Consolidation continues as Nifty closes modestly lower near 26,150

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we explore a small detour to close out the year with a curated movie watchlist for traders and investors—feature films (no documentaries, no series, no spoilers) that revolve around money, markets, power, risk-taking, and human behaviour.

Spanning the 2008 Global Financial Crisis, Wall Street excesses, niche trading ideas, Indian market films, and a few unexpected outliers, each movie is viewed through a simple trader’s lens: what it teaches, how real it feels, and how relatable it is if you’ve spent time around markets. Think of it as an end-of-year watchlist to dip into over the holidays—no charts, but still very much about money.

Market Overview

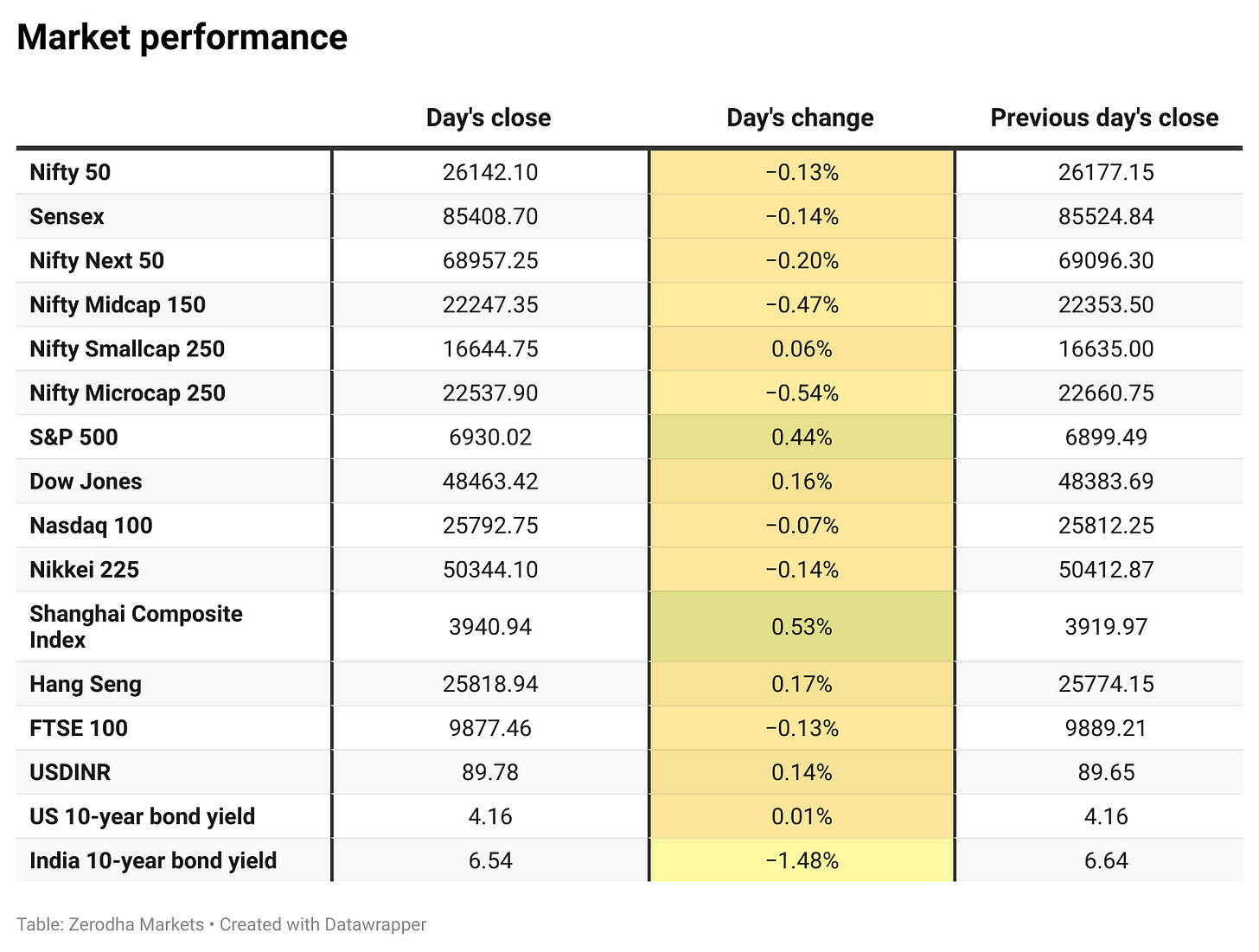

Nifty opened flat at 26,170 as global markets traded largely sideways on thin holiday volumes. After a brief uptick in the opening minutes, the index remained choppy throughout the morning session, oscillating between 26,200 and 26,230 before losing momentum late in the morning and slipping back toward the 26,180–26,190 zone.

In the second half, selling pressure gradually intensified, especially post 1 PM, dragging Nifty steadily lower toward the 26,150–26,160 range. The weakness persisted through the final hour, with only minor intraday pullbacks failing to gain traction. The index eventually closed near the day’s low at 26,142.10, ending marginally lower and reflecting a subdued, holiday-thinned session with a mild negative bias.

Looking ahead, markets are likely to remain sensitive to global risk appetite, currency movements, and further developments around India–U.S. trade negotiations.

Broader Market Performance:

The broader market had a mixed session today with a bearish bias. Out of 3,250 stocks that traded on the NSE, 1,359 advanced, while 1,768 declined, and 123 remained unchanged.

