Earnings disappointment and global weakness knock Nifty below 25,600

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we break down the origins of cryptocurrencies and trace how India’s crypto ecosystem has evolved over the past decade. Starting with the Cypherpunk movement and the birth of Bitcoin, we move through the rise of Indian exchanges, regulatory pushback, taxation frameworks, and recent security incidents to build a clear foundation of what crypto actually is, how it works, and what is legal in India today.

Along the way, we explain how Bitcoin functions without banks, how mining really works, what private keys represent, how Indians access crypto via exchanges, and why custody and security matter far more than most people realise. This is Part 1 of a two-part series on crypto in India.

Market Overview

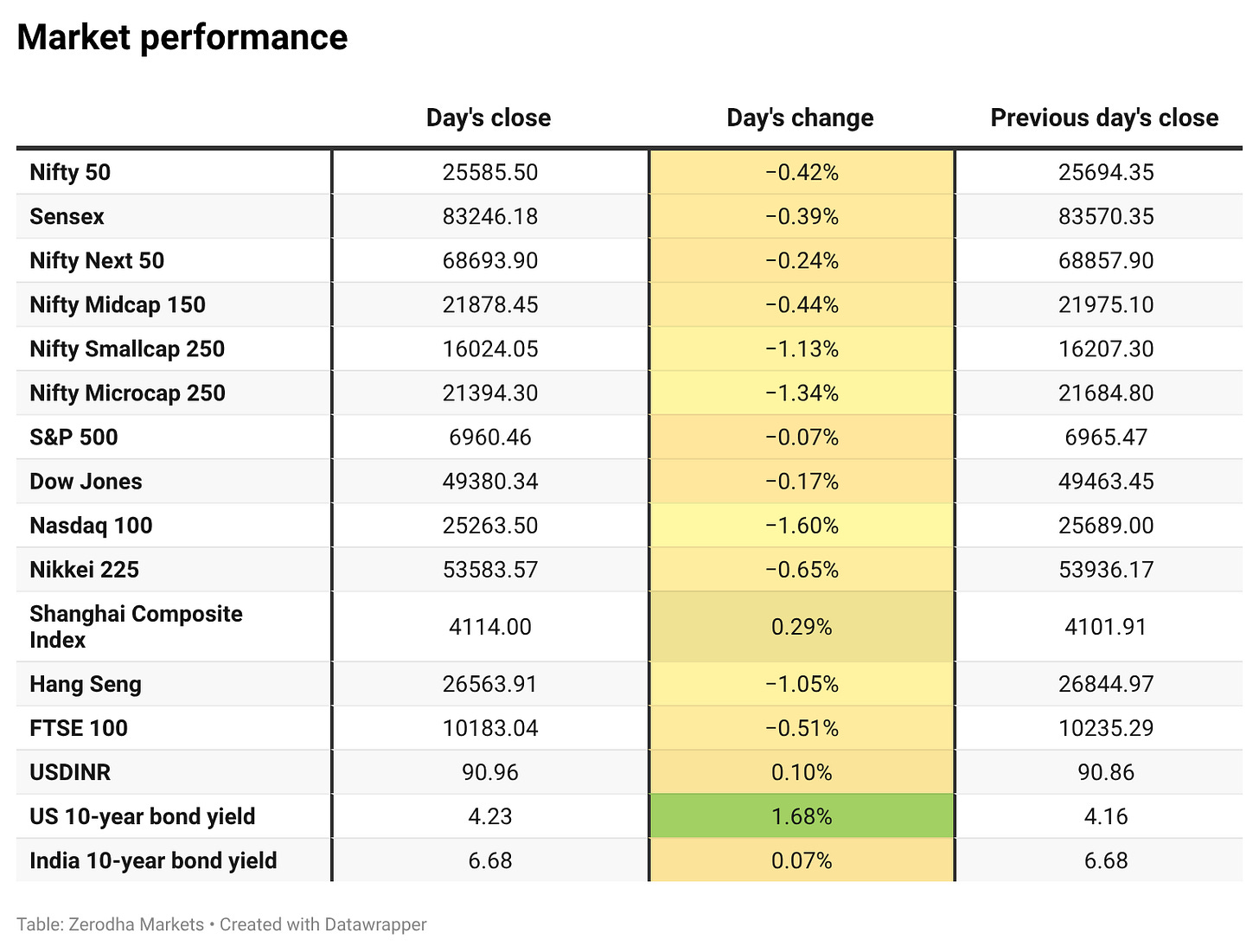

Nifty opened with a 41-point gap-down at 25,653, reacting to lacklustre earnings from index heavyweights Reliance Industries, HDFC Bank, and ICICI Bank, along with weak global cues after U.S. President Trump announced a fresh 10% tariff on select EU nations amid the Greenland issue. The index came under immediate pressure in the opening hour, slipping toward the 25,540–25,560 zone as sentiment remained cautious. Early recovery attempts were shallow, and after briefly breaching 25,500, Nifty largely traded range-bound through the late morning session between 25,520 and 25,560.

In the second half, buying interest emerged post 1:30 PM, helping the index recover sharply from intraday lows. Nifty climbed steadily to test the 25,620–25,640 zone during mid-afternoon trade. However, the recovery lacked follow-through, and profit-taking in the final hour dragged the index lower. Nifty eventually closed at 25,585.50, ending marginally lower for the day and reflecting a choppy, range-bound session marked by early weakness, a mid-session rebound, and late selling pressure.

Looking ahead, markets are likely to remain sensitive to global risk appetite, ongoing Q3 earnings, the upcoming Union Budget, and further developments around India–U.S. trade negotiations.

Broader Market Performance:

The broader market had an extremely weak session today. Out of 3,293 stocks that traded on the NSE, 871 advanced, while 2,315 declined, and 107 remained unchanged.

