Global cues lift Nifty above 25,950 as broader markets stabilize

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we explore a shift from penny options and tail risks to a far more practical, survivability-focused use of options: a Limited Downside Nifty strategy built to cap drawdowns while still participating in index upside.

This episode breaks down how structured products and market-linked debentures actually work—and how the same payoff can be replicated directly, without credit risk, lock-ins, or opaque structures. Anchored in the idea of optionality from Nassim Taleb’s Antifragile, the focus is on non-linear exposure where losses are limited, but upside remains open, making this a compelling framework for traders who care more about staying in the game than chasing hero returns.

Market Overview

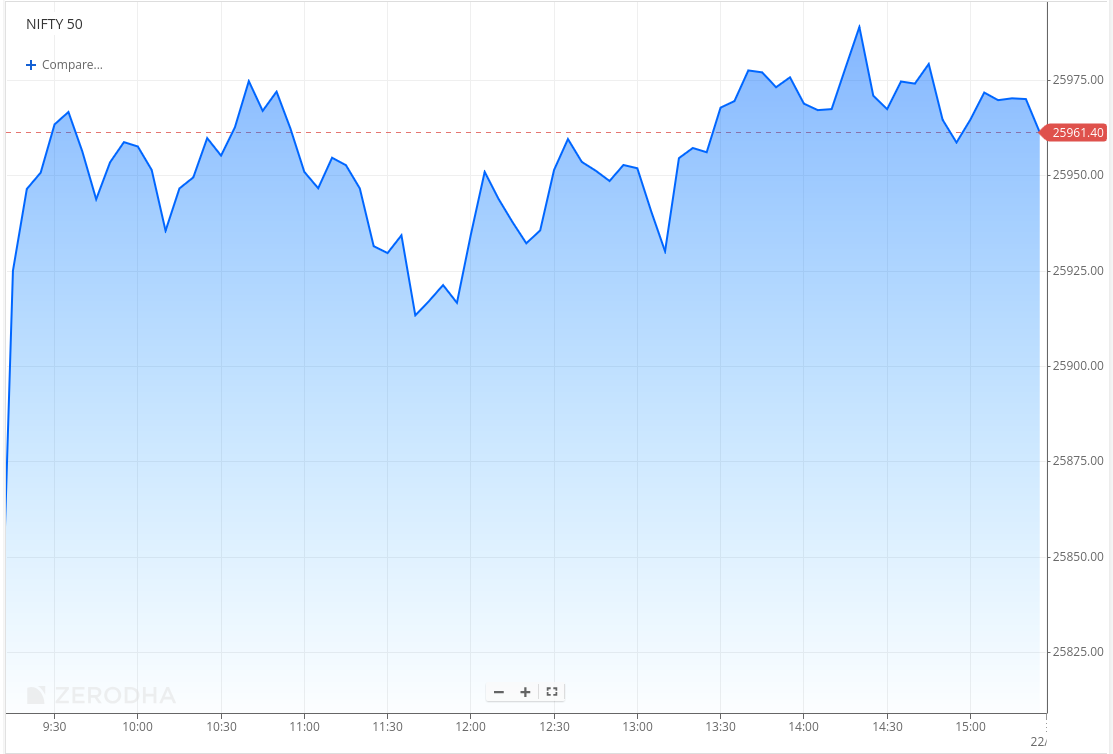

Nifty opened with a strong 96-point gap-up, buoyed by positive global cues after U.S. inflation came in lower than expected. The index held firm in the opening hour, trading with a positive bias and oscillating around the 25,930–25,980 zone, as early buying support helped absorb minor pullbacks.

Through the late morning and into the first half, Nifty turned choppy, slipping briefly toward the 25,910–25,920 area before recovering once again. By noon, the index stabilised and gradually moved higher, reclaiming the 25,950–25,980 range.

In the second half, Nifty maintained a steady upward bias, inching higher and testing levels near 25,990 during the afternoon. While intermittent intraday volatility persisted, declines were shallow and met with buying interest. The index eventually closed the day at 25,966.40, ending the session firmly in the green and reflecting a constructive day supported by improving global sentiment.

