Global rally + trade deal tailwinds lift Nifty above 25,850

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we explore where trade ideas really come from: observation, data, research, conversations, and experience, and introduce a simple framework to move ideas from vague intuition to clear, testable hypotheses.

Bringing this closer to real trading, we discuss how to find ideas using charts, data visualisation, research papers, books, blogs, and trading communities, while also highlighting why blindly copying popular strategies can be dangerous.

Finally, we talk about crowding risk, why most professionals never reveal the last-mile details of their strategies, and how to turn borrowed ideas into something robust and testable for your own trading.

Market Overview

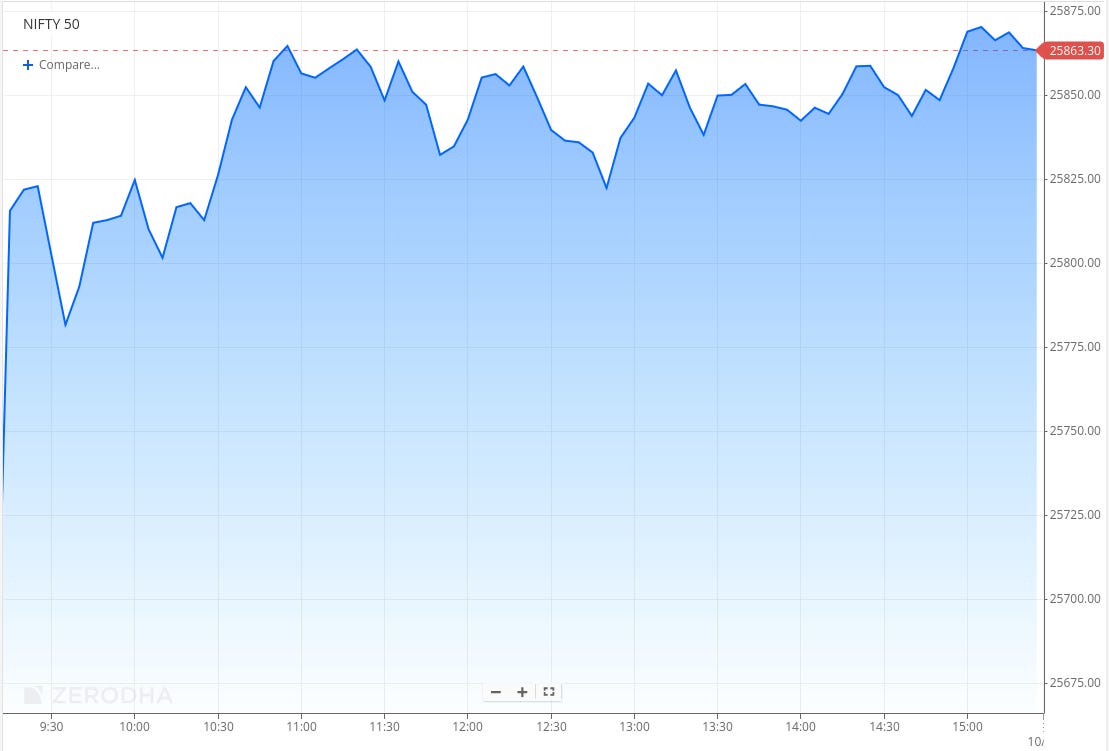

Nifty opened with a strong 195-point gap-up at 25,889, tracking positive global cues and a more constructive assessment of the fine print of the India–U.S. interim trade deal. After the gap-up, the index saw mild volatility in the opening hour but managed to hold above the 25,780–25,820 zone, indicating steady buying support at lower levels. Through the late morning session, Nifty traded with a positive bias, encouraged by strong results by SBI, and gradually moved higher, testing the 25,850–25,870 zone multiple times as sentiment remained firm.

In the second half, the index continued to consolidate near the highs with shallow dips being bought into, and Nifty largely remained range-bound between 25,820 and 25,870 for most of the afternoon. A small push in the final hour helped the index end near the top of the day’s range. Nifty eventually closed at 25,867.30, marking a strong follow-through after the previous session’s recovery and reflecting a steady session dominated by consolidation at higher levels.

Looking ahead, markets are likely to remain sensitive to global risk appetite, ongoing Q3 earnings, and domestic cues.

