Firm start to 2026 sees Nifty close at lifetime highs

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we explore one of the most persistent and puzzling market anomalies ever documented—the Turn-of-the-Month (TOTM) effect, where a disproportionate share of equity returns appears to cluster around the turn of the calendar month.

Starting with its academic origins in the 1980s, we trace research by Ariel, Lakonishok, and Smidt, and later McConnell & Xu, before moving into fresh data tests over the last decade across Nifty, Bank Nifty, Reliance, HDFC Bank, and SPY. By comparing Extended and Tight TOTM strategies through equity curves, drawdowns, trade stats, and year-wise performance, the focus stays less on blind replication and more on how to think about anomalies, robustness, market regimes, and disciplined strategy design.

Market Overview

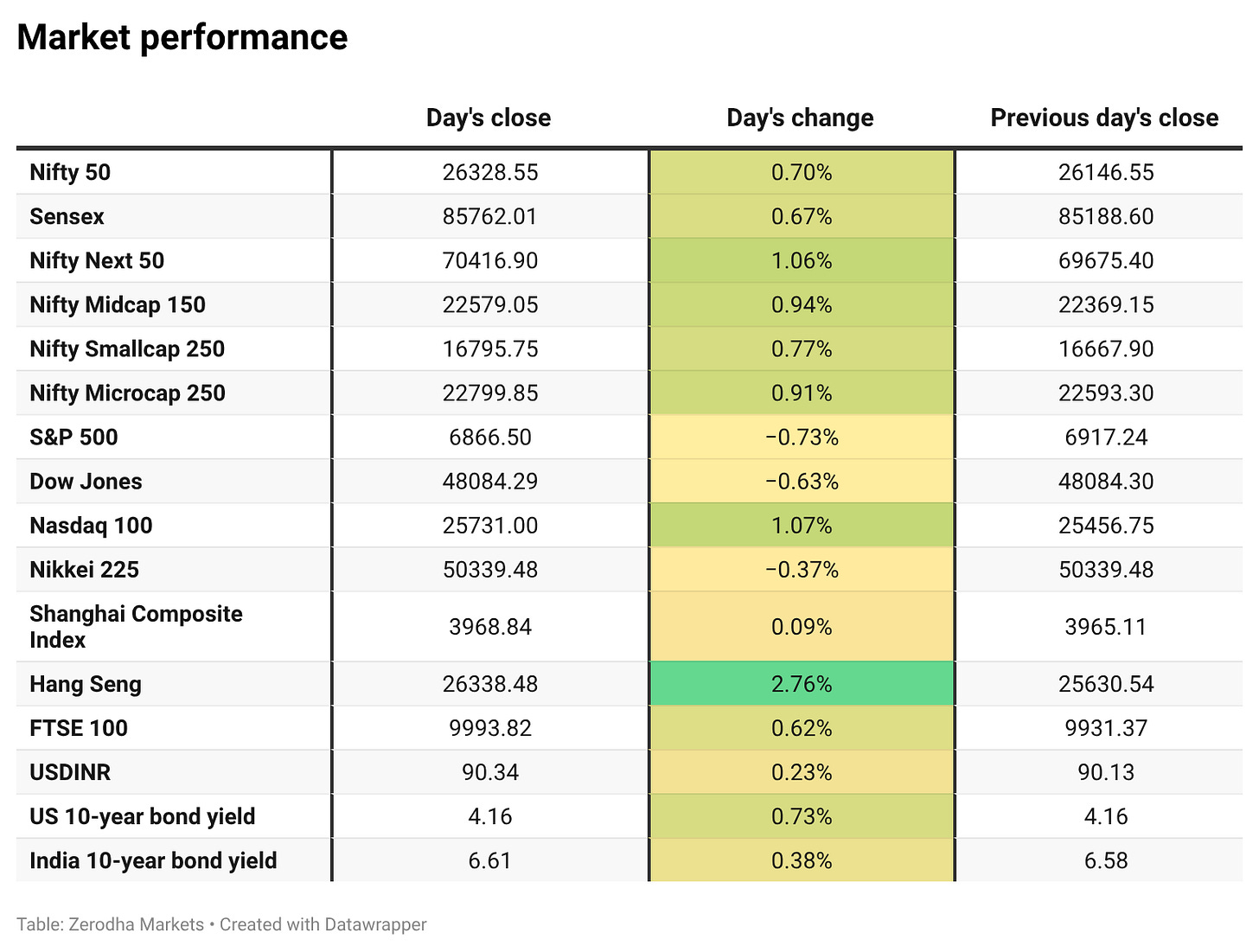

Nifty opened flat at 26,155 but saw immediate buying interest, pushing the index higher in the opening hour toward the 26,250–26,270 zone. After a brief phase of intraday consolidation through the mid-morning session, Nifty resumed its upward grind and crossed the 26,300 mark around 12:30 PM as sentiment improved.

