Broad-based weakness drags Nifty to 25,500; sentiment stays fragile

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we put two foundational trend-following signals under the microscope — Exponential Moving Averages (EMAs) and Supertrend — and show how timeframe reshapes everything you see and do as a trader.

We start with a simple idea: EMAs = speed, Supertrend = volatility-adjusted staying power. Then we build a rules-based SAR system and test both signals on Nifty (Spot) across three timeframes — Daily (8 EMA), 4-Hour (21 EMA), and 1-Hour (50 EMA) — with Supertrend (10,3) held constant. Using data from Jan 2015 to Oct 2025(illustrative backtests on spot prices), we compare long-only vs long+short, and break down trade frequency, average P&L per trade, win rate, and drawdowns.

Market Overview

Nifty opened flat at 25,593 and briefly moved higher toward the 25,650–25,675 zone within the first 10 minutes before slipping sharply in early trade, testing the 25,520–25,540 range as weak sentiment persisted through the week. Despite brief recovery attempts during the late morning session, the index struggled to gain traction and remained under pressure for most of the day.

In the second half, Nifty stayed subdued, oscillating in a narrow band between 25,540 and 25,580 before extending losses in the final hour. The index eventually settled near the day’s low at 25,509.70, down around 0.34%, as global risk-off sentiment and profit-taking continued to weigh on equities.

Looking ahead, markets are expected to remain sensitive to developments around the India–U.S. trade deal, while investors closely monitor Q2 earnings and management commentary on festive-season demand momentum following the recent GST rate cuts.

Broader Market Performance:

The broader markets had an extremely weak session today. Of the 3,195 stocks traded on the NSE, 794 advanced, 2,304 declined, and 97 remained unchanged.

