GST reforms drive positive sentiment; Nifty holds above 24,850

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real-time by Tijori.

Market Overview

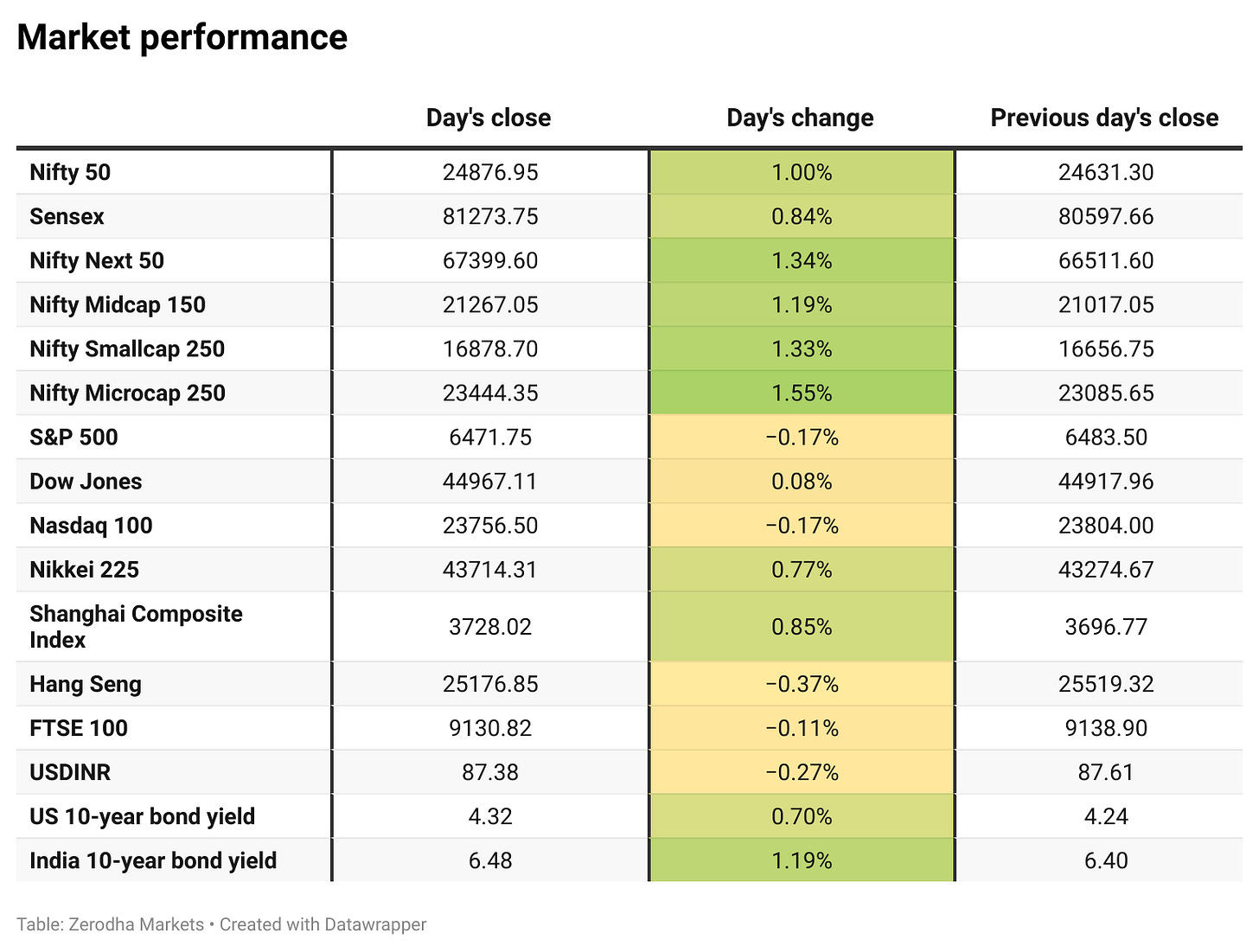

Nifty opened with a sharp gap-up of 307 points at 24,938, driven mainly by the Prime Minister’s Independence Day announcement of GST cuts before Diwali. Auto and consumption stocks led the rally, helping the index sustain its gains. In the first half, Nifty moved within a range of 24,950–25,000, while in the second half it oscillated between 24,870–24,950. Eventually, the index closed at 24,876.95, up 1%.

