Markets dip despite strong gains in PSU banks

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real time by Tijori.

Market Overview

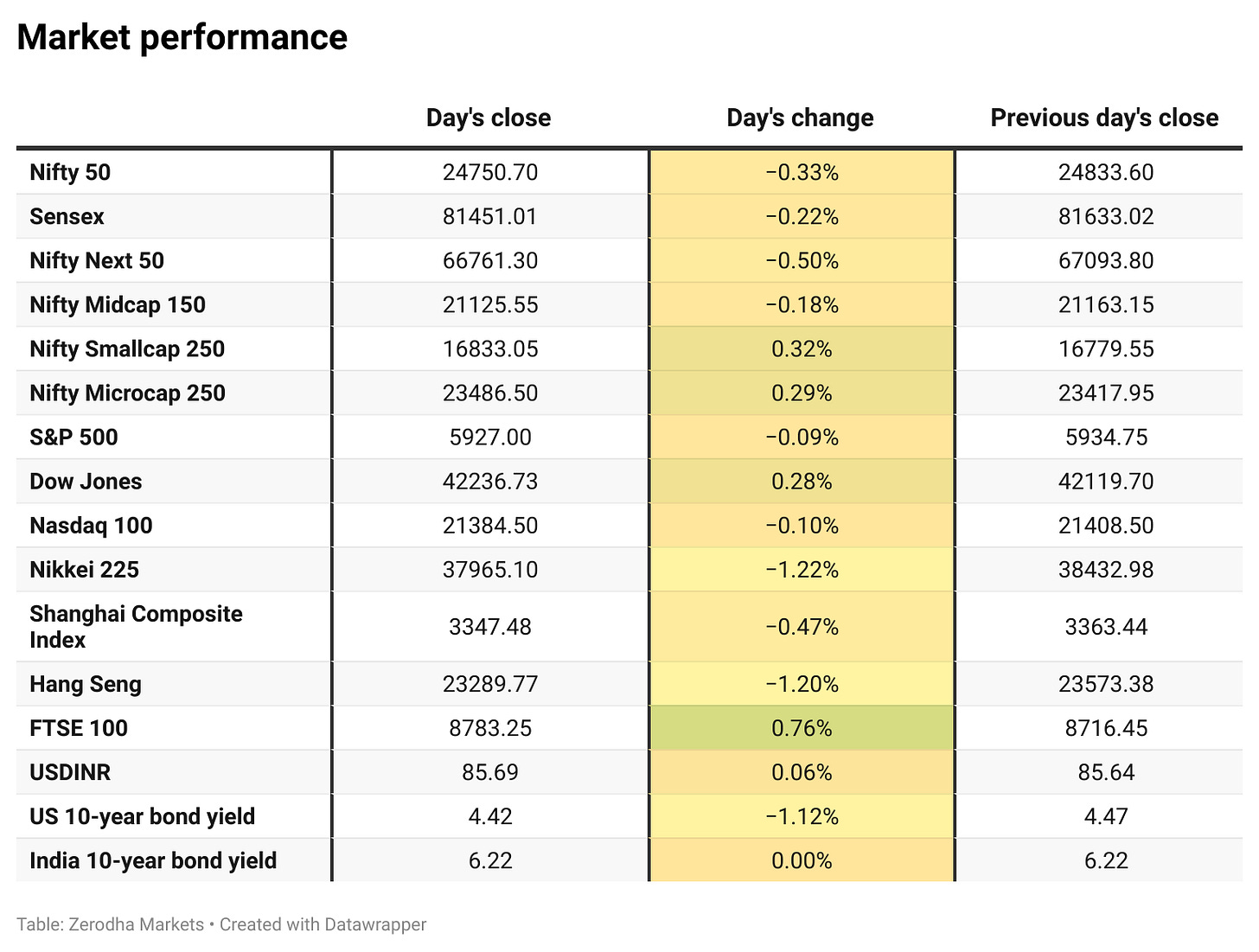

Nifty opened with a 20-point gap down at 24,812.60 and attempted to cross the 24,860 mark in the first 30 minutes. However, an intraday sell-off dragged the index down to 24,720 by 11 AM. For the remainder of the session, the market stayed rangebound within a 60-point band between 24,730 and 24,790, eventually closing at 24,750.70, down by 0.33%.

PSU Banks helped keep the Bank Nifty resilient throughout the day. Going forward, rising macroeconomic uncertainty remains a key concern. Investors are closely tracking progress on the India-U.S. trade deal, while the ongoing earnings season continues to guide near-term market sentiment

Broader Market Performance:

Broader markets had a mixed session with a negative bias today. Of the 2,955 stocks traded on the NSE, 1,299 advanced, 1,581 declined, and 75 remained unchanged.

