Markets cheer RBI policy as Nifty climbs past 24,800 to close strong

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we dive into one of the most fundamental skills every systematic trader must have in their toolkit — Backtesting. We’ll explore where the idea of backtesting began, how to use historical data, what the outputs of a backtest really mean, and the key metrics you must know before putting any strategy into action.

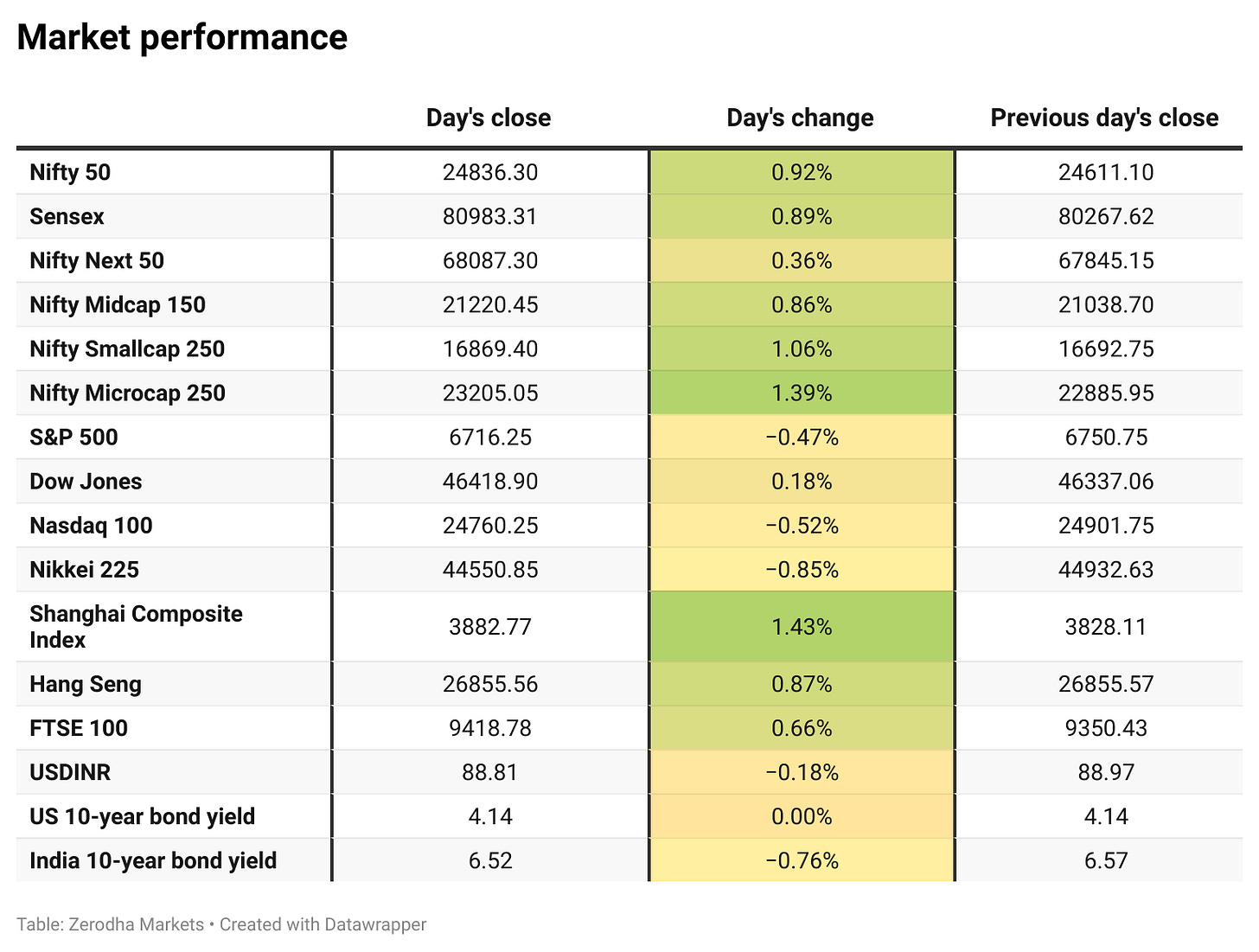

Market Overview

Nifty opened flat at 24,620 ahead of the RBI policy announcement and showed some early volatility, briefly dipping after the policy before stabilizing. Through the morning session, the index steadily climbed, crossing 24,750 by midday as buying interest emerged across sectors. In the second half, momentum picked up further, with financials and autos leading the rally, helping Nifty sustain above key resistance levels. Despite minor pullbacks, sentiment remained firm, and the index ended near the day’s high at 24,836.30, up over 215 points from the open. The strong close reflects renewed optimism around policy clarity.

Market sentiment has once again turned cautious after tariffs on Pharma and a hike in H1-B visa fees affecting the IT sector. As we advance, investors will closely track festival season sales and management commentary on demand trends across industries.

Broader Market Performance:

Broader markets had a super strong session today. Of the 3,159 stocks traded on the NSE, 2,199 advanced, 875 declined, and 85 remained unchanged.

