Nifty and broader markets slide; Rupee weakness weighs as Index closes near 25,850

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we explore Week 50 of 2025, a volatile yet largely directionless stretch for markets, marked by sharp early-week moves followed by a late recovery. A delayed reaction to the US Fed’s 25 bps rate cut kept traders on edge, while Indian indices continued to hover near all-time highs, struggling to commit to a clear directional trend with just two weeks left in the year.

Market Overview

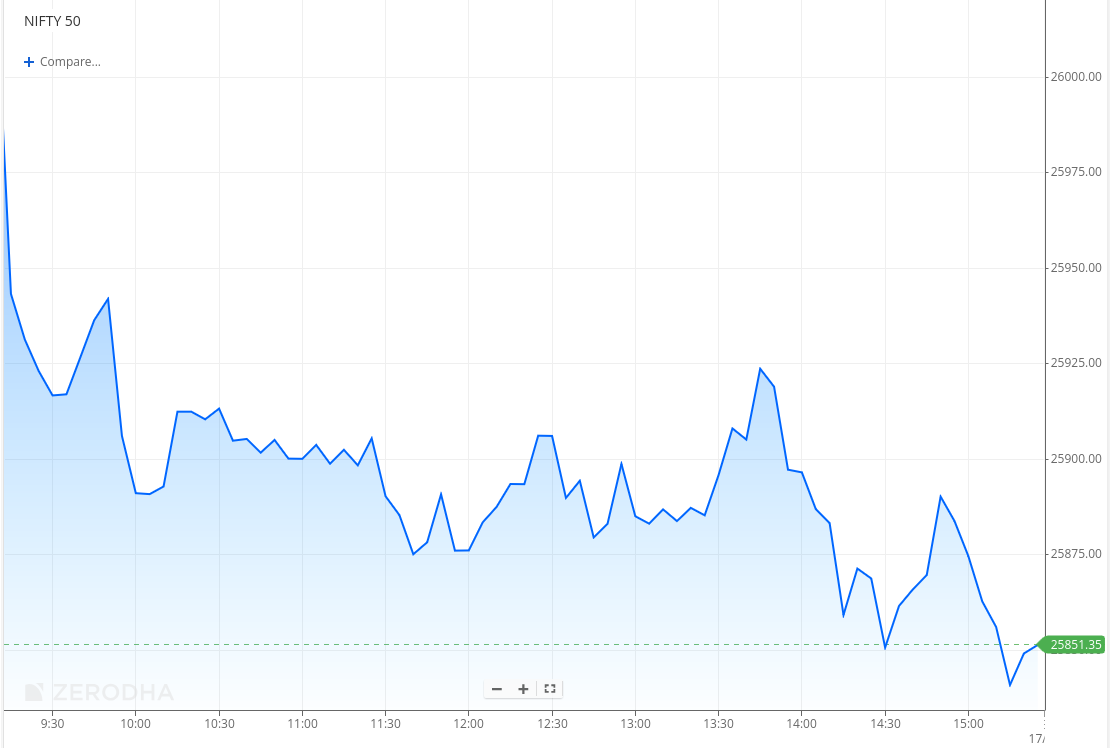

Nifty opened with a 75-point gap-down at 25,952, tracking weak global cues, and stayed under pressure right from the opening bell. The index slipped further in the first hour, testing the 25,880–25,900 zone, before attempting a modest rebound toward 25,920. Through the late morning session, Nifty remained range-bound and choppy between 25,880 and 25,930, struggling to generate any meaningful upside momentum.