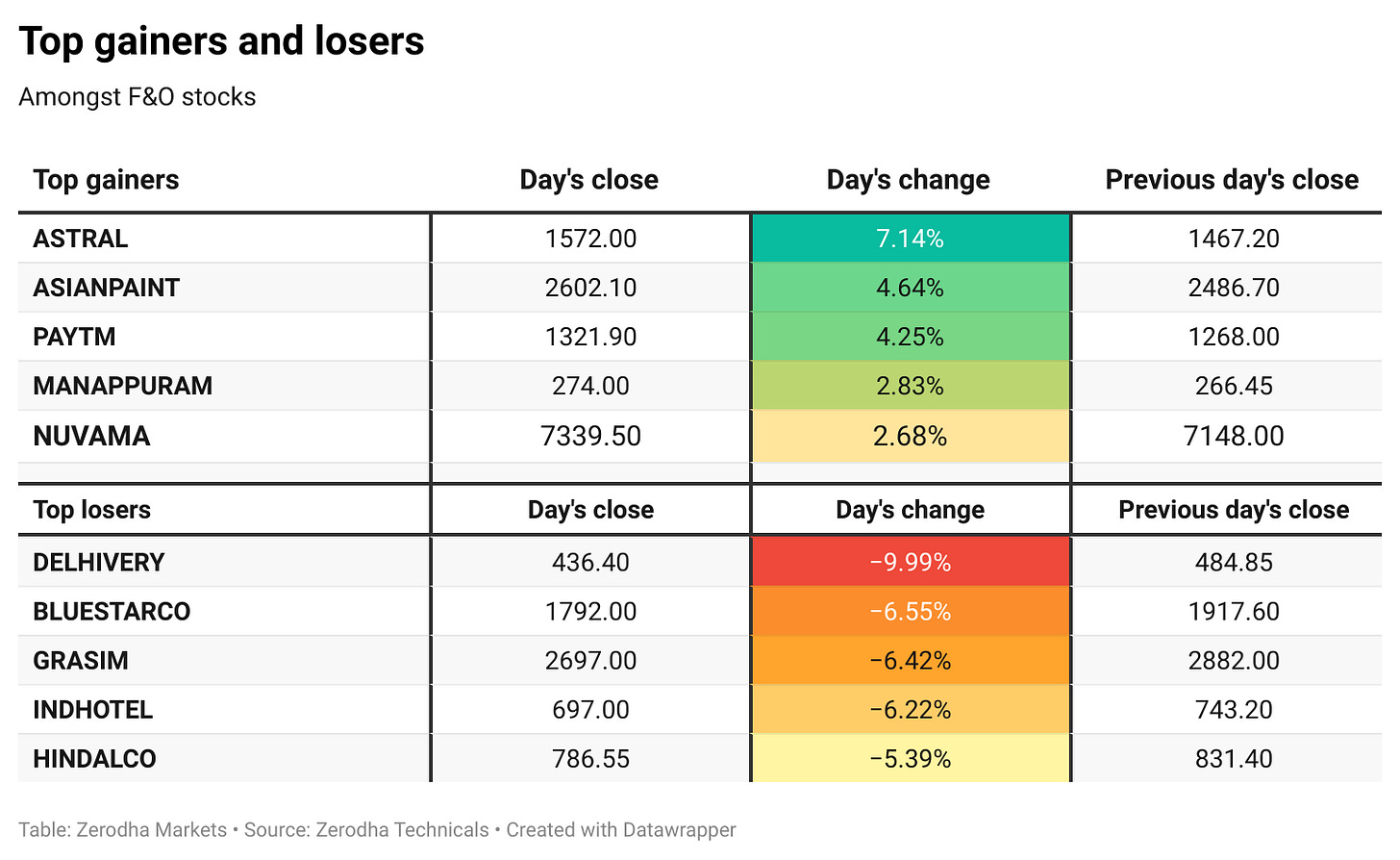

Sectoral Performance:

Nifty IT was the top gainer, rising 0.18%, while Nifty Media was the biggest loser, slumping 2.54%. Out of the 12 sectoral indices, only 2 ended in the green and 10 closed in the red, indicating broad-based weakness across the market.

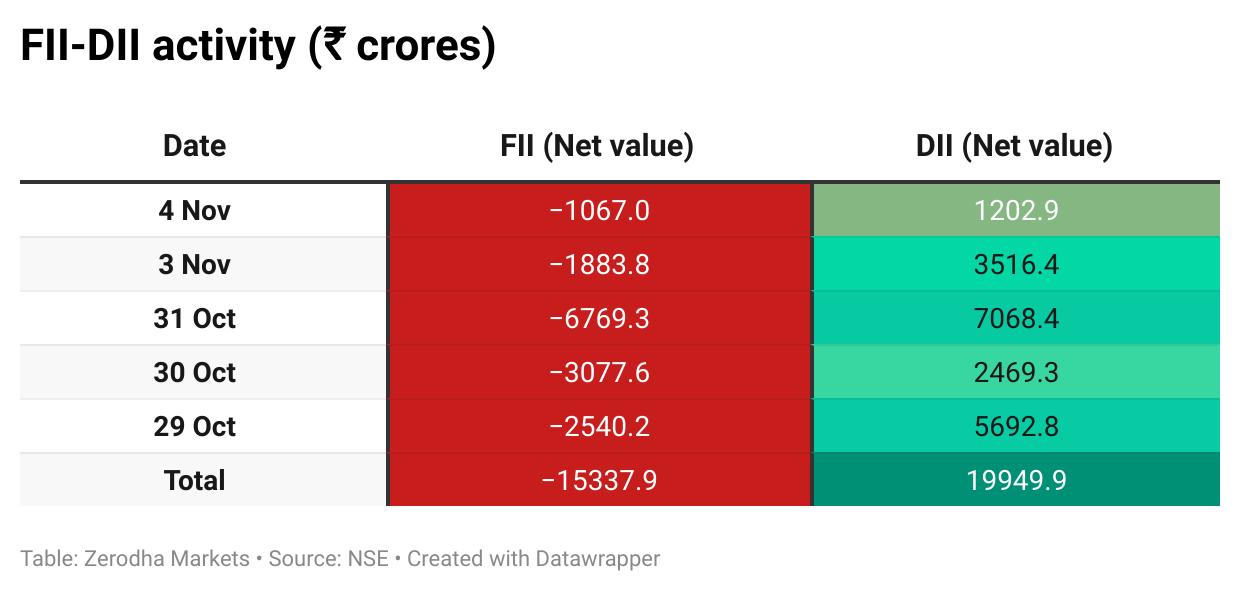

Here’s the trend of FII-DII activity from the last 5 days:

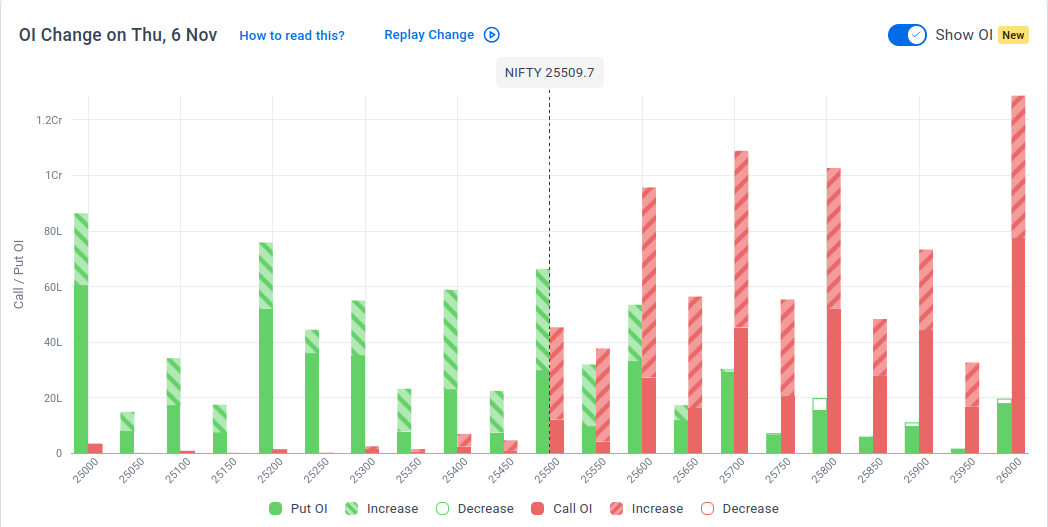

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 11th November:

The maximum Call Open Interest (OI) is observed at 26,000, followed by 25,700 & 25,800, indicating potential resistance at the 25,700 -25,800 levels.

The maximum Put Open Interest (OI) is observed at 25,000, followed by 25,200, suggesting support at the 25,400 to 25,300 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