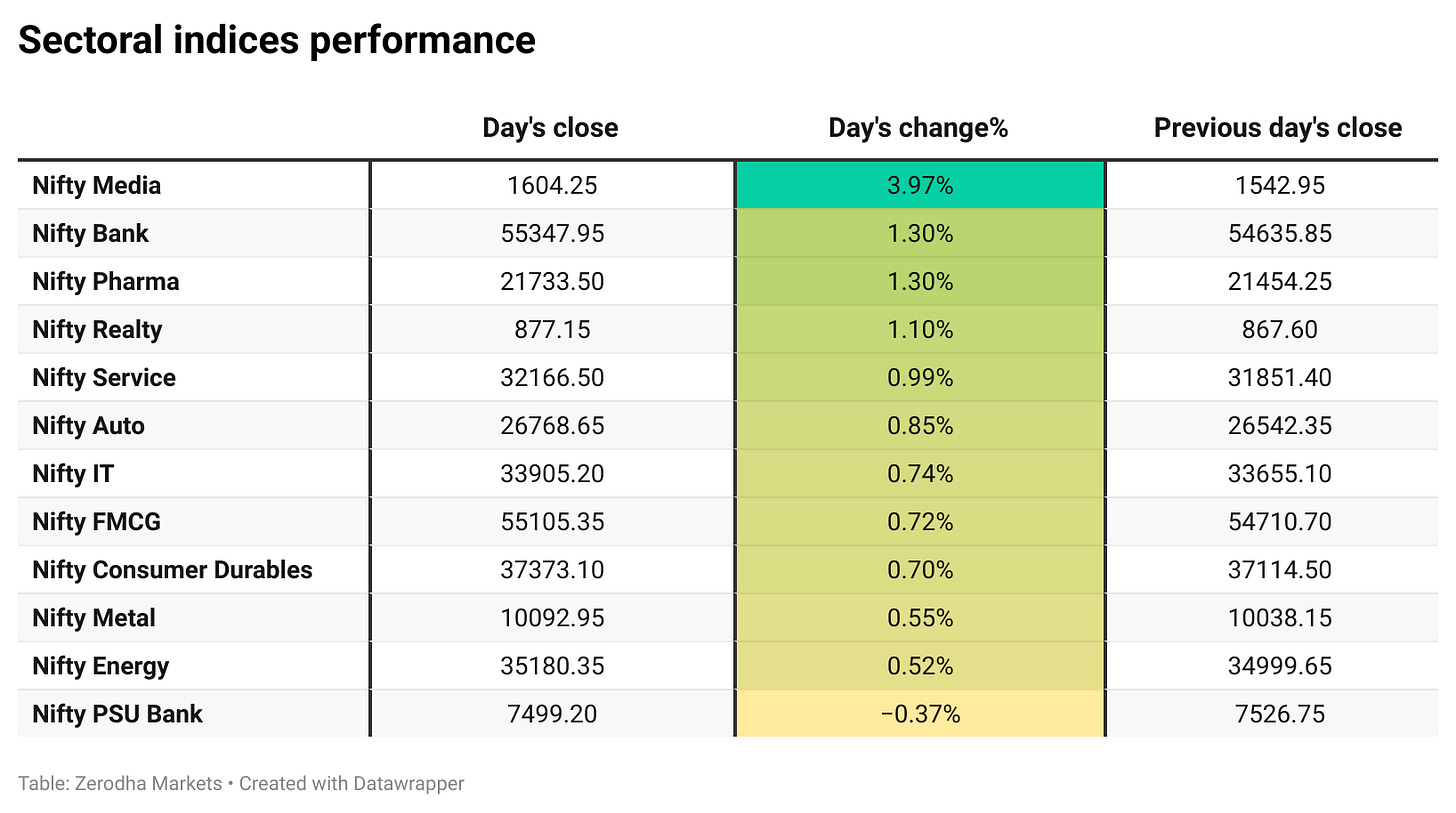

Sectoral Performance

The top-gaining sector for the day was Nifty Media, which surged 3.97%, while Nifty PSU Bank was the only sector to close in the red, declining 0.37%. Out of the 12 sectoral indices, 11 ended in the green and only 1 closed in the red, indicating a broad-based recovery across sectors.

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 7th October:

The maximum Call Open Interest (OI) is observed at 25,000, followed by 25,200, suggesting strong resistance at 25,000 - 25,100 levels.

The maximum Put Open Interest (OI) is observed at 24,700, followed by 24,600, suggesting strong support at 24,700 to 24,600 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

RBI kept the repo rate unchanged at 5.5% and maintained a neutral policy stance, while raising its FY26 GDP growth forecast to 6.8%. Dive deeper

Sebi has extended the rollout timeline for retail algo trading, requiring brokers to register at least one strategy by October 31 and complete full registration by November 30, with mandatory mock trading by January 3, 2026, before wider implementation. Dive deeper

Kalyan Kumar has taken charge as MD and CEO of Central Bank of India, succeeding M.V. Rao, who retired in July 2025, after serving as Executive Director of Punjab National Bank since October 2021. Dive deeper

