Nifty closes in red after 4 days; manages to close above 25,000

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we take on a topic that often gets ignored but sits at the very foundation of markets — Trading & Investing Products. Every financial product is designed with a specific purpose in mind. Or, as we like to call it, the “horses for courses” problem. If you want to get better at trading or investing, you need to understand the toolkit available to you and what each tool is meant for.

We’ll go step by step through all the major products available in India - equities, debt, mutual funds, and derivatives, breaking down their role, their use cases, and how professionals and retail traders actually use them in practice.

Market Overview

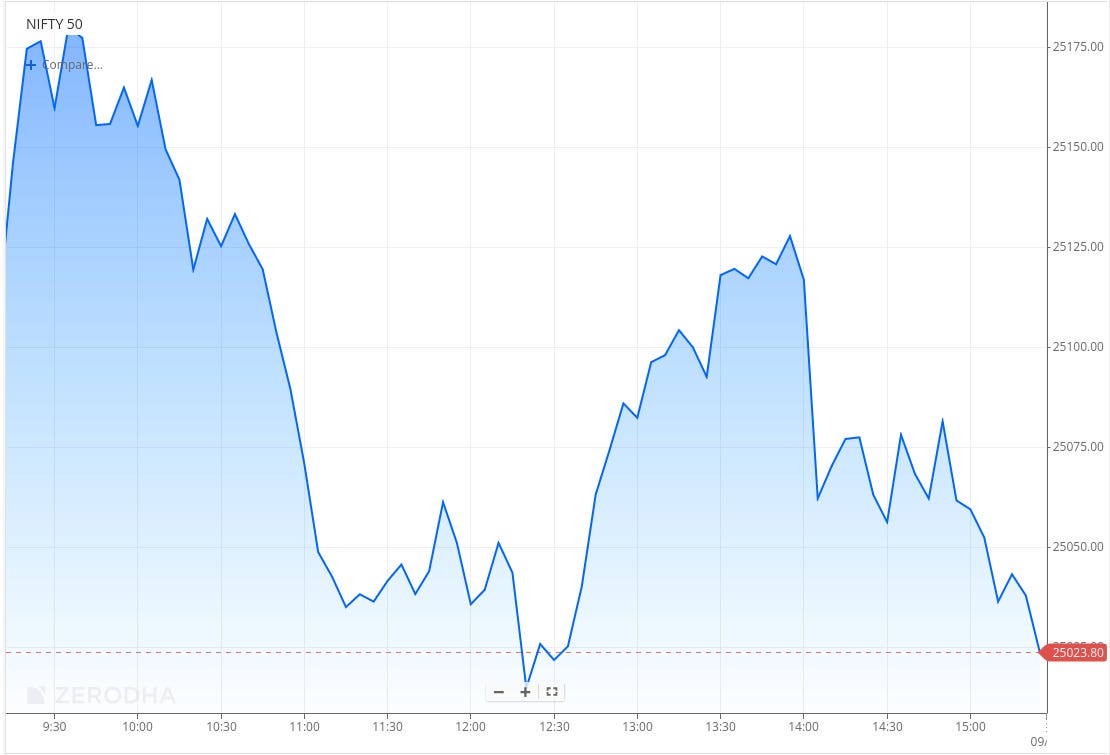

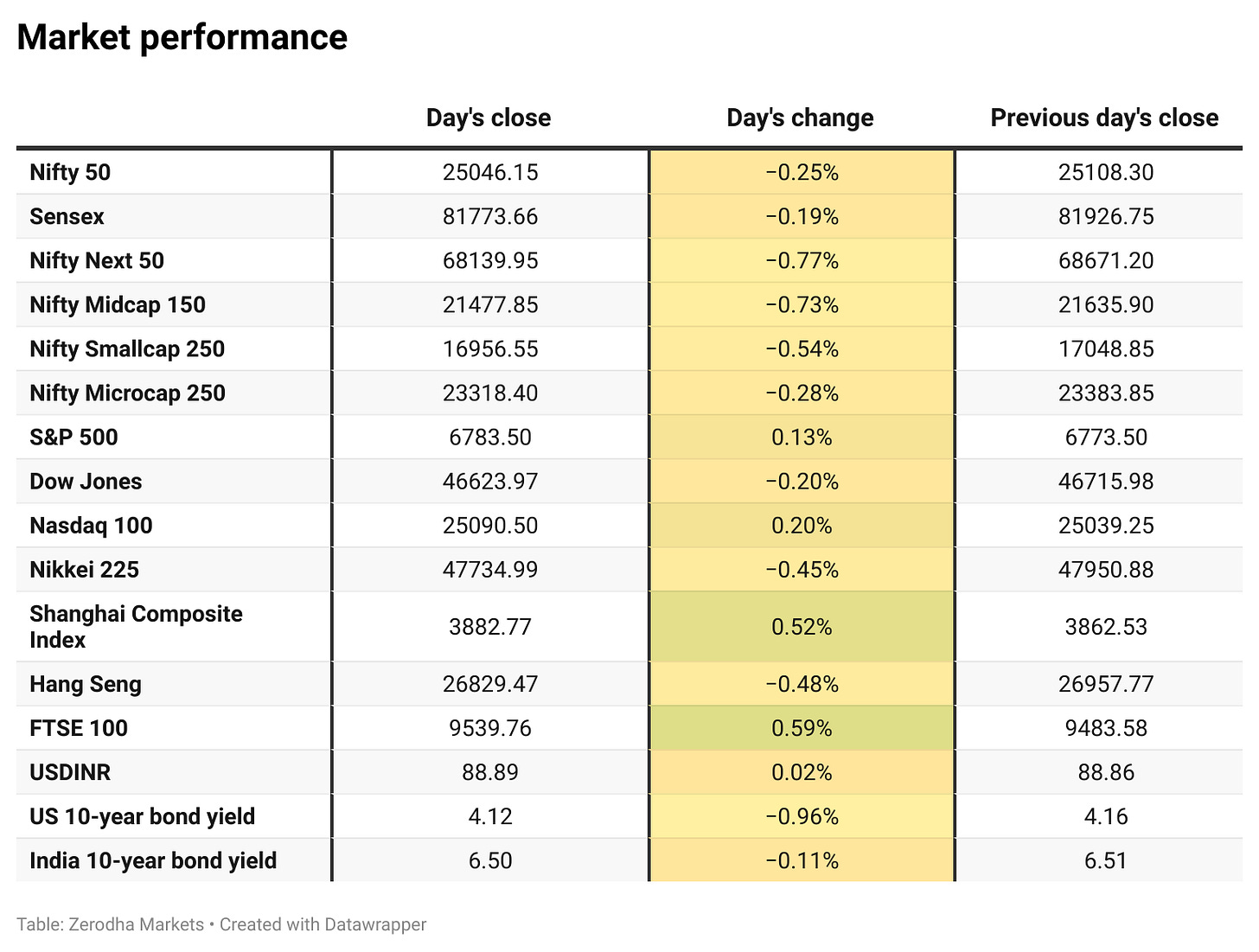

Nifty opened with a small gap-down of 30 points at 25,080 and briefly moved higher in early trade, testing the 25,190 zone. However, the index failed to sustain these gains and slipped steadily through the morning session, hitting an intraday low near 25,000 by midday as selling intensified across counters.

In the second half, Nifty attempted a mild recovery, climbing back above 25,100, but renewed weakness in the final hour dragged it lower once again. The index eventually closed at 25,046.15, down around 60 points from its previous close, marking a subdued session dominated by profit-booking and cautious sentiment.

Market sentiment has once again turned cautious after tariffs on Pharma and a hike in H1-B visa fees affecting the IT sector. As we advance, investors will closely track the upcoming quarterly results, festival season sales, and management commentary on demand trends across industries.

Broader Market Performance:

Broader markets had a weak session today. Of the 3,207 stocks traded on the NSE, 1,250 advanced, 1,864 declined, and 93 remained unchanged.

