Nifty dips for 3rd day in a row as consolidation continues; Broader markets outperform

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we explore Week 1 of 2026, where markets began the new year on a strong note, with NIFTY and BANKNIFTY closing at fresh all-time highs. Expanding ranges, improving momentum, and leadership from cyclicals like banking and metals drove the move, while mid-week compression gave way to rising volatility into Friday — setting a constructive early-year tone even as option-implied moves stayed relatively modest.

Market Overview

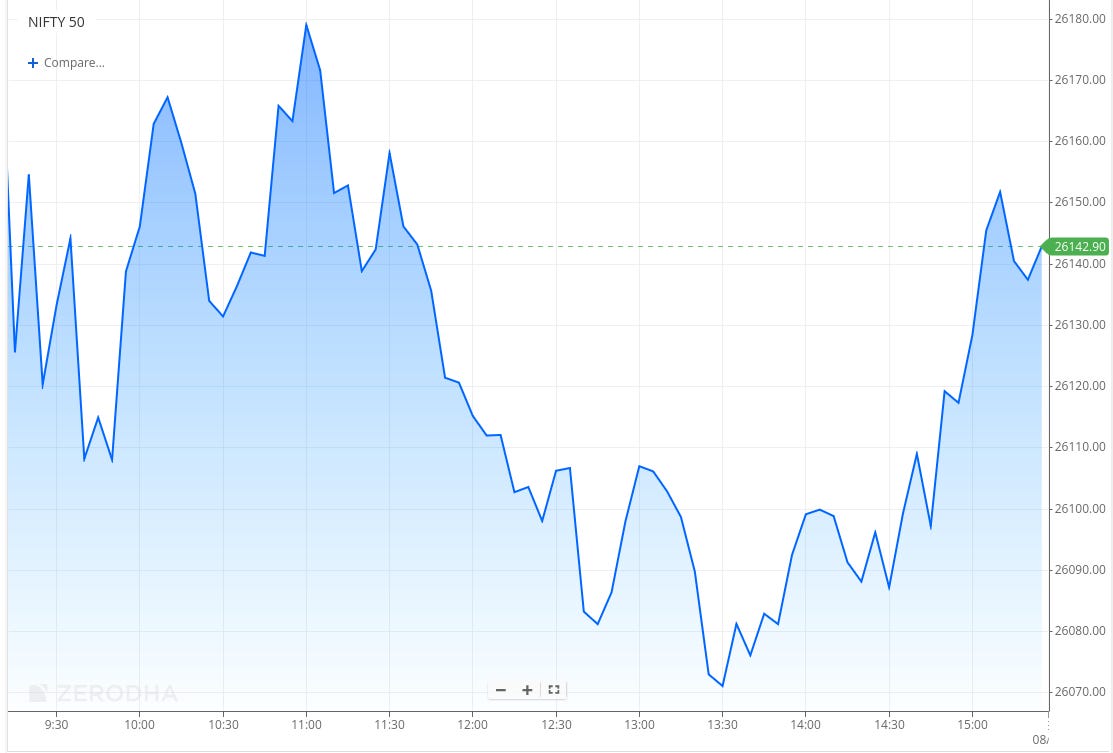

Nifty opened with a 35-point gap-down at 26,143 and slipped toward 26,100 within the first hour, accompanied by sharp volatility that reflected low conviction and nervous intraday trade. The index then attempted a brief recovery, momentarily moving into positive territory near 26,180, but the bounce was short-lived. Selling pressure resumed soon after, pushing Nifty back below 26,120 and extending losses through the first half.

Post noon, weakness intensified further, with the index sliding sharply to hit the day’s low around 26,070–26,080 near 1:30 PM, marking the weakest phase of the session.

After 2 PM, a strong recovery unfolded from the lows, as Nifty steadily clawed back losses through the afternoon. The index reclaimed 26,120 and then 26,150 in the final hour, before eventually closing at 26,140.75, ending almost flat for the day and well off its intraday lows.

Looking ahead, markets are likely to remain sensitive to global risk appetite, the start of the Q3 earnings season, and further developments around India–U.S. trade negotiations.

Broader Market Performance:

The broader market had a mixed session today. Out of 3,246 stocks that traded on the NSE, 1,578 advanced, while 1,550 declined, and 118 remained unchanged.

Sectoral Performance:

