Dull trade continues as Nifty ends the week near 26,050

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we explore a small detour to close out the year with a curated movie watchlist for traders and investors—feature films (no documentaries, no series, no spoilers) that revolve around money, markets, power, risk-taking, and human behaviour.

Spanning the 2008 Global Financial Crisis, Wall Street excesses, niche trading ideas, Indian market films, and a few unexpected outliers, each movie is viewed through a simple trader’s lens: what it teaches, how real it feels, and how relatable it is if you’ve spent time around markets. Think of it as an end-of-year watchlist to dip into over the holidays—no charts, but still very much about money.

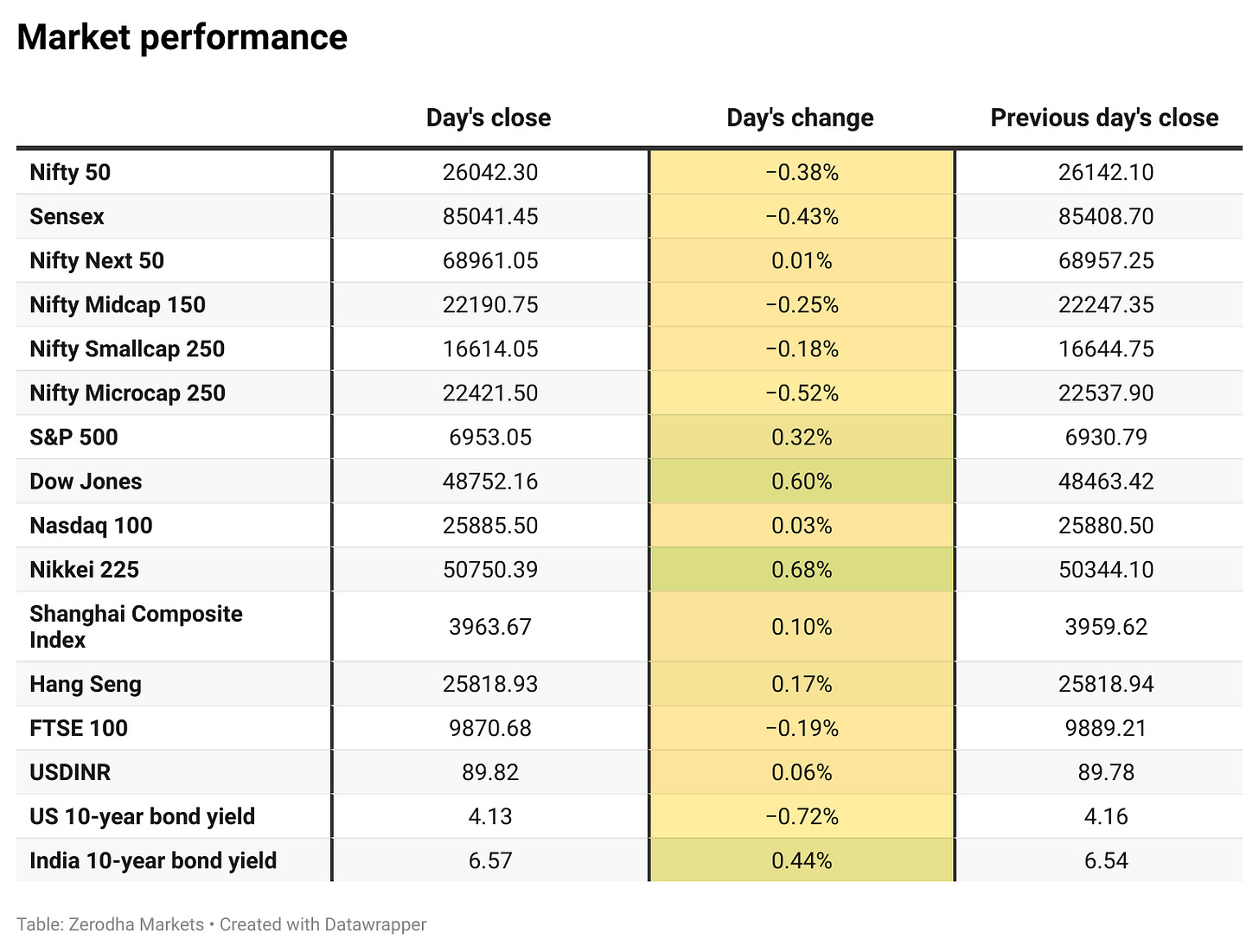

Market Overview

Nifty opened with a small 21-point gap-down at 26,121 and came under pressure immediately with the index slipping below 26,100 and traded in a narrow 20-point range between 26,080 and 26,100 till 11 AM before drifting toward the 26,050 zone by noon as selling pressure gradually built up.

In the second half, weakness persisted with Nifty sliding further to the 26,020–26,040 range. A sharper dip in the final hour dragged the index close to 26,010 before a mild late rebound helped it recover part of the losses. Nifty eventually closed at 26,042.30, ending the session lower and reflecting a dull, low-momentum day marked by a lack of buying interest.

Looking ahead, markets are likely to remain sensitive to global risk appetite, currency movements, and further developments around India–U.S. trade negotiations.

Broader Market Performance:

The broader market had a weak session today. Out of 3,249 stocks that traded on the NSE, 1,285 advanced, while 1,867 declined, and 97 remained unchanged.

