Nifty continues its slide below 24,700 as pharma tariffs hit sentiment

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we put a few famous Warren Buffett lines back into their original context and explain what they mean for real traders and investors in India today—risk, leverage, sizing, single-stock vs. index exposure, contrarian traps, and the limits of the “circle of competence.” Less slogan, more substance.

Market Overview

Nifty opened with a 72-point gap-down at 24,819, reacting to U.S. President Trump’s announcement of fresh tariffs on the pharma sector. The index slipped further in early trade, testing 24,780 within the first hour, and remained under pressure through the morning session.

By mid-day, Nifty consolidated in a narrow band between 24,760 and 24,800 but failed to generate any meaningful recovery. In the second half, weakness deepened as the index drifted below 24,700, hitting an intraday low near 24,630 by 2:30 PM. A late rebound helped trim some losses, and Nifty eventually closed at 24,654.70, down nearly 236 points from the previous close.

Market sentiment is gradually shifting from caution to optimism, aided by signs of easing U.S.-India trade tensions. However, concerns over steep 50% tariffs, persistent foreign investor outflows, and muted earnings continue to cap the upside. As we advance, investors will closely track festival season sales and management commentary on demand trends across industries.

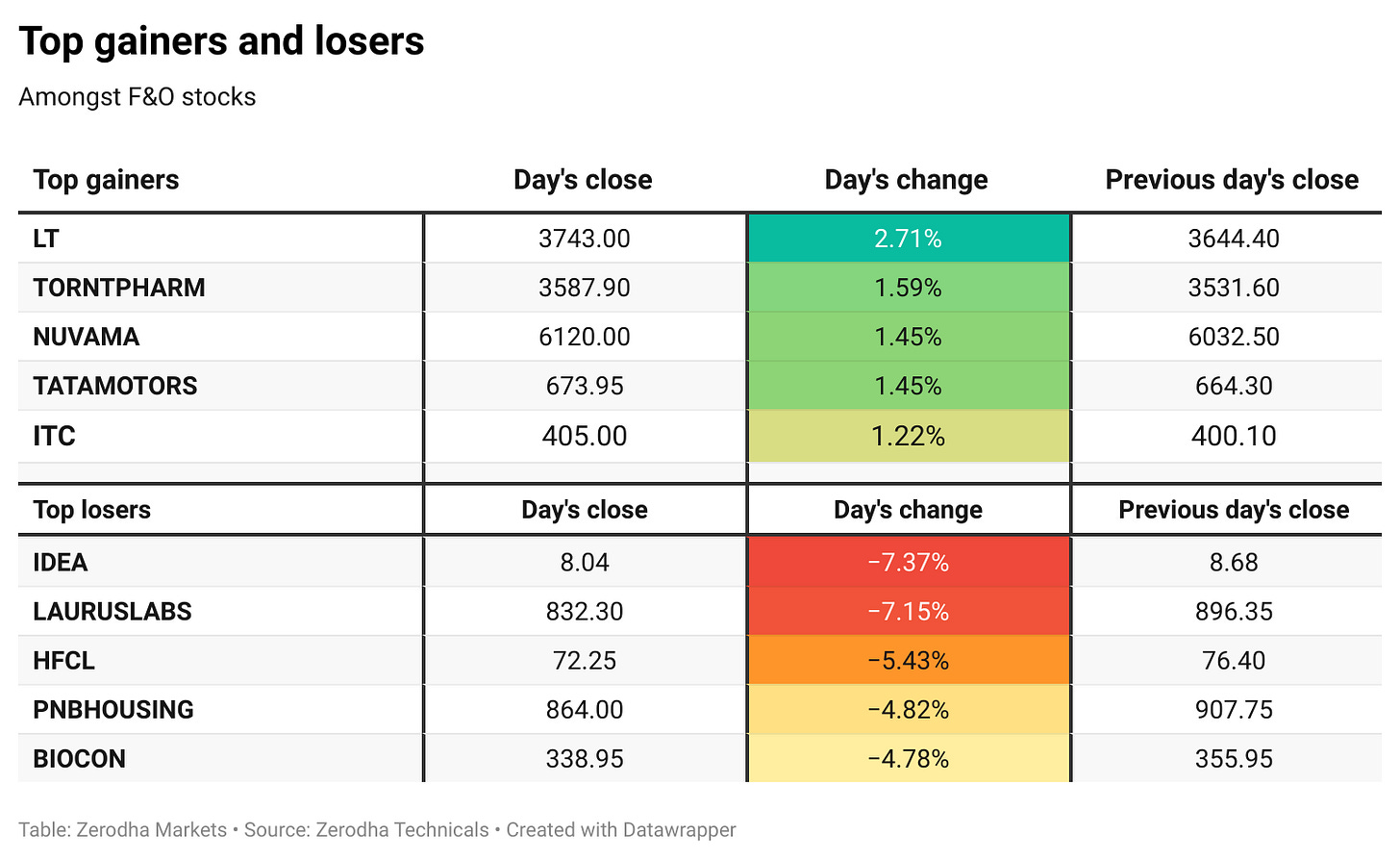

Broader Market Performance:

Broader markets had an extremely weak session today. Of the 3,138 stocks traded on the NSE, 627 advanced, 2,424 declined, and 87 remained unchanged.