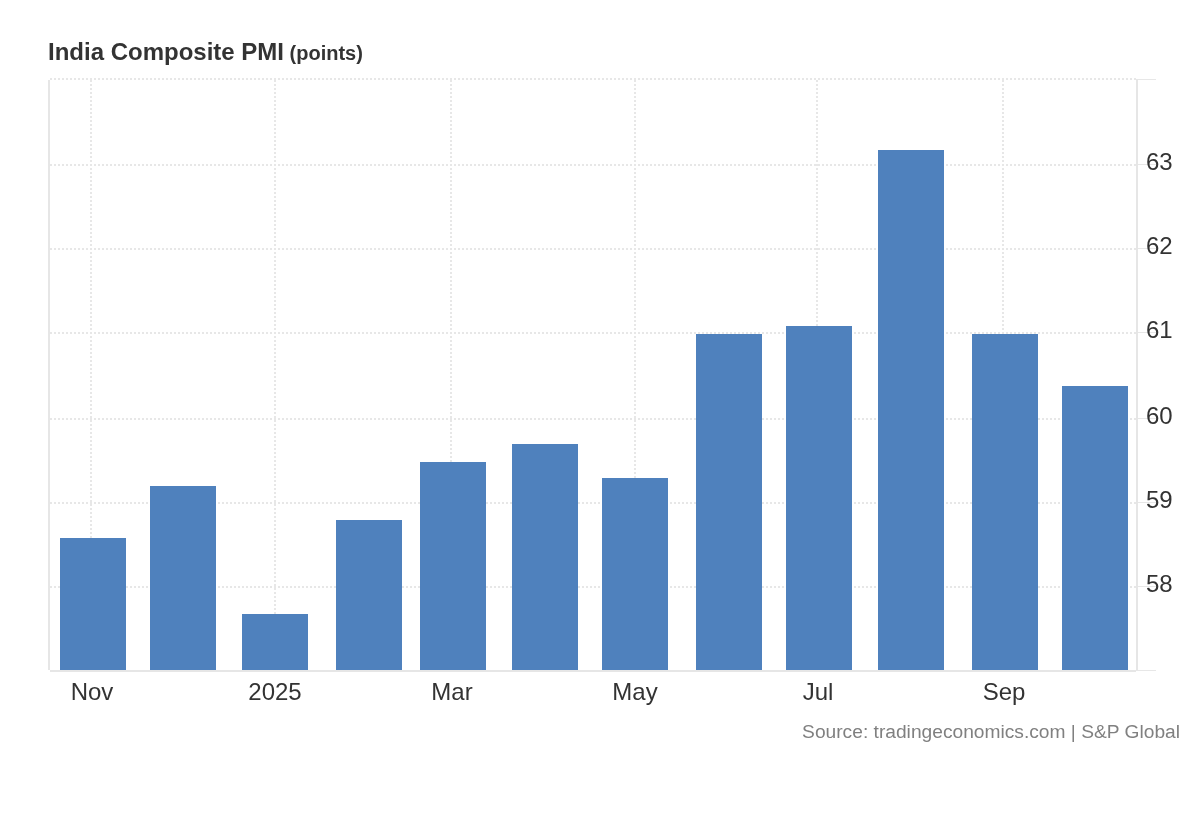

India’s composite PMI eased to 60.4 in October from 61.0 in September, its lowest since May, as services growth moderated while manufacturing strengthened; input cost pressures fell to their weakest since August 2024. Dive deeper

India’s services PMI was revised to 58.9 in October from 60.9 in September, signaling the slowest expansion since May as new business growth eased amid competition and weather disruptions, while input cost inflation fell to a 14-month low. Dive deeper

India’s 10-year G-Sec yield fell to a two-week low as the RBI and other long-term investors bought nearly ₹50 billion in bonds to stabilize the market. Dive deeper

Emirates NBD Bank has proposed an open offer to acquire a 26% stake in RBL Bank at ₹280 per share, totaling ₹11,636 crore. The move is part of a $3 billion plan to secure a 60% majority stake, marking the largest FDI in India’s banking sector. Dive deeper

LIC reported a 31% YoY rise in Q2 FY26 consolidated net profit to Rs 10,098 crore, while net premium income grew 5.5% to Rs 1.27 lakh crore. The insurer’s AUM rose 3.3% to Rs 57.23 lakh crore, and its solvency ratio improved to 2.13. Dive deeper

Britannia Industries reported a 23% YoY rise in Q2FY26 net profit to ₹655 crore, driven by cost control and stable commodity prices. Revenue grew 4% to ₹4,752 crore, and the company appointed Rakshit Hargave as its new CEO effective December 15, 2025. Dive deeper

Mahindra & Mahindra sold its entire 3.45% stake in RBL Bank for ₹678 crore via a block deal at ₹321 per share, earning a 63% return on its 2023 investment. The sale comes as Emirates NBD plans to acquire a 60% stake in RBL Bank through a ₹26,853 crore preferential issue. Dive deeper

Sebi has expanded the IPO anchor book size to 40% from 33% to boost institutional participation, reserving 33% for mutual funds and 7% for insurers and pension funds. The number of anchor investors for large IPOs has also been increased to widen long-term institutional involvement. Dive deeper

SBI will divest a 6.3% stake in SBI Funds Management through an IPO, while partner Amundi India Holding will sell 3.7%, totaling a 10% stake. The IPO, expected in 2026, will make SBIFML the third SBI subsidiary to be listed after SBI Cards and SBI Life. Dive deeper

Amazon Web Services has expanded its Marketplace in India, enabling customers to buy software and services from India-based firms in rupees. The platform now supports local invoicing, tax compliance, and payments to simplify procurement for Indian buyers and sellers. Dive deeper

Redington reported a 32% YoY rise in Q2FY26 net profit to ₹388 crore, with revenue up 17% to ₹29,118 crore, driven by strong growth across geographies and segments. The Software Solutions division led with 48% growth, reflecting rising demand in cloud and cybersecurity services. Dive deeper

Ola Electric reported a narrowed Q2FY26 consolidated loss of ₹418 crore from ₹495 crore a year earlier, while revenue fell 43% YoY to ₹690 crore. The company achieved Auto EBITDA profitability for the first time, supported by improved margins and lower operating expenses. Dive deeper

Grasim Industries reported a 76% YoY rise in Q2FY26 net profit to ₹553 crore, with consolidated revenue up 17% to ₹39,900 crore, driven by strong performance in Building Materials, Chemicals, Paints, and B2B E-commerce segments. Dive deeper

