Expiry volatility fails to break the range as Nifty closes flat near 25,950

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we take a step back from charts and strategies to talk about trading resolutions—why we make them, why most fail, and what actually helps them stick.

We briefly explore the history and psychology behind New Year’s resolutions, the behavioural traps that derail traders, and then move into 26 practical trading resolutions for 2026, spanning mindset, risk, learning, discipline, mental health, and long-term survival. This isn’t a checklist or a rulebook, but a menu you can pick from depending on where you are in your trading journey. No predictions. No systems. No hype. Just reflections on what helps traders stay in the game.

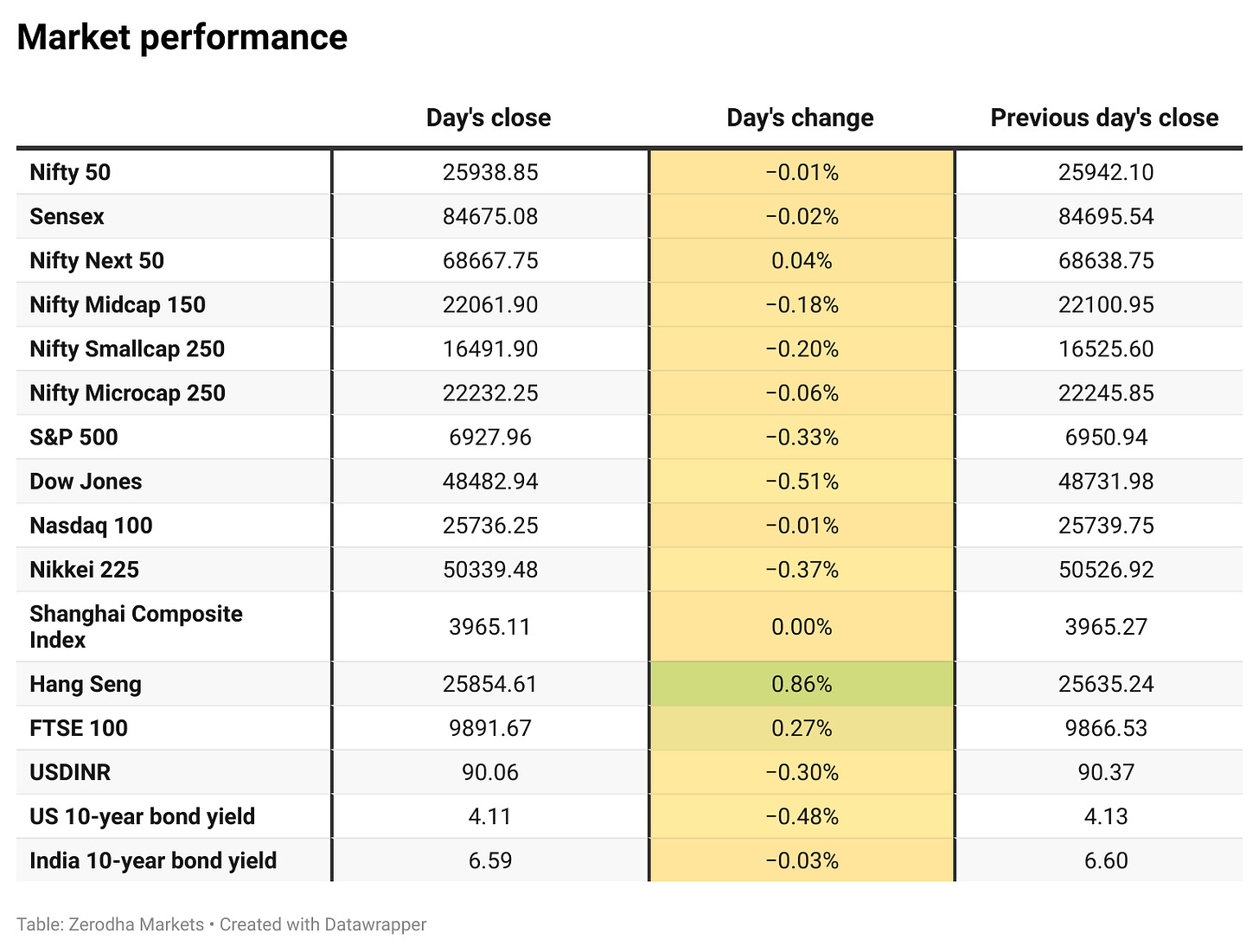

Market Overview

Nifty opened absolutely flat at 25,941 and saw sharp intraday volatility right from the start. After an early dip toward the 25,880–25,900 zone in the opening minutes, the index rebounded strongly and surged to the day’s high near 25,970-975 zone by 10:30 AM. However, the strength proved unsustainable, and Nifty gradually drifted lower through the late morning session, slipping back toward the 25,880–25,890 zone once again by noon.