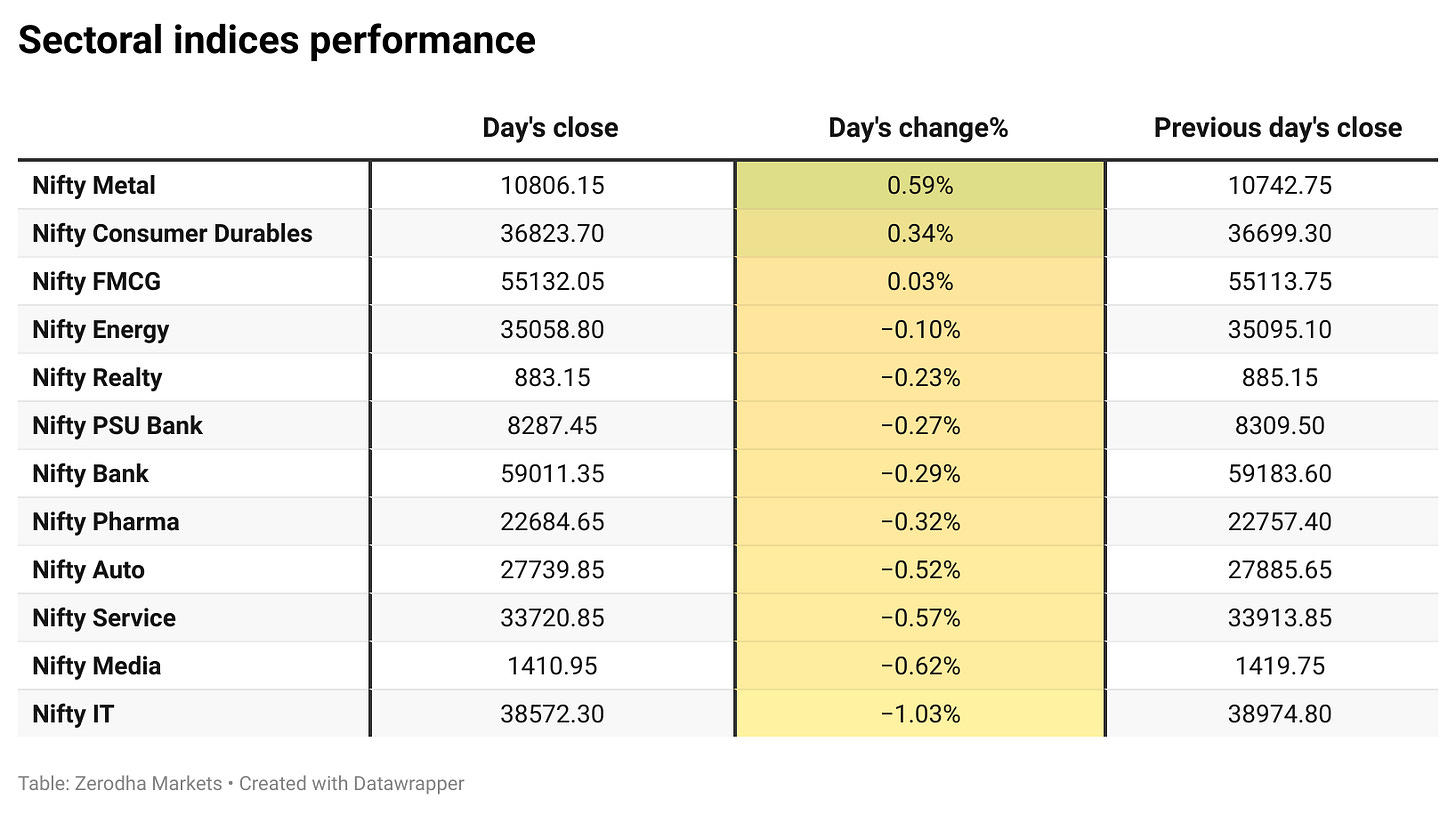

Sectoral Performance:

Nifty Metal was the top gainer for the day, rising 0.59%, while Nifty IT was the biggest laggard with a sharp decline of 1.03%. Out of the 12 sectoral indices, only 3 closed in the green and 9 ended in the red, indicating broad-based weakness across sectors.

