IT & FMCG drive Nifty higher for 5th straight Day

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real-time by Tijori.

Market Overview

Nifty opened flat with a 15-point gap-down at 24,965.80. After moving in a narrow range between 24,930 and 24,980 during the first hour, the index crossed the 25,000 mark and stayed strong for the rest of the day, gradually inching up to 25,088. It then traded in a range before eventually closing at 25,050.55, up 0.28%.

Market sentiment, though improving since last week, remains fragile amid escalating tariffs, persistent FII outflows, and muted earnings reactions. Investors continue to focus on intensifying U.S.-India trade tensions and developments around U.S.-Russia talks, both of which are expected to guide near-term market direction.

Broader Market Performance:

Broader markets continued the positive momentum today. Of the 3,062 stocks traded on the NSE, 1,711 advanced, 1,263 declined, and 88 remained unchanged.

Sectoral Performance

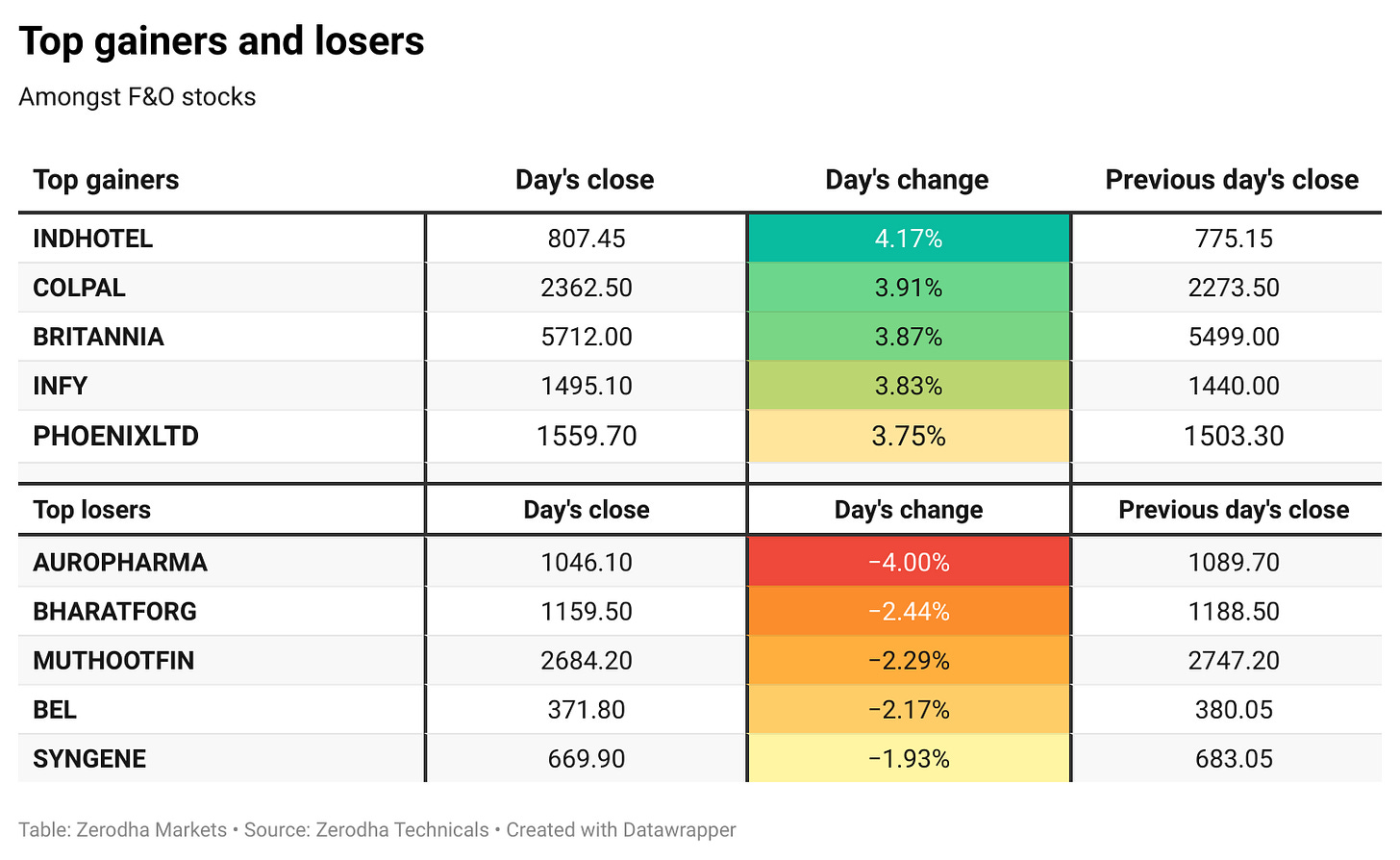

Nifty IT was the top gainer with a strong rise of 2.69%, while Nifty Media was the top loser, slipping 1.98%. Out of the 12 sectors, 8 closed in the green and 4 ended in the red.

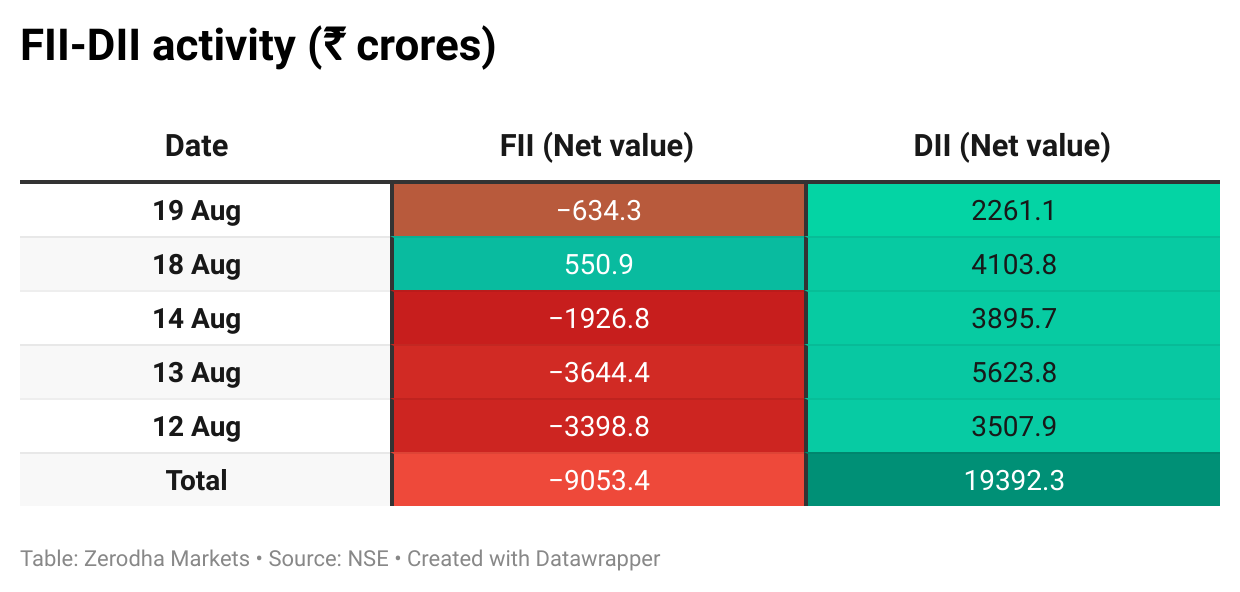

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 21st August:

The maximum Call Open Interest (OI) is observed at 25,500, followed closely by 25,100, suggesting strong resistance at 25,100 - 25,200 levels.

