Late burst of buying drives Nifty above 25,900; defies global weakness

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we explore how combining Nifty + Gold using a simple Supertrend (10,3), 1-hour, long-only system drastically reduces drawdowns while keeping returns healthy. Along the way, we break down covariance, correlation, why Nifty & Gold work so well together, and how leverage should be approached realistically.

Market Overview

Nifty opened with a 110-point gap-down at 25,768 amid weak global cues and initially moved higher, touching the 25,870 zone within the first 20 minutes. However, the index quickly slipped back toward 25,780, and through the rest of the morning, it remained under pressure, oscillating in a narrow and choppy range as early Bihar election trends pointed to a clear NDA victory.

By midday, Nifty continued to drift sideways with a slight negative bias, hovering largely between 25,770 and 25,820. However, right at 3 PM, the index staged a sharp rebound, surging nearly 180 points, reclaiming the 25,900 mark and making intraday highs around 25,940. Nifty eventually closed at 25,910.05, ending flat versus the previous session but well off its intraday lows.

Looking ahead, markets are likely to stay sensitive to developments around the India–U.S. trade deal. Investors will also monitor Q2 earnings and management commentary on festive-season demand trends following the recent GST rate cuts.

Broader Market Performance:

The broader markets had a mixed session, slightly tilted towards bearish bias today. Of the 3,184 stocks traded on the NSE, 1,476 advanced, 1,623 declined, and 85 remained unchanged.

Sectoral Performance:

Nifty PSU Bank was the top gainer, rising 1.17%, while Nifty IT was the biggest loser, slipping 1.03% for the day. Out of the 12 sectoral indices, 8 ended in the green and 4 closed in the red, indicating a broadly positive market breadth despite some pressure in IT, Metal, and Auto sectors.

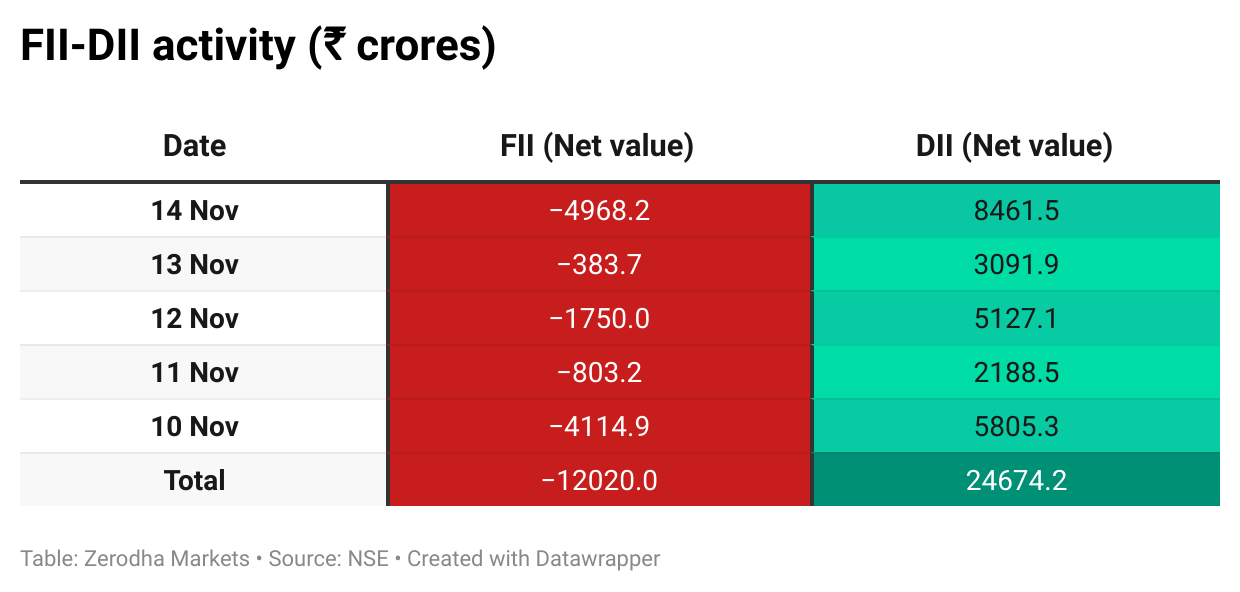

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 18th November:

The maximum Call Open Interest (OI) is observed at 26,000, followed by 26,100, indicating potential resistance at the 26,000 -26,100 levels.