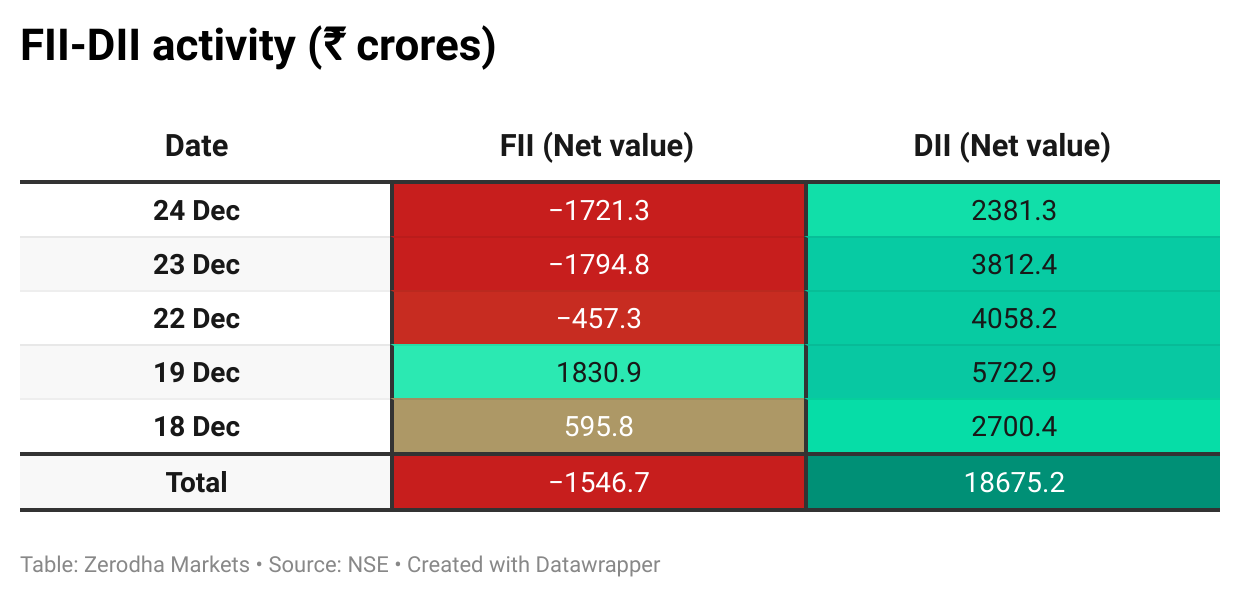

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 30th December:

The maximum Call Open Interest (OI) is observed at 26,200, followed by 26,100, indicating potential resistance at the 26,100 -26,200 levels.