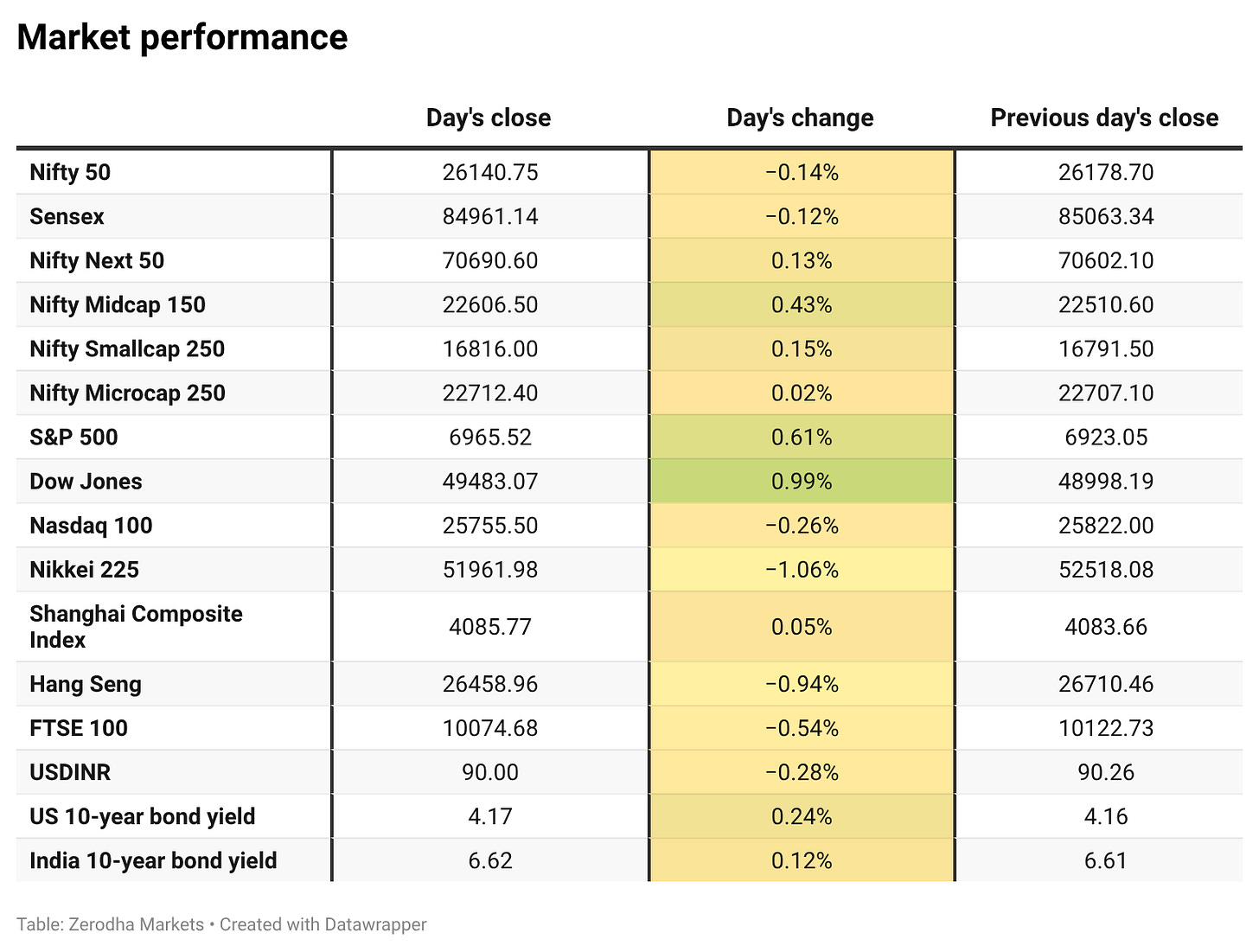

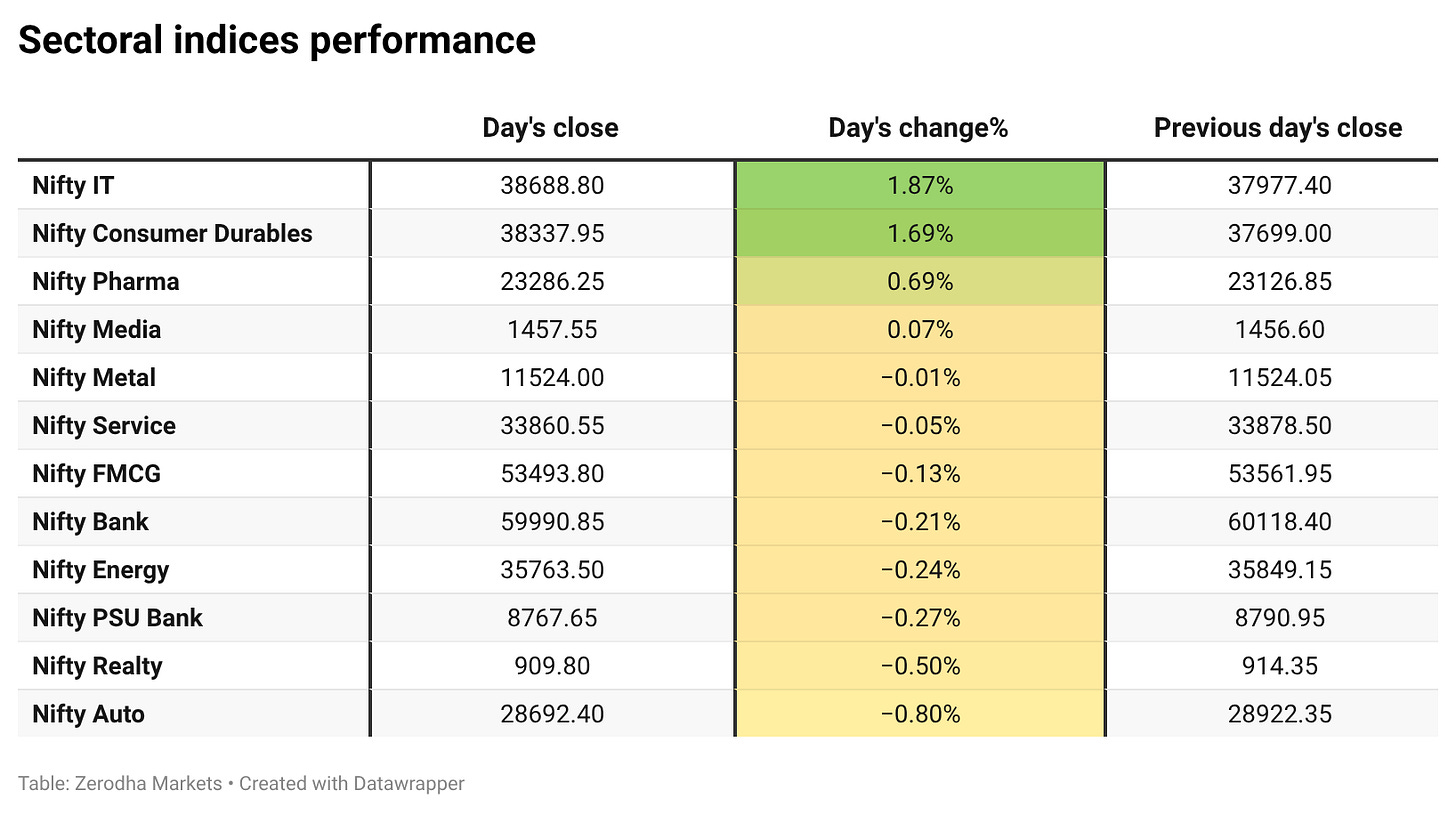

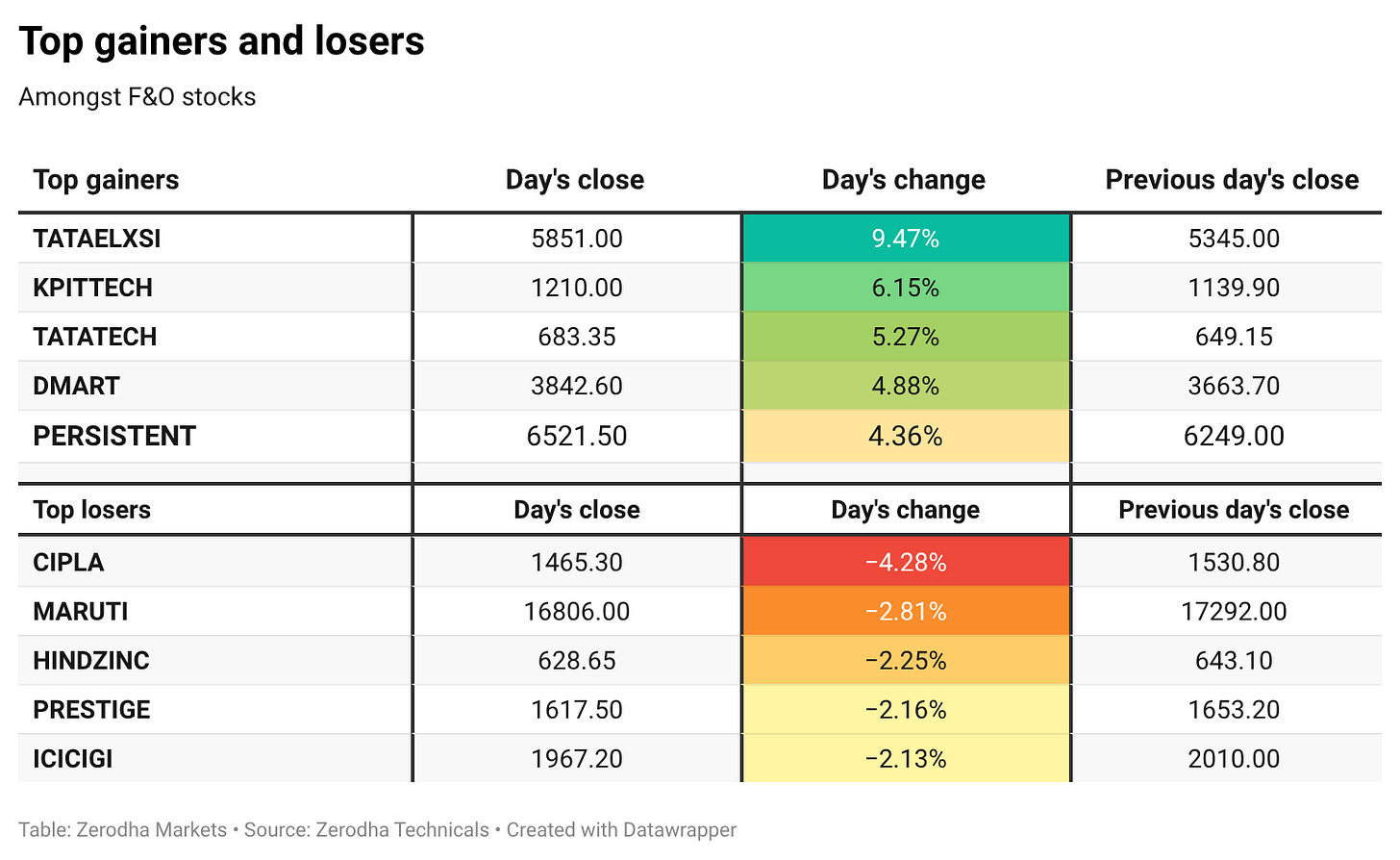

Nifty IT emerged as the top gainer, rising 1.87%, while Nifty Auto was the biggest laggard, slipping 0.80%. Out of the 12 sectoral indices, only 4 ended in the green, whereas 8 sectors closed in the red, indicating broad-based weakness despite strength in select pockets like IT and consumer durables.

