Nifty cools off after recent rally; consolidates near 25,800

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we explore how culture and psychology shape our views on debt and risk — from Airbnb’s founders maxing out credit cards to Bruce Kovner’s first leveraged trade.

We’ll break down secured vs unsecured loans, the real math behind borrowing to trade, and why beating loan interest consistently is harder than most think.

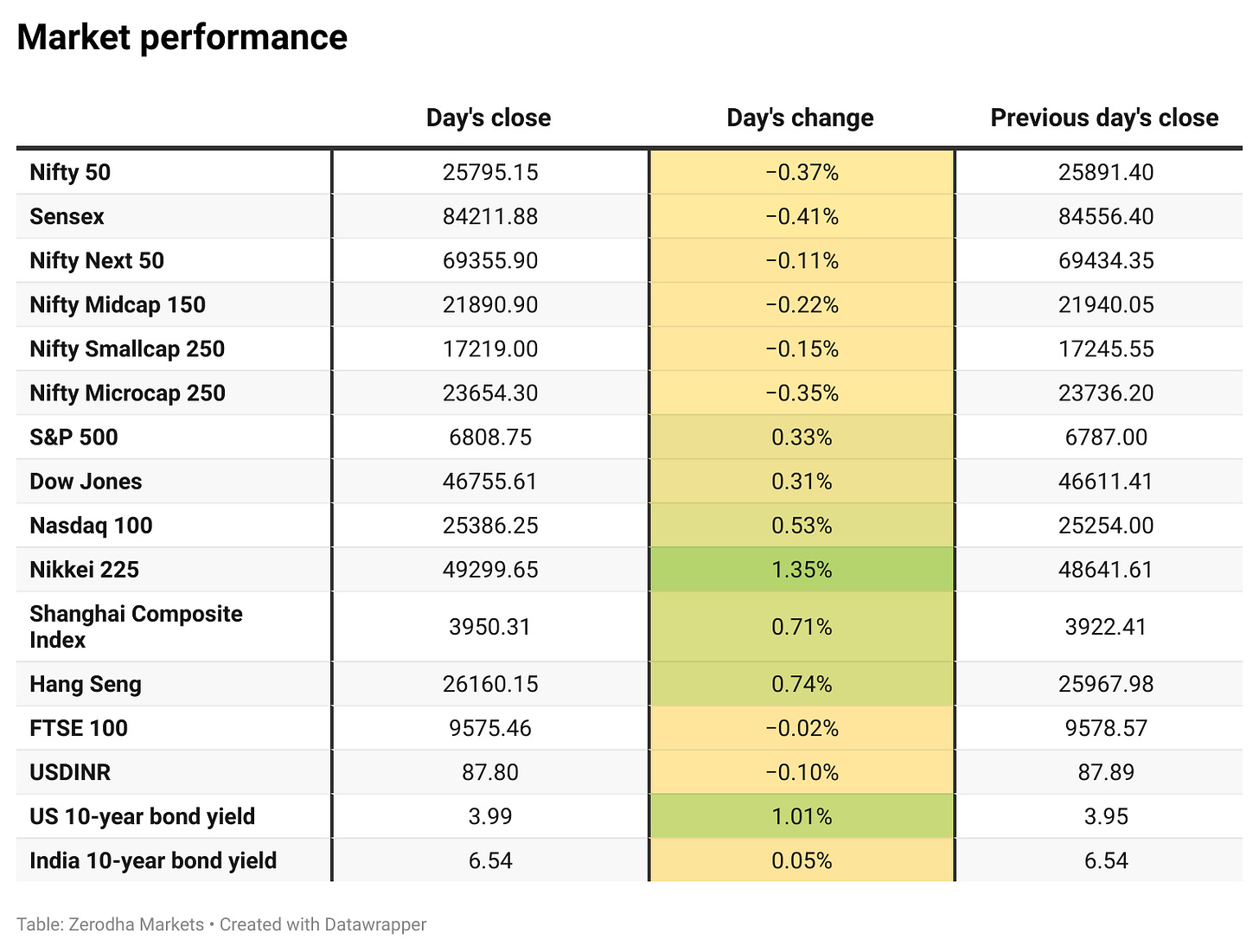

Market Overview

Nifty opened with a 45-point gap-up at 25,935, extending the positive sentiment from Thursday’s close. However, the index failed to sustain at higher levels and slipped below 25,900 within the first half hour amid weakness in banking and FMCG stocks. Through the morning session, Nifty remained volatile, moving in a tight range between 25,820 and 25,870.

By midday, selling pressure intensified, dragging the index below 25,800, with the index extending its decline to test the 25,720 zone, marking the day’s low before staging a recovery in the last 30 minutes. Despite the late bounce, the index closed at 25,795.15, down by 0.37%, reflecting broad-based weakness and end-of-week consolidation. Overall, markets took a breather after the recent rally, with traders locking in gains ahead of the weekend.

