Nifty cracks below 24,900 as selling pressure intensifies

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we put a few famous Warren Buffett lines back into their original context and explain what they mean for real traders and investors in India today—risk, leverage, sizing, single-stock vs. index exposure, contrarian traps, and the limits of the “circle of competence.” Less slogan, more substance.

Market Overview

Nifty opened with a 22-point gap down at 25,035 and, after an initial uptick, slipped further in the opening hour, moving toward 25,000 as selling pressure weighed on sentiment. Through the morning session, the index remained weak, oscillating in the 25,000–25,030 range before drifting lower by mid-day.

In the second half, attempts at recovery were short-lived as Nifty failed to sustain above 25,000. Selling intensified post 2 PM, dragging the index to an intraday low near 24,880. A mild rebound toward the close helped limit losses, but Nifty eventually settled at 24,890.85, down by 150 points from the opening level.

Market sentiment is gradually shifting from caution to optimism, aided by signs of easing U.S.-India trade tensions. However, concerns over steep 50% tariffs, persistent foreign investor outflows, and muted earnings continue to cap the upside. As we advance, investors will closely track festival season sales and management commentary on demand trends across industries.

Broader Market Performance:

Broader markets had an extremely weak session today. Of the 3,125 stocks traded on the NSE, 912 advanced, 2,123 declined, and 90 remained unchanged.