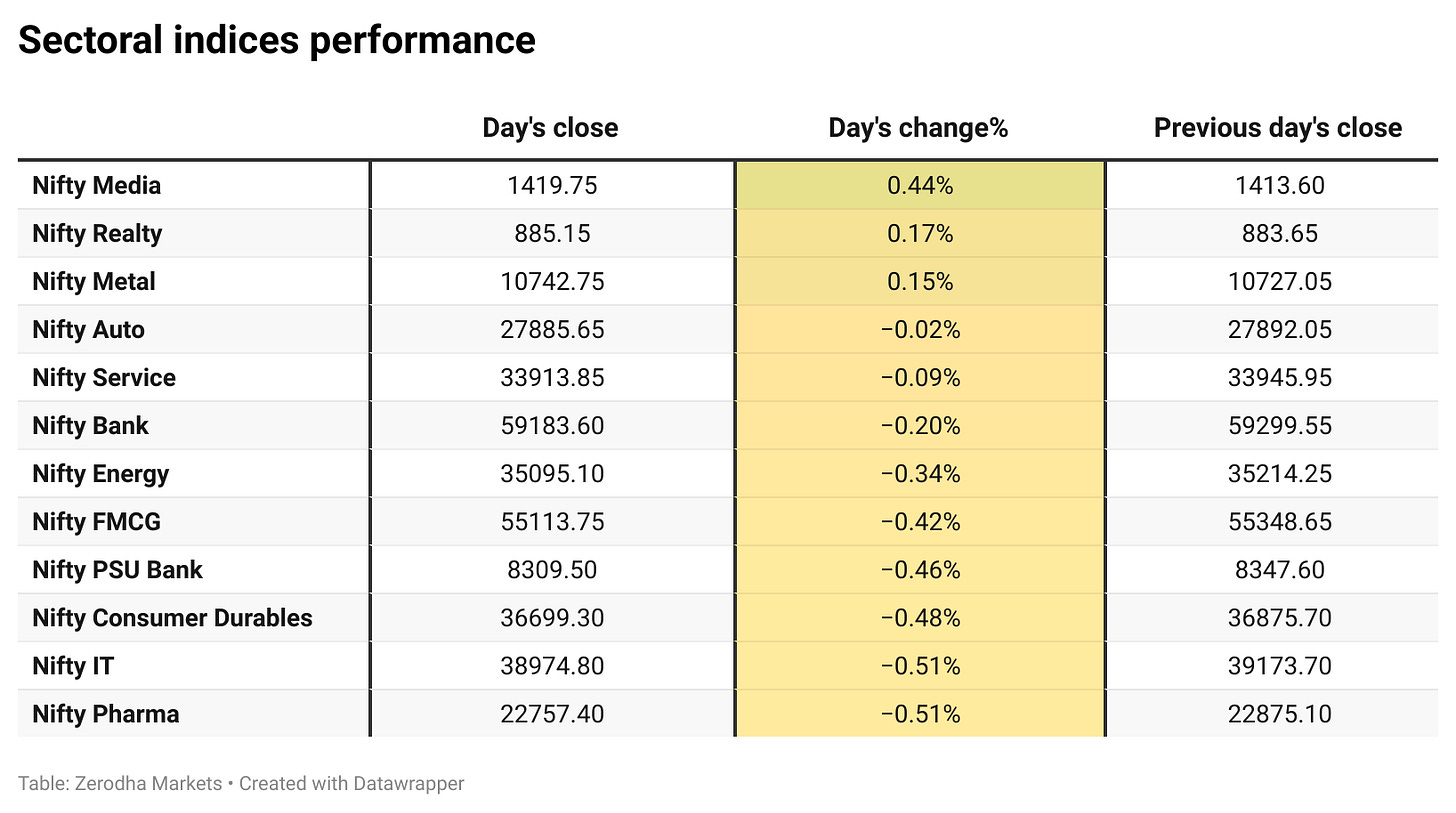

Sectoral Performance:

Nifty Media emerged as the top gainer with a 0.44% rise, while Nifty IT and Nifty Pharma were the biggest laggards, both falling by 0.51%. Out of the 12 sectoral indices, 3 closed in the green and 9 ended in the red, indicating a largely negative market breadth for the day.

