Nifty closes flat after a volatile session; Broader markets continue to bleed

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we explore a shift from penny options and tail risks to a far more practical, survivability-focused use of options: a Limited Downside Nifty strategy built to cap drawdowns while still participating in index upside.

This episode breaks down how structured products and market-linked debentures actually work—and how the same payoff can be replicated directly, without credit risk, lock-ins, or opaque structures. Anchored in the idea of optionality from Nassim Taleb’s Antifragile, the focus is on non-linear exposure where losses are limited, but upside remains open, making this a compelling framework for traders who care more about staying in the game than chasing hero returns.

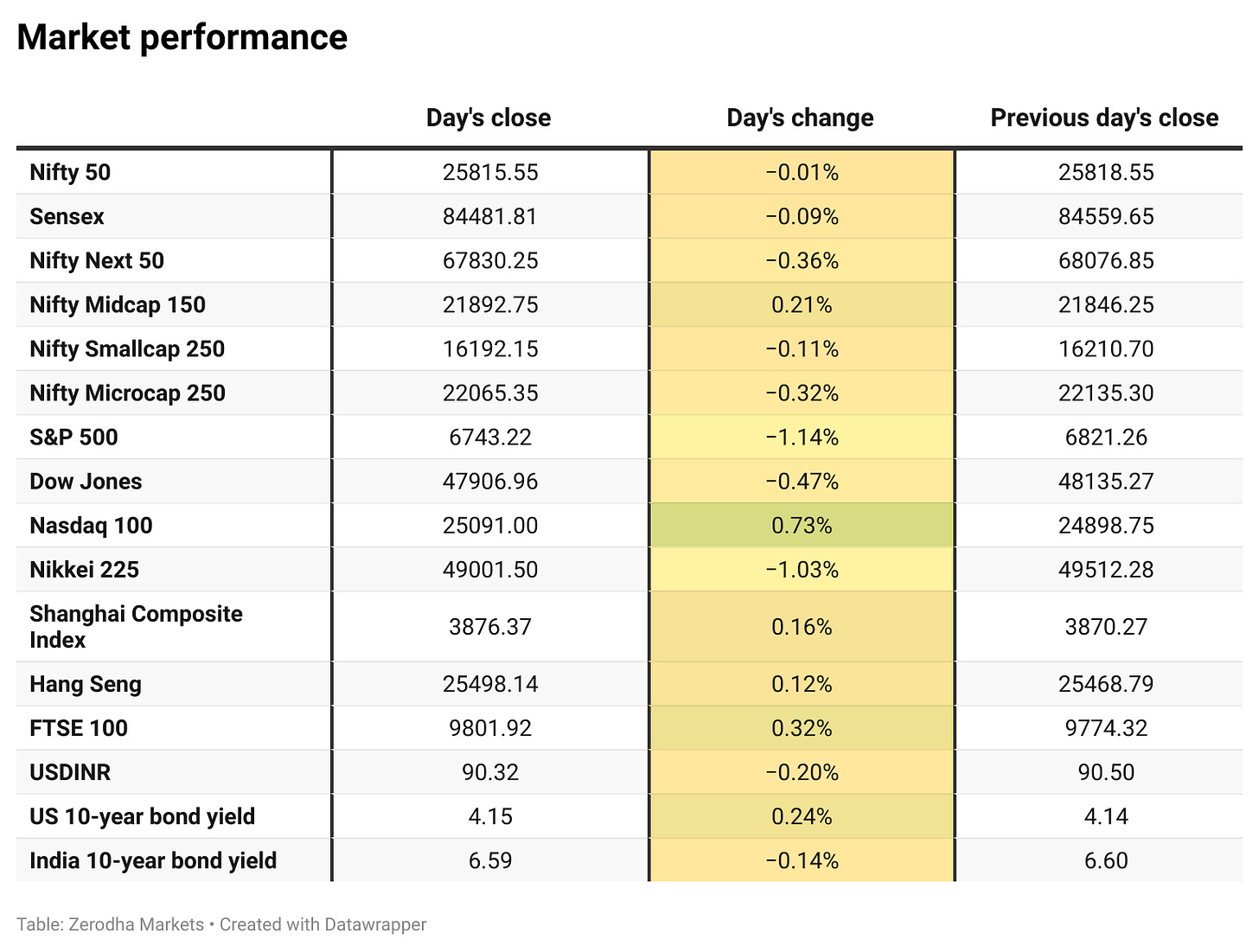

Market Overview

Nifty opened with a 53-point gap-down at 25,765, extending the weakness from the previous session, and slipped further in the first 30 minutes to test the 25,730–25,740 zone. The index then staged a sharp rebound through the morning, climbing past 25,830 by 10:30 AM and pushing into the 25,880–25,900 zone around noon, aided by short-covering.