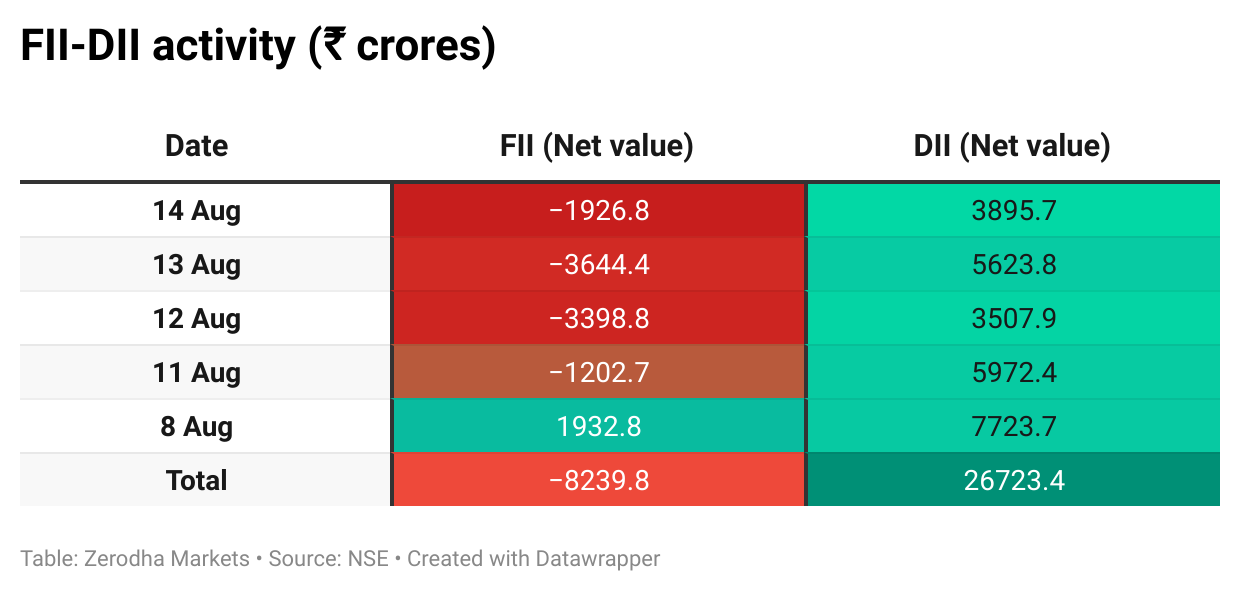

Market sentiment, however, stayed fragile amid escalating tariffs, persistent FII outflows, and muted earnings reactions. Investors remain focused on intensifying U.S.-India trade tensions and developments around the U.S.-Russia talks, both of which are expected to guide near-term market direction.

Broader Market Performance:

Broader markets had a positive session today. Of the 3,147 stocks traded on the NSE, 2,012 advanced, 1,047 declined, and 88 remained unchanged.