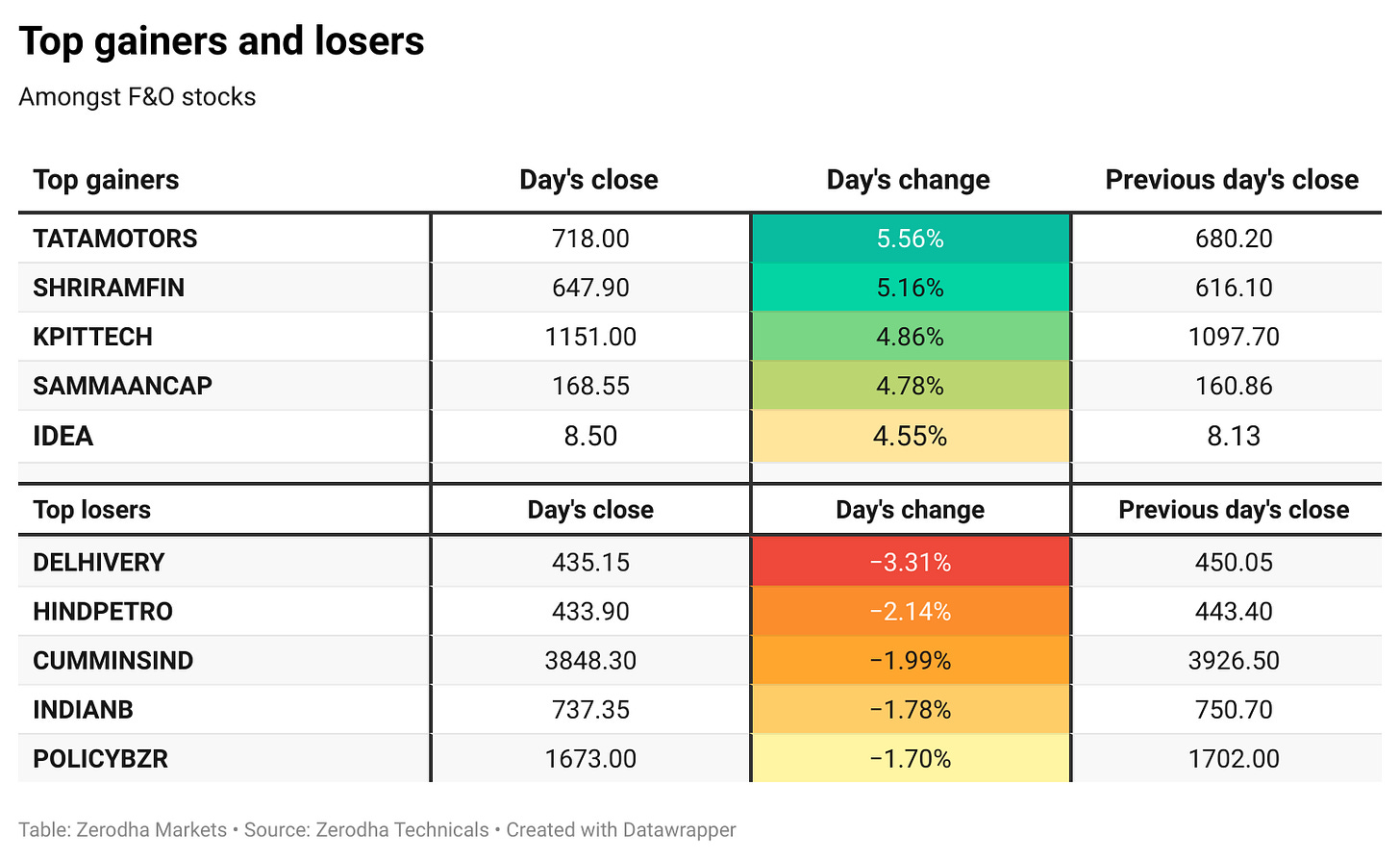

Tata Motors has invested an additional ₹120 crore in digital freight platform Freight Tiger, taking its total investment to ₹270 crore, aimed at building an AI-powered integrated logistics ecosystem to enhance efficiency and connectivity in India’s freight sector. Dive deeper

Sun TV shares surged up to 18% after reports of a $2 billion valuation for RCB raised expectations of higher valuations for IPL franchises, boosting the implied worth of its team, Sunrisers Hyderabad, which accounts for a significant share of Sun TV’s market value. Dive deeper

Tata Motors’ demerger took effect on October 1, with October 14 set as the record date for shareholders to receive 1 equity share of TML Commercial Vehicles Ltd for every Tata Motors share held. The restructuring aims to sharpen business focus and unlock long-term value. Dive deeper

RBI announced measures to support exporters facing US tariffs, including extending repatriation from foreign currency accounts in IFSC to three months, increasing forex outlay for trade transactions to six months, and simplifying compliance for small exporters and importers. Dive deeper

Hyundai Motor India reported domestic sales of 51,547 units in September 2025, up 1% from last year, while exports rose sharply by 43.5% with nearly 19,000 vehicles shipped. Dive deeper

Vedanta Group’s Sterlite Electric has filed its DRHP with Sebi for an IPO comprising a fresh issue and an offer for sale of 77.9 lakh shares each, with proceeds earmarked for debt repayment, capex, and general corporate purposes. Dive deeper

RBI raised the loan against shares limit from Rs 20 lakh to Rs 1 crore and increased the IPO financing limit to Rs 25 lakh per person, as part of measures to boost credit flow alongside expanded bank lending scope and revised growth and inflation forecasts. Dive deeper