In the second half, the index remained firm despite minor pullbacks, holding comfortably above the 26,280–26,300 zone. A brief dip post 2:30 PM toward 26,270 was quickly bought into, and strong late-session buying lifted Nifty to fresh intraday highs. The index eventually closed near the day’s high at 26,328.55, up 0.70%, marking a decisive, trend-driven session and a fresh record closing.

Looking ahead, markets are likely to remain sensitive to global risk appetite, currency movements, and further developments around India–U.S. trade negotiations.

Broader Market Performance:

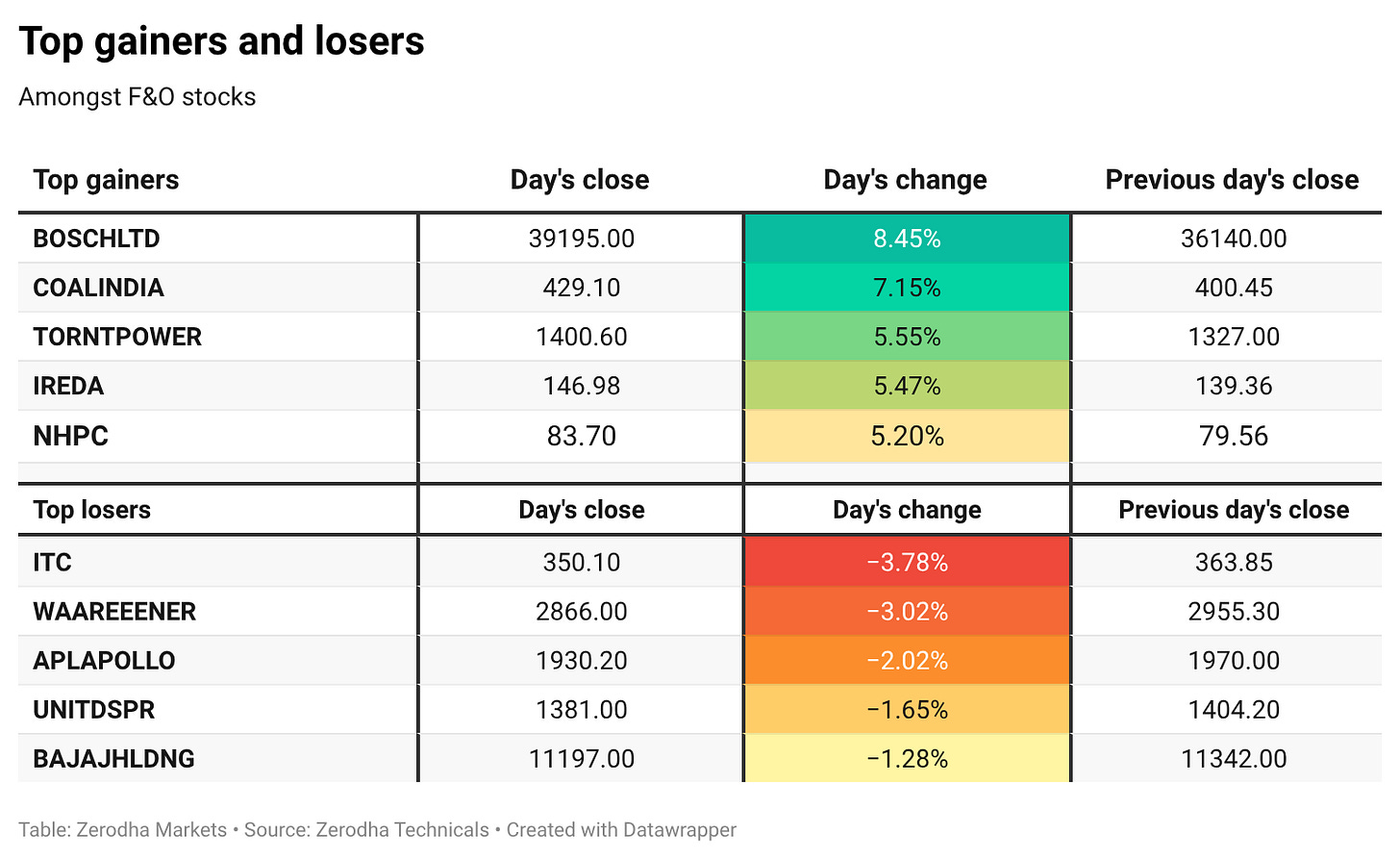

The broader market had a super strong bullish session today. Out of 3,246 stocks that traded on the NSE, 2,247 advanced, while 895 declined, and 104 remained unchanged.

Sectoral Performance:

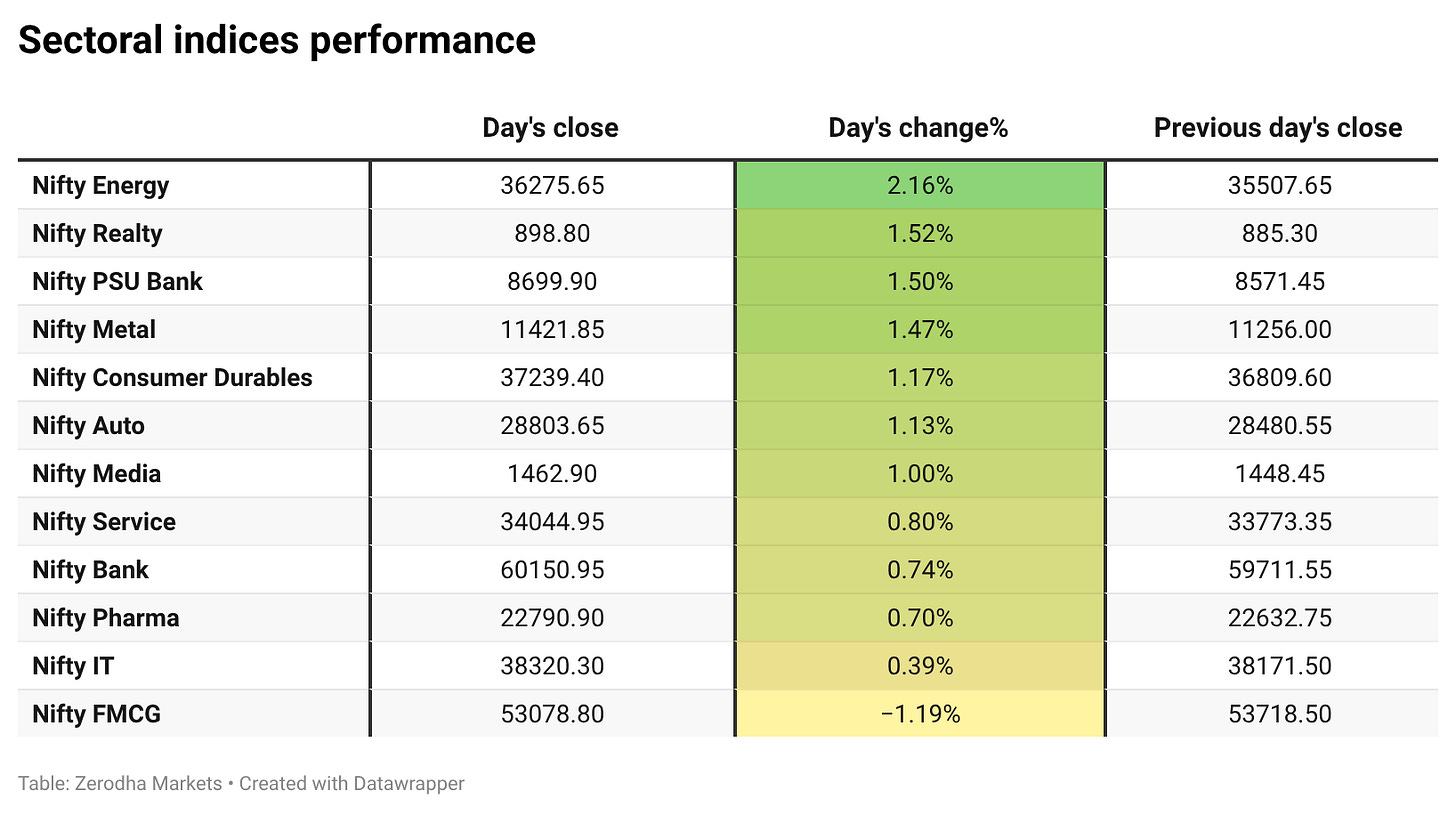

Nifty Energy was the top gainer, rising 2.16%, while Nifty FMCG was the biggest loser, slipping 1.19%. Out of the 12 sectoral indices, 11 closed in the green and only 1 ended in the red, reflecting broad-based positive momentum across sectors.

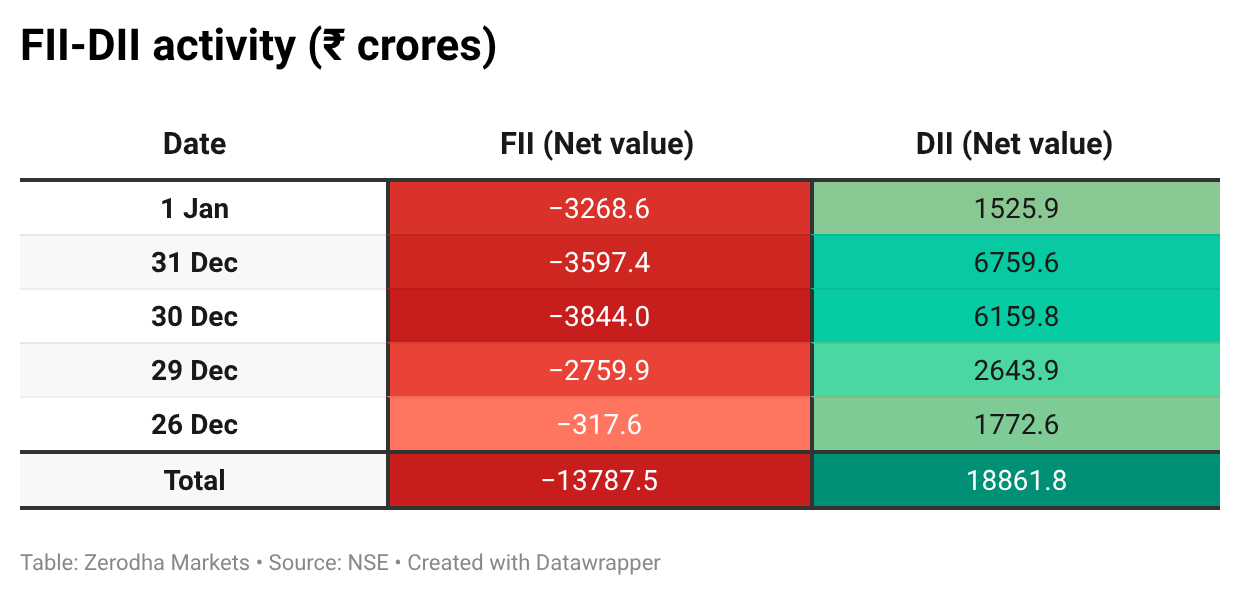

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 6th January:

The maximum Call Open Interest (OI) is observed at 26,500, followed by 26,600 & 26,300, indicating potential resistance at the 26,400 -26,500 levels.

The maximum Put Open Interest (OI) is observed at 26,000, followed by 26,200, suggesting support at the 26,300 to 26,200 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