Sectoral Performance:

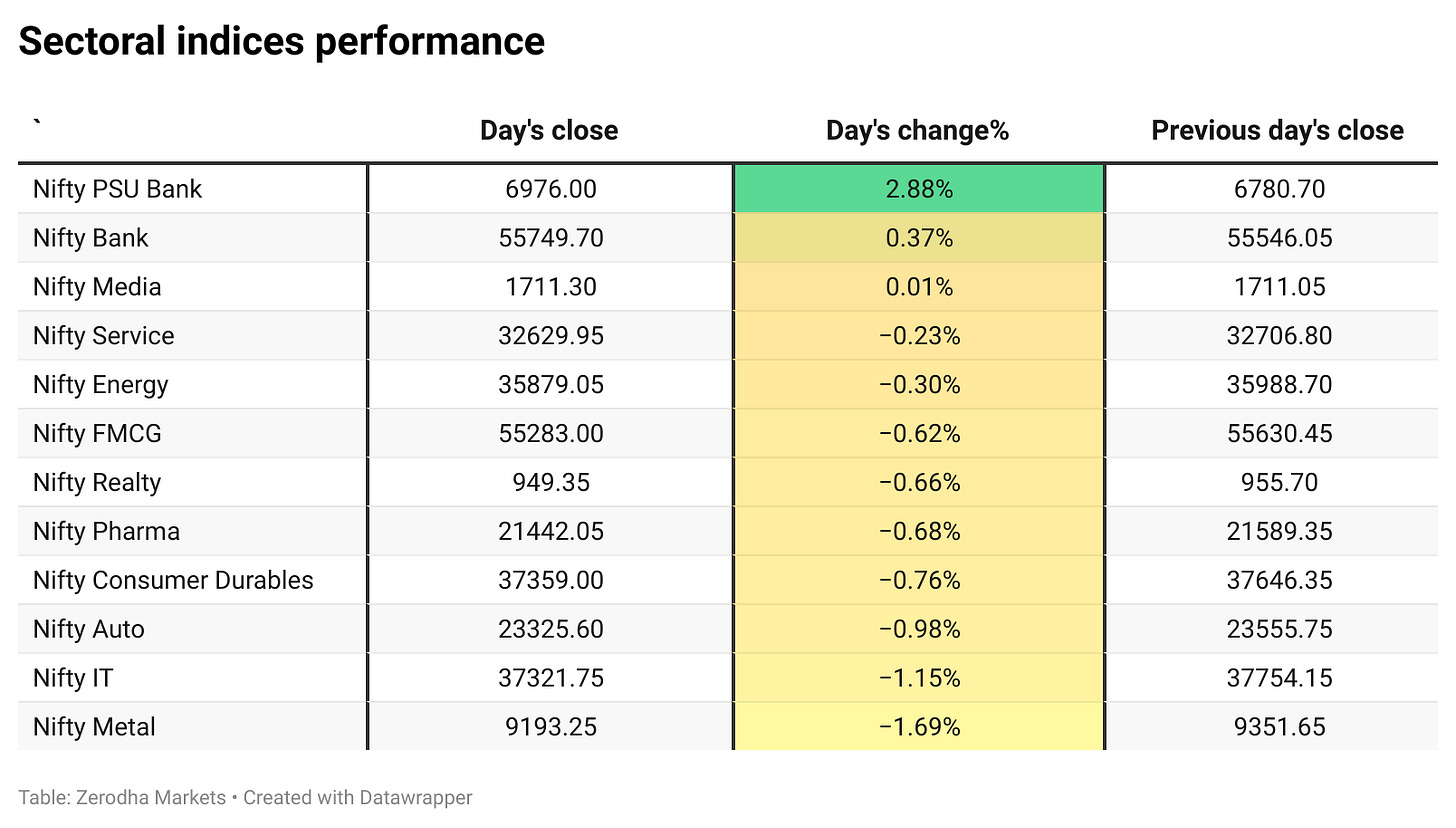

The top-gaining sector for the day was Nifty PSU Bank, which surged by 2.88%, followed by Nifty Bank with a modest gain of 0.37%. On the other hand, Nifty Metal was the worst-performing sector, falling by 1.69%, closely followed by Nifty IT, which declined by 1.15%.

Out of the 12 sectoral indices listed, 3 sectors closed in the green (PSU Bank, Bank, Media), while 9 sectors ended in the red, indicating a largely negative trend across the broader market.