The maximum Put Open Interest (OI) is observed at 25,000, followed closely by 24,900, suggesting strong support at 24,900 to 24,800 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

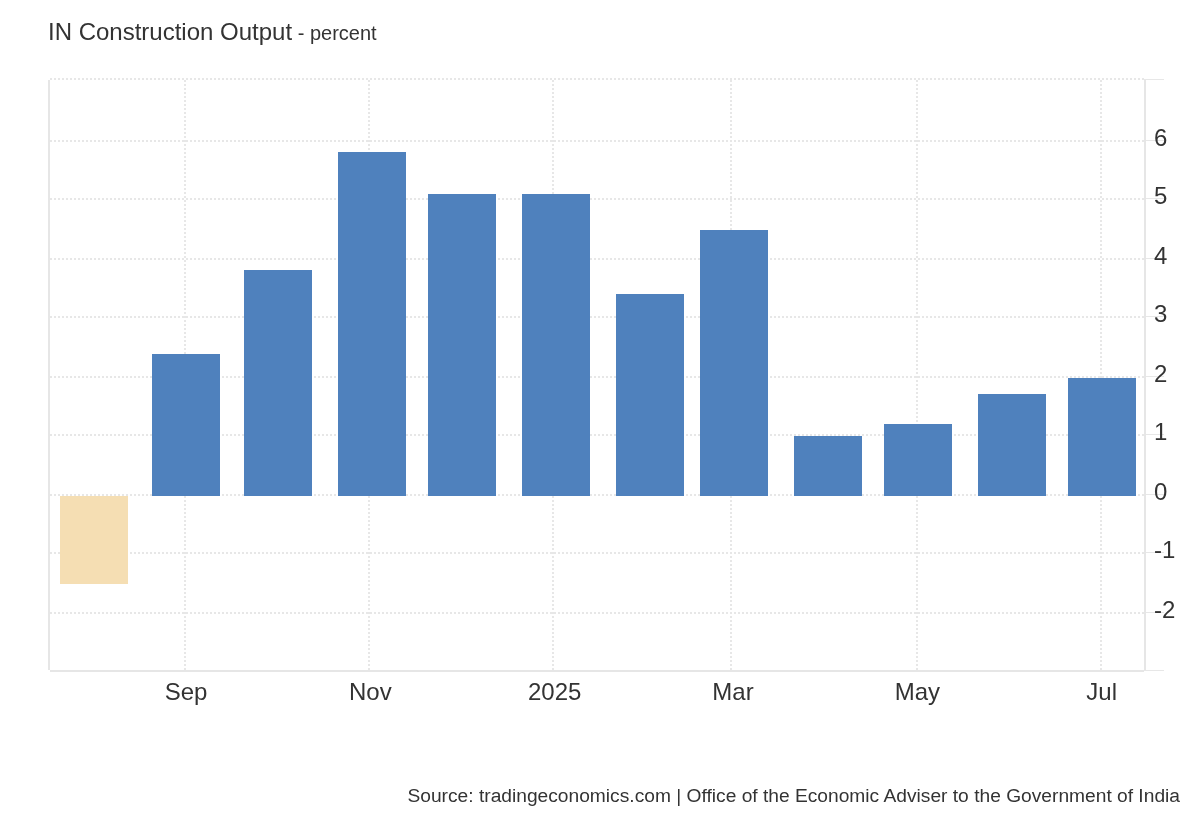

India’s infrastructure output rose 2% in July 2025, marking the eleventh straight month of growth. Steel and cement posted strong double-digit gains, with electricity and fertilizers rebounding. Refinery output declined 1% amid tariff concerns linked to Russian oil. Dive deeper

India’s core sector growth slowed to 2% in July 2025, down from 6.3% a year earlier, as coal, natural gas, crude oil, and refinery products contracted. Steel and cement posted double-digit growth, while fertilisers and electricity saw modest gains. The slowdown highlights weakness in fossil fuels even as construction-linked sectors remained strong. Dive deeper

