Nifty drifts lower ahead of expiry, settles near 25,950

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we take a step back from charts and strategies to talk about trading resolutions—why we make them, why most fail, and what actually helps them stick.

We briefly explore the history and psychology behind New Year’s resolutions, the behavioural traps that derail traders, and then move into 26 practical trading resolutions for 2026, spanning mindset, risk, learning, discipline, mental health, and long-term survival. This isn’t a checklist or a rulebook, but a menu you can pick from depending on where you are in your trading journey. No predictions. No systems. No hype. Just reflections on what helps traders stay in the game.

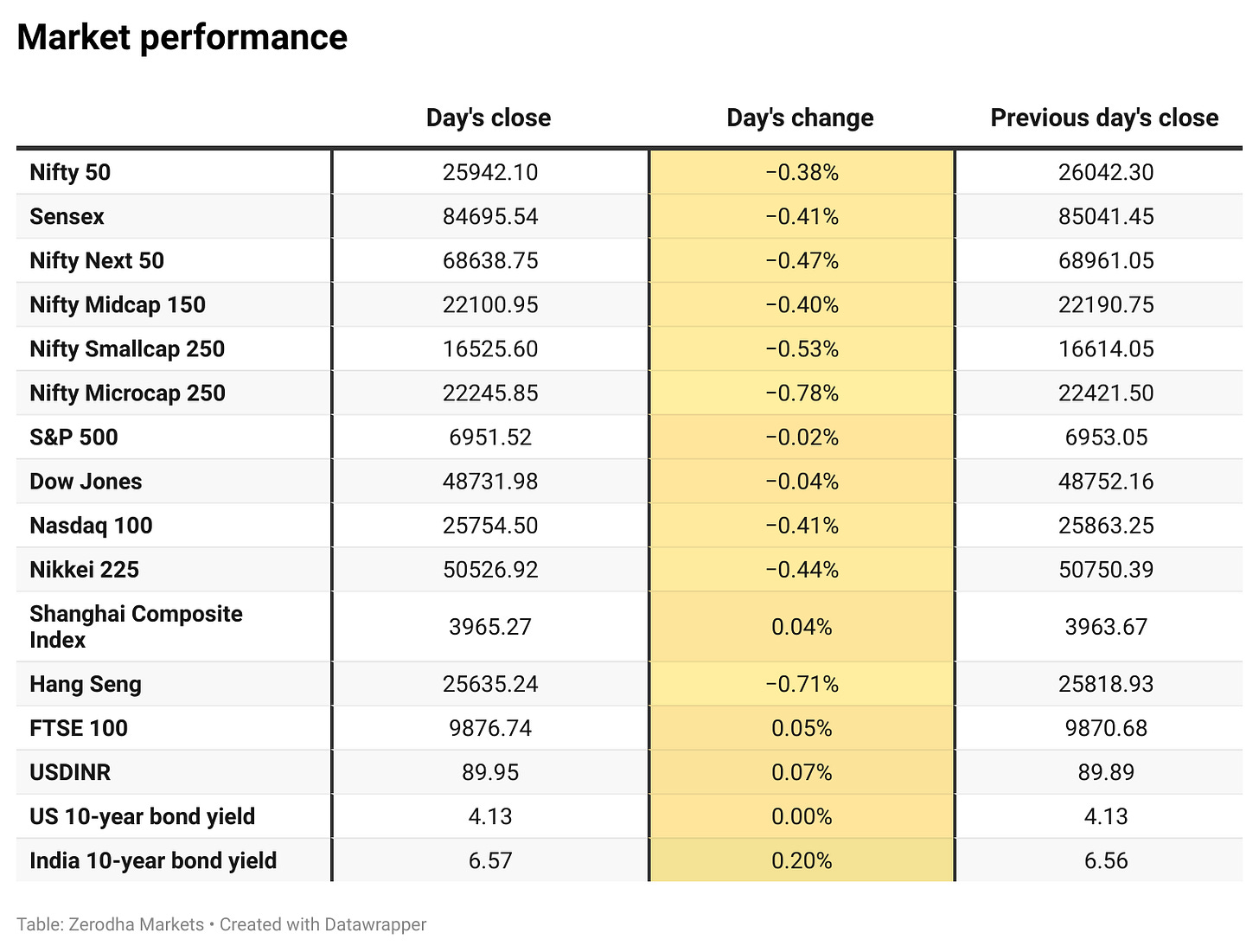

Market Overview

Nifty opened with a modest 21-point gap-up at 26,063 but failed to sustain early gains as selling pressure emerged almost immediately. The index slipped steadily through the first hour, breaking below the 26,000 mark and drifting toward the 25,950–25,970 zone, where it attempted a brief stabilisation during the late morning session.

In the second half, weakness persisted with Nifty continuing to trade with a clear bearish bias. The index gradually slid toward the 25,920 zone, with intermittent and shallow recovery attempts failing to attract follow-through buying. Late-session volatility did little to change the tone, and Nifty eventually closed at 25,942.10, down by nearly 0.4%. Overall, it was a dull and one-sided session marked by a lack of buying interest and continued consolidation with a negative undertone ahead of the monthly expiry tomorrow.

Looking ahead, markets are likely to remain sensitive to global risk appetite, currency movements, and further developments around India–U.S. trade negotiations.

