Nifty drops to 24,500 as US tariffs trigger sell-off

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

Introducing In The Money by Zerodha

This newsletter and YouTube channel aren’t about hot tips or chasing the next big trade. It’s about understanding the markets, what’s happening, why it’s happening, and how to sidestep the mistakes that derail most traders. Clear explanations, practical insights, and a simple goal: to help you navigate the markets smarter.

Market Overview

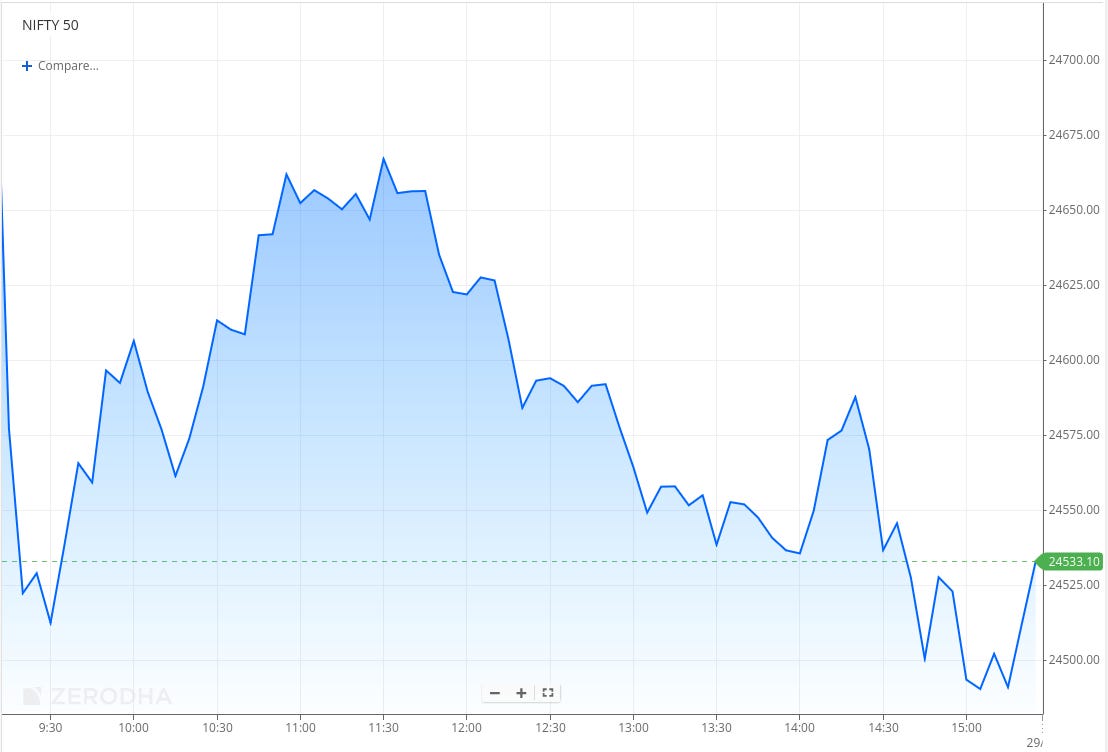

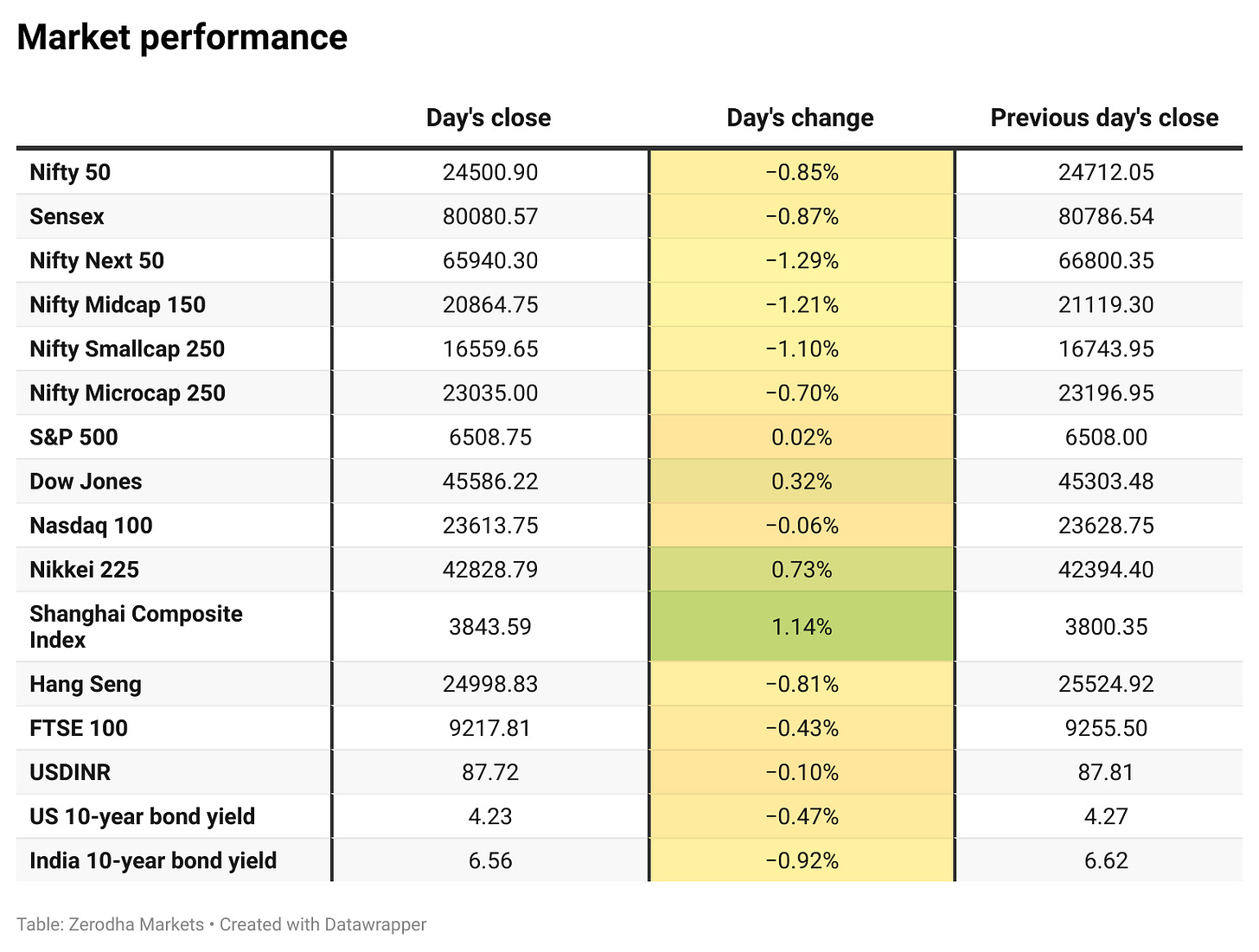

Nifty opened with a mild gap down at 24,695 but quickly plunged nearly 170 points to an intraday low of 24,530 in the first 10 minutes, amid weak global and domestic sentiment. It then rebounded sharply, recovering over 120 points to revisit the 24,650–24,660 zone by late morning.

However, the recovery lacked momentum and the index drifted lower through the afternoon, trading in a narrow, downward range between 24,500 and 24,575. Nifty eventually closed near the day’s low at 24,500.90, down 0.85%, reflecting persistent selling pressure.

Market sentiment remains fragile, while last week’s GST cut announcement boosted consumption hopes, concerns over rising tariffs, continued FII outflows, and muted earnings are weighing on sentiment. Investors remain watchful of worsening U.S.-India trade tensions, which are expected to guide near-term market direction.

Broader Market Performance:

Broader markets had an extremely weak session today. Of the 3,075 stocks traded on the NSE, 957 advanced, 2,015 declined, and 103 remained unchanged.