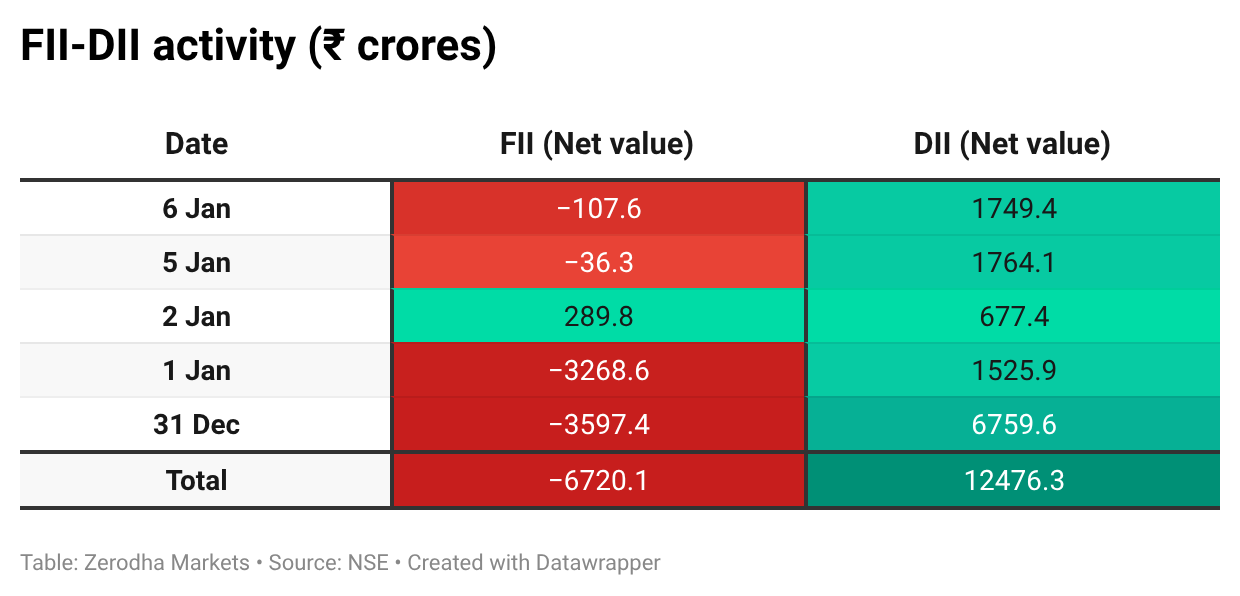

Here’s the trend of FII-DII activity from the last 5 days:

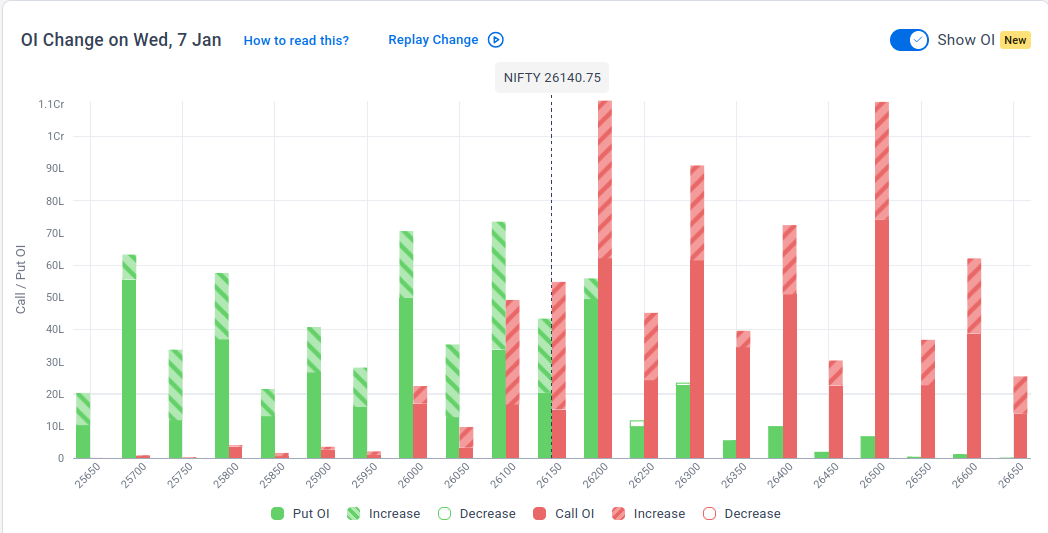

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 13th January:

The maximum Call Open Interest (OI) is observed at 26,200, followed equally by 26,500, indicating potential resistance at the 26,300 -26400 levels.