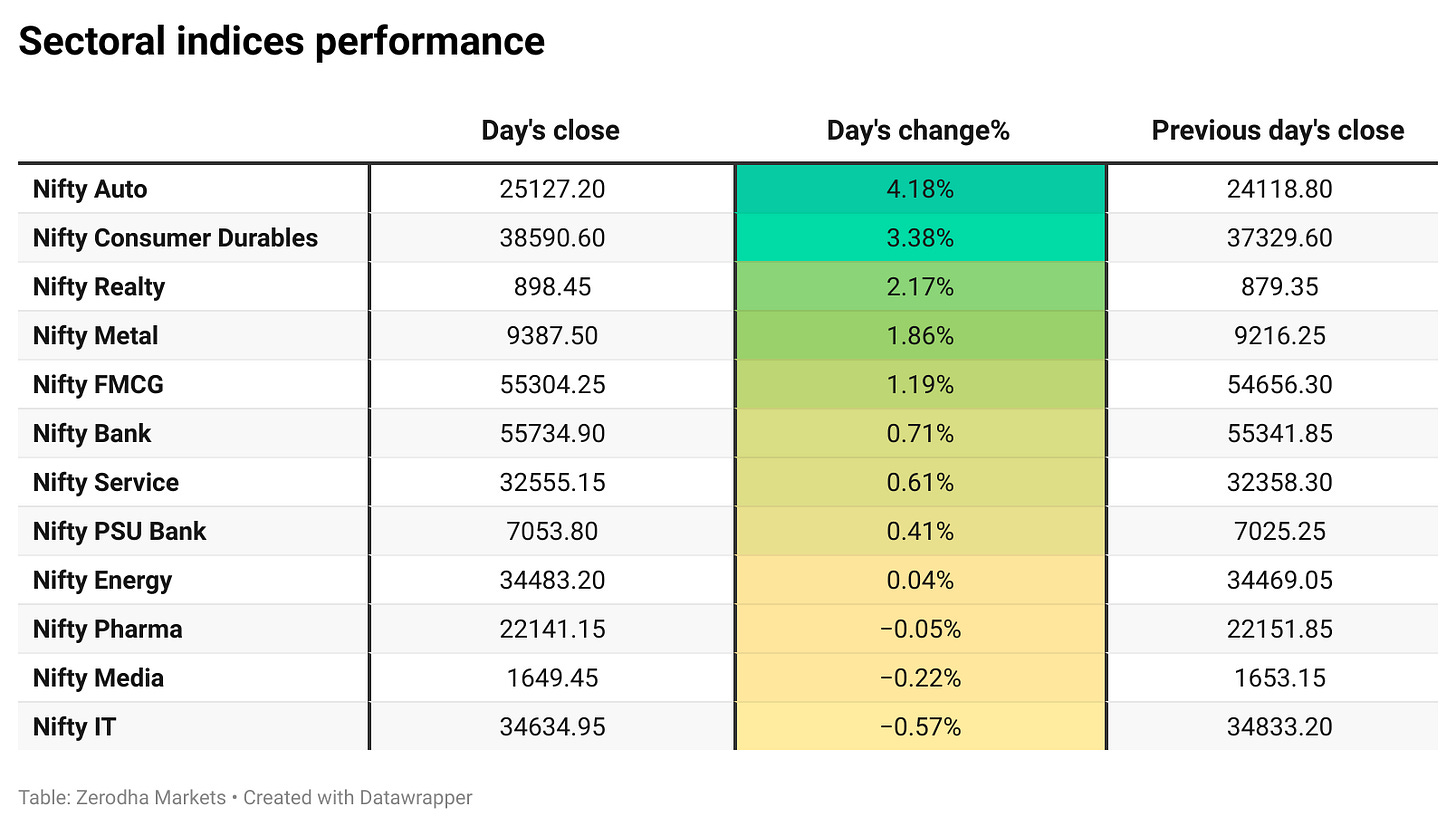

Sectoral Performance

Nifty Auto emerged as the top gainer, rising sharply by 4.18%, followed by Nifty Consumer Durables and Nifty Realty, which gained 3.38% and 2.17% respectively. On the losing side, Nifty IT was the worst performer, slipping 0.57%, trailed by Nifty Media and Nifty Pharma, which fell 0.22% and 0.05% respectively. Out of the 12 sectoral indices, 9 closed in the green while 3 ended in the red, reflecting a broadly positive market trend.

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 21st August:

The maximum Call Open Interest (OI) is observed at 25,000, followed closely by 25,200, suggesting strong resistance at 25,000 - 25,100 levels.