The maximum Put Open Interest (OI) is observed at 25,500, followed by 25,800, suggesting support at the 25,800 to 25,700 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

India’s wholesale prices fell 1.21% YoY in October 2025, the steepest drop since July 2023 and the first decline in three months. The fall was led by sharply lower food prices, continued easing in fuel, and softer manufacturing inflation. Dive deeper

Eureka Forbes posted a 32% YoY rise in Q2 net profit to ₹61.6 crore, with revenue up 14.9% to ₹773.4 crore and EBITDA crossing ₹100 crore at a 13.1% margin. Growth was driven by strong product performance across categories and a continued turnaround in the service business. Dive deeper

Asian Paints reported a strong Q2 with net profit rising 43%, marking a sharp improvement in performance. The news also coincided with renewed investor interest following the exit of a rival CEO. Dive deeper

Eicher Motors reported a 24% YoY rise in Q2 net profit to ₹1,369 crore, with revenue up 45% to ₹6,071 crore and Royal Enfield posting record quarterly sales of 3,27,067 units. VECV’s revenue grew 10.3% YoY to ₹6,106 crore, with PAT at ₹249 crore and stronger vehicle deliveries. Dive deeper

Tata Motors PV reported a consolidated Q2 net profit of ₹76,170 crore due to a one-time gain from discontinued operations, while revenue fell 13% YoY to ₹71,714 crore. Performance was impacted by a cyber incident at JLR, though domestic operations stayed steady. Dive deeper

Marico reported a marginal 0.7% YoY dip in Q2 PAT to ₹420 crore, while revenue rose 31% to ₹3,482 crore. Growth was supported by strong domestic volumes and a 20% constant-currency increase in its international business. Dive deeper

MRF reported a 12% YoY rise in Q2 net profit to ₹526 crore, with revenue up 7% to ₹7,379 crore. The company also declared an interim dividend of ₹3 per share for FY26, with a record date of November 21. Dive deeper

Oswal Pumps reported a 48% YoY rise in Q2 net profit to ₹97.5 crore, with total income increasing to ₹546.48 crore from ₹310.84 crore last year. The company manufactures solar pumps and is based in Haryana. Dive deeper

Paras Defence reported a 50% YoY jump in Q2 net profit to ₹21 crore, with revenue rising 22% to ₹106 crore. The company also secured defence orders worth about ₹39 crore, including a major Portable Counter-Drone Systems order from the Ministry of Defence. Dive deeper

Pine Labs made a strong market debut, listing at ₹242 per share at a 9.5% premium and rising to an intraday high of ₹283.70. Dive deeper

Voltas reported a sharp 76% YoY drop in Q2 net profit to ₹32 crore, with total income down 11.5% to ₹2,412 crore. The quarter saw margin pressure and weak performance in its cooling products division despite some recovery in other segments. Dive deeper

Star Air has raised ₹150 crore in a Series B round to support fleet expansion and aims to raise an additional ₹200 crore. The airline plans to expand its fleet from 9 aircraft to 50 by 2030 while also investing in route efficiency, charter operations, and MRO capabilities. Dive deeper

What’s happening globally

Brent crude rose over 1% toward $64 per barrel amid renewed supply risks following a Ukrainian drone strike on Russia’s Novorossiysk port. Dive deeper

Gold prices fell below $4,120 per ounce on Friday but were still on track for a weekly gain of about 3%. The move came amid uncertainty from delayed US economic data following the prolonged government shutdown. Dive deeper

UK 10-year gilt yields jumped to 4.57% after reports that the government may drop planned income-tax increases due to an improved fiscal outlook. The OBR now expects a smaller budget shortfall of about £20 billion. Dive deeper

The dollar index hovered near 99.3, heading for a second weekly decline amid uncertainty from delayed US economic data after the government reopened. Dive deeper

China’s fixed-asset investment fell 1.7% YoY in January–October 2025, the steepest drop since June 2020, driven by deeper declines in property and infrastructure investment. On a monthly basis, investment slid 1.62% in October, extending September’s fall. Dive deeper

China’s new home prices fell 2.2% YoY in October 2025, marking the 28th straight month of declines and matching September’s pace. On a monthly basis, prices dropped 0.5%, the steepest fall in a year. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

B.K. Soni, CMD, Eco Recycling on India’s e-waste recycling potential and investment needs

“The recycling industry’s biggest challenge is the availability of raw materials for formal recycling.”

“Only about 5% of India’s e-waste is recycled today with ₹2,500 crore invested so far.”

“To achieve full-scale recycling, the sector needs close to ₹50,000 crore, which presents a massive investment opportunity.” - Link

George Alexander Muthoot, Managing Director, Muthoot Finance, on record Q2 performance

“In view of our record performance, we are upgrading our FY26 gold loan growth guidance to 30–35% from 15%.”