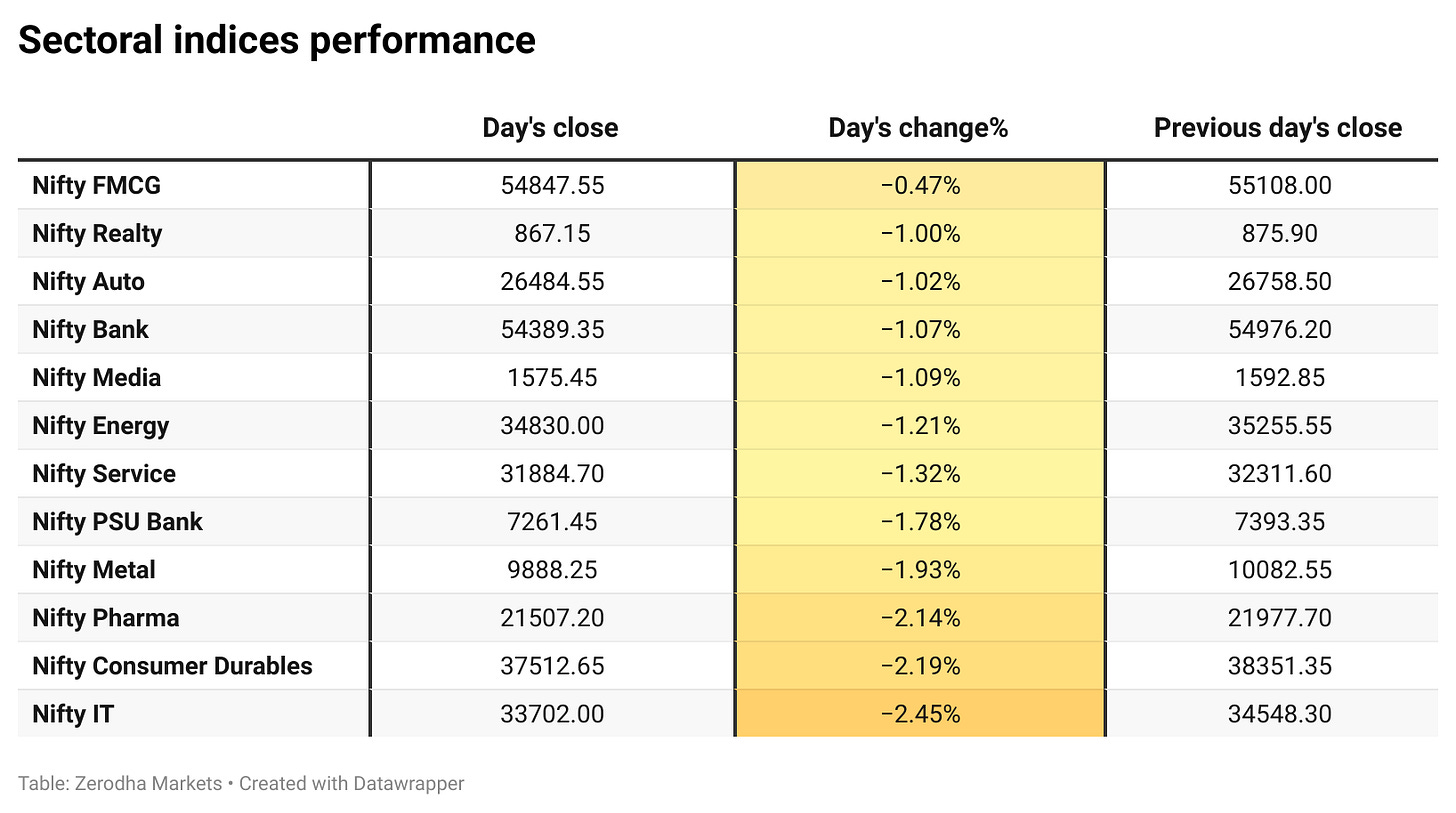

Sectoral Performance

All 12 sectoral indices ended in the red, with no gainers for the day. Nifty FMCG was the least hit, slipping just 0.47%, while Nifty IT was the top loser, plunging 2.45%, indicating broad-based weakness across sectors.