In the second half, after 1:30 PM, Nifty staged a steady recovery retracing most of the losses and climbing back toward the 25,960 zone. The index eventually closed flat at 25,938.85 after a highly volatile and expiry-bound session marked by sharp swings on both sides.

Looking ahead, markets are likely to remain sensitive to global risk appetite, currency movements, and further developments around India–U.S. trade negotiations.

Broader Market Performance:

The broader market had a mixed session tilted towards bearish bias today. Out of 3,244 stocks that traded on the NSE, 1,409 advanced, while 1,723 declined, and 112 remained unchanged.

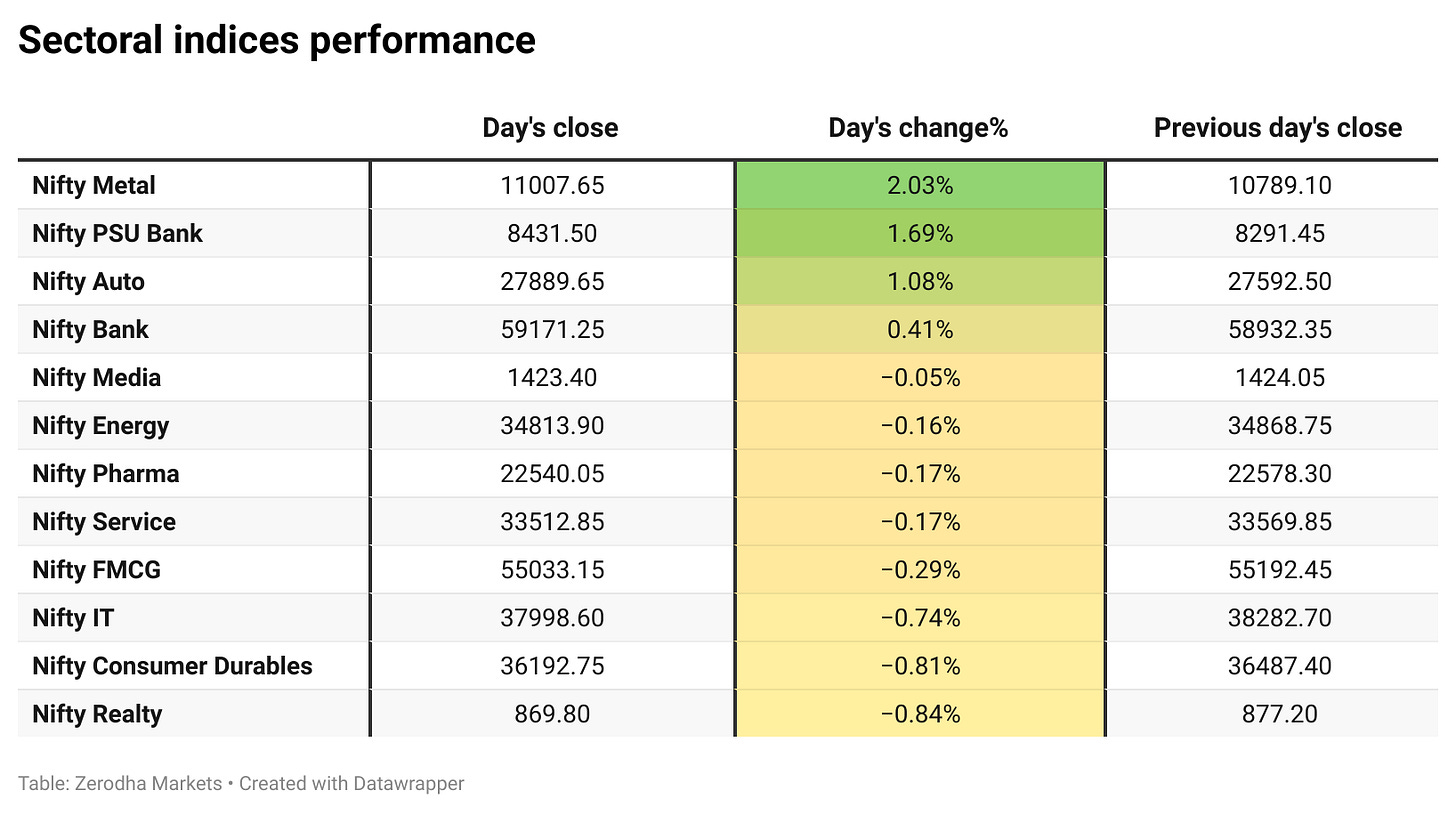