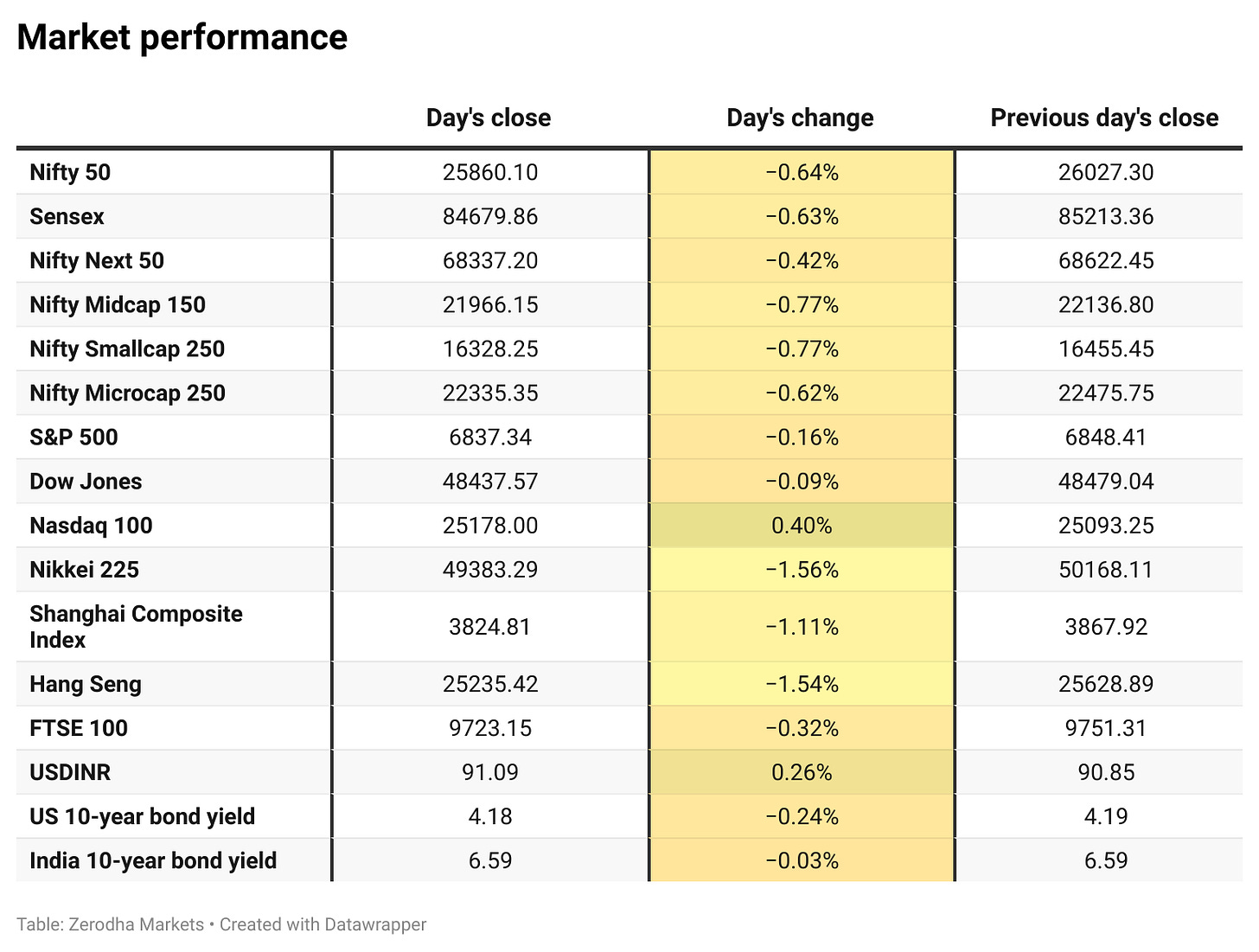

In the second half, selling pressure resurfaced—particularly after 2 PM—dragging the index lower toward the 25,850–25,860 zone. A brief recovery attempt in the final hour to reclaim 25,900 failed to sustain, and Nifty slipped once again into the close. The index eventually settled near the day’s low at 25,860.10, down 0.64%, marking a weak session dominated by persistent selling and cautious sentiment amid continued INR weakness against the U.S. dollar.

Looking ahead, markets are likely to remain sensitive to global risk appetite, currency movements, and further updates on India–U.S. trade negotiations.

Broader Market Performance:

The broader markets experienced a particularly weak session today. Out of 3,211 stocks that traded on the NSE, 1,023 advanced, while 2,095 declined, and 93 remained unchanged.

Sectoral Performance:

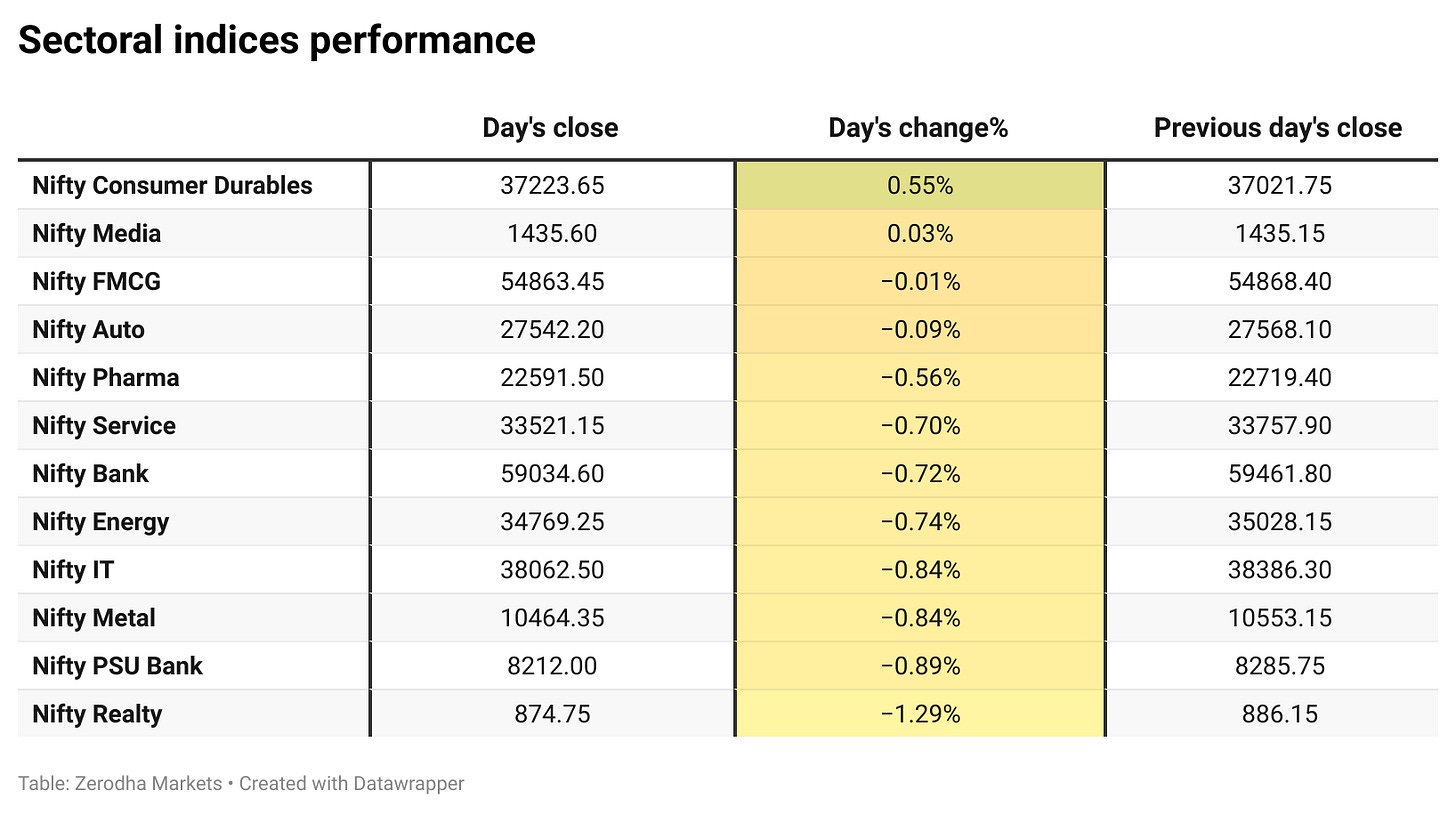

The top-gaining sector for the day was Nifty Consumer Durables, which rose by 0.55%, while the top losing sector was Nifty Realty, down 1.29%.