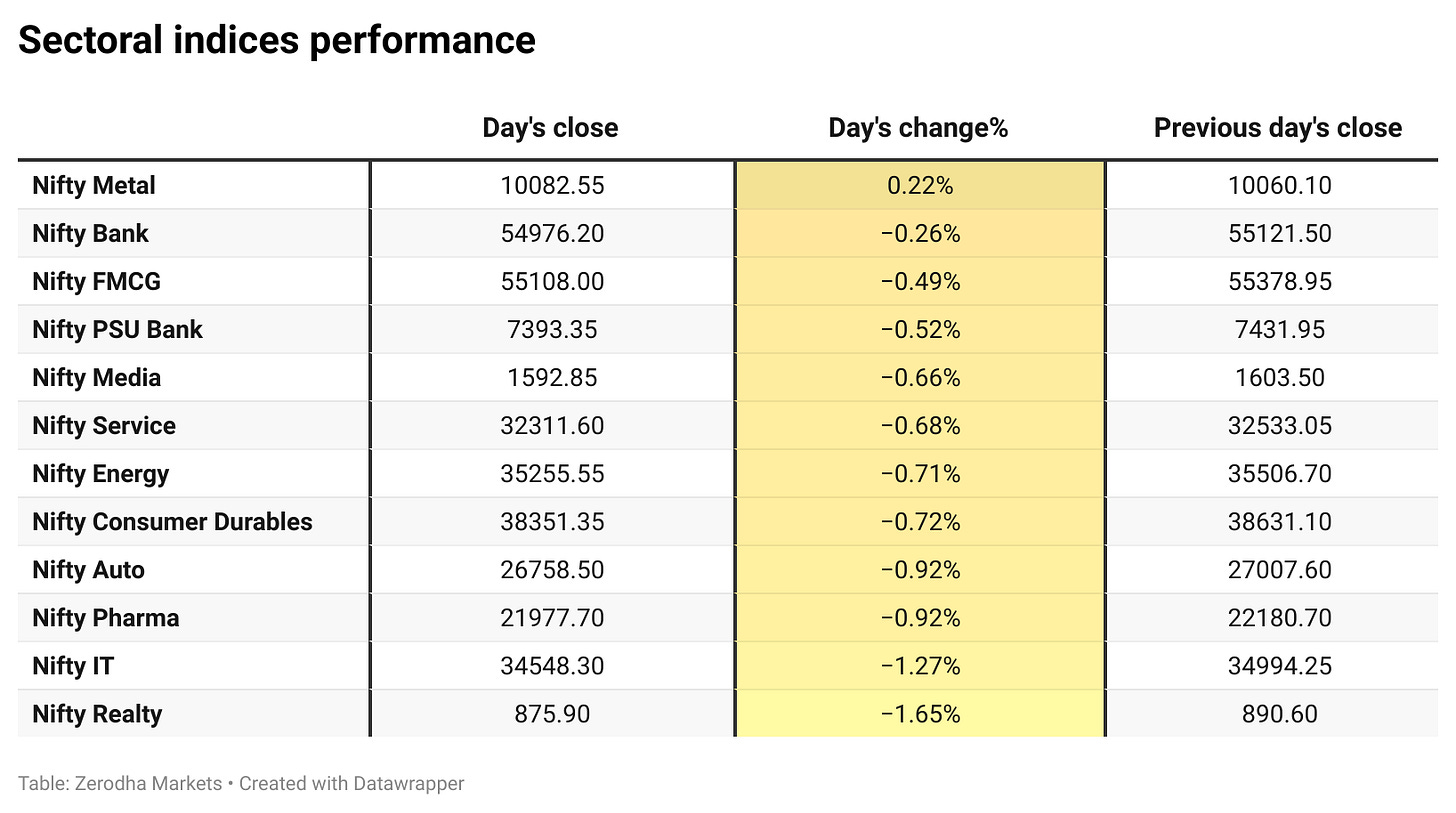

Sectoral Performance

Nifty Metal was the top gainer for the day, rising 0.22%, while Nifty Realty was the worst performer, falling 1.65%. Out of the 12 sectoral indices, only one closed in the green, while the remaining 11 ended in the red, indicating a broad-based market decline.

Here’s the trend of FII-DII activity from the last 5 days:

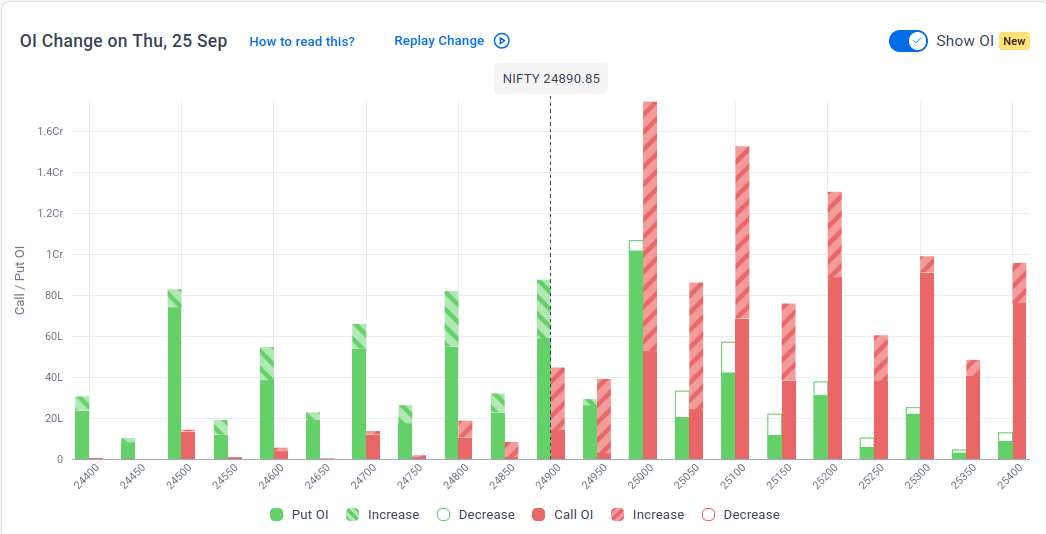

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 30th September:

The maximum Call Open Interest (OI) is observed at 25,000, followed by 25,100, suggesting strong resistance at 25,000 - 25,100 levels.

