Nifty caps off 2025 with a solid close above 26,100

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we take a step back from charts and strategies to talk about trading resolutions—why we make them, why most fail, and what actually helps them stick.

We briefly explore the history and psychology behind New Year’s resolutions, the behavioural traps that derail traders, and then move into 26 practical trading resolutions for 2026, spanning mindset, risk, learning, discipline, mental health, and long-term survival. This isn’t a checklist or a rulebook, but a menu you can pick from depending on where you are in your trading journey. No predictions. No systems. No hype. Just reflections on what helps traders stay in the game.

Market Overview

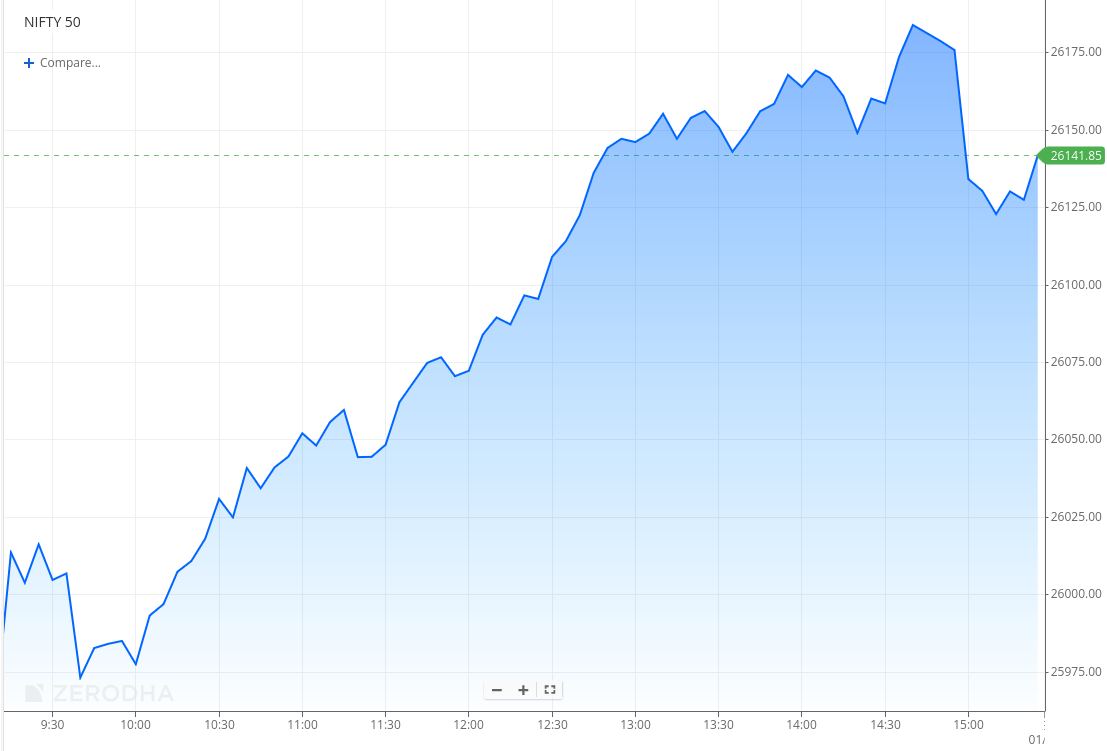

Nifty opened with a modest 32-point gap-up at 25,971 and witnessed early volatility, trading in a 50-point range between 25,975 and 26,025 during the first hour. Buying interest soon emerged, helping the index recover steadily through the morning session. By late morning, Nifty reclaimed the 26,050 level and continued to grind higher in a controlled manner, crossing 26,100 by 12:30 PM and moving past 26,150 around 1 PM.

Between 1 PM and 2:30 PM, the upward momentum remained intact, with Nifty consolidating in the 26,150–26,175 zone. While some profit-taking of around 50 points emerged in the final hour, the index managed to hold most of its gains and eventually closed at 26,129.60. Overall, it was a strong, trend-driven session marked by consistent buying and a decisive recovery from early intraday dips.

Looking ahead, markets are likely to remain sensitive to global risk appetite, currency movements, and further developments around India–U.S. trade negotiations.