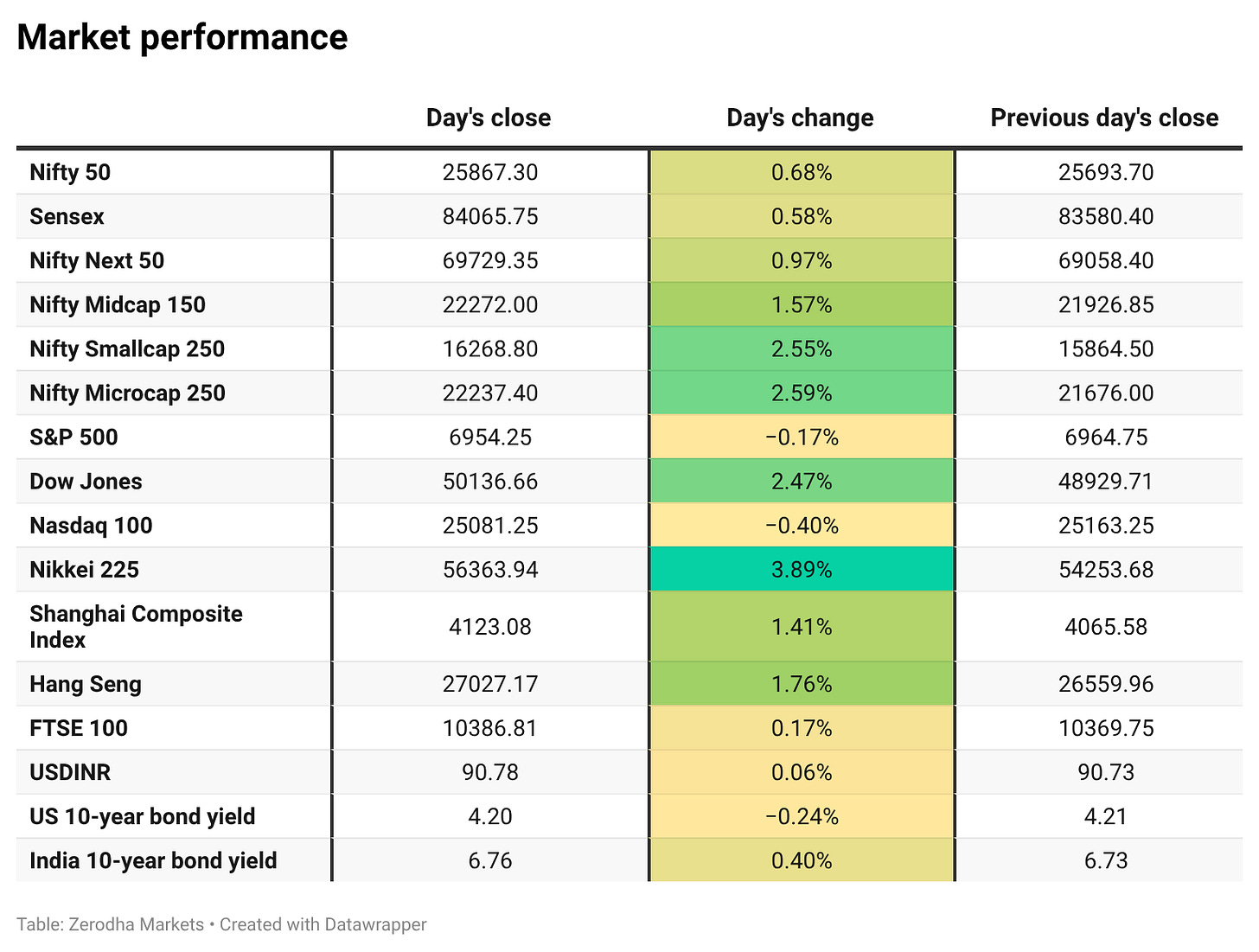

Broader Market Performance:

The broader market had an extremely strong bullish session today. Of the 3,305 stocks that traded on the NSE, 2,485 advanced, 728 declined, and 92 remained unchanged.