“Gold loan demand remained strong, driving an 88% jump in profit and a 42% expansion in our loan book.”

“Asset quality has improved, and we continue to see robust customer additions and disbursements.” - Link

Anil Ambani, Chairman, Reliance Group, on ED summons in the FEMA case

“The matter is 15 years old, dates to 2010, and concerns issues associated with a road contractor.”

“This was a purely domestic contract with no foreign exchange component involved whatsoever.”

“I have assured full cooperation and offered to appear before the Enforcement Directorate through virtual means.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

Calendars

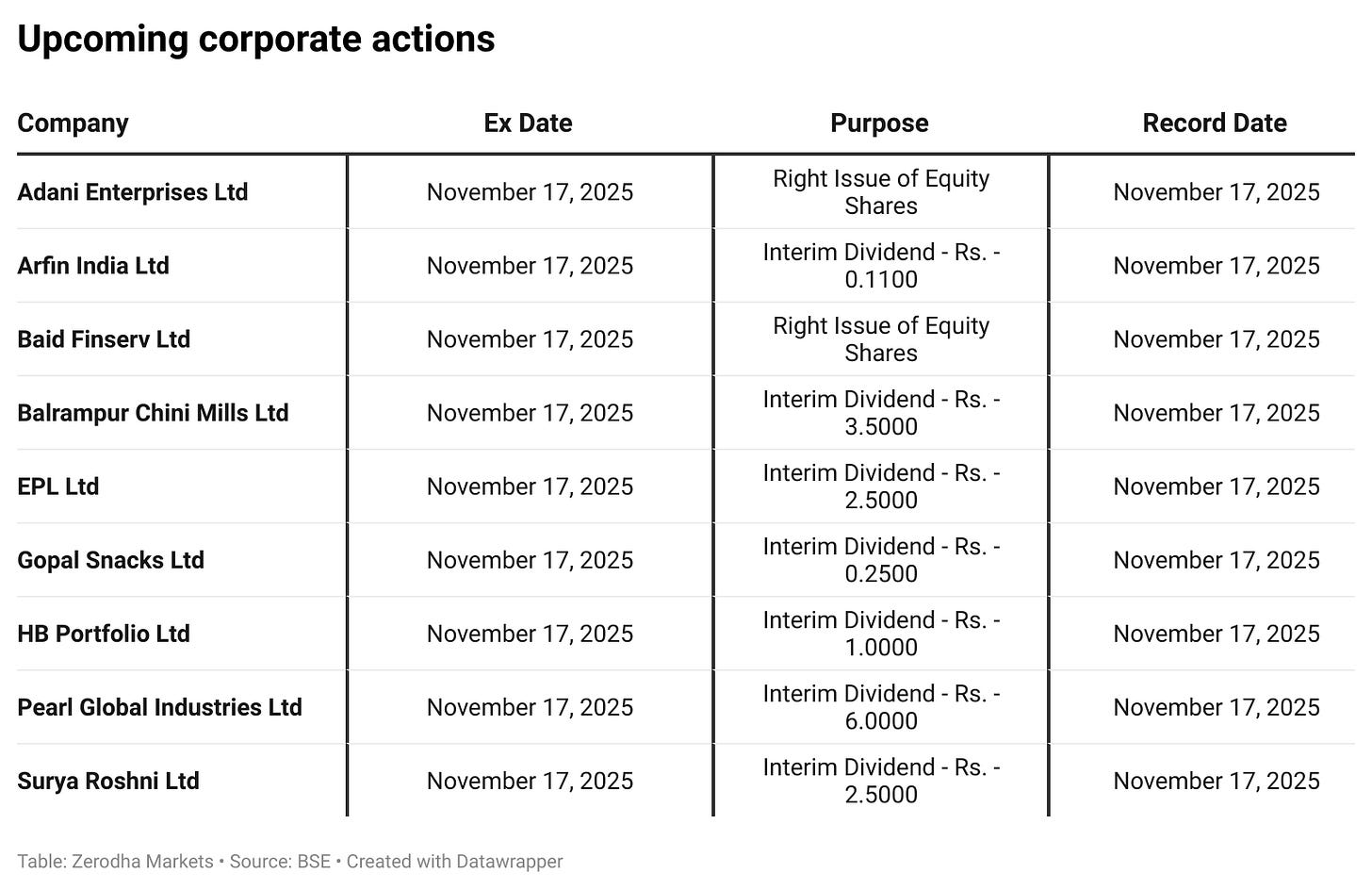

In the coming days, we have the following quarterly results, significant events, and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!