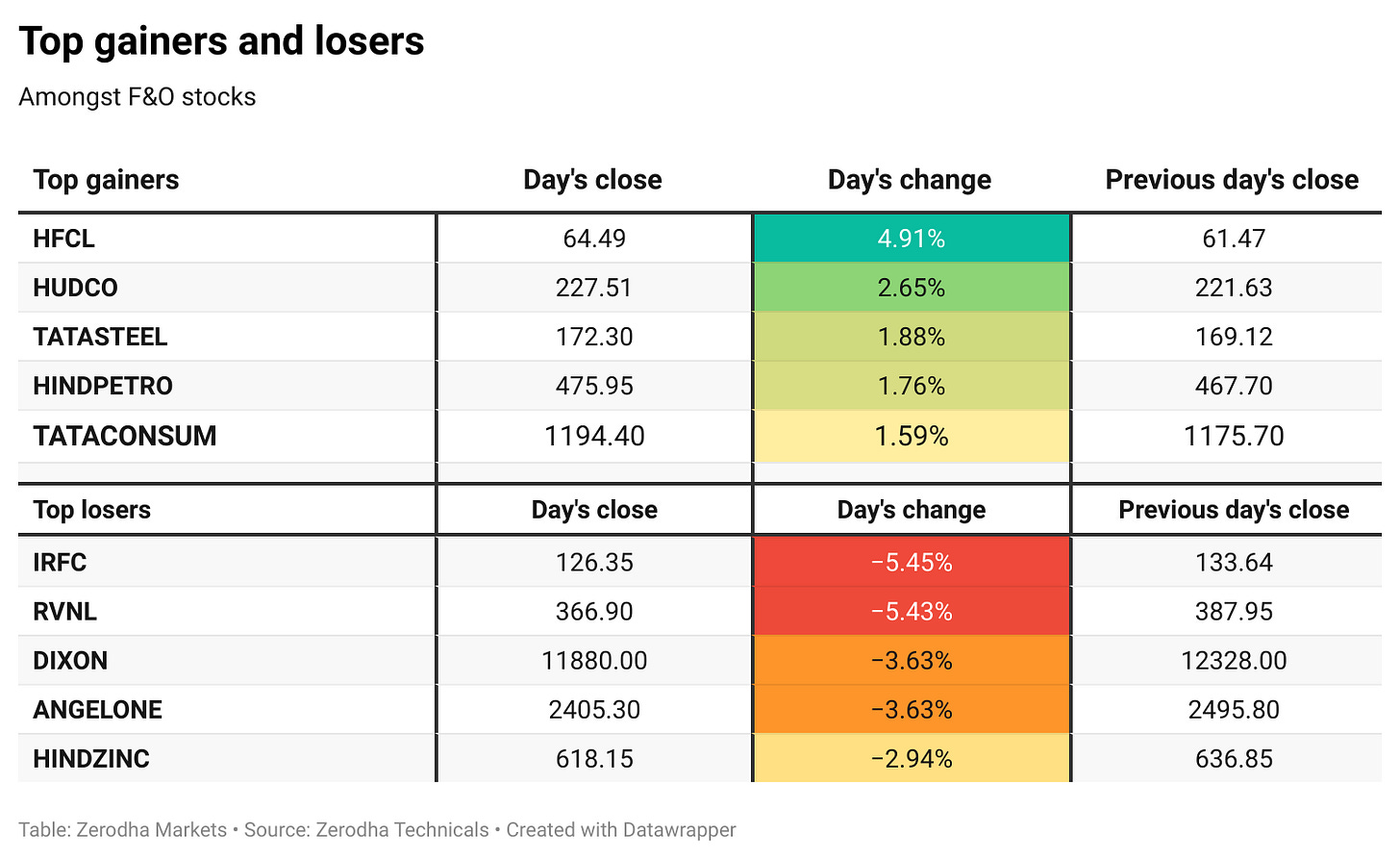

Broader Market Performance:

The broader market had an extremely weak session today. Out of 3,294 stocks that traded on the NSE, 1,022 advanced, while 2,185 declined, and 87 remained unchanged.