The maximum Put Open Interest (OI) is observed at 26,000, followed by 25,800, suggesting support at the 26,000 to 25,900 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

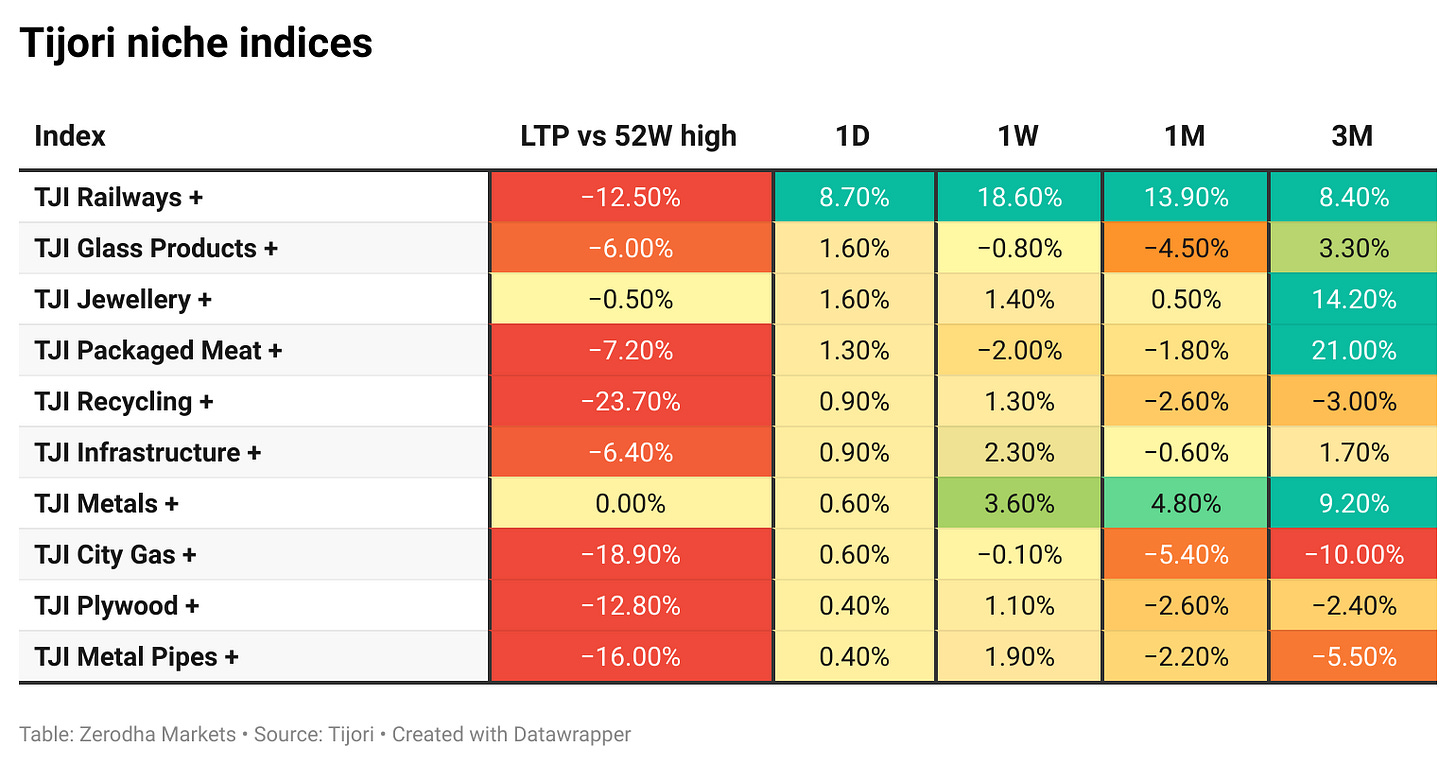

Tijori is an investment research platform that has constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

India imposed anti-dumping duties on imports of cold-rolled non-oriented electrical steel and refrigerant gas R-134a from China, and on calcium carbonate filler masterbatch from Vietnam, to protect the domestic industry from below-cost imports. Dive deeper