The maximum Put Open Interest (OI) is observed at 25,000, followed by 24,900, suggesting strong support at 24,800 to 24,700 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

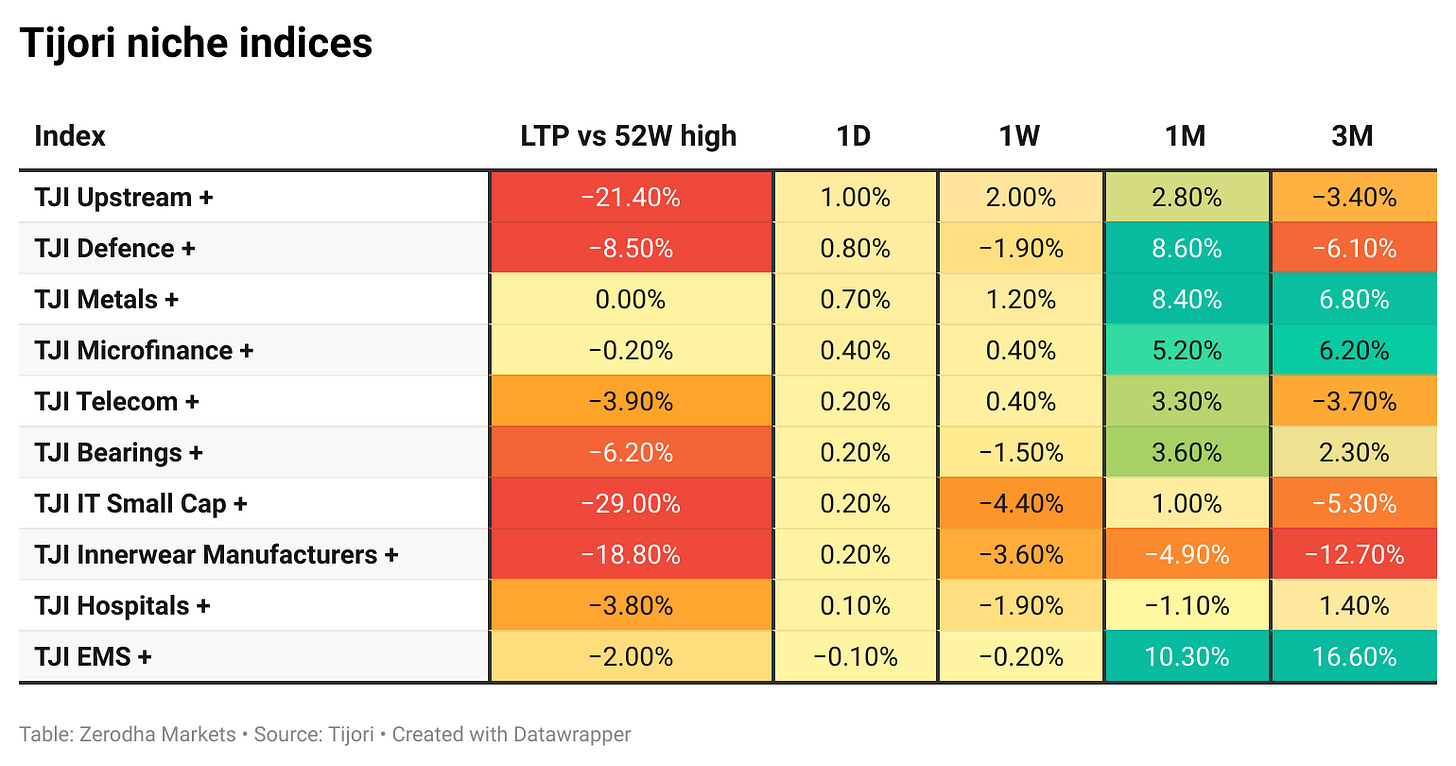

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

The Cabinet approved a ₹69,725 crore package to boost shipbuilding and maritime capacity, extending support schemes and creating dedicated funds. The plan targets 4.5 million gross tonnage capacity, 30 lakh jobs, and ₹4.5 lakh crore in investments. It aims to cut reliance on foreign vessels and position India among the top five shipbuilding nations by 2047. Dive deeper

NSE’s investor base has crossed 12 crore, with women forming one-fourth and 40% under 30. Growth was supported by streamlined KYC, financial literacy, and rising SIP inflows. Dive deeper

