Nifty cools off; closes below 25,900 after early weakness

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we dig into one of the oldest and most durable ideas in trading: Trend Following. A strategy that doesn’t try to predict the future — but simply follows the price. We trace this philosophy back to Richard Donchian, the father of systematic trend following — long before modern quant funds and algorithms. We also test Donchian strategies — like the 20-day breakout and the 5×20 SMA crossover — directly on the Indian market (Nifty), to see whether these classic systems still hold up.

Market Overview

Nifty opened with a 70-point gap-down at 25,984, weighed down by weak global cues and profit-booking after the recent uptrend. The index extended losses in the first hour, slipping below 25,920, as pressure in heavyweight stocks kept sentiment subdued.

A brief attempt to recover toward 25,980 in late morning trade fizzled out, and Nifty gradually drifted lower through the afternoon, moving into the 25,880–25,900 zone. The weakness persisted for most of the second half, with the index briefly testing 25,850, before a modest rebound in the final hour. Nifty eventually closed at 25,877.85, down 0.67%, marking a day of consolidation after its recent strong run.

Going forward, markets are likely to remain sensitive to developments around the India–U.S. trade deal, while investors track Q2 earnings and management commentary on festive-season demand trends following the recent GST rate cuts.

Broader Market Performance:

Broader markets had a weak session today. Of the 3,178 stocks traded on the NSE, 1,320 advanced, 1,745 declined, and 113 remained unchanged.