Out of the 12 sectoral indices, 2 closed in green, 1 was flat, and 9 ended in the red, indicating a broadly negative market breadth across sectors.

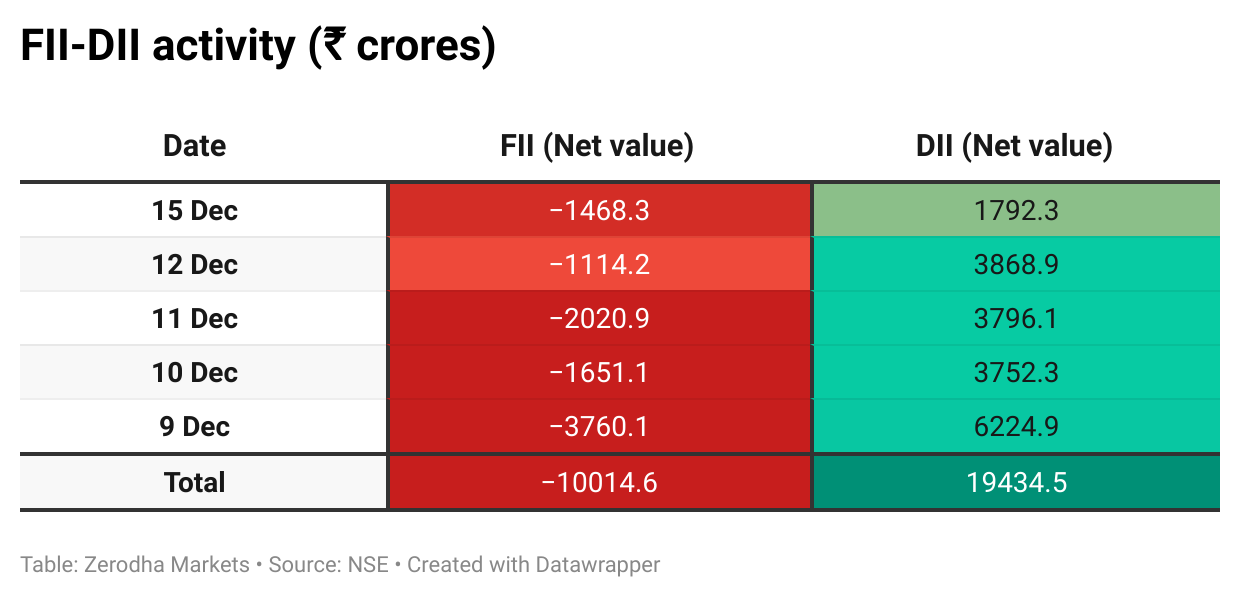

Here’s the trend of FII-DII activity from the last 5 days:

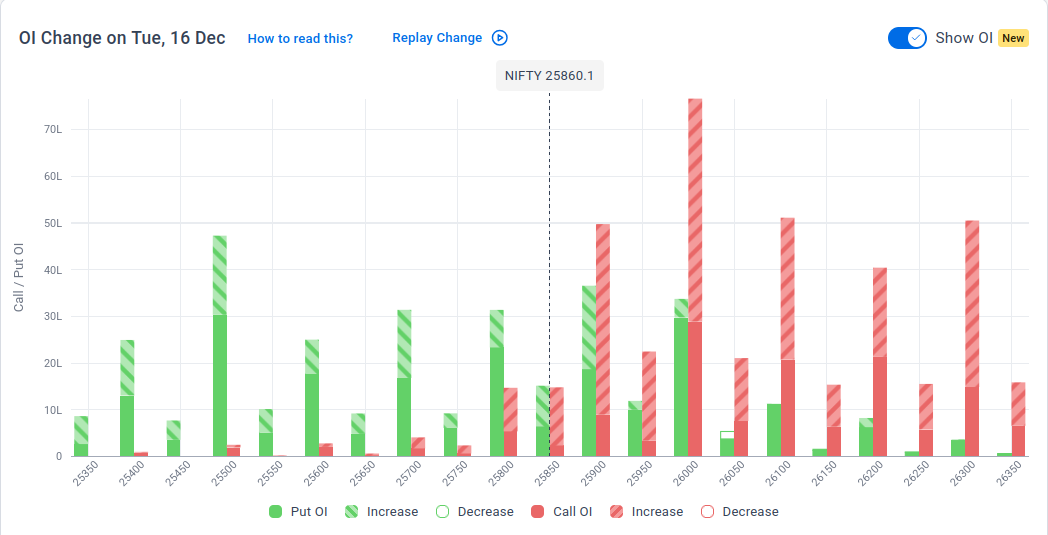

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 23rd December:

The maximum Call Open Interest (OI) is observed at 26,000, followed by 26,100 & 26,300, indicating potential resistance at the 26,000 -26,100 levels.

