Nifty closes flat as markets go into holiday mood

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we explore a small detour to close out the year with a curated movie watchlist for traders and investors—feature films (no documentaries, no series, no spoilers) that revolve around money, markets, power, risk-taking, and human behaviour.

Spanning the 2008 Global Financial Crisis, Wall Street excesses, niche trading ideas, Indian market films, and a few unexpected outliers, each movie is viewed through a simple trader’s lens: what it teaches, how real it feels, and how relatable it is if you’ve spent time around markets. Think of it as an end-of-year watchlist to dip into over the holidays—no charts, but still very much about money.

Market Overview

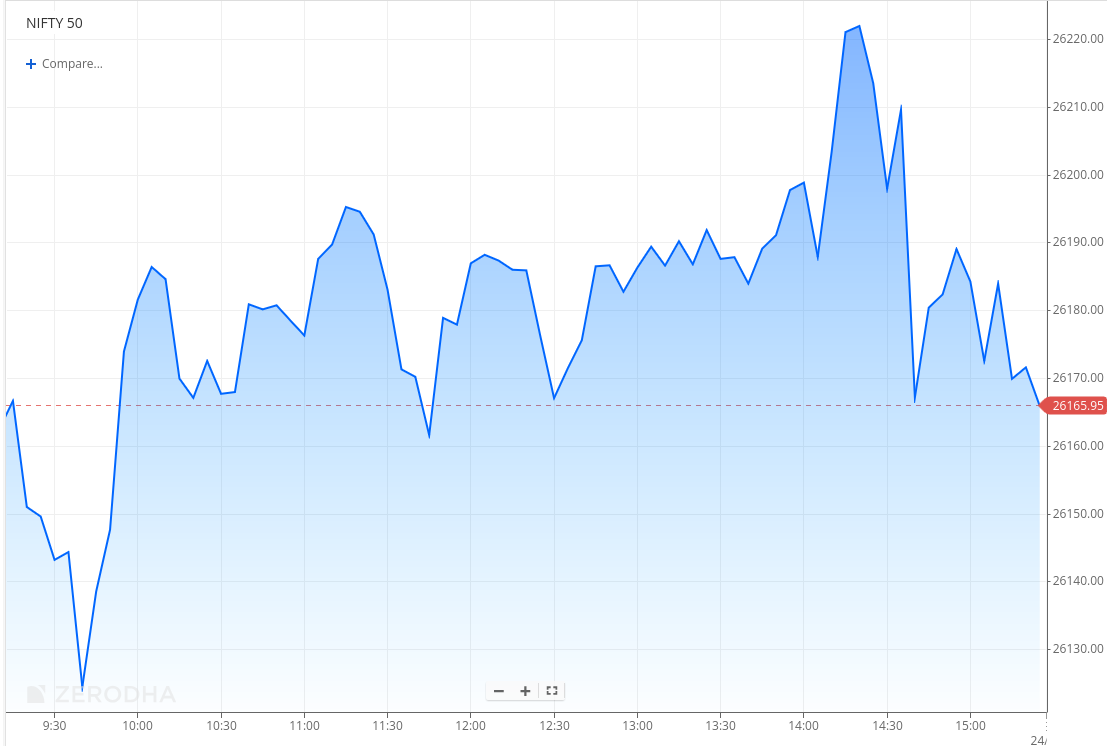

Nifty opened with a 33-point gap-up at 26,205 and saw sharp volatility in the opening minutes, slipping quickly toward the 26,120–26,130 zone in the first 30 minutes before recovering just as swiftly. From 10:30 AM to 2 PM, the index oscillated in a choppy manner between 26,160 and 26,200, reflecting intraday uncertainty.

After 2 PM, the index turned slightly volatile, with the Nifty rising to the 26,230 zone and then immediately dropping by 70 points to the 26,160 zone. After attempting recovery once again, Nifty eventually closed flat for the day at 26,177.15.

Overall, it was a volatile yet range-bound session, with the index consolidating near record levels and lacking strong follow-through.

Looking ahead, markets are likely to remain sensitive to global risk appetite, currency movements, and further developments around India–U.S. trade negotiations.