In the second half, the recovery lost momentum, with selling pressure re-emerging post 1 PM. Nifty gradually drifted lower from the highs, slipping back toward the 25,775–25,800 zone. A modest late-hour bounce helped limit losses, and the index eventually closed near the middle of the day’s range at 25,815.65, ending flat for the session. Overall, it was a volatile and range-bound day marked by a sharp intraday rebound followed by renewed selling pressure.

Looking ahead, markets are likely to stay sensitive to global risk appetite, currency movements, and further developments around the India–U.S. trade negotiations.

Broader Market Performance:

The broader market had a weak session once again today. Out of 3,209 stocks that traded on the NSE, 1,273 advanced, while 1,827 declined, and 109 remained unchanged.

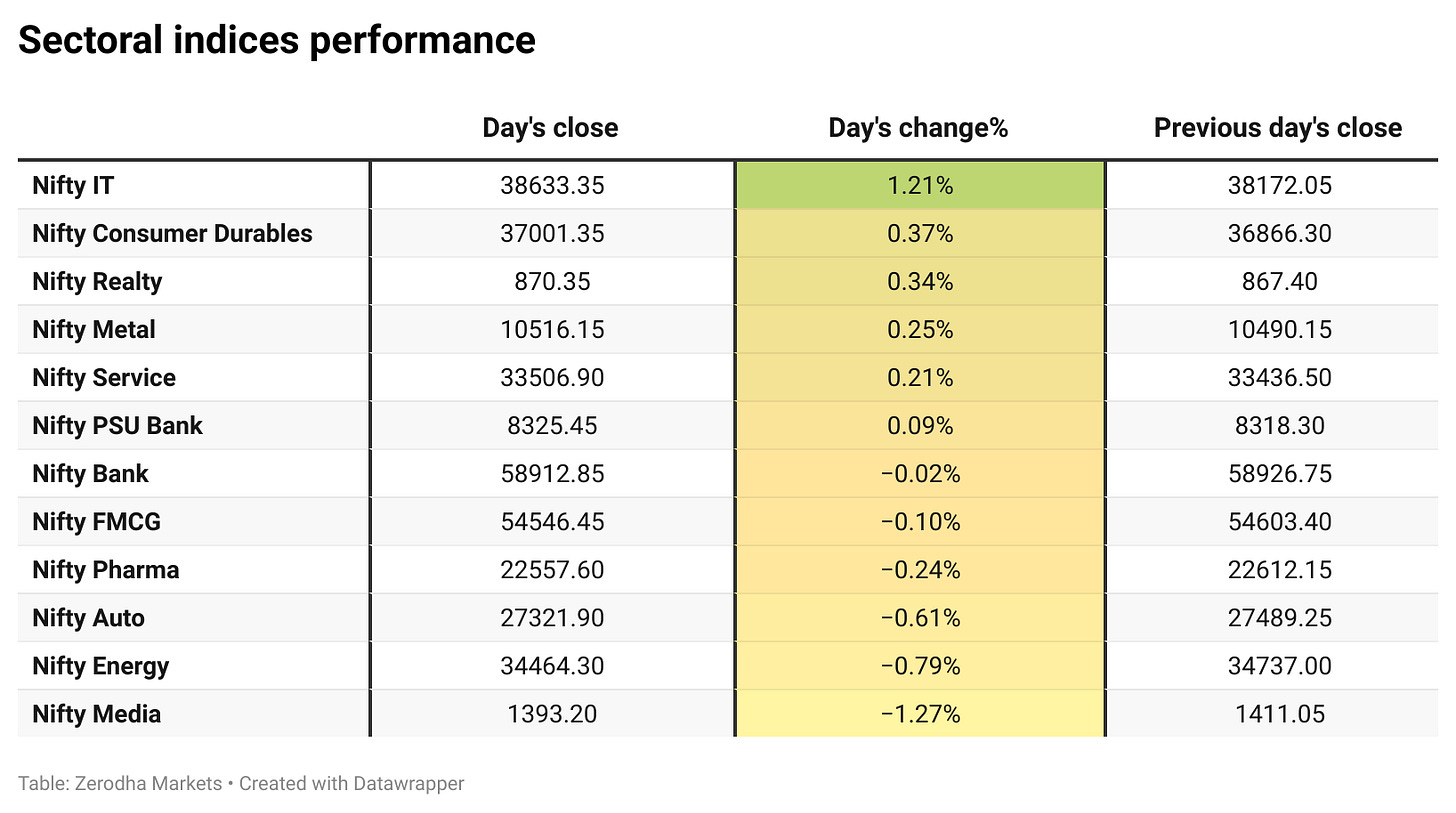

Sectoral Performance:

Nifty IT led the gains with a 1.21% rise, while Nifty Media was the top laggard, slipping 1.27%. Out of the 12 sectoral indices, 6 ended in the green and 6 closed in the red, reflecting a mixed market breadth.

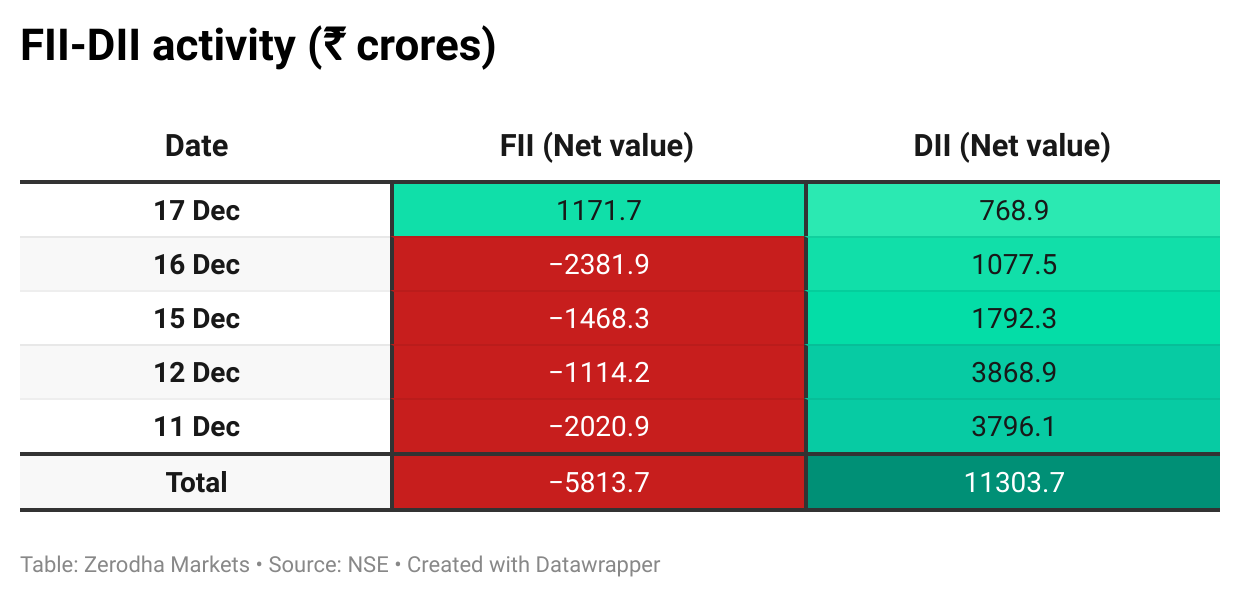

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 23rd December:

The maximum Call Open Interest (OI) is observed at 26,000, followed by 25,900, indicating potential resistance at the 25,900 -26,000 levels.