Sectoral Performance:

Nifty Metal was the top gainer, rising 2.03%, while Nifty Realty was the worst performer with a 0.84% decline. Out of the 12 sectoral indices, 4 closed in the green and 8 ended in the red, indicating a broadly negative market breadth for the day.

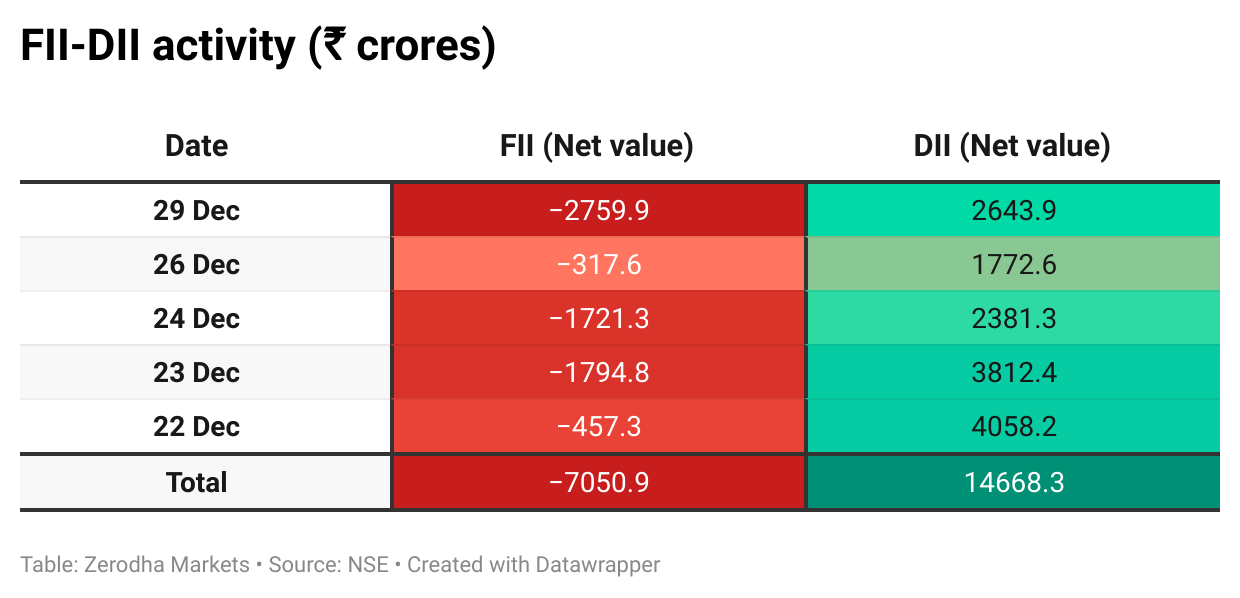

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 6th January:

The maximum Call Open Interest (OI) is observed at 26,000, followed by 26,300, indicating potential resistance at the 26,000 -26,100 levels.

The maximum Put Open Interest (OI) is observed at 26,000, followed by 25,900, suggesting support at the 25,900 to 25,800 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

