Muted month-end close for Nifty under 25,750; PSU banks stand tall

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we dig into one of the oldest and most durable ideas in trading: Trend Following. A strategy that doesn’t try to predict the future — but simply follows the price. We trace this philosophy back to Richard Donchian, the father of systematic trend following — long before modern quant funds and algorithms. We also test Donchian strategies — like the 20-day breakout and the 5×20 SMA crossover — directly on the Indian market (Nifty), to see whether these classic systems still hold up.

Market Overview

Nifty opened flat with a mild 15-point gap-down at 25,864 and initially attempted an uptick, briefly moving above 25,950 in the first 30 minutes. However, selling pressure in heavyweight names soon dragged the index lower.

Through the late morning session, Nifty steadily slipped below 25,800 and traded in a tight range between 25,770 and 25,820, reflecting a lack of directional conviction. In the second half, weakness persisted as selling pressure continued to cap any recovery attempts. The index slid to lows near 25,710 post 3 PM and hovered near these levels into the close. Nifty eventually settled at 25,722.10, down 0.60%, marking a subdued end to the month amid profit-booking after the recent rally.

Looking ahead, markets are likely to remain sensitive to updates around the India–U.S. trade deal, while investors closely track Q2 earnings and management commentary on festive-season demand trends following the recent GST cuts.

Broader Market Performance:

Broader markets had a weak session today. Of the 3,181 stocks traded on the NSE, 1,266 advanced, 1,806 declined, and 109 remained unchanged.

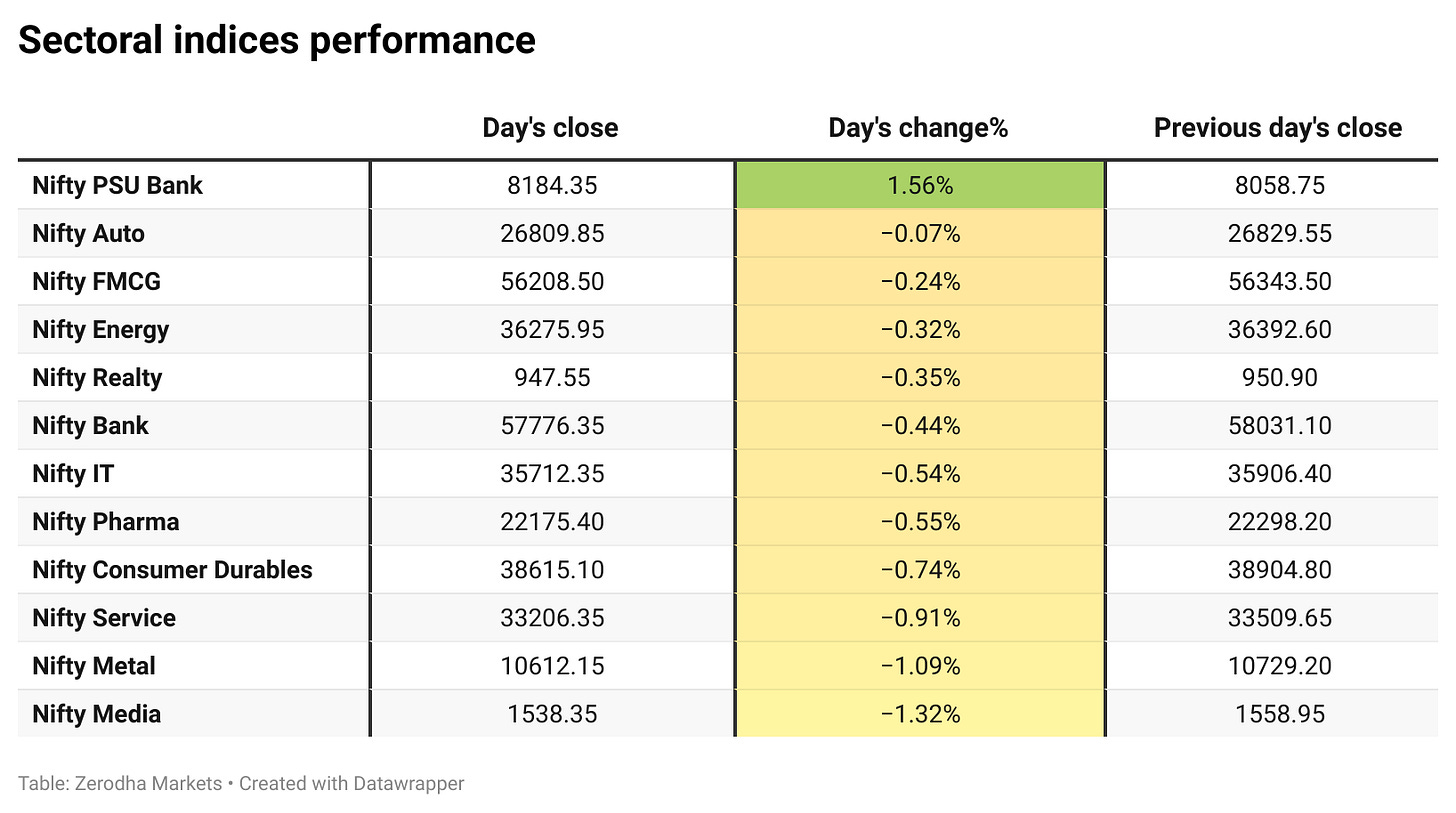

Sectoral Performance:

Nifty PSU Bank was the top gainer, rising 1.56%, while Nifty Media was the biggest loser, slipping 1.32%. Out of the 12 sectoral indices, only one closed in the green and 11 ended in the red, indicating broad-based weakness across the market.

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 4th November:

The maximum Call Open Interest (OI) is observed at 26,000, followed by 25,900, indicating potential resistance at the 25,900 -26,000 levels.

The maximum Put Open Interest (OI) is observed at 25,700, followed by 25,500 & 25,800, suggesting support at the 25,600 to 25,500 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

India’s fiscal deficit reached 36.5% of the full-year target at the end of the first half of FY26, higher than 29% in the same period last year. The deficit stood at ₹5.73 lakh crore during April–September 2025. Dive deeper

Ford announced plans to restart operations at its Chennai plant with a ₹3,250 crore investment to produce next-generation engines, creating over 600 jobs. Dive deeper

SEBI capped the top stock weight in the Bank Nifty at 20% and limited the combined weight of the top three stocks to 45%. The regulator also mandated a minimum of 14 constituents for indices eligible for derivatives trading, with full compliance due by March 2026. Dive deeper

Bandhan Bank reported an 88% year-on-year decline in Q2FY26 net profit to Rs 110 crore. Net interest income fell 12% to Rs 2,590 crore, while GNPA rose to 5% and NIM declined to 5.8%. Dive deeper

Reliance Industries partnered with Google to expand AI adoption in India, offering Jio users free access to Google’s AI Pro plan for 18 months. Separately, Bank of America acquired Rs 44 crore worth of RIL shares through a block deal. Dive deeper

Vedanta reported a 59% year-on-year decline in consolidated net profit to Rs 1,798 crore in Q2 FY26 due to an exceptional loss of Rs 2,067 crore. Revenue rose 6% to Rs 39,868 crore, its highest ever, while EBITDA increased 12% to Rs 11,612 crore, supported by strong aluminium and zinc output. Dive deeper

Bharat Electronics secured new defence orders worth Rs 732 crore for systems including software-defined radios, missile components, and cybersecurity solutions. The company expects additional orders of Rs 27,000 crore this fiscal, taking total inflows beyond Rs 50,000 crore in FY26. Dive deeper

Bank deposit growth slowed to 9.5% year-on-year as of October 17, down from 9.9% earlier, while credit growth remained steady at 11.5%, according to RBI data. The widening gap comes as savers shift from low-yielding CASA accounts to fixed deposits for better returns. Dive deeper

Shriram Finance reported a 7% year-on-year rise in consolidated net profit to Rs 2,314 crore for Q2 FY26, with total income increasing to Rs 11,921 crore. Gross NPAs improved to 4.57%, and the board declared an interim dividend of Rs 4.80 per share. Dive deeper

Maruti Suzuki India reported an 8% year-on-year rise in consolidated net profit to Rs 3,349 crore for Q2 FY26, while revenue grew 13% to Rs 42,344 crore. Exports surged 42%, offsetting a slight dip in domestic sales ahead of the GST transition. Dive deeper

India’s REIT market is projected to grow to Rs 19.7 lakh crore by 2030 from Rs 10.4 lakh crore in 2025, according to a Knight Frank India–CII report. The growth will be driven by high occupancy, favourable taxation, and diversification into sectors such as industrial parks, data centres, and hospitality. Dive deeper

What’s happening globally

WTI crude fell toward $60 per barrel on Friday, set for a third monthly drop as rising global output and a stronger dollar weighed on prices ahead of the OPEC+ meeting. Dive deeper

Gold traded around $4,020 per ounce on Friday, set for a second consecutive weekly loss as fading expectations for a Fed rate cut and a US-China trade truce weighed on demand. Central banks bought 220 tons of gold in Q3, led by Kazakhstan and Brazil. Dive deeper

Silver rose above $49 per ounce on Friday, heading for a weekly gain as market volatility increased demand for safe-haven assets. Dive deeper

US natural gas futures rose above $4.1 per MMBtu, the highest in seven months, supported by higher heating demand and record LNG exports. Dive deeper