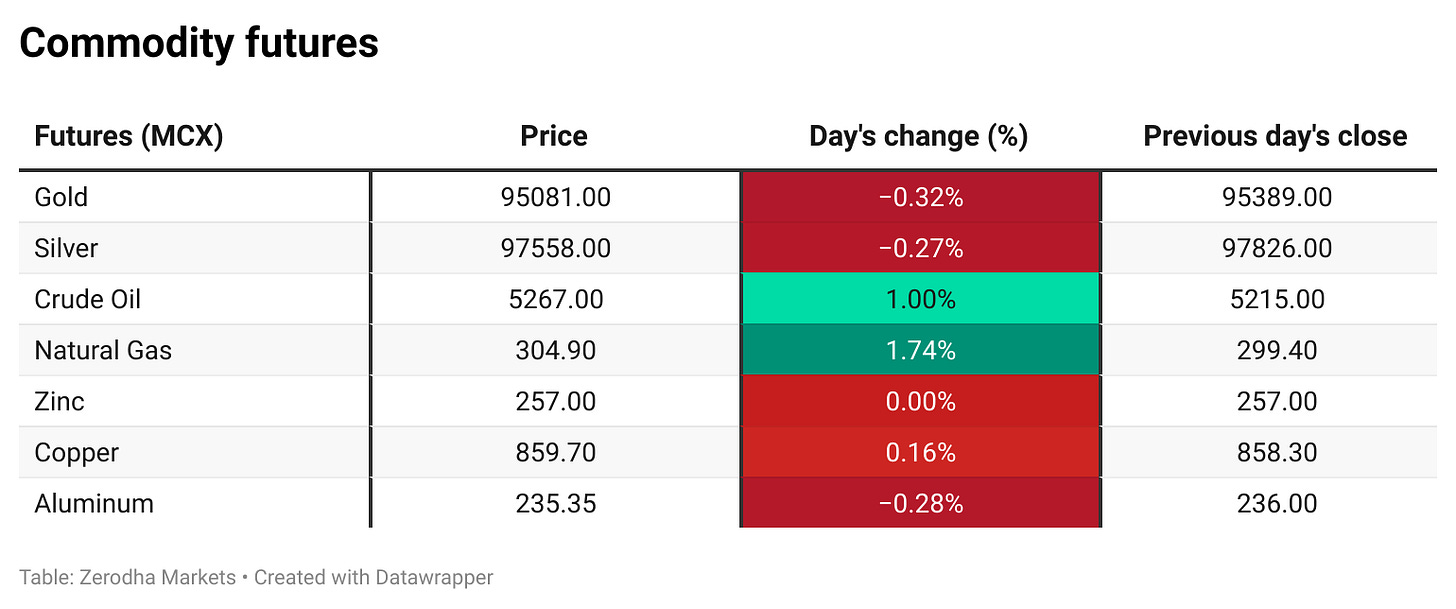

Note: The above numbers for Commodity futures were taken around 5 pm. Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 5th June:

The maximum Call Open Interest (OI) is observed at 24,800, followed closely by 25,000, suggesting strong resistance at 25,000 - 25,100 levels.

The maximum Put Open Interest (OI) is observed at 24,800, followed closely by 24,400 & 24,500, suggesting strong support at 24,600 to 24,500 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in the call OI indicates resistance in a falling market, and an increase in the put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