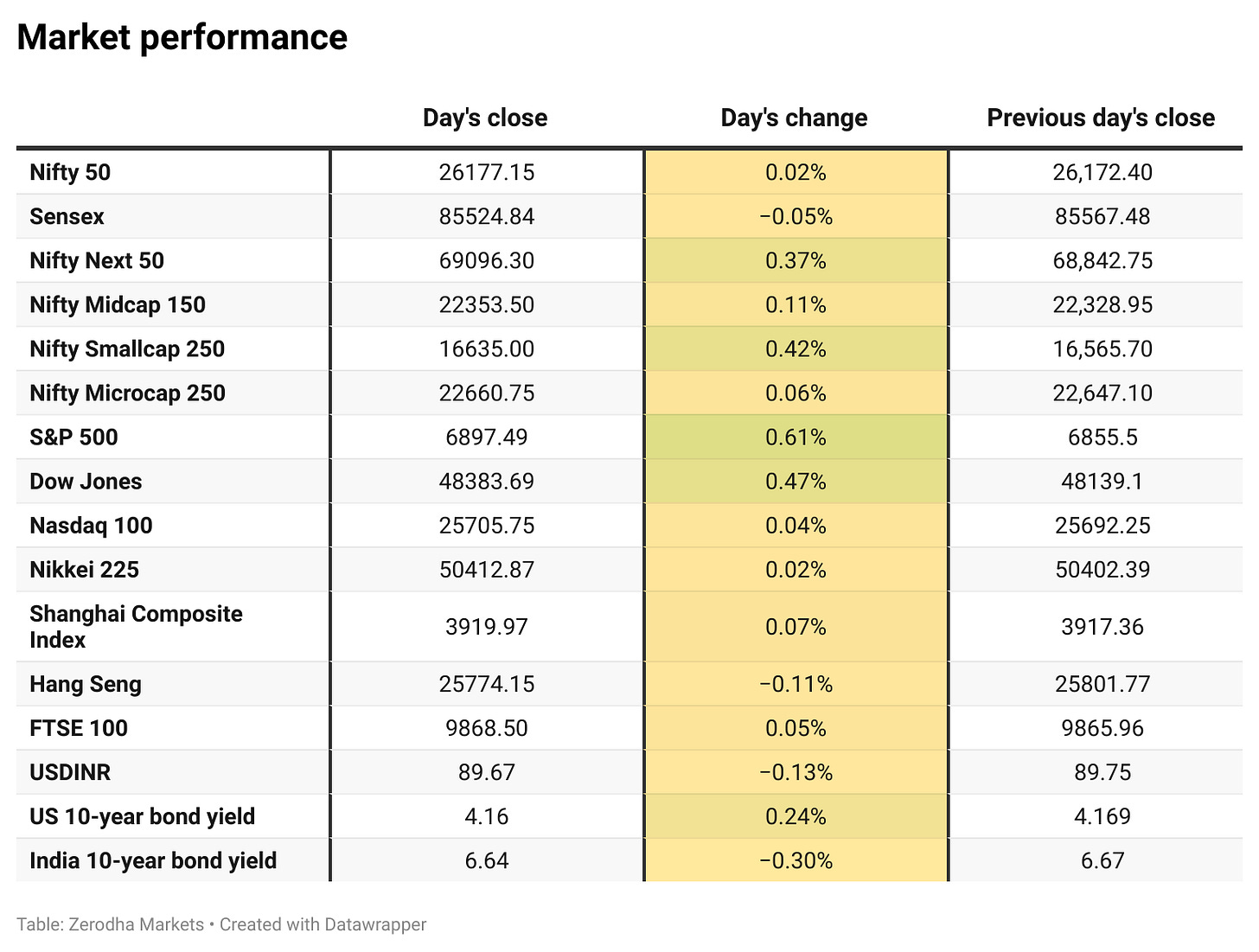

Broader Market Performance:

The broader market had a bullish session today. Out of 3,261 stocks that traded on the NSE, 1,831 advanced, while 1,320 declined, and 110 remained unchanged.