The maximum Put Open Interest (OI) is observed at 25,500, followed by 25,800, suggesting support at the 25,800 to 25,700 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

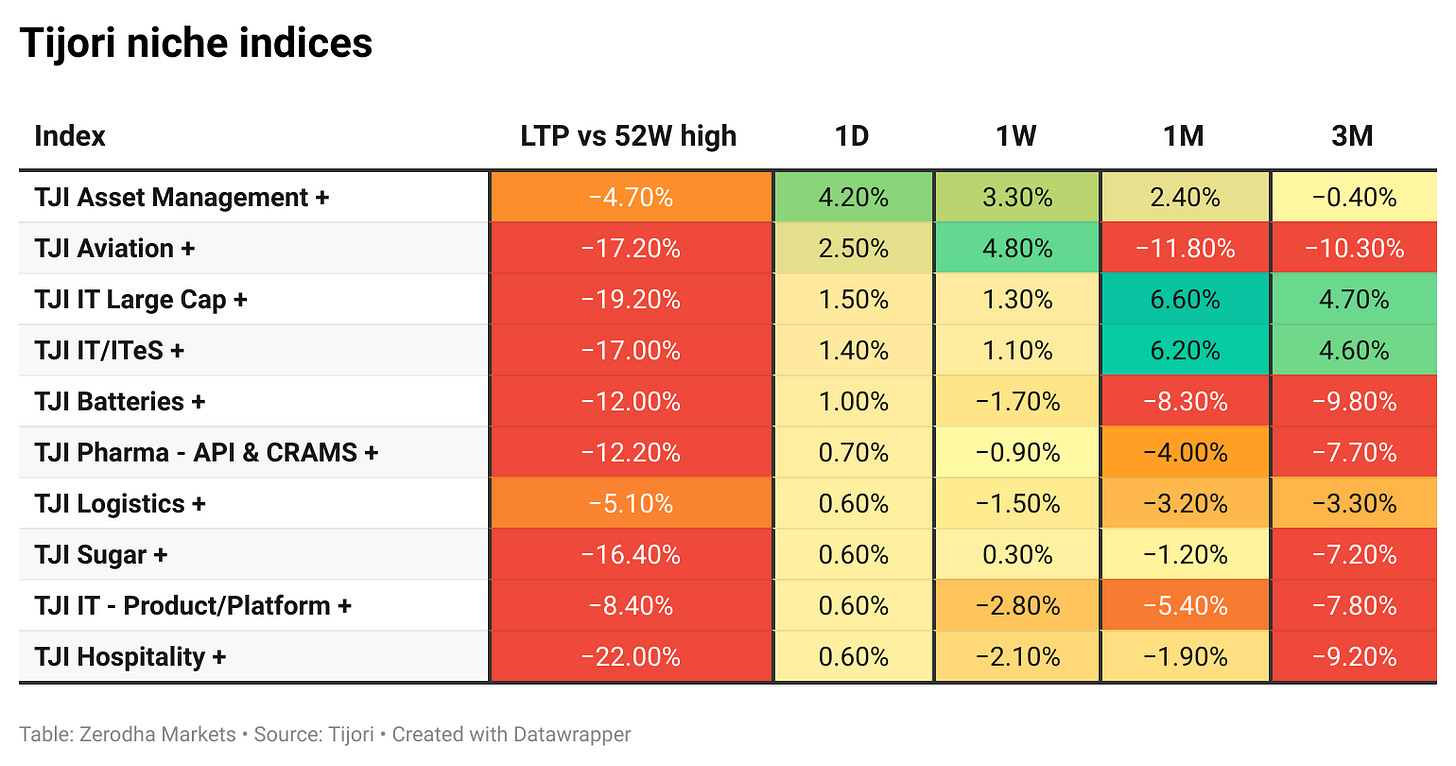

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

Cyient Semiconductors will acquire a majority stake of over 65% in U.S.-based Kinetic Technologies for $93 million through its Singapore subsidiary. The deal aims to strengthen its capabilities in power semiconductor and custom IC solutions. Dive deeper

India’s home loan disbursements are projected to reach ₹150 lakh crore over the next decade, driven by rising urbanisation, demographics, and policy support, according to a report by Omniscience Capital. Dive deeper

Finance Minister Nirmala Sitharaman introduced the Securities Markets Code Bill, 2025, in the Lok Sabha, proposing to merge existing securities laws into a single framework. The Bill aims to strengthen regulatory oversight, enhance investor protection, and simplify compliance in capital markets. Dive deeper