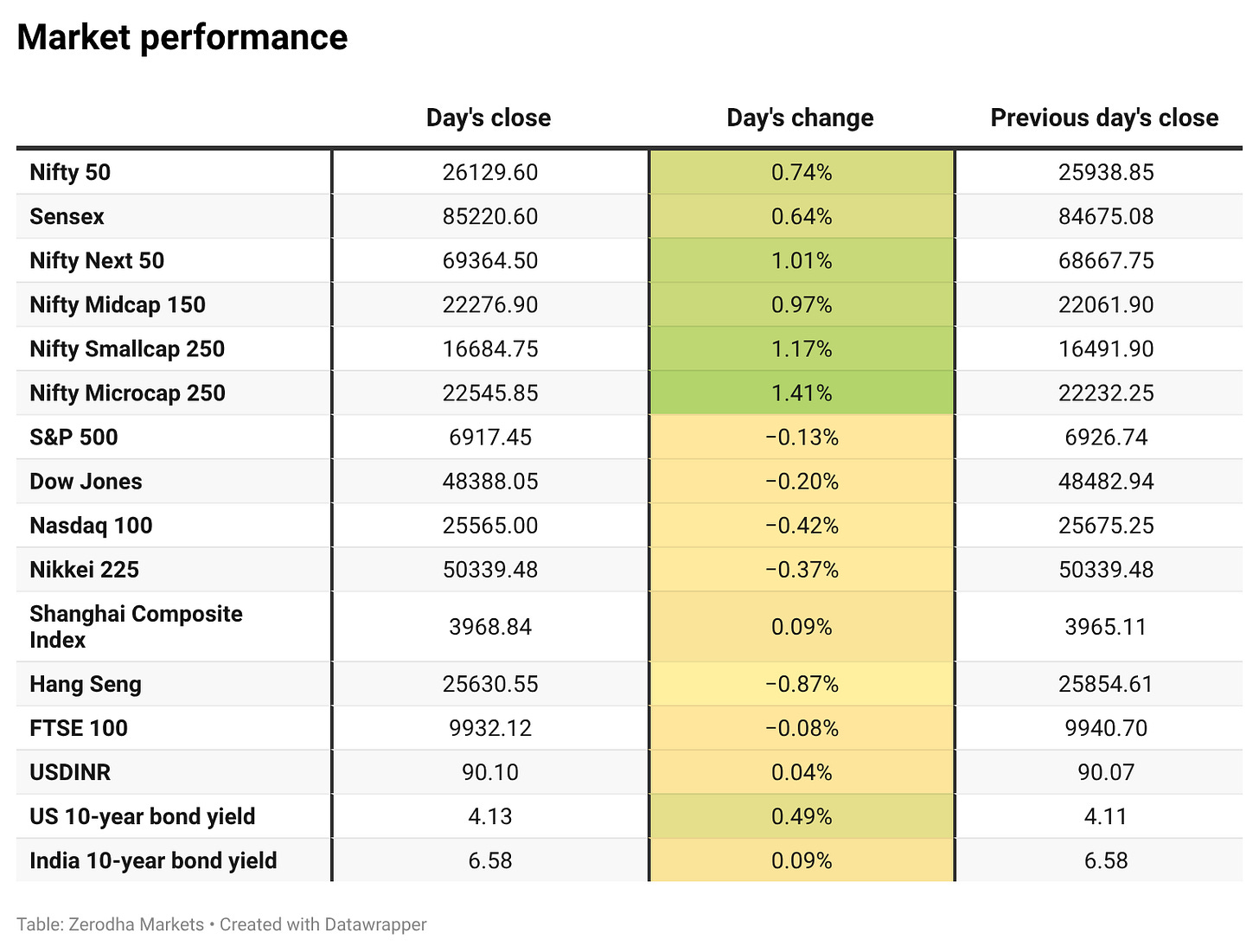

Broader Market Performance:

The broader market had a strong bullish session today. Out of 3,250 stocks that traded on the NSE, 2,221 advanced, while 935 declined, and 94 remained unchanged.