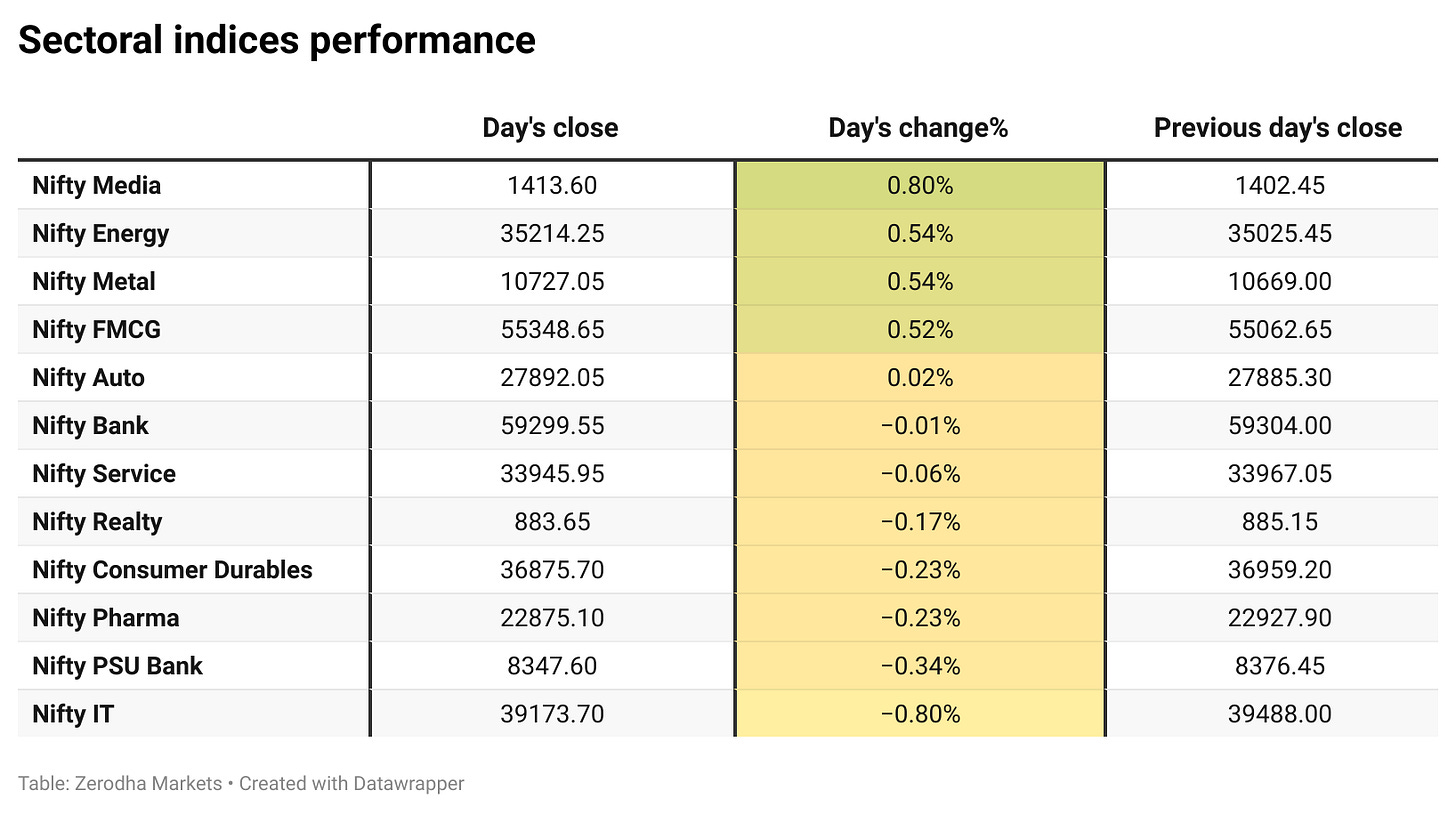

Sectoral Performance:

Nifty Media was the top gainer of the day, rising 0.80%, while Nifty IT was the worst performer, slipping 0.80%. Out of the 12 sectoral indices, 5 ended in the green and 7 closed in the red, reflecting a mixed but slightly negative market breadth.