The maximum Put Open Interest (OI) is observed at 26,100, followed by 26,000, suggesting support at the 26,100 to 26,000 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

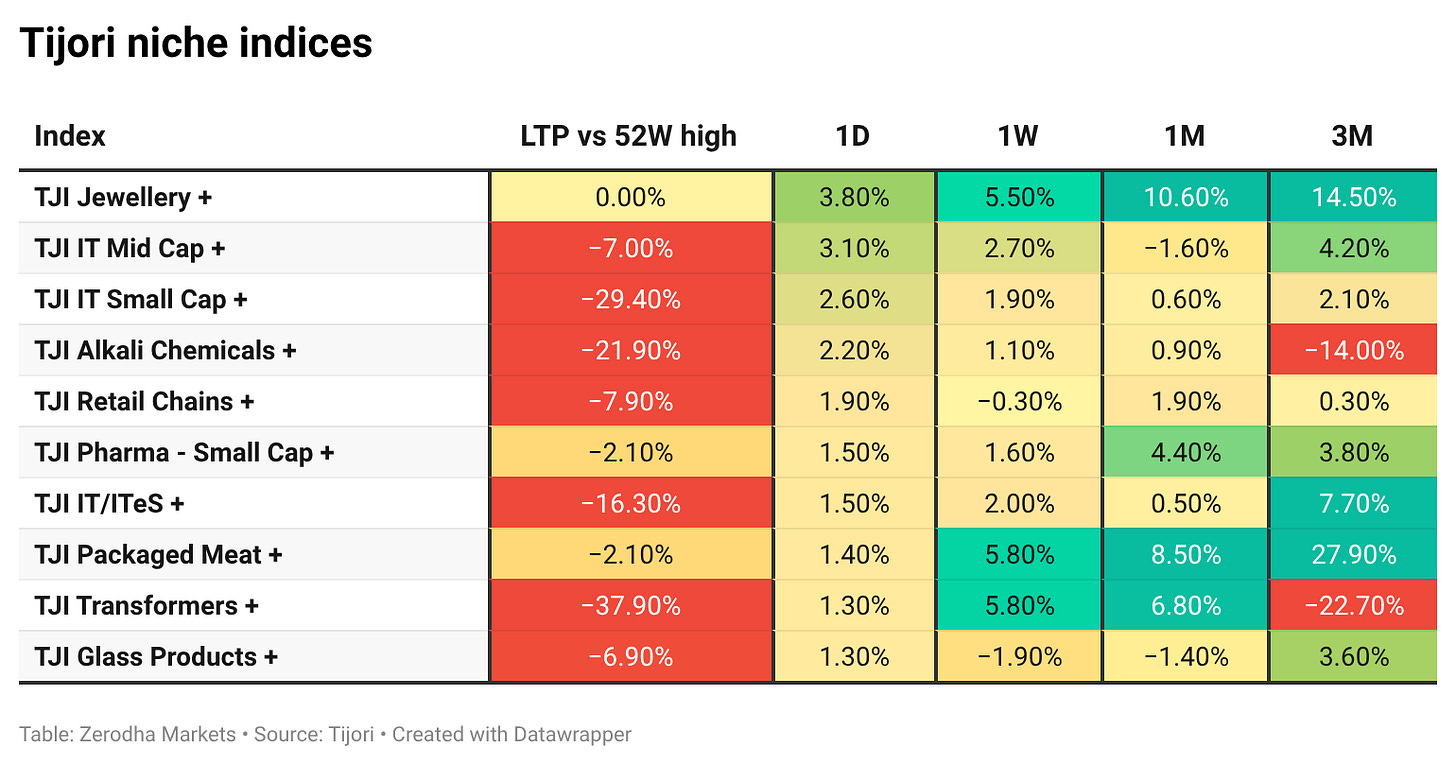

Tijori is an investment research platform that has constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

India’s real GDP is estimated to grow 7.4% in FY2026, rebounding from 6.5% in the previous year, supported by higher government spending and steady capital formation. Growth in private consumption moderated slightly, while imports outpaced exports during the year. Dive deeper

SEBI has proposed a uniform 30-day lag for sharing price data of listed companies for educational and awareness purposes. The move aims to prevent misuse of market data while keeping educational content relevant. Dive deeper

Automobile retail sales rose 7.71% year-on-year in CY25 to over 2.81 crore vehicles, according to data from the Federation of Automobile Dealers Associations (FADA). Dive deeper

Titan Company reported a 40% year-on-year growth in its consumer businesses in Q3FY26, led by a 41% increase in jewellery sales, while international and domestic segments grew 79% and 38% respectively. Watches and eyecare businesses recorded growth of 13% and 16% during the quarter. The company added 56 stores, taking its total retail network to 3,433. Dive deeper

The RBI has proposed capping banks’ dividend payouts at 75% of net profit under a new draft framework. The rules will apply from FY27 and link dividend payouts to banks’ capital strength. Dive deeper

Eternal, the parent entity of Zomato and Blinkit, has received a GST demand order worth ₹3.7 crore, including interest and penalty, for the period April 2019 to March 2020. The company said it will appeal the order passed by the West Bengal tax authority. Dive deeper

