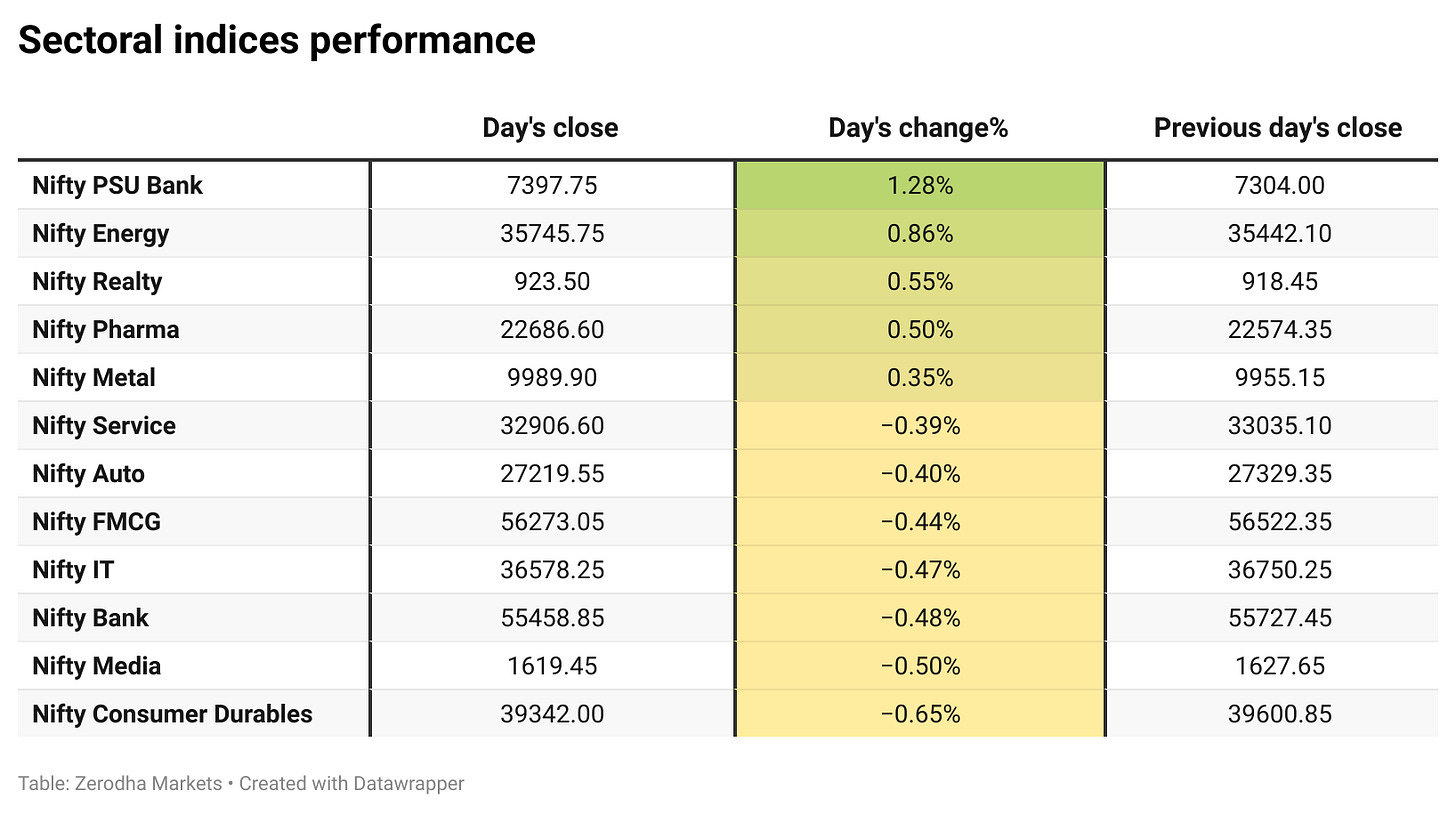

Sectoral Performance

The top gainer for the day was Nifty PSU Bank, rising 1.28%, while the top loser was Nifty Consumer Durables, which fell 0.65%. Out of the 12 sectoral indices,5 closed in the green and 7 ended in the red, indicating a mixed but slightly negative market breadth.