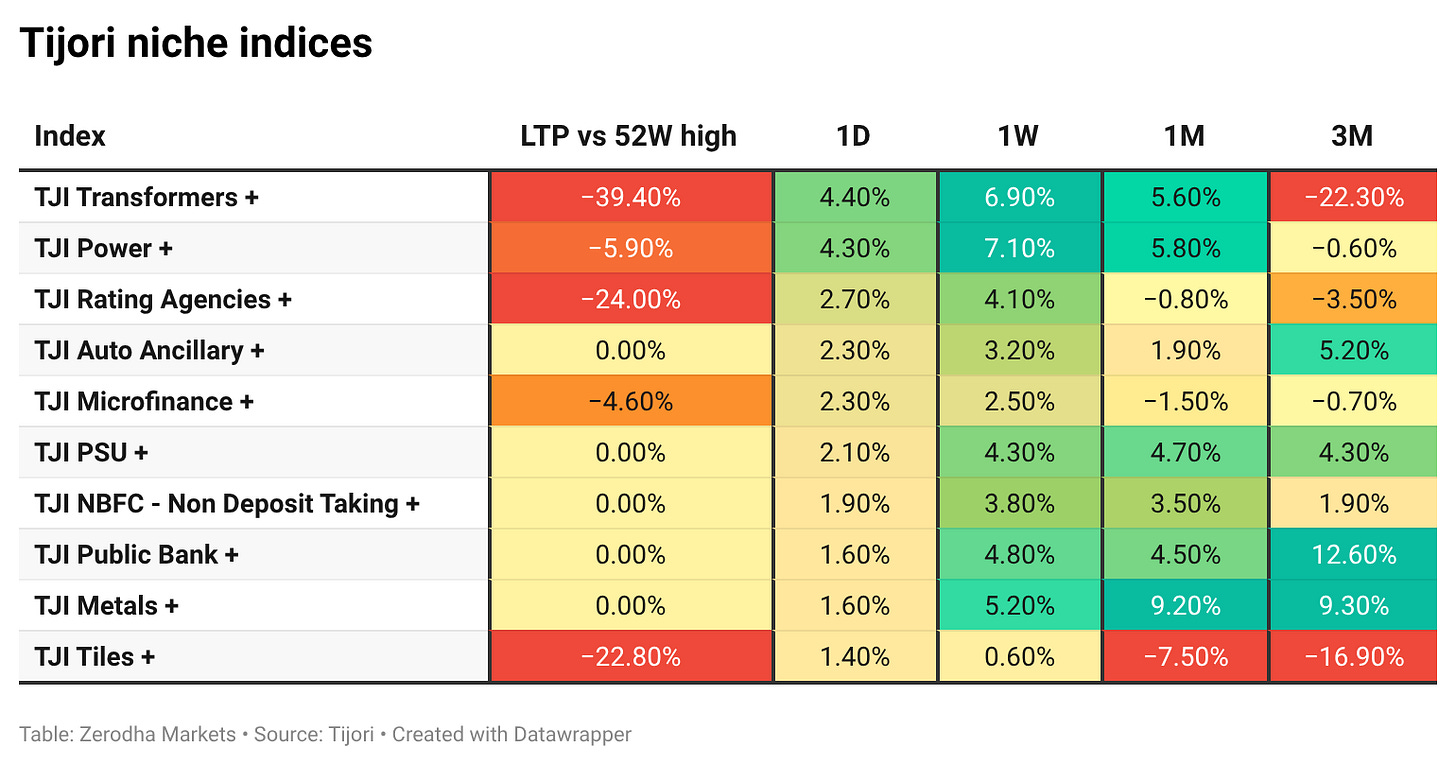

Tijori is an investment research platform that has constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

The rupee slipped past 90/$ at the start of the year as strong dollar demand and foreign outflows outweighed RBI support. Weakening domestic activity and trade-related pressures kept the currency among the worst-performing in Asia. Dive deeper

India’s manufacturing PMI eased to 55.0 in December, the weakest expansion in two years, as output and new orders growth slowed. Softer export demand and easing price pressures pointed to moderating momentum. Dive deeper

Coal India shares hit a fresh 52-week high after the company said it will allow direct participation by foreign coal consumers in its e-auction platform, a move seen as boosting demand and transparency in auction sales. Dive deeper

Devyani International announced a $934 million merger with Sapphire Foods, creating a combined fast-food operator with over 3,000 KFC and Pizza Hut outlets in India and overseas. Dive deeper

The government approved 22 new proposals under the Electronics Components Manufacturing Scheme, with projected investment of ₹41,863 crore and production worth ₹2.58 trillion. Dive deeper