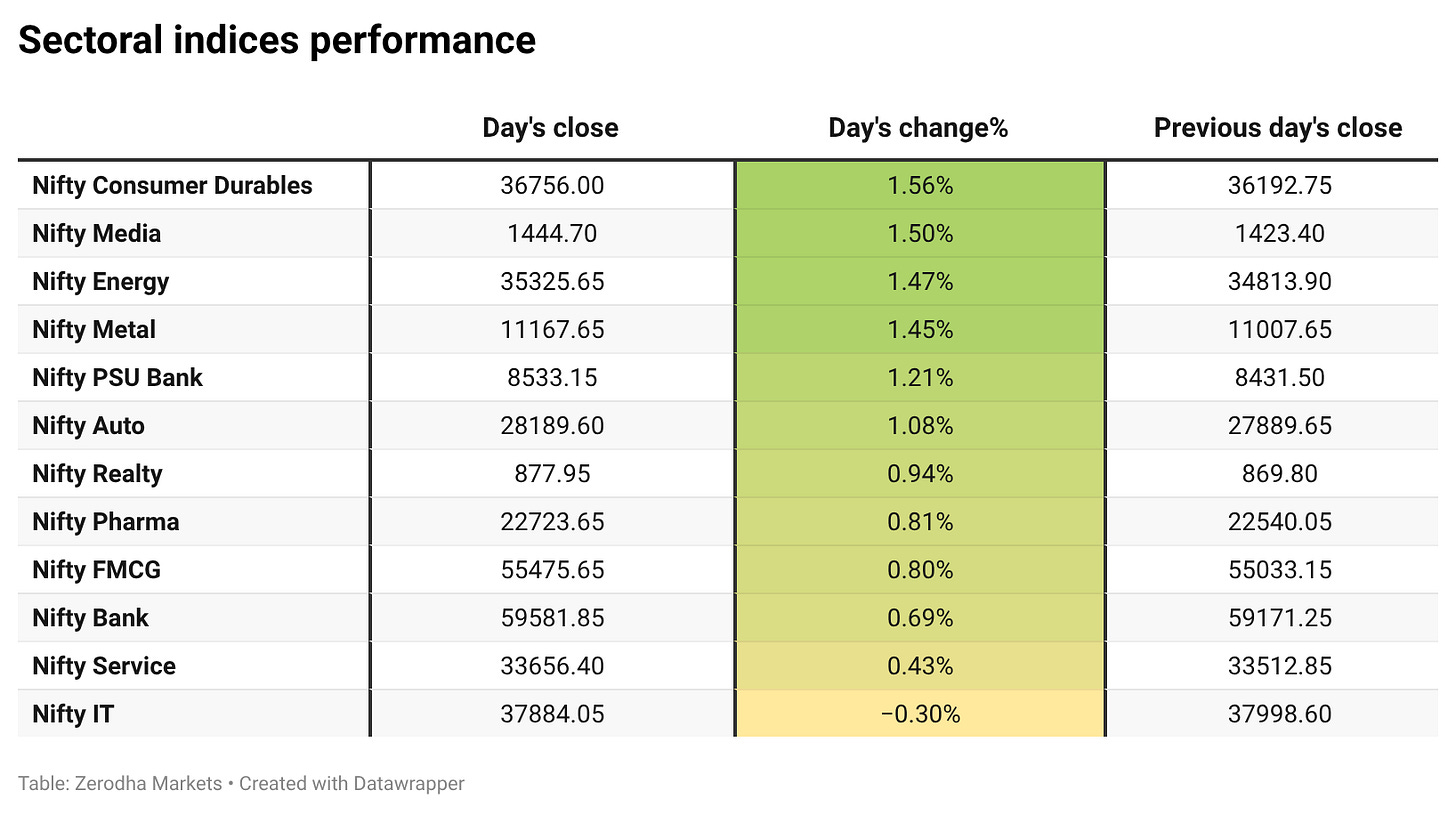

Sectoral Performance:

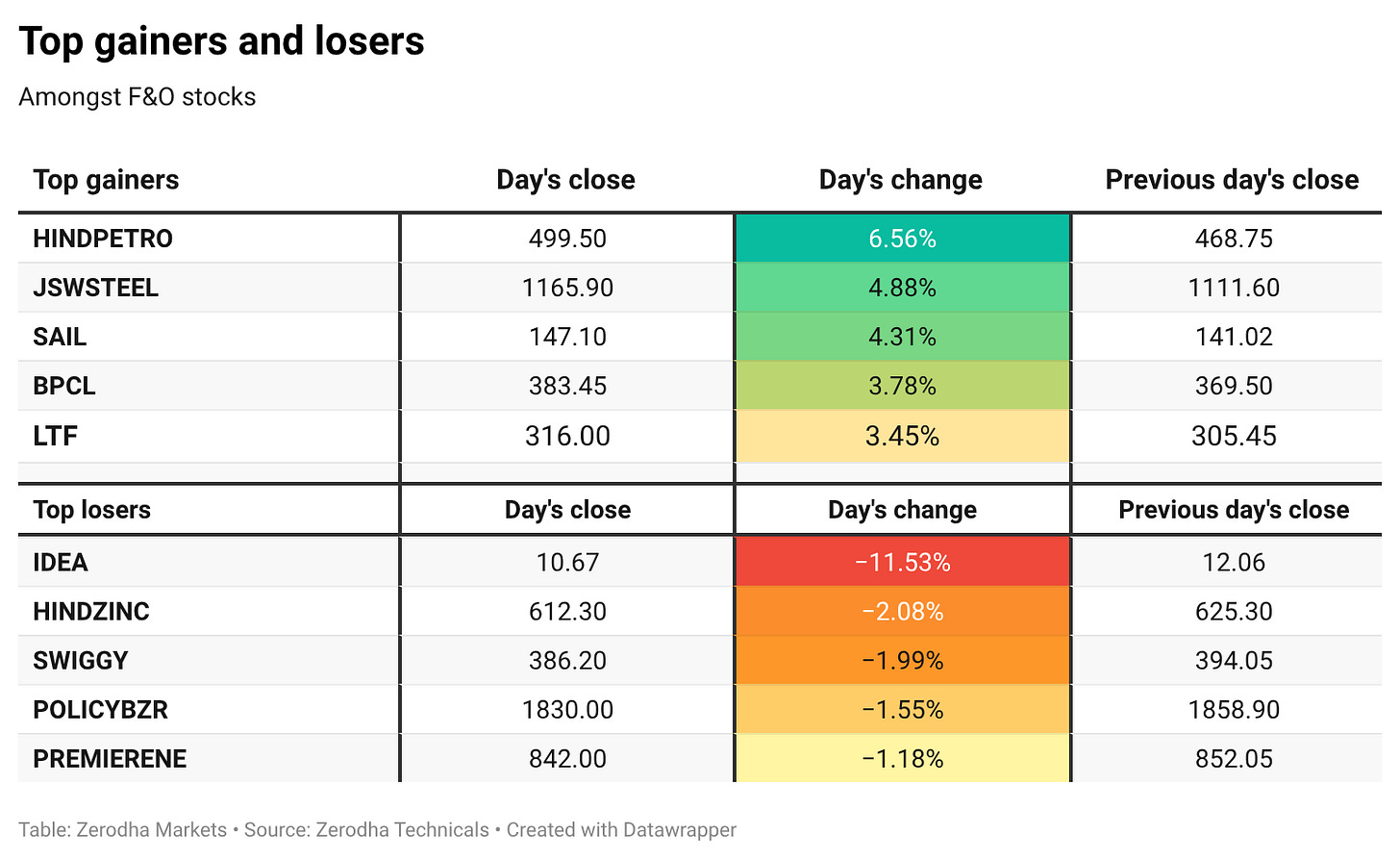

Nifty Consumer Durables led the gains with a 1.56% rise, while Nifty IT was the sole loser of the day, ending 0.30% lower. Out of the 12 sectoral indices, 11 closed in the green and only 1 closed in the red, indicating broad-based market strength.

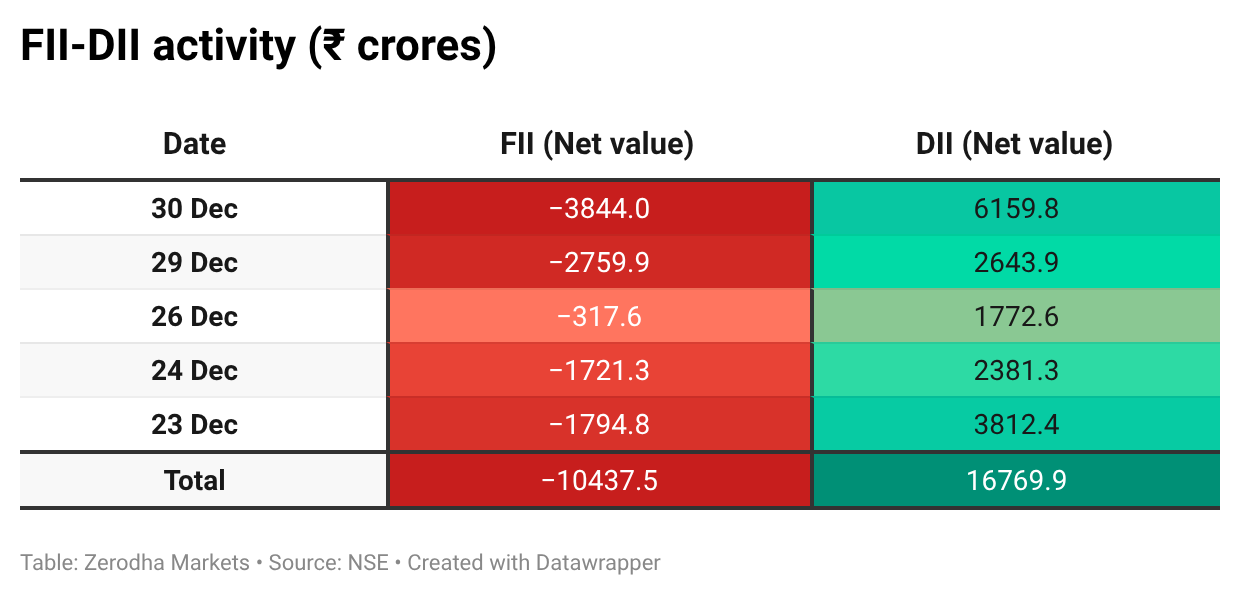

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 6th January:

The maximum Call Open Interest (OI) is observed at 26,400, followed by 26,200, indicating potential resistance at the 26,200 -26,300 levels.