Going forward, markets are likely to remain sensitive to developments around the trade deal, while investors will closely track Q2 earnings and management commentary on festive season demand trends following the recent GST rate cuts.

Broader Market Performance:

Broader markets had a weak session today. Of the 3,179 stocks traded on the NSE, 1,233 advanced, 1,847 declined, and 99 remained unchanged.

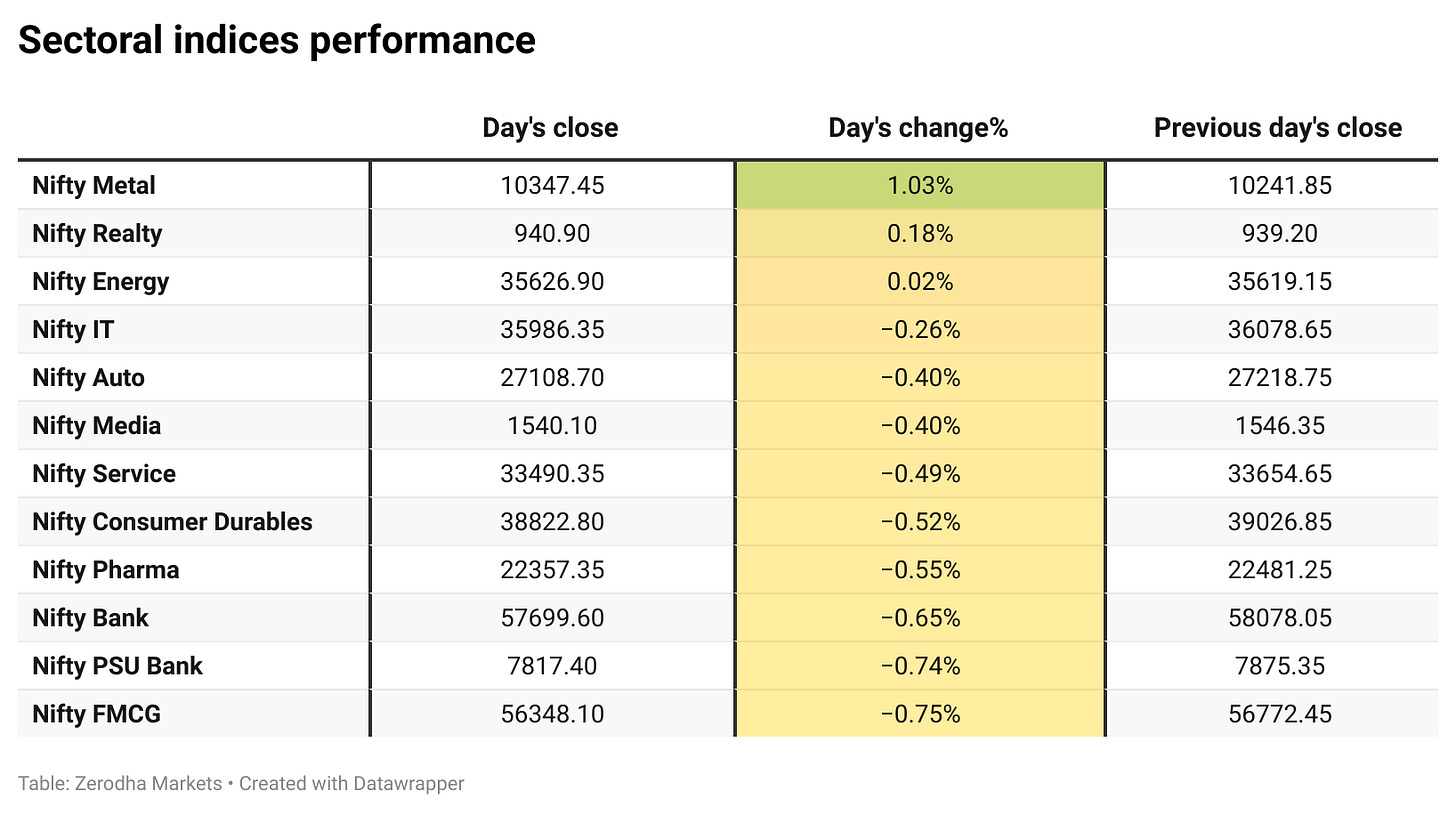

Sectoral Performance

Nifty Metal led the gains with a 1.03% rise, while Nifty FMCG was the biggest loser, slipping 0.75%. Out of the 12 sectoral indices, 3 ended in the green and 9 closed in the red, indicating broad-based weakness across the market.