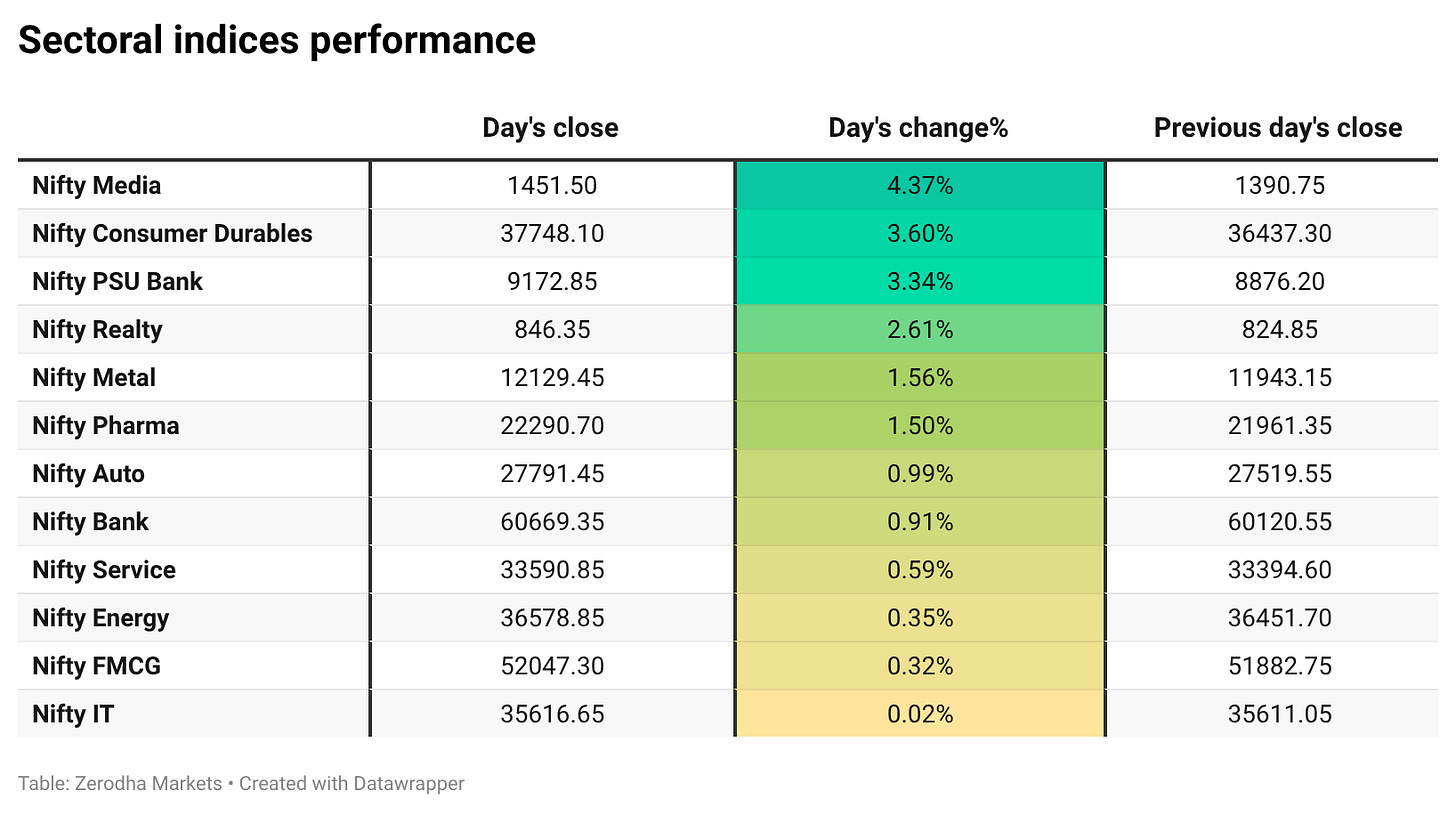

Sectoral Performance:

Nifty Media was the top gainer today, rising 4.37%, while there were no losing sectors—all 12 sectors closed in the green, with 0 ending in the red, indicating broad-based strength across the market.

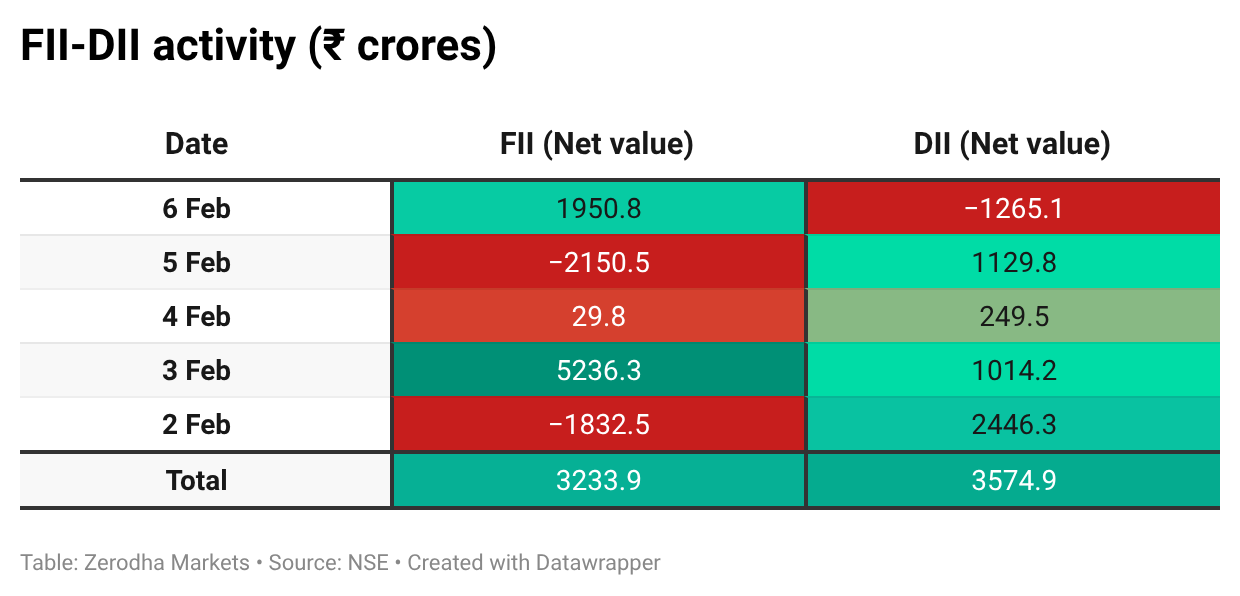

Here’s the trend of FII-DII activity from the last 5 days:

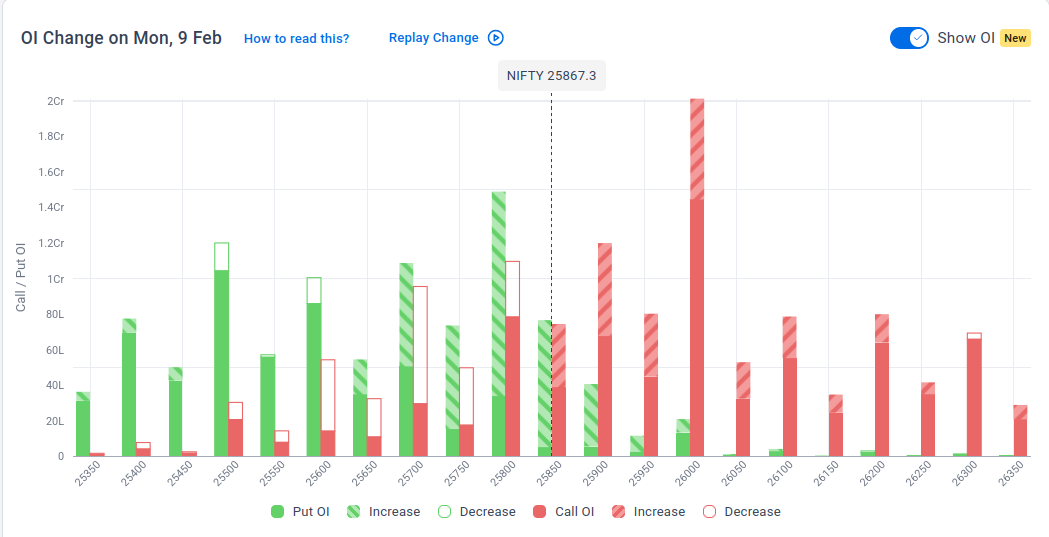

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 10th February:

The maximum Call Open Interest (OI) is observed at 26,000, followed by 25,900, indicating potential resistance at the 25,900 -26,000 levels.