City Union Bank reported a 15% YoY rise in Q2FY26 net profit to ₹329 crore, with total income up to ₹1,912 crore and operating profit at ₹471 crore. Asset quality improved as gross NPAs fell to 2.42% from 3.54% a year earlier. Dive deeper

Ramco Cements reported a three-fold YoY rise in Q2FY26 net profit to ₹78 crore, while revenue grew 9.5% to ₹2,239 crore. Cement volumes remained flat, and the company plans to expand capacity to 30 MTPA by March 2026. Dive deeper

What’s happening globally

WTI crude oil rose toward $60 per barrel after US crude inventories surged by over 5 million barrels and Saudi Arabia cut December prices for Asian buyers. Dive deeper

Gold prices rose above $4,000 per ounce, supported by a weaker US dollar and ongoing economic uncertainty amid the prolonged US government shutdown. Dive deeper

Germany’s industrial production rose 1.3% in September, rebounding from a 3.7% drop in August, driven by a 12.3% surge in automotive output, though total output remained 1.6% lower year-on-year. Dive deeper

The Bank of England’s MPC voted 5-4 to hold the Bank Rate at 4%, with four members favoring a 25 bps cut to 3.75%. Policymakers said inflation has peaked and disinflation is advancing, citing weaker demand and easing wage growth, while future rate moves will depend on data. Dive deeper

The ISM Services PMI rose to 52.4 in October 2025 from 50 in September, marking the strongest expansion since February, driven by rebounds in business activity and new orders despite continued employment contraction. Dive deeper

US private sector employment rose by 42,000 in October 2025, exceeding forecasts, driven by gains in trade, health, and finance, while professional services, information, and hospitality continued to shed jobs. Dive deeper

Qatar Airways will sell its entire 9.57% stake in Cathay Pacific for $896 million through a share buyback, ending its eight-year investment in the Hong Kong carrier. The sale, subject to shareholder approval, reflects Cathay’s confidence in its long-term growth. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Nirmala Sitharaman, Finance Minister of India, on banking reforms and financial inclusion

“India needs big and world-class banks, and discussions are underway with the Reserve Bank of India and other lenders to move in that direction.”

“Banks must adhere to system-driven lending practices and maintain financial discipline by learning from past experiences.”“With GST-driven demand and a fivefold rise in capital expenditure, a virtuous investment cycle is set to strengthen India’s path toward Viksit Bharat 2047.” - Link

V. Narayanan, Chairman, ISRO, on industry participation and India’s space expansion

“We plan to transfer 50% of PSLV development to the Indian industry consortium once two successful launches are completed.”

“Indian industries already contribute nearly 80–85% of systems for ISRO missions, reflecting their growing capability and partnership.”

“With over 330 startups and 450 companies now engaged in space programs, India is on track to scale annual launches from 10–12 to around 50 within five years.” - Link

Praveen Someshwar, Managing Director & CEO, United Spirits Ltd., on the strategic review of RCB ownership

“RCSPL has been a valuable and strategic asset for USL; however, it’s non-core to our alcobev business.”

“We’ve initiated a strategic review of our investment in Royal Challengers Sports Pvt. Ltd. to ensure long-term value creation for all stakeholders.”

“This step aligns with USL and Diageo’s ongoing portfolio review in India, with the process expected to conclude by March 31, 2026.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