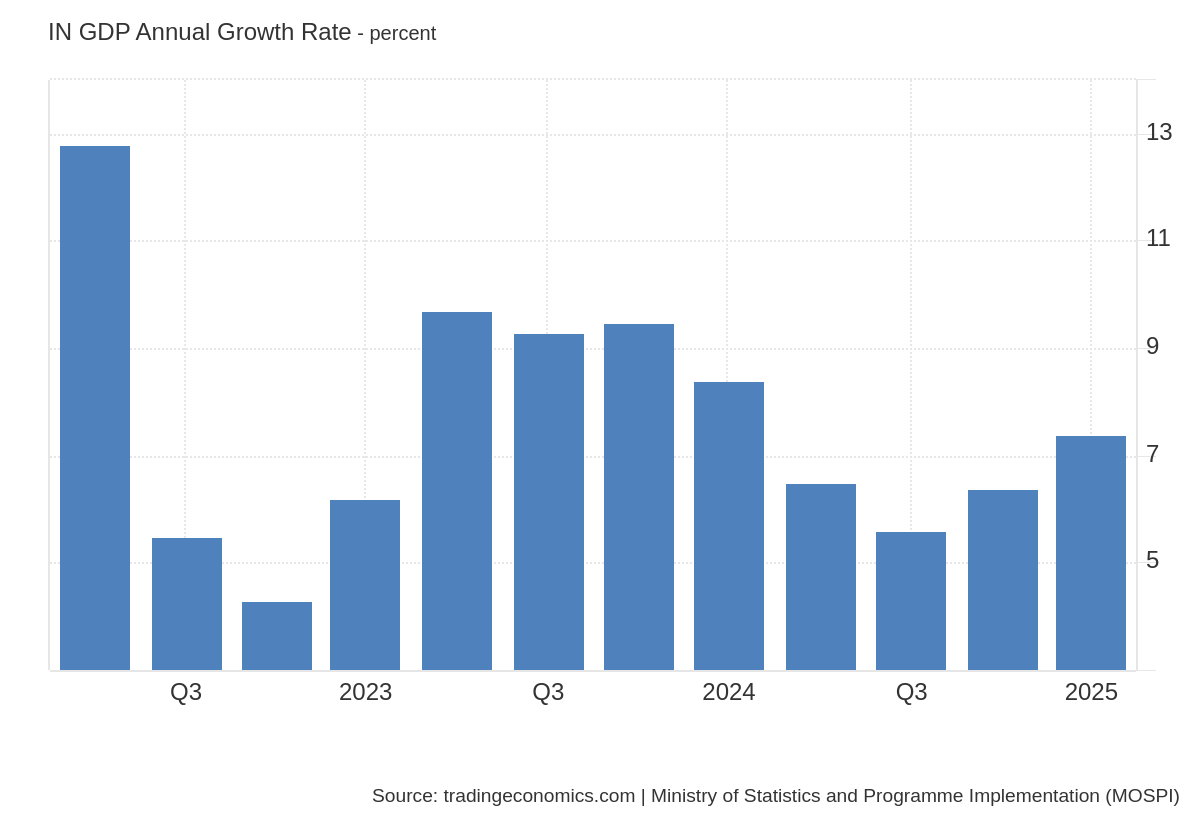

India’s GDP grew 7.4% YoY in Q4 FY25, the fastest pace of the year, driven by strong investment and consumption, along with a sharp drop in imports. Full-year growth stood at 6.5%, the lowest in four years, but remained resilient amid global trade uncertainties. Dive deeper

The Indian government is assessing the implications of a US court ruling that deemed Trump’s retaliatory tariffs unconstitutional. Officials confirmed that US negotiators will visit India on June 5-6 for FTA talks, which are said to be progressing well following a recent trip by the Indian delegation. Dive deeper

Coca-Cola said consumer demand in India remains resilient and aims to reduce seasonality by creating year-round consumption occasions. The company is expanding low- and no-sugar offerings and scaling its Coke Buddy platform. It also reaffirmed confidence in its local bottling partnerships for future growth. Dive deeper

LIC invested ₹5,000 crore in Adani Ports’ 15-year NCD issue at a 7.75% coupon, becoming the sole subscriber. The funds will be used for capex, debt refinancing, and general corporate purposes. This marks one of Adani Group’s longest-duration domestic bond deals. Dive deeper

Shapoorji Pallonji Group secured $3.4 billion through India’s largest private credit deal, issuing zero-coupon rupee bonds with a 19.75% yield maturing in three years. Major investors include Ares, Cerberus, Davidson Kempner, Farallon, and Deutsche Bank, which also arranged the deal. Dive deeper

Bajaj Auto’s Q4FY25 net profit fell 10% YoY to ₹1,802 crore, while revenue rose 9% to ₹12,646 crore. Despite strong export growth, domestic sales declined, and sequential profit dropped 18%. Dive deeper

Texmaco Rail secured a ₹140.55 crore order from the Ministry of Railways to supply 8 rakes of Flat Multi-Purpose Wagons within six months. Despite recent stock volatility, the company reported a 13.5% YoY drop in Q4 net profit to ₹39 crore, citing supply constraints, while revenue rose 17.6% to ₹1,346 crore. Dive deeper

SJVN reported a net loss of ₹127.6 crore in Q4 FY25, reversing from a ₹61 crore profit a year ago, mainly due to the absence of one-time gains. Revenue rose 4.5% YoY to ₹504 crore, with ₹67.5 crore from renewables. The board declared a ₹3.1 per share dividend. Dive deeper

The government has asked the RBI to delay implementation of its draft gold loan norms to January 1, 2026, to avoid impacting small borrowers. It also suggested exempting loans up to ₹2 lakh and sought wider stakeholder consultation. The draft proposed a uniform 75% LTV, ownership checks, and purity certification. Dive deeper