Euro area inflation eased to 2.1% in October 2025 from 2.2% in September, nearing the ECB’s 2% target. Core inflation held steady at 2.4%, while energy prices fell 1% and services inflation rose to 3.4%. Dive deeper

UK house prices rose 2.4% year-on-year in October 2025, up from 2.2% in September, while monthly prices increased 0.3%. Nationwide said the market remains stable despite high mortgage rates and expects gradual recovery as affordability improves. Dive deeper

China’s official manufacturing PMI fell to 49.0 in October 2025 from 49.8 in September, marking the seventh straight month of contraction and the lowest level since April. Output, new orders, and exports all declined, while business confidence weakened. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Tim Cook, CEO of Apple indicated his belief that the iPhone 17 lineup will continue to do well

“As we head into the holiday season with our most powerful lineup ever, I couldn’t be more excited for what’s to come.” - Link

Tribhuwan Adhikari, MD & CEO, LIC Housing Finance, on growth outlook and margin stability

“Our credit costs remain well under control, and asset quality continues to improve, with most legacy defaults nearing resolution.”

“We expect double-digit growth in FY26, led by retail housing demand and project loan recoveries in the second half.”

“NIMs have bottomed out at 2.62% after the recent rate resets, and we anticipate stability within the 2.6–2.8% range going forward.” - Link

Dr. Ewa Suwara, Deputy Head of Delegation, European Union to India, on climate impact and green collaboration

“India could face a GDP loss of up to 24.7% by 2070 due to climate change; immediate and collective action is essential.”

“Green energy and clean industries are not choices but imperatives for a sustainable future.”

“The EU deeply values its partnership with India to advance climate resilience, foster innovation, and ensure ambition translates into action.” - Link

Vikas Kaushal, CMD, Hindustan Petroleum, on refinery operations and contamination impact

“The impact of the chloride contamination was limited and much lower than anticipated.”

“The affected part of our Mumbai refinery is fully back online and ramping up to full capacity.”

“The situation has been contained effectively, with minimal disruption to overall operations.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