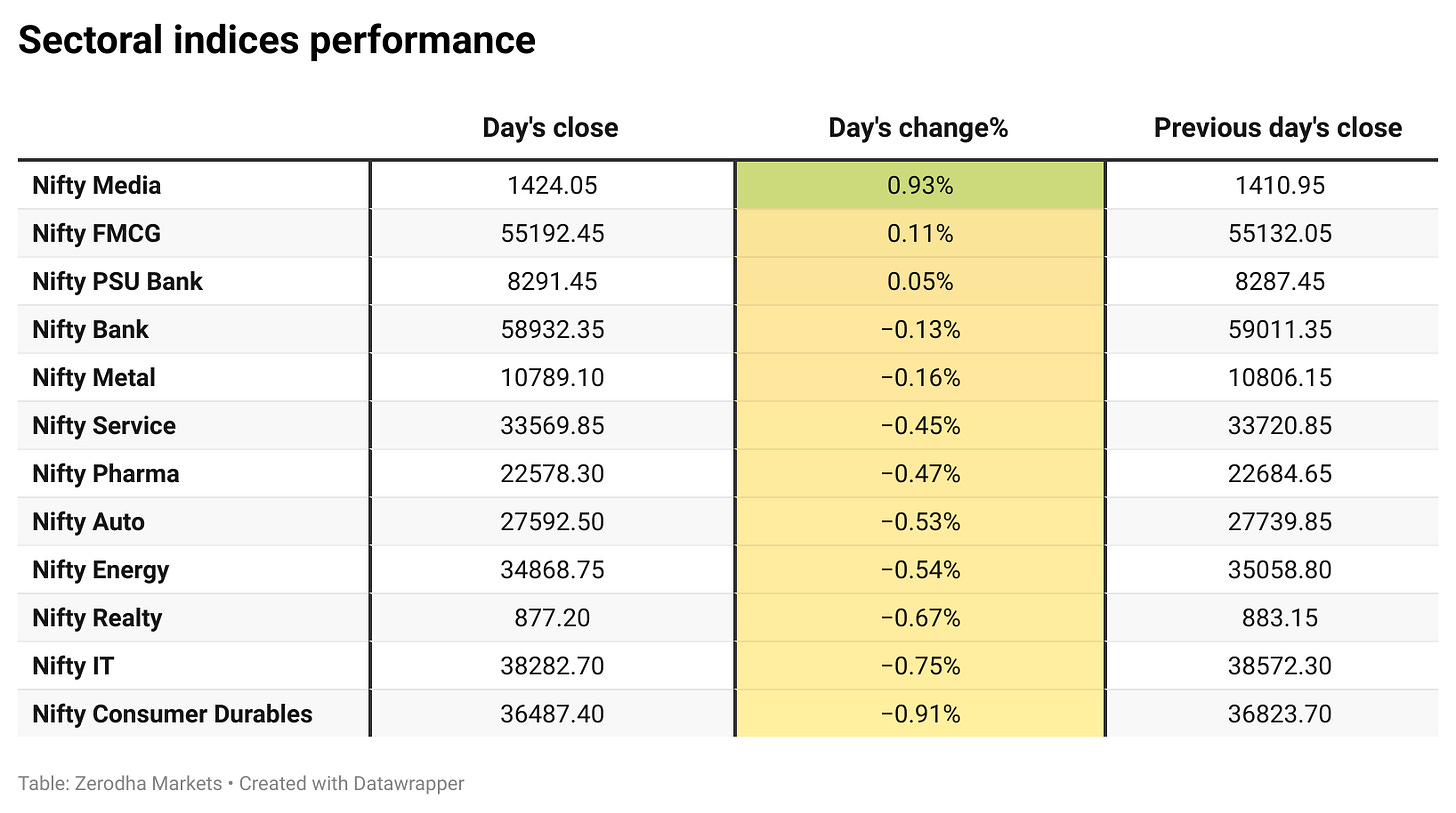

Sectoral Performance:

Nifty Media was the top gainer, rising 0.93%, while Nifty Consumer Durables was the worst performer, slipping 0.91%. Out of the 12 sectoral indices, only 3 closed in the green, while the remaining 9 ended the day in the red.