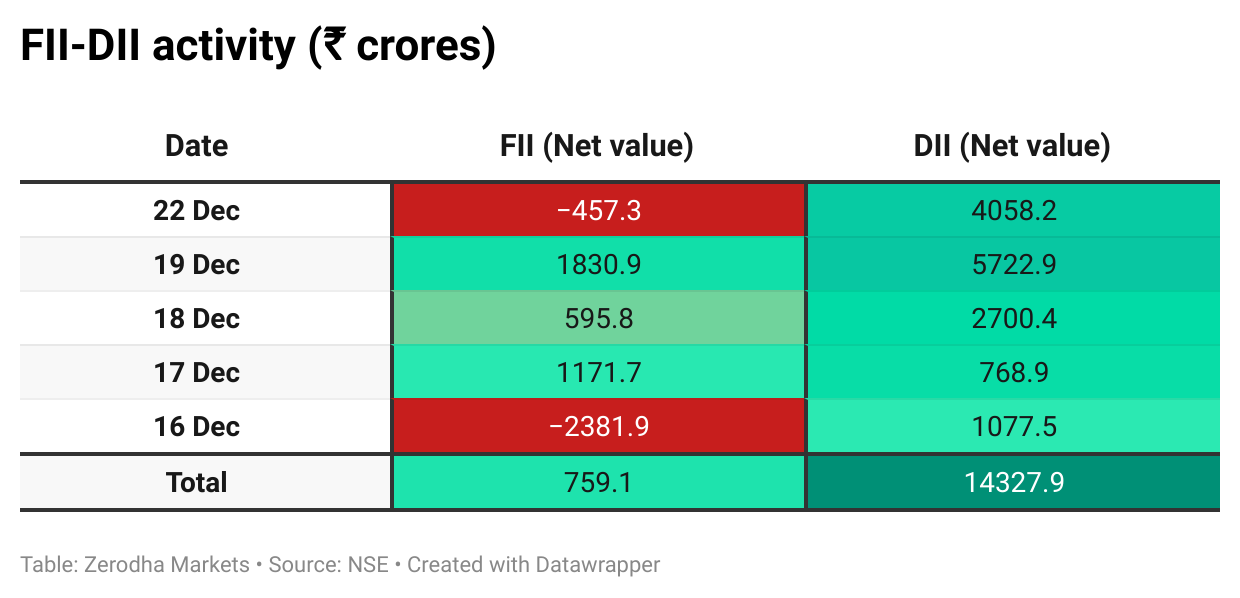

Here’s the trend of FII-DII activity from the last 5 days:

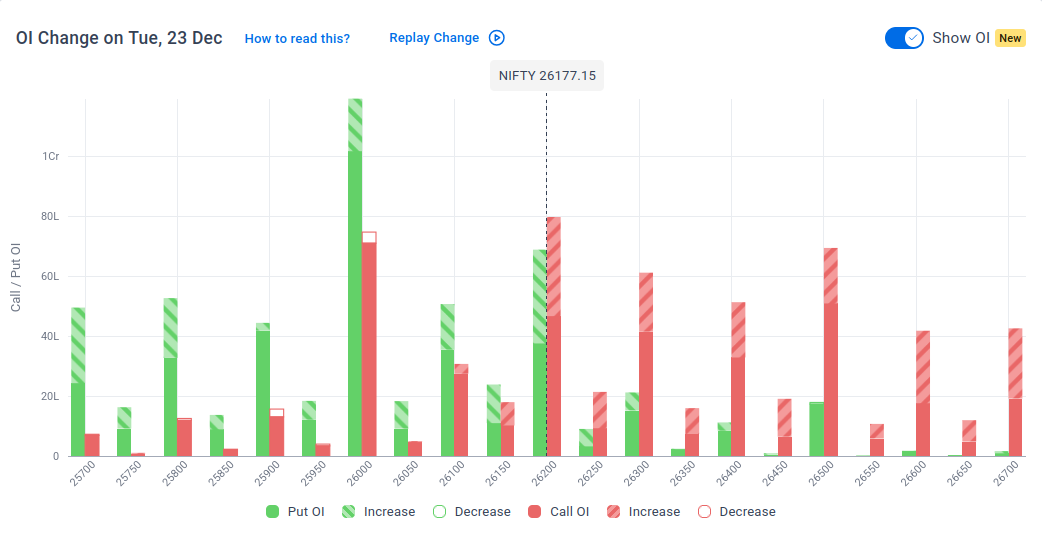

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 30th December:

The maximum Call Open Interest (OI) is observed at 26,200, followed by 26,000 & 26,500, indicating potential resistance at the 26,200 -26,300 levels.