The Coal Ministry notified new rules removing the requirement of approval from the Coal Controller Organisation for opening or restarting coal mines, transferring the authority to the boards of coal companies to speed up mine operationalisation. Dive deeper

Navi Mumbai International Airport, developed by Adani Airports, has begun commercial operations with an initial capacity of 20 million passengers per annum. Dive deeper

Titan Company announced the launch of a new women-focused lifestyle brand, beYon from the House of Titan, with its first exclusive store set to open in Mumbai on December 29, 2025. Dive deeper

BSE BANKEX was reconstituted with effect from December 26, adding Canara Bank, AU Small Finance Bank, Punjab National Bank, and Union Bank of India, taking the index constituents to 14. Dive deeper

Lenskart Solutions said its Singapore subsidiary has approved an investment to acquire a minority stake in a South Korea–based eye-care technology company focused on eye-testing and lens-cutting equipment. Dive deeper

IndusInd Bank said it has received a letter from the Serious Fraud Investigation Office seeking information as part of an investigation into accounting discrepancies of about ₹2,600 crore identified during audits up to March 2025. Dive deeper

National Asset Reconstruction Company has submitted a bid of about ₹345 crore to acquire the debt of Kurukshetra Expressway, a stressed highway asset with outstanding dues of around ₹1,500 crore. The bid is under lender evaluation following the project’s concession termination in 2021. Dive deeper

India has been selected to chair the Kimberley Process, the global conflict-free diamond certification body, from January 1, 2026. Dive deeper

The Central Electricity Regulatory Commission rolled out a framework for Virtual Power Purchase Agreements, introducing a new mechanism for renewable energy compliance. Dive deeper

Housing sales across seven major Indian cities declined 14% in 2025, according to data released by Anarock. Dive deeper