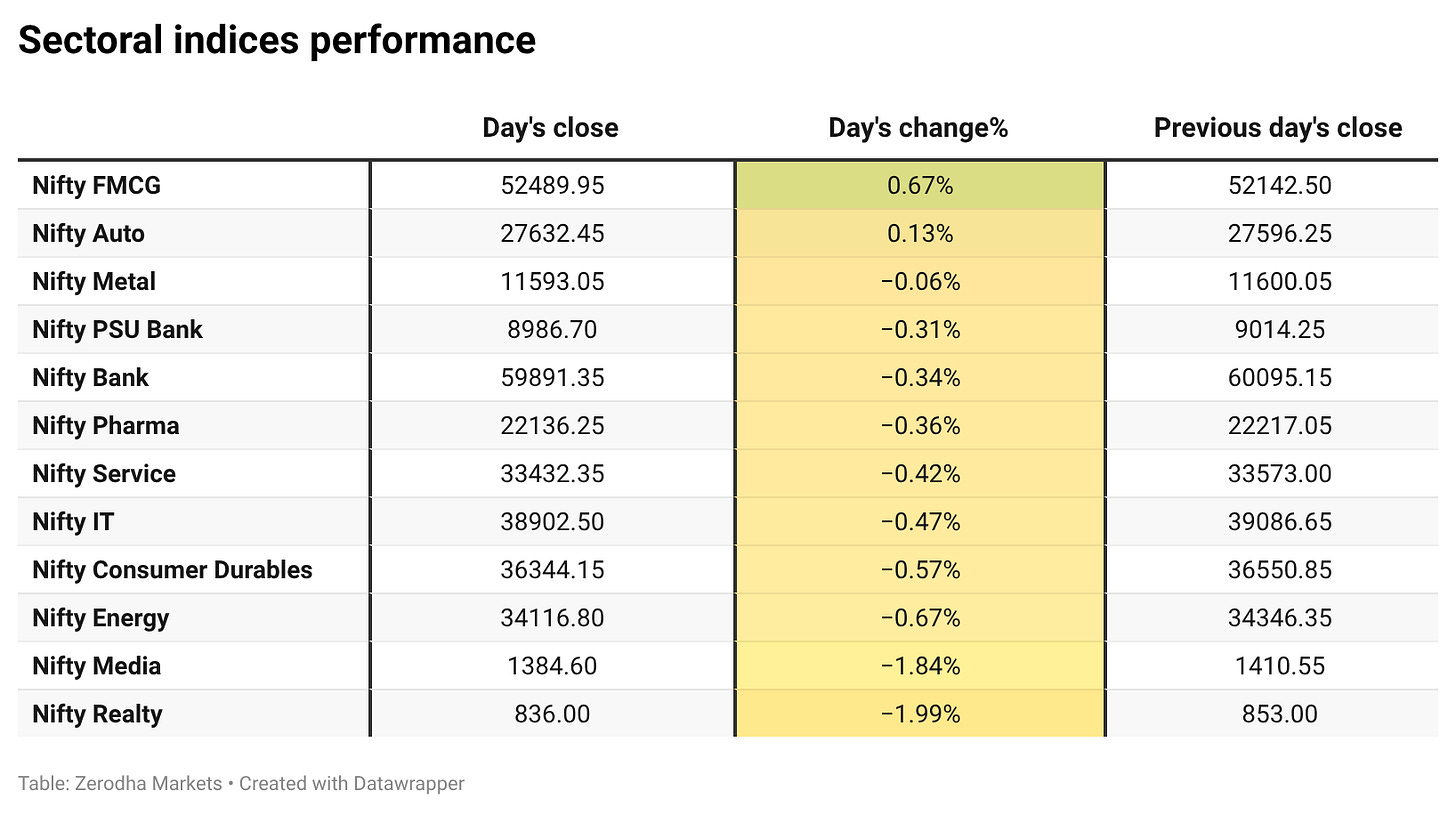

Sectoral Performance:

Nifty FMCG was the top gainer for the day, rising 0.67%, while Nifty Realty was the top loser, falling 1.99%. Out of the 12 sectoral indices, 2 closed in the green and 10 ended in the red, reflecting a broadly negative session across sectors.