MCX has set January 2, 2026, as the record date for its first-ever 1:5 stock split, under which shareholders will receive five shares for every one share held. Dive deeper

India’s InvIT and REIT distributions increased in Q2 FY26, with payouts by public trusts rising 55% year on year, according to an ICRA Analytics report. Dive deeper

Ola Electric founder Bhavish Aggarwal sold about 4.19 crore shares through open market transactions, according to exchange data. Dive deeper

Titagarh Rail Systems has secured a 273-crore order from the Ministry of Railways for 62 Rail Borne Maintenance Vehicles, covering design, manufacturing, supply, and lifecycle maintenance. Dive deeper

Tata Power plans to raise 2,000 crore through a bond issue, comprising two tranches of 1,000 crore each with three and five-year maturities, according to sources. Dive deeper

KPI Green Energy rose as much as 4.5% before ending 1% higher after KP Group signed an MoU with the Government of Botswana. The partnership will focus on developing large-scale renewable power generation, energy storage, and transmission infrastructure in the country. Dive deeper

What’s happening globally

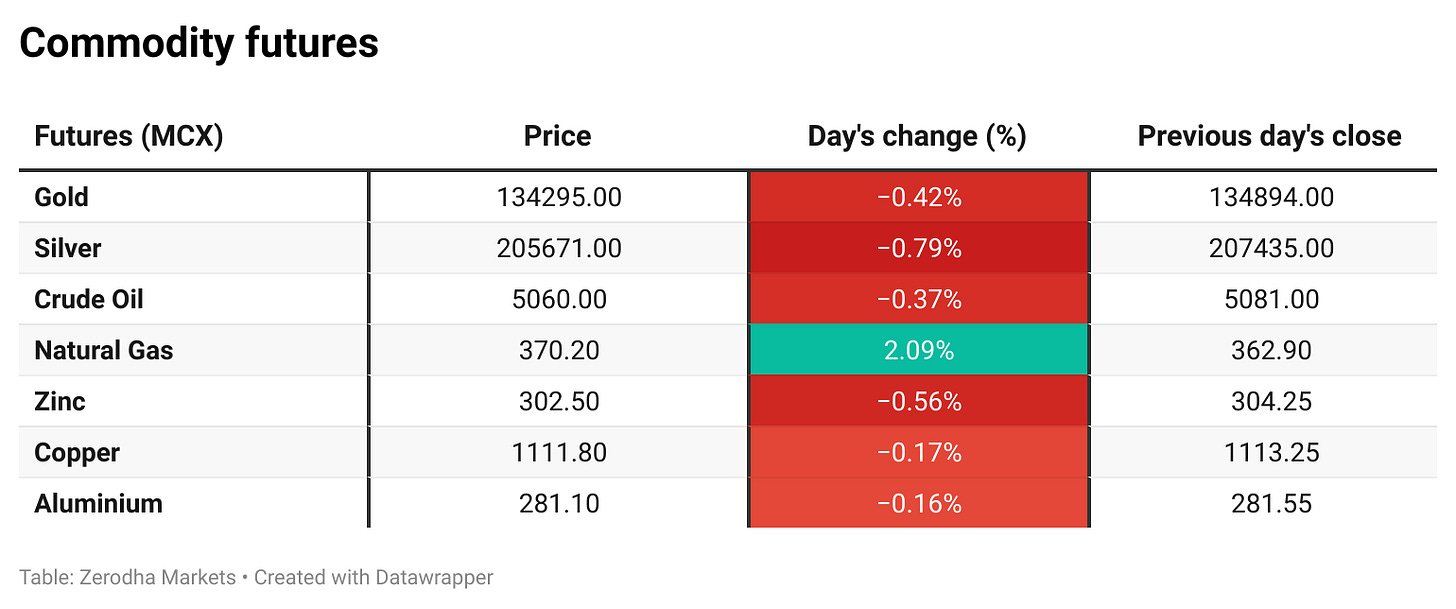

Brent crude rose above $60 a barrel, extending its rebound from recent lows amid rising geopolitical tensions and concerns over potential supply disruptions. U.S. crude inventories declined for a second straight week, according to EIA data. Dive deeper