The maximum Put Open Interest (OI) is observed at 25,500, followed by 25,900, suggesting support at the 25,800 to 25,700 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

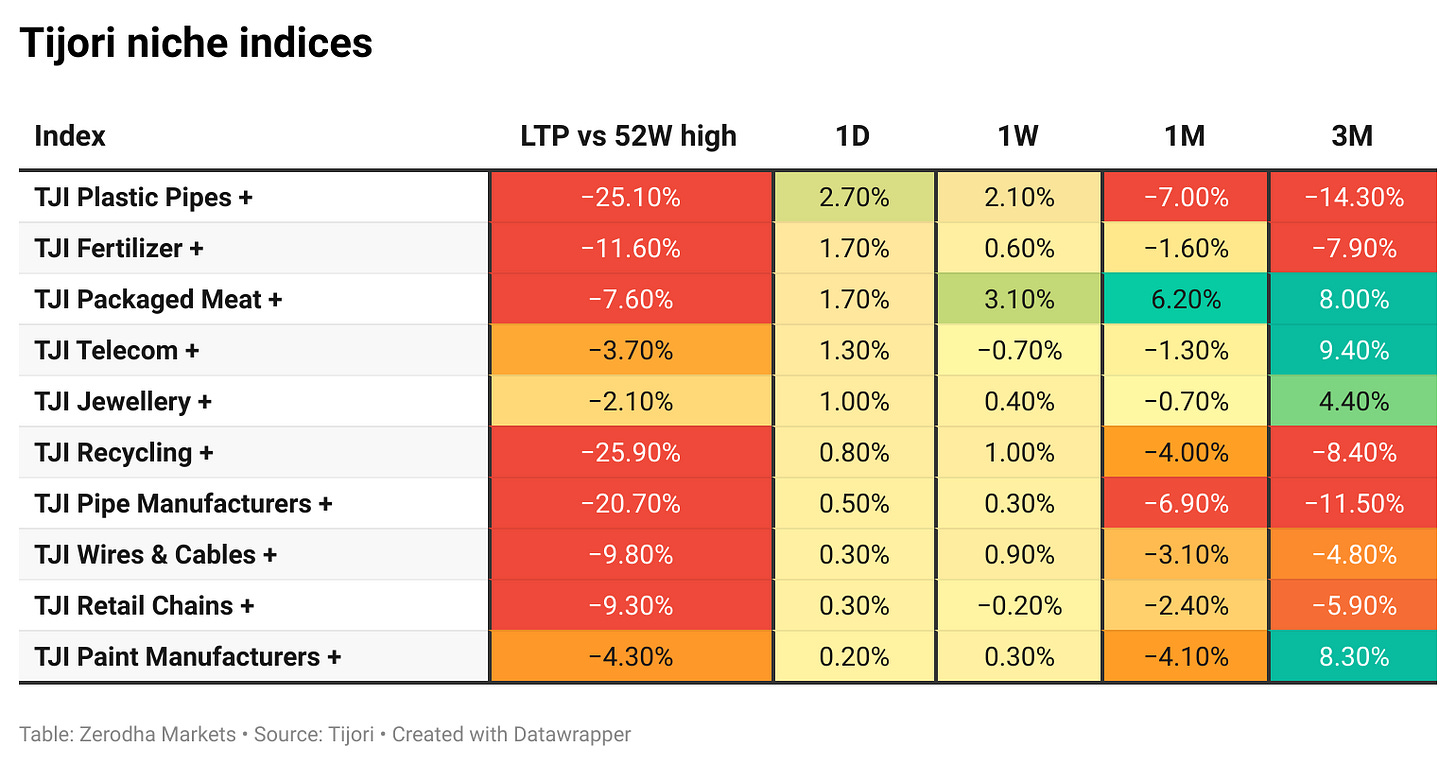

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

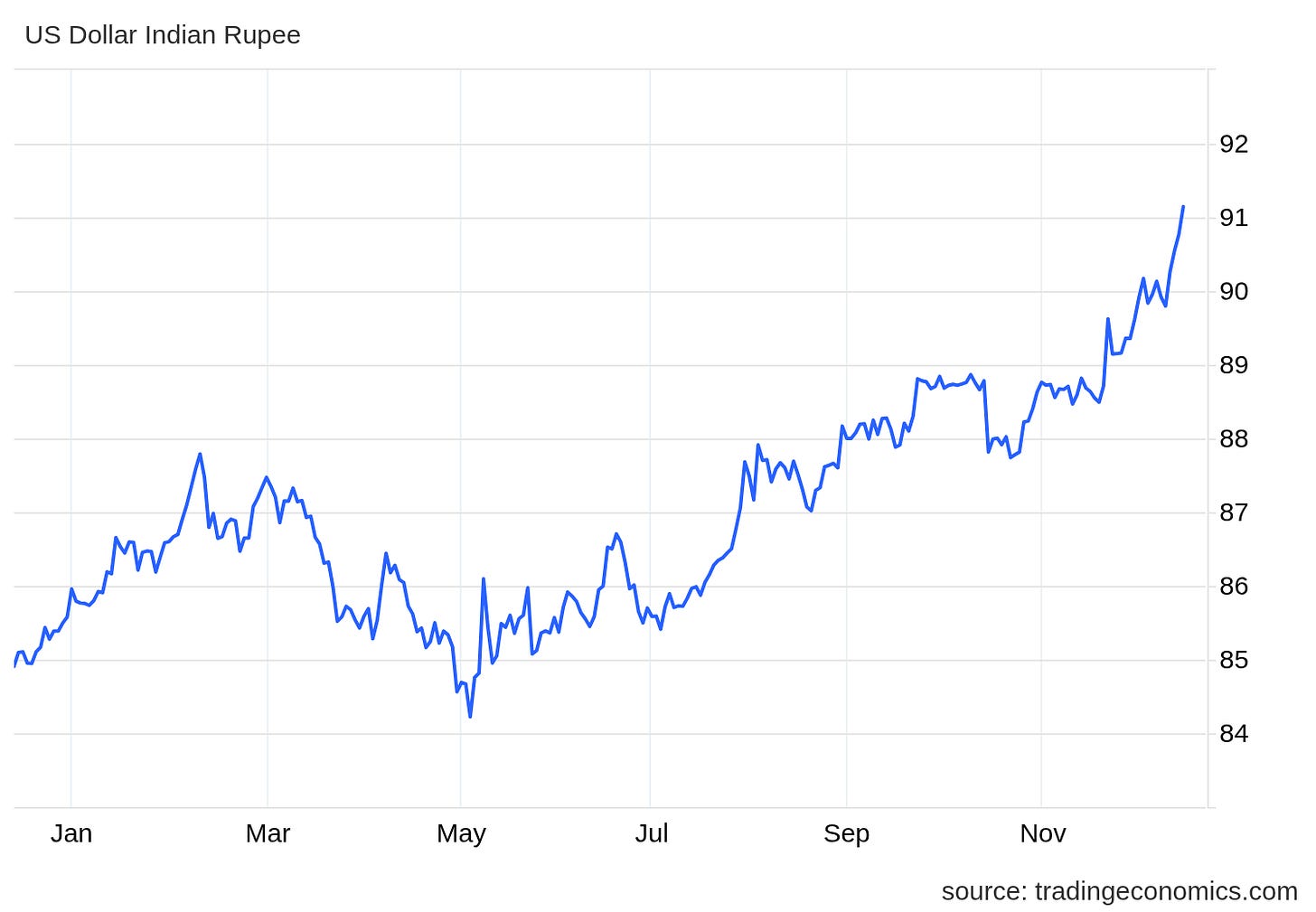

The rupee slipped past 91 per dollar for the fourth straight session as foreign money