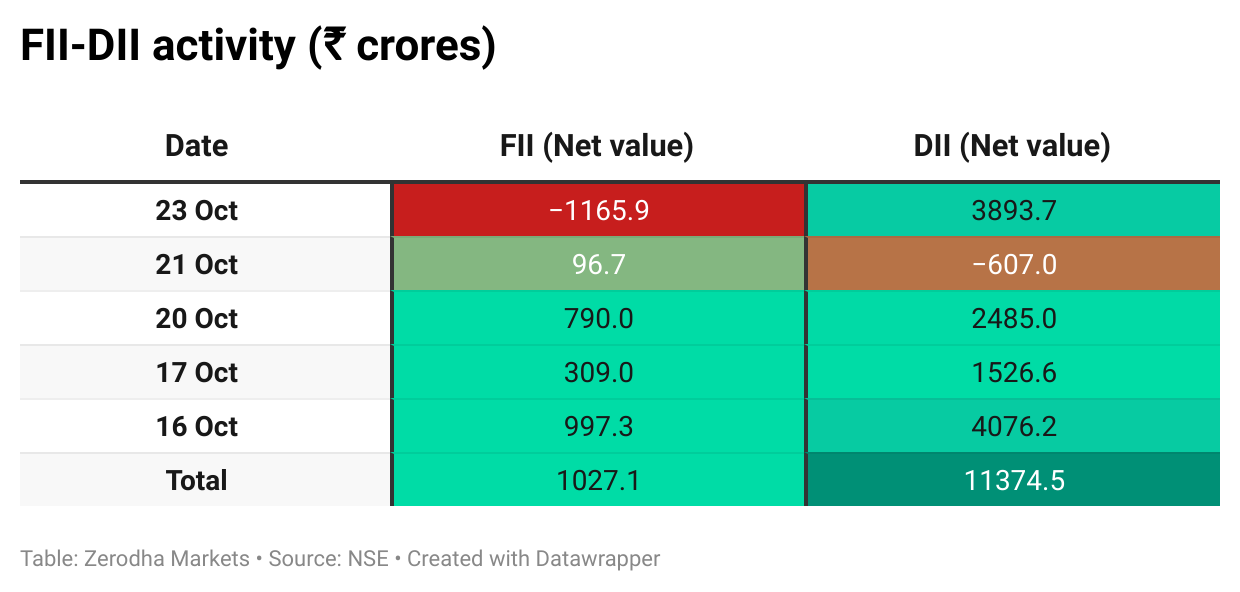

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 28th October:

The maximum Call Open Interest (OI) is observed at 26,000, followed by 26,100 & 26,200, indicating potential resistance at the 26,000 -26,100 levels.

The maximum Put Open Interest (OI) is observed at 25,500, followed by 25,700, suggesting support at the 25,700 to 25,600 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