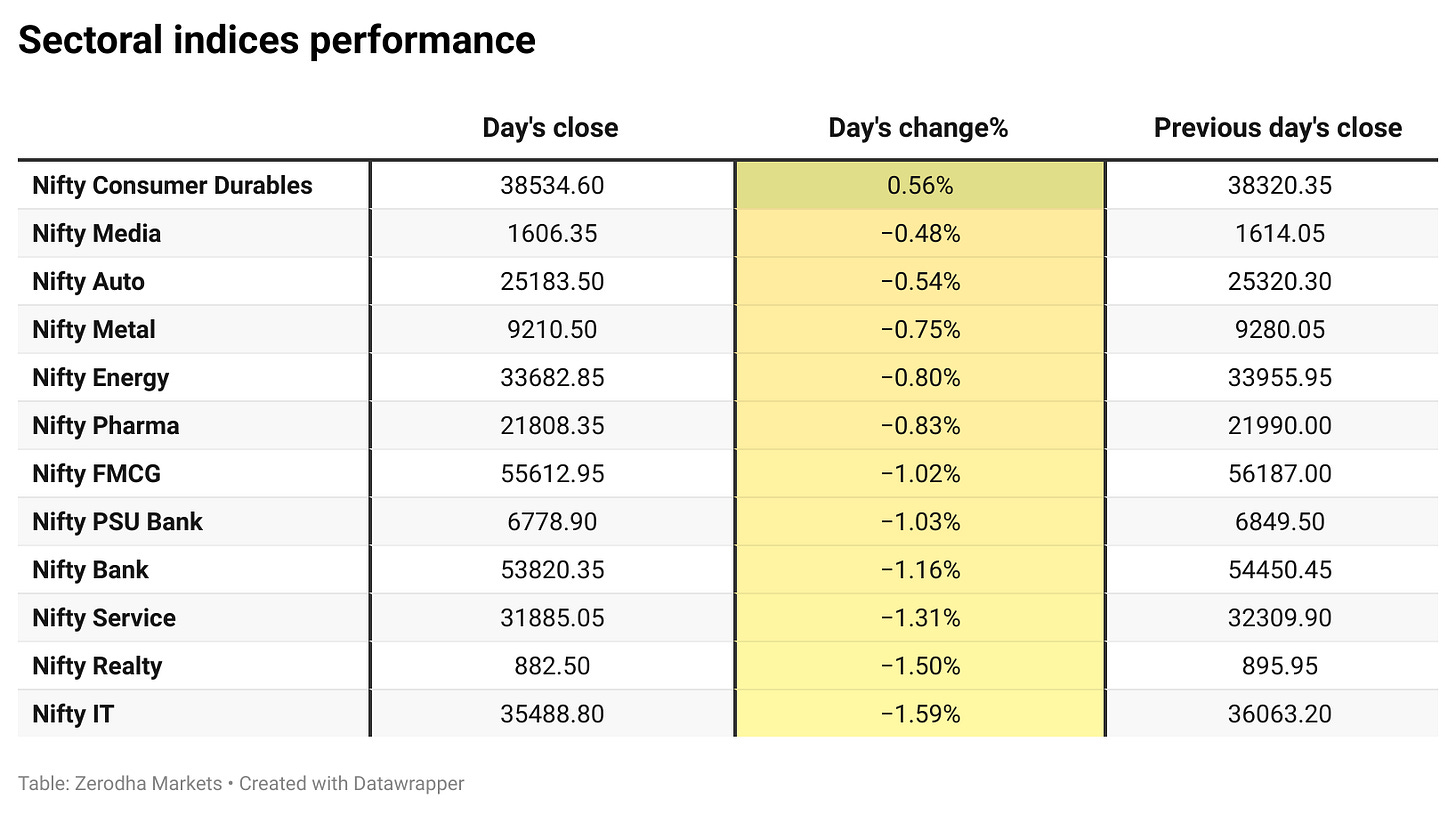

Sectoral Performance

Among the sectoral indices, Nifty Consumer Durables was the top gainer, rising 0.56%, while Nifty IT was the top loser, falling 1.59%. Out of the 12 sectors listed, only 1 sector ended in the green, while 11 sectors closed in the red, reflecting broad-based weakness led by sharp declines in IT, realty, and banking stocks.