The maximum Put Open Interest (OI) is observed at 26,000, followed by 26,100 & 25,900, suggesting support at the 26,000 to 25,900 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

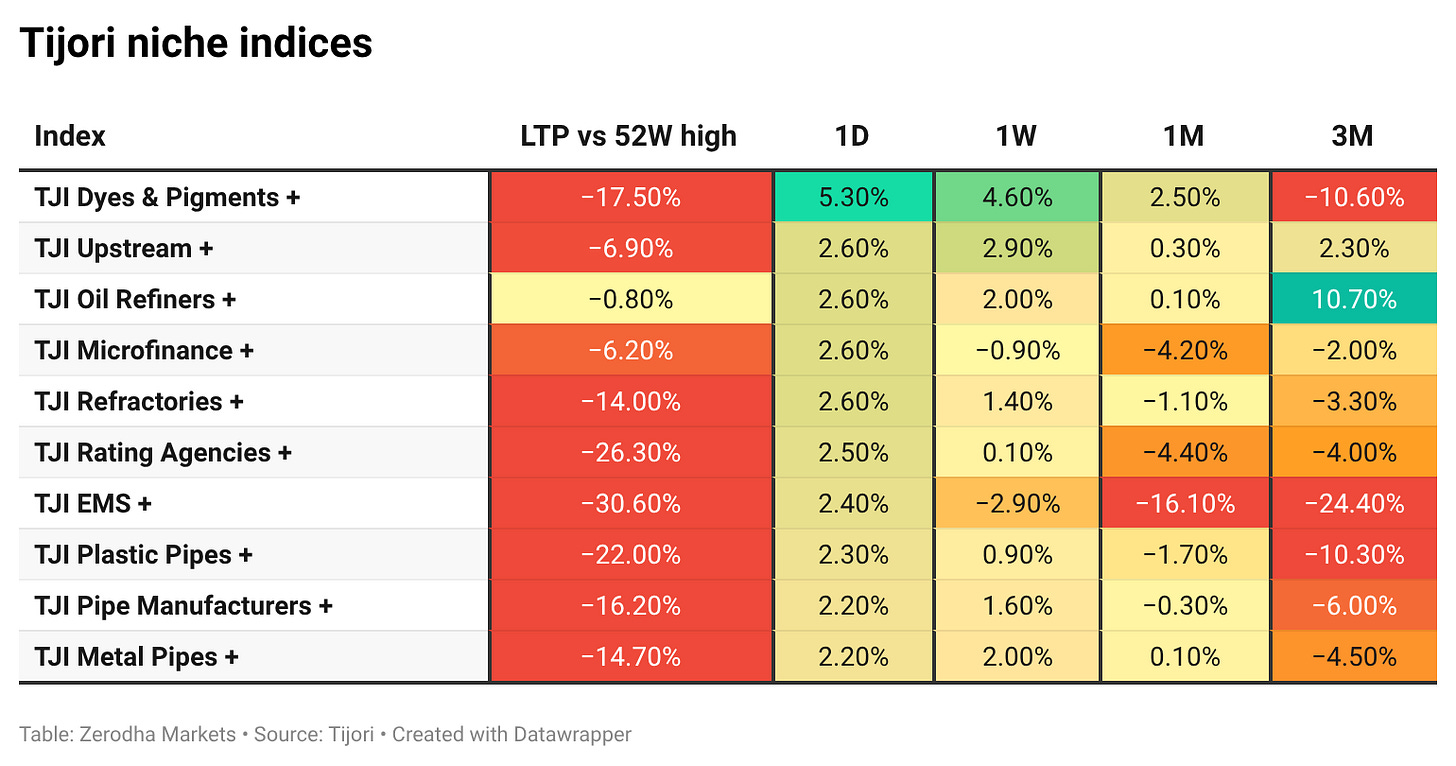

Tijori is an investment research platform that has constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