The maximum Put Open Interest (OI) is observed at 25,800, followed by 25,700, suggesting support at 25,800-25,700.

Note: OI is subject to multiple interpretations; however, generally, an increase in Call OI indicates resistance in a falling market, while an increase in Put OI indicates support in a rising market.

Source: Sensibull

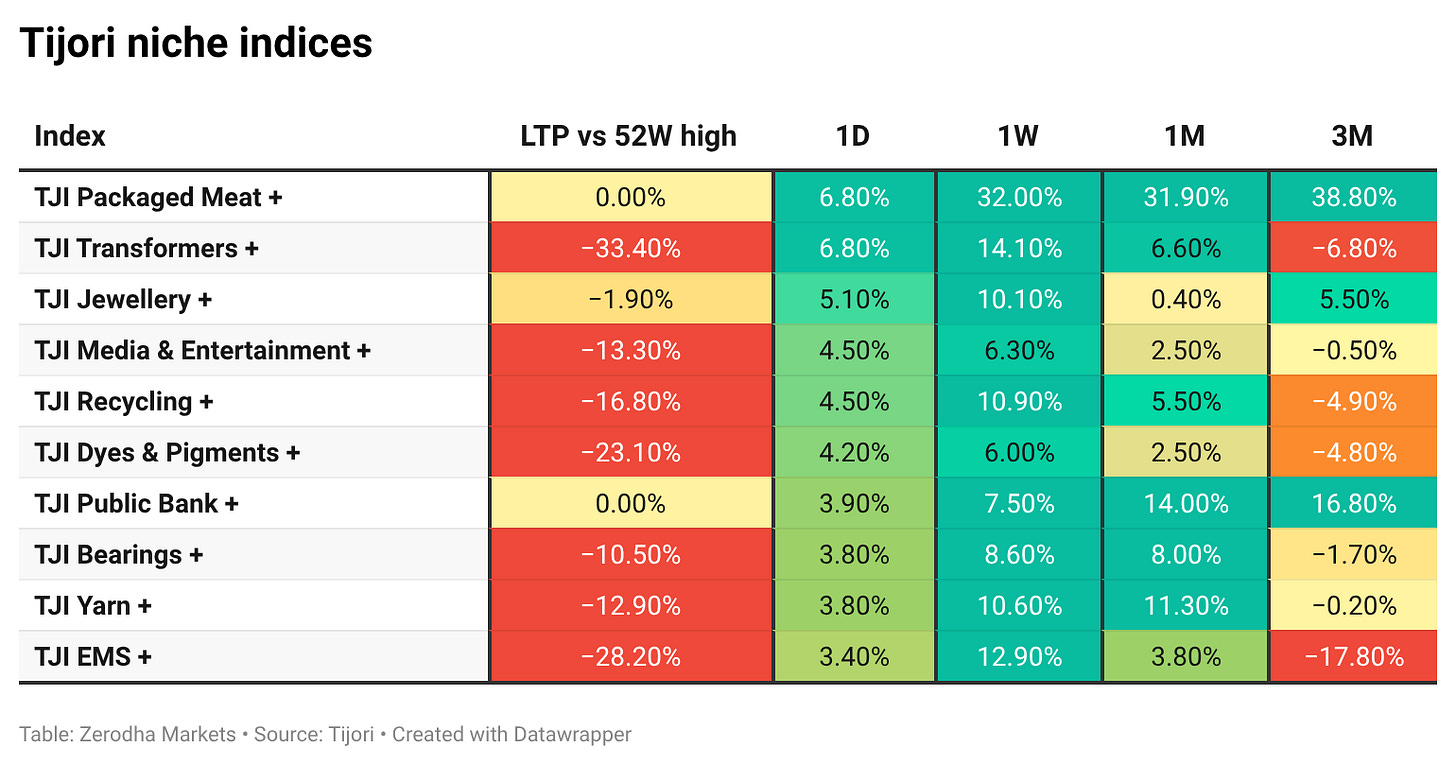

Tijori is an investment research platform that has constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

The rupee edged up to around 90.4 per dollar as foreign investors returned to Indian equities on optimism around an interim US–India trade deal. Dive deeper

India’s 10-year G-Sec yield rose to around 6.76% as heavy state bond supply, and the absence of fresh RBI liquidity support weighed on demand. Dive deeper