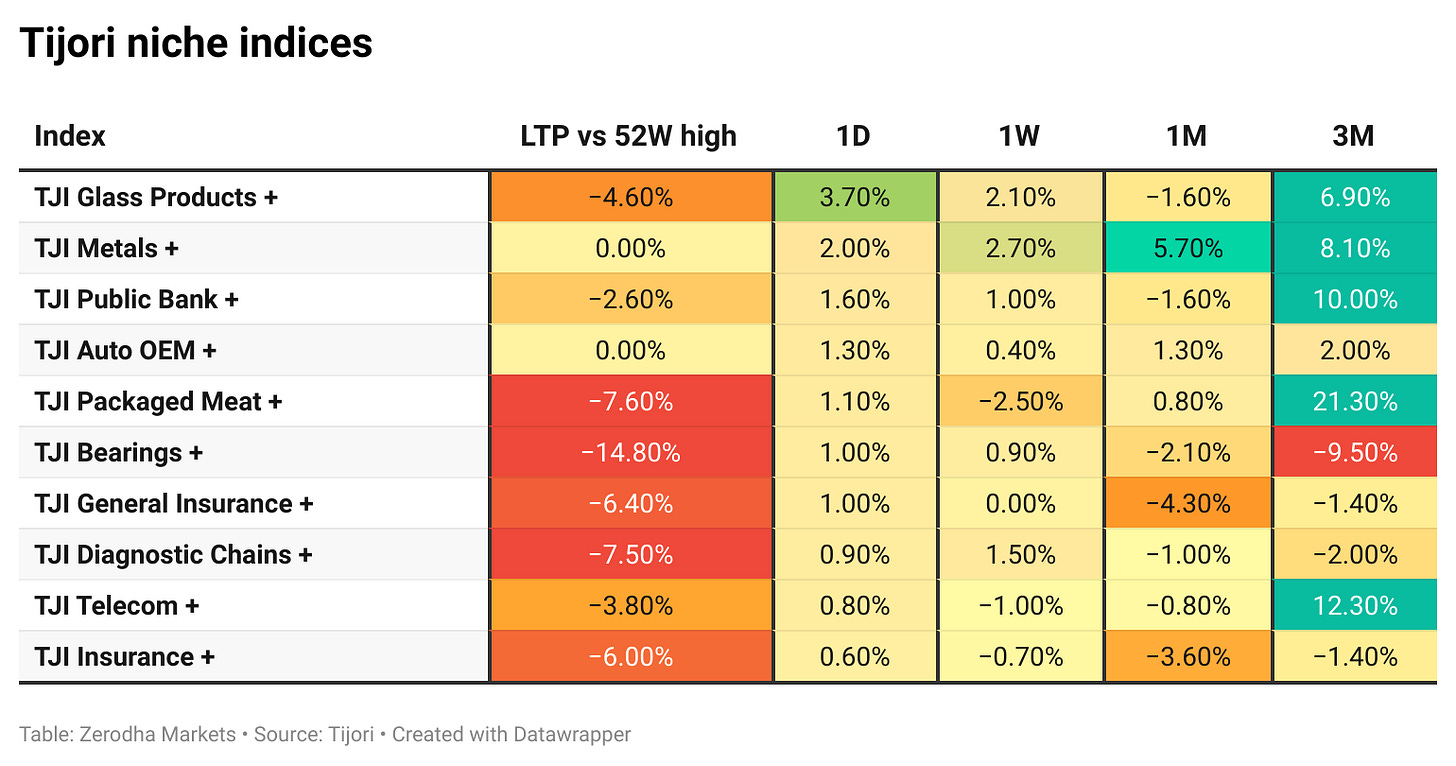

Tijori is an investment research platform that has constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

Reliance Industries denied reports claiming a $30 billion gas underproduction demand, calling them factually incorrect. The company said the government claim related to the KG D6 block is about $247 million, and the matter is sub judice. Dive deeper