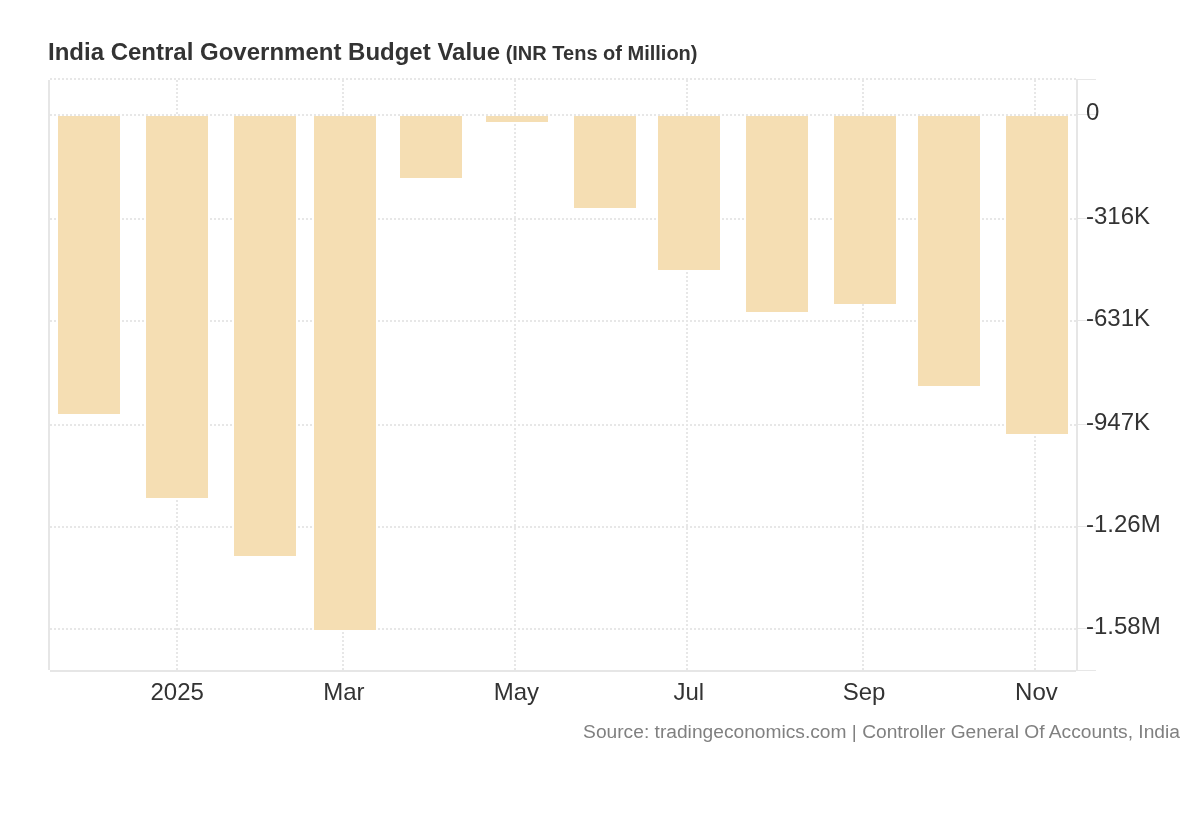

India’s fiscal deficit widened to ₹9.77 trillion in April - November FY26, reaching 62.3% of the full-year target, compared with 52.5% a year earlier, according to the Controller General of Accounts. Total expenditure rose to ₹29.26 trillion, while capital spending increased to ₹6.6 trillion and receipts stood at ₹19.49 trillion. Dive deeper

Vodafone Idea fell more than 11.5% on reports that the Union Cabinet approved a relief package freezing Vodafone Idea’s AGR dues at ₹87,695 crore, with repayment scheduled over 10 years starting FY32, while FY18-19 dues remain payable as per the existing timeline. Dive deeper

The Indian rupee stabilised around 89.8 per US dollar, supported by a softer dollar and measures taken by the Reserve Bank of India to steady market sentiment. Dive deeper

Bharat Forge secured a ₹1,661.9 crore contract from the Ministry of Defence for the supply of 255,128 indigenously developed Close Quarter Battle carbines to the Indian Army. Dive deeper

The Insurance Regulatory and Development Authority of India has been empowered under amendments to the Insurance Act to set limits on commissions paid to insurance agents and intermediaries. Dive deeper

RBL Bank received approval from the Reserve Bank of India to appoint Jaideep Iyer as Executive Director from February 21, succeeding Rajeev Ahuja, subject to shareholder approval. Dive deeper

Varun Beverages completed the acquisition of South Africa–based beverage brand Twizza for ₹1,119 crore, strengthening its presence in the region and expanding its international operations. Dive deeper

IFCI sold its 10% equity stake in North Eastern Development Finance Corporation (NEDFi) for ₹121.77 crore, as disclosed in an exchange filing. Dive deeper

RITES Ltd said it has secured an international order worth $3.6 million for the supply of diesel-electric locomotives from a Zimbabwe-based entity, to be executed within three months. Dive deeper

Power Grid Corporation of India said it has won a 2,000 MWh battery energy storage project in Andhra Pradesh under tariff-based competitive bidding and received the letter of award on December 29. Dive deeper

Premier Energies said it has secured new orders worth ₹2,307 crore during Q3 FY26, with execution scheduled over FY27 and FY28, as disclosed in a regulatory update. Dive deeper

InterGlobe Aviation received a GST demand order of ₹458.26 crore from tax authorities for FY2019 - FY2023 and plans to challenge the order through legal channels. Dive deeper