ICICI Bank disclosed receiving a Rs 216 crore GST show cause notice from the Mumbai East Commissionerate over services linked to minimum account balance requirements, with the matter under ongoing litigation. Dive deeper

India’s external debt rose 1.5% in Q1 FY26 to $747.2 billion, though the debt-to-GDP ratio eased to 18.9% and over 93% of the liabilities are covered by forex reserves. The assets-to-liabilities ratio also improved to 79.25% as reserves and direct investments strengthened India’s external position. Dive deeper

What’s happening globally

WTI crude fell toward $62 per barrel, the lowest in over three weeks, as OPEC+ considers faster supply hikes amid warnings of oversupply, record US output, and forecasts of a surplus next year, with Russia’s fuel export curbs offering little support. Dive deeper

Gold traded above $3,870 per ounce near record highs, supported by safe-haven demand as the US government shutdown began and private payrolls unexpectedly fell by 32,000 in September, reinforcing expectations of further Fed rate cuts. Dive deeper

US stock futures slipped about 0.4% as the government entered its first shutdown in seven years, halting services and delaying key data releases. The ADP report showed private payrolls fell 32,000 in September, deepening labor market concerns and weighing on bank stocks. Dive deeper

US private businesses cut 32,000 jobs in September 2025, the steepest drop since March 2023 and the second straight monthly decline, with losses concentrated in leisure, professional services, finance, trade, construction, and manufacturing, partly offset by gains in education and health. Dive deeper

Uranium futures traded at $82 per pound, easing from a near one-year high, as physical funds boosted purchases while supply tightened with production cuts at Cameco and Kazatomprom, against forecasts of a 28% rise in nuclear fuel demand by 2030. Dive deeper

Euro area inflation rose to 2.2% in September 2025 from 2.0%, led by a smaller decline in energy costs, while core inflation held steady at 2.3%, its lowest since January 2022. Services edged higher, food inflation eased, and industrial goods remained unchanged. Dive deeper

The UK Nationwide House Price Index rose 2.2% year-on-year in September 2025, above forecasts, while monthly prices rebounded 0.5%. Nationwide said stable growth reflects steady activity and supportive buyer conditions despite high interest rates. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Sanjay Malhotra, RBI Governor on UPI and credit-linked mobile phones

“There is no proposal before us to levy charges on UPI transactions.”

“We are examining the issue of remotely locking mobile phones bought on credit in case of EMI default, balancing customer rights, privacy, and creditor requirements.”“India’s GDP growth projection has been revised upwards to 6.8% for FY26, with price stability and private capex expected to support momentum.” - Link

Pranjul Bhandari, Chief India & ASEAN Economist, HSBC, on RBI rate cut outlook

“There is space now, but the right time to cut could be December, once Diwali consumption fades and if US tariffs remain at 50%.”

“If the tariff burden persists, the RBI may be compelled to cut rates again in February 2026.”

“India has its own unique growth-inflation dynamics, the Fed will play a smaller role, with RBI focusing more on domestic growth data.” - Link

Vinay M. Tonse, MD, State Bank of India, on RBI policy pause and outlook

“The pause provides breathing space for banks, with rate transmission already significant, we expect the terminal repo rate to settle at 5.25% and a cut may come in December.”

“The traditional busy season is setting in earlier this year, partly due to recent GST rate cuts, and we are seeing uniform traction across segments.”

“SBI is well-prepared for the ECL framework glide path till FY31, and risk-based deposit insurance premiums will especially benefit large banks like us.” - Link

Nilesh Shah, MD, Kotak AMC on RBI policy stance

“Markets were divided on expecting a rate cut, but the RBI chose to wait and watch as growth came ahead of expectation and inflation well below.”

“A key takeaway is the RBI giving banks more flexibility on capital market exposure, creating a level playing field for supporting acquisitions and restructuring.”

“This is a reasonable policy. Liquidity will remain nimble, growth estimates are revised up, inflation down, though equity markets will focus on other factors for now.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

Great summary and writeup...