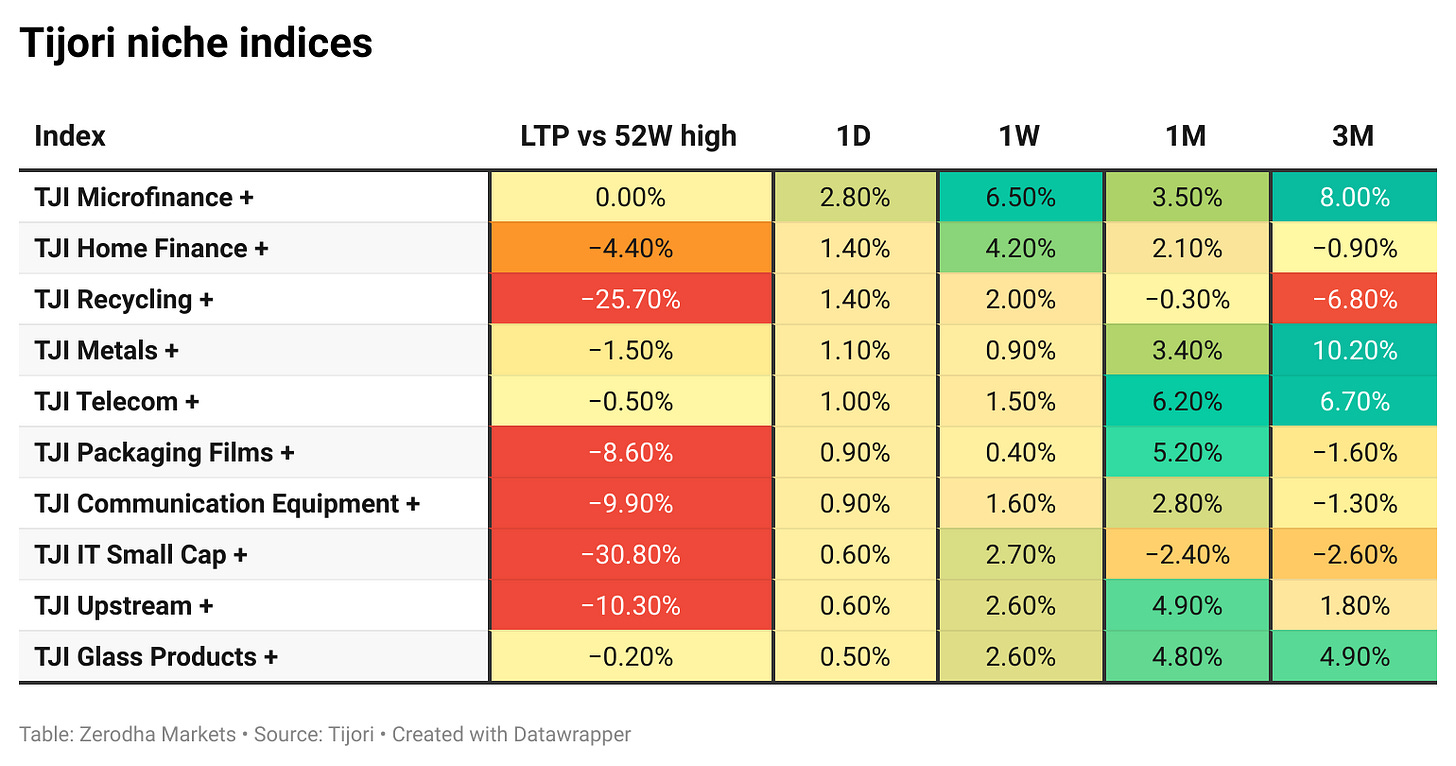

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

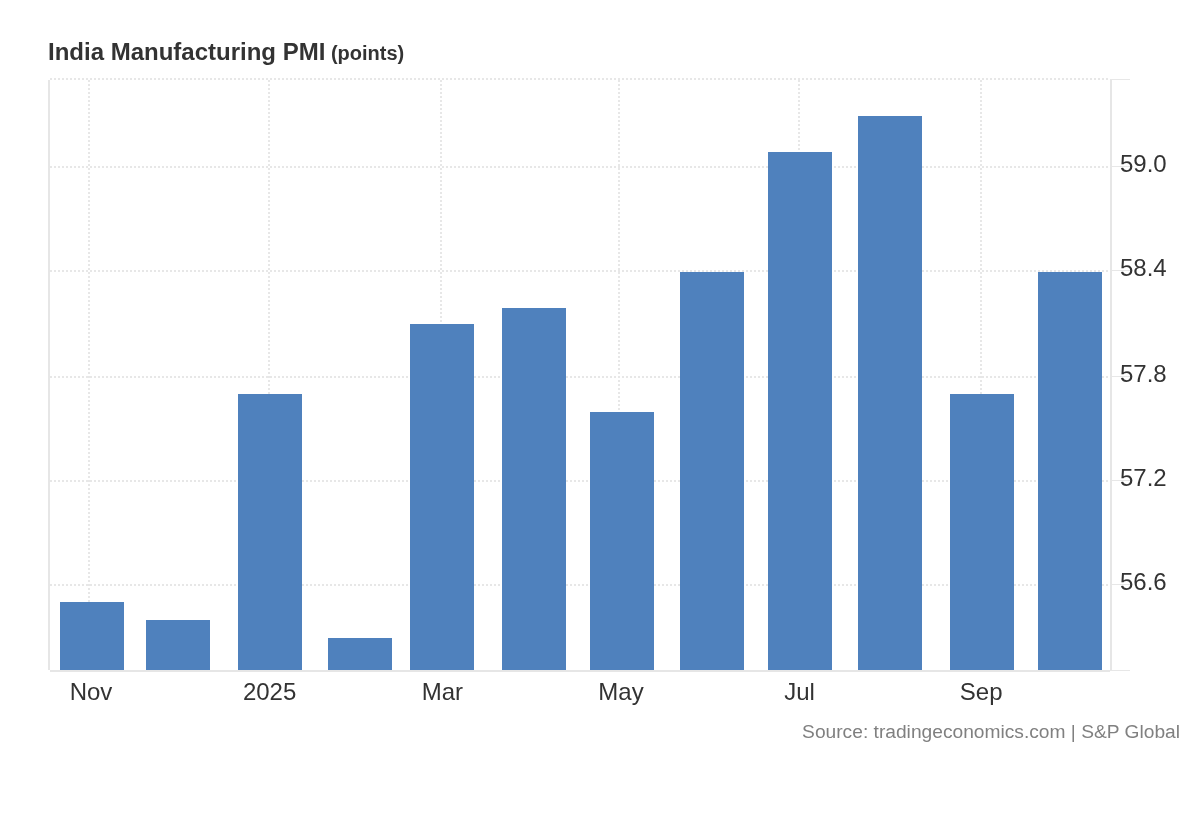

The HSBC India Manufacturing PMI rose to 58.4 in October from 57.7 in September, indicating strong factory growth driven by higher new orders and steady export demand, while input costs eased amid GST relief. Dive deeper