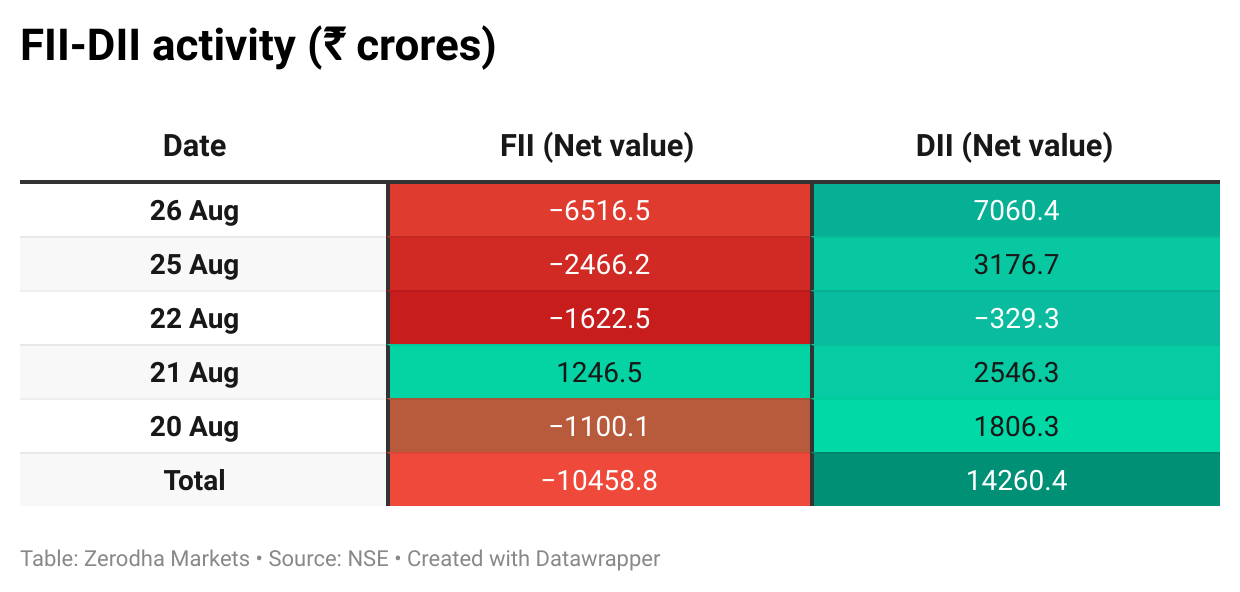

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 2nd September:

The maximum Call Open Interest (OI) is observed at 25,000, followed closely by 24,800, suggesting strong resistance at 24,700 - 24,800 levels.

The maximum Put Open Interest (OI) is observed at 24,000, followed closely by 24,500, suggesting strong support at 24,300 to 24,400 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