What’s happening globally

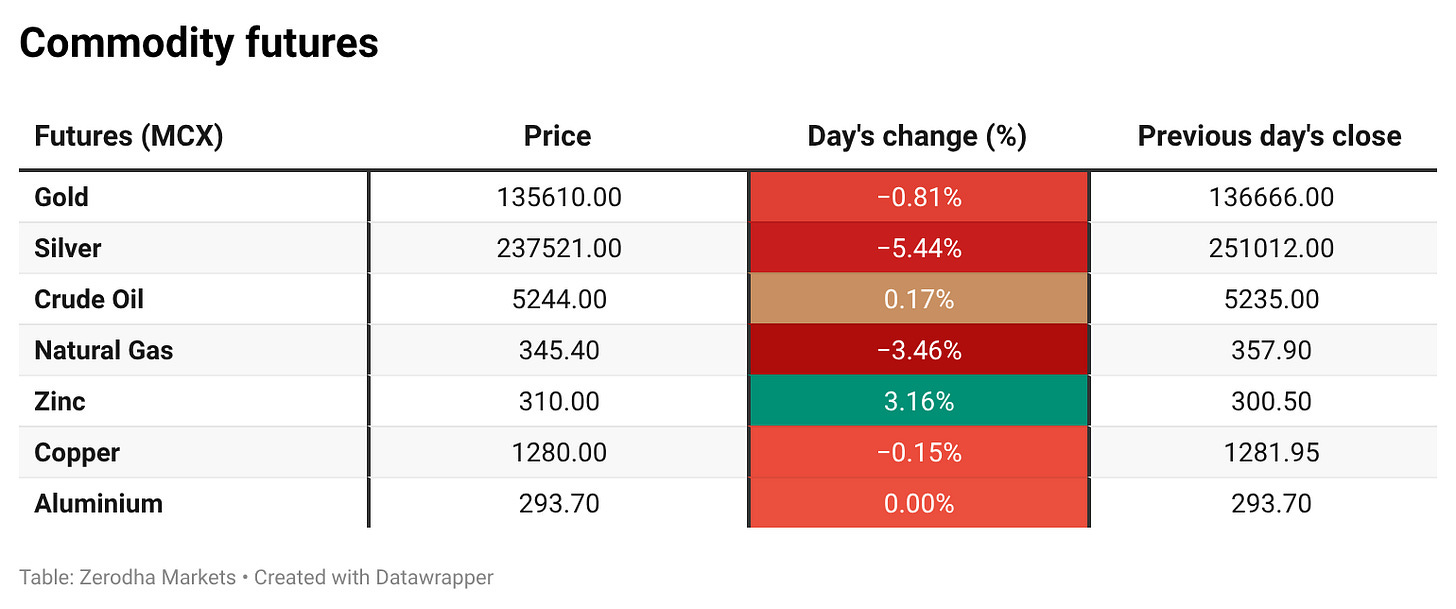

WTI crude oil futures fell to around $57.7 per barrel, on track for their steepest annual decline since 2020 amid concerns over excess supply. Dive deeper

Gold prices slipped below $4,330 per ounce on the final trading day of 2025, even as the metal remained on track for its strongest annual performance in over four decades. Dive deeper

Silver fell over 5% to $72 per ounce, retreating from a record high of $86.62 reached earlier this week. Dive deeper

China’s economy grew by 5% in 2024, matching the official target, supported by stimulus measures and stronger manufacturing output, according to the National Bureau of Statistics of China. Manufacturing rose 6.1%, services grew 5%, and total goods trade increased 5% during the year. Dive deeper

China’s general manufacturing PMI rose to 50.1 in December 2025 from 49.9 in November, signalling a marginal expansion in factory activity, according to S&P Global. Dive deeper

SoftBank Group has completed its $40 billion investment in OpenAI, according to a CNBC report citing people familiar with the matter. Dive deeper

Nvidia has approached Taiwan Semiconductor Manufacturing Company to ramp up production of its H200 AI chips, as demand from Chinese technology companies accelerates, according to Reuters. Dive deeper

Management chatter

In this section, we highlight interesting comments made by the management of major companies and policymakers from the Indian and Global Economies.

Ajay Bhadoo, Director General of Foreign Trade, on the rollout of Export Promotion Mission guidelines

“We have substantially completed the task of detailing the guidelines, with one notified today and one or two more to follow in the next few days.”

“There are 11 components under the Export Promotion Mission, and our target is to notify guidelines for all of them by January 31, 2026.”

“The caps on assistance are designed to ensure diversification, so benefits are not cornered by a few players, with special focus on MSMEs.” - Link

Sanjay Malhotra, Governor, Reserve Bank of India, on growth and financial stability

“Maintaining financial stability and strengthening the financial system remains our north star.”

“Despite a volatile and unfavourable external environment, the Indian economy is projected to register high growth, driven by strong domestic consumption and investment.”