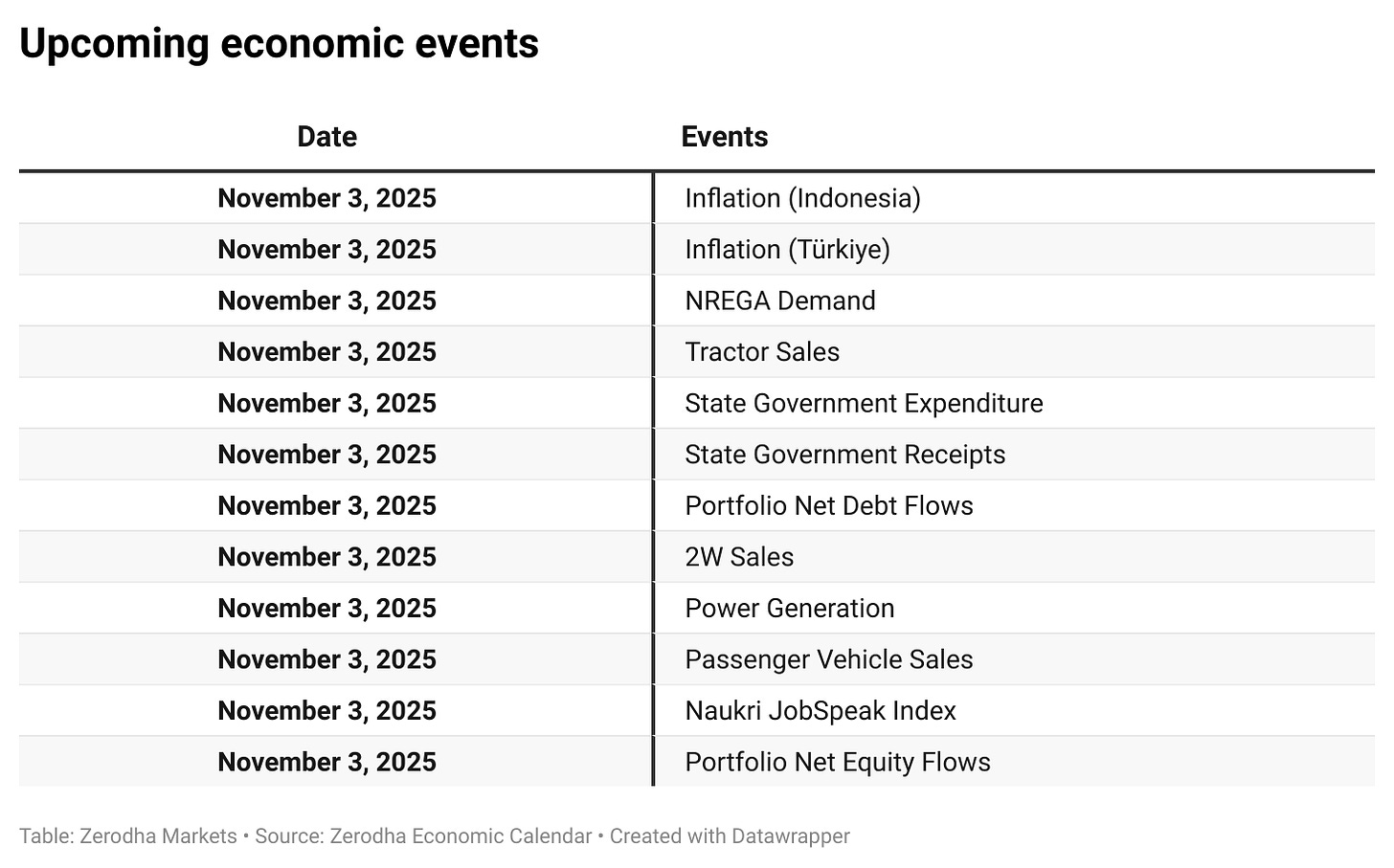

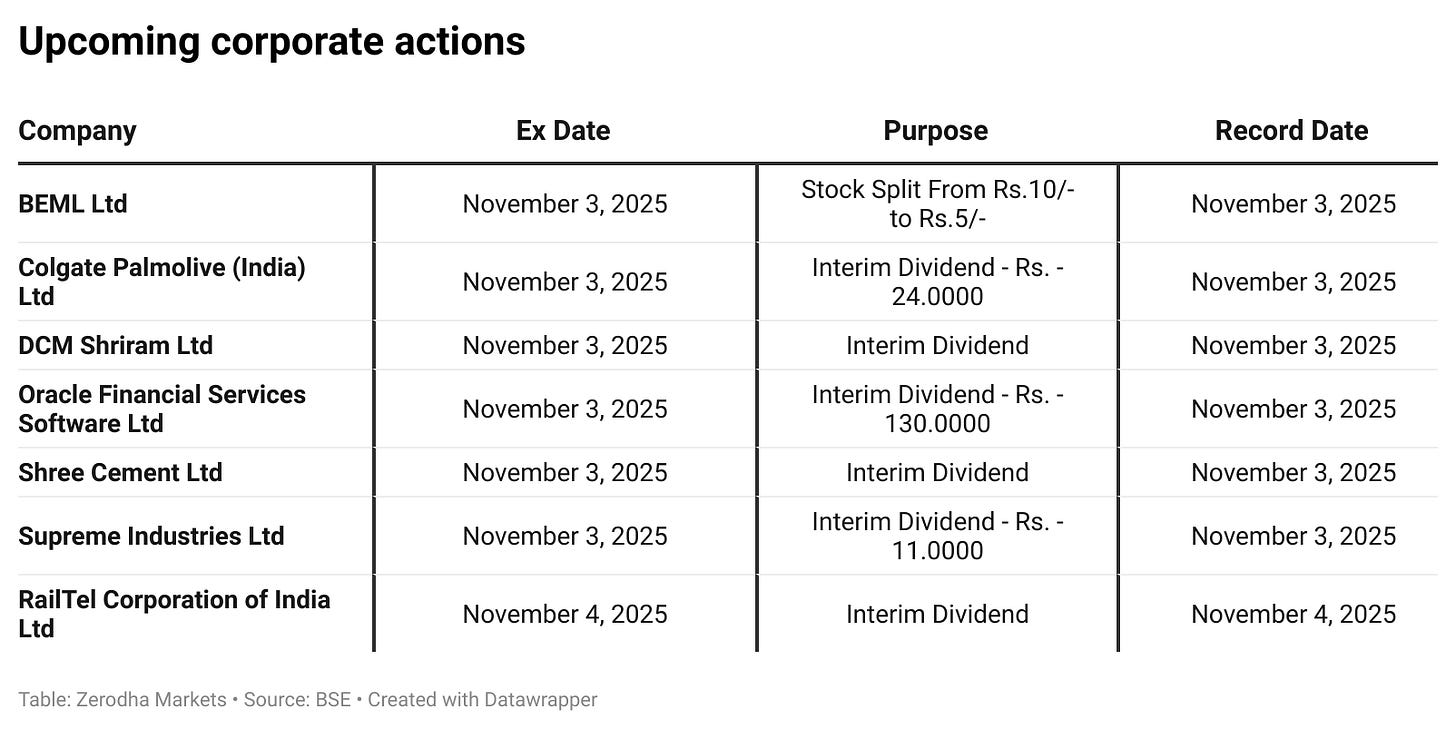

Calendars

In the coming days, we have the following quarterly results, significant events, and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

This piece truly made me think about enduring power of classic trend-following strategies. It's fascinating how they still inform modern algorithms. Thanks for such clear, insightful analisys!