keeps moving out and US-India trade talks remain stuck. Heavy selling by overseas investors and pressure from US tariffs are weighing on sentiment. Dive deeper

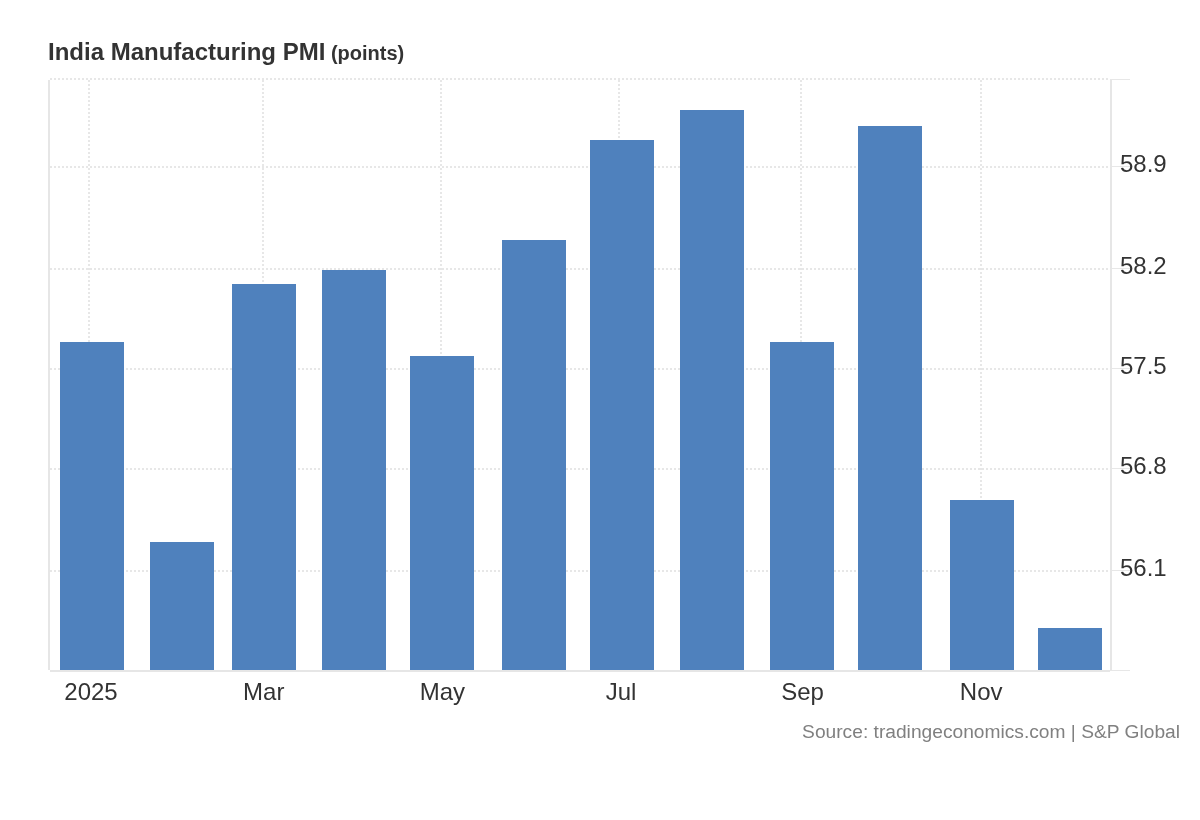

India’s manufacturing growth cooled in December, with the PMI at a one-year low as new orders and output growth softened, reflecting tariff-related pressure on labour-intensive sectors. Dive deeper