The maximum Put Open Interest (OI) is observed at 26,000, followed by 26,200, suggesting support at the 26,100 to 26,000 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

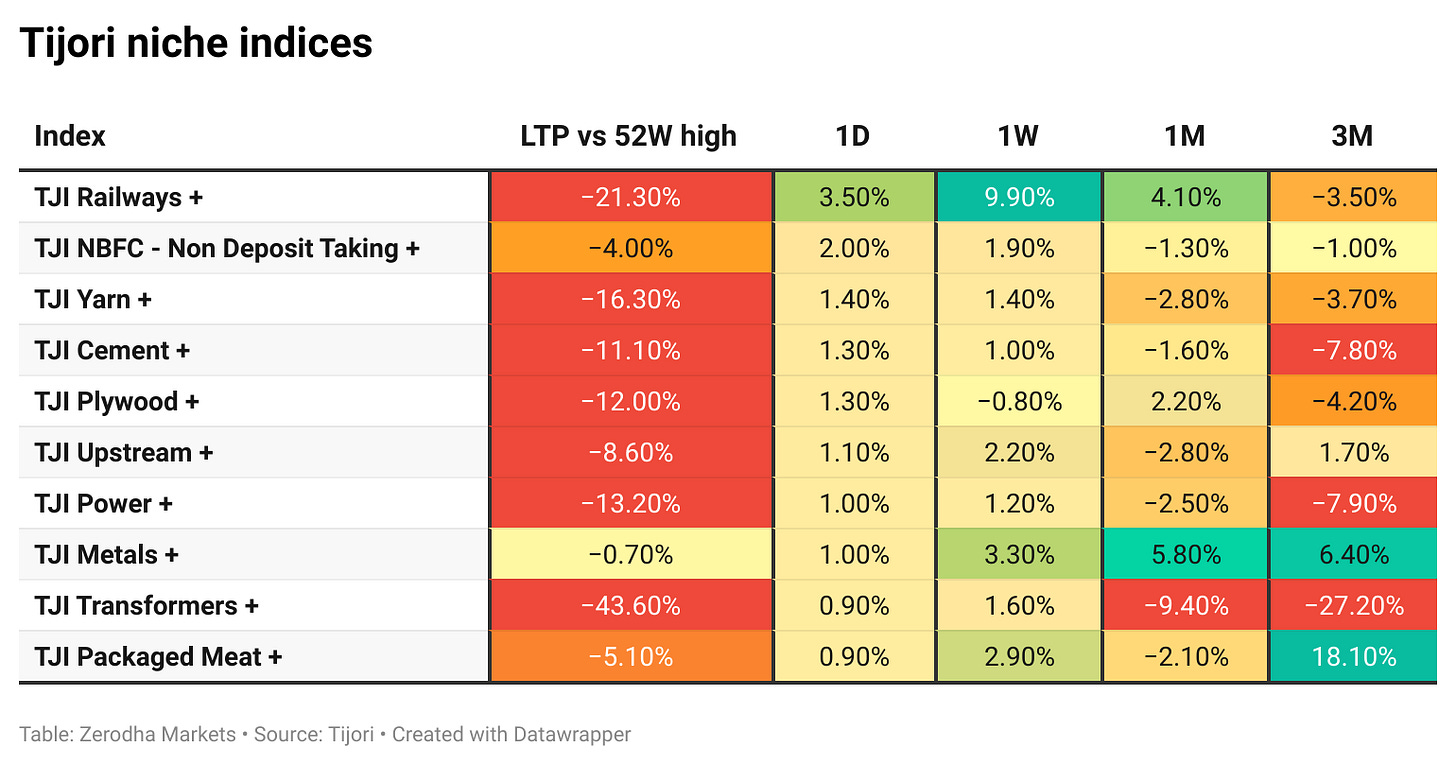

Tijori is an investment research platform that has constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