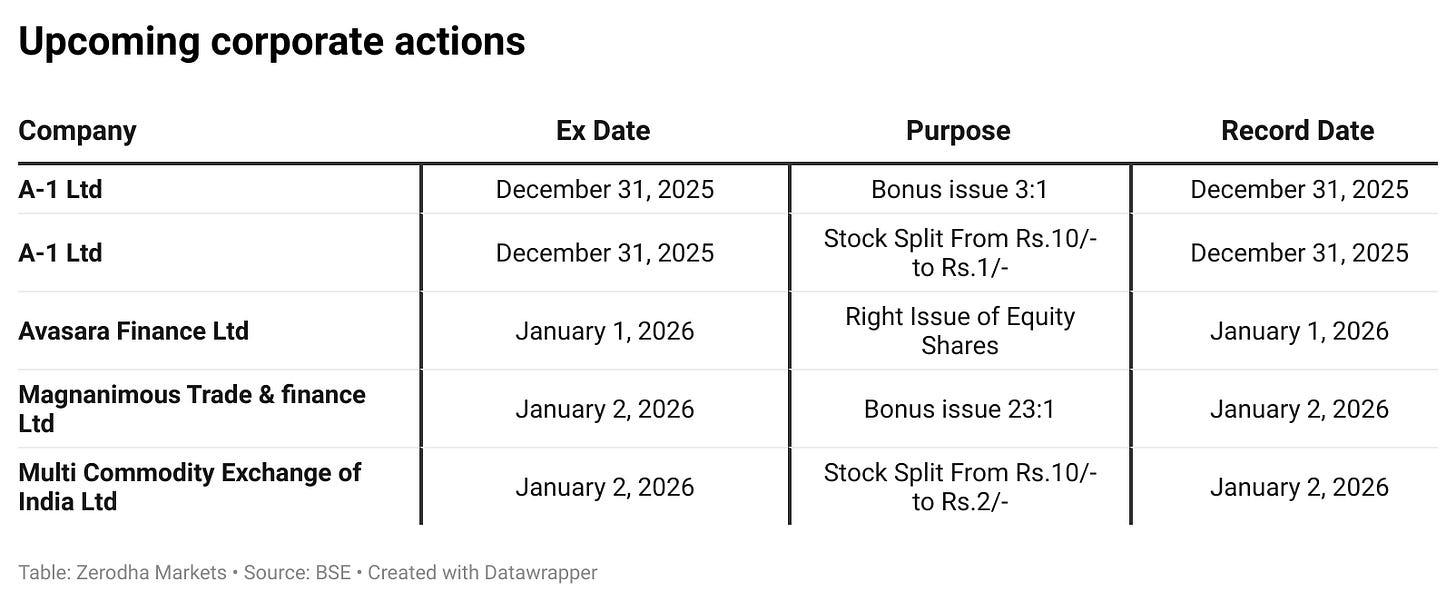

Kotak Mahindra Bank has fixed January 14, 2026, as the record date for its stock split. The bank will subdivide one equity share of face value ₹5 into five equity shares of face value ₹1 each. Dive deeper

Eternal shares fell to a more than five-month low after Blinkit CFO Vipin Kapooria resigned. Dive deeper

Bharat Electronics Limited has secured additional defence and strategic orders worth ₹569 crore, according to an exchange filing. The orders include radars, communication systems, tank overhaul, simulators, upgrades, spares, and related services. Dive deeper

Reserve Bank of India said NBFC balance sheets expanded in FY25 driven by strong loan growth, with overall asset quality and capital adequacy remaining stable. However, stress persisted in the microfinance segment, where bad loans rose sharply despite broader improvements across the sector. Dive deeper

Arvind Fashions will acquire Flipkart’s 31.25% stake in Arvind Youth Brands for ₹135 crore. Post the transaction, Arvind Youth Brands will become a wholly owned subsidiary of Arvind Fashions. Dive deeper

SBI Mutual Fund sold a 2.43% stake in Nazara Technologies for about ₹216 crore through open market bulk deals. Following the sale, SBI Mutual Fund’s holding in the company declined to 3.35% from 5.78%. Dive deeper

The value of bank frauds increased in FY25 despite a decline in the number of cases, largely due to reporting of large advances related frauds, according to the Trend and Progress of Banking in India report by the Reserve Bank of India. Dive deeper

Ola Electric’s Roadster X+ electric motorcycle, powered by an in-house developed 4680 Bharat Cell battery pack, has received government certification, enabling the start of deliveries. The model has been approved under CMVR norms by the International Centre for Automotive Technology. Dive deeper

Revised lot sizes for index F&O contracts will come into effect from tomorrow for the January 2026 series, as per the earlier circular issued by the National Stock Exchange of India. The changes apply to Nifty 50, Bank Nifty, Nifty Financial Services, and Nifty Midcap Select contracts. Dive deeper