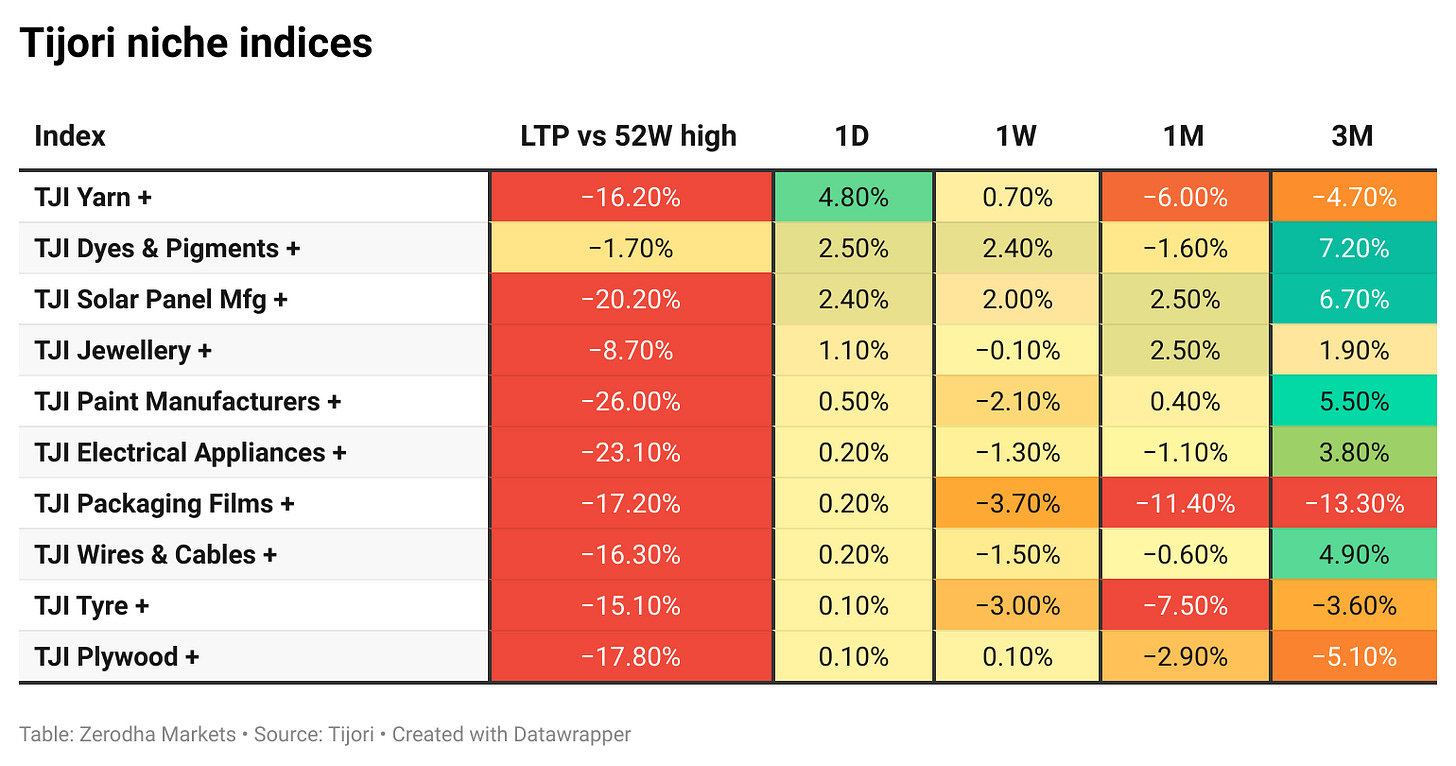

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

BSE will launch a pre-open trading session for index and stock futures from December 8, 2025, as directed by Sebi to improve trading convenience and risk monitoring. Testing begins October 6 using existing equity segment structures, with detailed modalities to be issued separately. Dive deeper

SEA has asked the government not to extend the ban on de-oiled rice bran exports beyond September 30, 2025, saying it has hurt processors, farmers, and exporters. Despite protein meal prices falling, milk prices remain high, and India has lost markets to substitutes. The body said lifting the ban would revive exports, improve incomes, and create jobs. Dive deeper

Waaree Energies’ U.S. arm secured a 452 MW solar module order from an American renewable developer, adding to a series of large contracts as it doubles capacity at its Texas plant by 2025. Dive deeper

Jaiprakash Power Ventures’ board approved exploring a 50 MW solar PV project worth about Rs 300 crore at its Jaypee Bina Thermal Plant site in Madhya Pradesh. The plan will proceed subject to necessary approvals, including from lenders. Dive deeper

Ola Electric secured PLI certification for its Gen 3 scooter range, making it eligible for incentives of 13-18% of sales until 2028 and boosting margin prospects. The move supports profitability, though competition and financial pressures persist. Dive deeper

IndiGo’s co-founder Rakesh Gangwal and the Chinkerpoo Family Trust offloaded up to 1.21 crore shares, a 3.1% stake worth Rs 7,028 crore, via a block deal priced at a 4% discount. The Gangwal Group has raised over Rs 45,000 crore from stake sales since 2022, with about 4.8% residual holding remaining. Dive deeper

CCI has cleared Adani Group’s acquisition of up to 100% in Jaiprakash Associates, advancing its push in infrastructure and real estate. JAL is under insolvency with claims of around Rs 57,000 crore and holds key real estate and cement assets. The Committee of Creditors will now review resolution plans. Dive deeper