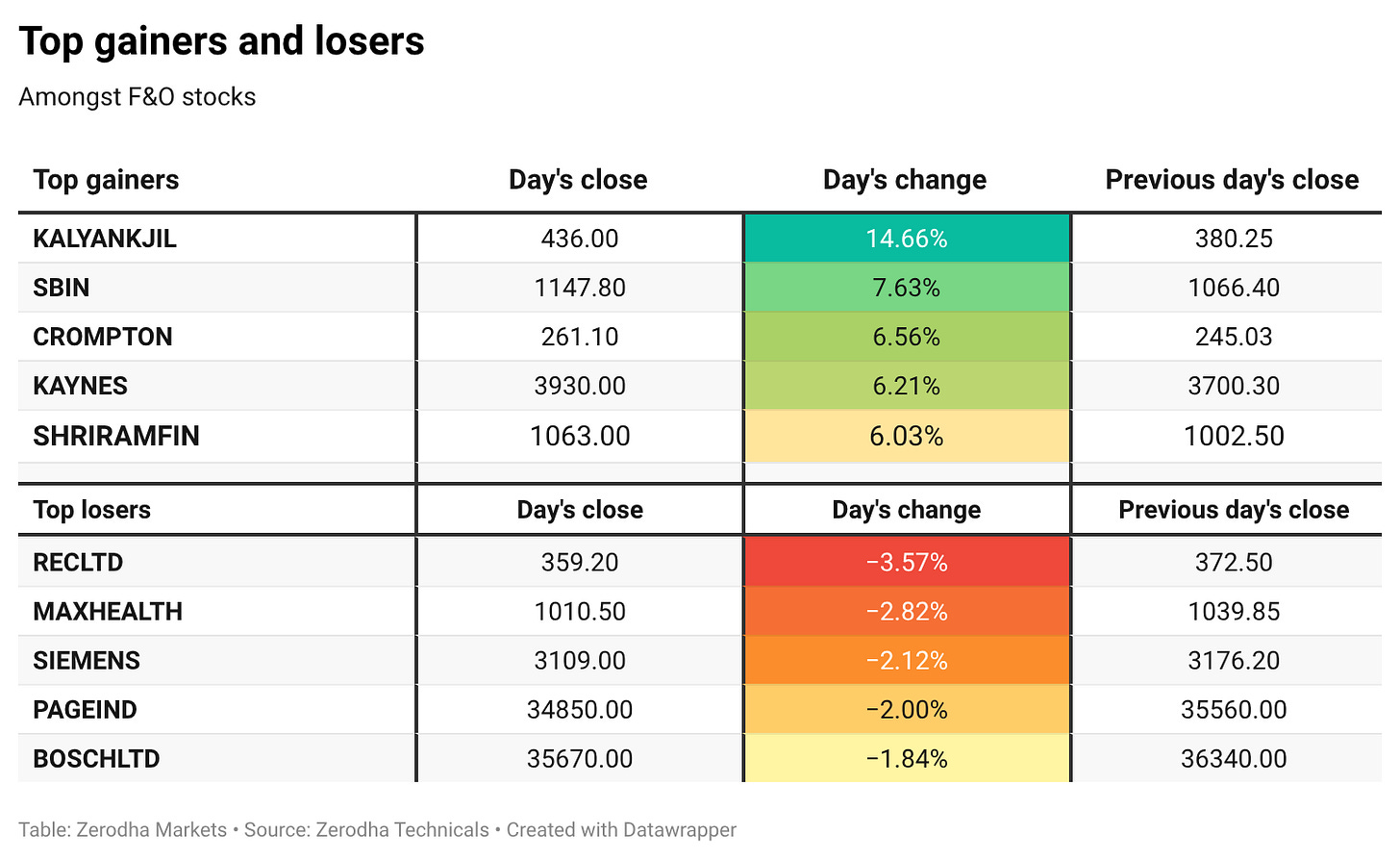

State Bank of India shares surged over 7% after the lender posted its highest-ever quarterly net profit of ₹21,028 crore in Q3 FY26 and crossed ₹10 lakh crore in market capitalisation. Net interest income rose 9% to ₹45,190 crore, while asset quality improved sequentially with gross NPAs falling to 1.57% and net NPAs to 0.39%. Dive deeper

Tata Motors has inaugurated a ₹9,000-crore Jaguar Land Rover passenger car manufacturing plant in Ranipet, Tamil Nadu, marking JLR’s first facility in India to produce its luxury models. Dive deeper

IDBI Bank shares fell up to 2.5% amid fresh developments in its proposed strategic sale, with bids reportedly coming from Fairfax Financial and Emirates NBD. Kotak Mahindra Bank denied submitting a financial bid, while the government aims to announce the winning bidder by March. Dive deeper

Adani Energy Solutions secured long-term financing from Japanese banks MUFG and Sumitomo Mitsui Banking Corporation for its flagship HVDC transmission project to evacuate renewable energy from Rajasthan’s solar regions to India’s national grid. Dive deeper

Reliance Consumer Products, the FMCG arm of Reliance Industries, has acquired a majority stake in Australia-based Goodness Group Global Pty Ltd, marking its strategic entry into the Australian consumer goods market. Dive deeper

Velocity has earmarked ₹100 crore to scale its AI-led shipping platform over the next two years, focusing on product development and hiring. Dive deeper

What’s happening globally

US Treasury yields surged, with benchmark 10-year yields climbing four basis points to 4.25% and 30-year yields rising to 4.88%, after reports that Chinese regulators advised domestic financial institutions to reduce US government bond holdings amid market volatility concerns. Dive deeper