Kalyan Jewellers reported a 42% year-on-year increase in revenue in Q3 FY2026, with growth seen across domestic and international operations. The company also continued to add showrooms during the quarter. Dive deeper

Indian Energy Exchange said the Electricity Appellate Tribunal raised concerns over the formulation of the market coupling framework during ongoing hearings. Separately, the exchange reported higher electricity trading volumes in the December quarter, supported by improved power supply conditions. Dive deeper

Lodha Developers reported a 25% year-on-year increase in sales bookings in Q3 FY26, driven by residential demand across key markets. During the quarter, the company added five new projects across MMR, NCR, and Bengaluru, expanding its development pipeline. Dive deeper

India’s solar module manufacturing capacity rose to 144 GW in 2025, more than doubling from 63 GW in 2024, according to the Union Minister for New and Renewable Energy. This indicates an addition of 81 GW of capacity over the year. Dive deeper

What’s happening globally

Brent crude fell over 1% to around $60 per barrel after the US said Venezuela would supply 30-50 million barrels of oil, adding to global supply expectations. Dive deeper

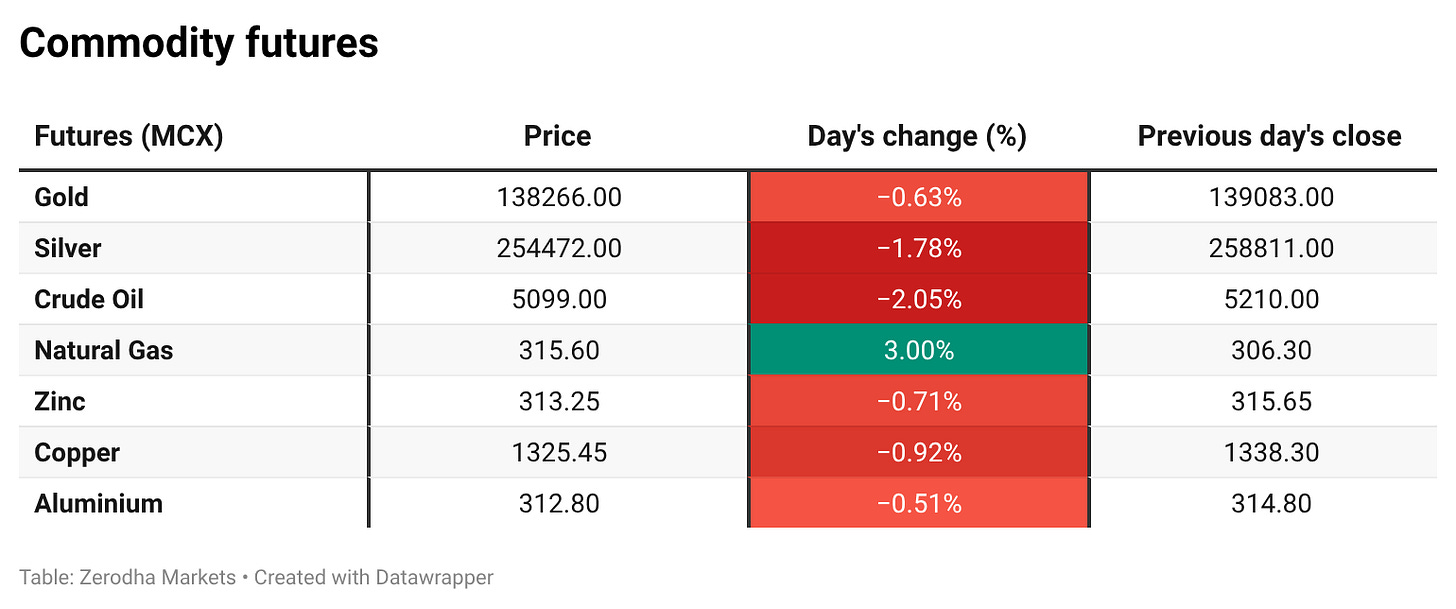

Gold fell to around $4,440 per ounce after a two-day rise. Attention remained on upcoming US economic data and the Federal Reserve’s policy outlook, with geopolitical risks in the background. Dive deeper

Silver slipped below $80 per ounce, ending a three-day rally as prices pulled back from recent highs. Dive deeper

The average US 30-year fixed mortgage rate fell to 6.25% in the week ending January 2, the lowest level since September 2024, according to the Mortgage Bankers Association. Mortgage applications declined 9.7% over the past two weeks. Dive deeper

China’s foreign exchange reserves increased by USD 11.5 billion to USD 3.358 trillion in December 2025, marking a sixth consecutive monthly rise. The People’s Bank of China also added to its gold reserves for the fourteenth straight month. Dive deeper

Euro area inflation eased to 2.0% in December 2025 from 2.1% in November, according to preliminary data. Core inflation also declined to 2.3%, marking its lowest level in four months. Dive deeper

Israel raised $6 billion through a three-tranche international bond sale, with investor demand reaching $36 billion. The offering included 5-, 10-, and 30-year bonds and saw participation from around 300 investors across 30 countries. Dive deeper

Sterling traded near a more than three-month high against both the euro and the dollar on Wednesday as risk appetite stabilised. European stocks were little changed after a three-day rally to record highs. Dive deeper

Elon Musk’s AI startup xAI said it raised $20 billion in its latest funding round, exceeding the initial $15 billion target. The fresh capital will accelerate development of its Grok AI models. Dive deeper

Management chatter

In this section, we highlight interesting comments made by the management of major companies and policymakers from the Indian and Global Economies.