Sectoral Performance

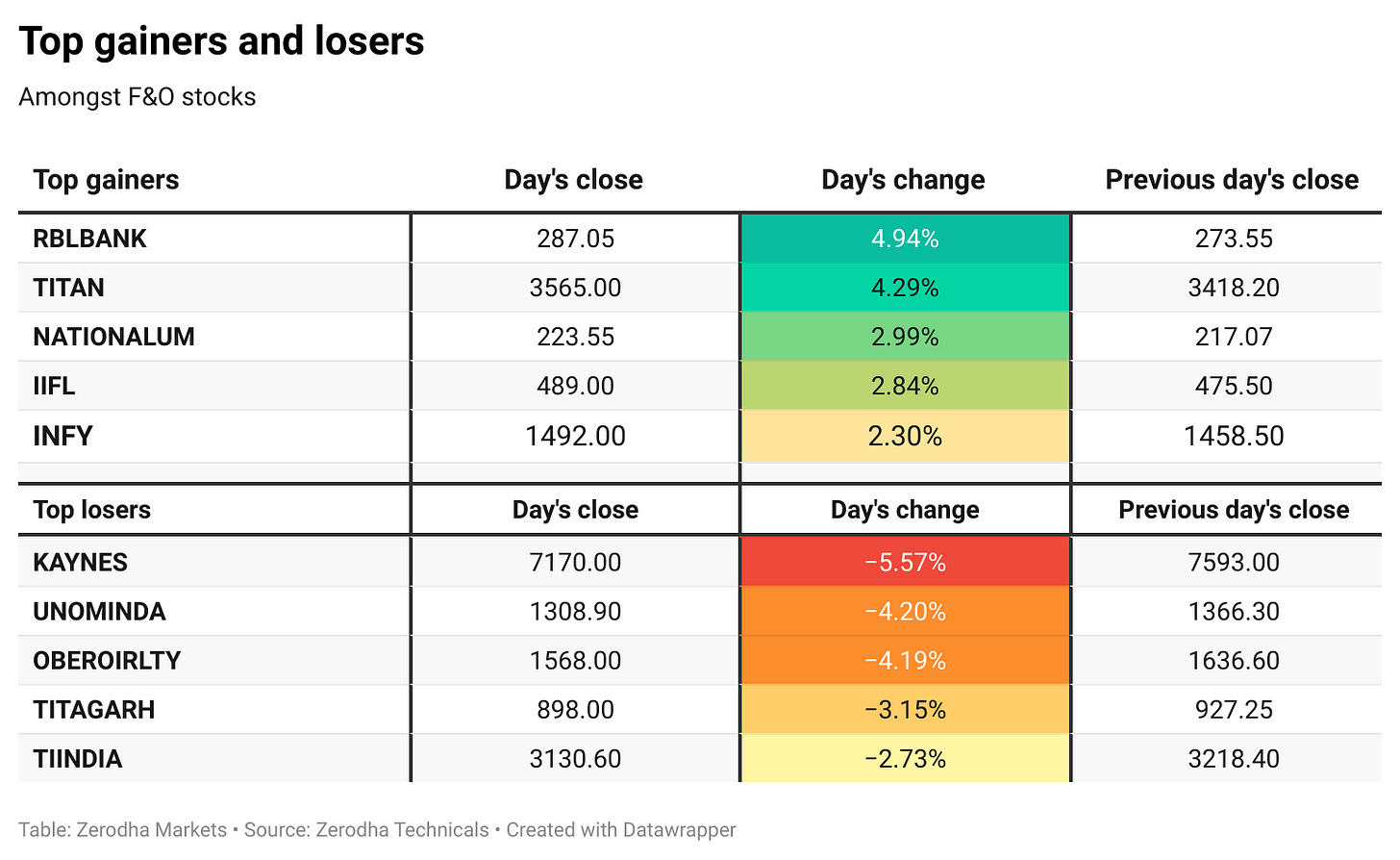

The top gainer among sectoral indices was Nifty IT, rising 1.51%, while Nifty Realty was the worst performer, falling 1.83%. Out of the 12 sectors listed, 3 closed in the green and 9 ended in the red, indicating broad-based weakness in today’s session despite strength in tech and consumer durables.

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 14th October:

The maximum Call Open Interest (OI) is observed at 25,200, followed by 25,100, indicating potential resistance at the 25,200 -25,300 levels.