What’s happening globally

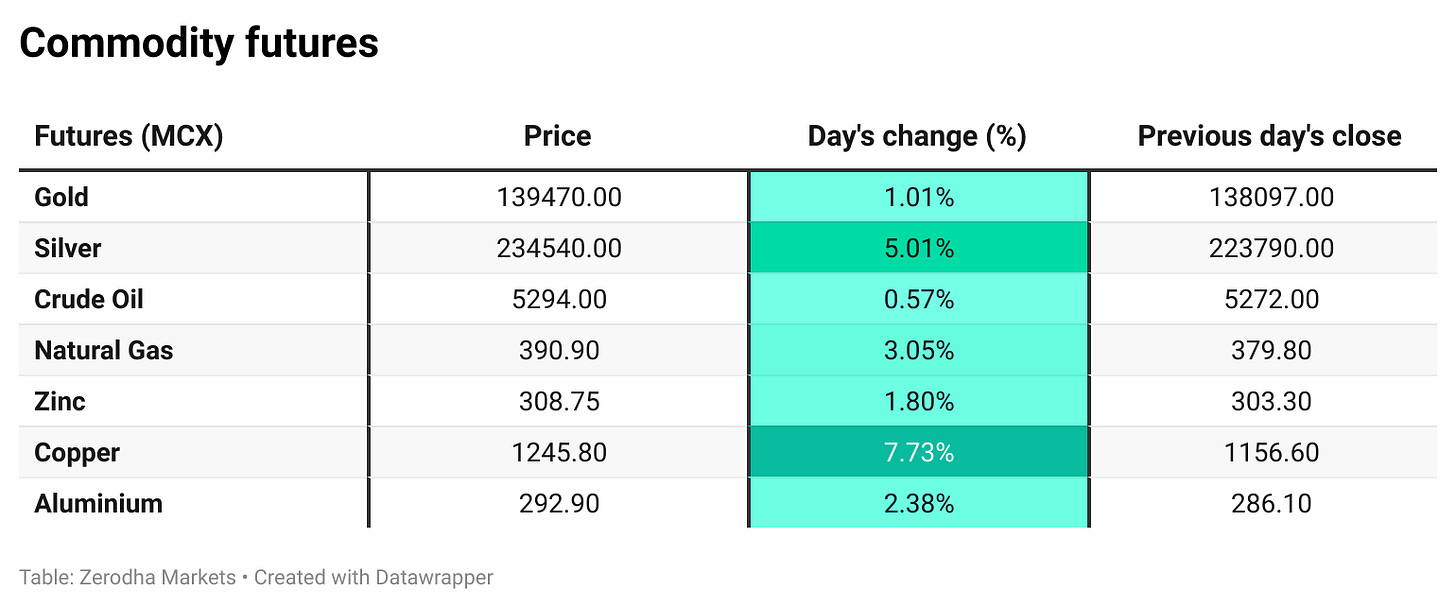

WTI crude oil futures were at $58.6 per barrel amid heightened geopolitical tensions and concerns over global oil supply conditions. Dive deeper

Gold prices touched a record high of $4,530 per ounce, supported by strong safe-haven demand and expectations of US interest rate cuts. Dive deeper

Silver topped $75 per ounce for the first time, extending its sharp rally. Dive deeper

Copper futures traded near a five-month high amid strong global demand and supply constraints, supported by energy transition needs and ongoing feedstock shortages, particularly in China. Dive deeper

Japan’s industrial production fell 2.6% month-on-month in November 2025, the sharpest drop since January 2024, reflecting weaker demand and inventory adjustments, data from the Ministry of Economy, Trade and Industry showed. Dive deeper

Singapore’s manufacturing production grew 14.3% year-on-year in November 2025, marking a third straight month of expansion but a sharp slowdown from October, according to the Singapore Economic Development Board. Dive deeper

Management chatter

In this section, we highlight interesting comments made by the management of major companies and policymakers from the Indian and Global Economies.

Gaura Sengupta, Chief Economist, IDFC First Bank, on RBI liquidity measures and rate transmission

“To ensure that banking system liquidity surplus stays at around 1% of NDTL until March 2026, there could be space for an additional ₹1 lakh crore of OMO purchases in February–March.”

“Persistent liquidity drain from forex interventions and tax outflows has kept conditions tight despite recent rate cuts.”

“Additional OMOs would help restore surplus liquidity and support smoother monetary transmission.” - Link

Nilesh Shah, Managing Director, Kotak Asset Management Company, on SIPs, returns, and asset allocation for 2026

“Equity and fixed income delivered returns well below expectations in 2025; the only asset class that decisively beat expectations was precious metals.”

“If investors align expectations realistically, SIPs will continue because they still deliver real returns over inflation.

”

“The kind of equity returns seen over the last five years are unlikely to repeat; multi-asset allocation and moderate expectations will be key in 2026.” - Link

Avinash Vashishtha, CEO & Chairman, Tholons Inc., on GCCs sustaining India’s tech job market

“This people’s growth is strategic, driven by a pivot to high-value and specialised work, not just cost arbitrage.”

“The current hyperactivity in the GCC space represents a second wave of capability, positioning GCCs as the strategic core for high-end talent and R&D.”

“India is transitioning into strategic enterprise AI brains, with GCCs driving long-term growth and employment momentum.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