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 23rd September:

The maximum Call Open Interest (OI) is observed at 25,400, followed by 25,500, suggesting strong resistance at 25,400 - 25,500 levels.

The maximum Put Open Interest (OI) is observed at 25,300, followed by 25,000, suggesting strong support at 25,300 to 25,200 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

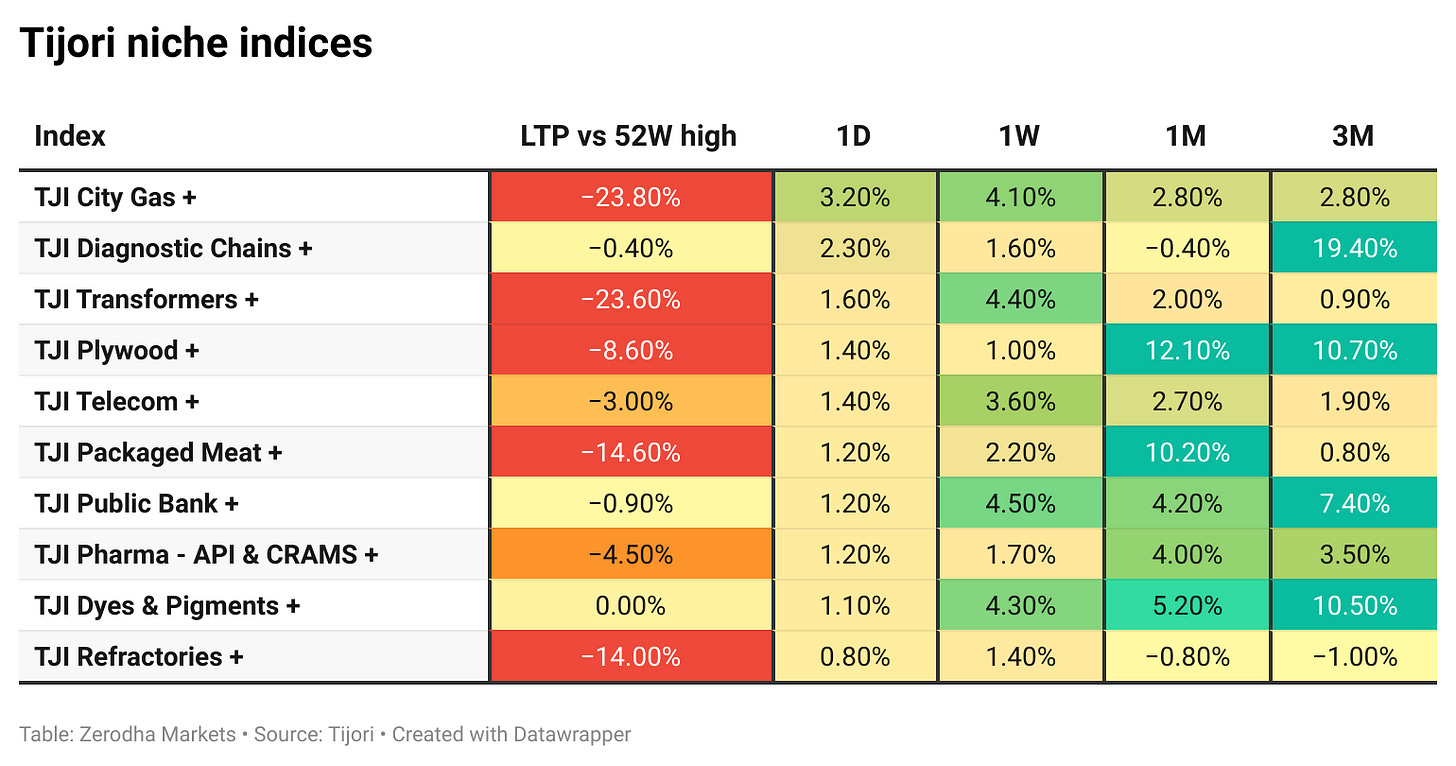

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

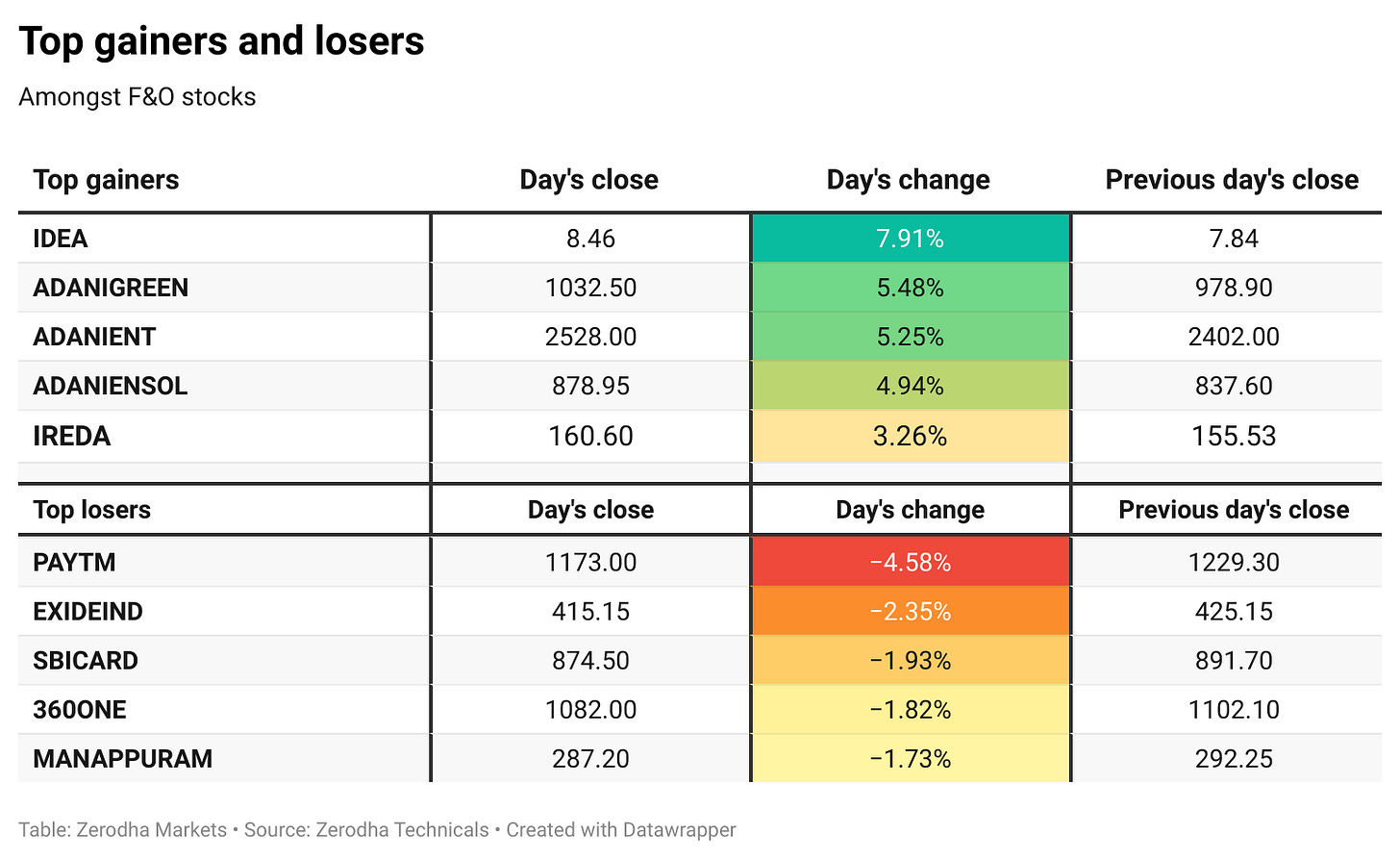

Shares of Adani Group companies rose up to 5% on September 19 after SEBI gave the conglomerate and its founder, Gautam Adani, a clean chit in the stock manipulation case. Dive deeper