The HSBC India Services PMI fell to 58.8 in October from 60.9 in September, marking the slowest growth since May amid softer sales and weather-related disruptions, though business sentiment stayed positive. Dive deeper

The HSBC India Composite PMI fell to 59.9 in October from 61.0 in September, the lowest since May, as growth in new orders and employment slowed, while business confidence weakened slightly amid softer demand. Dive deeper

Coforge’s Q2 net profit rose 86% YoY to ₹376 crore, while revenue increased 32% to ₹3,986 crore. EBITDA grew 48% YoY to ₹728 crore with an 18.3% margin, and the board declared an interim dividend of ₹4 per share. Dive deeper

SEBI has proposed mandating KYC verification before opening new mutual fund folios to prevent non-compliant cases. Folios will be opened only after KRAs verify documents, with investors updated at each stage. Comments are open until November 14, 2025. Dive deeper

The RBI has proposed mandating a Unique Transaction Identifier (UTI) for all over-the-counter derivative transactions involving rupee interest rates and foreign exchange from April 1, 2026. The move aims to enhance transparency and regulatory oversight, with comments on the draft invited until November 14, 2025. Dive deeper

SEBI introduced a new framework allowing portfolio managers to transfer their PMS business to another manager with prior approval. Transfers can be full or partial within the same group, while cross-group transfers must cover the entire business and meet all regulatory obligations. Dive deeper

Bondada Engineering secured a ₹1,050 crore contract from Adani Group for a 650 MW solar project at Khavda in Gujarat, covering design, engineering, and supply work. Dive deeper

SEBI has proposed easing the geo-tagging rule for NRI clients by removing the need for them to be physically present in India during digital KYC or re-KYC. Intermediaries must still verify GPS details with the client’s address, and comments are open until November 13, 2025. Dive deeper