S Mahendra Dev, Chairman, Economic Advisory Council to the Prime Minister on Economic growth and impact of US tariffs on India’s economy

"High domestic consumption, and continued thrust on public capital expenditure is likely to keep growth around 6.5-7 percent in the next fiscal year (FY27),"

“As per reports, corporate investment announcements between April and September have increased to a decade high of Rs 15.1 lakh crore. This is reflected in announcements like Google setting up AI data centres in Andhra Pradesh with an announced investment of USD 15 billion.”

"our exporters have diversified to other countries, and due to which our goods exports in April-November are higher than last year in the backdrop of global uncertainty surrounding trade. Going forward, the growth in exports will only rise, and add to GDP." - Link

Securities and Exchange Board of India (SEBI) on a proposal to introduce a 30-day lag for price data usage

“One of the essential elements distinguishing investor education from advice or recommendation is the market data on which educational content is developed.”

“Using live data for educational purposes is clearly outside the scope of pure educational activity, as it involves analysing current data to predict future prices.”

“A uniform 30-day lag is proposed to prevent misuse of price data while keeping educational and awareness content relevant.” - Dive deeper

Ajay Srivastava, Founder, Global Trade Research Initiative, on India’s silver strategy and import risks

“India must learn to process silver from the ore stage for domestic value addition instead of importing finished silver.”

“India should recognise silver as a critical industrial and energy-transition metal and integrate it into its minerals and clean-energy strategy.”

“In a fragmenting global order, securing silver is becoming as important as securing energy, and policy must reflect that shift.” - Link

Jensen Huang, CEO, Nvidia, on H200 chip approvals and China demand

“My expectation is that we’re not expecting any press releases or large declarations; approval will show up through purchase orders.”

“If the purchase orders come, it’s because Chinese customers are able to place them.”

“Customer demand is high; we’ve fired up our supply chain, and H200s are flowing through the line.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