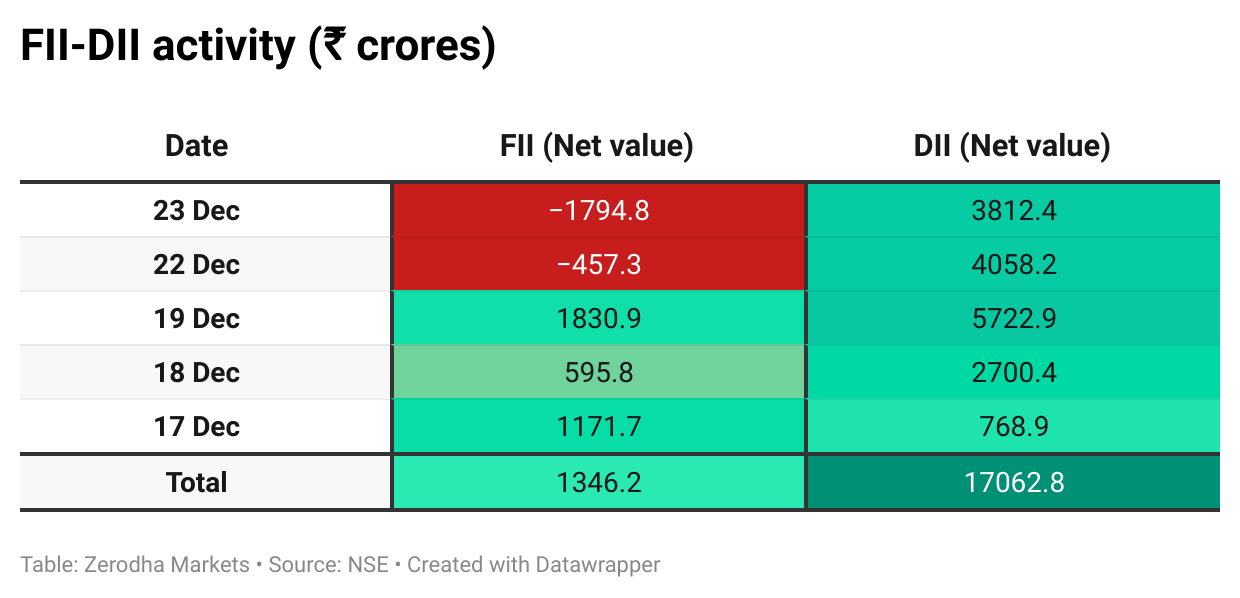

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 30th December:

The maximum Call Open Interest (OI) is observed at 26,200, followed by 26,500, indicating potential resistance at the 26,200 -26,300 levels.