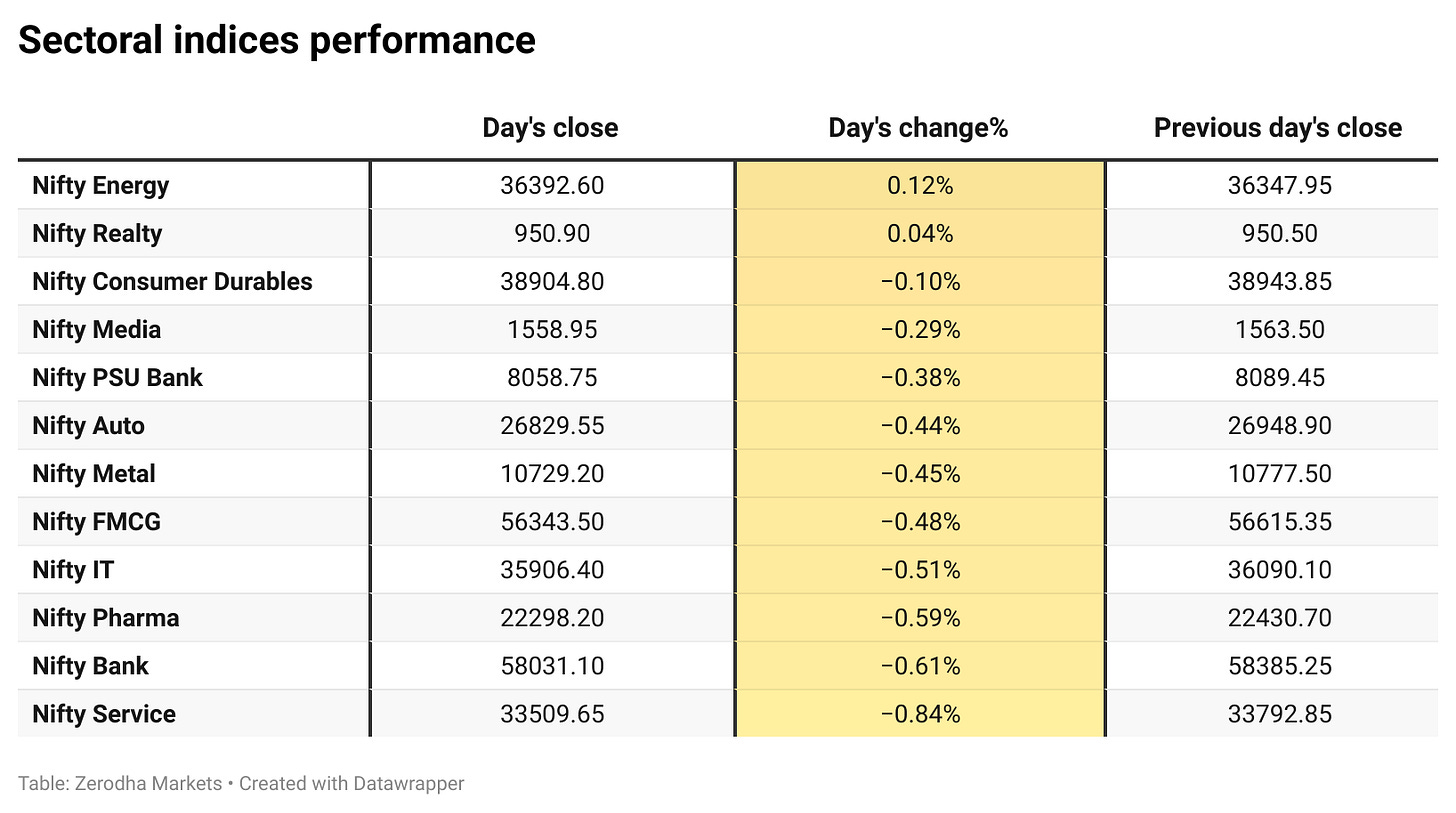

Sectoral Performance:

Nifty Energy emerged as the top gainer, rising 0.12%, while Nifty Service was the biggest loser, slipping 0.84%. Out of the 12 sectoral indices, only 2 closed in the green and 10 ended in the red, reflecting broad-based weakness across the market.

Here’s the trend of FII-DII activity from the last 5 days:

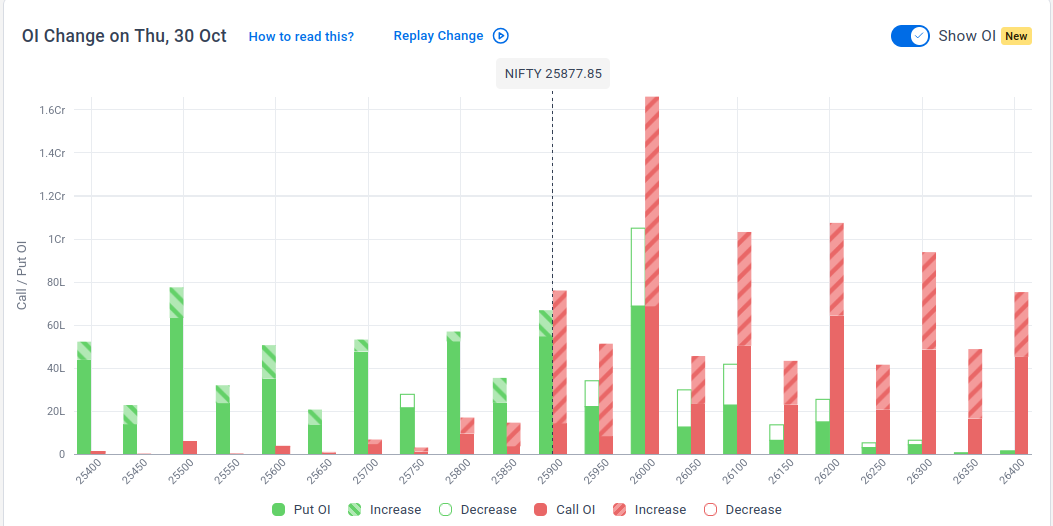

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 4th November:

The maximum Call Open Interest (OI) is observed at 26,000, followed by 26,200, indicating potential resistance at the 26,100 -26,200 levels.

The maximum Put Open Interest (OI) is observed at 25,500, followed by 26,000 & 25,900, suggesting support at the 25,800 to 25,700 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

ITC reported a 3% YoY rise in Q2 FY26 net profit to ₹5,126 crore, while revenue declined 1% to ₹21,256 crore. The FMCG and cigarettes segments grew, while agri and paper businesses faced pricing and import pressures. Dive deeper

Canara Bank’s Q2FY26 net profit rose 19% YoY to ₹4,774 crore, while net interest income dipped 2% to ₹9,141 crore. Asset quality improved, with GNPA at 2.35% and NNPA at 0.54%. Dive deeper

Shriram Properties signed a Joint Development Agreement to develop a ₹700 crore premium housing project in Hinjewadi, Pune, spanning 0.7 million sq. ft. This marks the company’s second project in the city. Dive deeper

Swiggy reported a consolidated net loss of ₹1,092 crore in Q2 FY26, up from ₹626 crore a year ago, while revenue rose 54% YoY to ₹5,561 crore. The company plans to raise ₹10,000 crore via a QIP to strengthen its balance sheet. Dive deeper