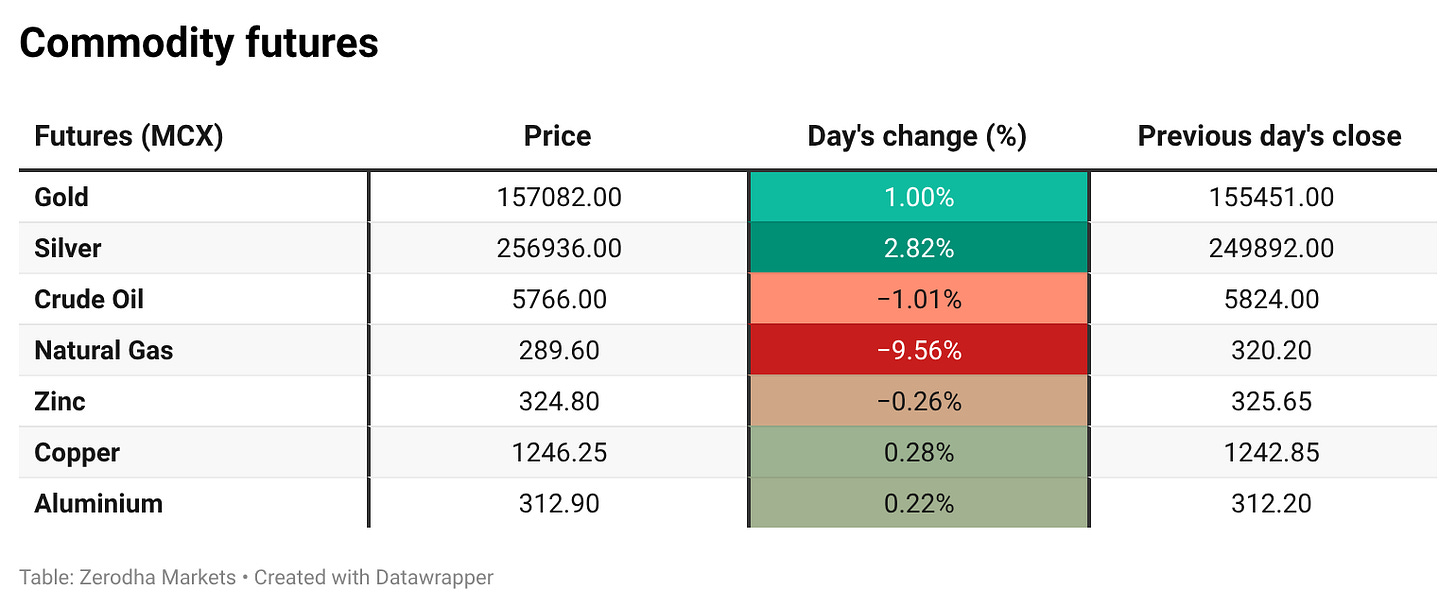

Brent crude slipped to around $67.4 per barrel as easing US–Iran tensions reduced immediate supply disruption concerns. Dive deeper

Gold climbed above $5,000 per ounce, supported by a softer dollar ahead of key US jobs and inflation data. Prices also drew support from continued central bank buying in China and ongoing US–Iran talks. Dive deeper

European stocks hit fresh record highs, with the STOXX 50 and STOXX 600 rising on broad-based gains led by healthcare and select financial stocks. Dive deeper

UK 10-year gilt yields rose above 4.5% amid political uncertainty, while expectations of Bank of England rate cuts increased after a more dovish policy signal. Dive deeper

Japan’s Nikkei and Topix hit record highs after the ruling LDP secured a two-thirds majority in the lower house, reinforcing expectations of looser fiscal policy. Dive deeper

China’s foreign exchange reserves rose to USD 3.399 trillion in January, the highest since 2015, supported by a weaker US dollar. Dive deeper

Taiwan’s exports surged 69.9% year-on-year to a record USD 65.8 billion in January, driven by strong demand for electronics and related products. Dive deeper

Management chatter

In this section, we highlight interesting comments made by the management of major companies and policymakers from the Indian and Global Economies.

Finance Minister Nirmala Sitharaman on FII flows and AI:

There is a narrative that net inflow has reduced. For that, countries like Norway, Canada are showing keen interest for their pension funds and their larger sovereign funds to come here. But there are some in North America — big fund managers — who wait and watch to see which way the trend moves, if I can say that, and then they take a call. And I’ll be open in saying this that since the call between the US President and our Prime Minister, I get the feeling that is why the stock market in India, and particularly, the rupee, has covered some lost ground.

See, India needs solutions. It’s not only solutions for the youth in the name of jobs. You need technology, need innovation to solve day-to-day problems that are faced by the citizens. Using AI, for instance, we want to focus on solving problems. Now, if we look at AI displacing people from work alone, you’ll be obsessed in that rather than looking at — is it giving solutions? And for giving solutions, do we have enough people who can deal with it and get it applied for such situations? We are taking that route. - Link

Rahul Shukla, Vice President and Chief Sales and Marketing Officer, Watches Division of Titan, on its revenue targets and growing premiumization:

“We have taken a very ambitious target of growing to 1 billion by next year and 2 billion by the financial year 2030, and that’s more than 20 per cent CAGR.”

“If you were to divide the market today as it stands today, half of it is below ₹25,000, the other half is above ₹25,000, which is roughly ₹12,500 crores out of ₹25,000 crores.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