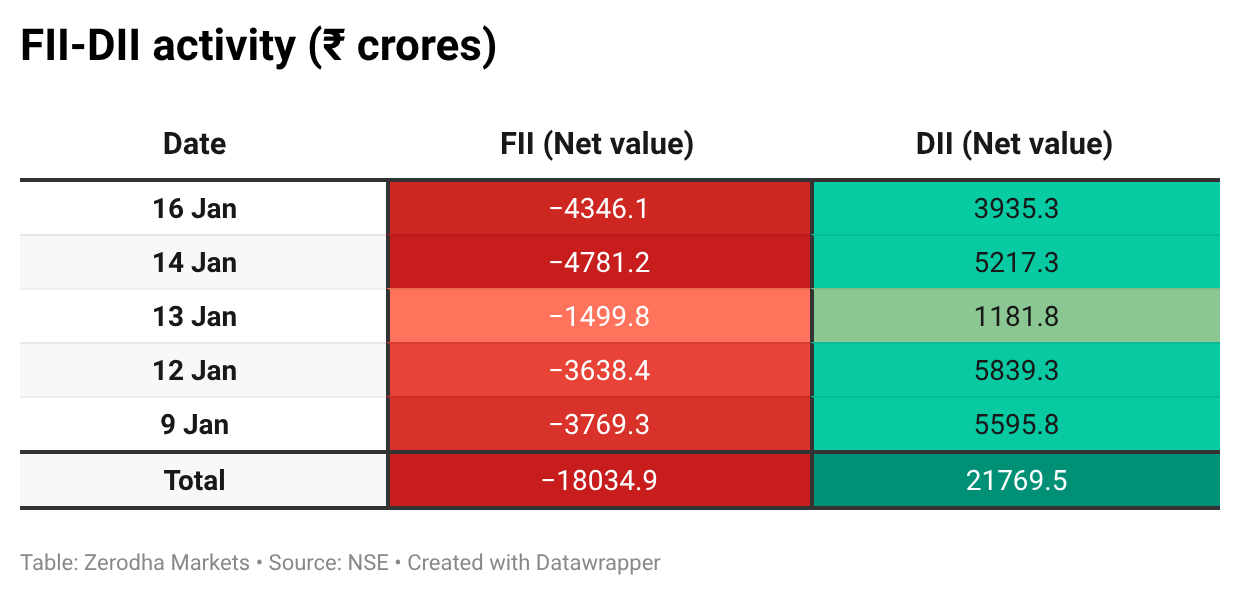

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 20th January:

The maximum Call Open Interest (OI) is observed at 25,800, followed by 26,000, indicating potential resistance at the 25,700 -25,800 levels.