Looking ahead, markets are likely to stay sensitive to global risk appetite, currency movements, and further developments around the India–U.S. trade negotiations.

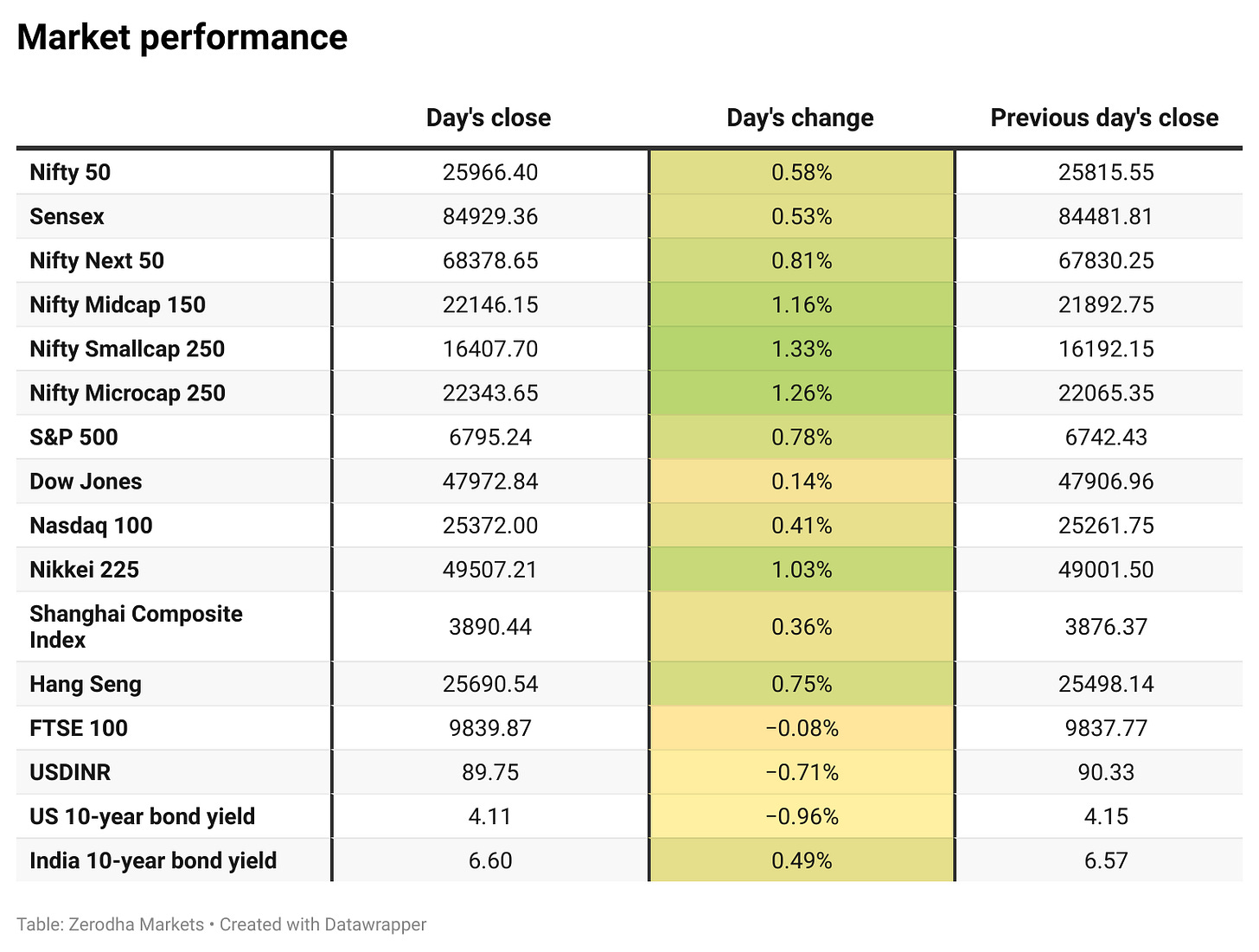

Broader Market Performance:

The broader market had a strong positive session after many days. Out of 3,215 stocks that traded on the NSE, 2,185 advanced, while 939 declined, and 91 remained unchanged.