Gold edged lower to around $4,330 per ounce but remained close to record highs, supported by expectations of US rate cuts and ongoing geopolitical tensions. Dive deeper

Wheat futures traded below $5.10 per bushel as the USDA projected higher global supplies, led by increased output from major exporters including Argentina and Australia. Dive deeper

The Bank of England cut its policy rate by 25 basis points to 3.75%, the lowest since 2022, citing easing inflation and signs of economic weakness. The decision was narrowly split, with policymakers saying future moves will depend on the inflation outlook. Dive deeper

U.S. 30-year fixed mortgage rates rose to 6.38% in the week to December 12, according to the MBA. Mortgage applications fell 3.8%, with declines in both purchase and refinancing activity. Dive deeper

Taiwan’s central bank kept its key discount rate unchanged at 2% in December, citing moderate inflation and strong economic growth driven by exports and demand for emerging technologies. Dive deeper

Management chatter

In this section, we highlight interesting comments made by the management of major companies and policymakers from the Indian and Global Economies.

Pieter Elbers, CEO, IndiGo, on operational recovery and outlook

“The worst is behind us,”

“Through the storm, we found our wings again, and as IndiGo employees, we stood tall and united.”

“Recovering our network to 2,200 flights in a short time shows the strength of our teamwork and operating principles.” - Link

A Balasubramanian, Managing Director & CEO, Aditya Birla Sun Life MF

“From an AMC perspective, the impact is zero to negligible. From an investor’s perspective, there is a marginal reduction in expenses, which is positive.” - Link

Tuhin Kanta Pandey, Chairman, SEBI, on mutual fund fee reforms and IPO rule changes

“We approved changes to make mutual fund costs more transparent and cost-efficient for investors, including lower expense ratios and brokerage caps.”

“Attempts to unbundle sell-side research and brokerage charges were not successful in Europe and the UK, and that business model is not available today.”

“On IPOs, money is fungible and can come in at any stage of a company’s journey, which is why offers for sale need to be seen in that context.” - Link

Gita Gopinath, Professor of Economics, Harvard University, on India’s growth and reform priorities

“India’s growth of over 8% is a dream rate globally, but sustaining it will require continued reforms, job creation, and skill development.”

“Sustained reforms, ease of doing business, deregulation, and skilling of the workforce are crucial to keep growth high and inclusive.”

“India has done well in improving physical and digital public infrastructure, which together have been powerful drivers of growth.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