Adani Group raised $275 million offshore, with Adani Airport Holdings securing $150 million and Adani Ports & SEZ $125 million. The loans were arranged with global lenders under four-year terms. Proceeds will go toward bond buybacks and capital spending. Dive deeper

UltraTech Cement approved the sale of up to 2.01 crore shares of India Cements, representing a 6.5% stake, through an offer for sale on August 21–22. The floor price has been set at ₹368 per share, slightly below the latest closing price. UltraTech currently holds an 81.49% stake in India Cements. Dive deeper

IDFC First Bank approved a ₹2,623 crore preferential issue of compulsorily convertible shares to Platinum Invictus B 2025 RSC Ltd. In Q1, profit fell 32% to ₹463 crore as provisions surged 67% to ₹1,659 crore on microfinance slippages. Net interest income rose 5.1% to ₹4,933 crore, with NIM at 5.71%. Dive deeper

Gaming stocks rose after cabinet approval of the Online Gaming Bill. The bill seeks to regulate the industry, making online betting a punishable offence amid rising fraud cases. It is expected to be introduced in the Lok Sabha soon. Dive deeper

The government approved a ₹62,000-crore deal to acquire 97 LCA Mark 1A fighter jets, supporting the replacement of the MiG-21 fleet. The move strengthens indigenous defence manufacturing and benefits SMEs in the sector. Dive deeper

Bharti Airtel has withdrawn its ₹249 plan offering 1 GB per day, raising the entry point to 1.5 GB daily plans at higher prices. The move is aimed at improving average revenue per user in the absence of broad tariff hikes. Dive deeper

Ola Electric shares moved higher in today’s trade, touching fresh levels during the session. The stock also witnessed increased activity with a few block deals reported on the exchanges. Dive deeper

India’s state-run refiners have resumed buying Russian Urals crude for September and October after a short pause. The decision comes despite US criticism and the threat of higher tariffs on Indian imports. New Delhi has reiterated that crude purchases are based on market factors and national interest. Dive deeper

Vedanta shares fell after NCLT deferred its demerger hearing to September 17 amid government objections over disclosures. The Petroleum Ministry raised concerns about dues recovery, and Sebi had earlier warned about changes to the scheme. The Supreme Court also dismissed Vedanta’s plea for extra benefits from the Talwandi Sabo project. Dive deeper

What’s happening globally

Brent crude rose above $66 a barrel after a prior session loss, supported by a larger-than-expected US inventory drawdown. Hopes of a Russia-Ukraine peace deal and easing sanctions kept the supply outlook uncertain, while OPEC+ output weighed on sentiment. Dive deeper

Gold hovered near $3,320 per ounce, a three-week low, as easing geopolitical risks and a stronger dollar pressured sentiment. Markets awaited Fed Chair Powell’s speech at the Jackson Hole symposium for policy signals. Dive deeper

UK annual inflation rose to 3.8% in July 2025, the highest since January 2024, driven by transport, hotels, and food costs. Housing and household services eased, partly offsetting the rise. On a monthly basis, CPI edged up 0.1%, while core inflation inched to 3.8%. Dive deeper

The average US 30-year fixed mortgage rate rose to 6.68% in the week ending August 15 from a recent low. Mortgage applications fell 1.4% from the prior week, though purchase activity held at its strongest pace in four weeks. Dive deeper

China’s fiscal revenue in the first seven months of 2025 rose 0.1% to CNY 13.58 trillion, with local revenue up and central revenue down. Tax income dipped slightly while non-tax revenue grew. Expenditure increased 3.4% to nearly CNY 16.1 trillion, led by social security and employment. Dive deeper

Intel’s market value jumped $24 billion this month after reports of a potential US government equity stake and a $2 billion investment from SoftBank. The surge has pushed its valuation to 53 times projected earnings, levels last seen during the dot-com era. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Nirmala Sitharaman, Finance Minister, on GST reforms

"The proposal by the Central Government is with a vision to usher in the next generation of GST reforms in India’s journey towards becoming Atmanirbhar Bharat."