The government told the Supreme Court that “some solution is required” in Vodafone Idea’s ₹9,450 crore AGR dues case, with the hearing deferred to September 26. The telco has contested the demand, citing errors and duplication, while lenders await clarity before proceeding with funding plans. Dive deeper

Urban Company shares surged 9.8% on Friday to a new high of ₹186.85, extending their rally. With this move, IPO investors are now sitting on gains of 81.4% over the issue price of ₹103. Dive deeper

Redington Ltd shares spiked 7.6% intraday to ₹310 before settling 4% higher, driven by bullish sentiment after the iPhone 17 launch. The stock has rallied 28% in five sessions, boosted by its deep Apple partnership and strong execution in growth markets. Dive deeper

Texmaco Rail & Engineering secured an order worth ₹86.85 crore from UltraTech Cement for BCFC wagons and a Brake Van, with delivery scheduled by March 2026. This follows recent contract wins from RVNL and Leap Grain Rail Logistics, strengthening its order pipeline in the wagon and engineering segment. Dive deeper

Suzuki Motorcycle India said it will cut prices across models by up to ₹18,024 from September 22, 2025, to pass on the benefit of the GST rate reduction. The lower GST will also reduce the costs of spare parts and accessories, enhancing overall ownership value for customers. Dive deeper

Indian Hotels Company (IHCL) dismissed reports of a $2 billion exit from New York’s The Pierre Hotel, clarifying it only operates the property under leasehold rights and not ownership. The company called the reports “misleading and speculative” and said hotel operations continue as usual. Any required disclosures will be made to exchanges as per regulations. Dive deeper

Pine Labs, backed by Mastercard and PayPal, plans to raise up to $700 million through an IPO in October. The offer includes a ₹26 billion fresh issue and a sale of 147.8 million shares by existing investors. The digital payments firm operates in India and abroad, with Axis Bank and global banks advising the deal. Dive deeper

The IT Ministry will set up 500 AI data labs across India, including in the North East, IT Minister Ashwini Vaishnaw said. Eight new projects have been approved for GPU support under the IndiaAI Mission, including IIT Bombay’s ₹988.6 crore BombayGen LLM project. An AI Governance Framework will also be released soon. Dive deeper

What’s happening globally

Japan’s Nikkei slipped into negative territory on Friday as the yen strengthened after the BOJ held rates steady in a split decision, with two members favouring a hike. Meanwhile, Japanese government bond yields surged to 17-year highs, reflecting rising policy divergence concerns. Dive deeper

German producer prices fell 2.2% year-on-year in August 2025, the steepest drop in 15 months and deeper than the expected 1.7% decline. This marks the sixth straight month of contraction, underscoring persistent disinflationary pressures in Europe’s largest economy. Dive deeper

UK retail sales rose 0.5% in August 2025, matching July’s pace and beating forecasts of 0.3%. Clothing, online retail, and specialist food shops led the gains, with retailers crediting favourable weather for the boost. Dive deeper

WTI crude slipped to about $63.3 a barrel on Friday, marking a third straight decline and trimming weekly gains. Prices eased as President Trump pushed for cheaper oil over new Russia sanctions, offsetting supply concerns from Ukrainian strikes on Russian energy assets. Dive deeper

Foreign ownership of U.S. Treasuries climbed to a record $9.16 trillion in July, marking the third straight monthly high and up nearly 9% year-on-year, led by Japan and the UK. China’s holdings, however, fell to $730.7 billion, the lowest since December 2008. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Sebi chairman Tuhin Kanta Pandey on broadening the investor base in infrastructure

"Our investor base is still narrow. Institutional investors dominate, while retail and foreign investors are cautious. Thin secondary market trading means liquidity is limited, which further discourages participation."

"This gap needs to be addressed. A variety of products and models exist for such monetisation, such as InvITs, REITs, various forms of public-private partnerships (PPP), and securitisation." - Link

Gaurav Gupta, COO, Edme Insurance Brokers, on GST cuts in insurance

"With the reduction of GST on premiums to zero, insurers cannot avail input tax credit, and pricing adjustments will decide how much benefit reaches consumers."

"The entire benefit might not be passed on, but the best possible option will be offered to policyholders."