The maximum Put Open Interest (OI) is observed at 25,500, followed by 25,400, suggesting support at the 25,500 to 25,400 levels.

Note: OI is subject to multiple interpretations; however, generally, an increase in Call OI indicates resistance in a falling market, while an increase in Put OI indicates support in a rising market.

Source: Sensibull

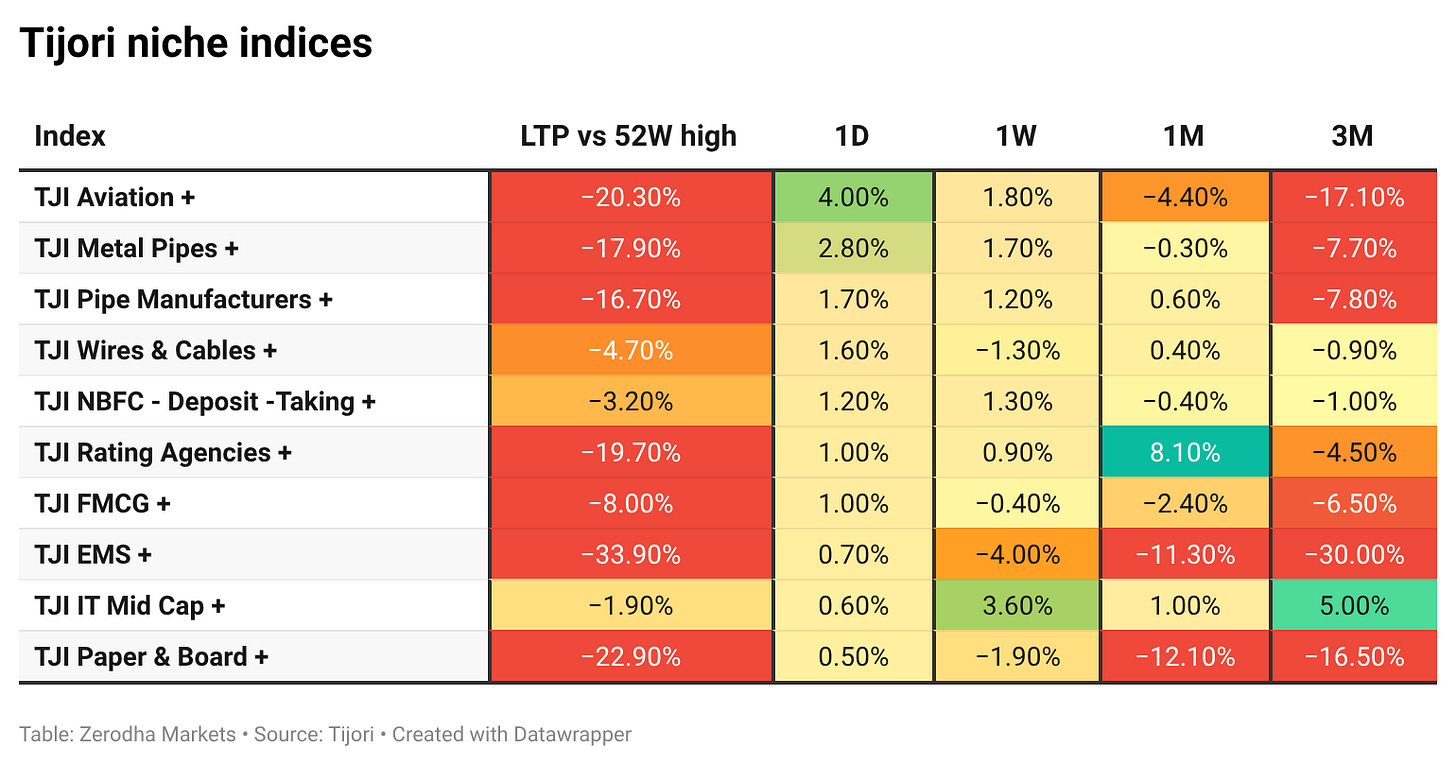

Tijori is an investment research platform that has constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