Groww will launch its IPO from November 4 to 7, 2025, aiming for an $8 billion valuation. The issue includes a ₹1,060 crore fresh issue and an OFS of 55.72 crore shares by existing investors. Dive deeper

Orkla India, the parent company of MTR Foods, Eastern Condiments, and Rasoi Magic, launched a ₹1,667 crore IPO that closes on October 31, 2025. The offer is a complete offer for sale (OFS) by Norway’s Orkla ASA, valuing the firm at around ₹10,000 crore with a price band of ₹695–₹730 per share. Dive deeper

Larsen & Toubro (L&T) reported a 16% year-on-year rise in consolidated net profit to ₹3,926 crore for Q2 FY26, with revenue up 10% to ₹67,984 crore. The company also reached an in-principle agreement with the Telangana government to divest its stake in L&T Metro Rail (Hyderabad). - Dive deeper

NMDC reported a 33% rise in standalone net profit to ₹1,694.7 crore for Q2 FY26, with revenue from operations up 30% year-on-year to ₹6,260.85 crore. Dive deeper

PB Fintech reported a 165% YoY jump in Q2 FY26 net profit to ₹135 crore, driven by strong insurance growth, while revenue rose 38% to ₹1,614 crore. Shares surged 5% after the results, with margins doubling to 10%. Dive deeper

What’s happening globally

The Federal Reserve cut the federal funds rate by 25 bps to 3.75% - 4.00% at its October 2025 meeting, citing rising employment risks and still-elevated inflation. It also announced plans to end balance sheet reduction on December 1. Dive deeper

Brent crude oil fell toward $64 per barrel on Thursday as the Trump-Xi summit ended without energy discussions, while markets awaited the November 2 OPEC+ meeting amid expectations of a possible output hike. Dive deeper

Gold prices rose to around $3,990 per ounce on Thursday, supported by a 28% quarterly increase in central bank purchases to 220 tons, according to the World Gold Council. Dive deeper

The Eurozone economy grew 0.2% quarter-on-quarter in Q3 2025, up from 0.1% in Q2 and above expectations, while annual growth stood at 1.3%. France and Spain led gains, offsetting stagnation in Germany and Italy, signaling continued resilience despite global uncertainties. Dive deeper

The Bank of Japan held its benchmark rate at 0.5% in October 2025, the highest since 2008, with a 7-2 vote. It maintained its FY 2025 core inflation forecast at 2.7% and reaffirmed a gradual tightening path. Dive deeper

Samsung Electronics reported a 32% year-on-year rise in Q3 profit, driven by strong AI-led demand for memory chips, and plans to invest 40.9 trillion won in semiconductor facilities this year. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Sunil Subramaniam, MD & CEO, Sundaram Mutual Fund, on SEBI’s fee cut proposal

“SEBI’s move to reduce mutual fund costs and cap brokerage fees is a long-term positive for the industry as it will expand participation and improve investor returns.”

“The current market reaction is a short-term overreaction, and quality AMCs and brokers will adapt easily, making this a good buying opportunity.”

“While smaller distributors may feel some pressure, the overall outcome will be stronger and more efficient growth across the mutual fund ecosystem.” - Link

Vinay Dube, CEO, Akasa Air, on IPO timeline and growth plans

“Akasa Air aims to launch its IPO within the next 2 to 5 years as part of our long-term growth strategy.”

“We’re well-capitalized following the $125 million investment from Premji Invest, Claypond Capital, and 360 ONE Asset, and are focused on scaling operations despite aircraft delivery delays and pilot shortages.” - Link

Poonam Gupta, Deputy Governor, Reserve Bank of India, on forex management and monetary policy outlook

“Our approach of building forex reserves and intervening to smooth volatility has delivered better results than the IMF’s hands-off model for emerging markets.”

“Excessive exchange rate volatility is not desirable; holding buffers ensures stability and resilience in uncertain global conditions.”

“There’s room to ease monetary policy, as inflation remains benign and growth, though steady at 6.50-6.8%, is still below India’s potential and aspirations.” - Link

Chetan Shah, Chairman, Solex Energy, on expansion plans and funding strategy

“Solex Energy plans to raise ₹500 crore via QIP and ₹1,000 crore in debt to fund a ₹1,400 crore expansion project.”

“We’re setting up a 2.2 GW solar cell plant and adding 2.5 GW of module capacity, aiming to reach 10 GW in both by 2030.”