Adani Total Gas cut CNG and domestic piped gas prices across multiple markets after PNGRB’s tariff reset lowered gas transportation costs. The price reduction varies by region and reflects the move to a uniform, lower transport tariff effective January 1, 2026. Dive deeper

Adani Enterprises plans to launch a ₹1,000-crore public bond issue next week, according to sources, as it seeks to diversify funding sources. The move is part of broader debt-management and capital-raising strategy amid active financing needs across the group. Dive deeper

Maruti Suzuki recorded annual production of 22.55 lakh vehicles in calendar year 2025, a new high and a double-digit gain over the prior year, underscoring strong manufacturing momentum. Dive deeper

What’s happening globally

WTI crude rose toward $58 as markets looked ahead to OPEC+ talks expected to maintain a pause on output increases. Dive deeper

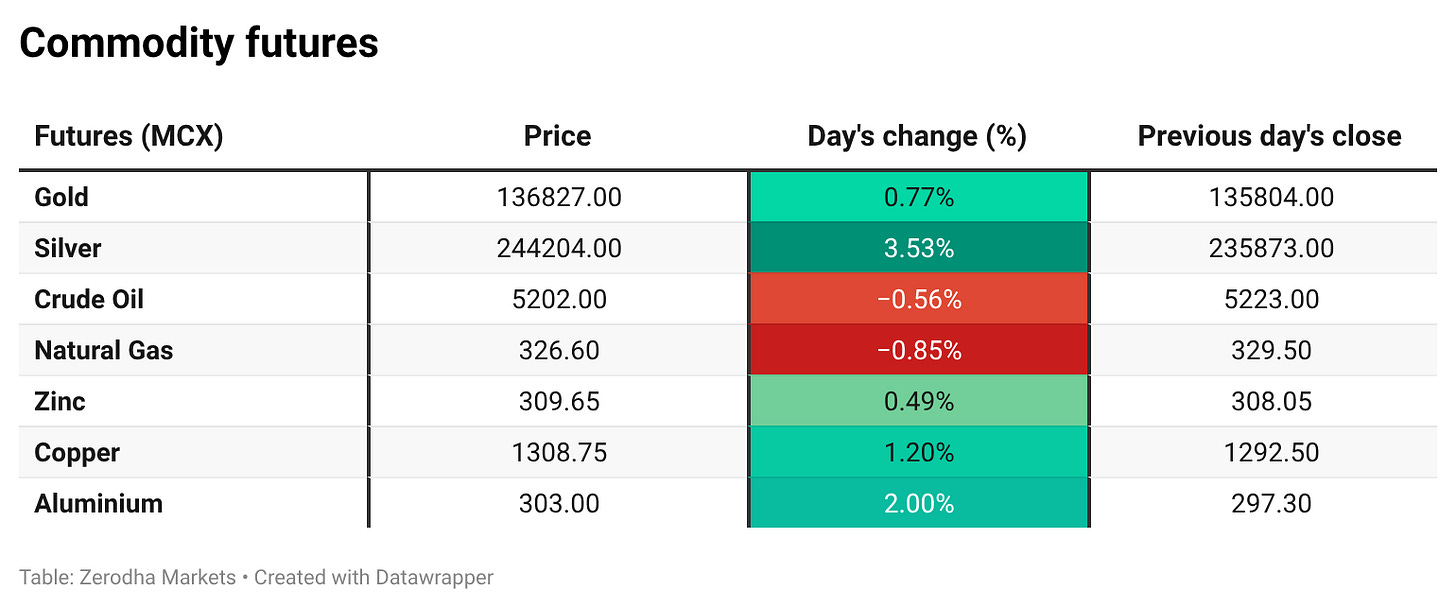

Gold traded near $4,360/oz at the start of 2026, extending momentum from its strongest annual gain in over four decades. Expectations of Fed rate cuts, sustained central bank buying and elevated geopolitical risks continue to support prices. Dive deeper

Silver rose above $74/oz at the start of 2026, extending momentum after its strongest year on record, supported by tight supply and robust industrial and investment demand. Dive deeper

Aluminium prices have climbed to around $3,000 a tonne for the first time in over three years, driven by tightening supply and steady demand expectations. The rally is largely supported by China’s cap on aluminium smelting capacity, signalling a potentially tighter global market after a prolonged period of ample supply. Dive deeper