"We remain committed to building a broad-based consensus with the States in the spirit of cooperative federalism."

"Rate rationalisation aims to provide greater relief to the common man, farmers, the middle class, and MSMEs, enhancing affordability and boosting consumption." - Link

Jitin Prasada, MoS for Commerce & Industry, on US tariff impact

"About $48.2 billion worth of Indian merchandise exports to the US, based on 2024 trade values, will be subject to 50% tariffs."

"Reciprocal tariffs at 25% came into effect on certain exports from Aug 7, with an additional 25% duty on more goods from Aug 27."

"The government is committed to secure and advance national interest, protecting farmers, workers, entrepreneurs, exporters, MSMEs, and all sections of industry." - Link

Nitish Mittersain, Joint MD & CEO, Nazara Tech, on real money gaming bill and growth outlook

"In Q1, Nazara delivered ~100% YoY revenue growth and over 100% PAT growth; real money gaming contributed nothing to these numbers."

"Our core business is the gaming IP business with over 80% of revenues from international markets; we will continue to build that diversified global platform."

"We are well-capitalised with nearly ₹800 crore cash and a de-risked portfolio, so any potential impact on PokerBaazi will not derail our growth path." - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

📚 Also reading Mind Over Markets by Varsity?

It goes out thrice a week, covering markets, personal finance, or the odd question you didn’t know you had. The Varsity team writes across three sections: Second Order, Side Notes, and Tell Me Why, thoughtfully put together without trying to be too clever.

Go check out Mind Over Markets by Zerodha Varsity here.