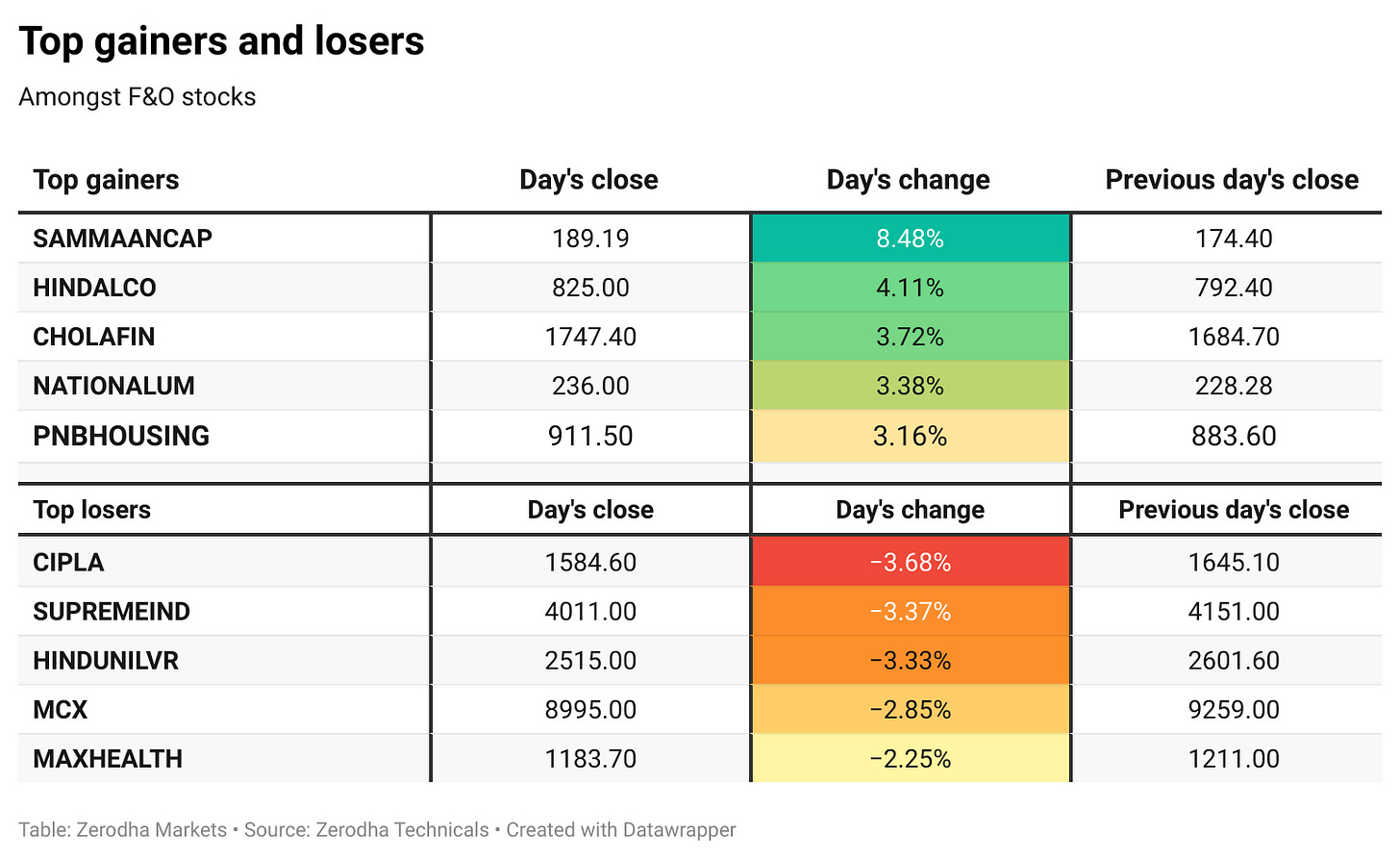

Cipla signed an agreement with Eli Lilly to market its weight-loss drug in India under the brand name Yurpeak, expanding Cipla’s presence in the obesity treatment segment. Dive deeper

Colgate-Palmolive India’s Q2 net profit fell 17% YoY to ₹328 crore, with revenue down 6% to ₹1,507 crore due to GST rate revisions on oral care products. The company declared an interim dividend of ₹24 per share. Dive deeper

Orkla India, the parent of MTR Foods, has set its IPO price band at ₹695–₹730 per share, targeting a valuation of ₹10,000 crore. The IPO opens for retail investors on October 29, with anchor bids on October 28. Dive deeper

Hero MotoCorp entered the UK market through a partnership with MotoGB, launching its Euro 5+ Hunk 440 motorcycle. This marks the company’s 51st international market as it continues expanding its presence across Europe. Dive deeper

Federal Bank approved issuing ₹6,196 crore worth of convertible warrants to Blackstone’s Asia II Topco XIII, enabling the private equity firm to acquire up to a 9.99% stake in the bank, subject to shareholder approval. Dive deeper

Dr Reddy’s Laboratories reported a 7% YoY rise in Q2 net profit to ₹1,347 crore, while revenue grew 10% to ₹8,828 crore. Growth was driven by strong performance in Europe and India, offsetting pricing pressure in North America. Dive deeper