RBI has issued new directions mandating tougher authentication for digital payments, effective April 1, 2026. Payment providers and participants must introduce risk-based checks beyond two-factor authentication and ensure interoperability. Issuers are required to adopt dynamic authentication methods and apply additional checks for high-risk and specific cross-border transactions. Dive deeper

CESC has raised Rs 300 crore through a private placement of 30,000 senior secured non-convertible debentures with a face value of Rs 1 lakh each. The debentures will be allotted on September 26, 2025, and mature on September 26, 2028. Dive deeper

Continuum Green Energy will acquire the remaining 26% stake from Clean Energy Investing, marking Morgan Stanley Infrastructure Partners’ full exit after over a decade. The deal consolidates control under founders Vikash Saraf and Arvind Bansal ahead of a planned ₹3,650 crore IPO, with proceeds earmarked for debt repayment, corporate purposes, and subsidiary investments. Dive deeper

JSW Group will raise ₹7,000 crore via zero-coupon NCDs to fund its AkzoNobel India acquisition. The bonds, with a 4-year 7-month tenor and 8.5% IRR, will be issued through JTPM Metal Traders. The total deal, including the open offer, is valued at around ₹12,915 crore. Dive deeper

Lupin has received tentative USFDA approval for its generic HIV treatment Bictegravir, Emtricitabine, and Tenofovir Alafenamide Tablets, a version of Gilead’s Biktarvy. The drug, to be manufactured at its Nagpur facility, targets a US market segment with estimated annual sales of $16.2 billion. Dive deeper

What’s happening globally

Oracle plans to raise $15 billion through corporate bond sales to fund heavy investments in cloud infrastructure amid rising AI demand. The debt will be issued in up to seven parts, with proceeds earmarked for corporate purposes including stock buybacks, debt repayment, and acquisitions. Dive deeper

Gold slipped below $3,740 after touching a record $3,790, as strong US data lowered hopes of Fed rate cuts. Dive deeper

WTI crude futures fell below $65 per barrel after profit-taking, despite a surprise drop in US inventories. Supply risks from Russia and Kurdish export suspensions provided some support. Dive deeper

US new single-family home sales rose 20.5% in August 2025 to an annualized 800K units, the highest since January 2022 and above forecasts. Gains were seen across all regions, led by the Northeast and South, while unsold inventory fell to 490K units. The median sales price increased 4.7% to $413,500. Dive deeper

The US economy grew at an annualized 3.8% in Q2 2025, the strongest since Q3 2023 and above the prior 3.3% estimate. The revision was driven by stronger consumer spending and higher fixed investment, partly offset by weaker net trade and inventory drag. Dive deeper

The Swiss National Bank kept its policy rate at 0% and reiterated its readiness to intervene in FX markets. Inflation remains subdued, projected at 0.2% in 2025 and gradually rising to 0.7% by 2027. Dive deeper

EU passenger car registrations rose 5.3% in August 2025, driven by gains in Spain, Germany, and France, while Italy declined. BEV sales surged 30.2%, led by Spain, Germany, and France. Year-to-date, overall sales were flat, but BEVs grew 12.6% to 1.13 million units. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Union Finance Minister (FM) Nirmala Sitharaman on India’s economic resilience during global uncertainty

“Several favourable factors, such as strong macroeconomic fundamentals, a young demography and greater reliance on domestic demand provide the core strength to the Indian economy to withstand global spillovers and grow at a higher aspirational trajectory”

“Today, as we stand in the last few months, we’ve seen global rating agencies reconsider their view on India,” - Link

Sudhanshu Vats, MD, Pidilite Industries, on taking over as ASCI chairman

“ASCI’s role has never been more important. As advertising evolves with new technologies and formats, our responsibility is to ensure it is executed with integrity, centered around the product promise, respectful of the community, and mindful of consumers.”

“I look forward to working closely with advertisers, agencies, platforms, and consumers to uphold high standards, encourage responsible creativity, and strengthen confidence in advertising. At the heart of this effort is a simple principle: always keep the consumer’s interest front and centre.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!