The maximum Put Open Interest (OI) is observed at 24,800, followed closely by 24,900, suggesting strong support at 24,800 to 24,700 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

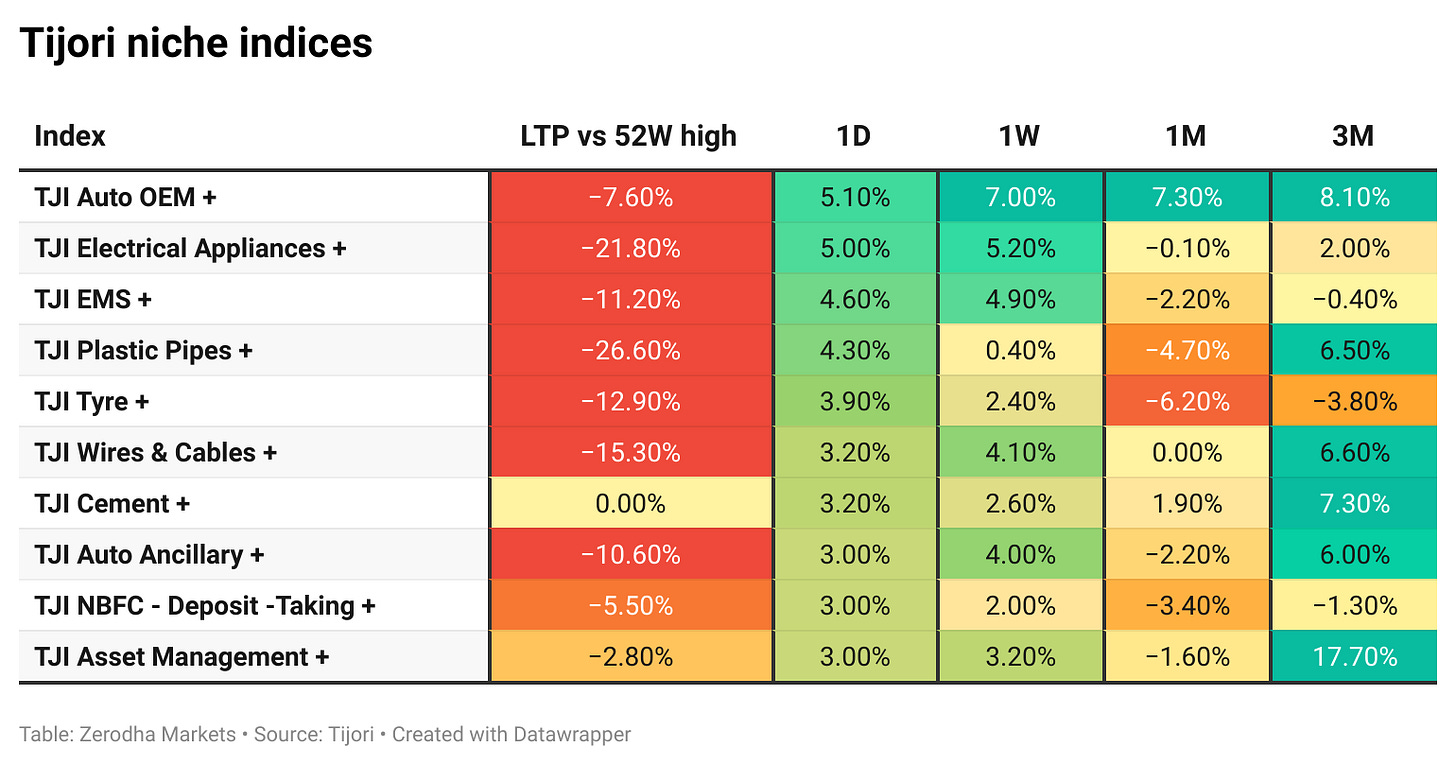

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

Prime Minister Modi announced a “next-generation” GST reform to be rolled out by Diwali, cutting the current four-tier tax system to two slabs of 5% and 18%, with a 40% rate on luxury and sin goods. The move aims to lower taxes on essentials, ease compliance for MSMEs, and improve affordability. He urged states to back the plan, calling it a “double Diwali” gift for citizens. Dive deeper