"Insurers will take one or two months to reach consensus on pricing, and penetration of individual policies is expected to rise, especially from January." - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

📚 Also reading Mind Over Markets by Varsity?

It goes out thrice a week, covering markets, personal finance, or the odd question you didn’t know you had. The Varsity team writes across three sections: Second Order, Side Notes, and Tell Me Why, thoughtfully put together without trying to be too clever.

Go check out Mind Over Markets by Zerodha Varsity here.

Calendars

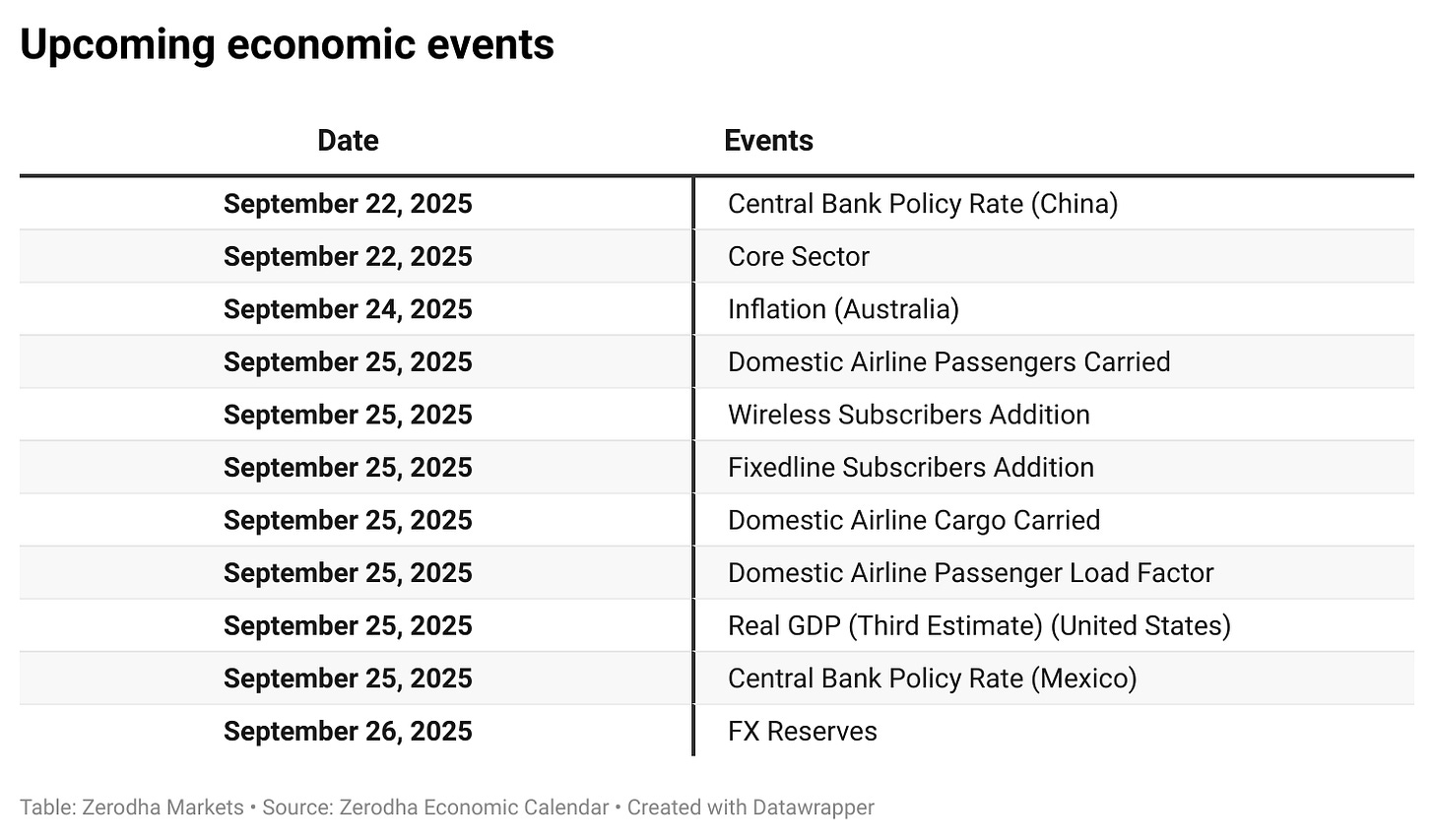

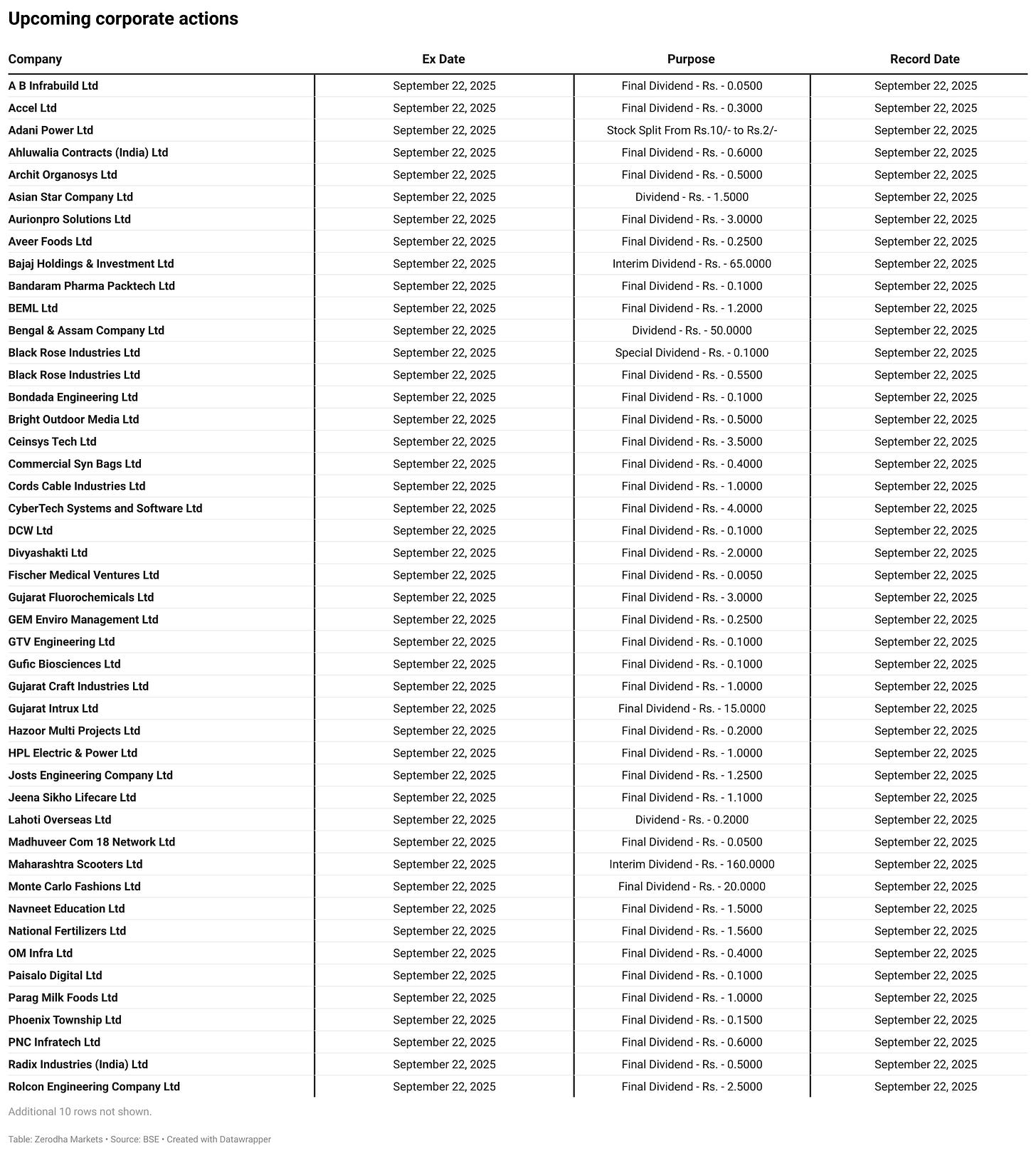

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!