The RBI announced major liquidity measures, including government bond purchases worth ₹2 lakh crore through OMOs in four tranches between December 29 and January 22. It will also conduct a $10 billion USD/INR buy–sell swap for a three-year tenor on January 13, 2026, to further ease banking system liquidity. Dive deeper

India’s infrastructure output rose 1.8% y/y in November, supported by strong cement and steel production, while October’s reading was revised down to a 0.1% contraction. Dive deeper

Bankers have urged the RBI to step in as excess dollar inflows and pressure from offshore NDF markets distort pricing in the onshore rupee forward market. Dive deeper

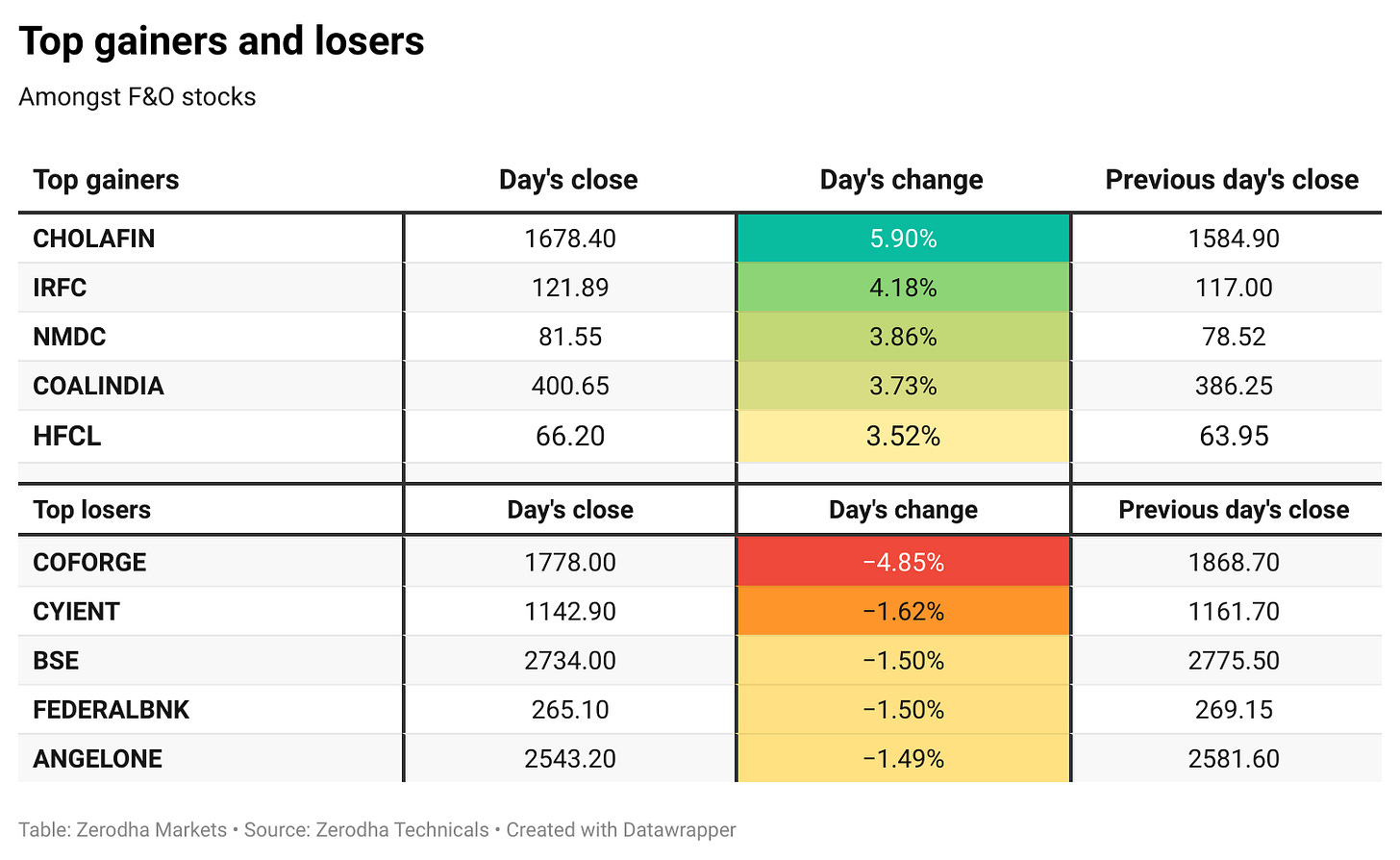

Cholamandalam Investment and Finance rejected Cobrapost’s misgovernance allegations as “malicious and baseless,” saying they were driven by ulterior motives. Dive deeper

Ola Electric clarified that the recent promoter stake sale was carried out to repay debt and fully release all pledged promoter shares. The company said the disclosure was made to address speculation and improve transparency around the transaction. Dive deeper

Adani Group is consolidating its cement operations by merging ACC and Orient Cement into Ambuja Cements, creating a unified “one cement platform. Dive deeper

GPT Infraprojects shares closed 2.5% higher after the company said it was declared the L1 bidder for a ₹670-crore project awarded by the National Highways Authority of India (NHAI). Dive deeper

What’s happening globally

