Currency jitters and weak breadth pull Nifty below 26,000

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we explore the rarely understood world of high-frequency trading — a space often portrayed as opaque or predatory, but in reality built on sophisticated firms, cutting-edge technology, and tight regulation that power much of today’s markets. This episode dives into that ecosystem, where microseconds matter, infrastructure is the real edge, and small advantages compound into enormous profits.

Market Overview

Nifty opened with a modest 27-point gap-down at 26,005 as sentiment remained weak after the USDINR breached the key psychological level of 90. The index slipped sharply in the opening minutes, testing the 25,930–25,950 zone, and then moved into a narrow, choppy range through the morning, oscillating between 25,900 and 25,950 with no clear directional bias.

In the second half, Nifty attempted a mild rebound of nearly 70 points toward the 25,980–26,000 zone in the final hour but failed to gather follow-through strength. The index eventually settled at 25,986, ending the session almost flat with a slight negative undertone.

Looking ahead, markets are expected to stay highly sensitive to movements in the USDINR, global risk sentiment, and developments around the India–U.S. trade deal.

Broader Market Performance:

The broader markets had a very weak session. Of the 3,213 stocks traded on the NSE, 1,052 advanced, 2,074 declined, and 87 remained unchanged.

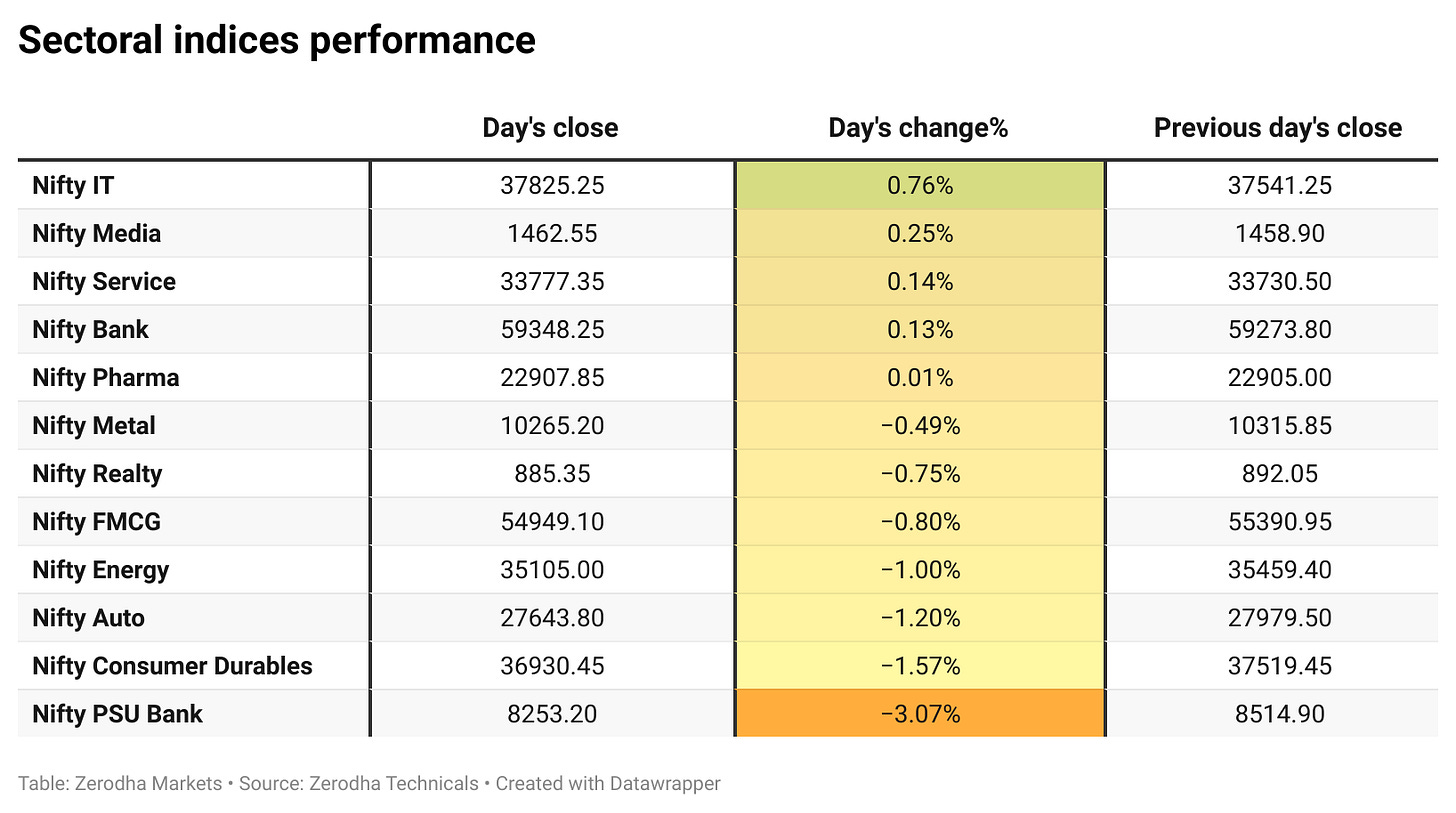

Sectoral Performance:

On the day, Nifty IT emerged as the top gainer with a 0.76% rise, while Nifty PSU Bank was the worst performer, tumbling 3.07%. Out of the 12 sectoral indices, 5 closed in the green, and 7 ended in the red, indicating a mildly negative bias across sectors.