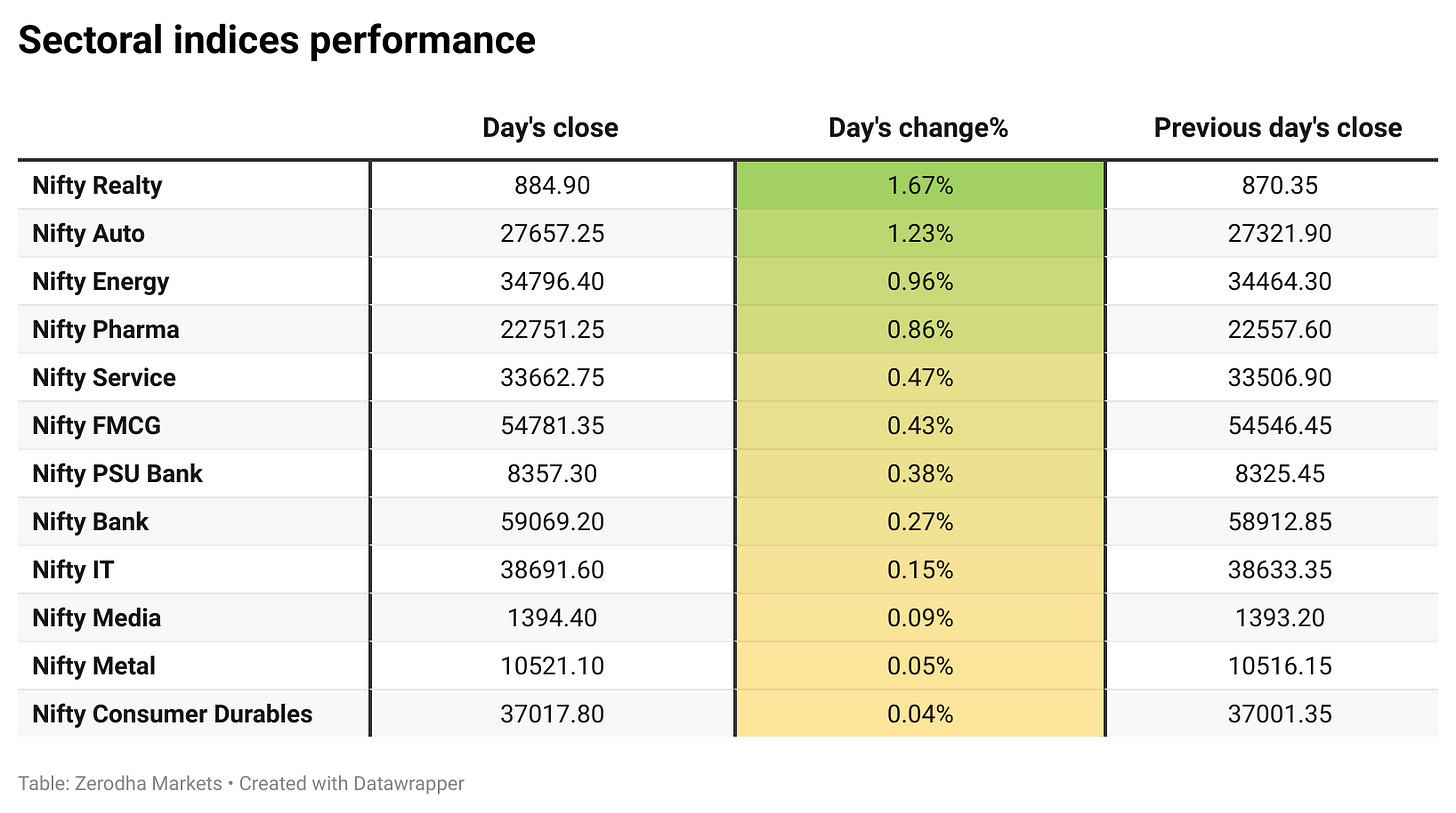

Sectoral Performance:

Nifty Realty led the gains with a strong 1.67% rise, while there were no losing sectors for the day. All 12 sectoral indices ended in the green, reflecting broad-based market strength.