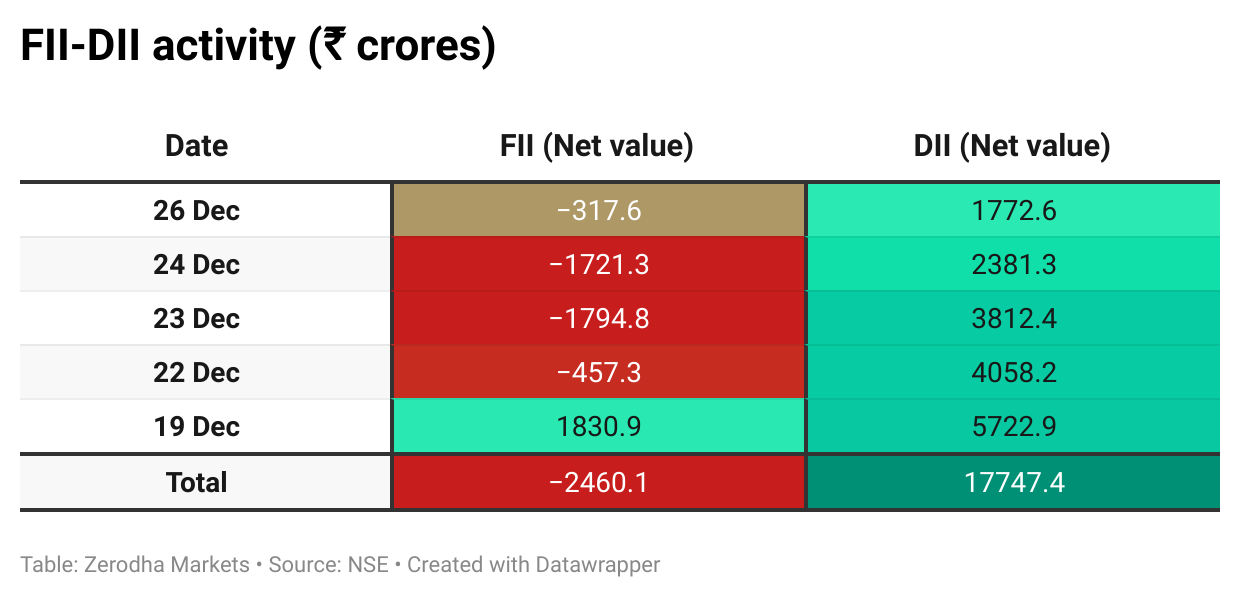

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 30th December:

The maximum Call Open Interest (OI) is observed at 26,000, followed by 26,100, indicating potential resistance at the 26,000 -26,100 levels.