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 9th December:

The highest Call OI is at 26,000, followed by 26,500 and 26,200, indicating potential resistance at the 26,100 -26,200 levels.

On the Put side, the highest Put OI is at 25,500, followed by 26,000 and 25,900. suggesting support at the 25,800 to 25,900 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

India’s 10-year G-Sec yield stayed near 6.5% as investors weighed the RBI’s upcoming policy decision against pressures from a weak rupee and uncertainty around a US–India trade deal. Dive deeper

The rupee slipped past 90/$ to a fresh record low as delays on a US trade pact, high tariffs and weaker capital flows kept pressure on the currency despite strong GDP. Dive deeper

India’s services PMI was revised up to 59.8 in November, indicating faster expansion led by stronger new orders, while export growth softened to an eight-month low. Dive deeper

Capri Global is targeting ₹50,000 crore AUM over the next 2–3 years, driven mainly by faster growth in gold loans and affordable housing. It expects co-lending to lift returns and a softer cost of funds to support profitability, with stress largely contained in unsecured MSME loans. Dive deeper

NBCC secured a ₹643 crore contract from the Ghaziabad Development Authority to redevelop the Tulsi Niketan housing colony as part of an urban renewal plan. The project is aimed at rebuilding unsafe, ageing flats and upgrading civic amenities under a redevelopment model. Dive deeper

Indian government bonds slipped as the RBI was seen as less active in market buying, leaving state-run banks to absorb more supply and support prices. This shift in demand has kept yields biased higher amid ongoing supply and liquidity concerns. Dive deeper

KPI Green Energy is in focus after winning an EPC contract from GSECL to develop a 142 MW floating solar project. The order strengthens its renewable execution pipeline and signals rising traction in utility-scale solar work. Dive deeper

RBI reiterated that SBI, HDFC Bank and ICICI Bank continue to be classified as Domestic Systemically Important Banks (D-SIBs), reflecting their critical role in financial stability. This keeps in place additional CET1 capital surcharges of 0.8% (SBI), 0.4% (HDFC Bank) and 0.2% (ICICI Bank) over the standard buffer. Dive deeper

IndiGo said flight delays and cancellations in recent days were driven by technology issues, airport congestion and operational requirements, with its on-time performance dropping to 35% on Tuesday. Dive deeper

What’s happening globally

Brent held near $63.3/bbl as fresh attacks on Russian energy assets and heightened Russia-Ukraine and US-Venezuela tensions raised supply-risk premia. Dive deeper

Gold held near $4,210/oz, close to a six-week high, as markets continued to price a high chance of a Fed rate cut in December amid softer US activity data. Focus is now on ADP jobs and delayed PCE inflation readings, with Fed leadership speculation adding to the dovish bias. Dive deeper

US stock futures inched higher as risk appetite improved, helped by a rebound in Bitcoin and hopes of a typical year-end rally. Markets continue to price a high probability of a Fed rate cut next week, with ADP jobs data in focus and upbeat corporate updates supporting sentiment. Dive deeper

Euro zone inflation edged up to 2.2% in November as services inflation firmed and the drag from energy prices eased, while core inflation held steady at 2.4%. Country trends diverged, with Germany re-accelerating above target even as France and Italy remained well below 2%. Dive deeper

China’s services PMI eased to 52.1 in November, the softest expansion since June, as new business growth slowed and confidence weakened further. Dive deeper

Japan’s Nikkei rose 1.14% to 49,865, tracking Wall Street gains and expectations of further Fed easing alongside improved risk appetite for a year-end rally. Dive deeper

Australia’s economy grew 0.4% q/q in Q3, undershooting expectations as household spending cooled and net trade and inventories dragged on growth. Offsetting this, private and public investment strengthened sharply, helping annual GDP edge up to 2.1%. Dive deeper

American Express was fined €1.5 million by France’s CNIL for cookie-consent violations, including placing cookies without valid consent and continuing after users refused or withdrew permission. Dive deeper

Management chatter

In this section, we highlight interesting comments made by the management of major companies and policymakers from the Indian and Global Economies.