Brent held near $62/bbl as geopolitical risks stayed in focus, with the US pursuing and seizing Venezuelan-linked tankers and Ukraine stepping up strikes on Russian energy infrastructure. Dive deeper

Gold hit a fresh record above $4,480/oz as safe-haven demand rose on escalating US–Venezuela tensions and expectations of Fed rate cuts next year. Dive deeper

The dollar index slipped toward 98, its lowest since early October, as markets priced in more Fed rate cuts amid easing inflation and a softer labour market. Dive deeper

European equities rose, with the STOXX 600 touching a record high, led by pharma stocks. Novo Nordisk jumped after US FDA approval for an oral version of Wegovy, while luxury names lagged. Dive deeper

Germany’s import prices fell 1.9% y/y in November, the steepest drop since March 2024, driven mainly by sharply lower energy costs, while non-energy prices were only slightly lower. Dive deeper

RBA minutes showed policymakers discussed scenarios where rates might need to rise in 2026 after recent inflation surprises lifted upside risks. Dive deeper

Management chatter

In this section, we highlight interesting comments made by the management of major companies and policymakers from the Indian and Global Economies.

Ray Dalio, hedge fund manager on U.S.–China conflict and why India could benefit:

“We’re in a trade war, we’re in a technology war, we’re in a geopolitical influence war.”

“The technology war is the most important war… almost whoever wins the technology war will win almost everything.”

“The winners of the wars lose… and the neutral countries prosper from the wars.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