State-owned coal miner Bharat Coking Coal Limited made a strong market debut, listing at ₹45 per share, up 95.65% from its ₹23 issue price. The stock later closed at ₹40.56 on the NSE, ending the day with a 76% gain.

India’s 10-year G-Sec yield rose to 6.68%, a ten-month high, tracking a sharp rise in US Treasury yields and continued selling pressure. RBI bond purchases and lower state bond supply offered limited support, while offshore OIS activity added to yield gains. Dive deeper

The rupee hovered near record lows at around 90.9 per dollar amid sustained foreign portfolio outflows and strong corporate dollar demand. A firm US dollar and elevated Treasury yields continued to pressure the currency, with RBI intervention limited to curbing volatility. Dive deeper

The IMF raised India’s FY26 growth forecast to 7.3%, citing stronger-than-expected momentum in the second half of the year. It expects growth to moderate to around 6.4% over the following two fiscal years as cyclical tailwinds ease. Dive deeper

Reliance Industries shares fell 3% after the company reported a largely flat Q3 net profit of ₹18,645 crore. Lower gas production and weakness in the retail business offset gains in other segments. Dive deeper

ICICI Bank shares fell as much as 3% before closing 2% lower after the lender reported a surprise 4.02% year-on-year decline in Q3 FY26 net profit. The drop came despite stable net interest income, margins, and asset quality. Dive deeper

Punjab National Bank reported a 13% rise in Q3 net profit to ₹5,100 crore. Asset quality improved during the quarter, with gross and net NPAs declining compared with a year earlier. Dive deeper

Bharat Heavy Electricals reported Q3 net profit more than tripled to ₹382 crore, with revenue up 16 % year-on-year on stronger execution and operating leverage. Dive deeper

Sun Pharma is in talks to acquire US-based Organon in a deal valued at around $10 billion, which would significantly expand its presence in the US market. Dive deeper

Hindustan Zinc reported a sharp rise in Q3 profit, supported by higher silver and zinc prices amid resilient demand. Record silver prices and firm base metal prices boosted earnings during the quarter. Dive deeper

What’s happening globally

Brent crude fell below $64 a barrel as easing Iran-related tensions reduced supply concerns. Trade-related demand worries and surplus supply expectations continued to weigh on prices. Dive deeper

Gold prices climbed over 1% to a record high above $4,670 an ounce as investors sought safe-haven assets after the US announced new tariffs on European countries. Ongoing geopolitical tensions and concerns over US policy also supported bullion prices. Dive deeper

Silver rose over 4% to a record high near $94 an ounce, supported by safe-haven demand after fresh US tariff threats on European nations. Structural supply deficits and tightness in the London market also underpinned prices. Dive deeper

Eurozone inflation eased to 1.9% in December, falling below the ECB’s 2% target for the first time since May. Softer services, goods and energy prices drove the decline, while core inflation also moderated. Dive deeper

European equities declined after the US announced new tariffs on imports from several European countries, raising trade tension concerns. Losses were broad-based across luxury, technology and auto stocks, while defence shares outperformed. Dive deeper

Japan’s 10-year government bond yield rose to its highest level since 1999 as markets priced in potential Bank of Japan rate hikes and higher fiscal spending expectations. Dive deeper

China’s economy grew 4.5% year-on-year in Q4 2025, marking its slowest pace in three years amid weak consumption and a prolonged property downturn. Full-year growth met the 5% target, supported by strong exports, though uncertainties remain for 2026 due to rising global trade risks. Dive deeper

Goldman Sachs economists said proposed US tariffs would have a limited impact on euro zone growth, trimming GDP by about 0.1%. The impact is expected to be slightly higher for Germany but modest overall. Dive deeper

Management chatter

In this section, we highlight interesting comments made by the management of major companies and policymakers from the Indian and Global Economies.