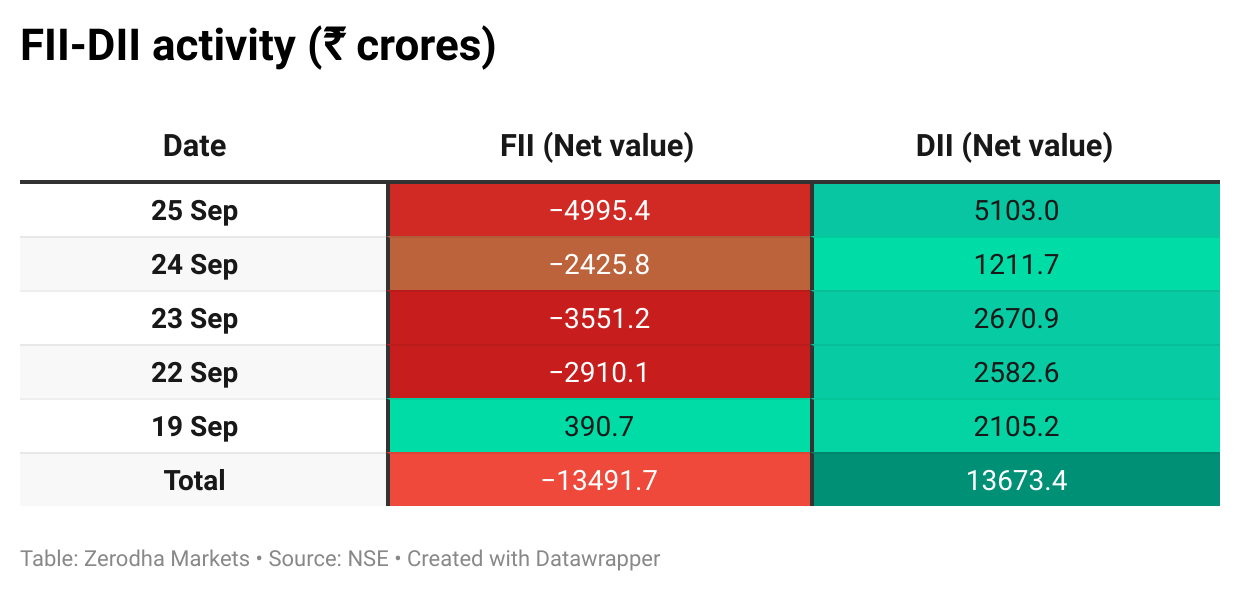

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 30th September:

The maximum Call Open Interest (OI) is observed at 25,000, followed by 25,100, suggesting strong resistance at 24,800 - 24,900 levels.