Calendars

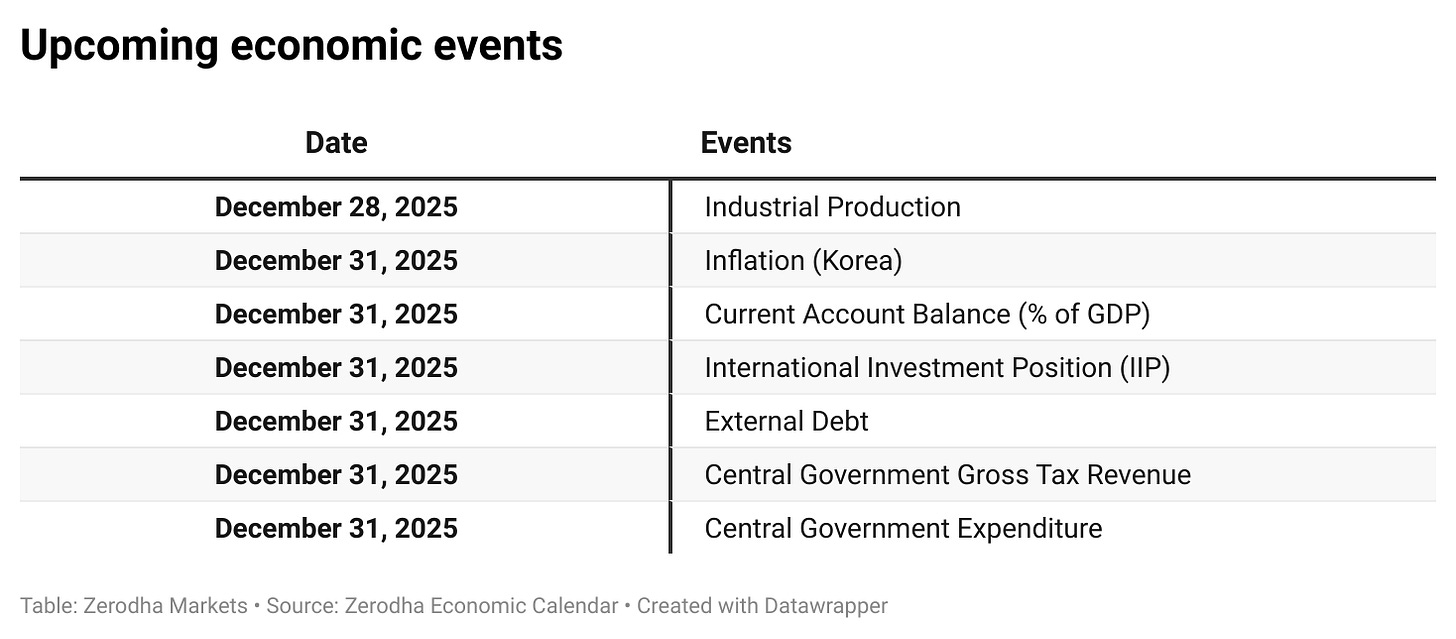

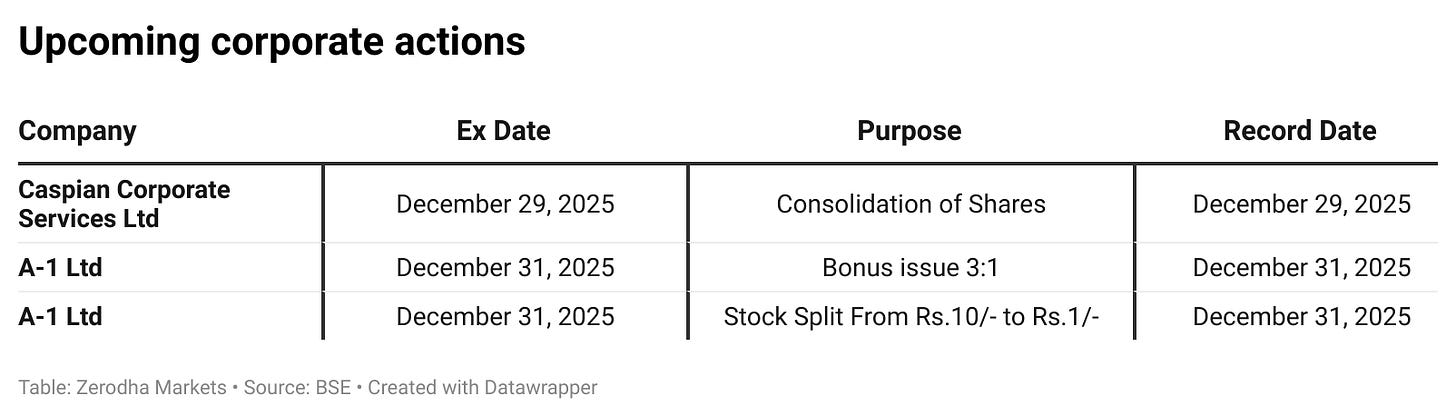

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

Wow, the idea of curating a movie watchlist to understand market psychology and human behavior really stood out to me. It's a profound reminder that even with all the technical data, market dynamics are ultimately driven by the very human elements those films explore, much like your thoughtful breakdowns always highlight the 'why' behind numbers.