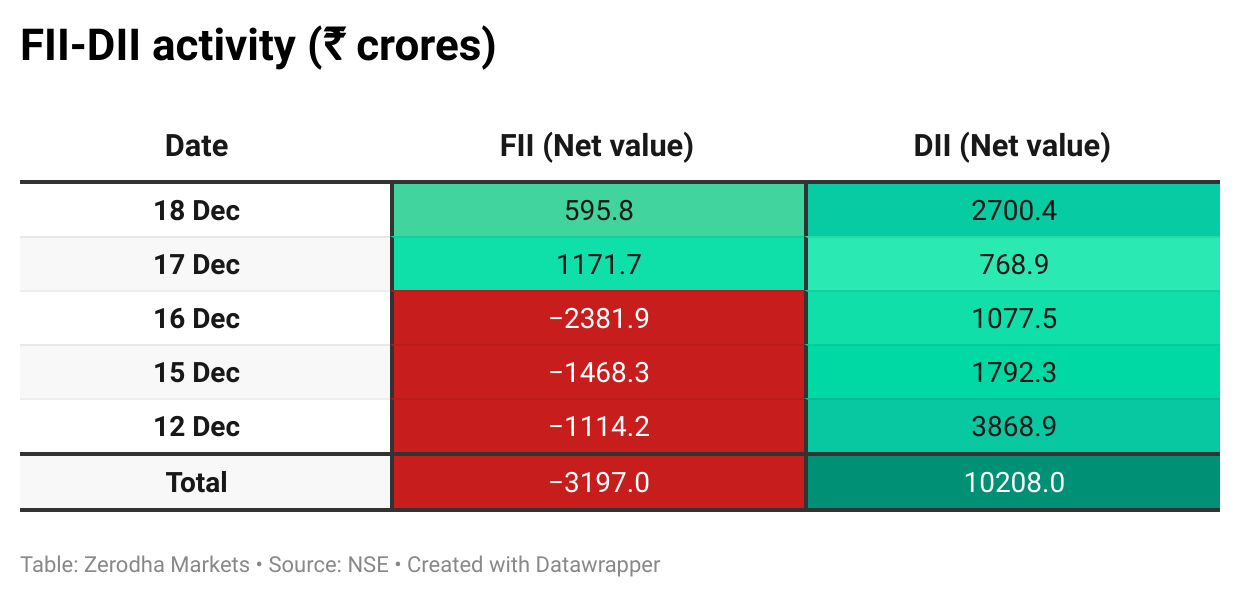

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 23rd December:

The maximum Call Open Interest (OI) is observed at 26,000, followed by 26,200, indicating potential resistance at the 26,100 -26,200 levels.

The maximum Put Open Interest (OI) is observed at 25,900, followed by 25,800, suggesting support at the 25,900 to 25,800 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