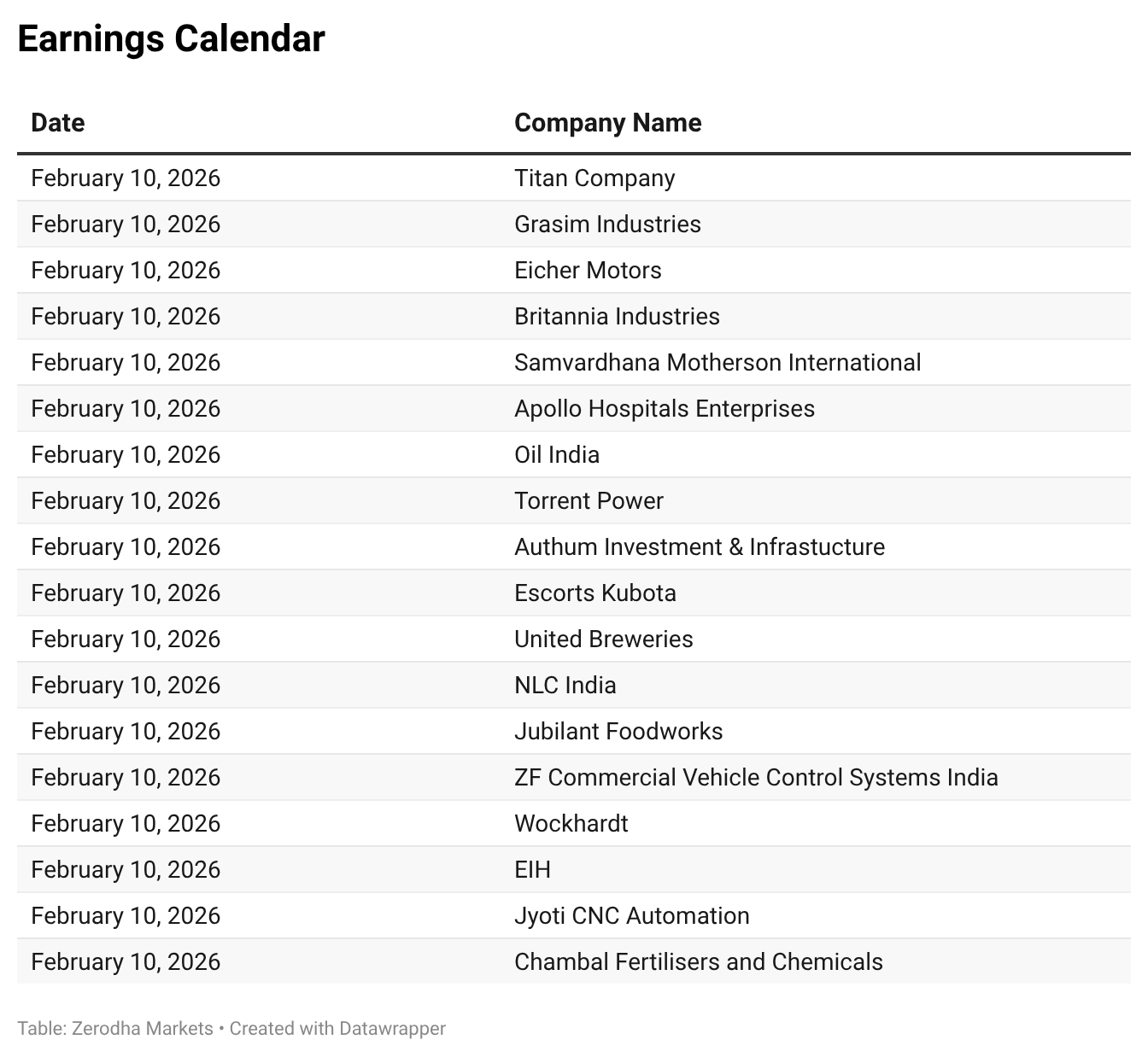

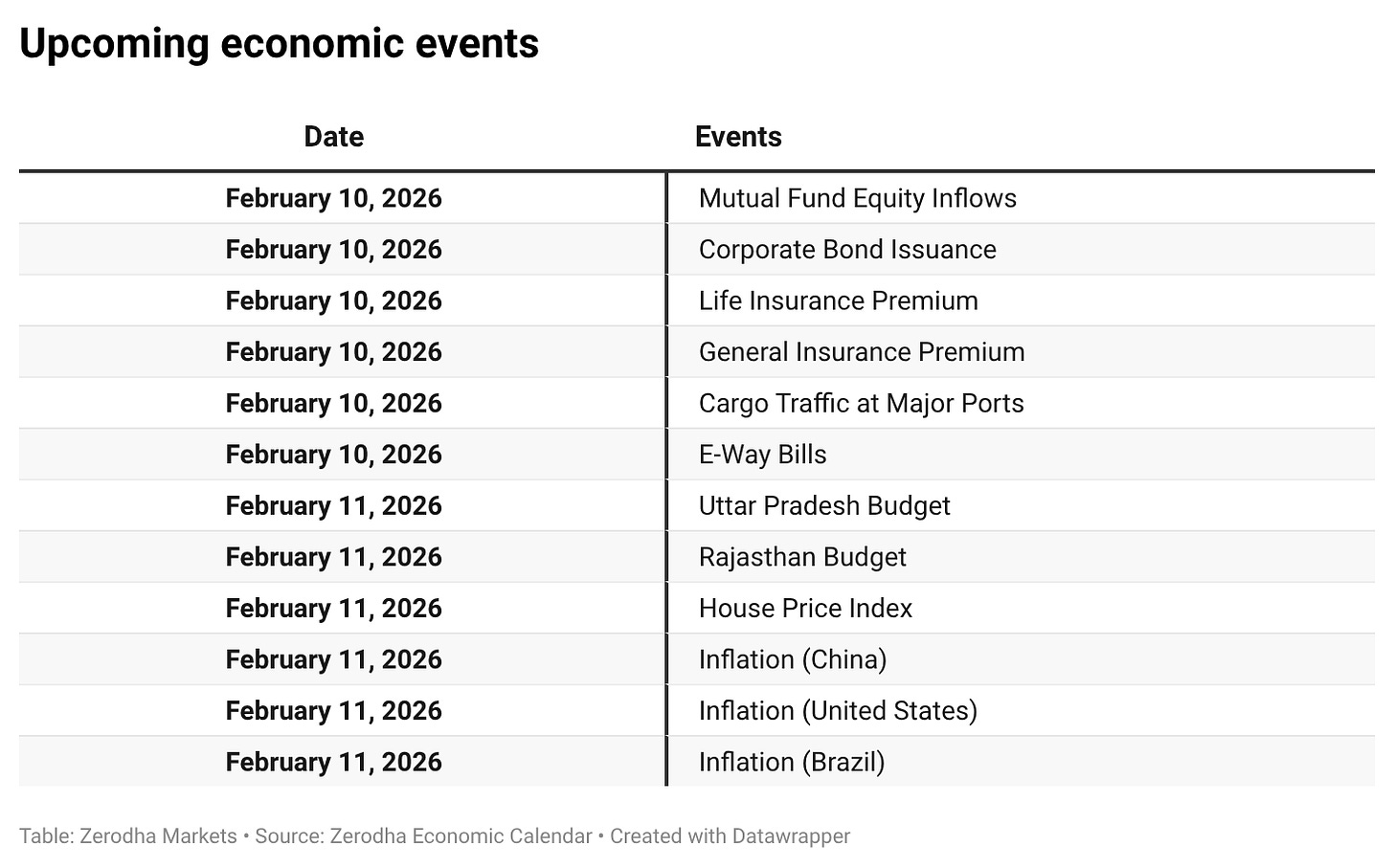

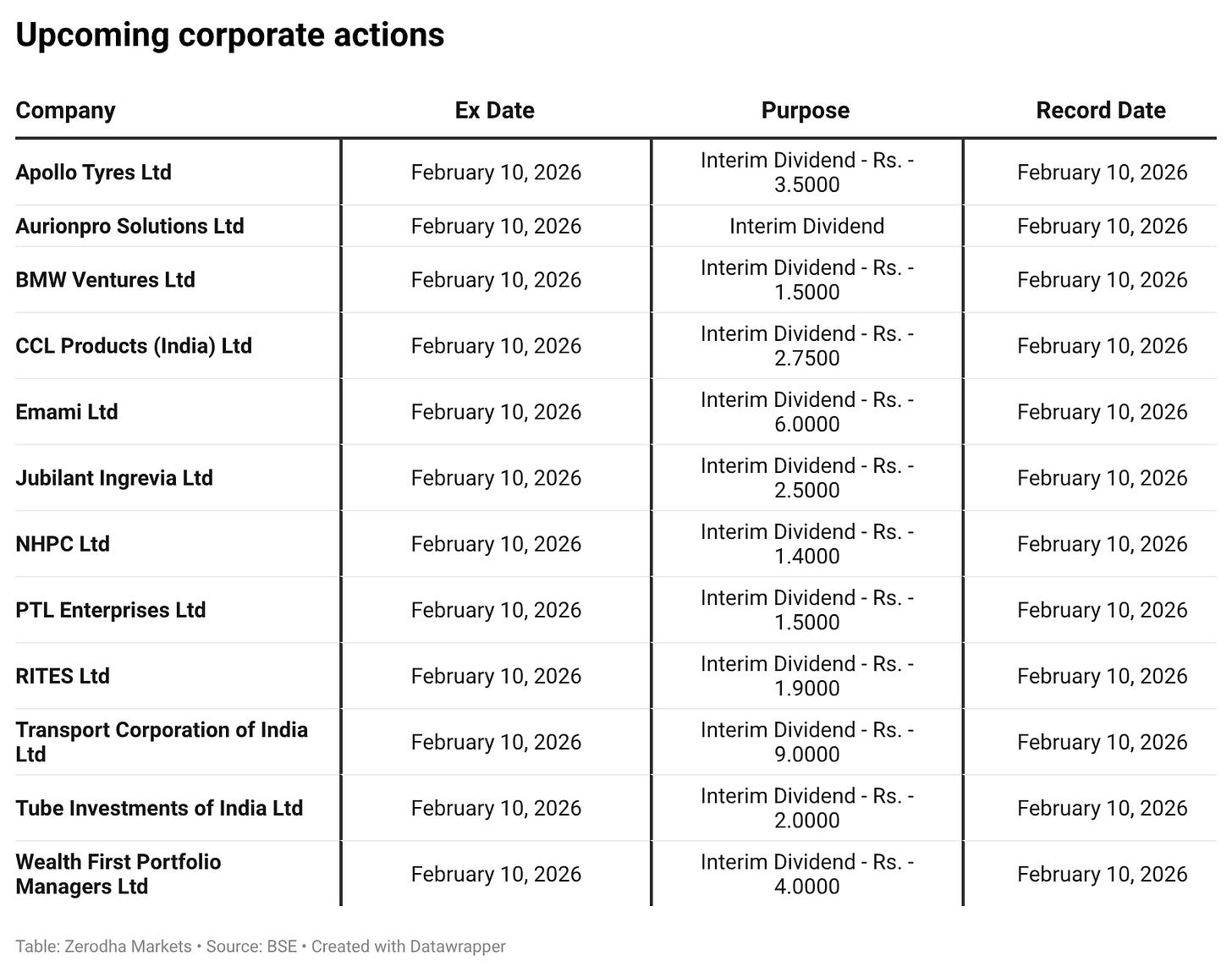

Calendars

In the coming days, we have the following significant events, quarterly results, and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

The 18% reciprocal tariff deal is a massive structural tailwind, but the tape shows the battle for the trend isn't over. While the Supertrend reclaim at 25,850 is a start, we are tracking a heavy Call wall at 26,000. Today’s Doji close suggests a 'Supply Strike' is active at the highs. Reclaiming the perimeter is easy; holding it against the 26k resistance is the real mission.