The maximum Put Open Interest (OI) is observed at 25,000, followed by 24,900, suggesting strong support at 25,000 to 24,900 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

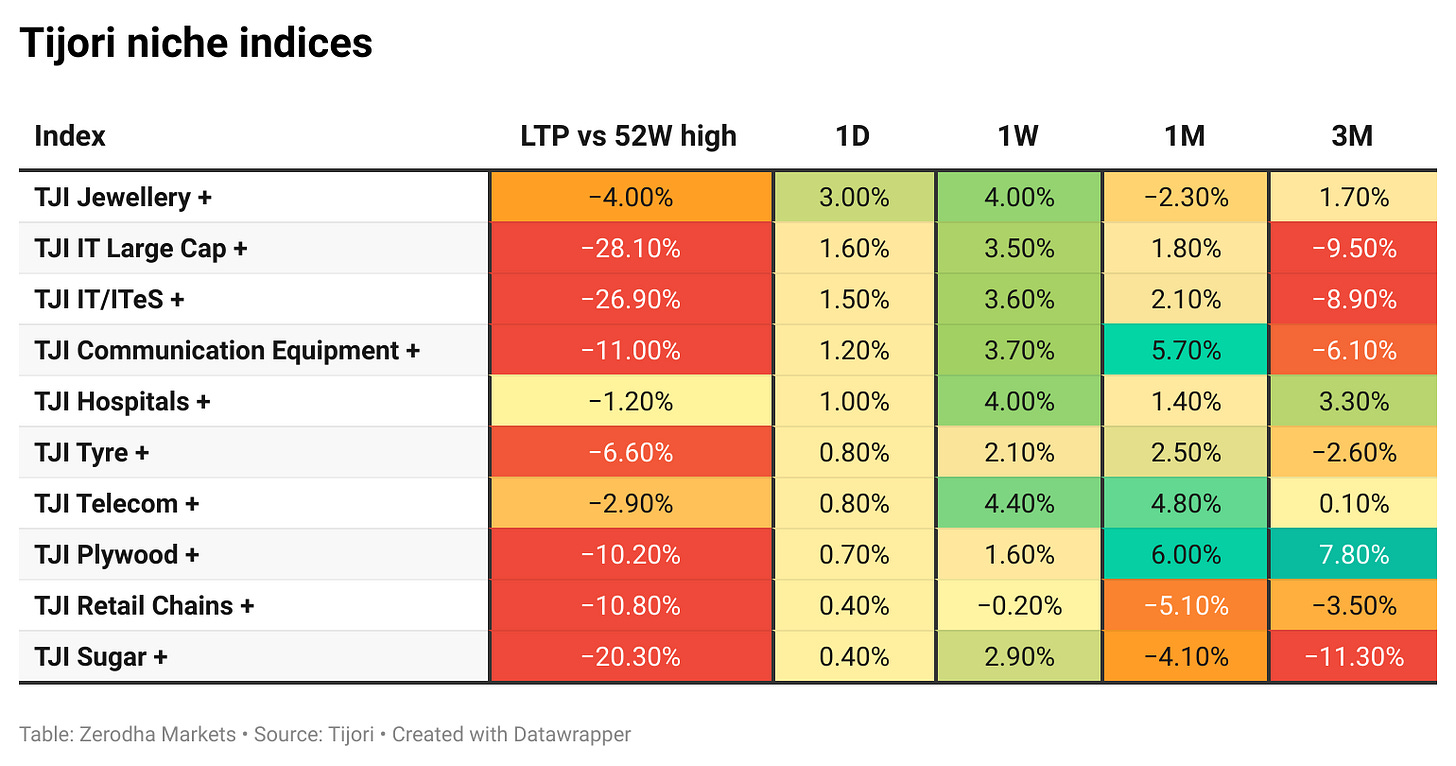

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

Tata Motors fell over 2.5% after Jaguar Land Rover reported a 17% year-on-year drop in Q2 retail sales. The decline was linked to a production halt following a cyberattack that disrupted operations. Dive deeper

The World Bank raised India’s FY26 growth forecast to 6.5% from 6.3%, citing strong consumption, investment, and GST reforms. However, it cut the FY27 outlook to 6.3%, warning that new 50% U.S. tariffs on Indian exports could dampen growth. Dive deeper

The RBI proposed revising banks’ credit risk and Expected Credit Loss frameworks to align with global norms. The changes aim to ease capital requirements through differentiated risk weights for corporate, MSME, and real estate loans. Credit card “transactors” may also be classified under the retail category. Dive deeper