The maximum Put Open Interest (OI) is observed at 26,000, followed by 26,200, suggesting support at the 26,100 to 26,000 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

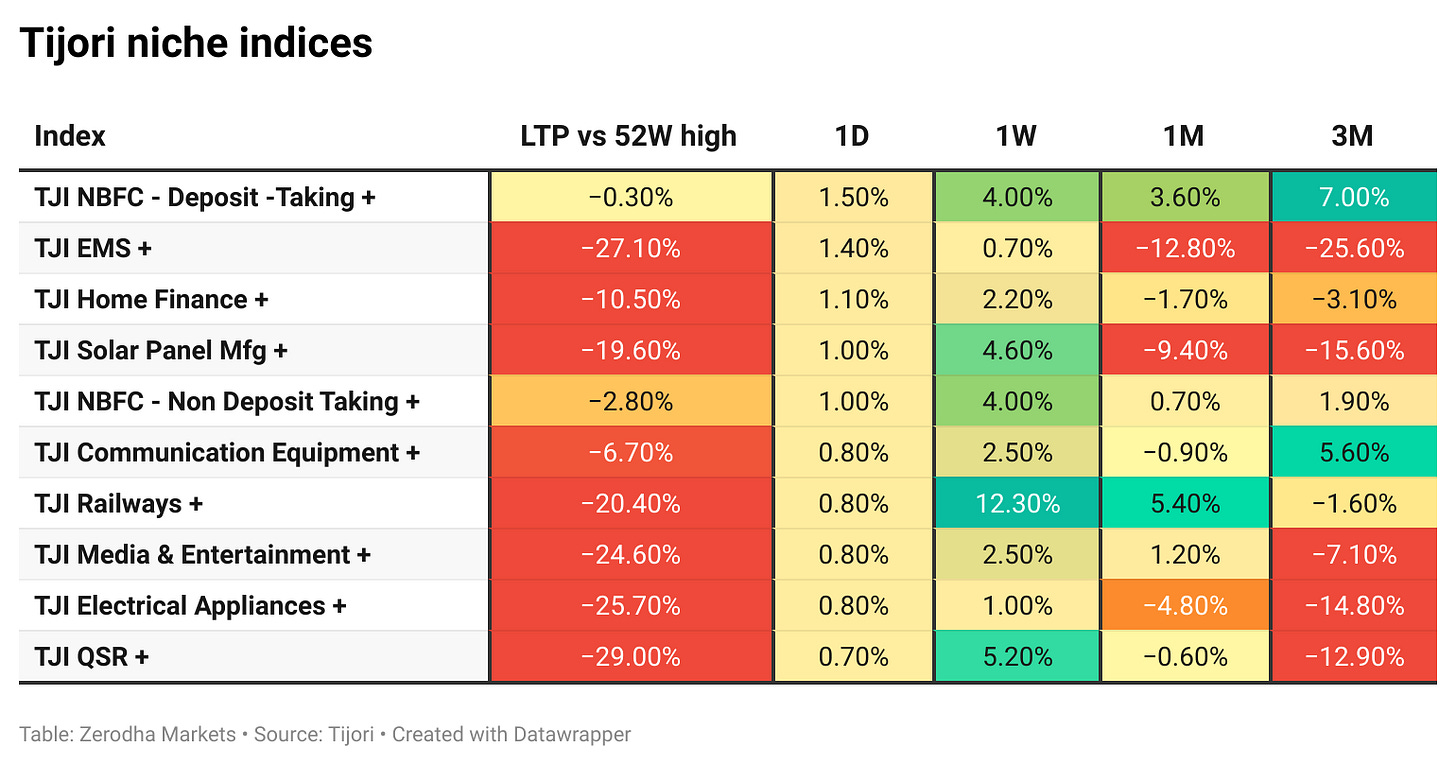

Tijori is an investment research platform that has constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