What’s happening globally

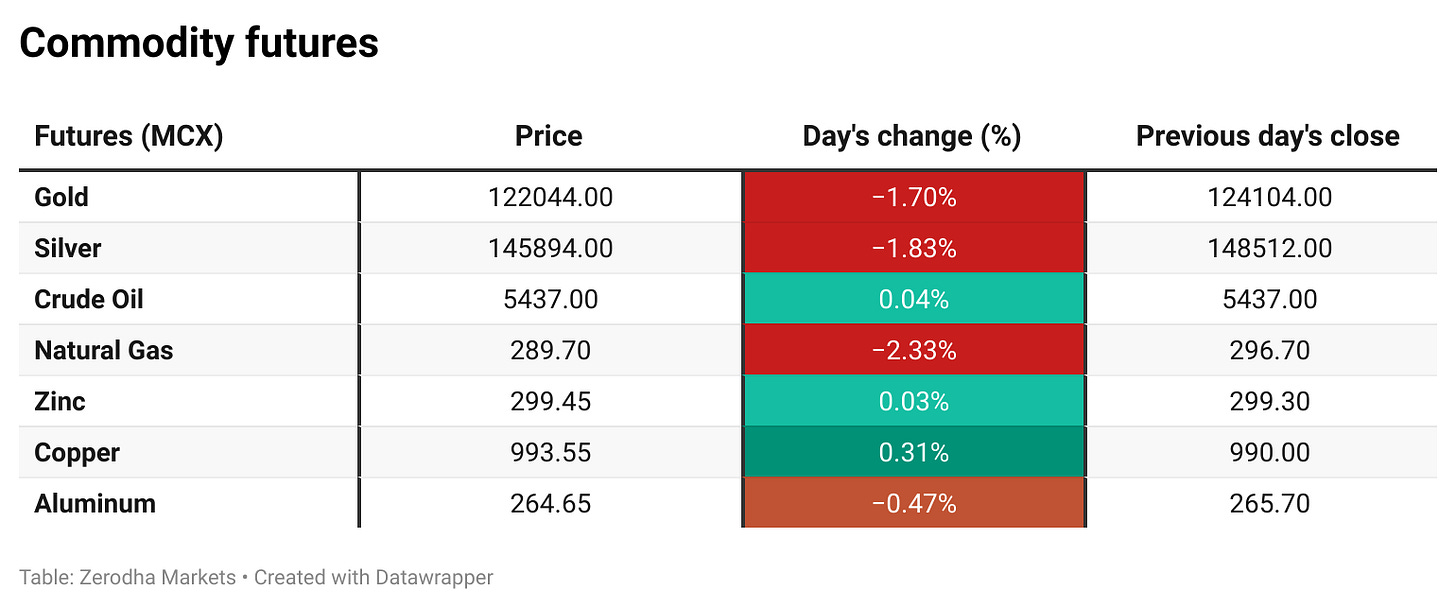

WTI crude oil rose above $61 per barrel, nearing a two-week high, after the US imposed sanctions on Russian oil giants Rosneft and Lukoil, fueling supply concerns amid reports of reduced purchases by Chinese and Indian refiners. Dive deeper

Gold prices stayed below $4,100 per ounce after weaker US CPI data boosted expectations of lower interest rates, ending a nine-week winning streak. Dive deeper

The S&P Global US Manufacturing PMI rose to 52.2 in October from 52.0 in September, indicating continued improvement in factory conditions. Dive deeper

The S&P Global US Composite PMI rose to 54.8 in October from 53.9 in September, the highest since July, indicating faster business activity growth across manufacturing and services despite tariff and cost pressures. Dive deeper

The US annual inflation rate rose to 3% in September from 2.9% in August, below expectations of 3.1%, while core inflation eased to 3%, indicating moderating price pressures despite higher energy costs. Dive deeper

The Bank of Russia cut its key interest rate by 50 bps to 16.5%, marking a fourth straight reduction, while warning that policy will stay tight amid elevated inflation risks from high food and fuel prices and upcoming VAT hikes. Dive deeper

The US trade deficit widened to $78.3 billion in July from $59.1 billion in June, the largest in four months, as imports surged 5.9% while exports rose only 0.3%, driven by higher purchases of gold, electronics, and transport equipment. Dive deeper

The IMF urged Asian nations to cut non-tariff barriers and boost regional trade integration to reduce vulnerability to US tariffs and global shocks, noting that deeper intra-Asian trade could buffer the region against external disruptions. Dive deeper

Tesla shares fell 4% after reporting a fourth straight profit miss despite record sales, as rising costs, higher tariffs, and lower regulatory credit revenue pressured margins. The company faces near-term headwinds but continues to bet on future growth through robotics and AI. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Piyush Goyal, Commerce & Industry Minister, on India’s trade strategy

“India does not do trade deals in a hurry or with a gun to our head. Our negotiations are guided purely by national interest.”

“We are in active dialogue with the EU and the U.S., but every agreement must be long-term and strategic, not driven by deadlines or external pressure.”

“India has never chosen its friends based on coercion. Whether it is the EU, the U.S., or Kenya, our partnerships are determined by what serves our national and economic interests best.” - Link

Finance Minister Nirmala Sitharaman on easing GST compliance

“GST officials should use technology and system-based checks instead of burdening taxpayers with excessive paperwork.”

“Technology and risk-based parameters must do the heavy lifting, not the taxpayers. No field officer should add an extra onus on them.”

“From November 1, simplified GST registration will automatically apply to small taxpayers and low-risk applicants, benefiting 96% of new registrants.”

“Officials must ensure GST Seva Kendras are well-staffed and accessible to provide timely and quality assistance to taxpayers.” - Link

Grant Thornton Bharat on India’s real estate fundraising surge

“India’s real estate sector raised $1.15 billion through capital markets in July-September, more than doubling from the previous quarter.”

“The quarter saw 42 deals worth $2.85 billion across M&A, private equity, and capital markets, with strong rebounds in both PE and IPO activity.”