S&P Global upgraded the long‑term credit ratings of major lenders such as SBI, HDFC Bank and Axis Bank, along with finance firms like Bajaj Finance and Tata Capital, following its raise of India’s sovereign rating to ‘BBB’. The agency expects these institutions to benefit from strong domestic growth and reforms like the Insolvency and Bankruptcy Code. Dive deeper

Vodafone Idea’s shares jumped nearly 5 % after quarterly results showed its net loss narrowing to about ₹6,608 crore from ₹7,166 crore the previous quarter. Revenue ticked up to roughly ₹11,023 crore, while operating income slipped and the average revenue per user improved to ₹177. Dive deeper

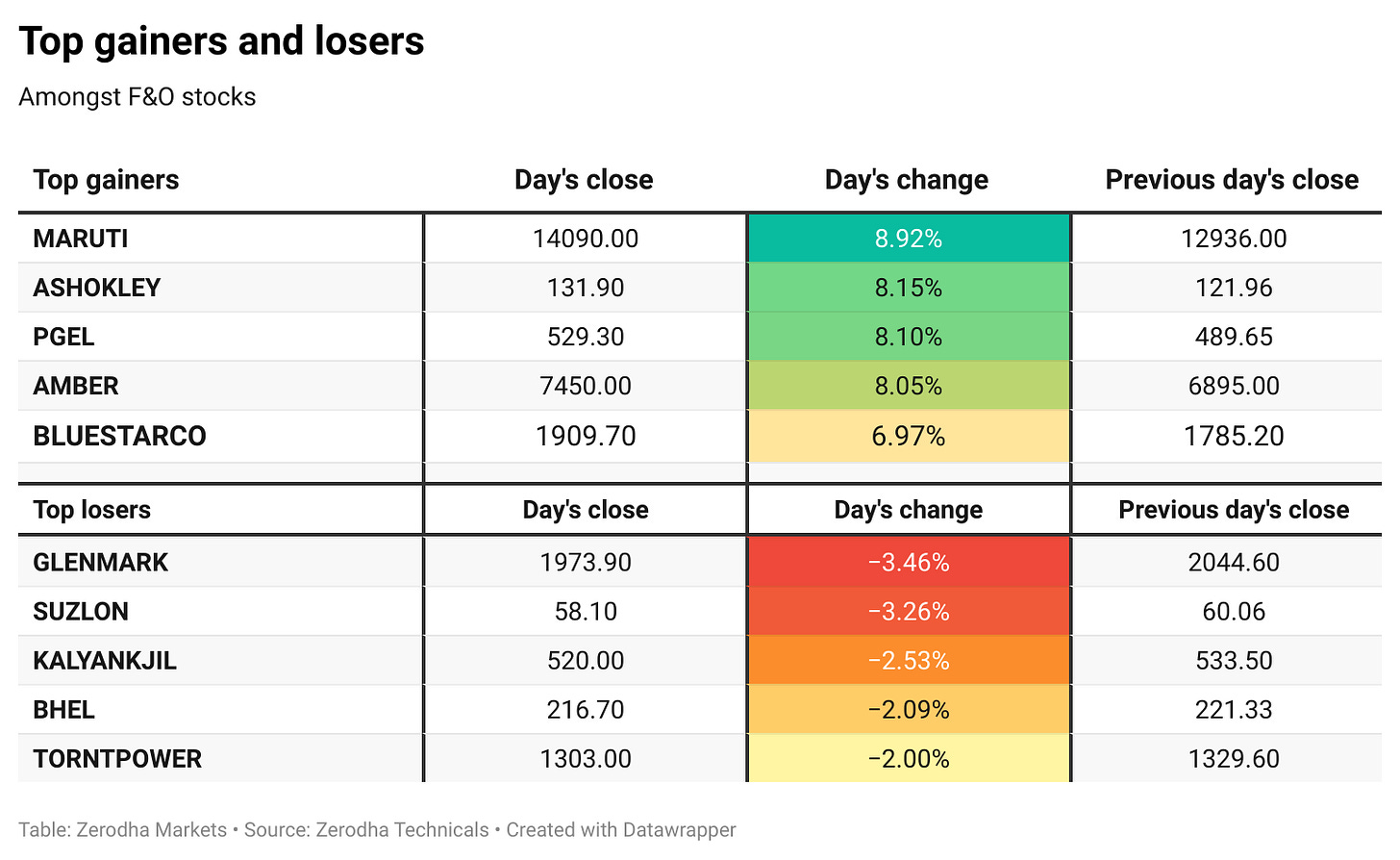

Indian auto stocks rose about 4 %, the best sectoral gain on the Nifty 50, after a report said the government may cut GST on small cars to 18 % from 28 %. All 15 auto index stocks gained. Dive deeper

Swiggy shares climbed roughly 3 % to ₹410.65 after it raised the platform fee for food deliveries to ₹14 in busy areas. Despite its April–June net loss doubling to ₹1,197 crore, operating revenue surged 54 % to ₹4,961 crore. Dive deeper

India’s trade remedies authority proposed a three‑year safeguard duty on certain flat steel imports, starting at 12 % and tapering to 11 %. It cited a surge in low‑priced imports threatening domestic producers, though auto and electronics firms warned of higher costs. Dive deeper

Rail Vikas Nigam’s stock gained about 2 % after winning a ₹178.65‑crore contract from IRCON to install signalling and interlocking systems at ten new stations. The project, including telecom upgrades, is scheduled to finish within 11 months. Dive deeper

Reliance Consumer Products Ltd (RCPL), the FMCG arm of Reliance Industries, has entered the functional beverage market by acquiring a majority stake in a joint venture with Naturedge Beverages. The partnership will focus on launching a range of herbal and natural drinks, tapping into the fast-growing healthy beverage segment. Dive deeper

What’s happening globally

Trump and Putin’s Alaska summit ended without a ceasefire or peace deal, though Putin signaled openness to NATO-style security guarantees for Ukraine, seen as a win for Moscow but criticized for lacking substance. Attention now shifts to Washington, where Trump will meet Zelenskyy and European leaders to push a U.S.–EU backed peace framework building on those assurances. Dive deeper

The Shanghai Composite gained 0.85% to 3,728 on Monday, its highest since 2015, while the Shenzhen Component rose 1.73% to 11,836. The rally was supported by strong institutional and retail buying, aided by the extension of the US-China tariff truce and expectations of fresh stimulus from Beijing. Dive deeper