India’s 10-year G-Sec yield fell below 6.55% after the RBI announced a 2 trillion rupee bond-buying programme (four tranches through December–January) and a $10 billion dollar–rupee swap, signalling a push to ease tight liquidity. Dive deeper

Bharti Enterprises and Warburg Pincus are set to buy a 49% stake in Haier India from the Chinese parent, with Haier retaining 49% and employees 2%, marking a major private-equity entry into India’s home appliances sector. Dive deeper

India recorded net FDI outflows of $1.5 billion in October 2025, marking the third straight month of negative flows. The RBI cited uncertainty around the India–U.S. trade deal as a key factor driving both FDI and foreign portfolio investor outflows. Dive deeper

India’s civil aviation ministry has granted initial clearance to two new airlines, Al Hind Air and Fly Express, to begin operations. The move comes weeks after mass cancellations by IndiGo highlighted the lack of competition in the rapidly growing aviation market. Dive deeper

Bank of India said it has raised ₹10,000 crore through the issuance of long-term infrastructure bonds at a coupon rate of 7.23 percent per annum. Dive deeper

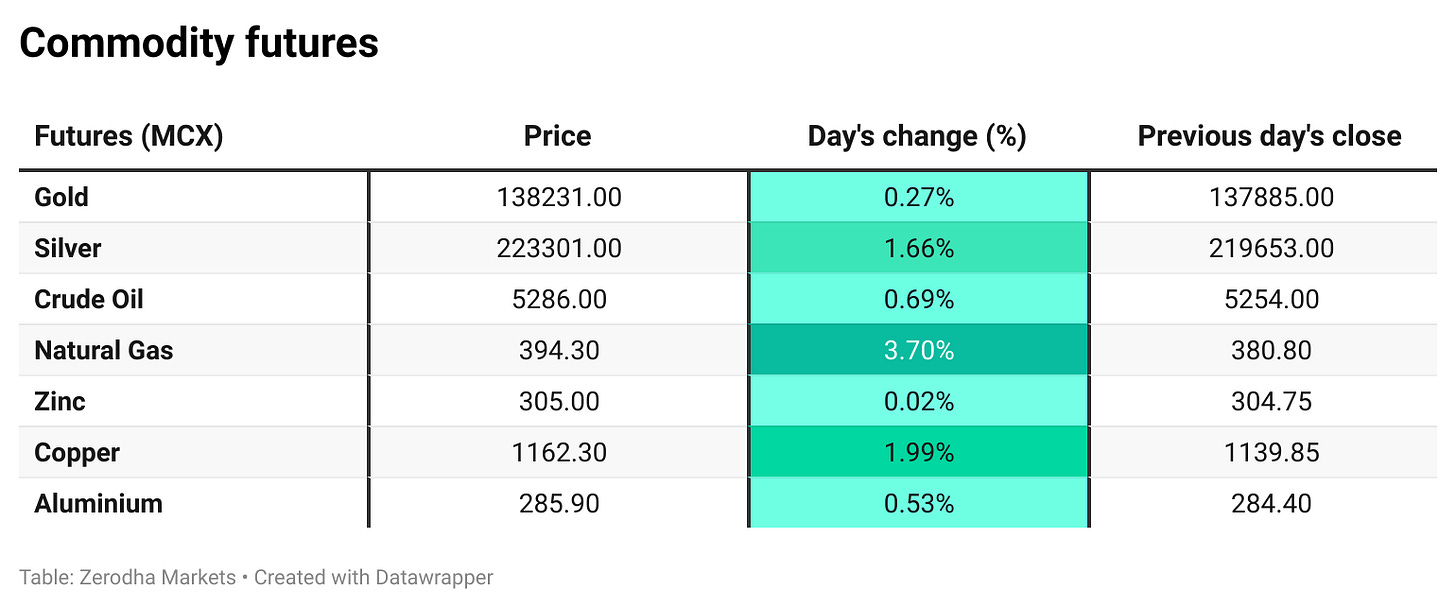

Hindustan Copper shares hit a record high after rising about 17% in a week, tracking a sharp rally in global and domestic copper prices that lifted sentiment across base-metal stocks. Dive deeper