What’s happening globally

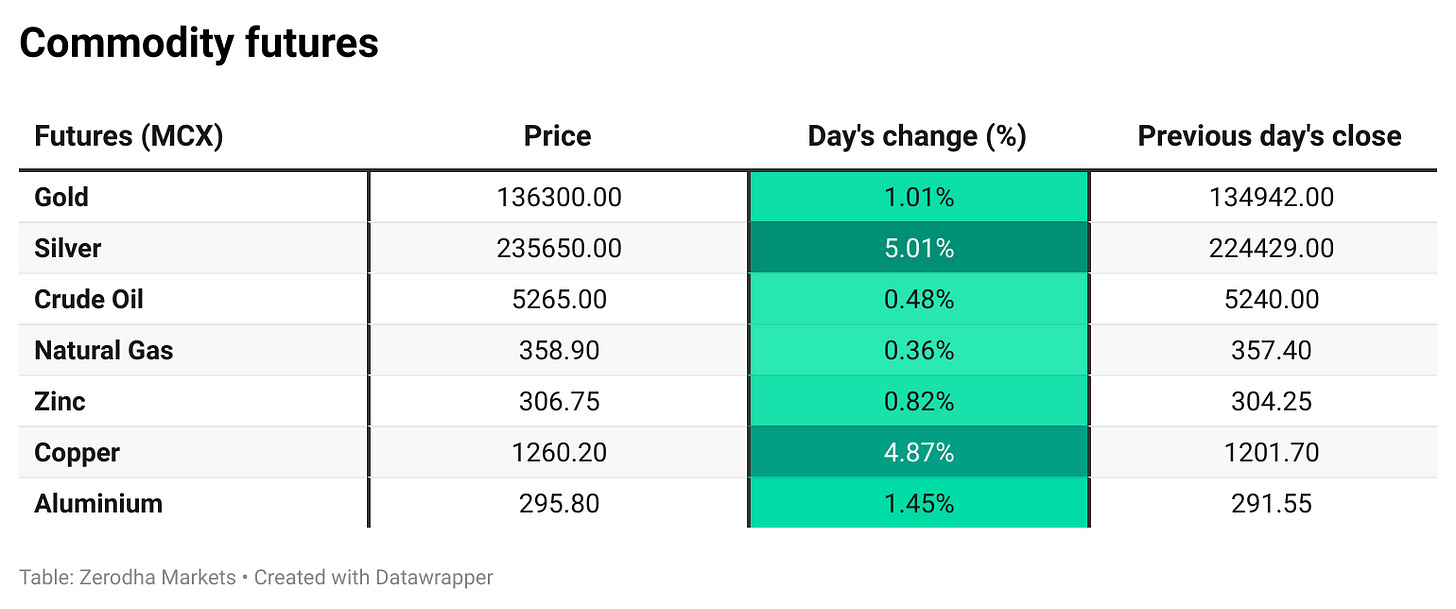

WTI crude oil futures hovered near $58 per barrel after a sharp rise in the previous session amid renewed geopolitical developments. Prices remain sharply lower for the year despite the recent rebound. Dive deeper

Gold prices edged above $4,360 per ounce, remaining on track for their strongest annual gain. Dive deeper

Silver prices moved to around $73 per ounce following recent market moves. Dive deeper

Russia’s services activity expanded for a third straight month in December, with the S&P Global Services PMI edging up to 52.3 from 52.2 in November. The reading marked the strongest performance since January, according to S&P Global. Dive deeper

Nvidia has completed a $5 billion investment in Intel by purchasing about 214.7 million Intel shares at $23.28 per share, as per a September agreement. The transaction was executed through a private placement and cleared by U.S. antitrust authorities. Dive deeper

SoftBank Group will acquire DigitalBridge Group in a $4 billion deal to expand its AI infrastructure exposure. DigitalBridge will continue to operate as a separately managed platform under CEO Marc Ganzi. Dive deeper

The U.S. has approved annual licenses for Samsung Electronics and SK Hynix to ship chipmaking equipment to their China facilities in 2026, sources said. Dive deeper

Management chatter

In this section, we highlight interesting comments made by the management of major companies and policymakers from the Indian and Global Economies.

Commerce Ministry official on rollout of Export Promotion Mission guidelines

“A series of guidelines needs to be issued, with a couple coming this week.”

“The Export Promotion Mission has already been approved by the Cabinet and announced in Budget 2025.”

“The initial guidelines will operationalise sub-schemes focused on trade finance access and export competitiveness.” - Link

Ola Electric Mobility on Roadster X+ government certification

“The government certification of the Roadster X+ is a major milestone in our journey towards building end-to-end EV technology in India.”

“With this approval, we begin deliveries of India’s first electric motorcycle certified with a fully in-house 4680 Bharat Cell battery pack.”

“This is a defining step towards accelerating EV adoption in India’s motorcycle-dominated two-wheeler market, backed by superior performance, safety, and reliability.” - Link

Piyush Goyal, Union Minister of Commerce & Industry, Government of India, on India - Australia trade agreement

“From 1 January 2026, 100% of Australian tariff lines will be zero-duty for Indian exports.”