Nazara Technologies said three of its subsidiaries have extended loans totaling about Rs 18 crore to its UK arm for working capital and expansion. The loans, to be disbursed in tranches, include Rs 8.7 crore from Kiddopia Inc, Rs 5 crore from Sportskeeda Inc, and Rs 4 crore from Nazara Mauritius. Dive deeper

GST authorities uncovered Rs 104 crore tax evasion in 61 illicit tobacco cases during Q1, seizing nearly 4 crore cigarette sticks. Rising smuggling of high-tax goods like tobacco has led to major revenue losses. Dive deeper

Jet Airways, currently under liquidation, has signed an agreement to transfer the lease of its Mumbai office space to Parthos Properties for about Rs 370 crore. The deal, subject to MMRDA approval, is being executed under IBC and liquidation regulations. Dive deeper

Cipla has initiated a recall of over 20,000 packs of an inhalation drug in the US after stability issues were flagged. The Class III recall was noted by the USFDA, which said the matter is not expected to pose serious health risks. Dive deeper

What’s happening globally

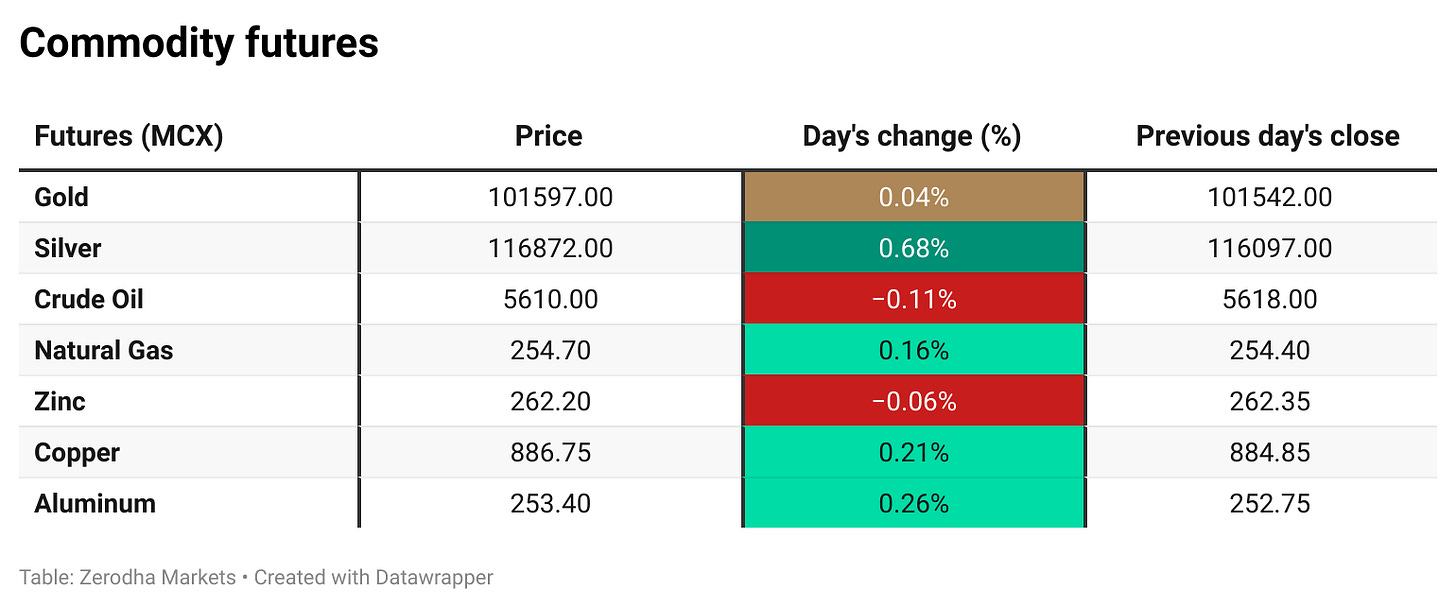

WTI crude slipped toward $63 as markets weighed softer US fuel demand at the end of the driving season against supply risks from Russia-Ukraine tensions and India’s tariff-related oil stance. Dive deeper