The maximum Put Open Interest (OI) is observed at 26,000, followed by 25,900, suggesting support at the 25,900 to 25,800 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

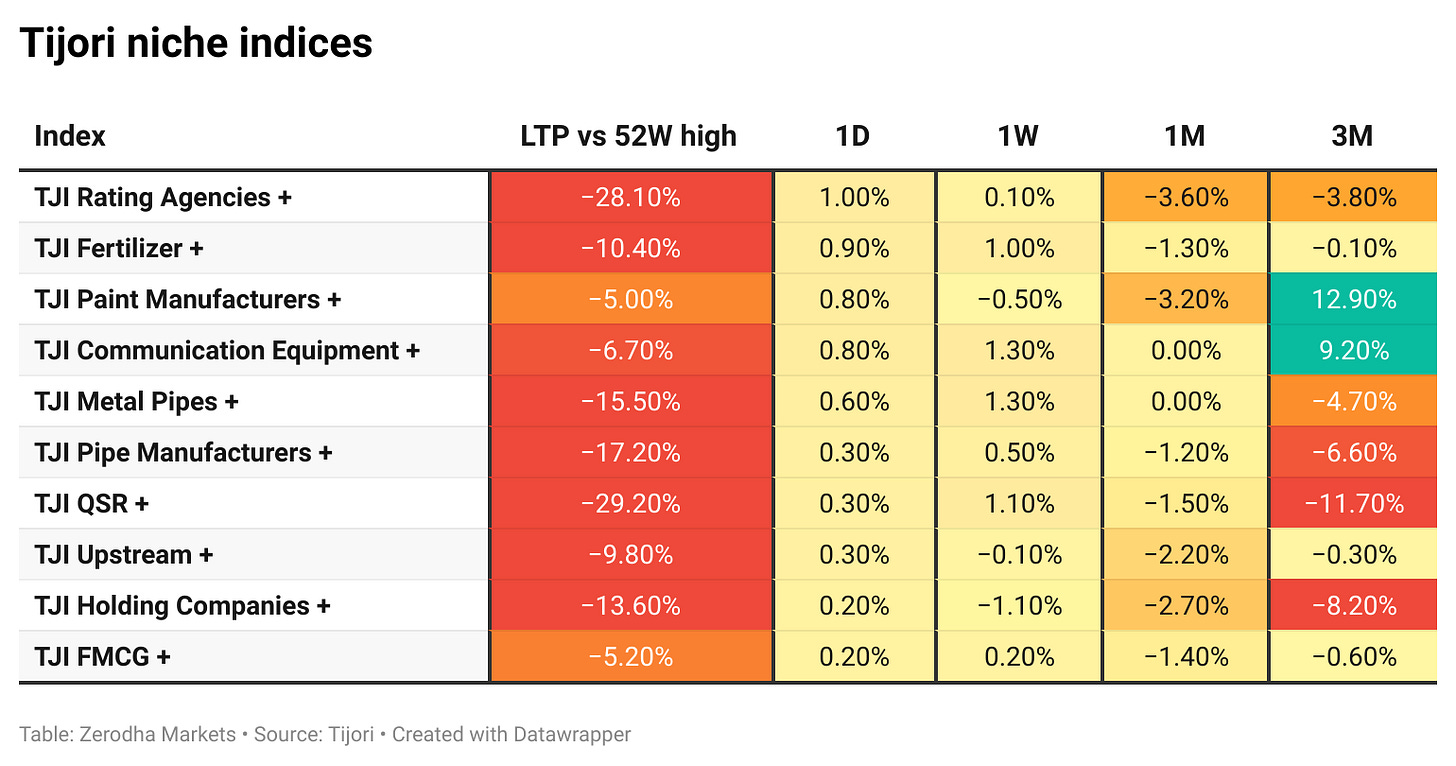

Tijori is an investment research platform that has constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