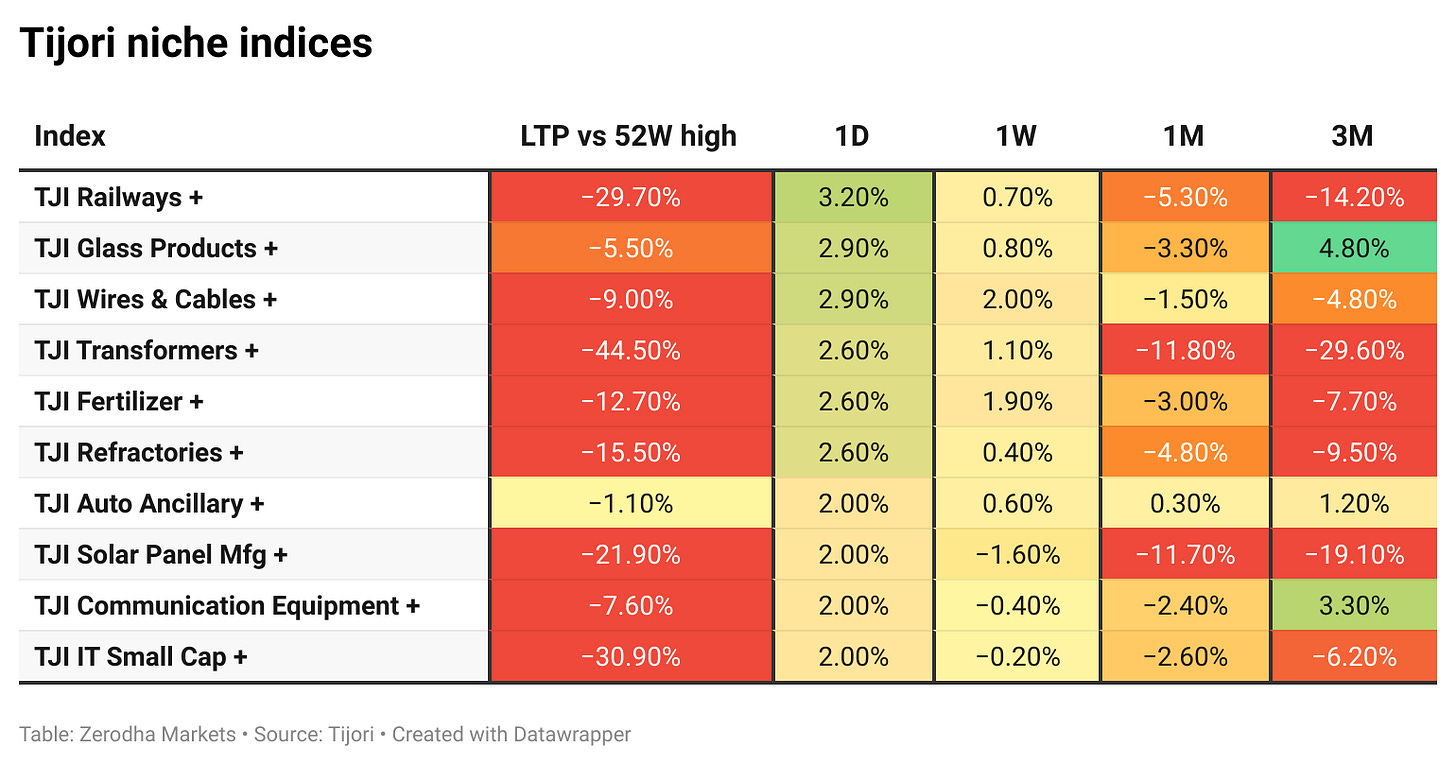

Tijori is an investment research platform that has constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

Adani Group said it plans to invest ₹1 lakh crore in its airports business over the next five years and will bid aggressively in the next round of airport privatisation. Navi Mumbai Airport is expected to begin operations on December 25. Dive deeper

India’s trade deficit with China is projected to widen to about $106 billion in 2025, as imports continue to rise faster than exports, according to GTRI. Dive deeper

Delhi High Court asked the Customs department to respond to IndiGo’s plea seeking a refund of over ₹900 crore paid as customs duty on aircraft engines and parts re-imported after overseas repairs. The matter has been listed for hearing on April 8, 2026. Dive deeper

India’s 10-year yield held near 6.6% as markets watched a ₹300 billion bond auction, seen as a key test of demand after RBI liquidity support. Dive deeper

Bharti Airtel’s board approved the first and final call of ₹401.25 per share on its partly paid-up equity shares, covering the remaining ₹15,700 crore portion of its rights issue. February 6, 2026, has been set as the record date, with the call payment window running from March 2 to March 16, 2026. Dive deeper