The maximum Put Open Interest (OI) is observed at 24,500, followed by 24,600, suggesting strong support at 24,600 to 24,500 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

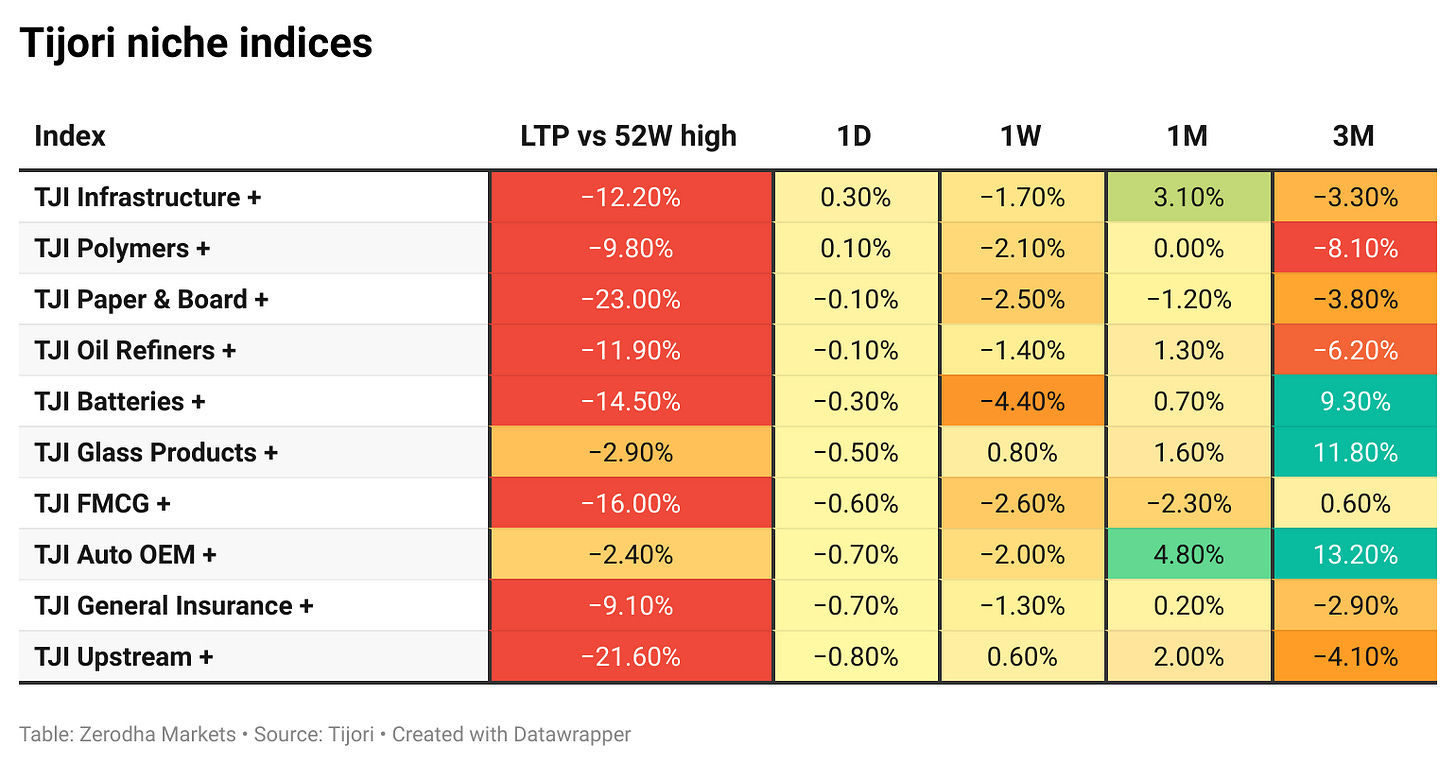

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

US President Donald Trump announced a 100% tariff on branded and patented pharmaceutical imports from October 1, 2025, unless companies are building plants in America. Additional tariffs include 50% on kitchen cabinets, 30% on upholstered furniture, and 25% on heavy trucks, raising concerns for India’s pharma exports to the US. Dive deeper

Polycab India promoters sold shares worth ₹1,739 crore in a block deal, reducing their stake from 48.7% to about 47.1%. Buyers included JP Morgan Fund, Morgan Stanley Asia Singapore, Kotak Mahindra Life, and HDFC Life. Dive deeper

U.S. Customs has opened an investigation into Waaree Energies over alleged tariff evasion by mislabeling Chinese-made solar components as Indian products. Dive deeper

The Supreme Court has deferred Vodafone Idea’s plea against over ₹5,000 crore in additional AGR dues to October 6, following a request from the Department of Telecommunications. Dive deeper

The Income Tax Department conducted survey actions at Raymond Lifestyle’s offices and manufacturing units under Section 133A of the Income Tax Act, with the company stating it is fully cooperating with officials. Dive deeper

The Ministry of Defence signed a ₹62,370 crore contract with Hindustan Aeronautics Limited to supply 97 Tejas Mk-1A fighter jets, including 68 fighter variants and 29 twin-seaters, with deliveries set to begin in 2027-28. Dive deeper

Elitecon International will raise ₹300 crore through a Qualified Institutional Placement to fund the acquisition of Sunbridge Agro and Landsmill Agro, aiming to expand its edible oils and FMCG portfolio. Dive deeper

Coca-Cola bottlers SLMG Beverages, Hindustan Coca-Cola Beverages, and Kandhari Group will invest ₹25,760 crore in India’s food processing sector through projects across nine states, with completion targeted by 2030. Dive deeper