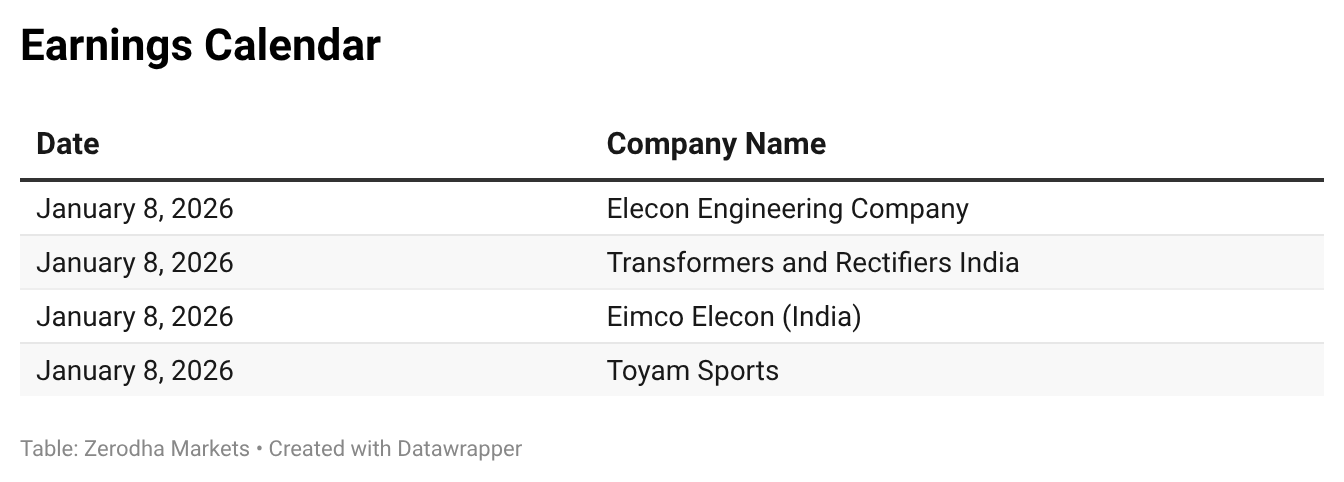

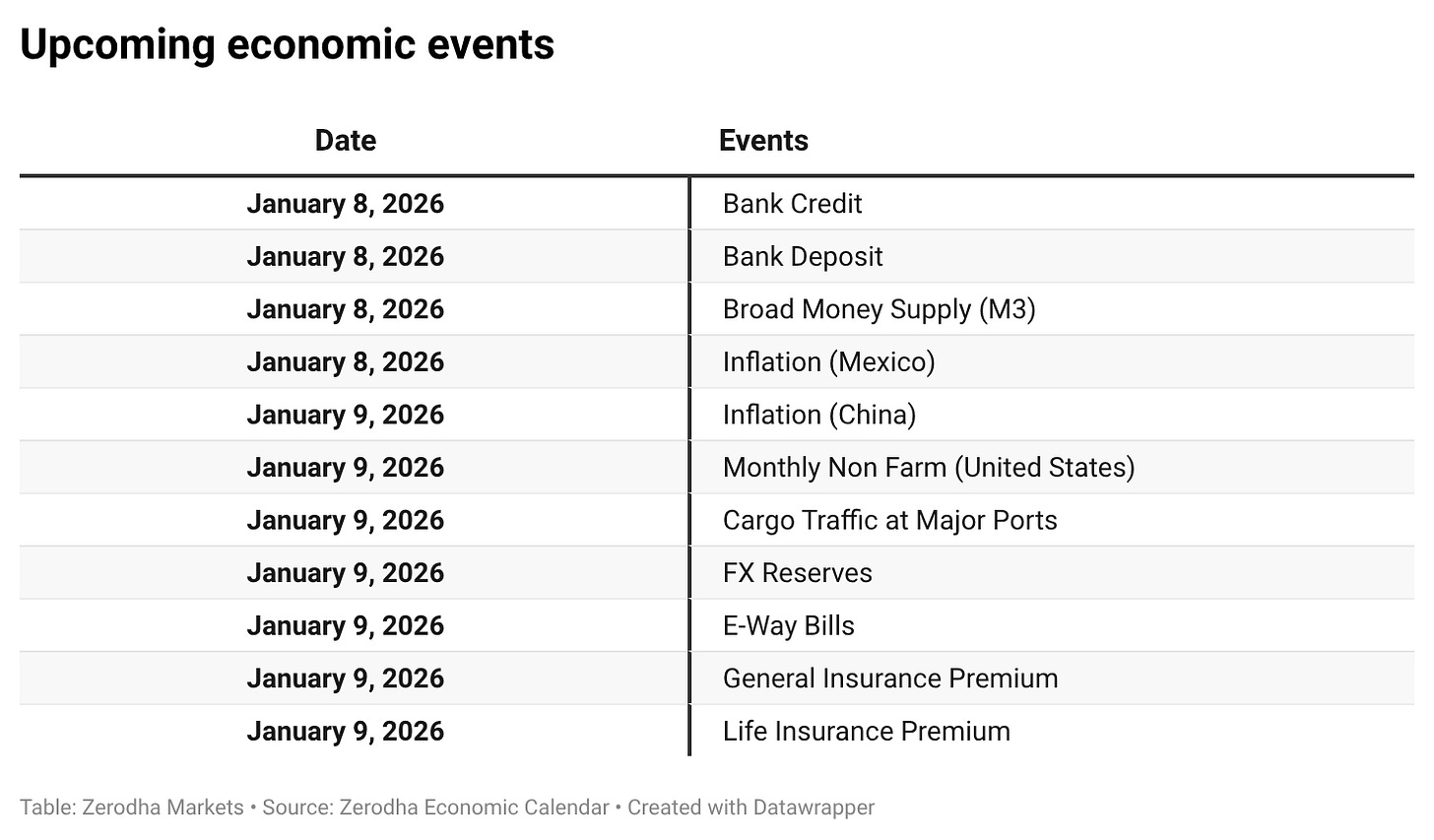

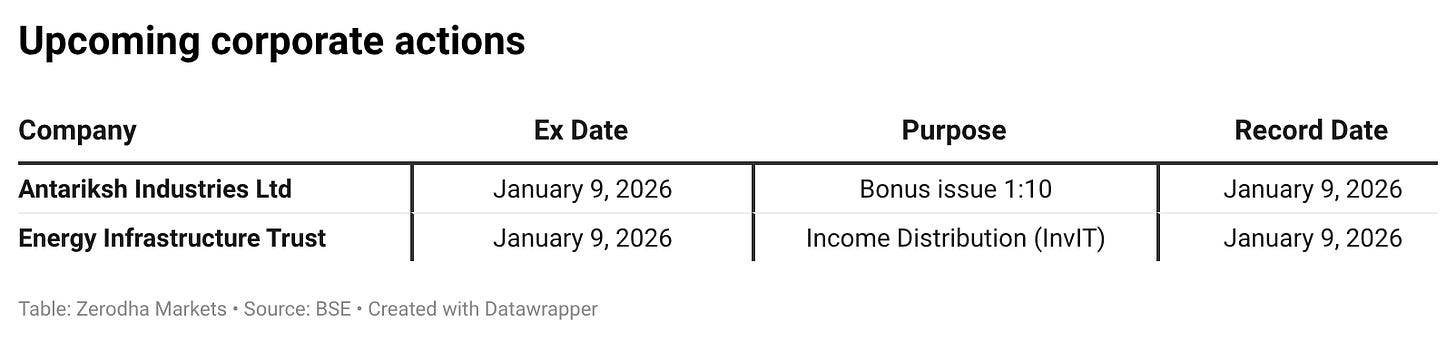

Calendars

In the coming days, we have the following significant events, quarterly results, and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

Headline is red, but the internal structure remains resilient.

The defence of the 26,100 Put base today was significant. We are seeing a classic 'Passing of the Baton'—Banking took a breather, so IT (+1.8%) stepped up to defend the index.

As long as the broader market (Midcaps +0.43%) refuses to crack and 26,050 holds, this remains a time-correction, not a trend reversal.