Calendars

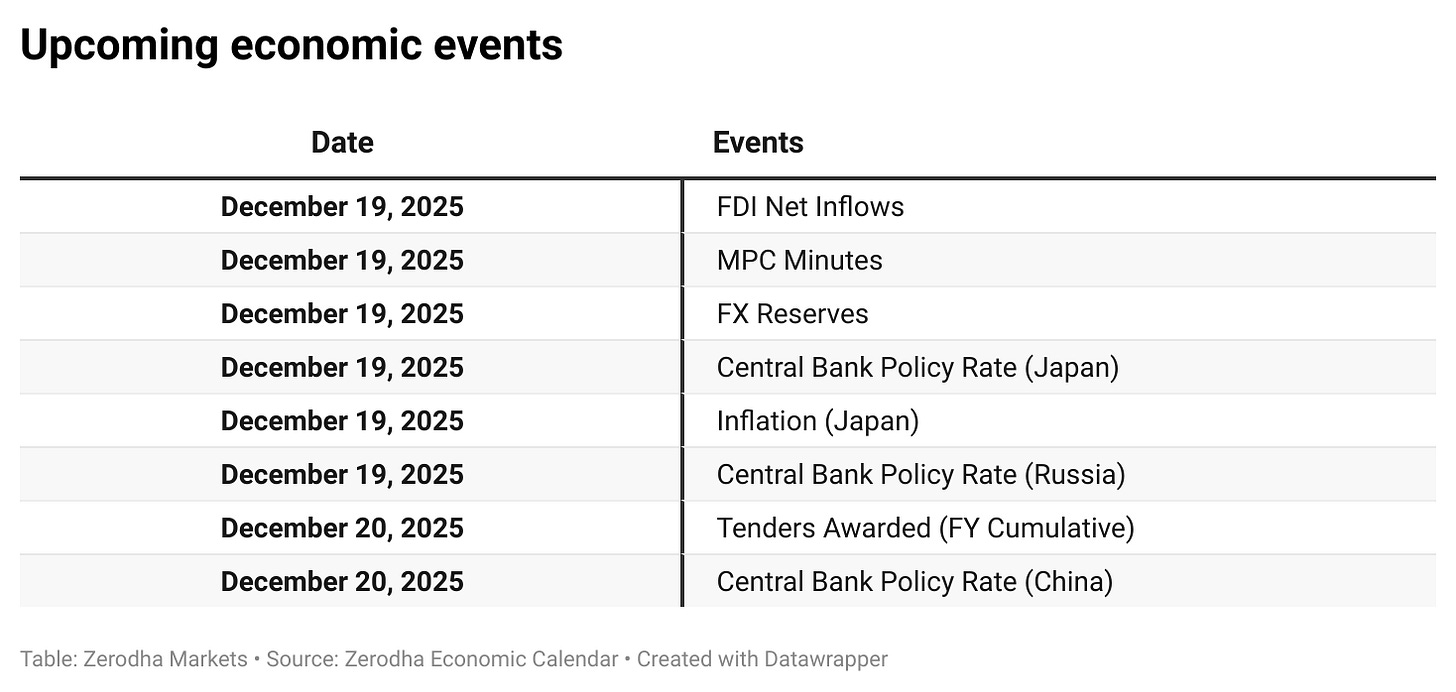

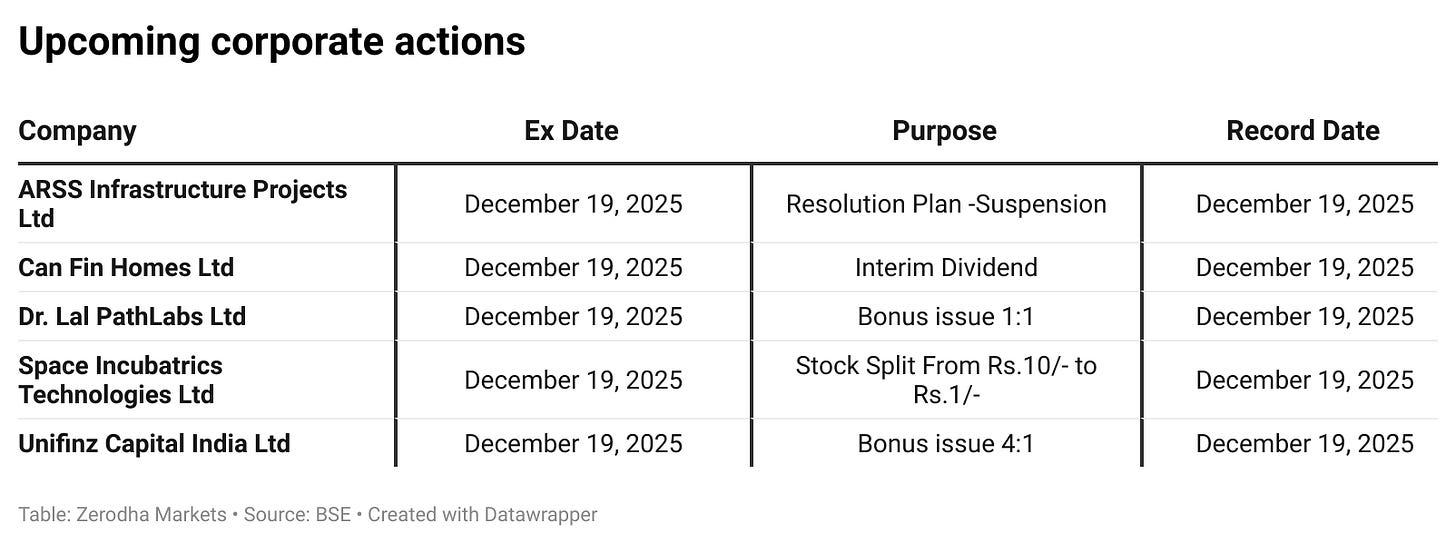

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!