What’s happening globally

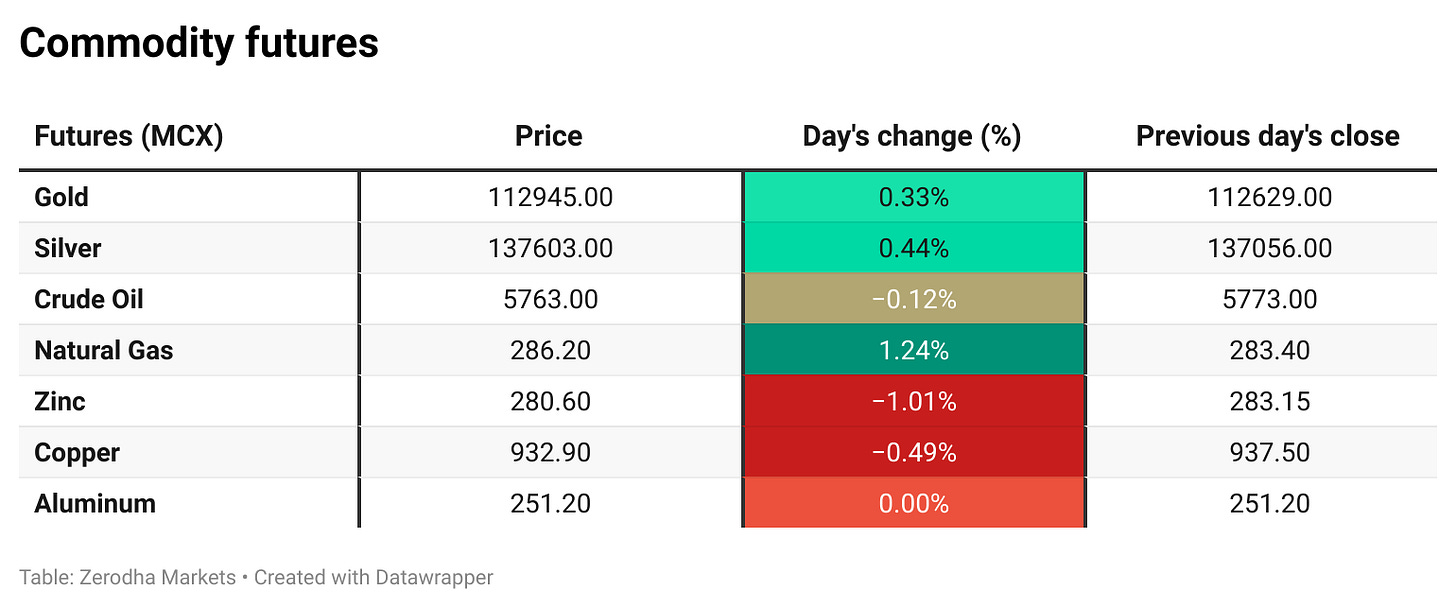

Brent crude futures traded near $70 per barrel, heading for their strongest weekly gain since June on supply concerns from Russia amid the Ukraine conflict. Dive deeper

Gold held near $3,750 per ounce, close to record highs, as safe-haven demand persisted ahead of the US inflation report. Dive deeper

The dollar index climbed above 98.4, a one-month high, after strong US data eased expectations of aggressive Fed rate cuts. Support also came from looser policies in other major economies, though gains were capped by US shutdown risks and new tariffs. Dive deeper

The US PCE price index is expected to rise 0.3% in August 2025, with annual inflation edging up to 2.7%, the highest in six months. Core PCE is projected to increase 0.2% on the month and remain at 2.9% year-on-year. Dive deeper

Eurozone median consumer inflation expectations rose to 2.8% in August 2025, the highest in three months, while three-year expectations held at 2.5% and five-year expectations climbed to 2.2%. Economic growth expectations stayed at -1.2%, and unemployment expectations edged up to 10.7%. Dive deeper

Spain’s economy grew 0.8% in Q2 2025, its fastest pace in a year, driven by stronger household spending, investment, and services. External demand made little contribution, while the primary sector contracted. Year-on-year GDP rose 3.1%, above the earlier 2.8% estimate. Dive deeper

Amazon will pay $2.5 billion to settle an FTC case alleging it enrolled users into Prime without consent. Of this, $1.5 billion will go toward refunds for about 35 million subscribers, though Amazon has not admitted wrongdoing. The company also agreed to make cancellations easier and improve subscription disclosures. Dive deeper

Bosch announced plans to cut 13,000 jobs in Germany, mainly in its auto unit, as it seeks €2.5 billion in annual savings amid weak demand, slow EV adoption, and intense competition from China. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Namit Joshi, Chairman of Pharmexcil, on U.S tariffs on pharma

“The proposed 100% tariff on branded and patented pharmaceutical imports is unlikely to have an immediate impact on Indian exports, as the bulk of our contribution lies in simple generics and most large Indian companies already operate U.S. manufacturing or repackaging units and are exploring further acquisitions,” - Link

Commerce Ministry on U.S. trade talks

“The delegation had constructive meetings with the U.S. government on various aspects of the deal. Both sides exchanged views on possible contours of the deal, and it was decided to continue the engagements with a view to achieve early conclusion of a mutually beneficial trade agreement.” - Link

Sudarshan Venu, Chairman, TVS Motor Company, on the acquisition of Engines Engineering

“By combining the creativity and racing expertise of Engines Engineering with our engineering and design strengths, we are expanding our ability to deliver premium, connected, and electric vehicles that set new global benchmarks.”