India’s industrial output grew 6.7% y/y in November, the strongest expansion since October 2023, led by a sharp pickup in manufacturing and a rebound in mining post-monsoon. Power generation stayed weak, contracting for a second straight month. Dive deeper

India’s banking system remains resilient as 2025 draws to a close, supported by strong balance sheets, stable profitability, and improving asset quality, the RBI said. Gross NPAs fell to a multi-decade low of 2.1% at end-September 2025 from 2.2% in March, highlighting sustained balance-sheet clean-up efforts. Dive deeper

The rupee steadied near 89.8/$, supported by a softer dollar and RBI liquidity measures after recent volatility. Despite signs of stabilisation, it remains under pressure this year from weak flows and trade-related uncertainty. Dive deeper

India’s 10-year G-Sec yield rose to around 6.6% as traders priced in heavier state bond supply and tight liquidity, with foreign outflows also weighing on demand. Dive deeper

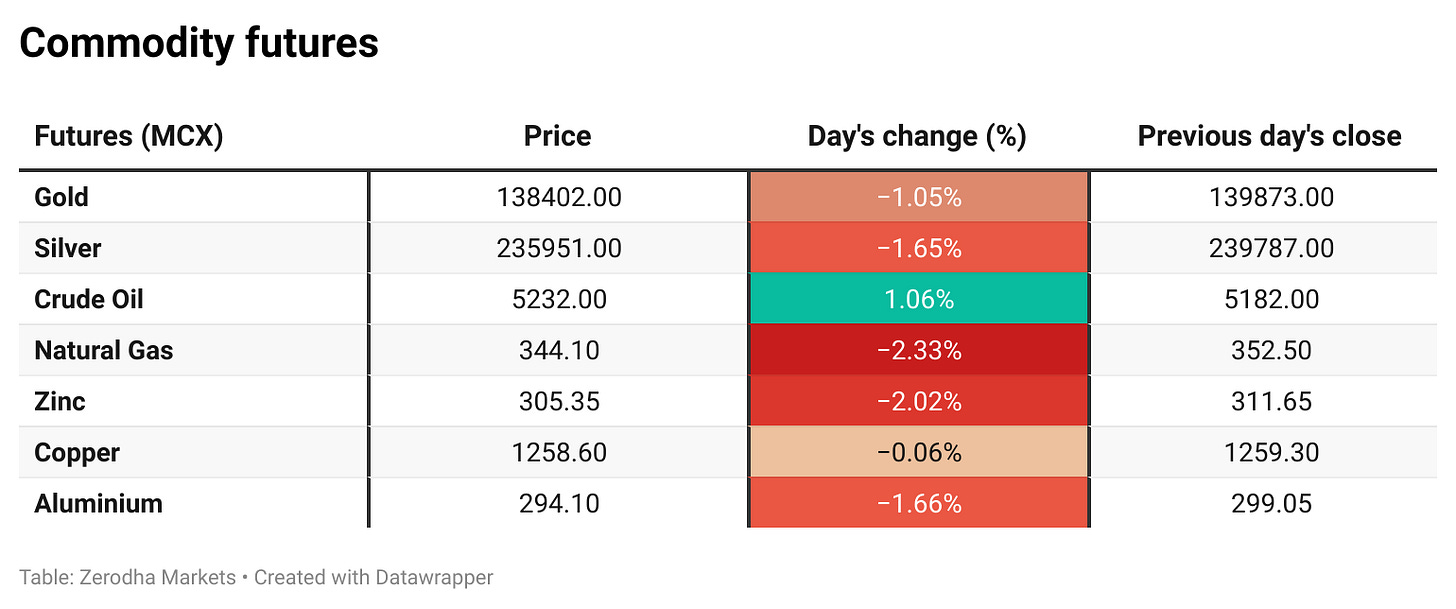

Silver prices fell sharply after CME raised margin requirements for silver futures, triggering profit-booking and forced unwinds in leveraged positions. Dive deeper