Piramal Finance said it will sell its entire 14.72% stake in Shriram Life Insurance to Sanlam Emerging Markets for about ₹600 crore, with the transaction expected to close by March 31, 2026, subject to regulatory approvals. Dive deeper

Reliance Consumer Products Limited has acquired a majority stake in Tamil Nadu-based Udhaiyams Agro Foods Private Limited for an undisclosed amount, with the existing promoters retaining a minority stake. Dive deeper

HCL Tech is in focus after agreeing to buy HPE’s Telco Solutions business for up to $160 million, aimed at strengthening its engineering and AI-led offerings for global telecom clients. Dive deeper

Japan’s MUFG said it will acquire a 20% stake in Shriram Finance for $4.4 billion, marking the largest cross-border investment in India’s financial sector, subject to regulatory approvals. Dive deeper

Indian mutual funds are increasingly favouring short-maturity debt as investors shift flows to sub-one-year schemes amid expectations that the RBI’s rate-cut cycle is nearing its end. Dive deeper

Net direct tax collections rose 8% to ₹17.04 lakh crore (Apr 1–Dec 17), helped by a 14% drop in refunds to ₹2.97 lakh crore. Gross collections grew 4.2% to ₹20.01 lakh crore, with corporate taxes at ₹8.17 lakh crore and non-corporate at ₹8.47 lakh crore. Dive deeper

Coca-Cola India reported a rise in FY25 profit to ₹615 crore, while revenue from operations increased to ₹5,042.56 crore for the year ended March 31, 2025. Dive deeper

What’s happening globally

The Bank of Japan raised rates by 25 bps to 0.75%, its highest since 1995, continuing a gradual exit from ultra-loose policy. It signalled further hikes remain data-dependent, with inflation expected to dip below target in early FY2026. Dive deeper

US inflation slowed to 2.7% in December, undershooting forecasts, while core inflation fell to 2.6%, its lowest since early 2021, strengthening expectations of Fed easing ahead. Dive deeper

Brent traded near $59.6/bbl and remained on course for another weekly drop as oversupply fears and softer demand signals outweighed geopolitical risks. Dive deeper

Gold hovered near $4,320/oz, close to its October record, as softer US inflation reinforced expectations of Fed rate cuts in the coming months. Dive deeper

UK public borrowing fell to £11.7 billion in November, the lowest for the month since 2021, though it came in above expectations. Higher tax and National Insurance receipts helped, but borrowing so far this year is higher than last year, and public debt remains elevated at about 95.6% of GDP. Dive deeper

Germany’s GfK consumer sentiment fell to a near two-year low as households cut spending plans and raised savings amid inflation and policy uncertainty. The drop signals weak consumer demand heading into early 2026 despite slightly better economic expectations. Dive deeper

Australian regulators secured a A$250 million ($165 million) court penalty against ANZ for widespread misconduct and systemic risk-management failures impacting government bond dealings and retail customers. Dive deeper

Management chatter

In this section, we highlight interesting comments made by the management of major companies and policymakers from the Indian and Global Economies.

Masashige Nakazono, Executive Officer, MUFG Bank, on acquiring stake in Shriram Finance and India strategy

“There’s a chance we may push our stake above 50%. The regulations allow for acquiring over 50%, so it’s a possibility at an appropriate time.”

“This investment marks MUFG’s largest commitment in India as we look to expand beyond corporate banking into lending for SMEs and individuals.”

“India’s fast-growing economy makes it a key market for our long-term global expansion plans.” - Link

Anand Ajay Piramal, Chairman, Piramal Finance, on divestment of Shriram Life Insurance stake

“This transaction is aligned with our focus on monetising non-core assets.”

“We will continue to pursue monetisation of other residual non-core assets.”

“The proceeds from the transaction will further strengthen our balance sheet.” - Link

T. Krishnakumar, Director, Reliance Consumer Products Limited, on acquiring a majority stake in Udhaiyams Agro Foods

“Udhaiyam is a brand that needs no introduction, reflecting Tamil Nadu’s rich heritage with superior quality.”