What’s happening globally

The US economy grew at an annualized 4.3% in Q3 2025, the fastest pace in two years, beating both Q2’s 3.8% and expectations of 3.3%, led by stronger consumer spending, a sharp rebound in exports, and higher government spending. Dive deeper

Brent crude rose to about $62.5/bbl for a sixth straight session, hitting a two-week high as tensions around Venezuela and renewed Russia-Ukraine strikes on energy-linked assets supported prices. Dive deeper

Gold climbed past $4,500 per ounce to a fresh record, supported by expectations of further US rate cuts and rising geopolitical tensions, including developments around Venezuela. Dive deeper

Silver rose past $72/oz for a fourth straight session, hitting a fresh high as markets priced in potential US rate cuts and geopolitical tensions boosted safe-haven demand. Dive deeper

Management chatter

In this section, we highlight interesting comments made by the management of major companies and policymakers from the Indian and Global Economies.

Siddharth Vora, Executive Director, PL Asset Management, on earnings revival, valuations, and FII return:

“India is genuinely set up for a good constructive cycle. Growth remains strong in a low-inflation environment, while monetary and fiscal policies are supportive.”

“India did not participate in the AI and crypto rally. As that trade unwinds, India becomes a neutral and attractive allocation for global investors looking for stability and growth.”

“It is a matter of when, not if, foreign investors return. India’s macro stability, earnings outlook and domestic liquidity make it a compelling long-term story.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