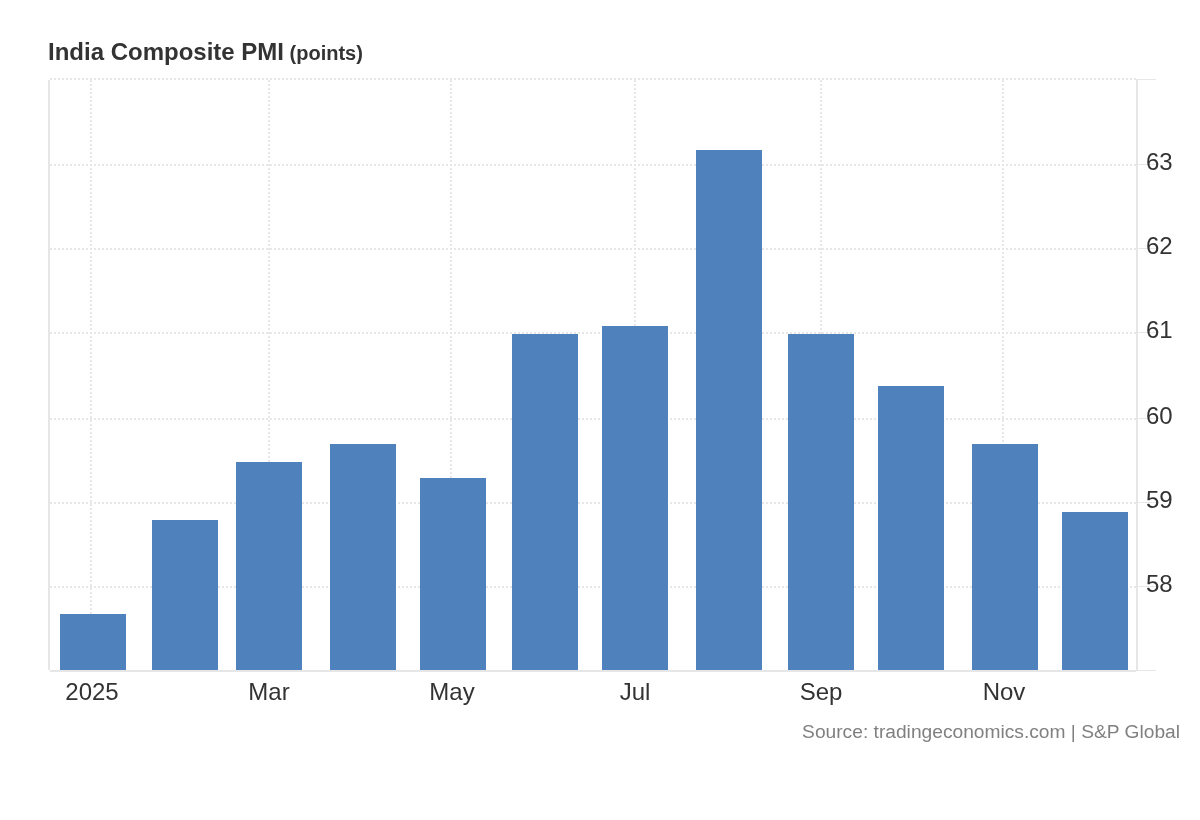

HSBC India’s Composite PMI slipped to 58.9 in December, the lowest since February, as growth in manufacturing and services softened. Price pressures stayed muted, and confidence remained positive, though optimism eased to its weakest level since July 2022. Dive deeper

HSBC India’s Services PMI eased to 59.1 in December, marking a slower but still strong expansion as growth in activity and new business softened. Price pressures remained muted, employment was stable, and business confidence weakened further. Dive deeper

India’s exports rebounded sharply in November despite steep US tariffs, with shipments to the US rising over 22% and total goods exports hitting a decade-high for the month. Dive deeper