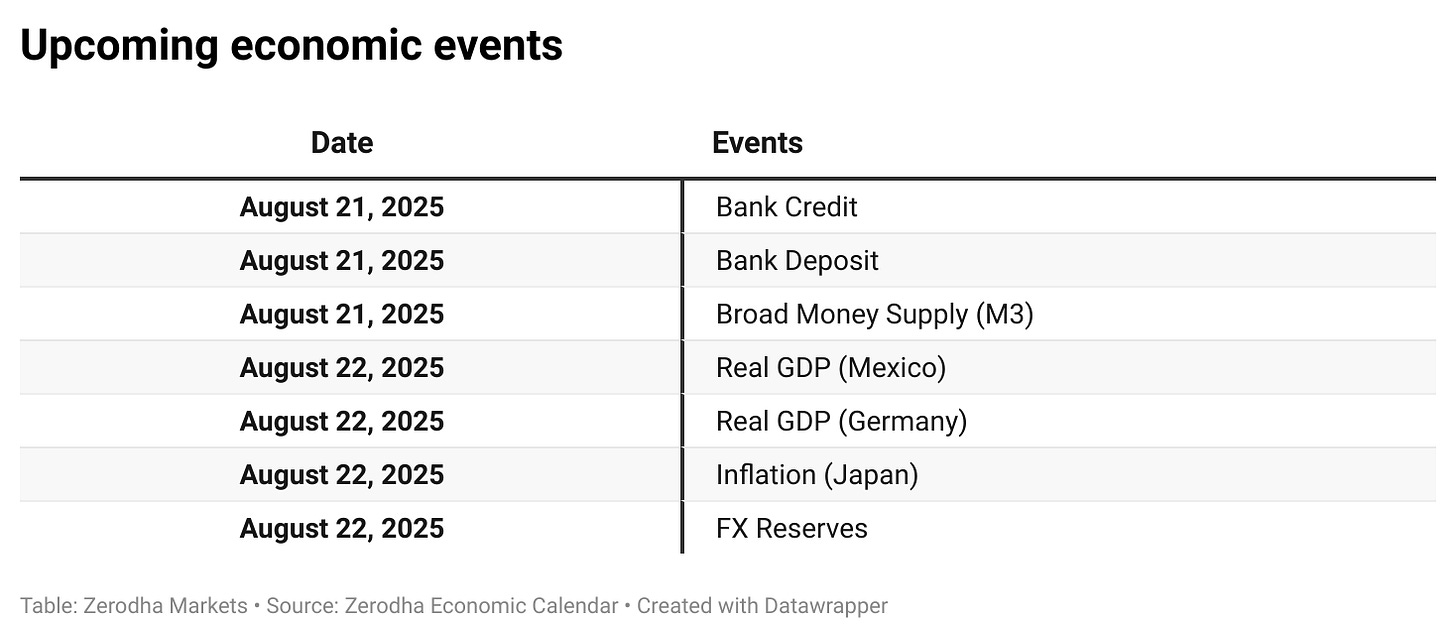

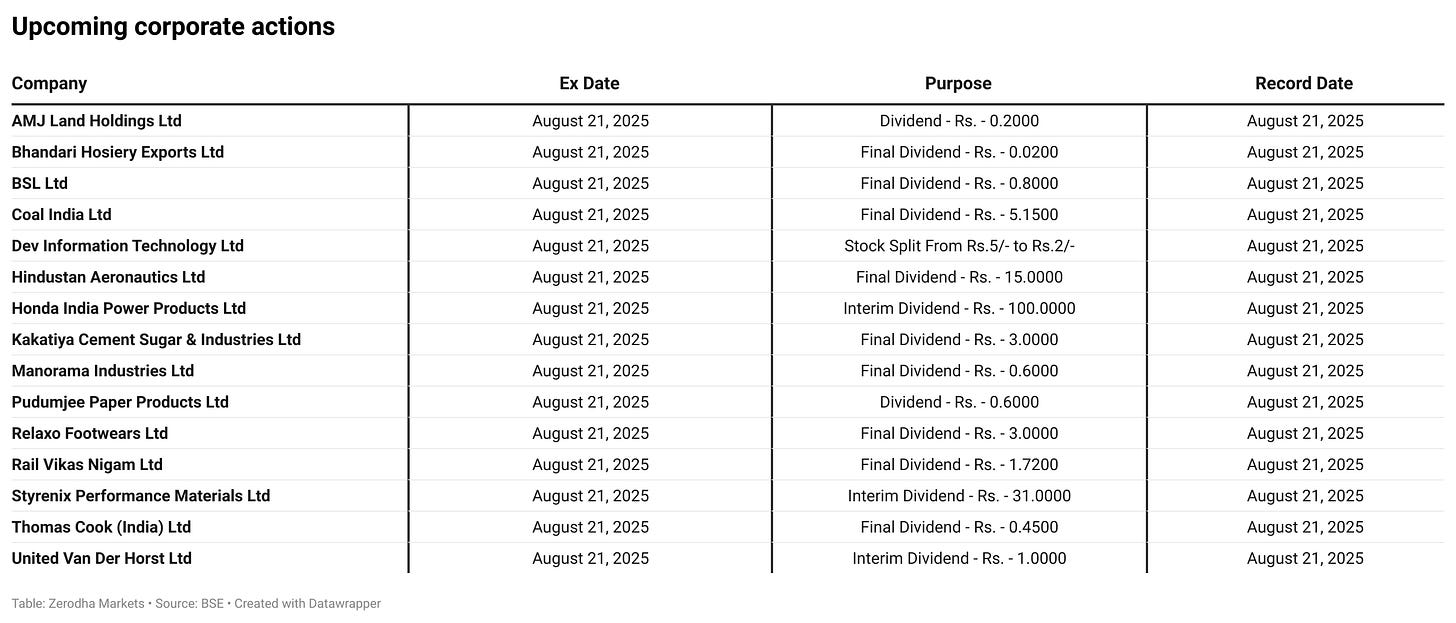

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.