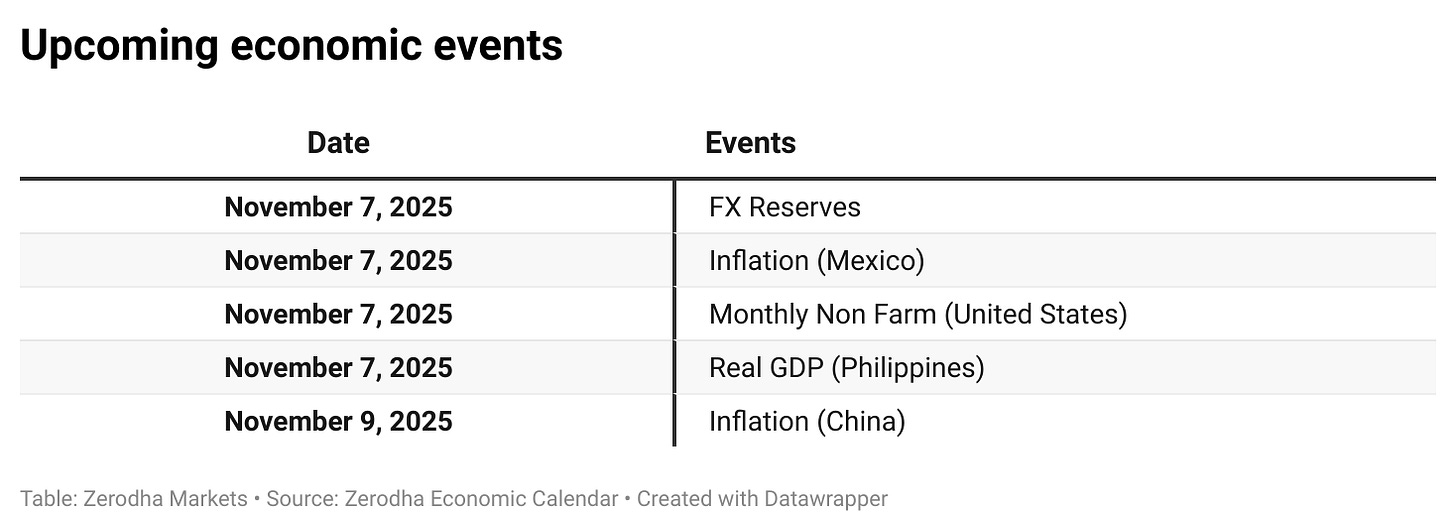

Calendars

In the coming days, we have the following quarterly results, significant events, and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

. If the Chinese government can keep the job market fairly stable, navigate the perils of growth, and avoid wars, ….never.

One good thing about the Chinese government is that it is always focused on the economy and plans years in advance. China can look 20, 30 years into the future and keep it’s growth aimed in a steady and unrelenting manner. China is a model for other underdeveloped countries to follow. Her diverse growth and economic stature is nothing short of amazing over the last 30 or so years.

This is one thing that western countries cannot do efficiently and effectively. Changes in parties, changes in government, compromises, budgetary constraints, and short range planning cause inefficient and sometimes paralyzing decisions. An uninformed and uneducated citizenry cannot optimize Democracy in today’s fast moving world. A biased, misleading, and false media and leadership makes a mockery of what Democracy was meant to be. In this environment, swings tend to be more pronounced and dramatic so false bubbles form and pop. Greed of a few overwhelm the desires and needs of the masses. Oligharchs are dominating many countries today, including the United States.

One thing China needs to watch out is her demographics. Like Japan, China’s senior population is growing and because of it’s ‘one child’ policy, a contraction in population with a aging of it’s working population will occur. Japan suffers from this malaise today and no end is in sight. Some predict her population will decline by a third by 2060. (Wikipedia) The decline in population in Japan is not because it had a ‘one child’ policy but because couples decided against having children or young people staying single, the effect is the same, population decline.

Japan’s technology lead is waning, her population is declining, and wealth creation is stagnant. Abe is trying to revive the military as one way to keep the economy alive. (the Korean War catalyzed Japan’s economic miracle after world war 2) North Korea’s threat has come at the right time for Japan to use this as the excuse to grow the military and to sell weapons overseas as a new growth market. Time will tell if this works.

Japan probably is in more peril than China because Japan tends not to allow new immigrants or foreigners to become Japanese citizens or residents. China too can suffer this effect if it does not plan ahead. With that in mind, automation is the future of manufacturing and many logistic processes. Japan and China are strong in this area and it will help offset the young people labor shortage in the near future. The future problem will be the support of seniors and the healthcare system as they live longer.

China’s Communist Party currently promotes innovation, disruptive technologies, and new ideas which, if the seeds sprout, will ensure future products and markets. Currently, things like infrastructure, fast trains, electric transportation, food production, super computers, QR code applications, high density batteries and capacitors, solar, and wind help to ensure current and future markets. Artificial Intelligence, nuclear (Thorium and Fusion, high temperature reactors), biologics, synthetic biology, genetics, nanotech, quantum applications, aerospace, marine mining, space applications, and more will continue to propel China in the future. Technology has been, is, and will be the wave that carries economic growth and prosperity forward for China.

As long as China’s government continues to support these efforts and shares these financial benefits with her citizens and expands to share these technologies with her neighbors and friends, the world will become more China centric and the future will look bright. China’s vision of a ‘peaceful rise’ should be the vision for all countries.