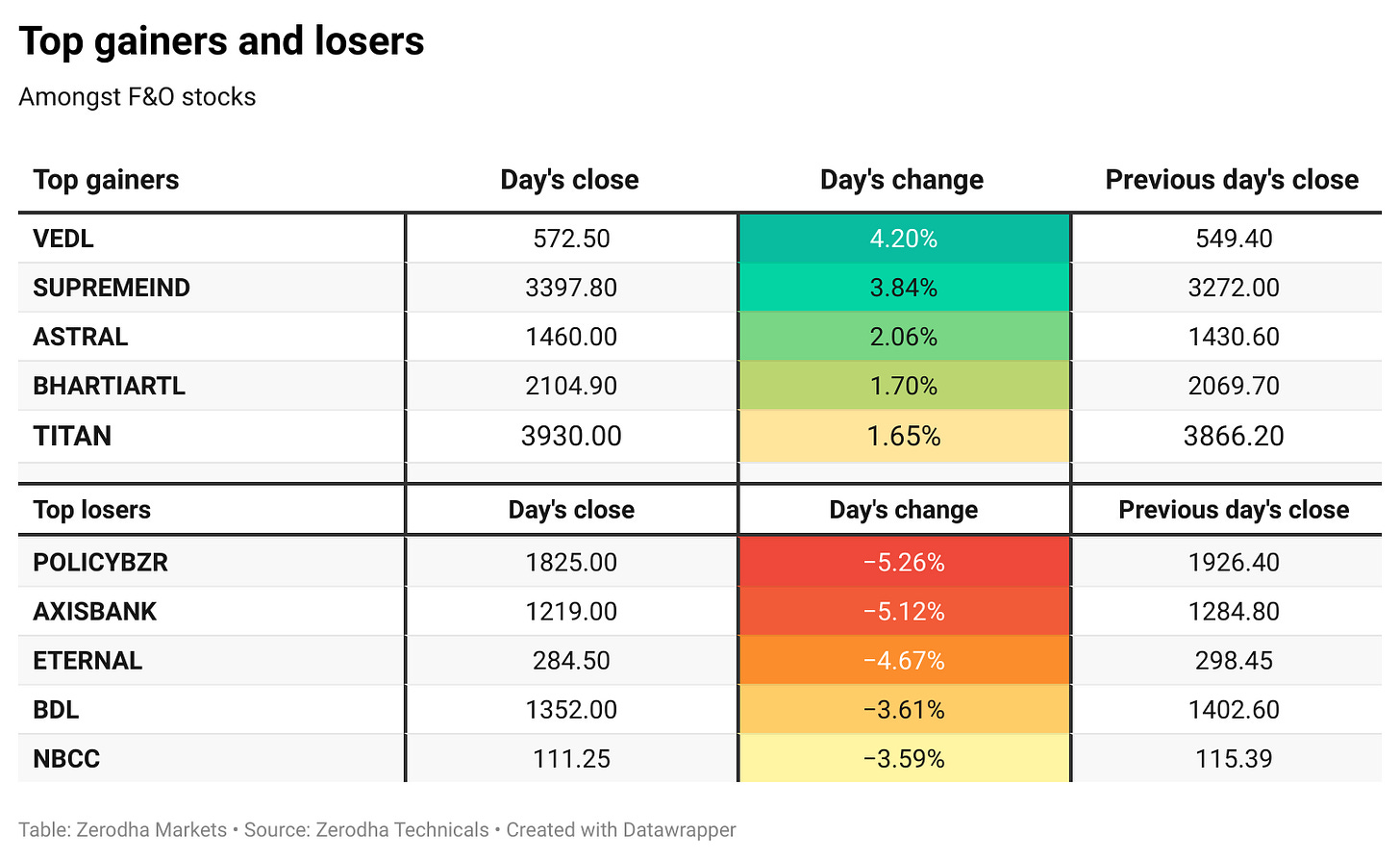

Axis Bank shares fell over 5% after Citi Research flagged a delay in net interest margin recovery. The lender’s management now expects NIM improvement only by Q4 FY26 or Q1 FY27, later than the earlier expectation of Q3 FY26. Dive deeper

RBI has approved HDFC Bank group entities to acquire up to a 9.5% stake in IndusInd Bank, with the approval valid for one year. The move comes as IndusInd remains under scrutiny following governance and accounting lapses and senior management exits. Dive deeper

Vedanta’s demerger plan has been cleared by the NCLT, paving the way to split the company into five focused businesses spanning aluminium, oil & gas, ferrous, power, and steel. Dive deeper

The unemployment rate fell to 4.7% in November, the lowest level since April, according to the government’s Periodic Labour Force Survey. Labour force participation rose to 55.8%, led mainly by higher participation in rural areas. Dive deeper

The proposed Insurance Bill 2025 is set to give IRDAI the power to decide and cap commissions paid to insurance agents and intermediaries through regulations. The Bill also raises the foreign investment limit in insurance companies to 100%, subject to conditions. Dive deeper

Sugar production rose to 78.25 lakh tonnes in the first 75 days of the current season, compared with 61.28 lakh tonnes in the same period last year. Output increased across major producing states such as Uttar Pradesh, Maharashtra, and Karnataka. Dive deeper

What’s happening globally

Brent slipped below $60 a barrel as hopes of a Russia-Ukraine peace deal raised expectations of more Russian oil supply, while weak China data added to demand concerns, outweighing geopolitical risks such as rising US-Venezuela tensions. Dive deeper

Gold prices eased after a recent rally as markets awaited key US jobs and inflation data for signals on the Federal Reserve’s policy outlook. Dive deeper

US payroll growth for November is expected to be modest, reinforcing signs that the labour market is cooling even as wage growth stays steady. Dive deeper

Canada’s inflation held steady at 2.2% in November, undershooting expectations and staying broadly on track toward the 2% target. Dive deeper

Germany’s ZEW sentiment index jumped to a five-month high in December, signalling improving expectations after a prolonged period of stagnation, with gains led by autos and other export-heavy sectors. Dive deeper

Eurozone private-sector growth cooled in December, with the composite PMI slipping to a three-month low as services lost momentum and manufacturing stayed in contraction. Dive deeper

Management chatter

In this section, we highlight interesting comments made by the management of major companies and policymakers from the Indian and Global Economies.

Rajesh Agrawal, Commerce Secretary, Government of India, on India-U.S. trade talks and reciprocal tariffs

“India and the U.S. are very close to finalising an initial framework agreement on reciprocal tariffs.”

“We are at the final stage where only a few issues of difference remain, and these are gradually being resolved.”

“Similar progress is being made in negotiations with the European Union, with discussions now focused on closing remaining gaps.” - Link

Nimesh Shah, Managing Director & CEO, ICICI Prudential AMC, on AMC valuations and IPO sentiment

“Muted retail response to the IPO should not be read as weak fundamentals; AMC valuations reflect how the business structurally operates.”

“This is a capital-light, high-cash-flow business that has delivered around 18% top-line growth over the last seven years without needing incremental capital.”“Valuations should be judged on operating profits, not headline PAT, as surplus net worth income can distort comparisons.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