Coffee Day Enterprises reported a Q4 FY25 net loss of ₹33 crore, sharply lower than ₹303 crore a year ago but higher than ₹10 crore in Q3. Revenue rose to ₹268 crore YoY but declined from ₹280 crore sequentially. Dive deeper

SBI's latest report estimates household net financial savings may reach ₹22 lakh crore in FY25, or 6.5% of GNDI, up from 5.1% last year. This growing capital pool is seen as vital for funding fiscal deficits and maintaining macroeconomic stability. The RBI’s ₹2.69 lakh crore surplus transfer also boosts fiscal space. Dive deeper

LTIMindtree CEO Debashis Chatterjee has taken early retirement due to personal reasons and will be succeeded by Venu Lambu from May 31, 2025. Lambu, a former CEO of Randstad Digital and industry veteran, will focus on cloud, AI, and infrastructure-led growth. Dive deeper

What’s happening globally

Brent crude hovered around $63.7 per barrel, heading for a second weekly decline amid tariff uncertainty and the upcoming OPEC+ meeting. Dive deeper

The US economy contracted 0.2% annualized in Q1 2025, its first decline in three years, as weaker consumer spending and a sharp import surge offset strong fixed investment. Imports jumped 42.6% amid tariff fears, while government spending saw its steepest drop since Q1 2022. Dive deeper

Core consumer prices in Tokyo’s Ku-area rose 3.6% YoY in May 2025, the highest in over two years and above expectations. The data reinforces speculation of a rate hike at the BOJ’s July meeting, though trade talks with the US add uncertainty to the outlook. Dive deeper

Italy’s annual inflation eased to 1.7% in May 2025, the lowest since February and below the ECB’s 2% target for the 20th straight month. The slowdown was led by weaker energy, food, and service price growth. Monthly consumer prices were flat, slightly below expectations. Dive deeper

European natural gas futures rose 10% in May to €35.2/MWh, snapping a three-month decline amid supply concerns. Delayed Russian gas prospects, Norwegian maintenance, and LNG redirection to the Middle East tightened availability. Storage refill efforts face challenges ahead of winter. Dive deeper

Turkey’s economy grew 2% YoY in Q1 2025, the slowest pace since 2020 and below expectations, as household spending, investment, and exports weakened. Industrial output contracted while services growth slowed, and imports rose. Monetary policy remains volatile amid political and market pressures. Dive deeper

Germany’s retail sales fell 1.1% MoM in April 2025, marking the first decline in four months, led by drops in non-food and online sales. YoY, sales rose 2.3%, driven by gains across both food and non-food segments, with online sales jumping 14.1%. Dive deeper

Australian retail sales fell 0.1% in April 2025, marking the first decline since December and missing expectations for a 0.3% rise. Weaker clothing, department store, and food sales offset gains in household goods and hospitality. Annual growth eased to 3.8% from 4.3% in March. Dive deeper

Foreign-branded mobile phone shipments in China rose 0.8% YoY in April 2025 to 3.52 million units, according to CAICT data. This includes brands like Apple, marking a slight increase from 3.50 million units in April 2024. Dive deeper

Nippon Steel will invest $6.05 billion to install electric furnaces at three domestic plants as part of its decarbonisation push. The Japanese government will subsidise up to ¥251 billion of the project, which aims to add 2.9 million metric tons of steel capacity by FY2029. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Rajneesh, Additional Secretary and Development Commissioner, Ministry of MSME, on MSME support and credit availability

"We want to increase credit availability to MSMEs. This year Budget provided for providing credit cards to micro enterprises."

"MSME NPAs (bad loans) were less than 5 per cent in last five years as per RBI data."

"MSMEs provide employment to 27 crore people, and that is why the ministry keeps them in mind while making policies." - Link

Ritesh Agarwal, Founder & CEO, OYO, on rebranding parent company Oravel Stays

“We’re renaming the corporate brand behind it all... the parent company powering a global ecosystem of urban innovation and modern living.”

“Born in India, but built for the world.”

“We’re inviting suggestions to help craft this new identity.” - Link

Oliver Blume, CEO, Volkswagen, on U.S. tariff discussions

"We are engaged in fair and constructive discussions with the United States government concerning tariffs."

"Our investment in Rivian underscores our commitment to the U.S. market."

"We intend to make further substantial investments in the country." - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.

Kindly include promoter buying and bull deal data of most tracked individuals or entities.

Bye god maza agaya.

Keep rocking