“Land, approvals, and technology tie-ups are already in place, and we expect the cell facility to be completed by March 2027.” - Link

Sundar Pichai, CEO, Alphabet Inc., on Q3 results and AI-led growth

“Alphabet delivered a landmark quarter with revenue crossing $100 billion for the first time, reflecting double-digit growth across Search, YouTube, and Cloud.”

“Our strong performance underscores how AI is powering every part of our business, from Search and Ads to Cloud and Gemini.”

“With Gemini now reaching over 650 million users, we’re shipping AI at scale and investing heavily in data centers and computing power to meet global demand.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

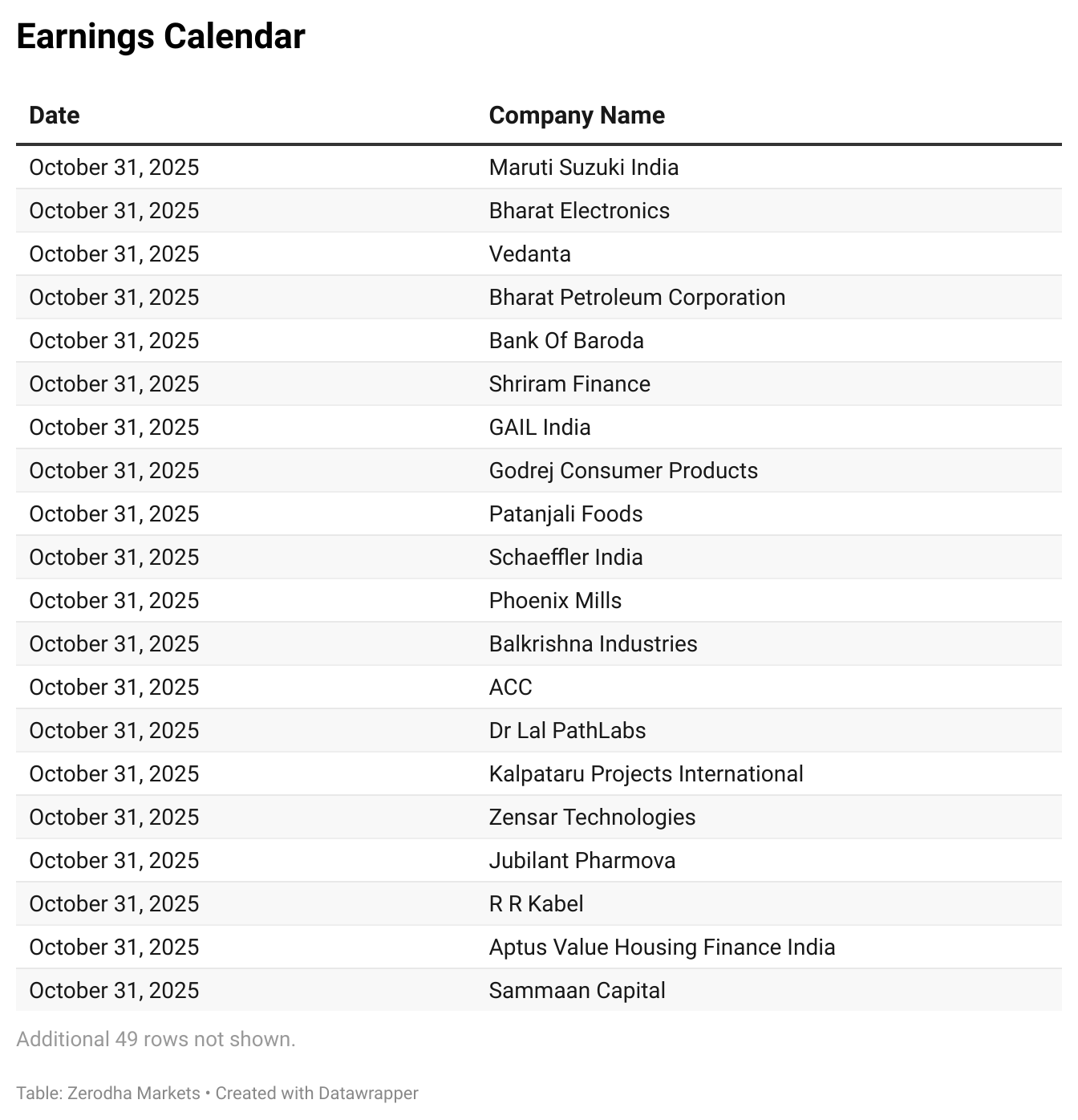

Calendars

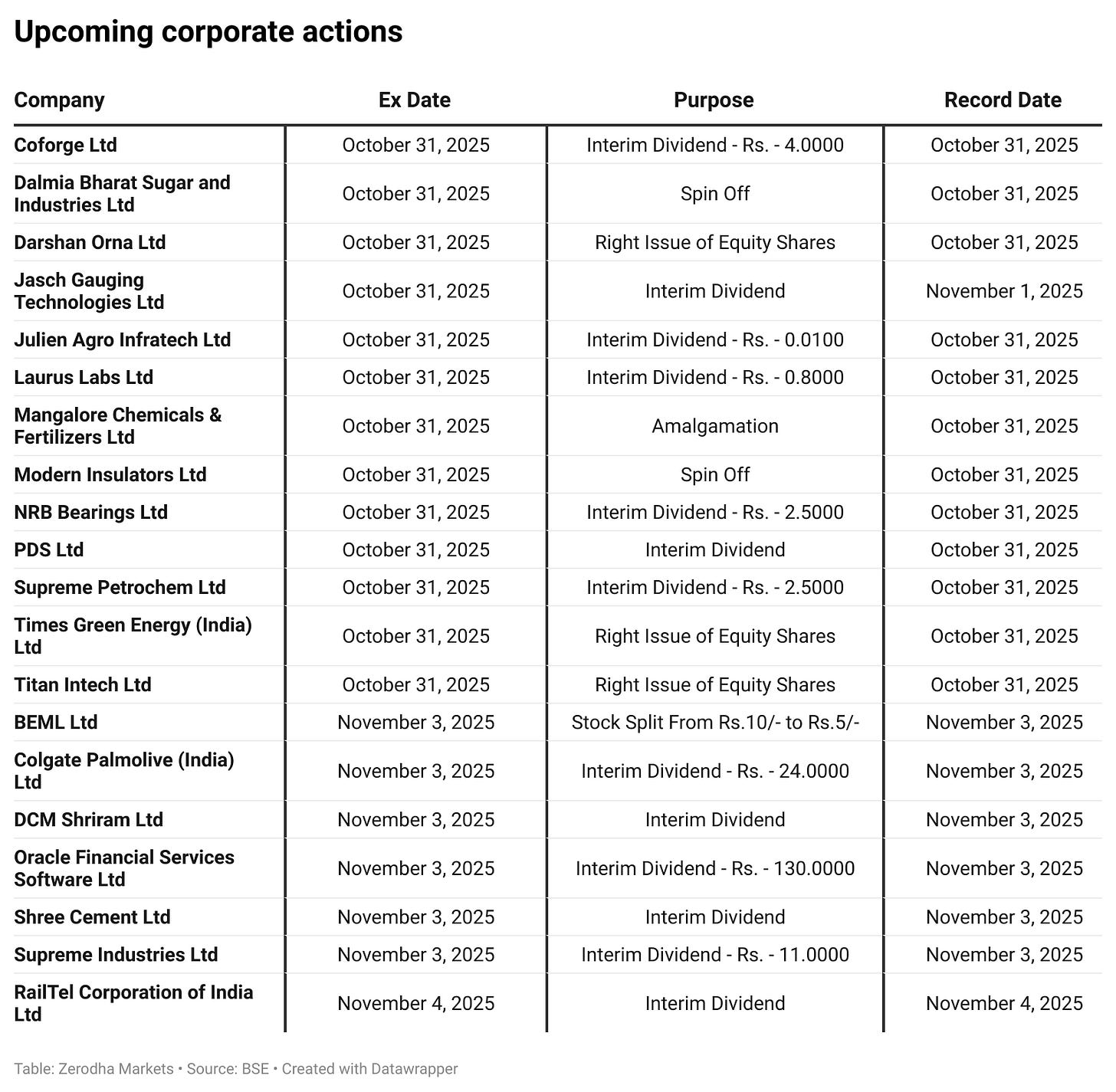

In the coming days, we have the following quarterly results, significant events, and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

Excellent coverage.

Today’s session perfectly captured the tug-of-war between weak global sentiment and domestic resilience.

Interesting times — next few sessions will show whether 25,850 acts as a real floor or not.