“Over the past three years, the agreement has delivered sustained export growth, deeper market access, and stronger supply-chain resilience.”

“India’s exports to Australia grew by 8% in 2024–25, with strong gains across manufacturing, agri-exports, and key value-added sectors.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

Calendars

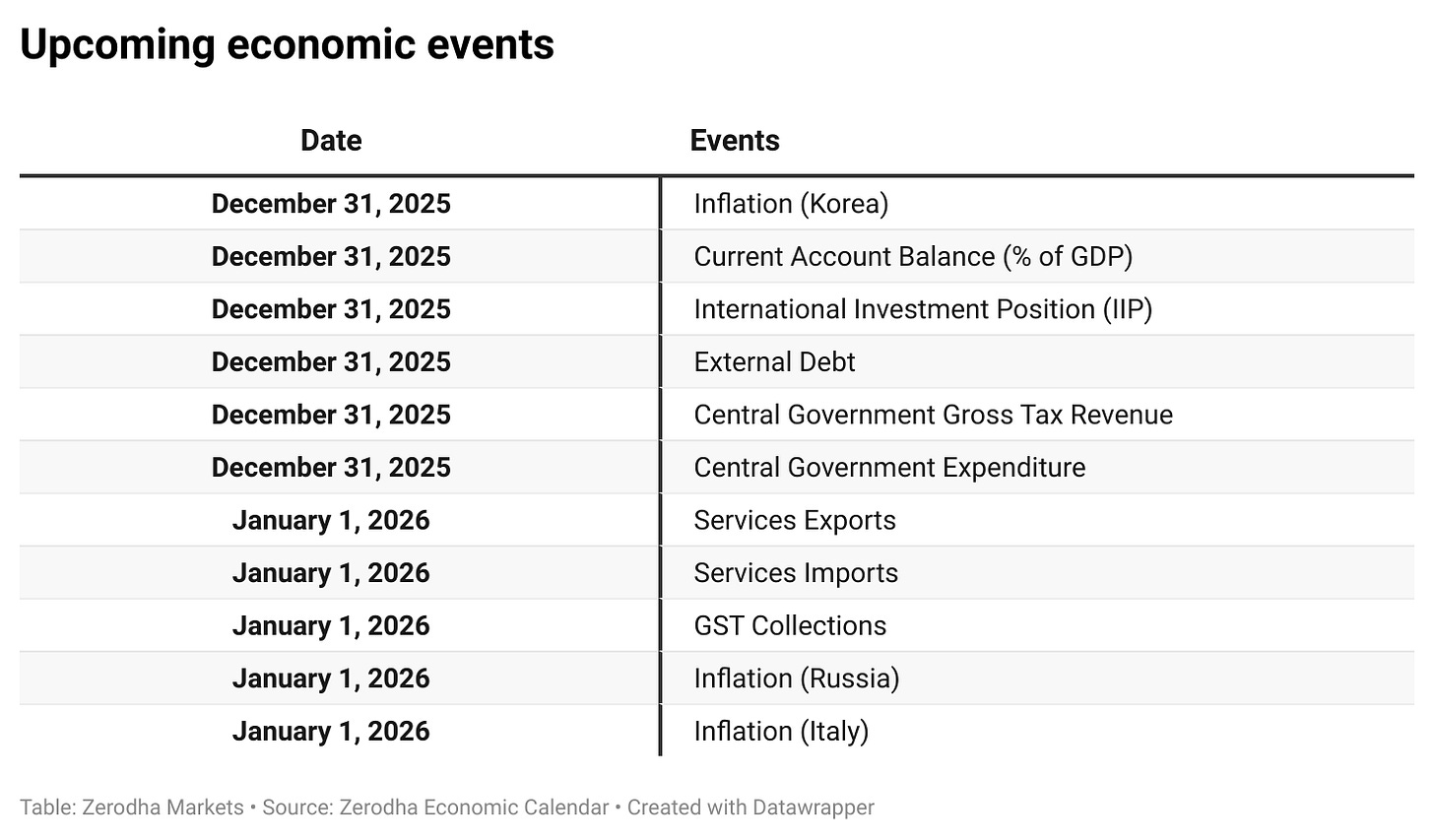

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

hii