EPFO plans to redeem its investments in the CPSE and Bharat 22 ETFs in FY26, likely earning a profit of ₹17,237 crore. The gains will be credited to members’ interest accounts. EPFO also plans to revamp its IT systems under the EPFO 3.0 project to enhance efficiency and expand coverage. Dive deeper

Brookfield-backed Clean Max plans a ₹5,200 crore IPO in November, including fresh shares and an offer for sale. Proceeds will fund debt repayment and corporate purposes. Dive deeper

The RBI plans to empower the banking ombudsman to award up to ₹30 lakh for customer losses and ₹3 lakh for harassment or time spent on grievances. From November 1, co-operative bank customers can also approach the ombudsman. Dive deeper

Adani Enterprises raised ₹1,000 crore through non-convertible debentures at an 8.7% rate, with ICICI Prudential MF investing ₹300 crore. The funds will be used for debt repayment, subsidiary support, and corporate expenses. Dive deeper

The CCI approved Tilaknagar Industries’ ₹4,150 crore acquisition of Pernod Ricard India’s Imperial Blue whisky business, executed as a slump sale with a deferred ₹282 crore payment. The deal strengthens Tilaknagar’s presence in India’s whisky market. Dive deeper

What’s happening globally

Brent crude rose toward $66 per barrel as OPEC+’s modest output hike supported prices. Russian exports stayed high despite refinery disruptions, while U.S. output and inventories increased. Dive deeper

Gold surpassed $4,000 per ounce, hitting a record high as investors sought safety amid global uncertainty and a dovish Fed outlook. The ongoing U.S. shutdown and political turmoil in France and Japan added to caution. Central bank buying and ETF inflows continued to support prices. Dive deeper

The dollar index rose to 98.8, a two-month high, supported by global currency weakness and dovish signals abroad. Dive deeper

The average 30-year fixed mortgage rate in the U.S. eased to 6.43% in the week ending October 3, 2025, from 6.46% a week earlier, according to the Mortgage Bankers Association. Refinance activity fell slightly, except for a modest rise in FHA applications. Dive deeper

Germany’s industrial production slumped 4.3% in August, the sharpest drop since March 2022, led by steep declines in autos, machinery, and pharmaceuticals. Output excluding energy and construction fell 5.6%, while construction rose slightly. Production was down 3.9% year-on-year. Dive deeper

Elon Musk’s xAI is reportedly raising $20 billion, including a $2 billion equity investment from Nvidia. The funding, split between $7.5 billion equity and $12.5 billion debt, will be used to purchase Nvidia chips for xAI’s Colossus 2 data center. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Jyotiraditya Scindia, Union Minister for Communications, on India’s digital and telecom ambitions

“India’s ambitions go beyond 5G, with a goal of securing 10% of global 6G patents through the Bharat 6G Alliance.”

“The satellite communications market, currently at $4 billion, is set to triple to nearly $15 billion by 2033, expanding connectivity from land to sea to space.”

“With ₹91,000 crore in new production, ₹18,000 crore in exports, and 30,000 jobs created under the PLI scheme, India has evolved from a service nation to a product nation.” - Link

Piyush Goyal, Union Minister for Commerce and Industry, on India-U.S. trade pact negotiations

“We are in constant dialogue with the U.S. on the trade pact, and talks are progressing at various levels.”

“There is every possibility of meeting the November deadline for concluding the negotiations.”

“You all know, the U.S. government is currently in shutdown mode, so we’ll have to see how, where, and when the next round of discussions can take place.” - Link

T. Rabi Sankar, Deputy Governor, Reserve Bank of India, on the rollout of digital currency

“We’re in no hurry because, for this system to launch, other countries also need to introduce their digital currencies simultaneously.”

“The most appropriate use-case for a central bank digital currency is cross-border payments, though a retail rollout isn’t ruled out.”