Gold climbed toward $3,400 per ounce, near record highs, as US political tensions and expectations of a Fed rate cut boosted safe-haven demand. Dive deeper

US initial jobless claims eased to 229,000 in the week ending August 23, slightly below expectations, while continuing claims dipped to 1.95 million. The data suggests no sharp deterioration in the labor market, though hiring remains subdued, with federal employee claims also edging lower. Dive deeper

The US economy expanded 3.3% in Q2 2025, rebounding from a 0.5% contraction in Q1 and slightly above the earlier 3% estimate. Growth was supported by stronger consumer spending and investment, though declines in business investment and exports, along with lower government spending, tempered the gains. Dive deeper

The ECB kept rates steady in July after eight cuts, with inflation at its 2% target. Policymakers adopted a wait-and-see stance amid trade uncertainties and potential US tariffs. Dive deeper

European natural gas futures fell over 3% to €31.8/MWh, extending a three-day decline as storage builds continued despite Norwegian outages. Higher LNG availability from weak Asian demand is easing supply concerns, though geopolitical risks around Russia and Ukraine still linger. Dive deeper

EU passenger car registrations rose 7.4% YoY in July 2025 to 914,680 units, led by strong gains in Spain and Germany, while France and Italy declined. BEV registrations jumped 39.1%, with Spain up 127% and Germany 59%, lifting year-to-date BEV sales 12.5% to 1.01 million units, or 15.6% of the market. Dive deeper

Japanese government bonds rebounded as record yields and easing pressure on Prime Minister Ishiba attracted buyers, supported by dovish Bank of Japan comments. Longer-term bonds saw strong demand, while a weak two-year auction highlighted risks for upcoming sales despite yield highs. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

R C Bhargava, Chairman, Maruti Suzuki India, on US tariffs on Indian products

"It is our duty as Indians to do our very best to promote and maintain our dignity and respect and not give in to any kind of bullying in this matter... the nation has to stand united,"

"You're all aware of the global uncertainty that has been caused in recent months. President Trump has in many ways, forced nations to rethink conventional policies and relationships. Personal use of tariffs in diplomacy is being seen for the first time,"

"We are all hopeful that the proposal which the Prime Minister made will result in the GST of small cars reducing to 18 per cent but we have to wait till the official announcement is made," - Link

Crisil on the impact of US tariffs on India’s diamond polishers

"Revenues are likely to fall 28–30% this fiscal to $12.5 billion from $16 billion last year due to the 50% US tariff."

"The industry, already hit by a 40% degrowth over the past three years, faces further pressure from weak US and China demand and rising competition from lab-grown diamonds."

"Operating margins could erode by 50–100 bps, with overall margins dropping 3.5-4%, while firms may need to boost domestic sales and diversify markets to navigate the tariffs." - Link

Scott Bessent, U.S. Treasury Secretary, on India-U.S. tariffs

"This is a very complicated relationship… but at the end of the day, we will come together."

"President Trump and Prime Minister Modi have very good relationships at that level, and it’s not just over the Russian oil."

"India is selling to us; they have very high tariffs, and we have a large deficit with them. It’s the surplus country that should worry, not the deficit one." - Link

Ashwini Vaishnaw, Union IT Minister, on India’s first semiconductor chip

"The first made-in-India chip will be rolled out soon from CG Semi’s pilot line at its OSAT facility in Sanand, Gujarat."

"CG Semi, with support from Centre and state governments and partners Renesas and Stars Microelectronics, is investing ₹7,600 crore over five years to build two world-class facilities."

"There is also significant progress at Micron Technology’s Sanand unit, as India moves ahead with its AI Mission, building an indigenous AI model, a homegrown AI chip, and a 10,000-GPU compute facility." - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

📚 Also reading Mind Over Markets by Varsity?

It goes out thrice a week, covering markets, personal finance, or the odd question you didn’t know you had. The Varsity team writes across three sections: Second Order, Side Notes, and Tell Me Why, thoughtfully put together without trying to be too clever.