Calendars

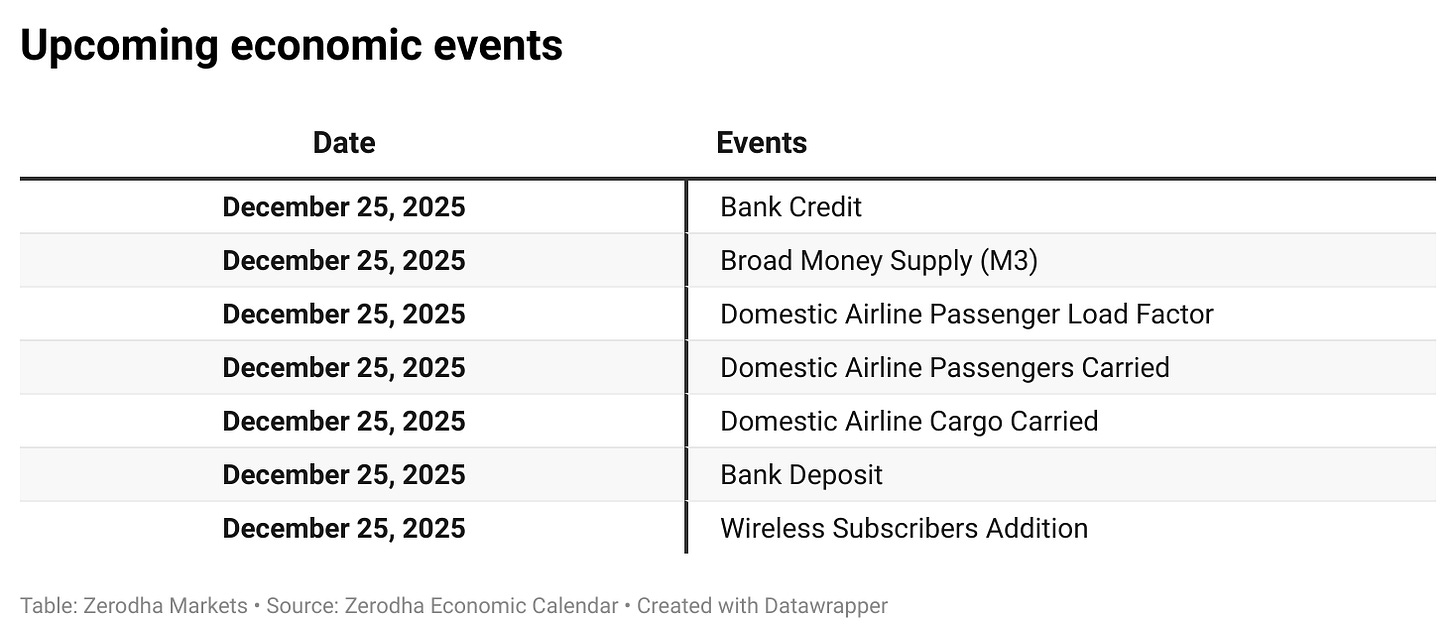

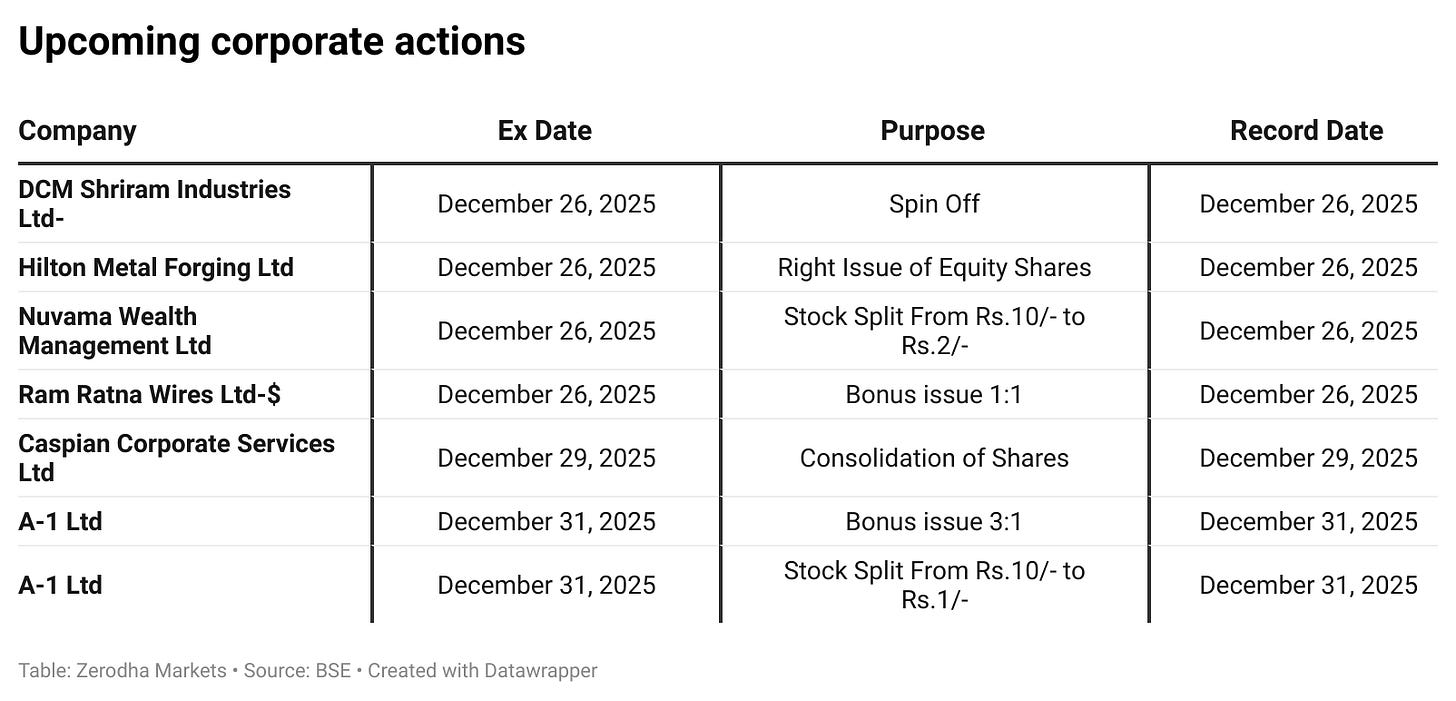

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!