“This joint venture strengthens our presence in the branded staples space.”

“We are confident Udhaiyam will scale up to a national brand and earn trust across India.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

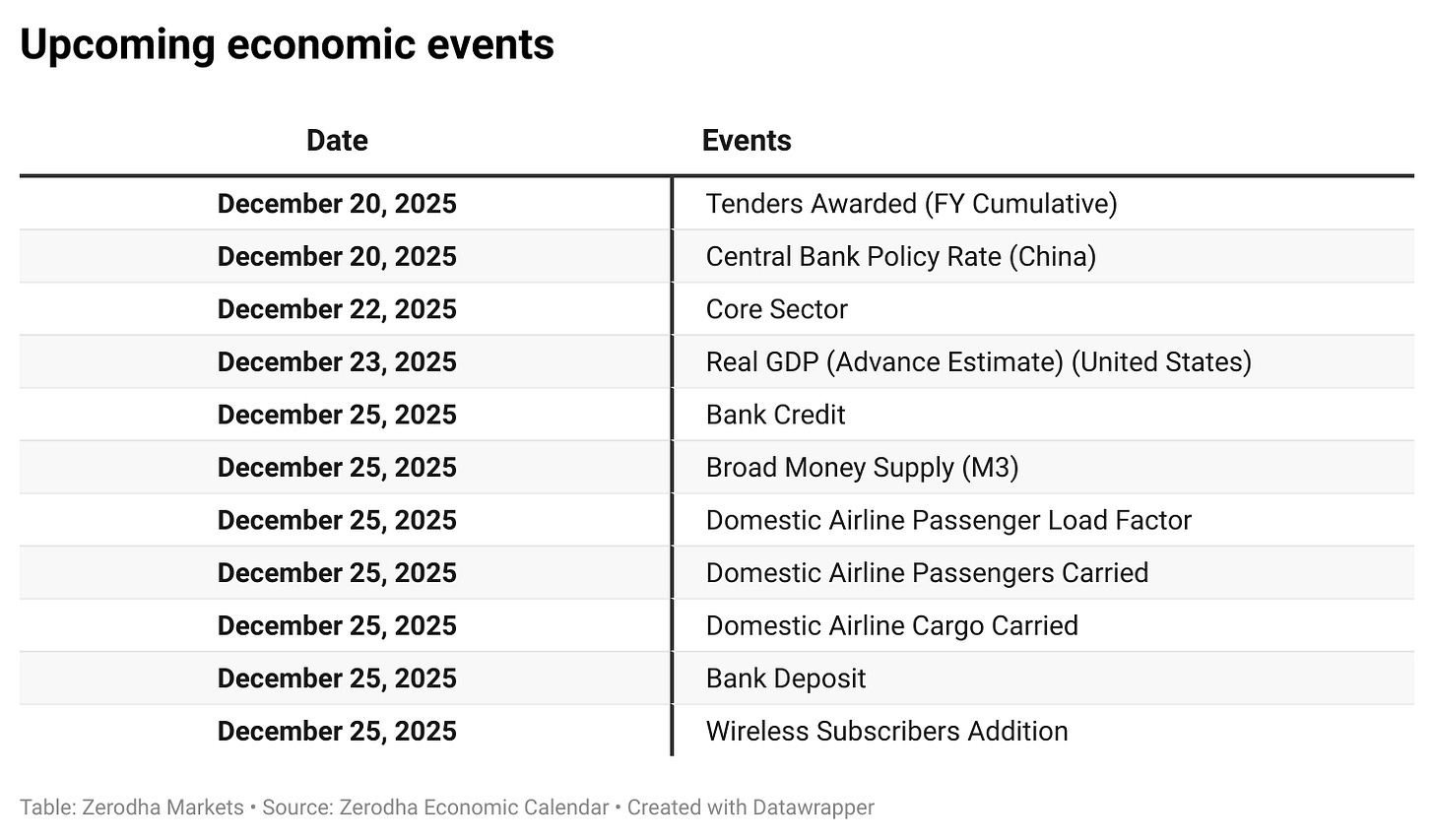

Calendars

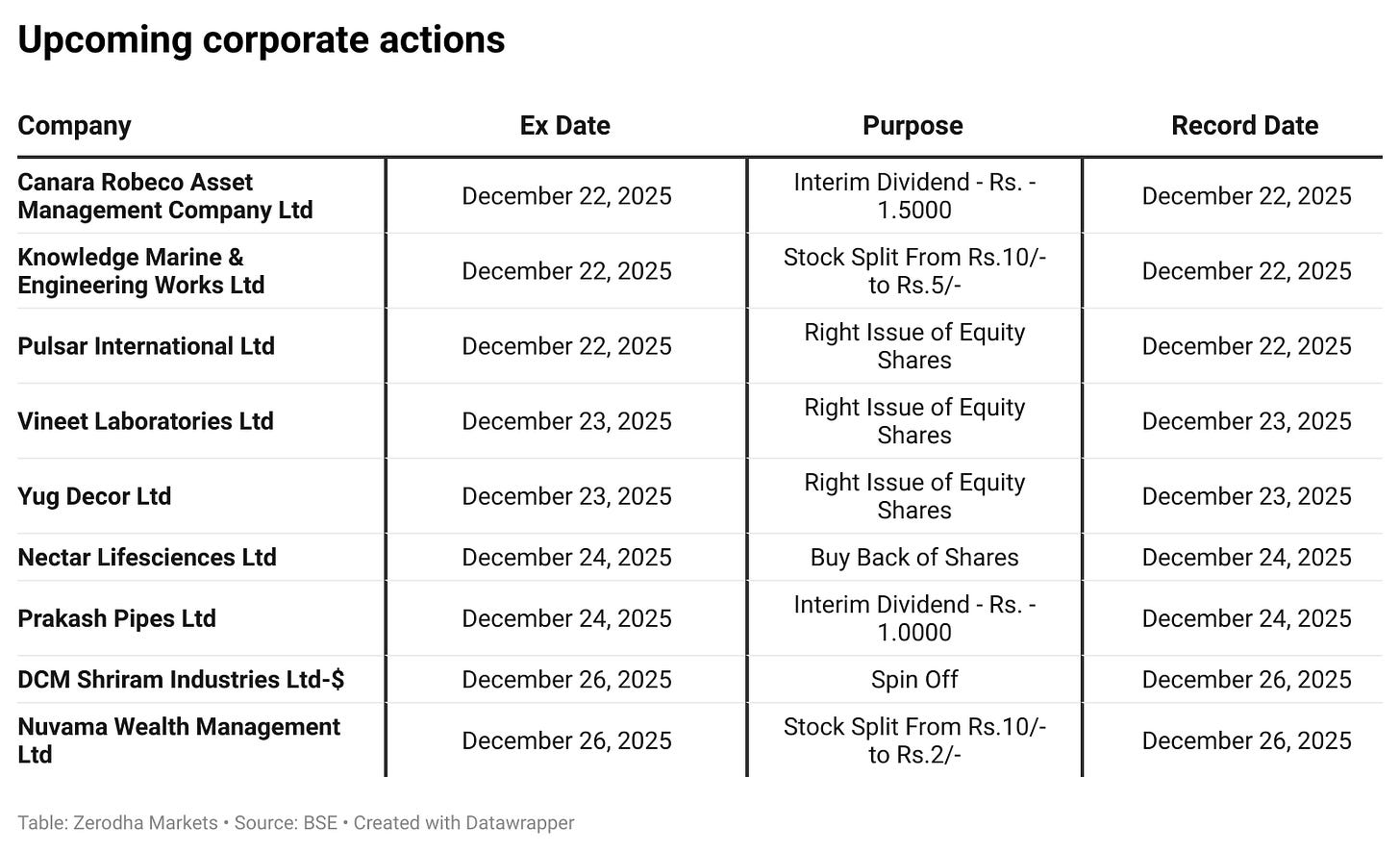

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!