Go check out Mind Over Markets by Zerodha Varsity here.

Calendars

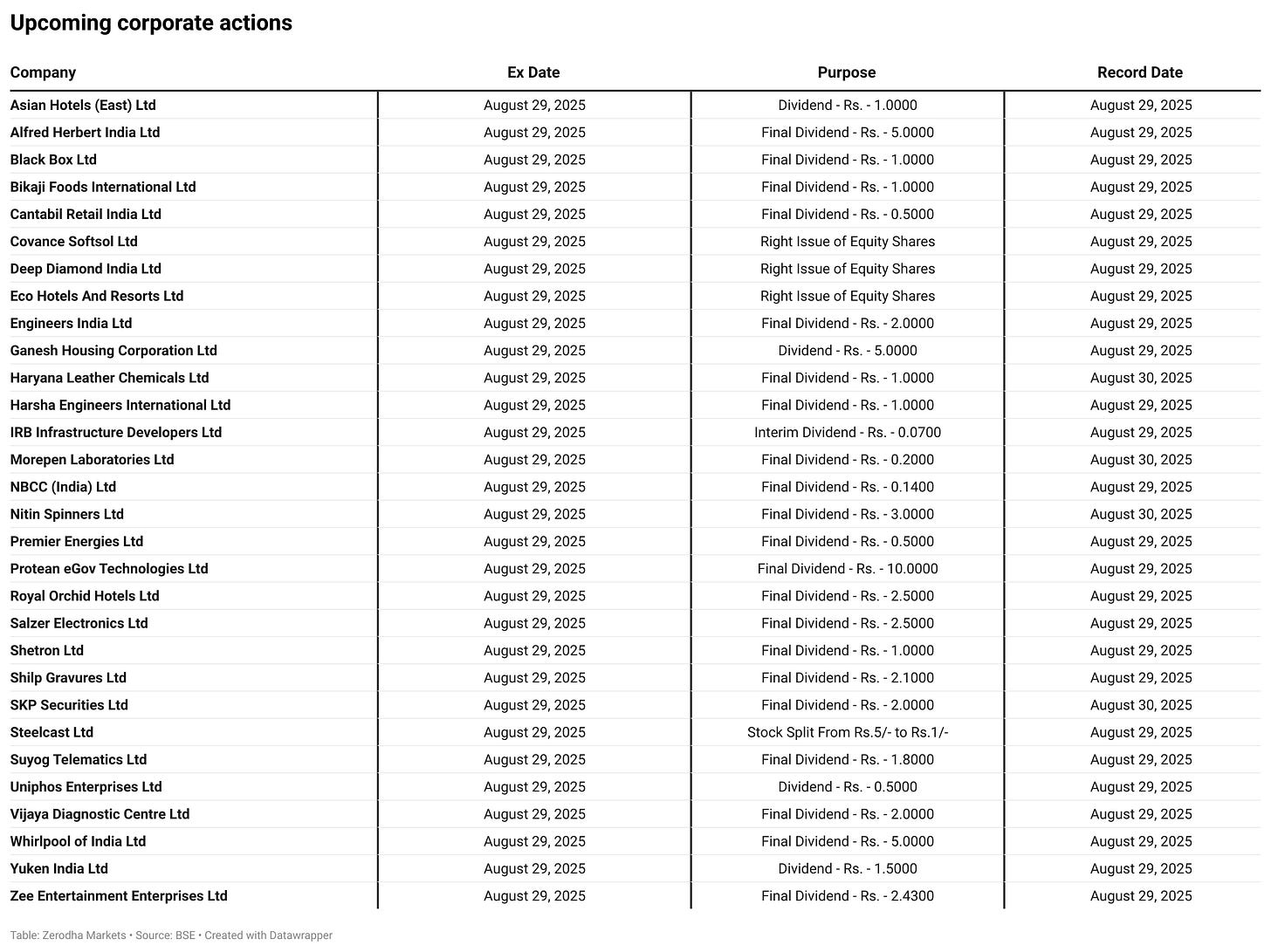

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.