“The priority is to foster a financial system that is robust, resilient to shocks, efficient, and supportive of responsible innovation.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

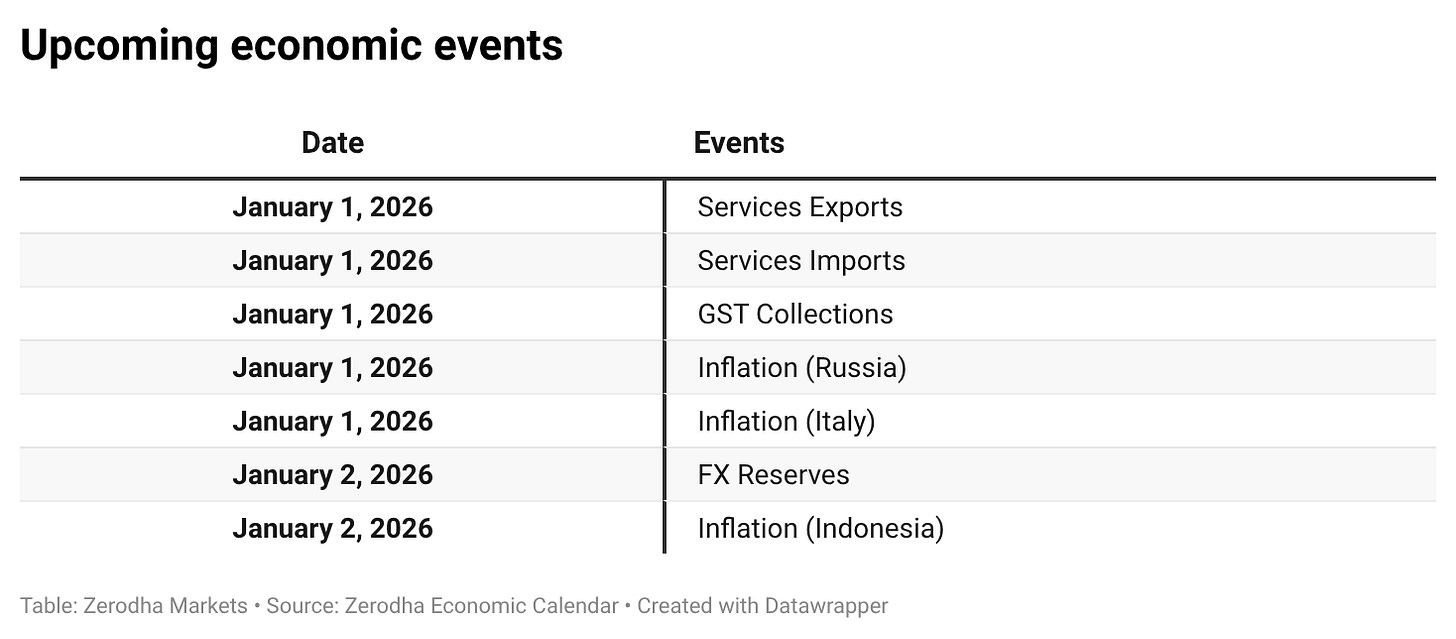

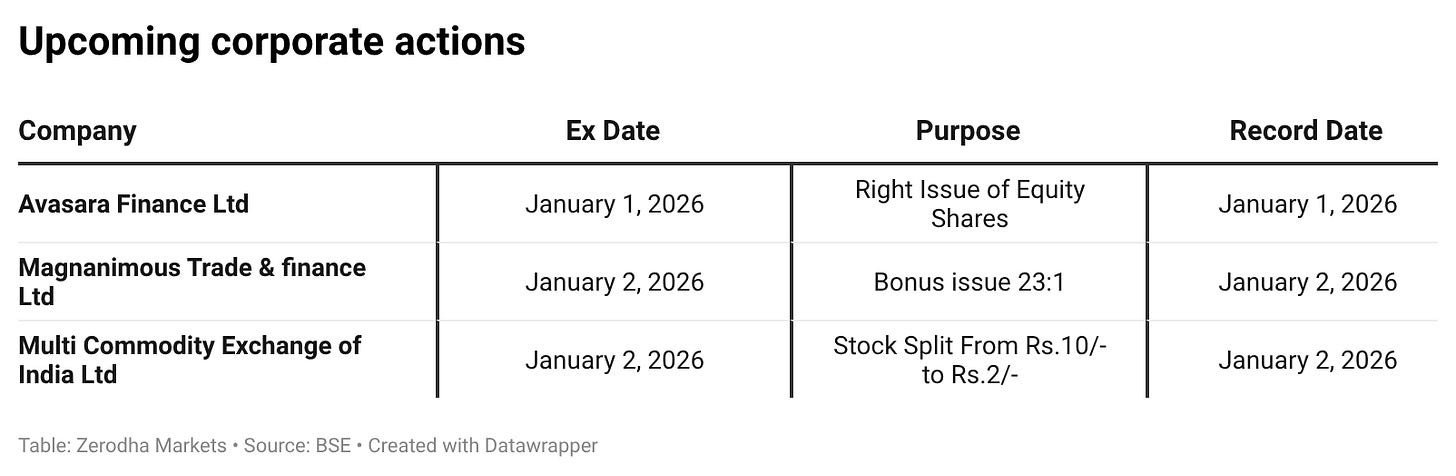

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!