Coforge announced a $2.35 billion acquisition of US-based AI engineering firm Encora to strengthen its AI-led services and expand its presence in the Americas. Dive deeper

India’s Defence Acquisition Council cleared procurement proposals worth about ₹790 billion ($8.8 billion) to buy equipment such as radars, radios and automatic take-off/landing recording systems for the army, navy and air force. Dive deeper

Quick-commerce firm Zepto has filed confidentially for a ₹110 billion ($1.22 billion) IPO, positioning it for a potential 2026 listing. The company competes with Blinkit and Instamart in India’s fast-growing 10-minute delivery space. Dive deeper

Larsen & Toubro has secured a “significant” order worth ₹1,000–2,500 crore for Phase II of the Hyderabad Greenfield Radial Road project. The contract involves building a 22.3 km, 3+3 lane access-controlled road in Ranga Reddy district to improve regional connectivity. Dive deeper

What’s happening globally

WTI rose above $57/bbl as Middle East tensions and optimism around Ukraine peace talks kept supply risks in focus, while China signalled more fiscal support for 2026 growth. Dive deeper

Silver fell toward $74/oz on profit-taking after a record $81 run-up, with traders also reacting to signs of progress in Ukraine peace talks. Dive deeper

US copper futures eased to around $5.6/lb after briefly testing record highs, as markets reassessed a rally fuelled by supply-disruption risks and fresh US tariff threats. Dive deeper

US equity futures were mixed in a holiday-thinned week, with sentiment cautious after Friday’s close near record highs amid lingering AI-valuation concerns. Dive deeper

European equities edged up in thin year-end trade, with the STOXX 600 holding near record highs as investors assessed prospects of Fed easing in 2026 and tracked Ukraine-war developments. Dive deeper

BoJ policymakers signalled comfort with further rate hikes and a gradual reduction in accommodation, citing rising confidence in a wage–price cycle supporting sustainable inflation. Dive deeper

China’s industrial profits rose just 0.1% y/y in Jan–Nov 2025, sharply slowing from earlier months as year-end demand weakened and cost pressures persisted. November profits fell 13.1% y/y, with state and private firms slipping while sector performance remained uneven. Dive deeper

Management chatter

In this section, we highlight interesting comments made by the management of major companies and policymakers from the Indian and Global Economies.

Manish Sonthalia, Emkay Investment Managers, on FY27 outlook as India’s macros improve:

“So, FY27 should be better than FY26 for sure on the back of better macros… you have very low inflation, you have very low interest rates and earnings growth is reviving. It is going to be better than FY26 and valuations have corrected.”

“I think the market is waiting with bated breath to see the light of the day for the US trade deal… if that happens, then that could be a trigger point which could lift the markets definitely higher from here.”

“The biggest concern in the market… you cannot paint everything with the same brush saying that everything is very expensive and the mid and the smallcap universe is to be avoided totally. I do not believe all that. I think it is to do with individual stocks.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