Vishal Manchanda, Equity Research Analyst – Pharma, Systematix Group on Wockhardt’s Zaynich NDA review and approval odds:

“The drug Zaynich has not yet been approved, but the review acceptance significantly improves its probability of success.”

“The US FDA has accepted its New Drug Application (NDA) for review.”

“The acceptance itself is seen as a positive indicator of its potential success.” - Link

Mayuresh Joshi, Head Equity, Marketsmith India on selectivity across banks, infra and paints:

“So, it is a mix and blend of both. So, within the large private names, ICICI Bank is something that we still continue holding on in our local and global portfolios. Within PSUs, State Bank of India and Bank of Maharashtra is something we continue holding as well.”

“Provisioning still remains relatively stronger on most bank balance sheets and therefore… being a little selective, but our take is that selectively banks will perform well as we head into the next few quarters.”

“Anybody holding Asian Paints should continue holding it.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

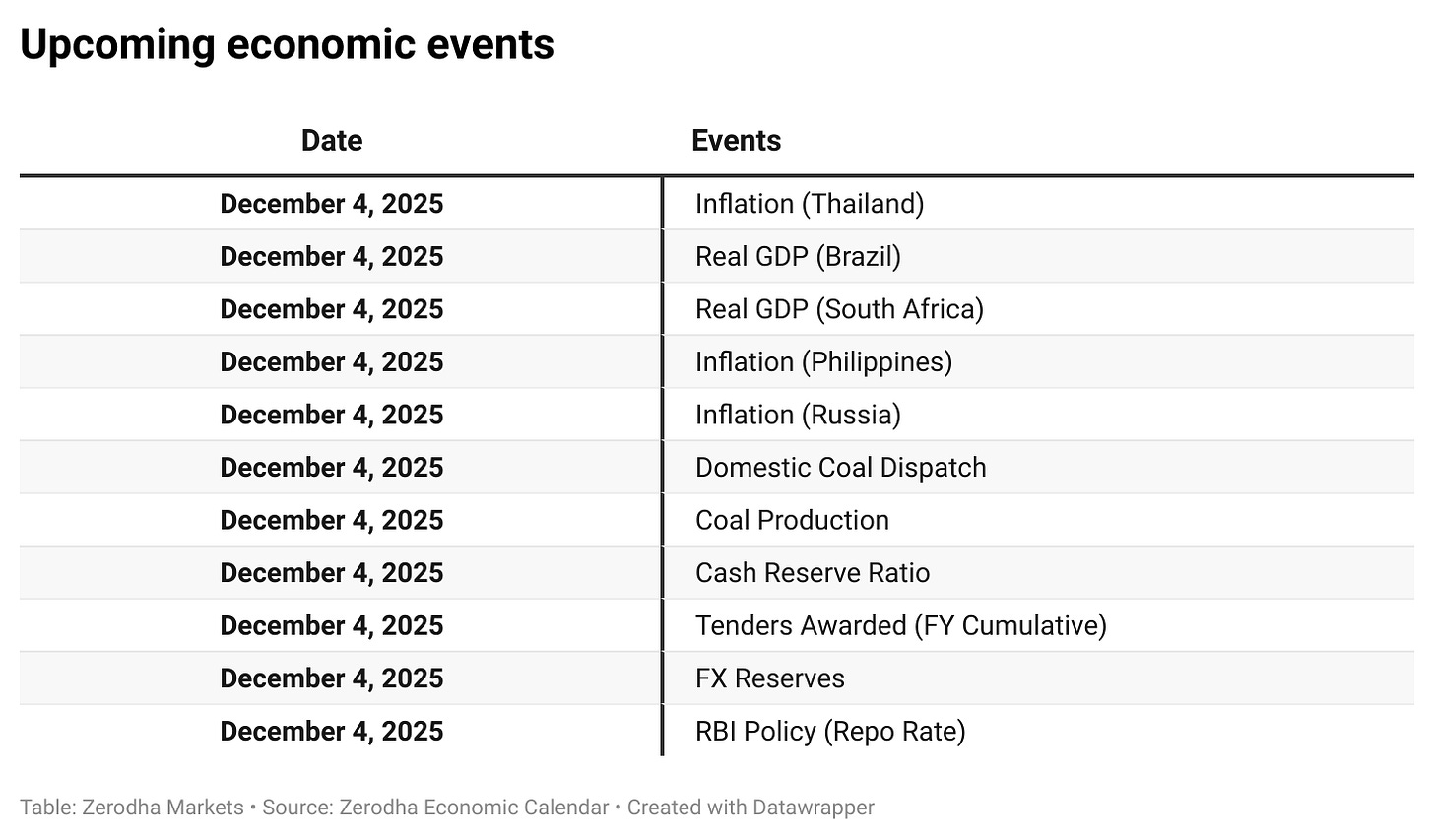

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!