US copper hovered near $5.7/lb, close to record highs, as supply risks from mine disruptions and tariff threats drove metal flows into US warehouses. Demand remains supported by electrification trends and rising data-centre and AI-related investment. Dive deeper

Eurozone bank lending to households grew 2.9% y/y in November, the fastest since March 2023, supported by ECB policy easing. Business lending also picked up, lifting overall private-sector credit growth to 3.4%. Dive deeper

US stock futures jumped at the start of 2026 after the White House delayed some tariff hikes and signalled flexibility on others, easing trade concerns. Dive deeper

South Korea’s exports hit a record $709.7 billion in 2025, driven by a surge in semiconductor shipments amid strong AI-led demand. December exports jumped 13.4% y/y, with chip exports hitting a monthly record despite weaker shipments to China and the US. Dive deeper

Tesla’s car sales in Spain fell 44.2% y/y in December, with full-year 2025 sales down 4% from the previous year. The decline contrasts with a sharp expansion in Spain’s broader electrified vehicle market, which grew nearly 95% over the year. Dive deeper

Management chatter

In this section, we highlight interesting comments made by the management of major companies and policymakers from the Indian and Global Economies.

S. Naren, CIO & Executive Director, ICICI Prudential AMC on gold and silver market sentiment:

“Gold and silver are showing signs of euphoria after a blistering rally.” (m.economictimes.com

“Gold has had a phenomenal run, reaching new all-time highs, but we have to be cautious about valuations.” (m.economictimes.com

“We believe there could be pockets of consolidation or correction ahead, and one must be selective and disciplined.” - Link

T V Narendran, CEO & MD of Tata Steel, on steel prices

“More and more countries are protecting themselves to ensure materials do not flow easily across borders. As a global industry, we have to deal with the consequences,”

"China has been exporting more than 100 million tonnes of steel, almost equivalent to India’s total steel production,”

“As a consequence, a lot of capacities have been built up this year. While our steel demand and supply are strong, steel prices in India for most of the year remained well below international prices. We actually experienced the lowest steel prices in the last five years in 2025,” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