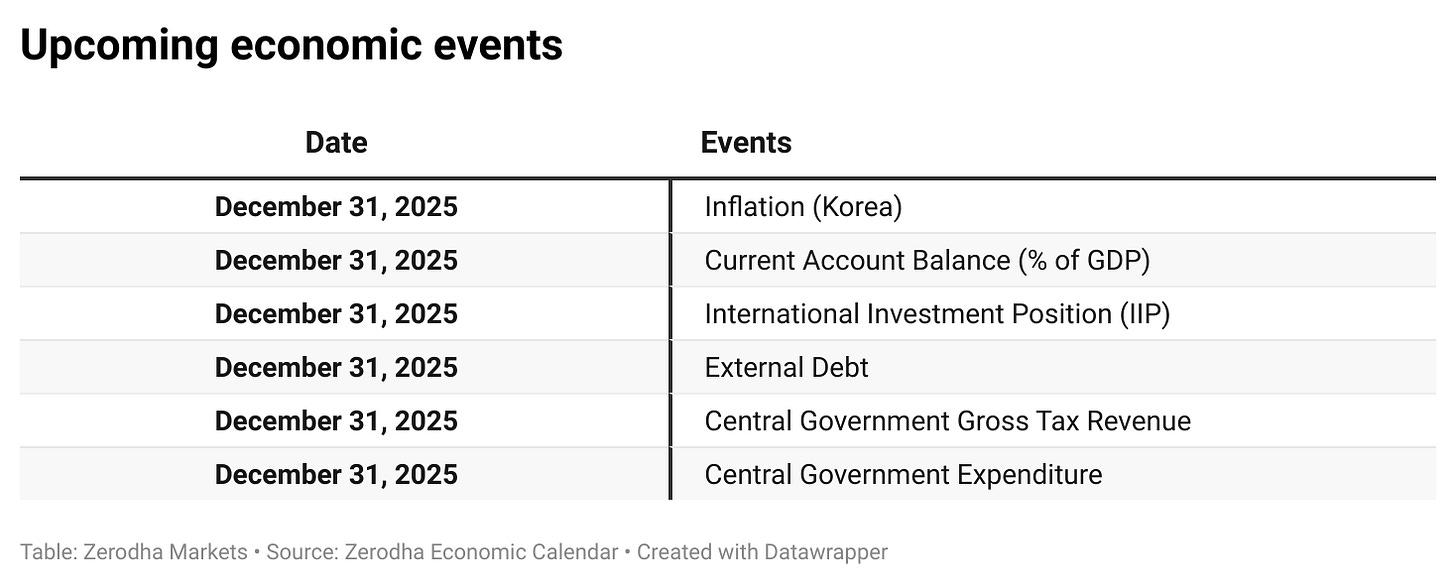

Calendars

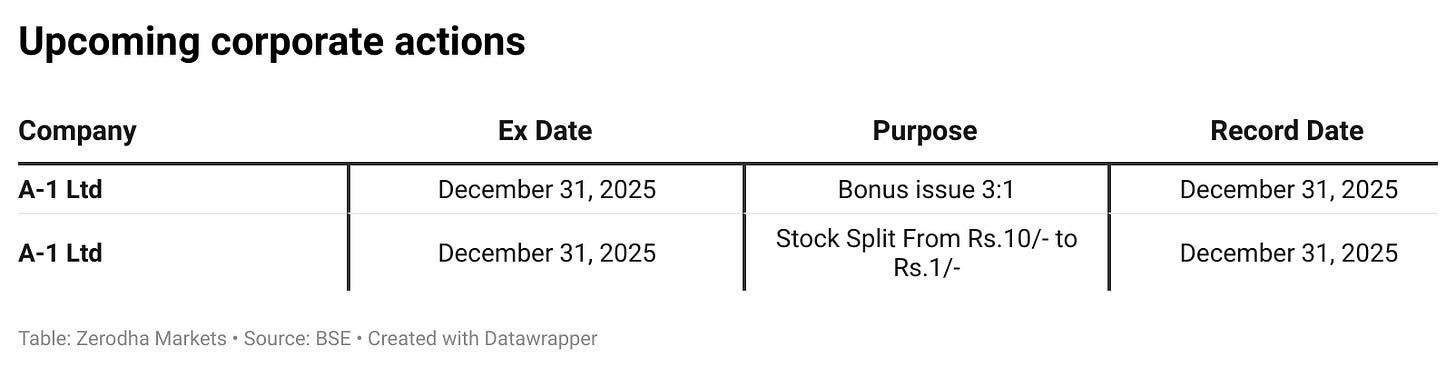

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

Your daily brief and after market reports are backbone for finance students the perspective you provide is unimaginable

Gap up tomorrow?