Deven Choksey, Managing Director, KRChoksey Shares & Securities, on fintech-powered NBFC growth vs PSU banks:

“Fintech-powered NBFCs have beaten PSU banks on growth despite having lower valuations.”

“Fintech NBFCs are growing at a much faster pace because cost of funds is lower and credit penetration is higher.”

“PSU banks’ credit growth is strong but NBFCs are outperforming them on growth metrics.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

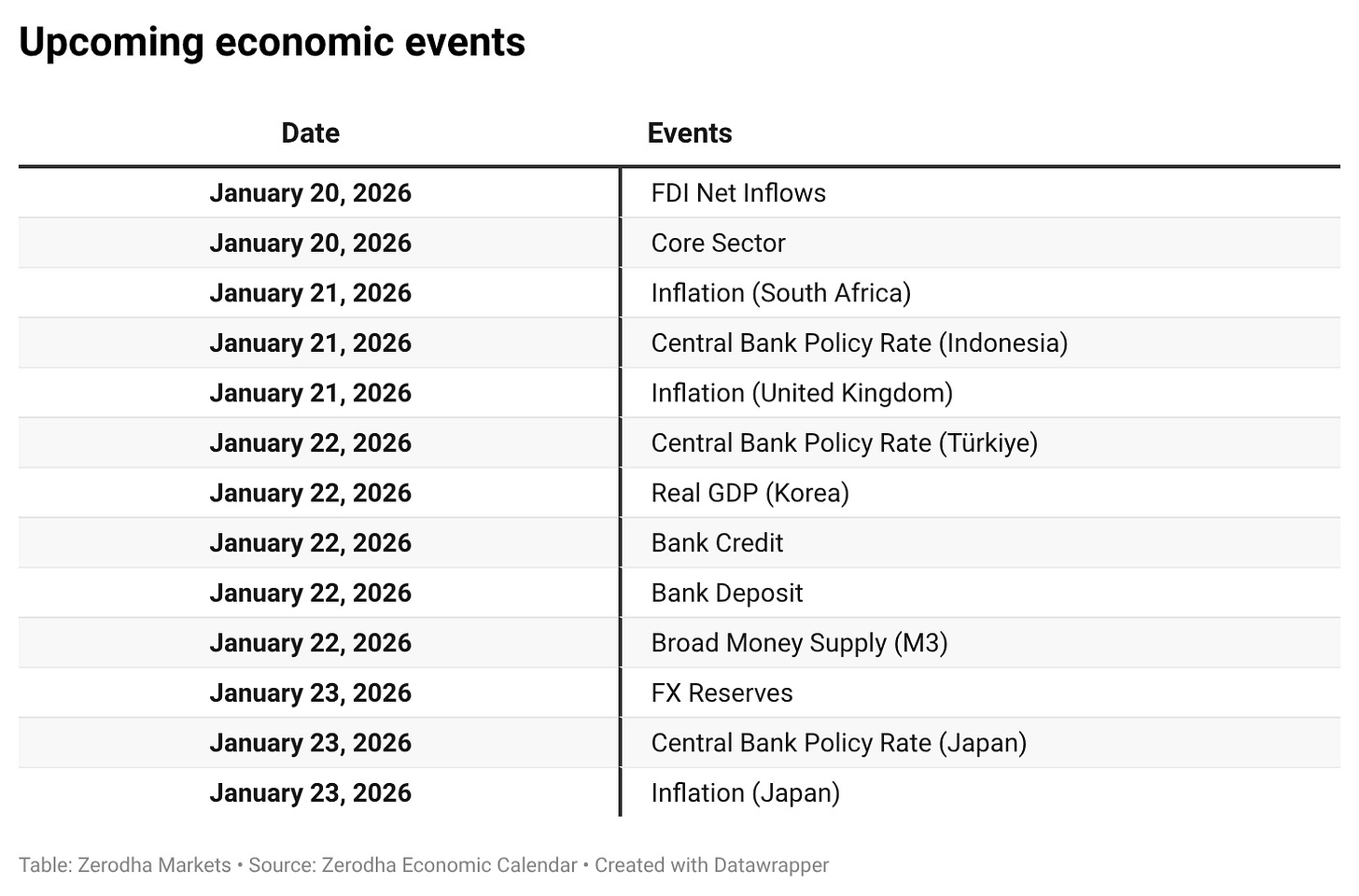

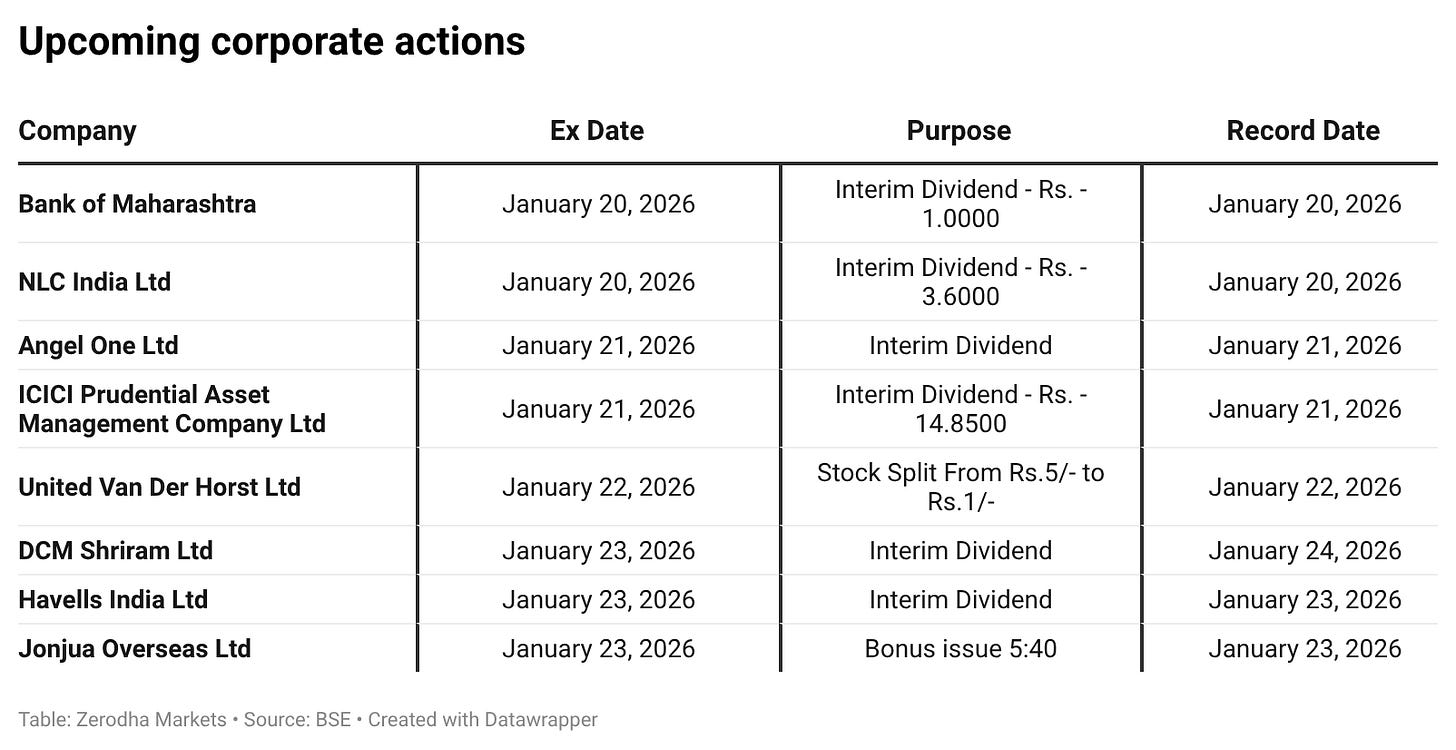

Calendars

In the coming days, we have the following significant events, quarterly results, and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!