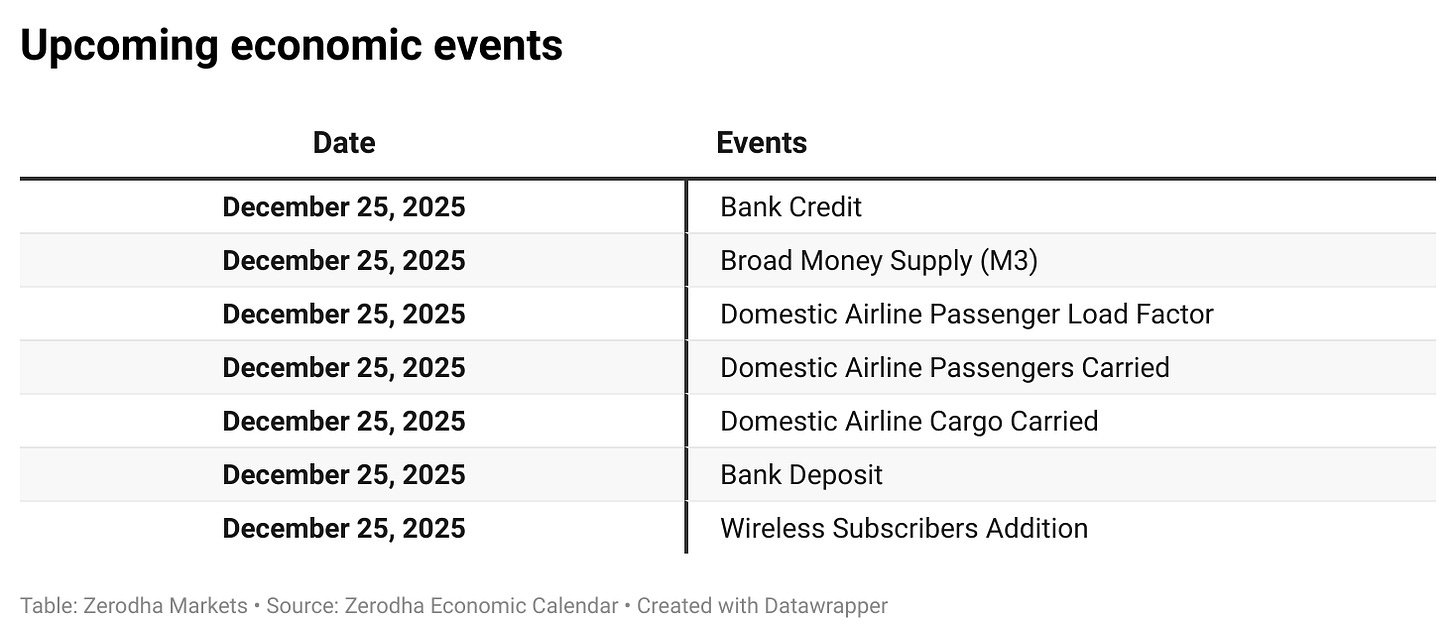

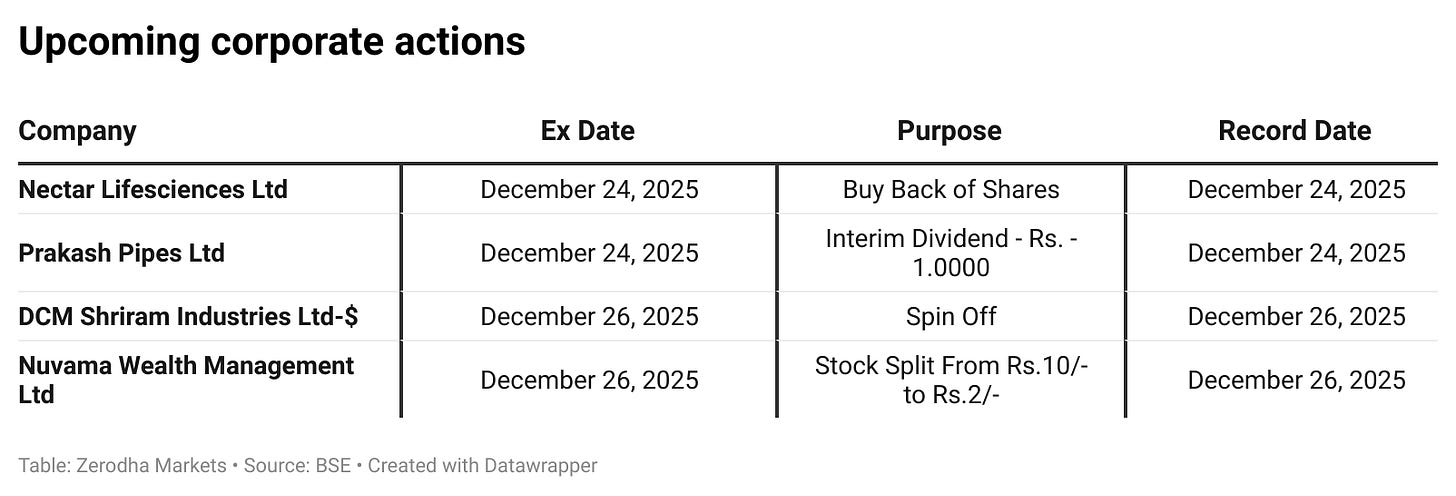

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!