Calendars

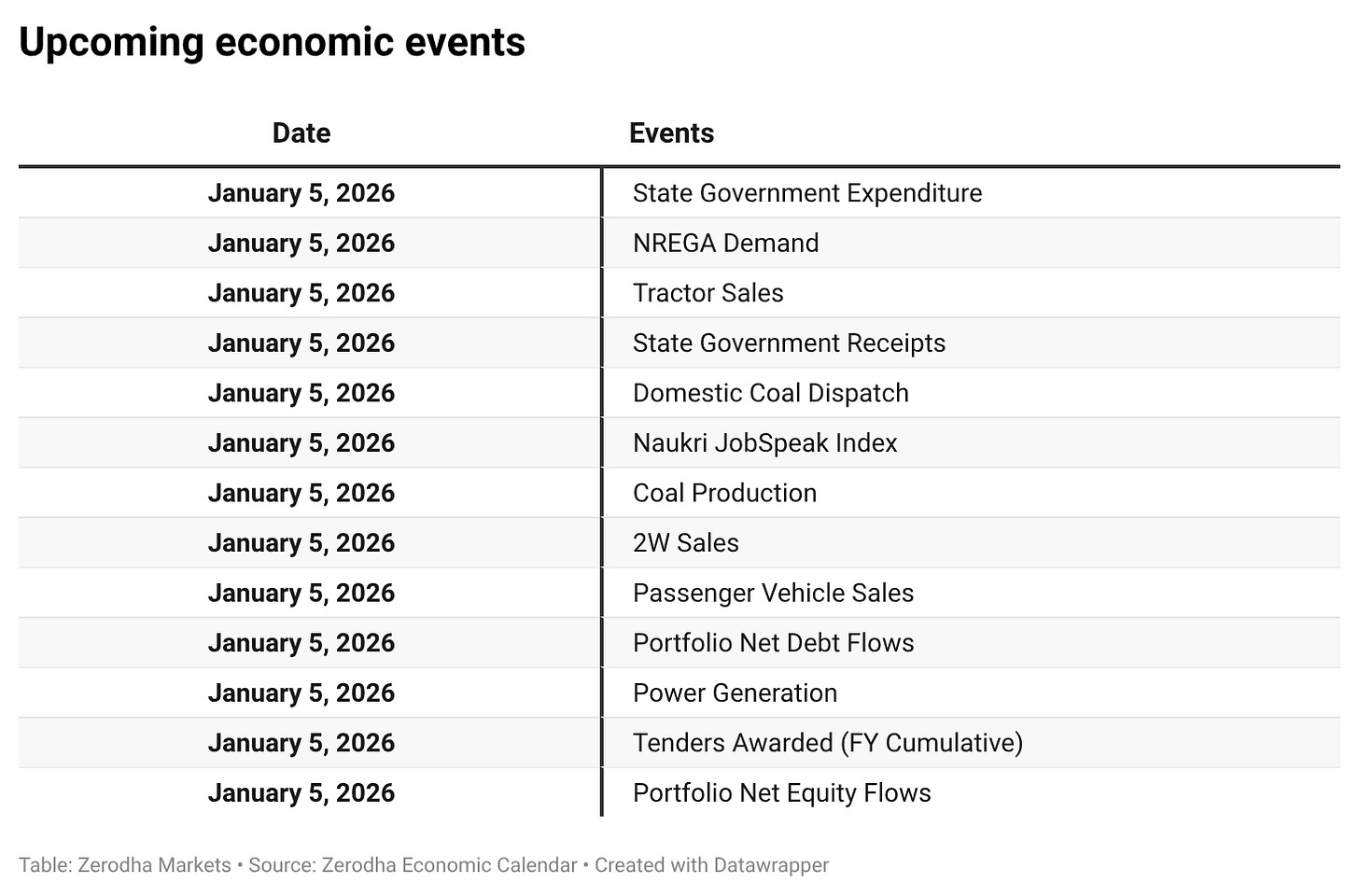

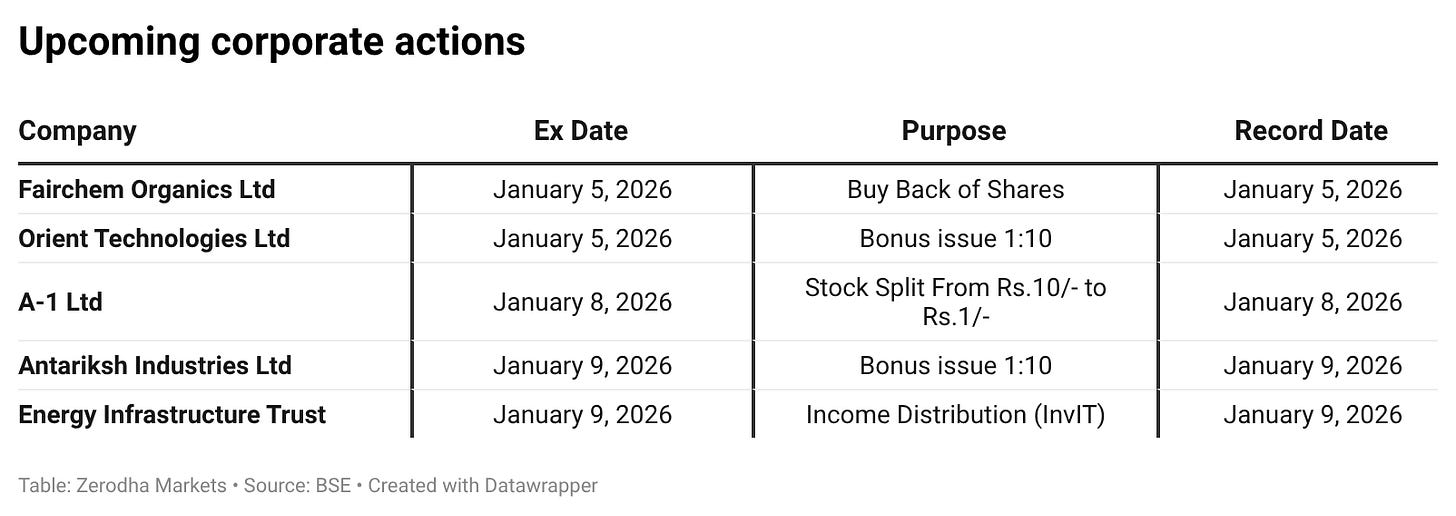

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!