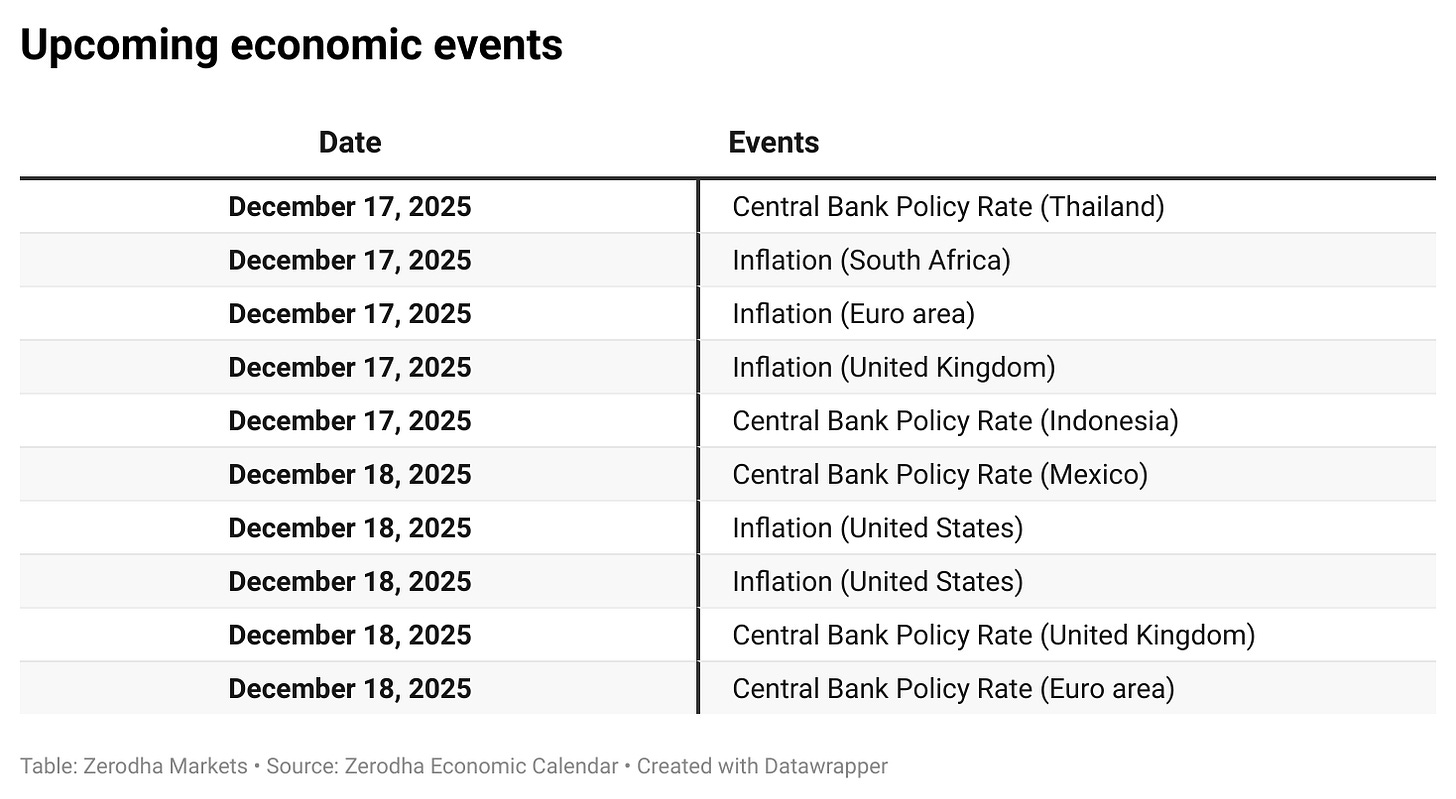

Calendars

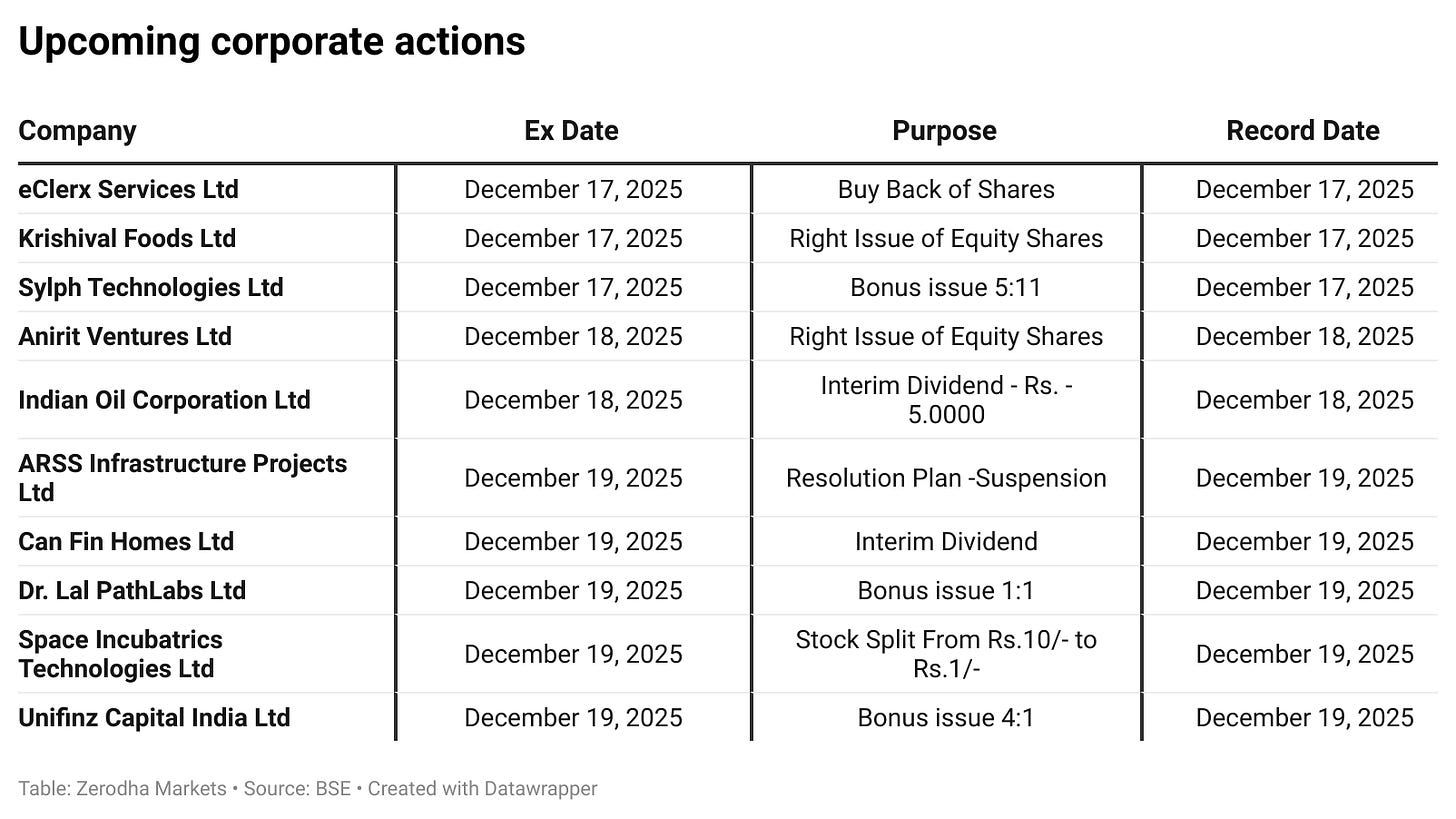

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!