“This Centre of Excellence in Bologna further augments Norton’s capabilities, enabling it to advance its craft of exceptional high-performance motorcycles.”

“The integration will help us reduce product development cycles, enhance design flexibility, and expand our premium portfolio including high-displacement motorcycles, advanced scooters, and new EV platforms.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

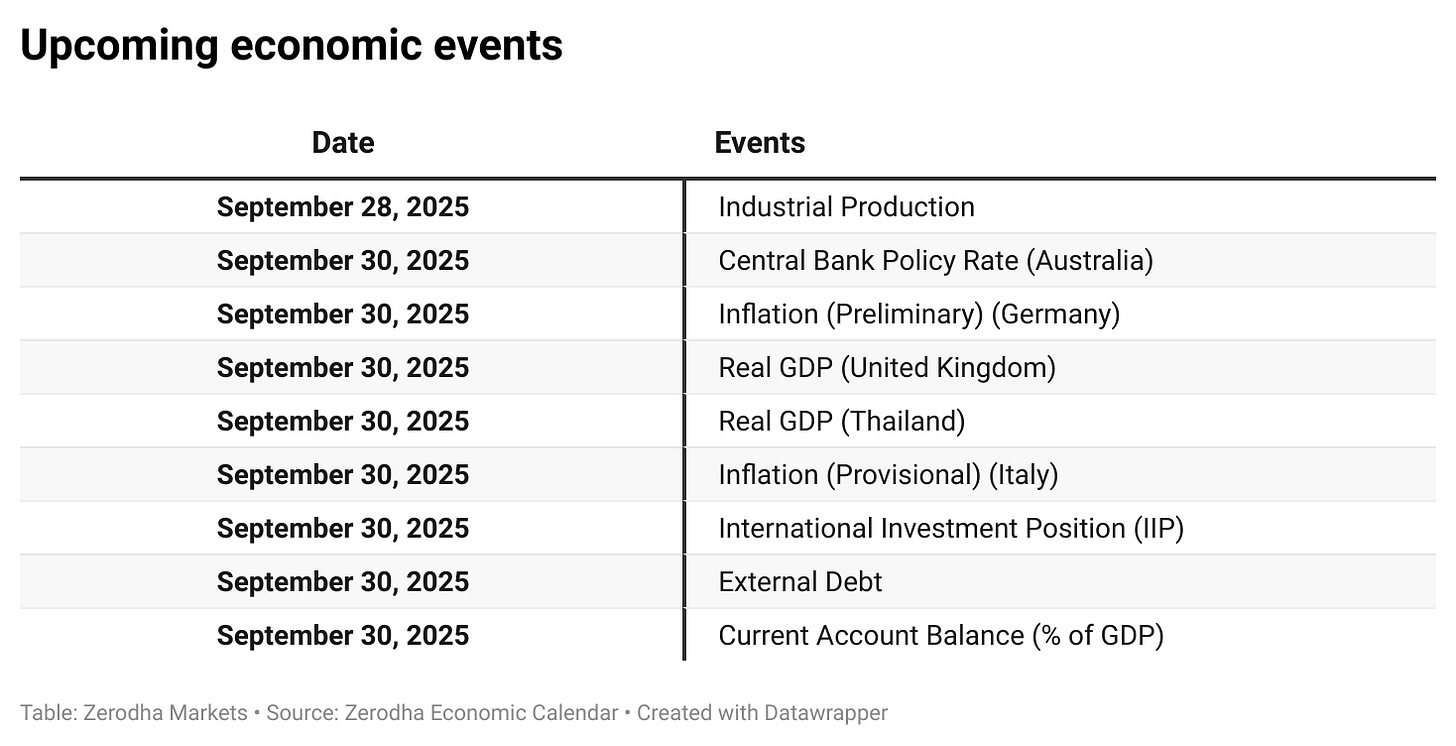

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!