“Capital market momentum was led by nine deals, including Sattva Group and Blackstone-backed Knowledge Realty Trust’s $547 million IPO, which accounted for 68% of total issue value.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

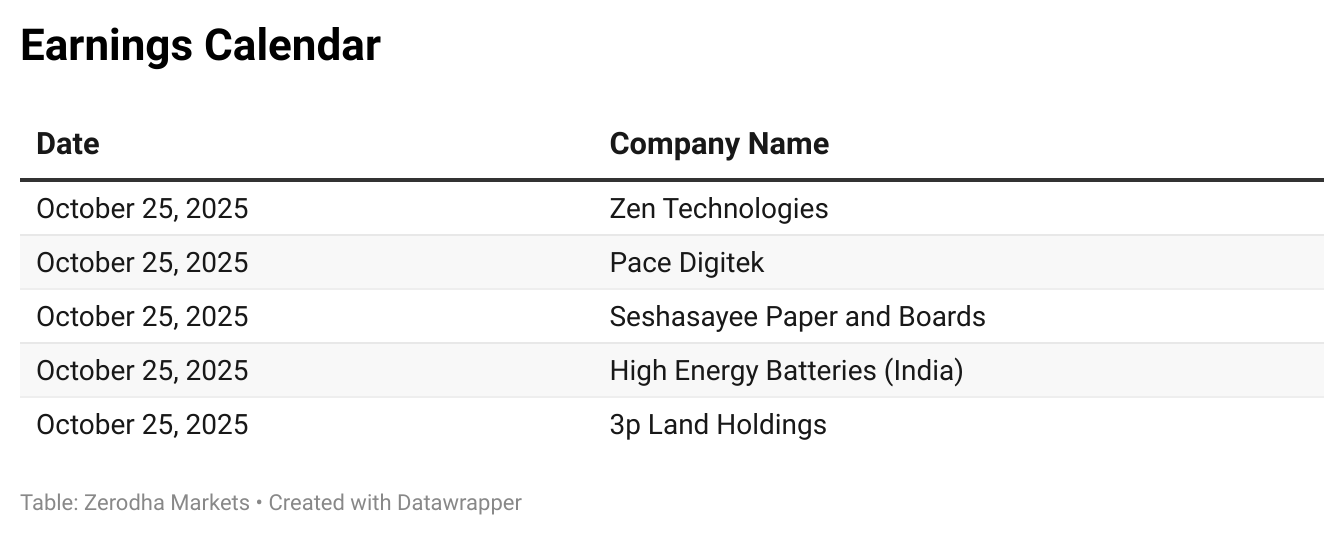

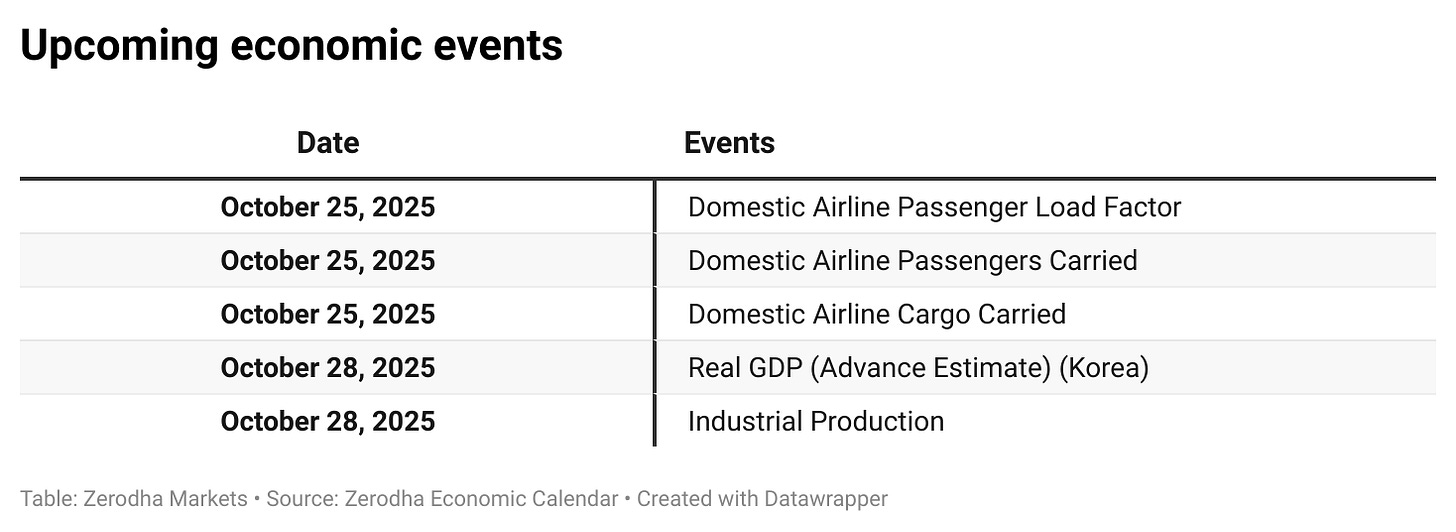

Calendars

In the coming days, we have the following quarterly results, significant events, and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

Thanks for writing this, it clarifies a lot. This detailed analysis of Nifty’s consolidation perfectly complements your insights from the 'In The Money' series on risk perception. Undestandig the broader psychological underpinings makes these market movements much more coherent. A very insightful wrap-up.