“Our approach is to move cautiously and learn from global developments before expanding nationwide.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

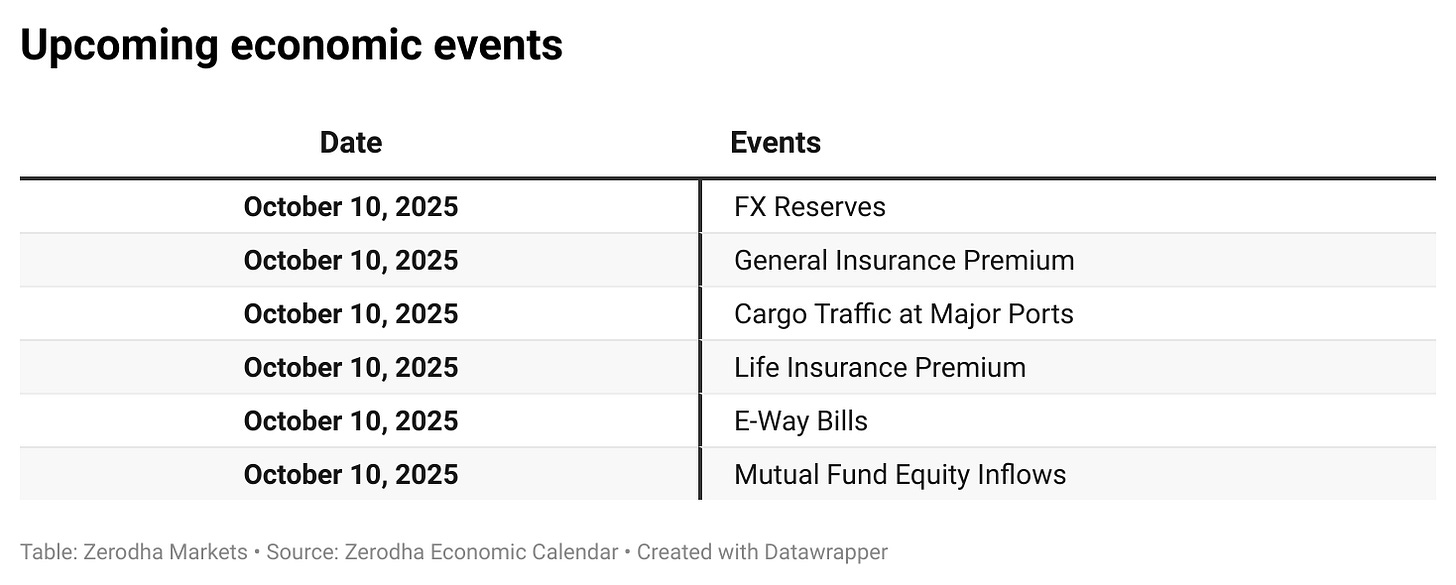

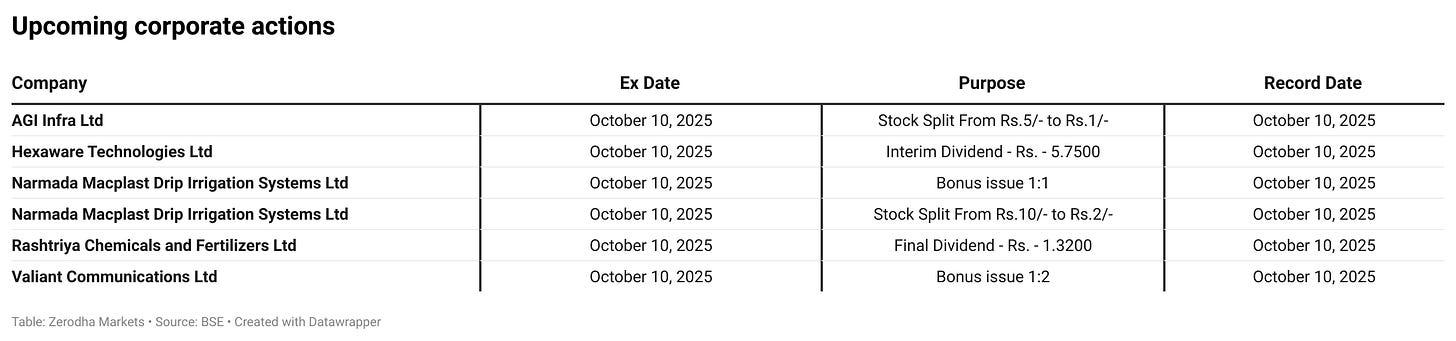

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!