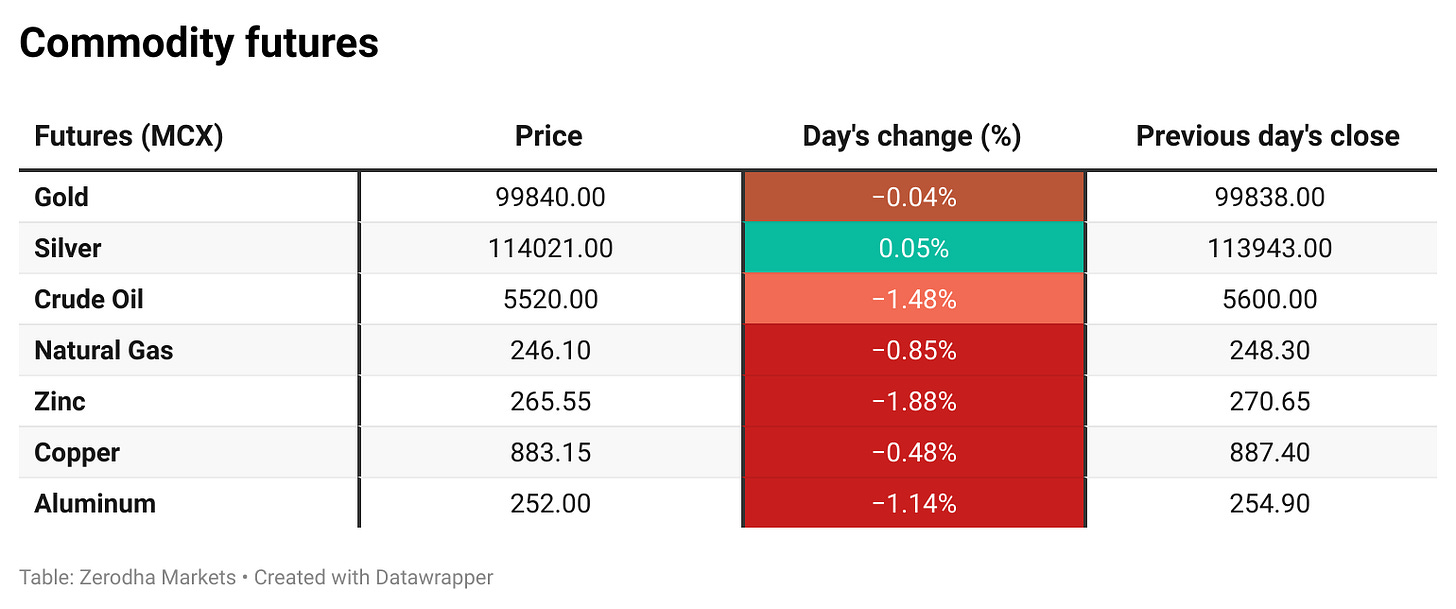

Steel rebar futures dropped below CNY 3,160 on Monday, their lowest in a month, after reports that the Trump administration expanded its 50% tariff on steel and aluminum to hundreds of additional products, effective immediately. Trump also signaled more tariff measures on steel and semiconductor chips in the coming weeks. Dive deeper

Japan’s Nikkei extended its gains from last week to close at a record high, powered by a weaker yen that boosted automaker stocks such as Toyota and Honda. The rally was further supported by renewed optimism about the domestic corporate outlook and strong interest from foreign investors. Dive deeper

Oil prices rose Monday after White House trade adviser Peter Navarro said India’s purchases of Russian crude were funding Moscow’s war effort and must stop, while markets awaited Trump-Zelenskyy peace talks. Brent gained 0.46% to $66.15 and WTI rose 0.61% to $63.18. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

CEO Bhavish Aggarwal, CEO of Ola Electric on company’s Indigenous Lithium-Ion Battery

“The heart of a vehicle is the cell… the biggest cost driver, the biggest performance driver, everything, is the cell,”

“When our cell comes in, that gross margin will further go up. So then that cell coming in starts this quarter.”

The Bharat Cell “comes with over 15 years of battery life, 5X the capacity of the competition and provides 80% charging within 15 minutes,” - Link

Samir Arora, founder and fund manager at Helios Capital Management on FII selling this year

"Why look at secondary data only? FII view on India is better understood by their total investments- their buying/selling of stocks plus their buying of stocks via IPOs and QIPs. FIIs own about 750 billion USD of stocks primarily in old, large cap names in IT, consumer and financial sector- so they are selling may be 2 pct of their portfolio to buy newer companies, smaller companies which they can only buy via IPOs or QIPs due to size. There is nothing wrong with this marginal rebalancing," - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

📚 Also reading Mind Over Markets by Varsity?

It goes out thrice a week, covering markets, personal finance, or the odd question you didn’t know you had. The Varsity team writes across three sections: Second Order, Side Notes, and Tell Me Why, thoughtfully put together without trying to be too clever.

Go check out Mind Over Markets by Zerodha Varsity here.

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.

Amazing piece.