China’s support of Africa, and now Eurasia (Belt Road Initiative), will grow the seeds of future growth in food, energy, and resources. Integrated economies will help lessen the threat of wars and discord. Shared logistics and development is a win-win for all countries involved.

America used to be that beacon and technology was her strength. Today, her government, politics, and wealth distribution is destroying the advantages she had to become the hegemon of the world. Her political leadership is void of moral, technical, and political wisdom. Today, America is in decline and her leadership is incompetent and lacks the wisdom to support future technologies and their ecosystems.

China’s only fear should be that she too will become ambivalent and become like America or like her history past during the century of humiliation. Let’s hope her leaders remembered that lesson well and China will continue to be a great and strong nation,

. If the Chinese government can keep the job market fairly stable, navigate the perils of growth, and avoid wars, ….never.

One good thing about the Chinese government is that it is always focused on the economy and plans years in advance. China can look 20, 30 years into the future and keep it’s growth aimed in a steady and unrelenting manner. China is a model for other underdeveloped countries to follow. Her diverse growth and economic stature is nothing short of amazing over the last 30 or so years.

This is one thing that western countries cannot do efficiently and effectively. Changes in parties, changes in government, compromises, budgetary constraints, and short range planning cause inefficient and sometimes paralyzing decisions. An uninformed and uneducated citizenry cannot optimize Democracy in today’s fast moving world. A biased, misleading, and false media and leadership makes a mockery of what Democracy was meant to be. In this environment, swings tend to be more pronounced and dramatic so false bubbles form and pop. Greed of a few overwhelm the desires and needs of the masses. Oligharchs are dominating many countries today, including the United States.

One thing China needs to watch out is her demographics. Like Japan, China’s senior population is growing and because of it’s ‘one child’ policy, a contraction in population with a aging of it’s working population will occur. Japan suffers from this malaise today and no end is in sight. Some predict her population will decline by a third by 2060. (Wikipedia) The decline in population in Japan is not because it had a ‘one child’ policy but because couples decided against having children or young people staying single, the effect is the same, population decline.

Japan’s technology lead is waning, her population is declining, and wealth creation is stagnant. Abe is trying to revive the military as one way to keep the economy alive. (the Korean War catalyzed Japan’s economic miracle after world war 2) North Korea’s threat has come at the right time for Japan to use this as the excuse to grow the military and to sell weapons overseas as a new growth market. Time will tell if this works.

Japan probably is in more peril than China because Japan tends not to allow new immigrants or foreigners to become Japanese citizens or residents. China too can suffer this effect if it does not plan ahead. With that in mind, automation is the future of manufacturing and many logistic processes. Japan and China are strong in this area and it will help offset the young people labor shortage in the near future. The future problem will be the support of seniors and the healthcare system as they live longer.

China’s Communist Party currently promotes innovation, disruptive technologies, and new ideas which, if the seeds sprout, will ensure future products and markets. Currently, things like infrastructure, fast trains, electric transportation, food production, super computers, QR code applications, high density batteries and capacitors, solar, and wind help to ensure current and future markets. Artificial Intelligence, nuclear (Thorium and Fusion, high temperature reactors), biologics, synthetic biology, genetics, nanotech, quantum applications, aerospace, marine mining, space applications, and more will continue to propel China in the future. Technology has been, is, and will be the wave that carries economic growth and prosperity forward for China.

As long as China’s government continues to support these efforts and shares these financial benefits with her citizens and expands to share these technologies with her neighbors and friends, the world will become more China centric and the future will look bright. China’s vision of a ‘peaceful rise’ should be the vision for all countries.

China’s support of Africa, and now Eurasia (Belt Road Initiative), will grow the seeds of future growth in food, energy, and resources. Integrated economies will help lessen the threat of wars and discord. Shared logistics and development is a win-win for all countries involved.

America used to be that beacon and technology was her strength. Today, her government, politics, and wealth distribution is destroying the advantages she had to become the hegemon of the world. Her political leadership is void of moral, technical, and political wisdom. Today, America is in decline and her leadership is incompetent and lacks the wisdom to support future technologies and their ecosystems.

China’s only fear should be that she too will become ambivalent and become like America or like her history past during the century of humiliation. Let’s hope her leaders remembered that lesson well and China will continue to be a great and strong nation,